Note: Trustplus247s official site - https://trustplus247.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. You can use the leverage to your benefit or to your detriment. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

Please note the information contained in this article is for general information purposes only.

General Information

What is Trustplus247?

Registered in Saint Vincent and the Grenadines, Trustplus247 is an offshore online forex broker offering clients series of trading instruments, such as forex, metals, energies, indices and cryptocurrencies.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

Trustplus247 Alternative Brokers

There are many alternative brokers to Trustplus247 depending on the specific needs and preferences of the trader. Some popular options include:

FXCM - a reputable broker with a wide range of trading instruments and robust trading platforms, making it a reliable choice for traders.

RoboForex - offers a diverse selection of trading accounts, competitive trading conditions, and a strong focus on client education, making it a recommended broker for both beginner and experienced traders.

Tickmill - a trusted broker known for its competitive pricing, fast execution, and comprehensive trading tools, making it a recommended choice for traders seeking reliable and transparent trading services.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is Trustplus247 Safe or Scam?

As far as we can tell, Trustplus247 is not governed by any regulatory authorities, thus that bit of data is settled. As a result, its regulatory status on WikiFX is classified as “No License”. Bear in mind trading with an unregulated forex broker carries a significant risk as there is no oversight or protection provided by a regulatory body. It is important to be cautious when dealing with unregulated brokers as there is a higher risk of potential scams or fraudulent activities. It is advisable to thoroughly research and consider the risks involved before engaging with Trustplus247 or any unregulated broker.

Market Instruments

Trustplus247 offers a range of popular and mainstream trading instruments for investors to trade. This includes 28 currency pairs, allowing traders to participate in the forex market and take advantage of currency fluctuations. Additionally, the platform offers 4 metals, providing opportunities to trade precious metals such as gold and silver.

Traders can also access 2 energy products, allowing them to speculate on the price movements of commodities like oil and natural gas. Furthermore, Trustplus247 offers 10 indices, enabling investors to trade on the performance of global stock market indices. Lastly, the platform provides access to 3 cryptocurrencies, allowing traders to participate in the rapidly growing digital asset market.

Accounts

Trustplus247 offers three trading accounts tailored to meet the diverse needs and goals of traders. The Micro account and ECN account require a minimum initial deposit of $100, making them accessible to traders with smaller capital. These accounts provide a range of trading features and tools to help traders execute their strategies effectively.

For more experienced traders or those looking for enhanced trading conditions, the Pro account is available with a minimum deposit requirement of $500. This account offers additional benefits, such as lower spreads, faster execution, and access to premium trading tools.

Leverage

With the Trustplus247 platform, the leverage offered depends on the specific instrument being traded.

Currency pairs: 1:200

Metals & Energies: 1:100

Indices: 1:50

Cryptocurrencies: 1:2

Note that leverage can amplify both profits and losses, so it should be used with caution. Higher leverage ratios involve higher levels of risk, as borrowed funds are being utilized, and traders should carefully consider their risk tolerance and employ risk management strategies when utilizing leverage in their trading activities.

Spreads & Commissions

Trustplus247 offers different types of trading accounts with varying spreads. For the Micro account, traders can experience floating spreads starting at 0.4 pips and fixed spreads starting at 2 pips. The ECN account provides traders with the advantage of tight spreads, starting from 0 pips. The Pro account offers even tighter spreads, starting from 0.2 pips.

However, Trustplus247 does not disclose specific details regarding commissions, so it's advisable to consult with the broker directly to obtain accurate information about any potential commissions associated with trading. Overall, the availability of competitive spreads across different account types provides traders with options to choose an account that aligns with their trading preferences and strategies.

Below is a comparison table about spreads and commissions charged by different brokers:

Please note that the spread and commission values may vary depending on the specific account type and market conditions. It is always recommended to refer to the broker's official website or contact their customer support for the most up-to-date and accurate information.

Trading Platforms

Trustplus247 falls short in terms of trading platforms as it does not offer the industry-leading MetaTrader4 (MT4) or MetaTrader5 (MT5) platforms. This can be seen as a drawback for traders, as MT4 and MT5 are widely recognized and preferred by traders worldwide for their advanced features, user-friendly interface, and extensive range of trading tools.

The absence of these platforms may limit the trading experience and convenience for traders who are accustomed to the features and functionality offered by MT4 and MT5. It is important for traders to carefully consider their preferred trading platform and assess whether Trustplus247's alternative platform meets their specific needs and requirements before engaging in trading activities.

See the trading platform comparison table below:

Customer Service

Traders with any inquiries or trading-related information can get in touch with Trustplus247 through the following channels:

Note: These pros and cons are subjective and may vary depending on the individual's experience with Trustplus247's customer service.

