Score

eToro

United Kingdom|15-20 years|

United Kingdom|15-20 years| https://www.etoro.com/

Website

Rating Index

Influence

Influence

AAA

Influence index NO.1

France 9.79

France 9.79Contact

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 38 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

United Kingdom

United KingdomA Visit to eToro in UK -- Finding No Office

The survey team went to London, UK, to visit the the dealer eToro and found no office at its business address. It was supposed that the dealer might just use that address to register its company, or there was no offline exhibition place. Please be prudent when trading with this broker.

United Kingdom

United KingdomAn On-Site Visit to eToro in Australia

After the on-site survey, the survey confirmed that the actual address of the Australian broker eToro is consistent with the regulatory address. It holds a MM forex license issued by ASIC (reference number: 491139), a MM forex license issued by CySEC (reference number: 109/10), a retail forex license issued by FCA (reference number 583263) and a retail forex license issued by IFSC. These licenses

Australia

AustraliaA Site Visit to eToro in Cyprus -- Regulatory Address Confirmed True

The company eToro did exist according to the investigation staff’s on-the-site visit. According to the investigation staff, the company was well located with enjoying environment but a relatively small scale.

Cyprus

CyprusA Visit to eToro in UK -- Finding No Office

The survey team went to London, UK, to visit the the dealer eToro and found no office at its business address. It was supposed that the dealer might just use that address to register its company, or there was no offline exhibition place. Please be prudent when trading with this broker.

United Kingdom

United KingdomAn On-Site Visit to eToro in Australia

After the on-site survey, the survey confirmed that the actual address of the Australian broker eToro is consistent with the regulatory address. It holds a MM forex license issued by ASIC (reference number: 491139), a MM forex license issued by CySEC (reference number: 109/10), a retail forex license issued by FCA (reference number 583263) and a retail forex license issued by IFSC. These licenses

Australia

AustraliaA Site Visit to eToro in Cyprus -- Regulatory Address Confirmed True

The company eToro did exist according to the investigation staff’s on-the-site visit. According to the investigation staff, the company was well located with enjoying environment but a relatively small scale.

Cyprus

CyprusAccount Information

Users who viewed eToro also viewed..

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Morocco

United Kingdom

France

etoro.com

Server Location

Japan

Most visited countries/areas

United States

Website Domain Name

etoro.com

Website

WHOIS.DOMAINTHENET.COM

Company

DOMAINTHENET.COM

Domain Effective Date

0001-01-01

Server IP

23.33.54.22

Genealogy

VIP is not activated.

VIP is not activated.CapTradeOptions

eToro

FR

Relevant Enterprises

MERON SHANI

Israel

Director

Start date

2023-08-04

Status

Employed

ETORO (UK) LIMITED(United Kingdom)

DAN MOCZULSKI

United Kingdom

Director

Start date

2022-05-01

Status

Employed

ETORO (UK) LIMITED(United Kingdom)

EDWARD CHARLES DRAKE

United Kingdom

Director

Start date

2021-11-29

Status

Employed

ETORO (UK) LIMITED(United Kingdom)

