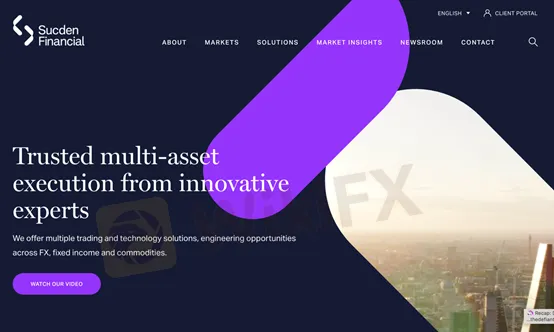

General Information

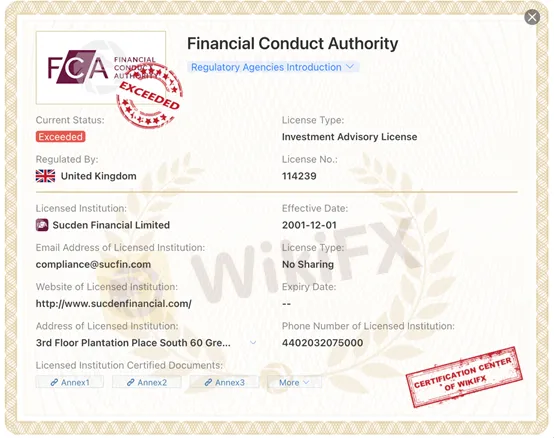

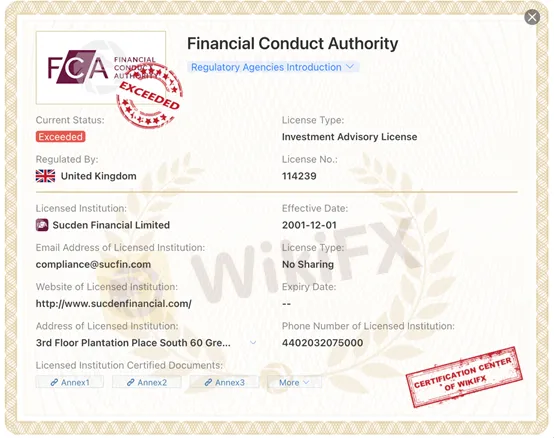

Sucden Financial Limited is a regulated brokerage firm headquartered in the United Kingdom. It holds an Investment Advisory License from the Financial Conduct Authority (FCA) with license number 114239. The company's address is 3rd Floor Plantation Place South, 60 Great Tower Street, London, EC3R 5AZ, United Kingdom. While Sucden is regulated by the FCA, there are potential risks associated with this broker.

According to available information, Sucden has exceeded its authorized business scope regulated by both the FCA in the UK and the National Futures Association (NFA) in the United States. The NFA lists Sucden as “Unauthorized” with license number 0403214. This warning indicates the need for caution and awareness of potential risks when considering this broker.

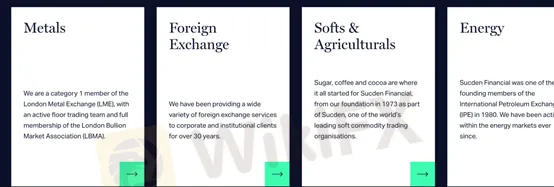

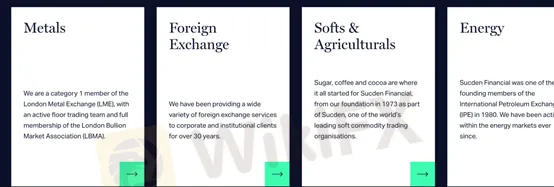

Sucden Financial offers a diverse range of market instruments across various sectors. In metals, they provide access to base metals, precious metals, steel, and iron ore markets, offering liquidity and risk management solutions. They are a Category 1 member of the London Metal Exchange (LME) and a full member of the London Bullion Market Association (LBMA). In foreign exchange (FX), Sucden provides FX spot, forwards, swaps, options, and more, along with credit intermediation and clearing services. They also offer execution and clearing services for futures and options contracts in softs and agriculturals, as well as energy markets, and provide access to the worldwide fixed income markets.

Sucden Financial tailors its services to different types of clients. For corporates, they offer commodity and FX hedging solutions, cash flow protection, and large corporate transaction facilitation. Financial institutions benefit from execution and clearing services, liquidity sourcing, and prime brokerage solutions. Brokers can access FX liquidity, market hedging, and execution or clearing services. Sucden uses various trading platforms, including CQG, STAR (proprietary), and TT, which offer advanced trading tools, connectivity to exchanges, and mobile trading capabilities.

While Sucden Financial Limited is regulated by the FCA, the warning about exceeding authorized business scope and the unauthorized status from the NFA should be taken into consideration when evaluating the potential risks associated with this broker.

Pros and Cons

Sucden Financial Limited has both pros and cons that should be considered when evaluating the brokerage firm. On the positive side, Sucden is regulated by the Financial Conduct Authority (FCA) in the United Kingdom, providing a level of oversight and accountability. They offer a wide range of market instruments, including metals, foreign exchange, softs and agriculturals, energy, and fixed income, catering to different trading preferences. Additionally, Sucden provides tailored solutions for corporates, financial institutions, and brokers, ensuring that clients' specific needs are met. They offer multiple trading platforms, including CQG, STAR, and TT, which provide advanced trading tools and connectivity to various exchanges. However, there are potential risks associated with Sucden as they have exceeded their authorized business scope regulated by the FCA and are marked as “Unauthorized” by the National Futures Association (NFA) in the United States. This warning suggests that caution should be exercised when considering Sucden as a broker.

Is Sucden Legit?

Based on the provided information, it appears that Sucden Financial Limited is regulated by the Financial Conduct Authority (FCA) in the United Kingdom. The license number is 114239, and the license type is an Investment Advisory License. The institution's address is 3rd Floor Plantation Place South, 60 Great Tower Street, London, EC3R 5AZ, United Kingdom.

However, there is a warning indicating a low score and potential risks associated with this broker. The information states that the broker has exceeded the business scope regulated by both the FCA in the UK and the National Futures Association (NFA) in the United States. The NFA license number is 0403214, and the official regulatory status is mentioned as “Unauthorized” by the NFA.

It's important to note that the warning suggests being cautious and aware of the potential risks involved with this broker.