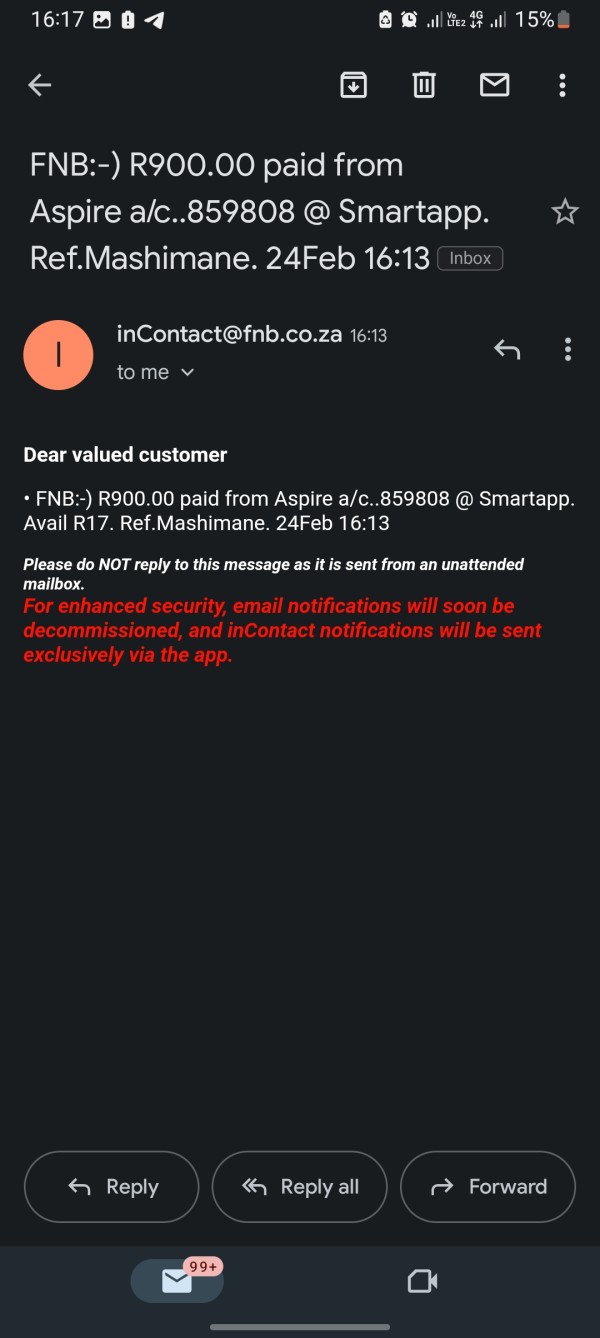

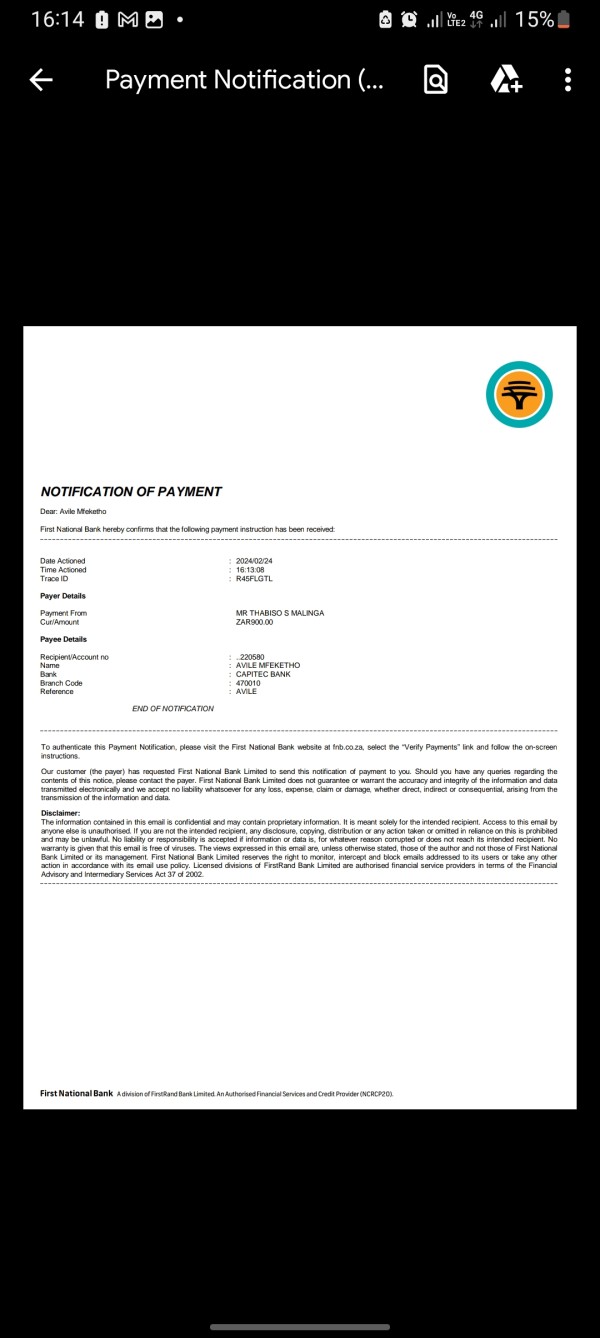

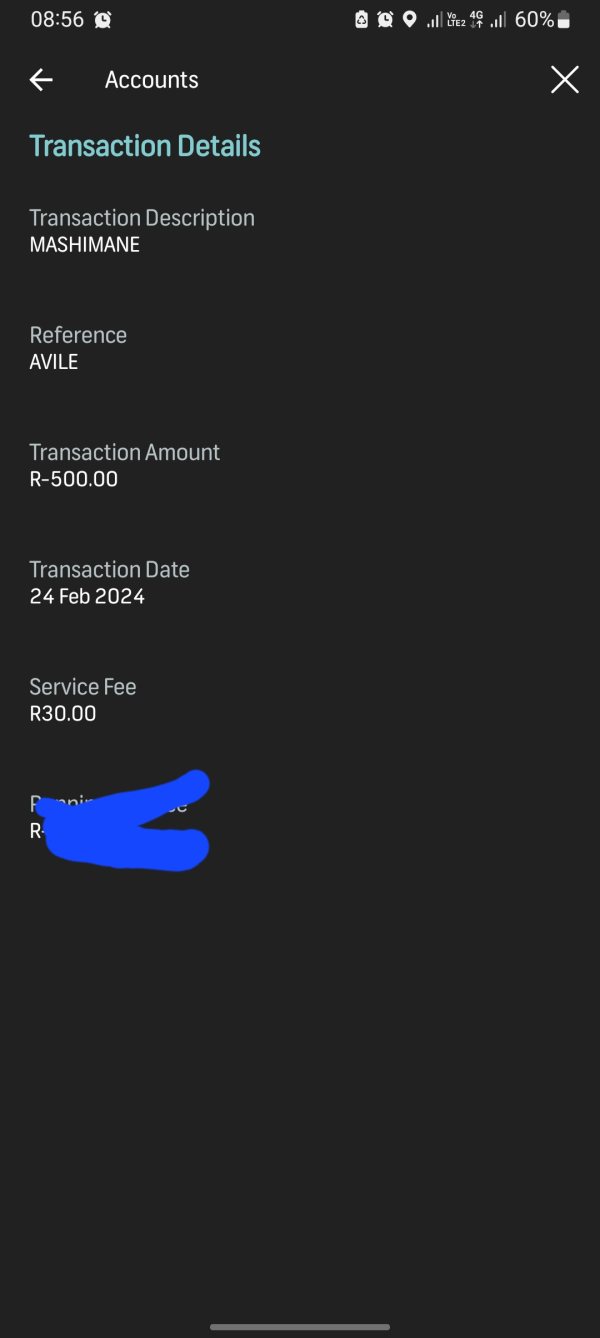

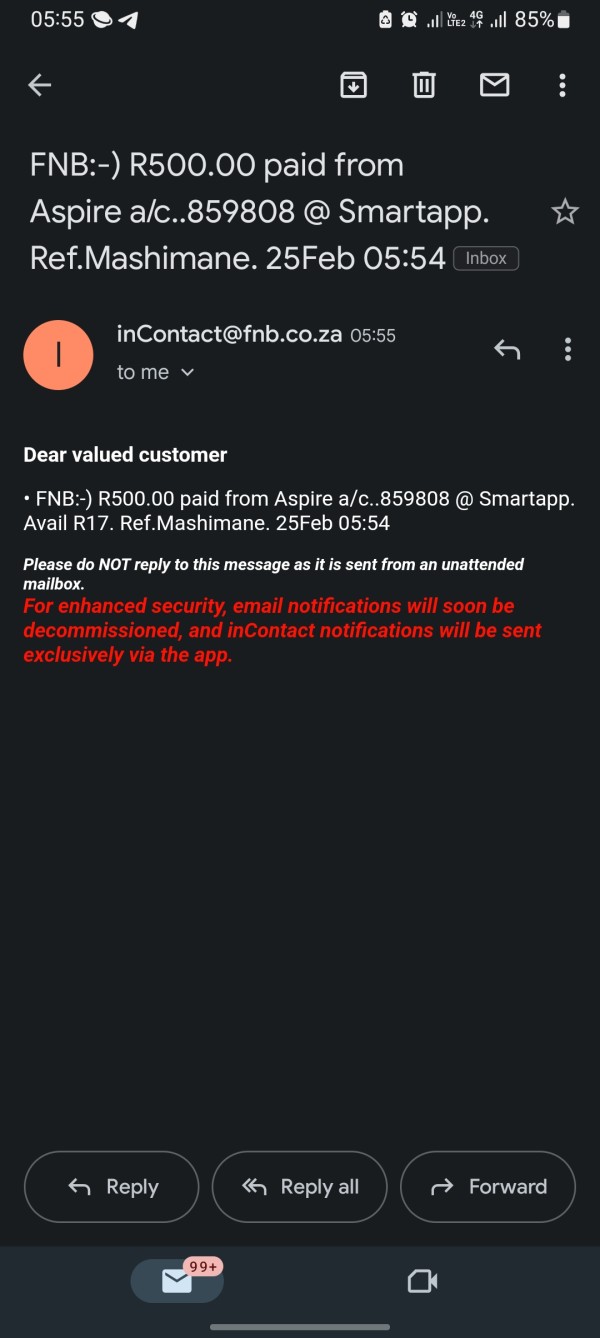

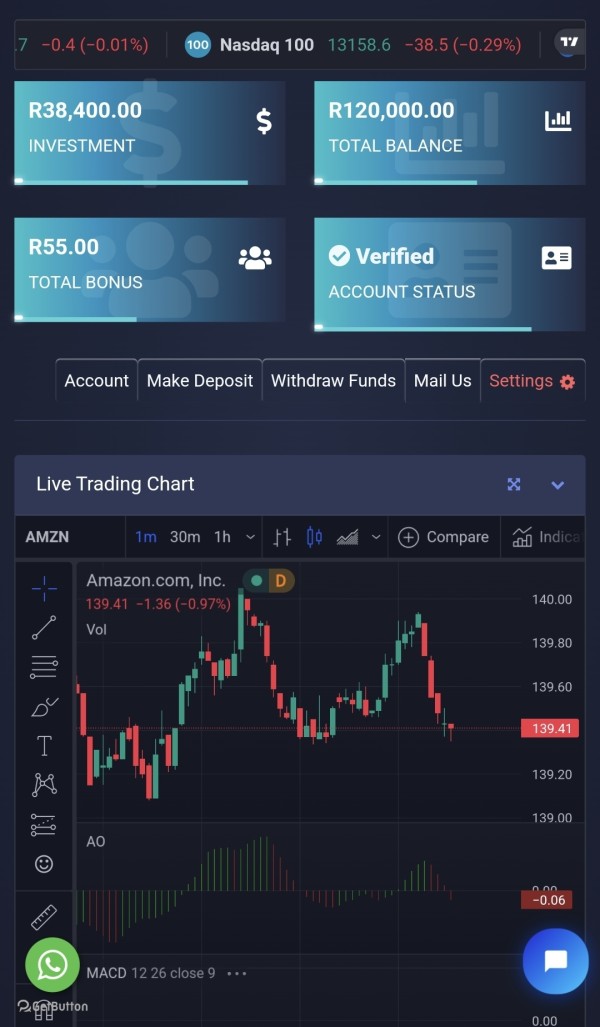