Company Summary

| Quick eToro Review Summary | |

| Founded in | 2007 |

| Headquarters | United Kingdom |

| Regulations | ASIC, CySEC, FCA |

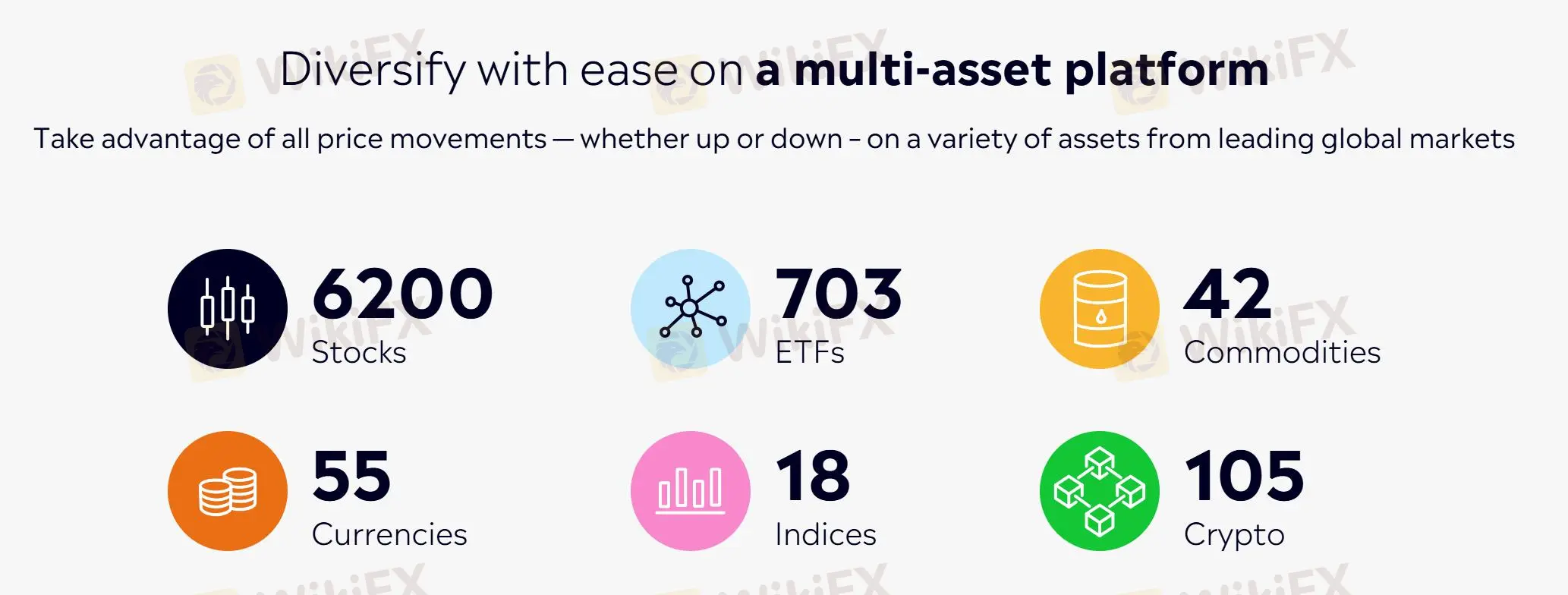

| Tradable Assets | 7,000+, 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, 106 cryptocurrencies |

| Demo Account | ✅ ($100,000 in virtual funds) |

| Min Deposit | $10 |

| Trading Fees | From 1 pip (EUR/USD) & commission-free (forex) |

| Non-Trading Fees | Withdrawal fee: Free (GBP and EUR accounts) or $5 (USD investment account) |

| Inactivity fee: $10/month applies to accounts with no logins in the previous 12 months | |

| Leverage | Up to 1:30 (retail)/1:400 (professional) |

| Trading Platforms | eToro proprietary platform, MetaTrader 4 |

| Copy/Social Trading | ✅ |

| Payment Methods | Credit/debit cards, bank transfers, PayPal, Neteller, Skrill |

| Customer Support | / |

Overview of eToro

eToro is a multi-asset social trading platform that has gained widespread popularity among investors, traders, and social media enthusiasts since its inception in 2007. It offers users access to a wide range of financial instruments, including stocks, cryptocurrencies, forex, indices, and commodities, among others. The platform provides a user-friendly interface that caters to both novice and experienced traders alike, making it one of the most popular trading platforms on the market.

One of eToro's standout features is its social trading capabilities, which allow users to copy the trades of successful traders and build their investment portfolios. The platform has a large community of traders who share insights, strategies, and knowledge, making it an excellent learning resource for traders looking to improve their skills.

Pros & Cons

eToro's user-friendly interface, range of trading assets, and social trading features have made it popular among both beginner and experienced traders.

However, as with any trading platform, eToro has its pros and cons, which potential users should consider before signing up.

In this section, we will discuss the advantages and disadvantages of using eToro as a trading platform.

| Pros | Cons |

| User-friendly and easy-to-use platform | Inactivity fee charged after 12 months of inactivity |

| Regulated by reputable financial authorities | $5 withdrawal fee for the USD investment account |

| Copy trading and social trading features | Limited contact options |

| Demo accounts available for practice |

Is eToro Legit?

eToro is a legitimate and regulated online brokerage firm that has been operating since 2007.

It is licensed and regulated by several reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

| Regulated Country | Regulated by | Regulated Entity | License Type | License Number |

| ASIC | ETORO AUS CAPITAL LIMITED | Market Making (MM) | 000491139 |

| CySEC | Etoro (Europe) Limited | Market Making (MM) | 109/10 |

| FCA | eToro (UK) Ltd | Straight Through Processing (STP) | 583263 |

The company is also a member of the Investor Compensation Fund, which provides additional protection for traders' funds.