Market Instruments

Sucden Financial offers a wide range of market instruments in different sectors:

1. Metals: Sucden Financial is active in base metals, precious metals, steel, and iron ore markets. They offer multiple access points and solutions for price risk and liquidity. They are a Category 1 member of the London Metal Exchange (LME) and a full member of the London Bullion Market Association (LBMA). They provide execution and clearing services for metal futures and options contracts.

2. Foreign Exchange (FX): Sucden Financial provides superior FX liquidity and a full range of FX services. They offer access to the most liquid financial market and provide FX spot, forwards, swaps, options, and more. They offer third-party credit intermediation, direct ECN access, and FX clearing. They also offer customised eFX solutions and OTC FX options.

3. Softs and Agriculturals: Sucden Financial offers comprehensive execution and clearing services for futures and options contracts on European and US exchanges in the softs and agricultural commodities market. They provide hedging, risk management assistance, and facilitation for corporations, traders, processors, producers, financial institutions, hedge funds, and investors active in the commodity futures and options markets.

4. Energy: Sucden Financial has been active in the energy markets since 1980. They offer energy clearing and execution services for listed futures and options. They are a member of ICE Futures Europe and cover all the main listed products on NYMEX. They provide direct electronic market access and expert hedging and risk management assistance.

5. Fixed Income: Sucden Financial provides access to the worldwide fixed income markets. They offer electronic (FIX) API and voice-execution solutions, trade assistance, and liquidity sourcing for a wide range of fixed income markets.

Solutions for Accounts

Sucden Financial offers tailored solutions for different types of clients:

1. Corporates: Sucden Financial provides wide-ranging corporate services, understanding the aims and objectives of large corporations. They offer commodity and FX hedging solutions to identify and manage price and market risks. They can assist with managing FX exposure as part of a commodities strategy, protecting cash flows in foreign currency, and facilitating large corporate transactions. They offer bespoke OTC FX options and deliverable FX products.

2. Financial Institutions: Sucden Financial has a strong history of working with various financial institutions, including banks, proprietary trading firms, hedge funds, pension funds, and asset managers. They provide customized solutions for execution and clearing, liquidity sourcing, and prime brokerage services. Their expertise covers commodities, fund services, eFX, and FX options. They offer voice and electronic DMA multi-asset execution and clearing solutions.

3. Brokers: Sucden Financial offers tailored solutions for brokers across different markets. They provide FX liquidity, market access for hedging requirements, and execution or clearing solutions. They can act as a counterparty and offer a broad product offering, including crosses in FX, precious metals, and spot energy contracts. They have a principal trading model, margin terms, and white-label services.

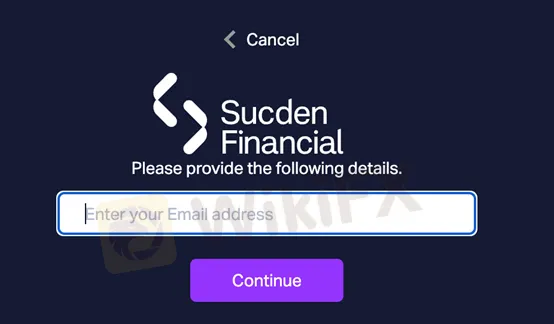

How to Open an Account?

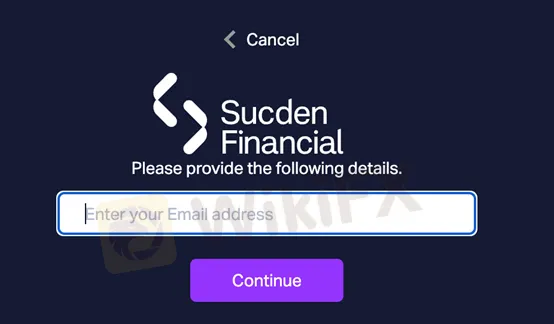

To open an account with Sucden, follow these steps:

1. Visit the Sucden website and navigate to the Client Portal section.

2. On the Client Portal page, you will be prompted to provide your email address.

3. Enter your email address in the designated field.

4. Submit your email address by clicking the appropriate button or link.

5. Check your email inbox for a confirmation email from Sucden.

6. Open the email and follow the instructions provided to continue the account opening process.

7. You may be required to provide additional personal information, such as your full name, contact details, and relevant financial information.

8. Fill out the required forms and submit any necessary documentation as requested.

9. Review and agree to the terms and conditions of opening an account with Sucden.

10. Once your application has been reviewed and approved by Sucden, you will receive further instructions on how to proceed, such as funding your account and accessing trading platforms.

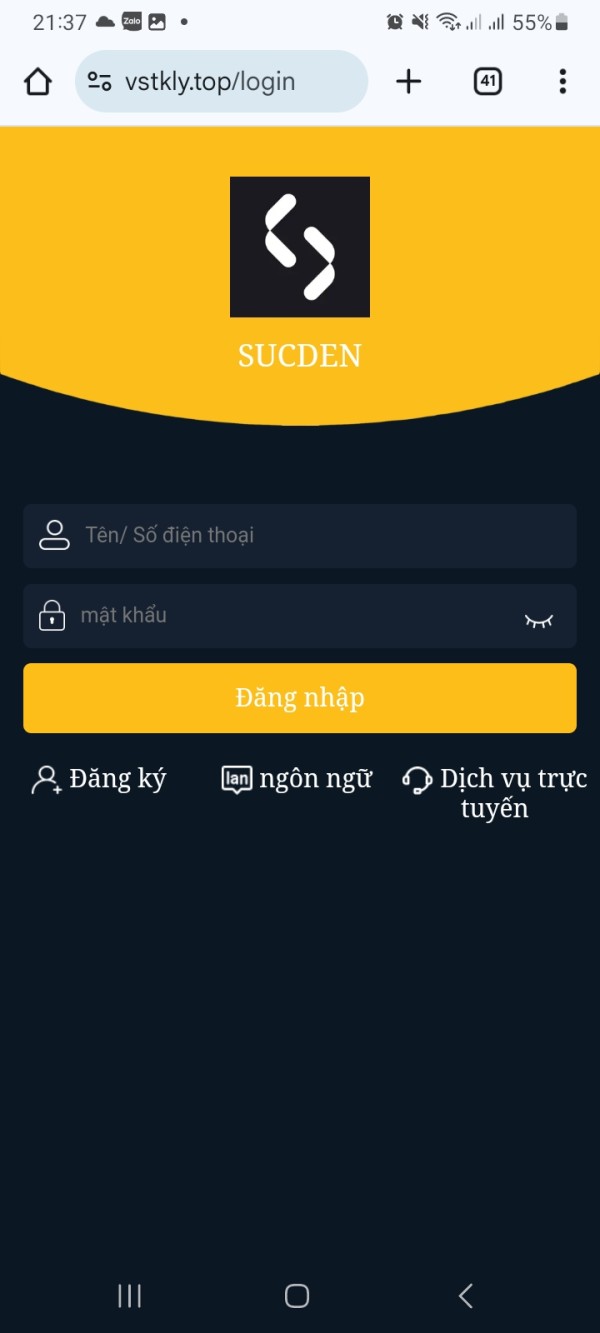

Trading Platform

Sucden offers a range of trading platforms to cater to the diverse needs of its clients. Here is a brief overview of the trading platforms provided by Sucden:

1. CQG: Sucden supports the CQG platform, which offers advanced trading and analytical tools for futures and options trading.

