【資訊】昨夜,美聯儲說了哪些要點?

摘要:綜合鮑威爾發佈會上的表態,本次會議傾向整體偏鴿派,安撫了之前敏感的市場。雖然不少記者仍然抓著點陣圖幾位官員的點不放,但鮑威爾很快將之解讀為FOMC內部少數的不同意見,以遏制市場加息預期前移。

摘要

美聯儲大幅上調了對今年的經濟預期,小幅上調了對未來兩年的預期。(經濟預測上調,失業率預測下調,通脹預測上調)

預計今年通脹將觸達2.4%,但鮑威爾認為通脹的上行是短暫的。新框架下的聯儲希望看到通脹小幅超調,但仍希望保持穩定的長期通脹預期。

對銀行業監管以及SLR指標問題不予置評,因為未來幾天馬上就會公佈結果。

對於退出資產購買,鮑威爾給出了晦澀的觸發條件,即“substantial further progress toward our goals”。

調整了隔夜逆回購工具的用量,但似乎市場並不當件事兒(本來就幾乎沒有用量)。

Mikko的點評

綜合鮑威爾在發佈會上的表態來看,本次會議傾向整體偏鴿派,安撫了之前敏感的市場。

投資者需要關注三個要點,第一是聯儲重新擁抱了“數據依賴性”,並不斷強調自己將按照新的平均通脹目標框架行事。整場發佈會的交流內容的很大一部分都圍繞經濟預測展開,雖然不少記者仍然抓著點陣圖幾位官員的點不放,但鮑威爾很快將之解讀為FOMC內部少數的不同意見,並強調了FOMC整體仍預期維持利率水準不變,以遏制市場加息預期前移。

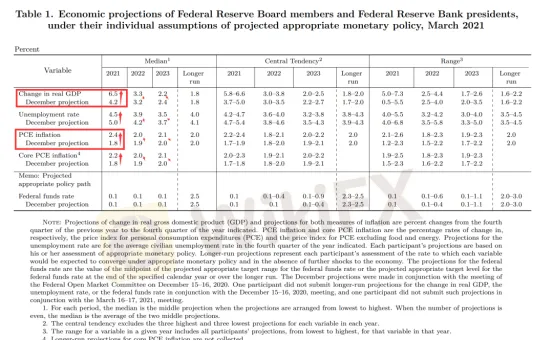

圖:有4位官員預計2022年就得開始加息

第二是聯儲雖然對今年的經濟前景比較樂觀,但是對於未來兩年的經濟走向仍然比較保守,從經濟預測上也能看出這一點。FOMC成員並不確定今年的復蘇力度是否可以延續。這和目前的市場預期是有較大分歧的(動不動就過熱、大週期和高通脹),鮑威爾營造出的政策當局與市場參與者的預期差也帶來了“鴿派”的效果。

第三是聯儲現階段對市場認知的金融穩定風險嗤之以鼻,聯儲對金融穩定風險的考量是一個框架,而不是某個單一市場的表現。因此,各種基於單一市場表現“要糖吃”的預期都是市場自身的意淫(鮑叔對記者OT的問題的態度很不屑)。

發佈會亮點問題1:有關Taper,點陣圖

鮑叔傻笑!Not yet!

We also understand that we will want to provide as much advance notice of any potential taper as possible. So when we see that we are on track, when we see actual data coming in that suggests that we are on track to perhaps achieve substantial further progress, then we'll say so. And we'll say so well in advance of any decision to actually taper.

如果做Taper會很提前跟大家做溝通,不要慌。

點陣圖的前移只是一部分官員有改變

part of that is wanting to see actual data rather than just a forecast at this point

問題2:SLR,是否影響了貨幣政策實施。

未來幾天馬上會公佈結果,拒絕回答

問題3:失業預測看什麼指標?

看一系列指標。(建議重讀Brainard的演講)

強調經濟預測(SEP)中並不包含所有聯儲官員參考的經濟指標

問題4:經濟預測的調整問題,對未來經濟很樂觀,為什麼卻不暗示加息呢?

SEP只是大家預測的集合而已,這份SEP忠於我們剛剛調整的框架。

The state of the economy in two or three years is highly uncertain, and I wouldn't want to focus too much on the exact timing of a potential rate increase that far into the future. So that's how I would think about the SEP.

未來兩三年的經濟前景不確定性很大,現在沒必要太早考慮加息的確切時間節點。

問題5:多少的通脹會讓你感到舒適?你的目標很晦澀,會不會讓市場定價對通脹更低的容忍?

is talking about inflation is one thing. Actually having inflation run above 2% is the real thing.

談論通脹是一回事,真實的通脹又是另一回事……

That's what we'd really like to do is to get inflation moderately above 2%. I don't want to be too specific about what that means because I think it's hard to do that. And we haven't done it yet.

鮑叔看上去好像對通脹沒什麼自信。

So over the years, we've talked about 2% inflation as a goal, but we haven't achieved it.

問題6:群體免疫會導致就業快速復蘇,為什麼聯儲的預測還是那麼保守?

There will still be some social distancing.

讓1000萬人重返就業崗位不可能在一夜之間完成。

問題7:10年期國債收益率的問題,其他央行表態擔心。OT的問題

I would be concerned by disorderly conditions in markets or by a persistent tightening of financial conditions that threaten the achievement of our goals.

The tools we have are the tools we have. 對OT的回答挺敷衍的,顯然沒當回事。

簡單來說就是可以,但沒必要。

問題8:就業市場族裔問題看什麼指標?疫苗注射問題

沒啥意思,看我們Brainard的那篇譯文就好。

問題9:財政政策的問題,如何影響長期經濟增長?