However, as with any investment platform, there are risks involved in trading, and traders should always be aware of the potential risks and take steps to protect their investments.

Market Instruments

eToro offers a wide range of financial instruments for traders to choose from, covering various markets globally.

Traders can access more than 7,000 assets, including 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, and 106 cryptocurrencies.

With this wide range of instruments available, traders can diversify their portfolios and explore various markets to find the best investment opportunities.

| Asset Class | Supported |

| Stocks | ✔ |

| ETFs | ✔ |

| Commodities | ✔ |

| Currencies | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

Leverage

eToro offers leverage for trading various financial instruments. The maximum leverage provided by eToro varies depending on the instrument and the jurisdiction of the client.

| Asset Class | Max Leverage (Reatil) | Max Leverage (Professional) |

| Major forex pairs | 1:30 | 1:400 |

| Commodities | 1:20 | 1:100 |

| Stocks | 1:5 | |

It is noted that high leverage can amplify your potential returns, but more importantly, it can increase your risks.

Spreads and Commissions

The spread for EUR/USD pair is from 1 pip, which is more competitive than most other brokers. If you are interested in spreads on other trading instruments, you can directly visit https://www.etoro.com/trading/fees/cfd-spreads/

As for commissions, if you trade on ETFs or CFDs, there is no commission. However, there is a commssion of $1 or $2 for stock trading and 1% commission for crypto trading.

| Asset Class | Commission |

| Stock | $1/2 |

| ETFs | ❌ |

| Crypto | 1% |

| CFDs | ❌ |

Fees

On eToro, account opening and management are both free of charge. However, withdrawal fee, inactivity fee, and conversion fee are charged, and you can find detailed info in the table below:

| Account Opening Fee | ❌ |

| Management Fee | ❌ |

| Withdrawal Fee | Free (GBP and EUR accounts) or $5 (USD investment account) |

| Inactivity Fee | $10/month applies to accounts with no logins in the previous 12 months |

| Conversion Fee | 0.75% |

Trading Platform

eToro offers its proprietary trading platform, which is designed to be user-friendly and intuitive, particularly for novice traders. The platform provides a variety of tools and features, including real-time market data, advanced charting tools, and an easy-to-use order entry system.

One of the most notable features of the eToro platform is its social trading functionality, which allows users to follow and copy the trades of successful traders. This feature is particularly appealing to new traders who may lack the knowledge or experience to make their own trades.

In addition to its proprietary platform, eToro also supports the popular MetaTrader 4 (MT4) platform, which is widely used by traders around the world. MT4 is known for its advanced charting capabilities, extensive library of technical indicators, and the ability to automate trading strategies through the use of Expert Advisors (EAs).

Deposits & Withdrawals

Deposit

eToro accepts multiple payment methods, including credit/debit cards, bank transfers, and e-wallets such as PayPal, Neteller, and Skrill.

The minimum deposit amount is $10, which is relatively low compared to other brokers in the industry.

Deposits are usually processed instantly or within one business day, depending on the payment method.

eToro does not charge any deposit fees, but some payment providers may have their own fees.

eToro allows you to withdraw funds using the same payment methods as deposits.

Withdrawal

The minimum withdrawal amount is $30, and there is a withdrawal fee of $5 for USD investment account, while free for GBP and EUR accounts.

Withdrawals are usually processed within one business day, but it may take longer for bank transfers.

Before making a withdrawal, you need to verify your identity and complete the necessary KYC (Know Your Customer) procedures.

eToro also has a policy of returning funds to the original payment method used for deposits, whenever possible.

When it comes to educational resources, Toro offers a variety of educational content to help traders improve their skills and knowledge of the financial markets.

These resources include but are not limited to:

- eToro Academy: This is an online education portal that provides traders with a wide range of educational materials, including articles, videos, webinars, and courses on various topics such as trading strategies, market analysis, risk management, and more.

- Trading Guides: eToro also offers a series of trading guides that provide in-depth information on various trading topics, including stocks, commodities, currencies, and indices.

- Market News and Analysis: eToro provides traders with up-to-date news and analysis on the financial markets. This includes daily market updates, weekly market analysis, and other educational content.

More other educational resources can be found on its official website.