2. STAR: Sucden's proprietary trading system, STAR, is available exclusively for clients and internal execution desks. STAR connects with major exchanges such as CME, ICE, and the London Metal Exchange, providing access to a unique prompt-date structure. It offers a user-friendly interface, advanced features, risk controls, and integration with mobile trading apps.

3. TT: Sucden supports the TT platform, which is known for its fast and reliable trading technology. TT provides access to a wide range of markets and offers advanced order types, risk management tools, and customizable trading interfaces.

Sucden also emphasizes connectivity in its trading systems. They offer electronic exchange connectivity to various exchanges, including ASX, CME/GLOBEX, Euronext Paris, HKEX, SGX, LME, and more. Sucden uses a hybrid approach to technology, combining in-house systems with third-party applications to ensure access to the most suitable solutions for clients. They maintain communication line resilience, data center architecture, and backup systems for stability in trading operations.

For foreign exchange (FX) trading, Sucden offers connectivity to over 20 FX platforms, providing access to liquidity pools, ECN central limit order books, and low-latency connectivity through data centers in LD4, NY4, and TY3.

Sucden's trading platforms cater to a broad spectrum of clients, including brokers, proprietary trading houses, hedge funds, and their internal execution desks. They provide user-friendly interfaces, multiple order types, integrated order books and risk management, strategy creators, option calculators, and white-labeling opportunities.

Sucden's trading platforms are supported by their 24-hour trade support experts who provide rapid assistance via telephone and email. Additionally, Sucden offers mobile trading apps for Android and iOS devices, allowing clients to monitor and react to market movements on the go.

Trading Tools

Sucden offers a range of trading tools to assist clients in navigating the markets. These tools include market insights, research reports, and analysis provided by Sucden's research team and experienced brokers. The insights cover a broad range of markets, including metals, foreign exchange (FX), soft commodities, and the electric vehicle and battery materials market.

The Metals Outlook provides analysis on the metals market, discussing factors such as demand, supply chain issues, and economic growth. The FX Outlook offers insights on recent developments in select currency pairs, while the Soft Commodities Outlook focuses on technical analysis and charts for key sugar, cocoa, and coffee contracts. The EV & Battery Materials Outlook provides updates on the transition to renewable energy and government policies supporting electric vehicle sales, along with a fundamental outlook for materials like nickel, cobalt, and lithium.

Sucden also produces reports and analysis specific to each market. The Quarterly Metals Report offers an in-depth analysis of base, precious, and ferrous metal markets, while the Daily Base Metals Report provides market news and closing prices for various metals. The Monthly FX Outlook and Weekly FX Options Analysis offer commentary and analysis on the foreign exchange market, and the Coffee Market Outlook provides a long-term perspective on the coffee market.

Additionally, Sucden's Perspectives provide insights into market events and trends, covering a range of topics and markets. These perspectives aim to provide clarity and trading ideas during uncertain times.

To stay updated on the latest updates and upcoming events, clients can visit Sucden's Newsroom. For press inquiries, there is a press team that can be contacted using the form provided on the contact page or by calling +44 (0)20 3207 5280.

Customer Support

Sucden Financial provides customer support to its clients through various channels. Clients can reach out to Sucden Financial Limited in London by calling +44 (0)20 3207 5000 or emailing info@sucfin.com. The London office is located at Plantation Place South, 60 Great Tower Street, EC3R 5AZ, United Kingdom.

For clients in Hong Kong, Sucden Financial (HK) Limited can be contacted at +852 3665 6000 or hk@sucfin.com. The Hong Kong office is situated at Unit 1001, 10/F., Li Po Chun Chambers, 189 Des Voeux Road Central, Hong Kong, China.

In New York, clients can reach Sucden Futures Inc. by calling +1 212 859 0296 or emailing ny@sucfin.com. The New York office is located at 156 West 56th Street, 12th Floor, New York, NY 10019, United States.

Conclusion

In conclusion, Sucden Financial Limited is a regulated brokerage firm offering a range of market instruments and tailored solutions for different types of clients. While they are regulated by the Financial Conduct Authority (FCA) in the United Kingdom, there are potential risks associated with Sucden as they have exceeded the business scope regulated by both the FCA and the National Futures Association (NFA) in the United States, with their NFA regulatory status listed as “Unauthorized.” Despite this, Sucden provides a variety of trading platforms, trading tools, and customer support options. Their diverse offerings in metals, foreign exchange, softs and agriculturals, energy, and fixed income markets make them appealing to traders and investors. However, caution should be exercised due to the mentioned risks and regulatory concerns.

FAQs

Q: Is Sucden Financial Limited regulated?

A: Yes, Sucden Financial Limited is regulated by the Financial Conduct Authority (FCA) in the United Kingdom. Their license number is 114239, and they hold an Investment Advisory License.

Q: What is the address of Sucden Financial Limited?

A: Sucden Financial Limited is located at 3rd Floor Plantation Place South, 60 Great Tower Street, London, EC3R 5AZ, United Kingdom.

Q: Are there any potential risks associated with Sucden Financial?

A: Yes, there is a warning indicating a low score and potential risks associated with Sucden Financial. The broker has exceeded the business scope regulated by both the FCA in the UK and the National Futures Association (NFA) in the United States. The NFA has listed their regulatory status as “Unauthorized.”

Q: What market instruments does Sucden Financial offer?

A: Sucden Financial offers a wide range of market instruments in different sectors. They are active in base metals, precious metals, steel, iron ore, foreign exchange (FX), softs and agriculturals, energy, and fixed income markets.

Q: What solutions does Sucden Financial offer for different types of clients?

A: Sucden Financial provides tailored solutions for various types of clients. They offer commodity and FX hedging solutions for corporates, execution and clearing services for financial institutions, and solutions for brokers across different markets.

