Overview of VMGFX

VMGFX is a broker that is registered in the Marshall Islands. The broker offers a diverse range of market instruments, including precious metals, forex, and Contracts for Difference (CFDs), which enables traders to explore various trading opportunities. Their trading platform is powered by the widely recognized MetaTrader 4 (MT4), a user-friendly platform known for its advanced trading tools and features. It's important for potential clients to conduct thorough research and due diligence to better understand VMGFX's offerings and ensure it aligns with their trading needs and preferences.

Is VMGFX regulated?

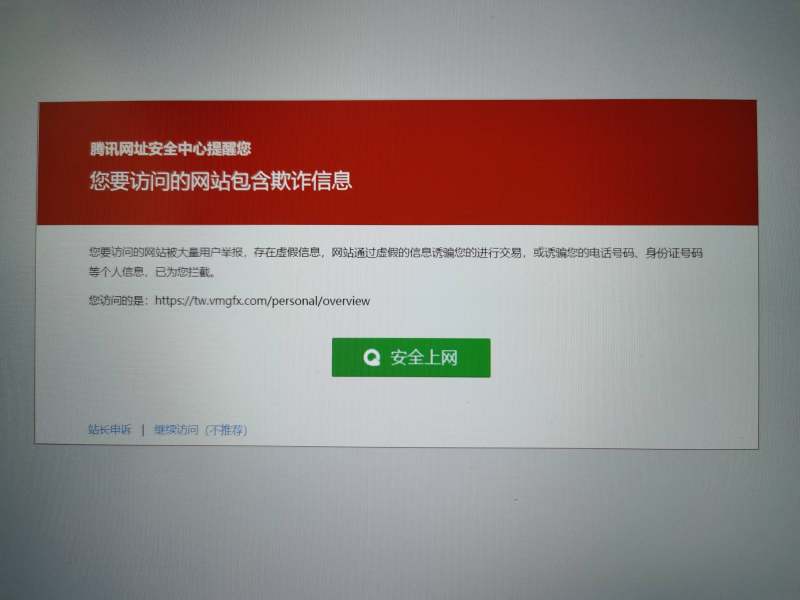

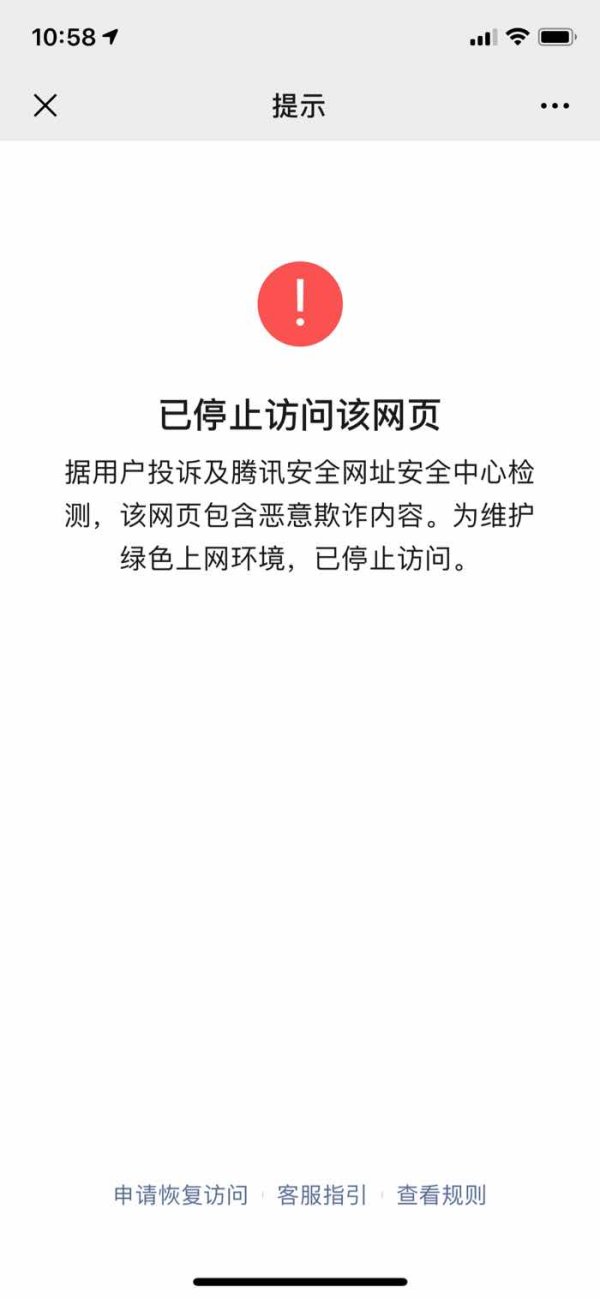

VMGFX broker claims to be regulated by the Vanuatu Financial Services Commission (VFSC) with license number 14663, but it has been verified as a clone firm, raising suspicion and risk. The broker also falsely claims to be regulated by the Financial Conduct Authority (FCA) in the UK with license number 442837, but its official regulatory status is “Revoked.”