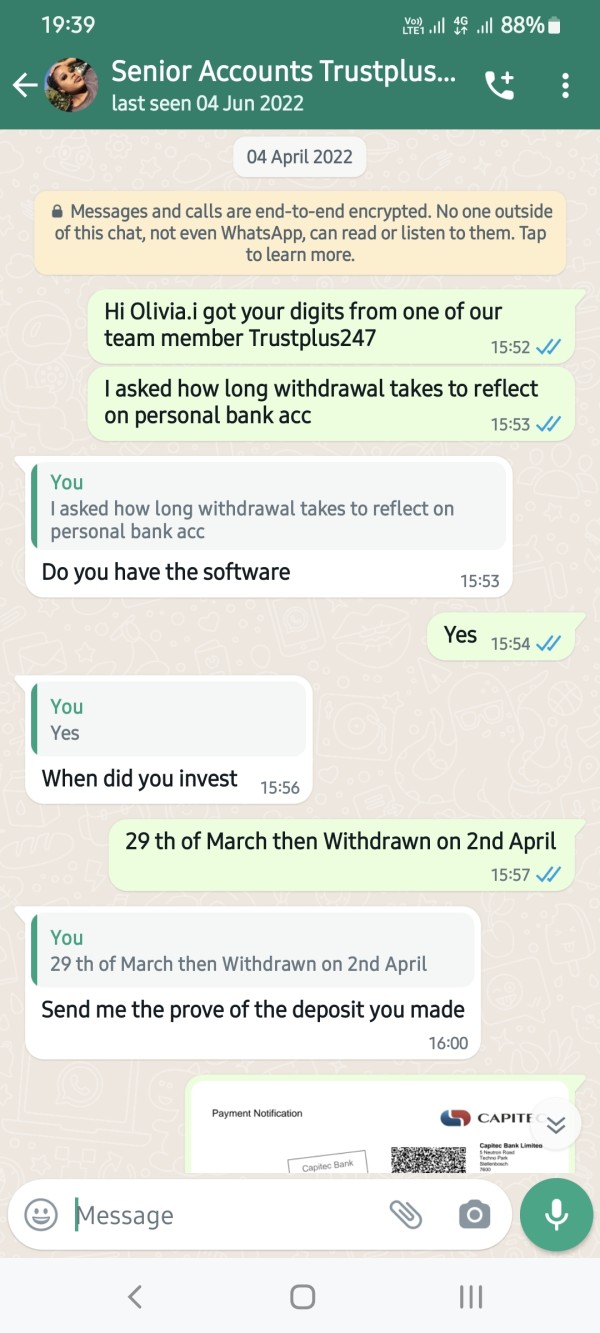

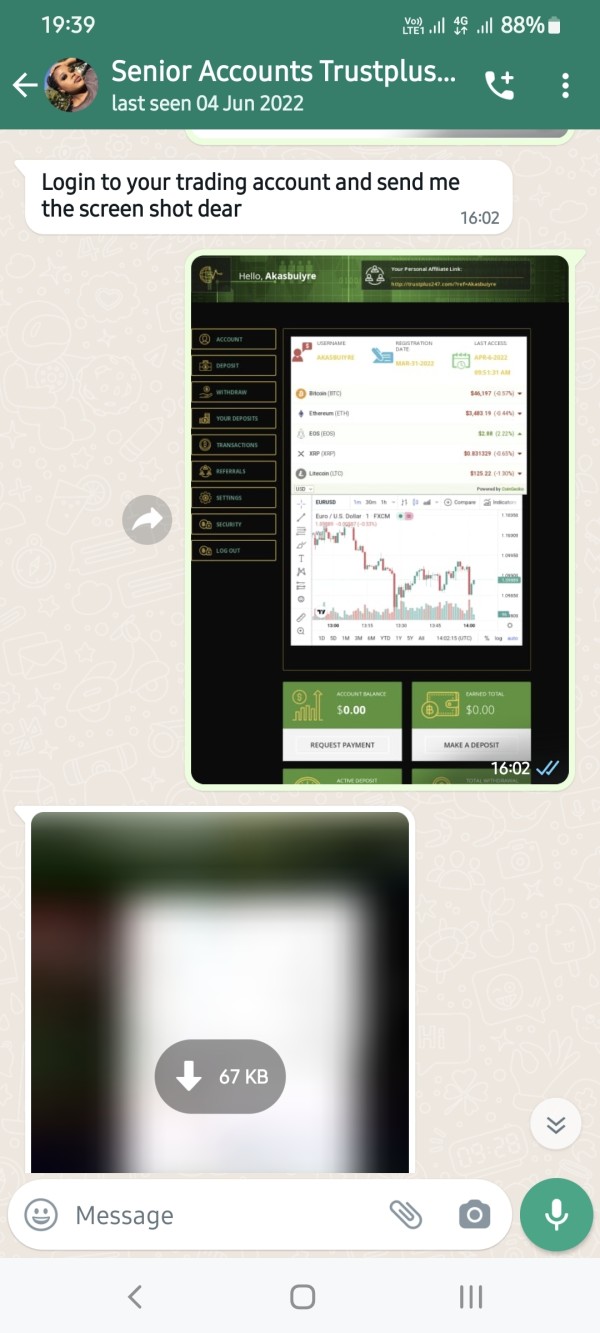

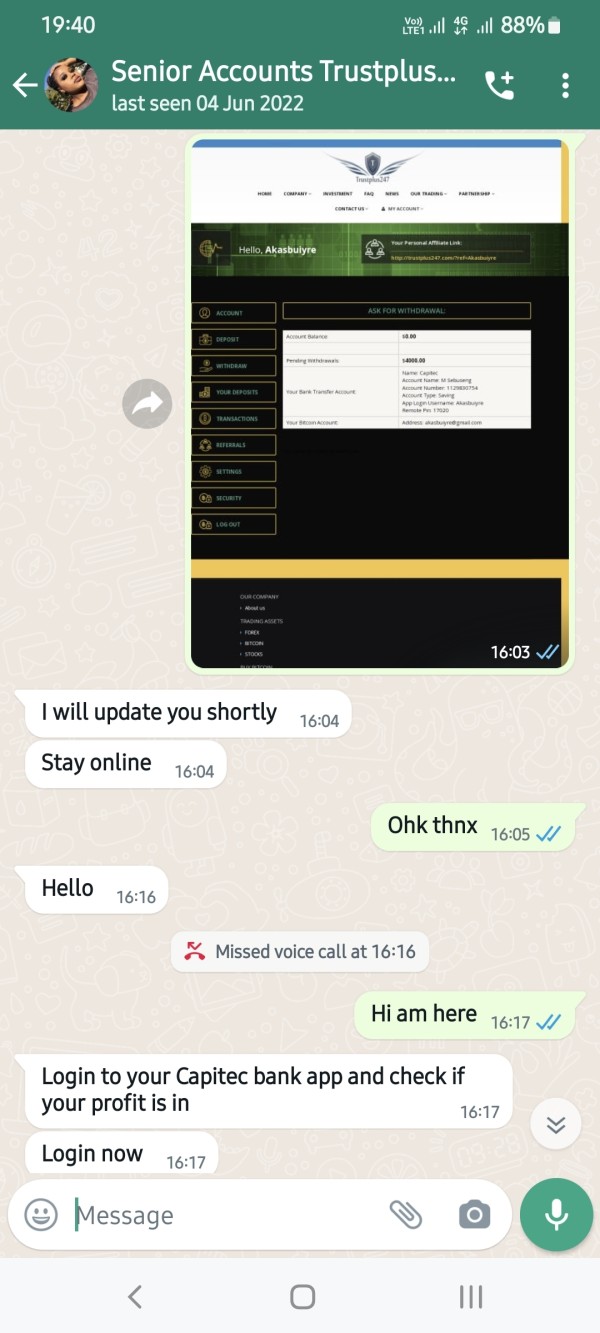

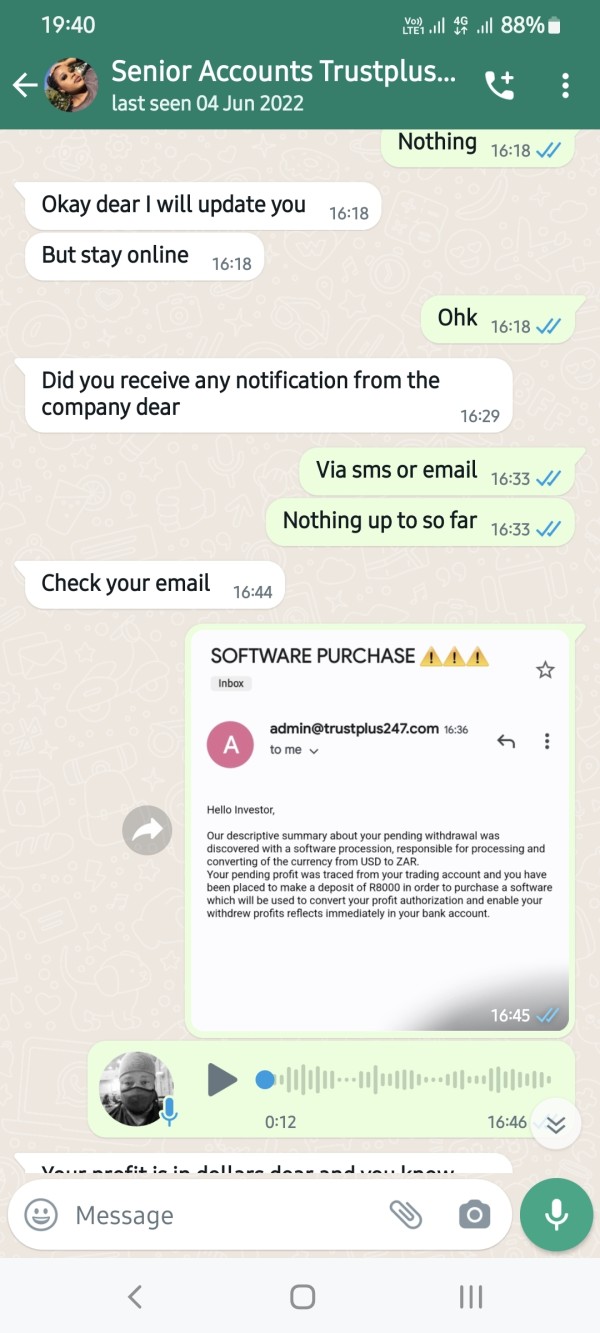

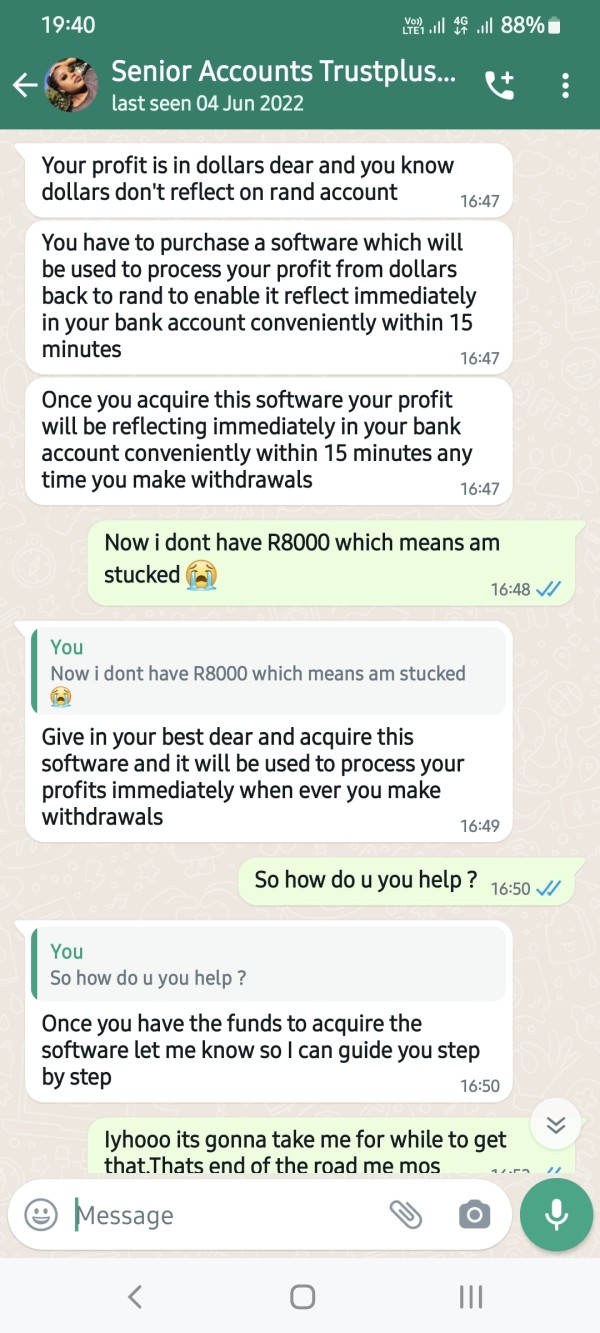