Q: How can I open an account with Sucden Financial?

A: To open an account with Sucden Financial, you need to visit their website and navigate to the Client Portal section. Provide your email address, follow the instructions in the confirmation email, fill out the required forms, submit necessary documentation, review and agree to the terms and conditions, and await approval from Sucden Financial.

Q: What trading platforms does Sucden Financial provide?

A: Sucden Financial offers multiple trading platforms, including CQG, STAR (their proprietary trading system), and TT. These platforms provide advanced trading tools, risk management features, and connectivity to various exchanges and liquidity pools.

Q: What trading tools does Sucden Financial offer?

A: Sucden Financial provides a range of trading tools, including market insights, research reports, and analysis. They cover markets such as metals, foreign exchange (FX), soft commodities, and the electric vehicle and battery materials market.

Q: How can I contact Sucden Financial for customer support?

A: You can contact Sucden Financial Limited in London by calling +44 (0)20 3207 5000 or emailing info@sucfin.com. For Hong Kong, you can reach them at +852 3665 6000 or hk@sucfin.com. In New York, the contact number is +1 212 859 0296 or email ny@sucfin.com.

FX2008307174

Vietnam

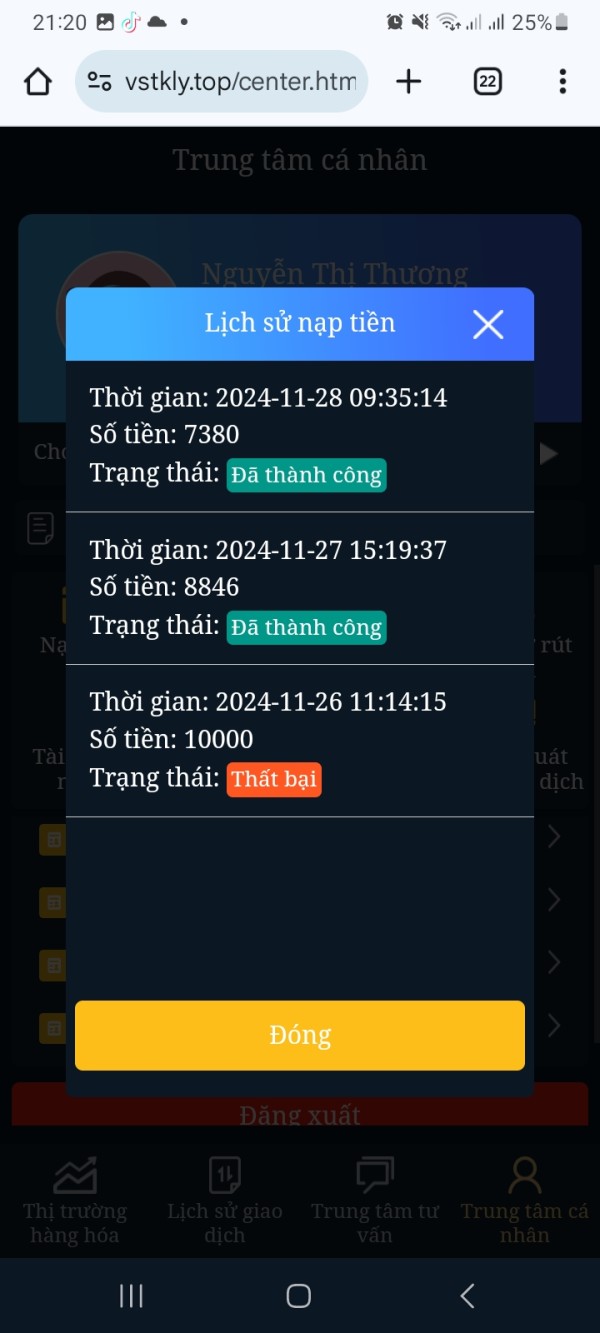

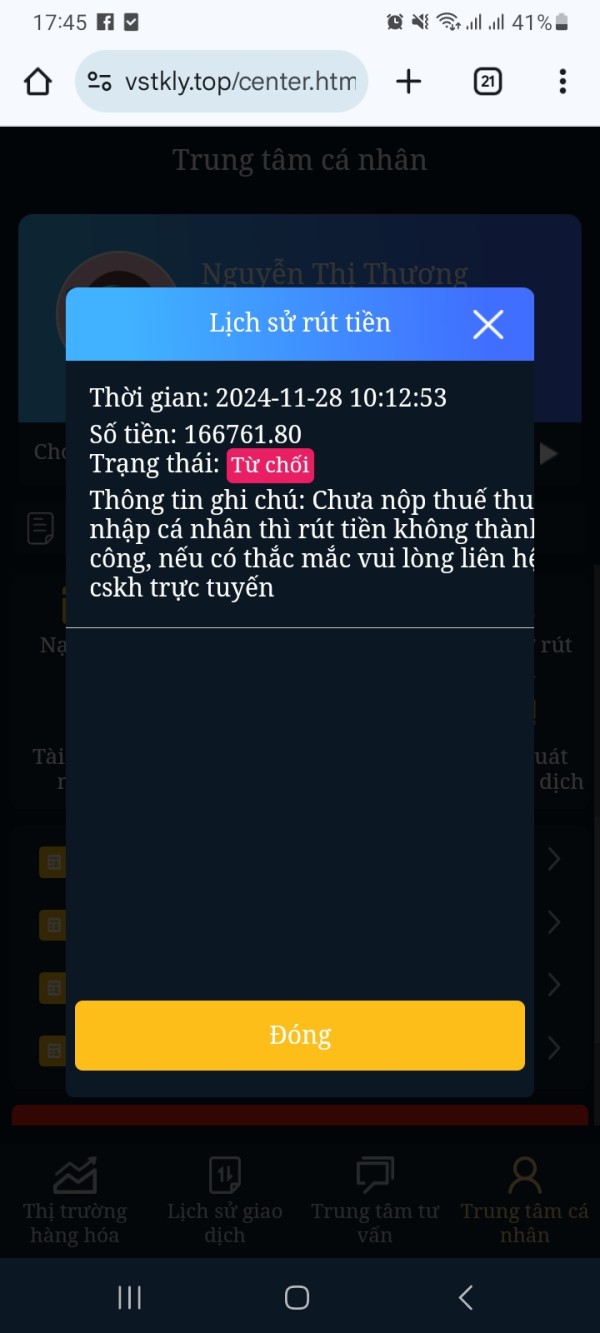

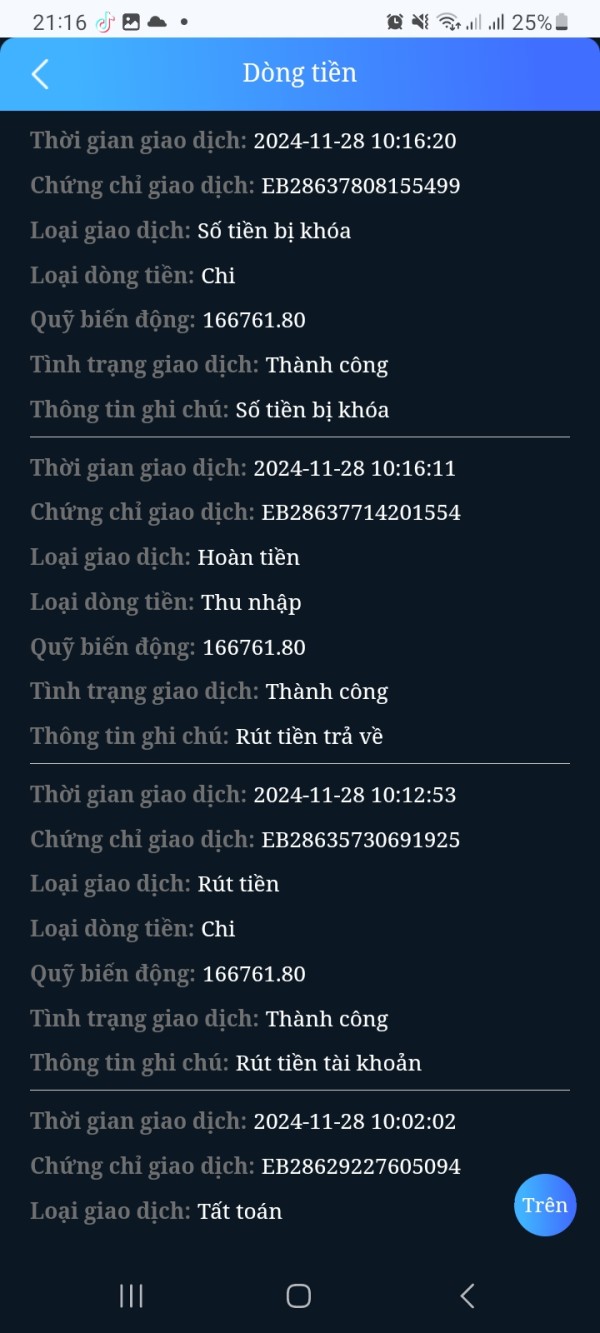

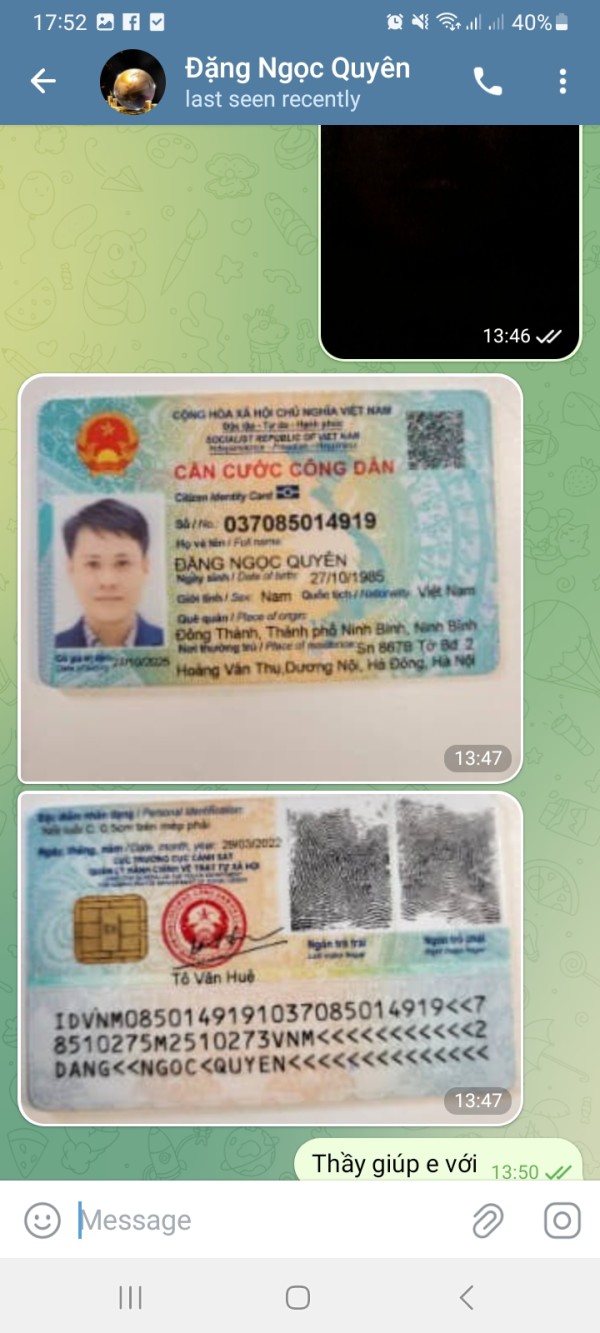

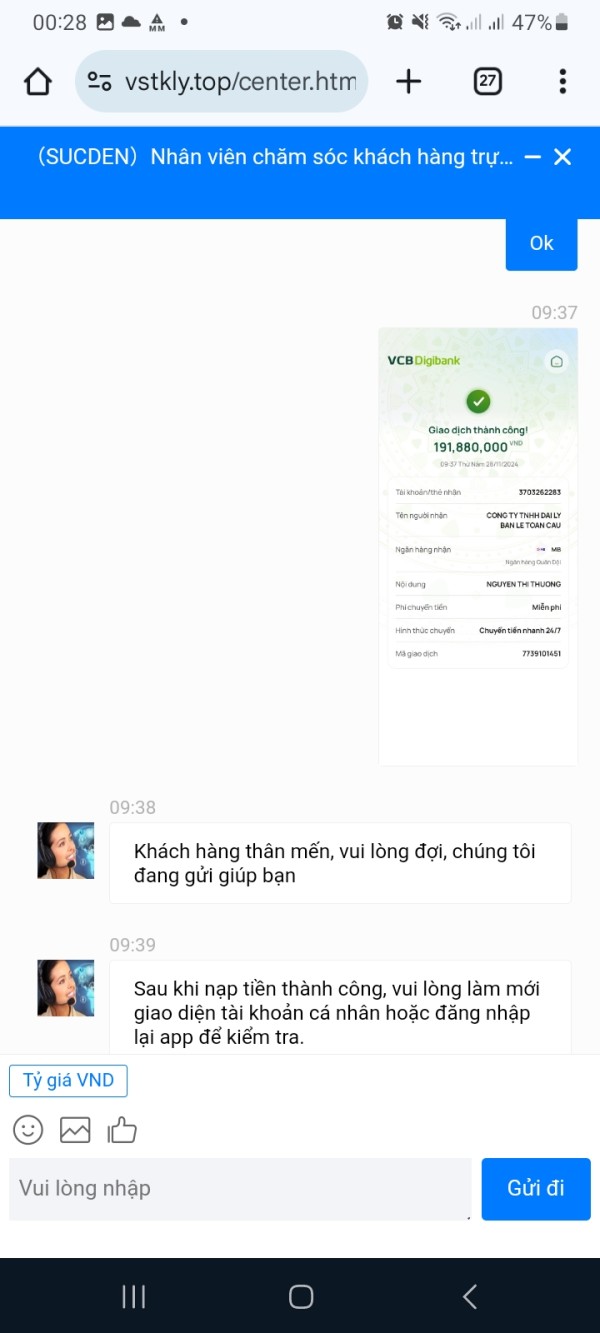