Moreover, it purports to be regulated by the National Futures Association (NFA) in the US with license number 0522063, yet its official status is listed as “Unauthorized,” and it exceeds the business scope regulated by the NFA. With six recent complaints and negative reviews, investors should be extremely cautious when dealing with VMGFX as there is a high risk of potential scams and fraudulent activities.

Pros and Cons

VMGFX offers a selection of market instruments, including precious metals, forex, and CFDs, providing traders with diverse trading opportunities. The broker's claimed low spread, as low as 0.0 pips, can be advantageous for reducing trading costs. Additionally, the availability of multiple payment methods, such as wire transfer, UnionPay, VISA, and MasterCard, allows for convenient and accessible fund transfers. VMGFX also provides the widely recognized MetaTrader 4 (MT4) trading platform, offering traders a user-friendly interface and advanced trading tools. Lastly, the broker's customer support channels via QQ account and email address enable clients to seek assistance and communicate efficiently.

VMGFX raises concerns due to its lack of transparency on commission fees or trading fees, potentially leading to hidden costs for traders. The absence of disclosed information on margin trading policies raises further uncertainties about the broker's offerings. Additionally, VMGFX does not provide educational materials or a demo account for clients, which could limit learning opportunities, especially for novice traders. The suspicion of being a clone firm adds another level of doubt, necessitating caution when considering this broker. Lastly, VMGFX does not offer a variety of account types.

Market Instruments

This broker offers a diverse range of market instruments, including precious metals, forex, and CFDs. Traders can access precious metals such as gold, silver, platinum, and palladium, providing a safe-haven option for portfolio diversification. The forex market is also available, allowing traders to exchange various currency pairs and capitalize on fluctuations in exchange rates. Furthermore, the broker offers CFDs on indices, stocks, commodities, and cryptocurrencies, enabling investors to speculate on the price movements of these underlying assets without owning them directly.

While these instruments offer potential profit opportunities, traders should be aware of the inherent risks associated with each market and practice diligent risk management to protect their investments. Additionally, understanding the specific terms, fees, and leverage options provided by the broker for each instrument is essential before engaging in trading activities.

How to open an account in VMGFX?

Opening an account with VMGFX is a straightforward process that can be completed with a few simple steps. Here's a step-by-step guide:

Go to the official website of VMGFX to begin the account opening process.

Look for the registration or account opening button on the website's homepage and click on it to proceed.

Provide the required information, such as personal details, contact information, and account preferences.

Follow the broker's instructions to verify your identity by submitting the necessary documents, such as identification proof and address verification.

After successful verification, proceed to fund your trading account using one of the available payment methods, such as wire transfer, UnionPay, VISA, or MasterCard.

Once your account is funded, you can begin trading various instruments offered by VMGFX, such as forex, precious metals, and CFDs, using the MetaTrader 4 trading platform.

Spread and Commission Fees

VMGFX offers a highly competitive spread, with rates as low as 0.0 pips for certain trading instruments. The spread represents the difference between the bid and ask price of an asset and is a critical factor in trading costs. A low spread is attractive to traders as it minimizes the difference between the bid and ask price, reducing their trading costs and potentially enhancing their profitability. However, it is essential to note that spreads can vary depending on the specific financial instruments being traded and market conditions.

In addition, it's important to note that while the broker emphasizes the advantage of a low spread, information regarding commission fees or trading fees is not disclosed on their platform. Traders should exercise caution and carefully review the broker's terms and conditions to understand the complete cost structure associated with their trading activities. Commission fees or other hidden charges can significantly impact overall trading costs, so transparency in this regard is crucial for informed decision-making.

Leverage

Unfortunately, VMGFX does not provide transparent information on margin trading on their platform. Margin trading is a significant aspect of leveraged trading, enabling traders to amplify their positions and potential profits, but it also comes with increased risk. Without clear disclosure of margin requirements, leverage ratios, and related policies, clients may not have a comprehensive understanding of the potential risks involved in their trades. Transparent information on margin trading is essential for traders to make well-informed decisions and manage their risk effectively. Therefore, the lack of disclosure in this regard raises concerns about the broker's commitment to providing comprehensive and reliable information to its clients.