Conclusion

Overall, eToro is a reputable and user-friendly online trading platform that offers a wide range of financial instruments and trading options to its clients. Its innovative social trading features, intuitive platform, and excellent customer service make it an attractive choice for both beginner and experienced traders. However, it does have some drawbacks, such as withdrawal and inactivity fees charged, as well as limited direct contact channels.

FAQs

Is eToro a regulated broker?

Yes, eToro is a regulated broker. It is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) in Europe, the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC) in Australia.

What trading instruments are available on eToro?

eToro offers 7,000+ trading instruments, including 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, and 106 cryptocurrencies.

Does eToro offer a demo account?

Yes, eToro offers a demo account that allows you to practice trading with up to $100,000 virtual funds. The demo account is free and can be used for an unlimited period of time.

Keywords

- 15-20 years

- Regulated in Australia

- Regulated in Cyprus

- Regulated in United Kingdom

- Market Maker (MM)

- Straight Through Processing (STP)

- Global Business

- Belize Retail Forex License Revoked

- High potential risk

News

News eToro Adds ADX Stocks to Platform for Global Investors

eToro now offers stocks from the Abu Dhabi Securities Exchange, giving global investors access to leading UAE companies in sectors like energy, finance, and healthcare.

2025-02-21 11:27

News eToro has teamed up with Stocktwits to Expand Retail Trading Access

In a bold move to enhance retail traders' access to global financial markets, eToro has teamed up with Stocktwits, a popular social platform for retail traders. The collaboration, which integrates the power of social media with trading tools, will introduce new features designed to streamline trading and foster a more engaged community of investors.

2025-01-25 11:29

News Is eToro Leaving London to Focus on a $5B U.S. IPO in 2025?

eToro plans a $5B U.S. IPO in 2025, shifting focus from London to the U.S. market. Discover details on eToro's valuation, SEC filing, and future in fintech.

2025-01-23 17:01

News Trump's Entry in Crypto Market: Launched "$Trump" Cryptocurrency

Since its debut, this coin has attracted a lot of trading activity. This currency is generating interest and debate among supporters and opponents.

2025-01-21 17:06

News eToro Pushes U.S. IPO Plans Amid $1.7B Valuation Drop

eToro plans U.S. IPO for Q2 2025 despite valuation drop from $10B to $1.7B. Goldman Sachs leads, aiming to tap crypto surge and retail trading growth.

2024-12-11 15:46

Exposure ASIC sues eToro!

ASIC has taken legal action against eToro Aus Capital Limited (eToro), an online investment platform, in the Federal Court.

2023-08-03 17:11

Comment 58

Within 1 year

Indonesia

Content you want to comment

Please enter...

