简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

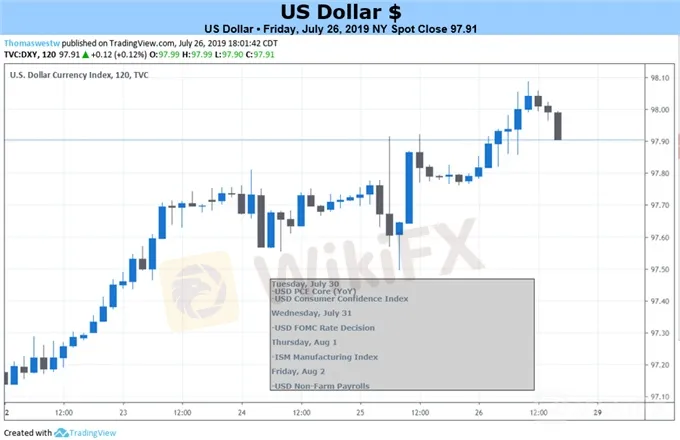

US Dollar Seems to be Biased Upward on FOMC Rate Decision

Resumo:The US Dollar seems more likely to rise than fall after the FOMC monetary policy announcement even as an interest rate cut is overwhelmingly expected.

US DOLLAR FORECAST: NEUTRAL

美国美元预测:中性

US Dollar marches higher as markets trim FOMC rate cut bets

随着市场减少FOMC降息押注,美元走高

Market pricing may still be more dovish than the Fed endorses

市场定价可能仍比美联储支持的价格更为温和

ISM, payrolls data unlikely to overshadow central bank impact

ISM,非农就业数据不太可能掩盖央行的影响

See the latest US Dollar technical and fundamental forecast to find out what will drive prices in Q3!

查看最新的美元技术和基本面预测,了解推动第三季度价格的因素!

The US Dollar marched steadily higher last week, tracking a shift away from dovish extremes on rate futures-implied Fed monetary policy expectations. The measured rise was only briefly interrupted by event-driven volatility – like the seesaw swings immediately after the ECB rate decision – but the conviction behind it never appeared to waver.

美元最后稳步走高跟踪美联储货币政策预期隐含的偏离温和期货的温和极端转变的一周。测量的上升只是由事件驱动的波动性短暂中断 - 就像欧洲央行利率决定后跷跷板立即摆动 - 但其背后的信念似乎从未动摇过。

Pre-positioning ahead of next weeks fateful FOMC monetary policy announcement probably explains such purposeful recovery. The markets appeared to have run out of room to price in an ever-more accommodative Fed policy outcomes. That made for asymmetrically high risk of a less dovish central bank than asset price levels presumed. Some portfolio rebalancing was apparently in order.

预定位在接下来的几个星期之前,FOMC的货币政策宣布可能解释了这种有目的的复苏。在更加宽松的美联储政策结果中,市场似乎已经没有足够的价格。这使得中央银行不那么温和的风险高于资产价格水平。一些投资组合的重新平衡显然是有序的。

US DOLLAR SEEMS BIASED UPWARD AFTER FOMC RATE DECISION

在美国联邦公开市场评级决定之后,美元价格上涨偏向上升

As it stands, the markets put the probability of a 25bps rate cut at 83 percent, while the chance of a 50bps reduction is at 17 percent. Tellingly, that leaves no room for an on-hold scenario yet clearly leans in favor of the smaller adjustment. A survey of recent economic data as well as commentary from Fed officials seems to support just such a result.

目前,市场将降息25个基点的可能性降至83%,而降低50个基点的可能性为17%。引人注目的是,这没有留下暂停场景的空间,但显然倾向于采用较小的调整。对近期经济数据的调查以及美联储官员的评论似乎只支持这样的结果。

This likely means that the announcements market-moving potential will come from the accompanying statement as well as the follow-on press conference with Chair Powell rather than the rate change itself. Traders will use the tone of the rhetoric in both for guidance on whether further stimulus expansion is on the menu in the near term.

这可能意味着公告市场转移的潜力将来自随附的声明以及与鲍威尔主席而不是老鼠的后续新闻发布会改变自己。交易员将利用两种言论的基调来指导短期内是否会进一步推动刺激措施。

For their part, investors see the likelihood of further easing before year-end at a commanding 90 percent. A relatively even chance is being assigned to 50bps or 75bps of additional easing (34.4 and 37.9 percent, respectively). Coupled with the end of quantitative tightening – the Feds balance sheet reduction scheme – this amounts to expectations of a rather dramatic policy shift in a very short time span.

对于投资者而言,他们认为可能会进一步放松在年底前以90%的命中率。一个相对均匀的机会被分配到50bps或75bps的额外宽松(分别为34.4和37.9%)。再加上量化紧缩的结束 - 联邦调查局的资产负债表减少计划 - 这相当于在很短的时间内实现相当戏剧性的政策转变的预期。

Once again, this seems to make the risk of a less-dovish outcome greater than the alternative. By extension, this means that the likelihood of a stronger US Dollar in the announcements aftermath is greater than that of a weaker one. Follow-on ISM and payrolls data may fractionally alter the weekly result one way or the other, but the Fed will probably have the defining say on where prices are headed.

再次,这似乎使风险较小的结果大于替代方案。通过扩展,这意味着在公告后果中美元走强的可能性大于弱势美元的可能性。后续的ISM和非农就业数据可能会以某种方式略微改变每周结果,但美联储可能会对价格走势的位置有明确的说法。

Isenção de responsabilidade:

Os pontos de vista expressos neste artigo representam a opinião pessoal do autor e não constituem conselhos de investimento da plataforma. A plataforma não garante a veracidade, completude ou actualidade da informação contida neste artigo e não é responsável por quaisquer perdas resultantes da utilização ou confiança na informação contida neste artigo.

Corretora WikiFX

IQ Option

Tickmill

ATFX

GO MARKETS

FOREX.com

EC Markets

IQ Option

Tickmill

ATFX

GO MARKETS

FOREX.com

EC Markets

Corretora WikiFX

IQ Option

Tickmill

ATFX

GO MARKETS

FOREX.com

EC Markets

IQ Option

Tickmill

ATFX

GO MARKETS

FOREX.com

EC Markets

Últimas notícias

2025: Expecativas para o Mercado Forex Brasileiro

Royal Camel: O Golpe dos Saques Retidos

EC Markets: É uma Boa Opção para Investir o seu Dinheiro?

Descubra as Corretoras ECN: Benefícios e Vantagens

O Relatório Anual de WikiFX 2024 foi lançado, venha e reivindique seu status exclusivo!

W7 Broker&Trading: Golpe dos Saques Bloqueados Atinge Brasileiros

Saxo Bank: Uma Análise Completa do Broker Multiactivos

Cálculo da taxa de câmbio