Trading Platform

VMGFX provides its clients with the renowned MetaTrader 4 (MT4) trading platform, a highly popular and widely used platform in the financial industry. With MT4, traders can access a user-friendly interface and a comprehensive set of tools and features to execute trades effectively and analyze financial markets. The platform supports various trading instruments, including forex, precious metals, and CFDs, allowing clients to diversify their trading strategies.

MT4 offers real-time price quotes, advanced charting capabilities, technical indicators, and expert advisors (EAs) for automated trading. Additionally, VMGFX ensures seamless and secure trading experiences by offering MT4 across different devices, including desktops, smartphones, and tablets, so that clients can stay connected to the markets at all times.

Payment Methods

VMGFX offers several payment methods for its clients, including wire transfers for secure bank-to-bank transactions, UnionPay for convenient transactions in Asia, and widely accepted card options like VISA and MasterCard for easy deposits and withdrawals. Clients can choose the method that suits them best, but clients need to be aware of any associated fees, processing times, and potential limitations imposed by the broker or the payment processors when using these payment methods.

Customer Support

VMGFX offers customer support through multiple channels, including QQ account and email address, to assist their clients with various inquiries and concerns. By providing a QQ account, the broker enables clients to communicate with their support team in real-time, which can be especially beneficial for resolving urgent issues or getting quick responses to questions. Additionally, the email address option offers a more traditional means of contacting customer support, allowing clients to send detailed inquiries or provide account-related information.

Educational Resources

VMGFX raises concerns as a broker due to its lack of providing any educational materials or a demo account as educational resources. Educational materials and demo accounts are essential tools for traders, especially beginners, to enhance their knowledge, develop trading skills, and gain practical experience in a risk-free environment. The absence of such resources suggests a lack of commitment to supporting their clients' growth and success in trading. This, coupled with the suspicion of being a clone firm, raises further red flags and highlights the importance of exercising extreme caution when considering VMGFX as a potential broker. Traders should be wary of the potential risks associated with dealing with a broker that lacks essential educational resources and transparency in its operations.

Conclusion

VMGFX is a broker that offers a variety of market instruments, including precious metals, forex, and CFDs, providing traders with diverse trading opportunities. They claim to offer a low spread, starting as low as 0.0 pips, which can be attractive for reducing trading costs. The broker supports multiple payment methods, such as wire transfer, UnionPay, VISA, and MasterCard, ensuring convenient and accessible fund transfers.

However, concerns have been raised about VMGFX's legitimacy as it has been verified as a clone firm. Additionally, there are uncertainties surrounding the broker's transparency on commission fees, trading fees, and margin trading policies. Furthermore, the absence of educational materials and a demo account may limit learning opportunities for traders, especially those who are new to the market. Traders should exercise caution and thoroughly research the broker before considering it as a potential trading platform.

FAQs

Q: What is the regulatory status of VMGFX?

A: VMGFX is a broker with a claimed Vanuatu VFSC regulation (license number: 14663), but it has been verified as a clone firm, which raises concerns about its legitimacy.

Q: What is the spread offered by VMGFX?

A: The broker offers a competitive spread, as low as 0.0 pips for certain trading instruments.

Q: How is customer support at VMGFX?

A: VMGFX provides customer support through a QQ account and email address, offering real-time communication options for traders.

Q: Which trading platform does VMGFX offer?

A: VMGFX provides the widely recognized MetaTrader 4 (MT4) trading platform.

Q: What market instruments are available on VMGFX?

A: VMGFX offers a range of market instruments, including precious metals, forex, and Contracts for Difference (CFDs).

金天88734

Hong Kong

VMGFX is a fraud platform, absconding. Unable wo withdraw

Exposure

2020-09-05

FX4269194004

Hong Kong

After I applied for the withdrawal for many times, VMGFX even banned my account. Both the service line and email are unavailable.

Exposure

2020-06-11

FX4179963982

Hong Kong

The platform refused my application for withdrawals after I deposited about half a year later. I can’t contact with all the customer service staff. As the number of the applications I made reached the limit, they also terminated my account.

Exposure

2020-04-03

lily~(利)

Hong Kong

Unable to log in to the platform. My fund was frozen.

Exposure

2020-01-09

FX3555745478

Hong Kong

Because of teacher’s wrong operation, our position were locked. But the teacher still asked us to add fund.

Exposure

2020-01-04

FX3555745478

Hong Kong

Though teachers’ order recommendation, I made a loss of $10000 or so. Now the remaining fund was unable to withdraw. Scam platform.

Exposure

2020-01-02

半月武$ ~明

Cambodia

I met issues in downloading the trading platform on my PC version. Thanks Robin, patiently helping me to fix this issue. Since then, I have been a loyal fan of VMGFX broker. 🙂🙂🙂

Positive

2023-03-07