對短期:快速就業復蘇和保障

長期:長期投資、生產率、勞工技術

看起來鮑叔和耶倫和拜登的基建政策看似一條心了……

問題10:歐元區經濟似乎沒跟上美國,你擔心這種分化嗎?會不會拖累美國經濟增長?

復蘇確實分化了,就像上次危機後那樣。本土目標優先。

And we conduct policy, of course, here. Our focus is on -- our objectives are domestic ones.

We monitor developments abroad because we know that those can affect our outcomes.

記者問得不錯,是做過功課的記者……

鮑叔回答的表態和2017年耶倫和費希爾的論調幾乎一模一樣,即聯儲考慮外部風險的前提是外部風險會衝擊本土的政策目標。

問題11:銀行業監管問題

日後再說

問題12:加息的問題,點陣圖有人提前了加息預期,有爭論嗎?

加息的標準很明晰——雙重使命

people on the Committee broadly say that uncertainty about the forecast is very high compared to the normal level.

強調不確定性。

So you are going to have different perspectives from Committee participants about how fast growth will be, how fast the labor market will heal, how fast inflation will move up, and those things are going to dictate where people write down an estimate of liftoff.

大家預測不一樣。

It isn't meant to actually pin down a time when we might or might not lift off.

點陣圖不是告訴你說那個時點就要加息了。

That will be very much dependent on economic outcomes, which are highly uncertain.

再強調不確定性和數據依賴性。

問題13:財政政策後續

聯儲決定不了財政支出,財政政策側重於長期投資,這是貨幣政策做不到的,財政政策可以提高潛在產出。

問題14:金融穩定風險問題

是一個框架,不是一個市場的表現,記者顯然沒做過功課,根本不知道聯儲的金融穩定框架在其金融穩定報告裏已經寫得很清楚了。

問題15:SEP的問題,為什麼到了合意的緊急狀態還不加息?日本化?19年嫌利率太低現在怎麼又那麼鴿派了?

I would point out that over the long expansion, longest in U.S. history, ten years and eight months, rates were very low for -- they were at zero for seven years, and then never got above, you know, 2.4%, roughly.

美國剛經歷一輪超長的擴張期,利率維持在0的水準有7年了,即便加了息也沒超過2.4%

During that, we didn't see, actually, excess buildup of debt. We didn't see asset prices form into bubbles that would threaten the progress of the economy. We didn't see the things -- we didn't see a housing bubble. The things that have tended to really hurt an economy and have, in recent history, hurt the U.S. we didn't see them build up despite very low rates. Part of that just is that you are in a low-rate environment. You are a much lower rate environment.

這一段挺有趣的,言下之意低利率根本沒有構成任何聯儲擔心的金融穩定問題——比如資產泡沫和債務積壓。(可能政府債務反正不用還?)

The connection between low rates and the kind of financial instability issues is just not as tight as people think it is. That's not to say we ignore it. We don't ignore it. We watch it very carefully. And we think there is a connection. I would say there is, but it's not quite so clear. We actually monitor financial conditions very, very broadly and carefully, and we didn't do that before the global financial crisis 12 years ago. Now we do. And we've also put a lot of time and effort into strengthening the large financial institutions that form the core of our financial system are much stronger, much more resilient.

話說得更死了,低利率和金融不穩定的關係沒人們想的那麼緊密。但很快鮑叔又太極了一波說我們現在也在時刻關注不穩定風險的。

問題16:就業和通脹的關係

There is a relationship between wage inflation and unemployment. But that has not -- what happens is that when wages move up because unemployment is low, companies have been absorbing that increase into their margins rather than raising prices. And that seems to be a feature of late-cycle behavior.

問題17:Taper的問題

What we are saying is substantial further progress toward our goals. We will tell people when we think -- until we say -- until we give a signal, you can assume we are not there yet. And as we approach it, well in advance, well in advance, we will give a signal that, yes, we are on a path to possibly achieve that, to consider tapering. So that's how we are planning to handle it. It's not different, really, from QE3, and I think we've learned what we've learned from the experience of these last dozen years is to communicate very carefully, very clearly, well in advance, and then follow through with your communications. In this case, it's an outcome-based set of guidance, as our rate guidance is, and it's going to depend on the progress of the economy. That's why it's not appropriate to start pointing at dates yet.

別怕Taper,會提前跟你們說!

問題18:居民部門儲蓄釋放會影響通脹嗎?

大家出門消費了以後,供給又有瓶頸,就會出現價格小幅提升,但是供給會動態調整。所以是一次性的通脹拉升。

免責聲明:

本文觀點僅代表作者個人觀點,不構成本平台的投資建議,本平台不對文章信息準確性、完整性和及時性作出任何保證,亦不對因使用或信賴文章信息引發的任何損失承擔責任

天眼交易商

熱點資訊

平台展業全球卻無監管?Binomo邦耀被爆出金困難,潛藏投資危機

美國FED到底是什麼?該機構具體有什麼作用?

交易環境獲AAA評級的澳洲券商Neex好用嗎?點擊查看平台監管情形、用戶評價、運作狀況

外匯天眼警報:3/24-3/30最新外匯詐騙券商黑名單

受塞浦路斯、塞席爾監管的WisunoFX斯瑞好用嗎?監管情況、用戶評價、網站概況一次看

外匯交易涵蓋哪些關鍵要素?

匯率計算