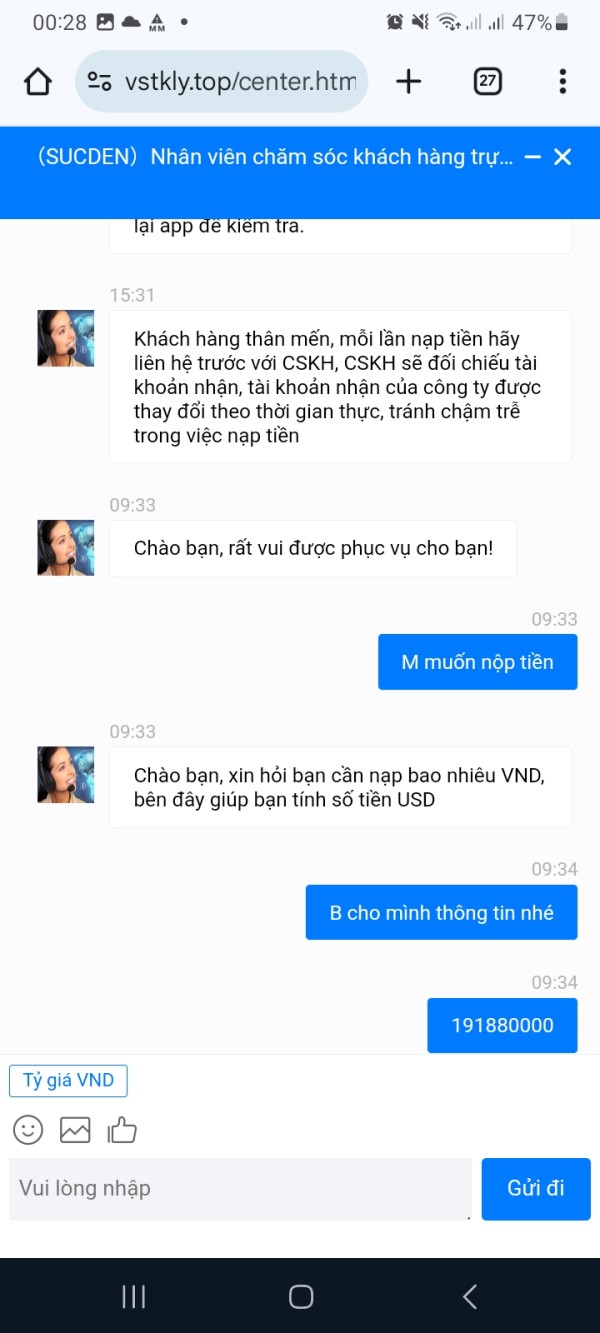

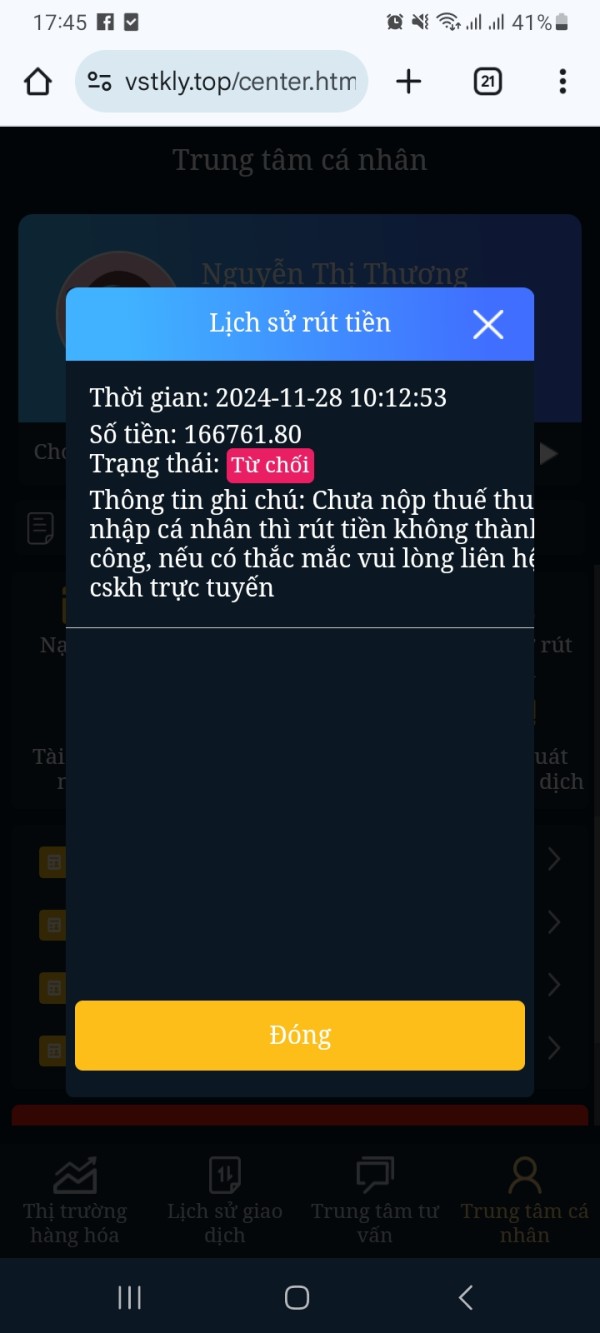

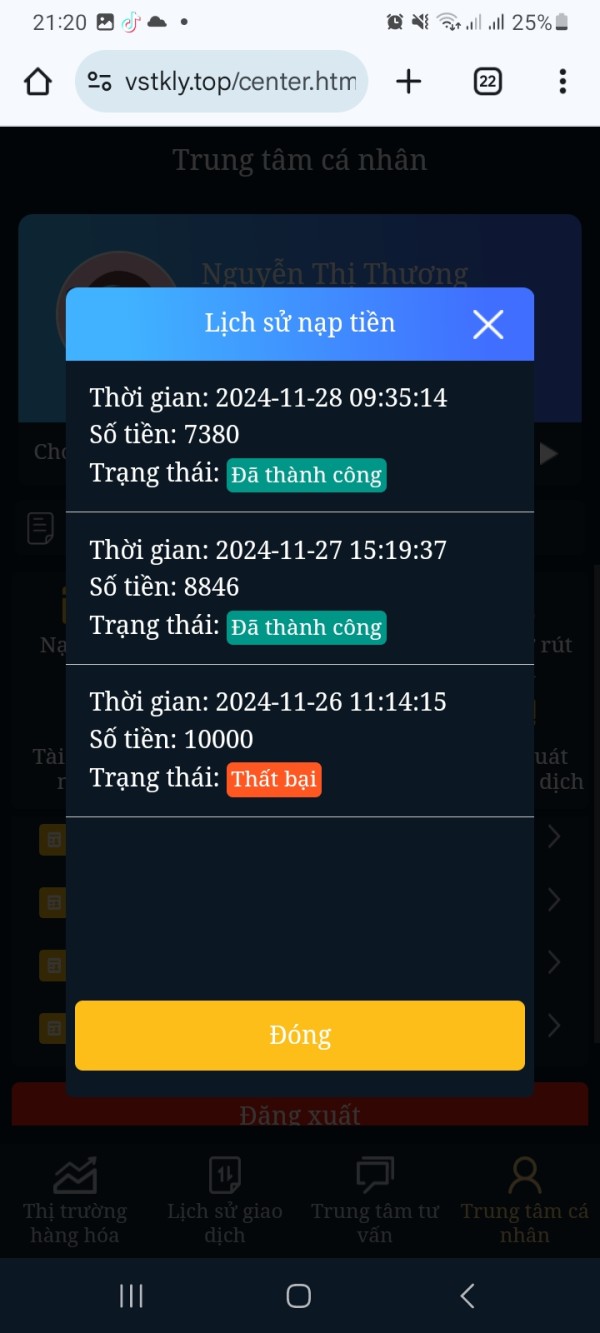

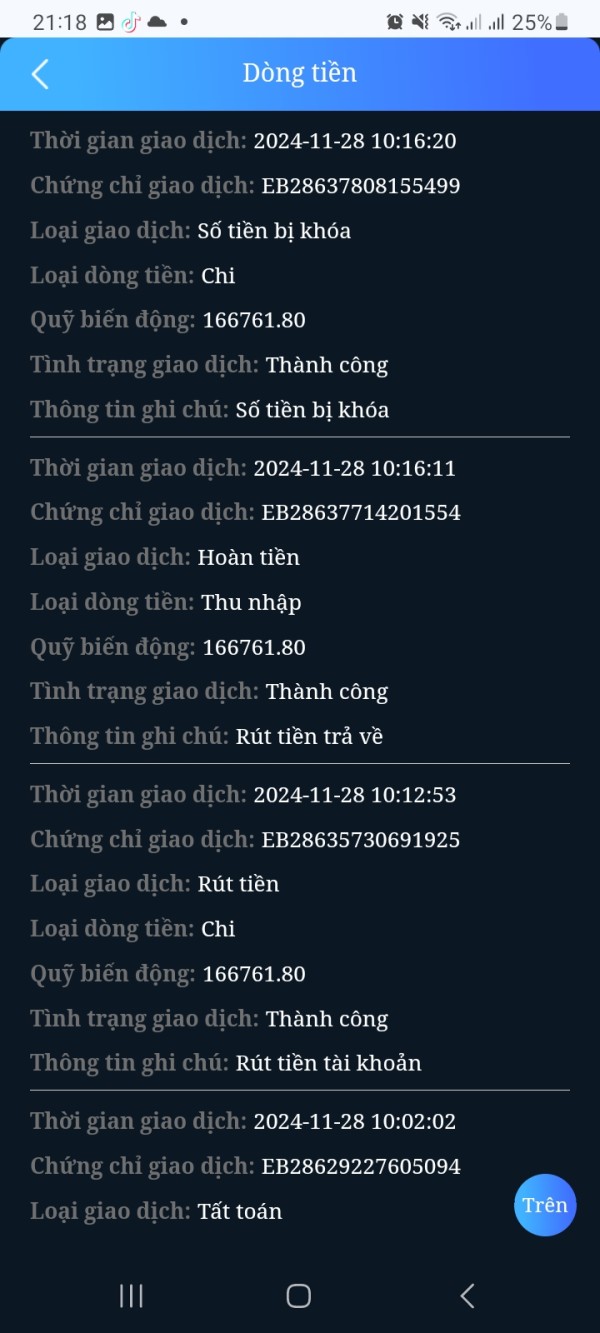

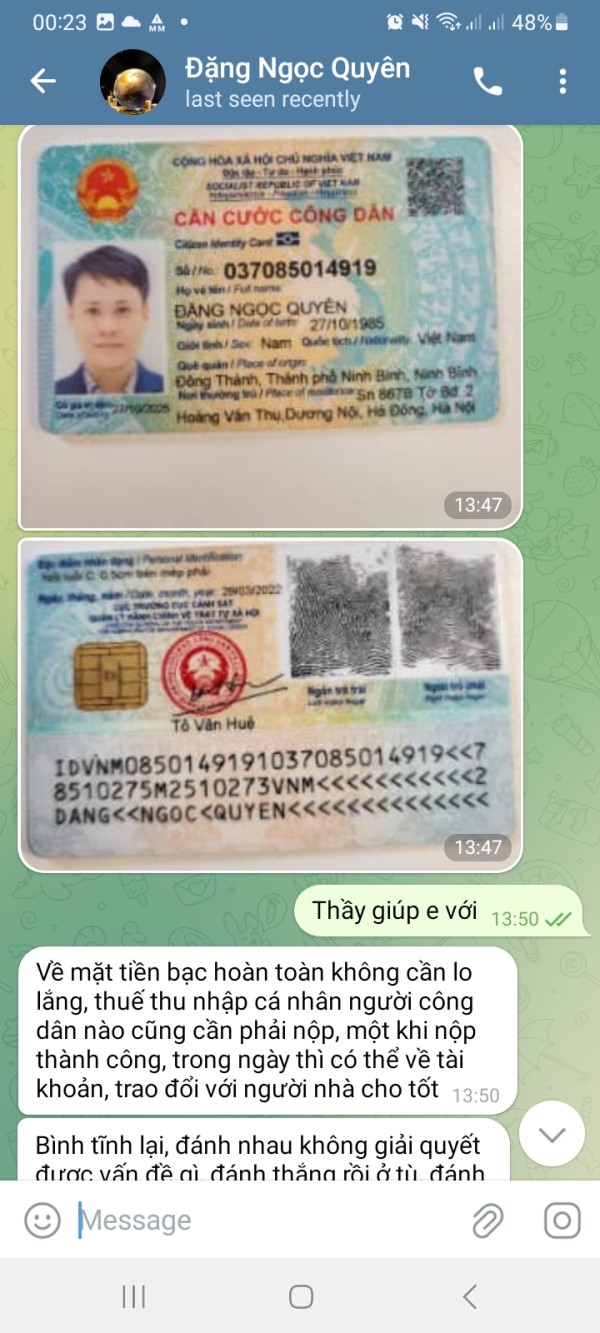

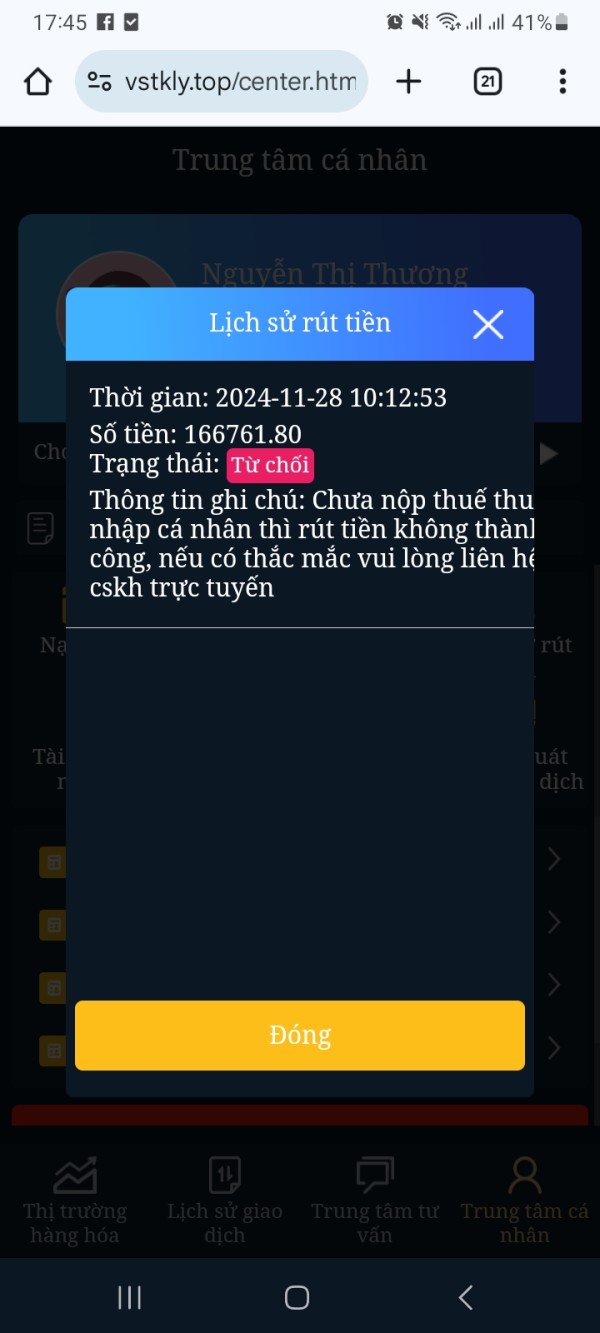

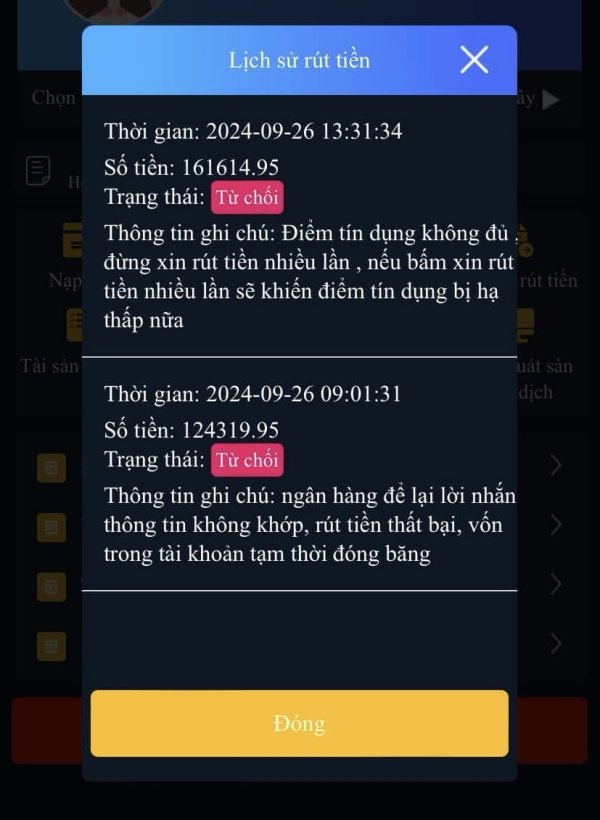

I withdrew money and was forced to pay 15%, then I filed a complaint and my account was locked.

Exposure

2024-12-09

FX2008307174

Vietnam

I joined the exchange when withdrawing money, 15% of the advance tax is required, I recommend locking my account

Exposure

2024-12-05

FX2008307174

Vietnam

I participate when withdrawing money is subject to a 15% tax, when I express my opinion about fraud, my account is locked.

Exposure

2024-12-05

Lăng Còi

Vietnam

Exchange does not allow withdrawal.

Exposure

2024-09-28

jimi

New Zealand

Outright fraud. It claims to be registered in the UK and regulated by the FCA, but these are all false. If you make a deposit foolishly, you will never never never get your money back.

Positive

2023-03-03