Comment 58

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

prastawa

Indonesia

Please return my money

Exposure

2024-05-31

FX8021856382

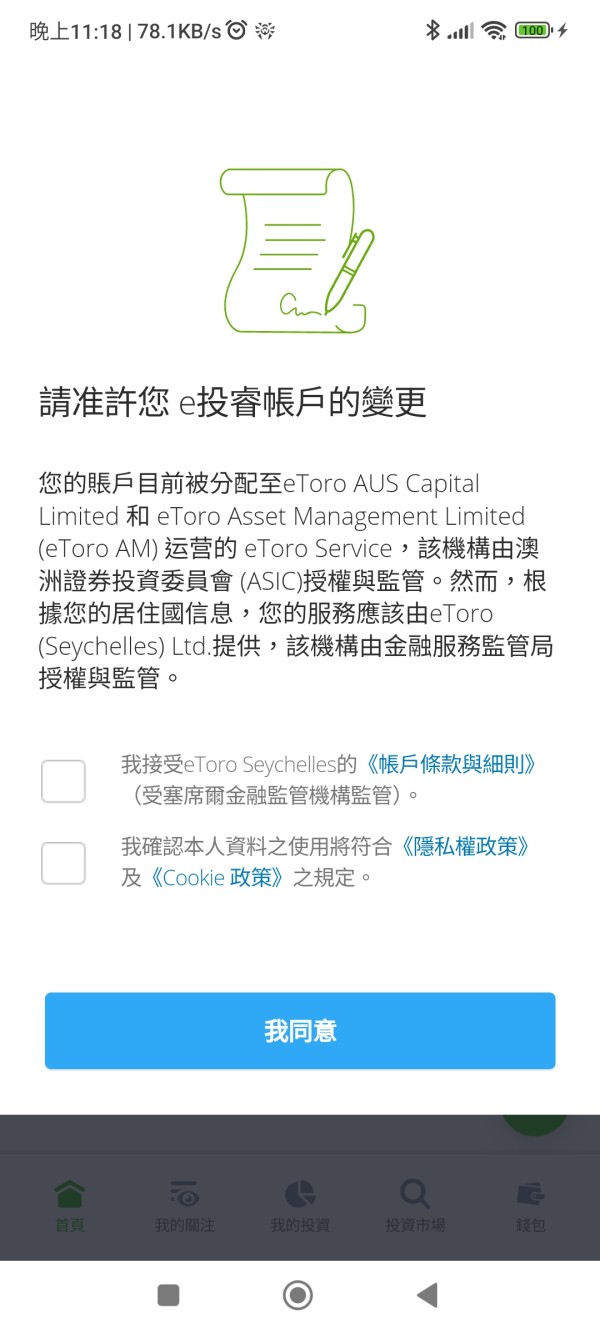

Taiwan

etoro requires the regulation of other regions before allowing you to trade, but this regulatory guarantee is not as good as the original one!

Exposure

2024-03-19

alma9252

Peru

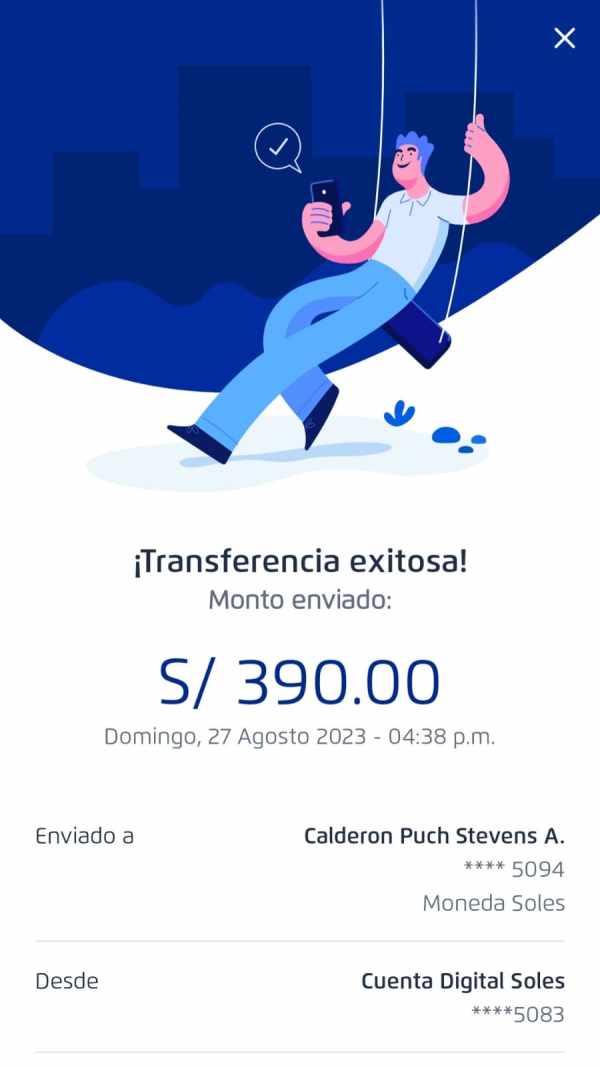

Today unfortunately I was scammed by a company called EFE-Mall that supposedly operates in Lima-Peru. Everything was going well, I started activating the account with 12 soles, and for each task I completed they deposited me, and later they assigned me more tasks where they wanted me to deposit more and I did it, until they asked me for the highest figure of almost 1400 soles but I didn't deposit it, because it's a lot, now they don't want to deposit the proceeds because they say that I must finish carrying out the entrusted task, which is 1400 soles. The last deposit I made was 390 soles as well as 100, 50, 26, 12, and 10 soles. In total deposited is 588 soles. I just want my money back.

Exposure

2023-08-28

Anson9942

Malaysia

Unable to withdraw the amount and after a period of time the amount is returned and $20 is deducted. The reason given is that my receiving bank refused to accept the amount.