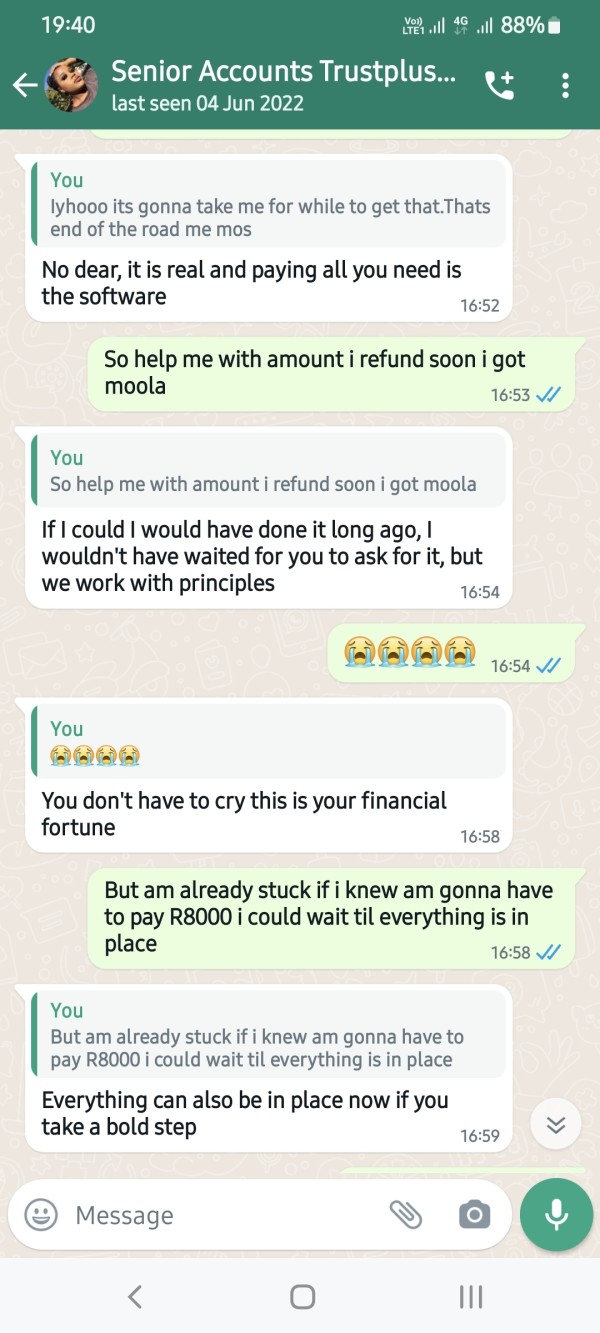

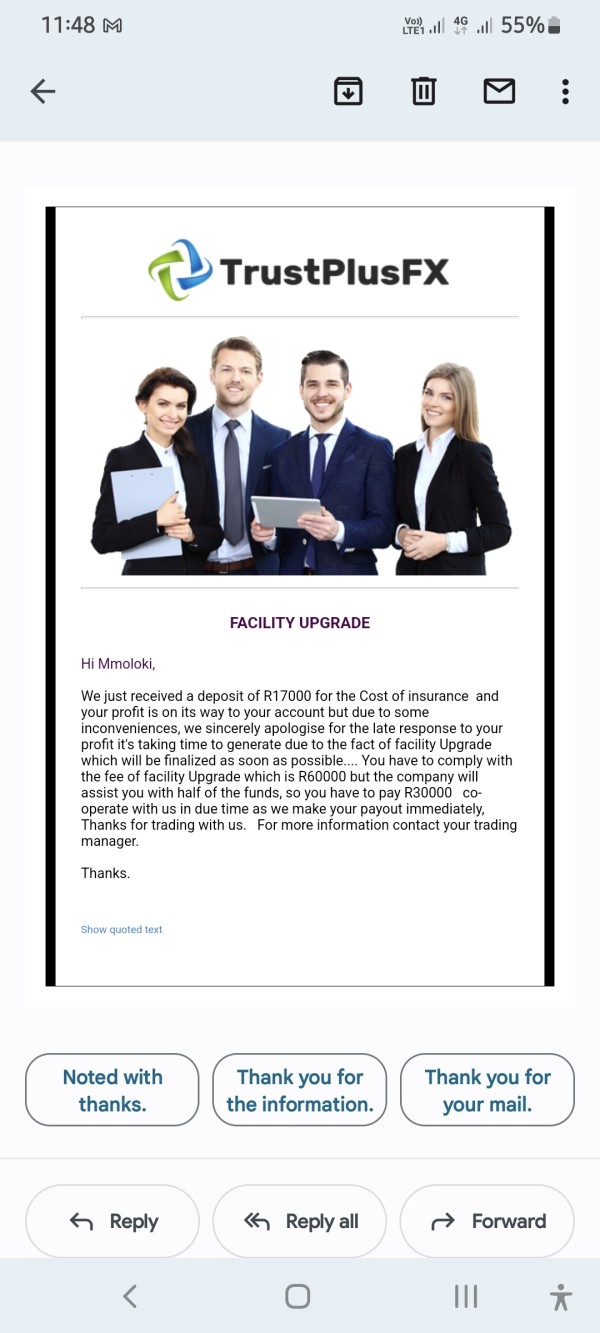

User Exposure on WikiFX

Some trader from South African shared his terrible trading experienced with Trustplus247. He complained that this broker rejected his withdrawal request and cheated on him. As we can see, genuine customer feedback plays a crucial part in informing potential clients about a forex broker's overall performance. WikiFX is the place to go for in-depth explanations.

Conclusion

Based on the available information, it is important to note that Trustplus247 is an unregulated broker, which poses significant risks for traders. The lack of regulatory oversight raises concerns about the safety of funds and the credibility of the broker. Additionally, the unavailable website further limits the ability to assess its services. Traders are strongly advised to exercise caution and consider alternative regulated brokers that provide greater transparency and regulatory protections.

Frequently Asked Questions (FAQs)