Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

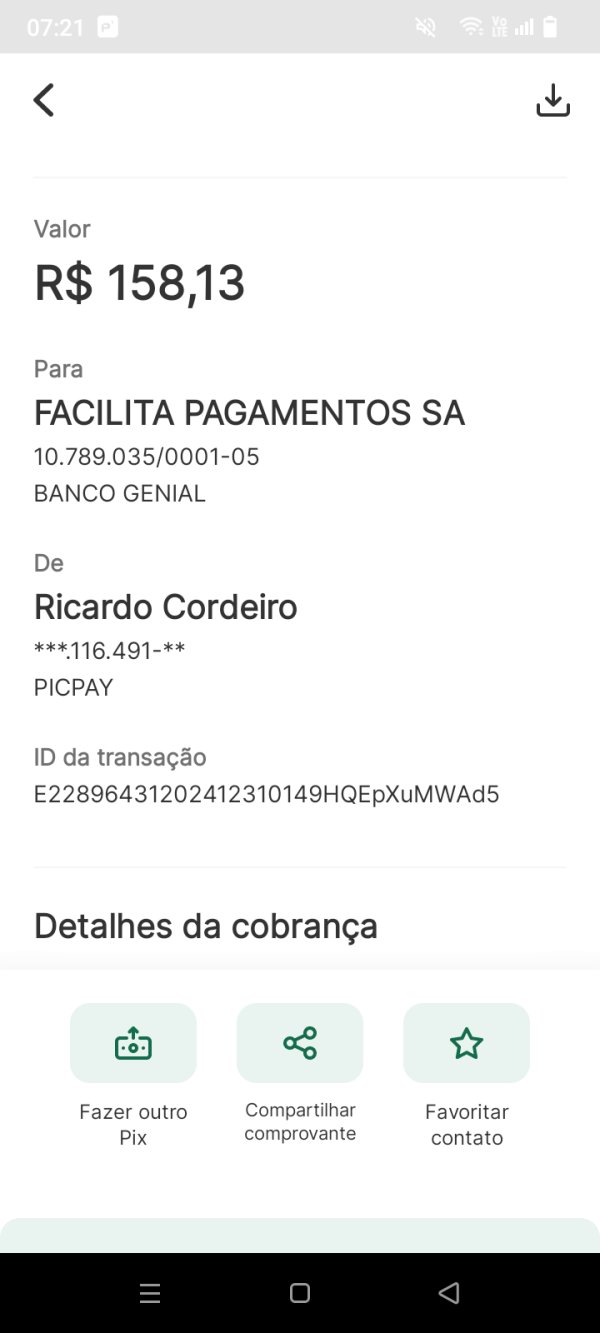

FX3718940092

Brazil

My deposit via Pix was not credited to my account, it was debited from my bank account instantly and they have been stalling me for 3 days, regrettable.

Exposure

01-02

FX2010537403

Philippines

how to withdraw thets mony

Exposure

2020-11-13

FX1507982103

Canada

Wow 10-15s to close a position. Terrible

Exposure

2020-03-26

FX1507982103

Canada

Watching the DJIA on 4 different platforms and the only one with a different price is EasyMarkets- almost $100 USD difference

Exposure

2020-03-24

Randem

Australia

Regulatory status gives me confidence, but the platform's trading restrictions can be frustrating. Need to stay within the rules.

Neutral

2024-08-06

不穿虾皮的皮皮虾大王

Malaysia

Strange, this company seems to be really reliable, the regulatory license is very good, and the score of wikifx is also very high. But I found someone said he was a scam? Although there are only three, I still have to be vigilant. I plan to read more about what people think of him online.

Neutral

2022-12-14

louy0

Malaysia

I've been trading with easyMarkets for a couple of years and appreciate their responsive customer service. The account managers are knowledgeable and genuinely helpful.👍

Positive

2024-06-21

FX-Sib

France

I was trading manually on easymarkets, the trading environment is quite good, but I have switched to automated copytrading from Angelite Trading.

Positive

2024-05-24

Charlie Edward

United Kingdom

A month in, and I'm impressed! Tight spreads, reasonable commissions, and even free deposits make this broker a breath of fresh air. While there are withdrawal fees, everything's clearly laid out on their website – transparency is key! To top it off, my small test withdrawal arrived in minutes. EasyMarkets might just be the best broker I've encountered!

Positive

2024-05-08

tayyab5718

Pakistan

EasyMarkets Trading offers a wide variety of trading instruments, including forex, stocks, and commodities, which is great for those who like to diversify their portfolio. Their trading conditions, such as low spreads and high leverage, are also competitive compared to other brokers.The trading terms and conditions offered were exceptionally advantageous, and their customer service is readily available to assist whenever required.

Positive

2023-06-17

Lv不是Lv

New Zealand

easyMarkets is a good broker, user friendly. Very nice and simple for newbies. I’m so happy to trade with these guys.

Positive

2023-02-14

FX1167728731

Hong Kong

Trading conditions were extremely favorable, and their customer support always assist when you need any help. They are patience in dealing with their customers. I gave five stars for their dedicated customer service.

Positive

2022-12-19