Exposure

2023-06-21

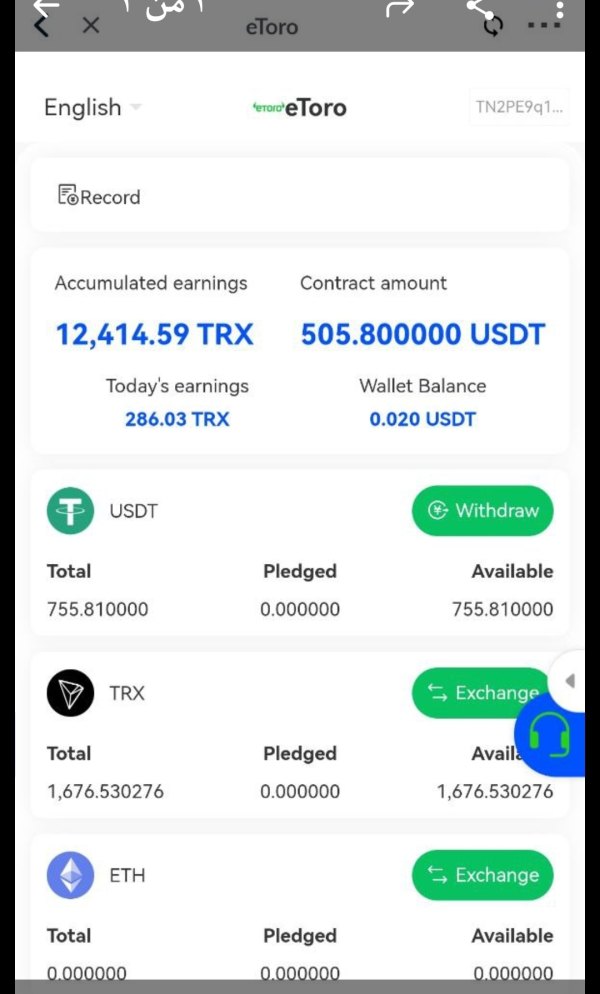

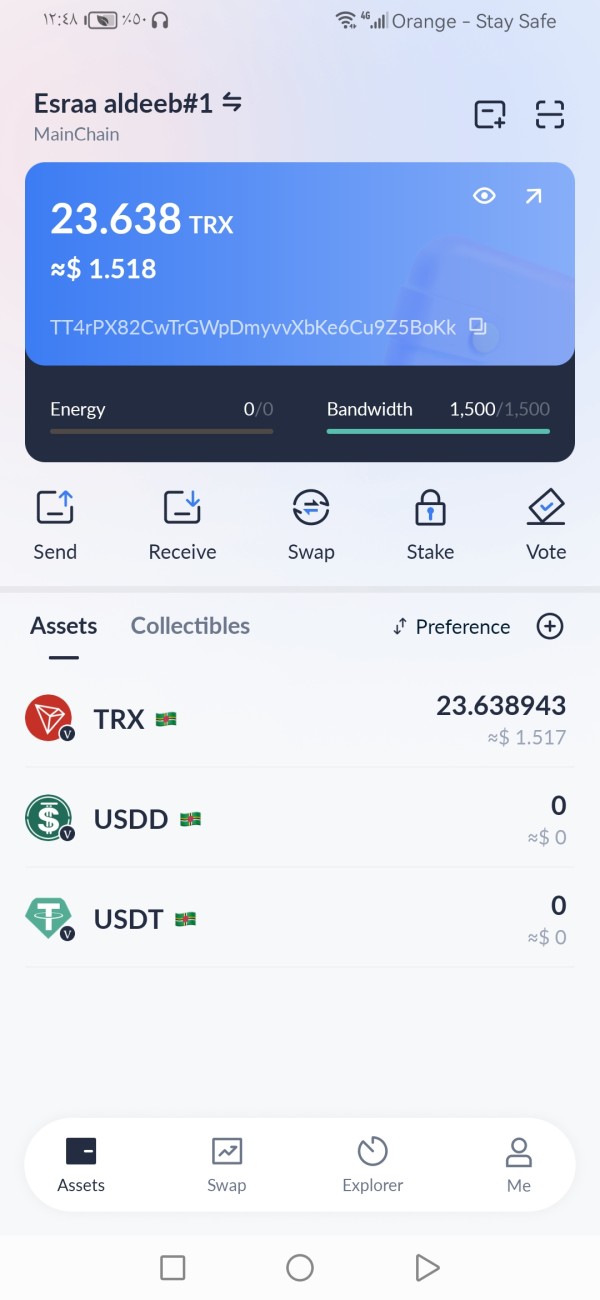

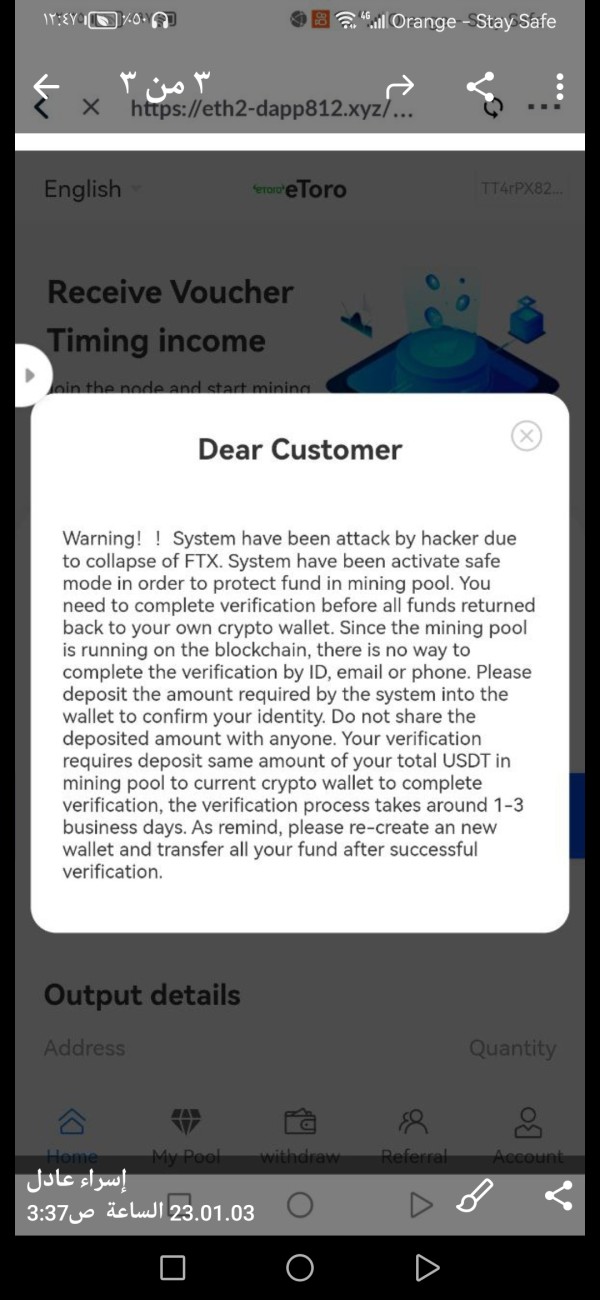

Esraa

Egypt

Whenever I deposit in the Tron Link wallet and register for mining with the Divi system, the deposit funds are withdrawn with profits, and I cannot take them out to the wallet again, although I spoke with a customer about this problem, they ask me to deposit the same money that is inside my mining pool, and I cannot deposit again because The total amount of money is 500 dollars, but I have the capacity for this amount. Really, I am very sad because I needed this money to sponsor my mother’s treatment, but what should I do?

Exposure

2023-02-06

FX3508054503

Hong Kong

Toro and ITGFX are partners with authrization, and ITGFX platform has absconded, please help me

Exposure

2022-08-10

Fx4679443

United Kingdom

I bought a product with no overnight fees. I held this product for 1.5 years. Then one day they decided to start charging me overnight holding fees. The fees amounted to $19900 and I only had $128000 in the account. Literally 15% of my account they sucked out in fees with no notification that fees were changing. I knew it was scam i had to involve Assetsclaimback/com against insolvency.

Exposure

2022-07-06

FX3723976012

Taiwan

On 2021 Nov 10, intc closed at 50.76 . On Nov 11, I placed a buy limit order at 50.76 . However, etoro strategically interpreted as that my order was 1 cent higher than market price, 50.75 . etoro filled my buy order at 51.05 , which was the open price on Nov 11.

Exposure

2021-11-12

FX2046354843

Philippines

I deposited over $1200. THEY WILL NOT COMMUNICATE, AND ALL CAPITAL PLUS PROFIT IS LOST. etoro is a thief, and all there organization is a scam. I will never invest any money with these people, Because I will never see it again. They will take all your money and leave you nothing.

Exposure

2021-09-19

FX3517856271

Philippines

Etoro is good since you want to withdrawal your money.There is many problems with etoro when you want to get your money back. My story is really simple, i start use etoro and put 5000$ on the account, then all my document (bank & identity card) where fasted verified.After 2 weeks, i win 12000$ then i wanted to withdrawal from etoro. the problem has begin :First things, the withdrawal process is LONNNG, all is done to discourage you, and when you finally reach the end of process, the window show this message “ANN ERROR OCCURED, PLEASE TRY AGAIN”I try many many times to do a withdrawal without succes.Then i decided to contact etoro…After 10 days i never have any “HUMAIN” responses, only robots says “We are still working on your request”Then, 10 days after, i finally receved a mail from etoro that precise that my account and money is bloked because the bank account is not verified ??? WHAT THE FUCK ? they verified it well on deposit …Now, the account is blocked and i loose 12000$ on etoro.please, just go away from etoro, etoro is scam, etoro is a robber, etoro will never paybaks you.If you loose money (90% of user loose) you will never heard this, but if one day you win, you will never see your money back.

Exposure

2021-09-14

FX2046354843

Philippines

Last December 24th I withdrew funds from my trading account. I used the wire transfer method to withdraw money. But they did not transfer my money into my account. I have emailed them regarding this matter. They replied me they did that in order for safety purposes of their clients’ funds. Now I have to send another ID confirmation, But still they are just replying my funds is process. After 3 Months, still receive my money.

Exposure

2021-09-14

Rey

Philippines

My first deposit was $3000 for a good start. I made a good profit of the deposited money. And I was encouraged by their advice that to be able to have a high profit income I will double my deposit so that I could have $100,000 in 3 months of trading. They are starting to be rude. Sometimes they will not answer my emails. That’s why I decided to withdraw all the money including my profit. But the request that I sent was rejected. I sent them an email and they called me back and offered to retrieve the money for me but I have to pay 10% up front and then 10% after, of the full amount of profit that I have. I haven’t paid them anything. And now there are ignoring me.

Exposure

2021-09-11

FX3028049359

Philippines

I'm from philippines and now it's nearly one month that I'm waiting for my money. I asked those of customer service in the chat and they told me that I don't have to worry because I just have to be patient, others told me that I must speak with my manager who can authorize it but incredibly he always was unavailable. When finally I could speak to him he told me that manually and for this reason it take a lot of time to process it. I think that he could find a lie more serious than this because I don't think there could be someone in this earth who can believe this. Now, I will write to all responsibles of ThinkMarkets that I can find in their web and if I still receive this kind of answers I will write to the CYSEC.

Exposure

2021-09-10

FX3028049359

Philippines

This is total fraud. I was never aware of any delays during dates 20 to 24th of December 2020, on their platform, and I certainly did not develop a strategy based on them. I can’t believe this company is actually licensed.Can’t get any more unfair than this.

Exposure

2021-09-08

iamjayylopezz

Philippines

After using etoro trading platform for two years, I realized by myself that my account was completely blocked, strange situation since I had not been given any notice. I couldnt open new positions, withdrawals were automatically rejected. Panic! I tried to get in touch with the company but it was in vain, I was ignored every time. At some point I thought their servers had been hacked. I discovered 7494.89 USD had been silently wiped out from my balance. I got really worried.

Exposure

2021-08-20

Lobo del Dolar

Argentina

They promised good profits and commission from a year ago. I deposited and gained a lot and wanted to withdraw. But they did not allow me to take it away. I complained and argued. This did not work.

Exposure

2021-08-13

FX1264817592

Colombia

Hi friends! Some time ago, a person named José Lizarraga contacted me on WhatsApp and invited me to use Bull. He told me that I could start generating huge profits with $400. He acted as a middleman with a broker and he helped me create an account. These, I deposited 400 US dollars, why did he say that he would give me another 100 US dollars for him to deposit into my account, and he would not reply to me after the deposit?

Exposure

2021-06-29

FX1378754589

Colombia

They send me an email saying that they cannot verify my TC but the payment has already been collected, and they do not respond to me for that money

Exposure

2021-06-22

FX7057704892

Venezuela

This so-called broker lacks ethics and professionalism. I invested 199 US dollars here. Thanks to my knowledge, I got 1,455 US dollars. How do you see in the picture and they are crazy when withdrawing money, on my account Nothing, please solve! !

Exposure

2021-06-18

FX2878625199

Costa Rica

They emailed me and asked me to offer some infor required by them. But then, I tried to contact them, no one replied to me

Exposure

2021-06-18