Overview of Caphouse Ltd.

CapHouse is a CFD broker operating in China from 2023. It offers a range of trading products through MetaTrader5(MT5) platform, including Forex, Indicex, Commodities, Shares CFDs and Crypto.

Traders can choose from four account types with competitive spreads and leverage up to 1000:1. The broker emphasizes customer support, Economic Calendar and providing multiple contact options.

However, the broker is not regulated by an authority, which means traders should pay attention to the potential investment risks.

Regulatory Status

CapHouse is currently in an unregulated state. It is suggested that traders should be cautious due to the lack of regulation by an authority.

Pros and Cons

CapHouse has several advantages, including a diverse range of tradable assets, a wide range of payment options, comprehensive customer support, competitive spreads, and leverage. Additionally, three account types have no commissions when customers deposit and withdraw, while the commission for the Zero account ranges from $0 to $10.

However, the broker is unregulated, which poses risks for clients. Additionally, educational resources are limited, and there is a lack of demo accounts.

Market Instruments

CapHouse offers five types of assets, including Forex, Indices, Commodities, Shares CFDs, and Crypto for clients.

Forex trading involves exchanging currencies and is known for its high liquidity. With access to a wide range of currency pairs, traders can maximize profits. Additionally, Indices trading involves speculating on market or sector performance without trading individual stocks. Explore popular indices for diverse trading opportunities and leverage high-leverage advantages.

For those interested in Commodity trading, CapHouse provides exposure to global markets and essential resources, allowing traders to buy and sell raw materials like metals, energy, and agriculture. Those intrigued by Shares CFDs always have access to transferring ownership in public companies, aiming to profit from price changes and dividends based on their performance. Cryptocurrency enthusiasts can exchange digital currencies on online platforms to profit from their volatile prices.

Account Types

CapHouse offers four types of trading accounts: Standard Account, Fixed Account, Zero Account, VIP Account. Each account offers a 100% welcome bonus, boosting your initial trading capital and enhancing your potential profits. Besides, there are no commissions for other accounts except the Zero account, which has a commission ranging from $0 to $10.

How to Open an Account?

Opening an account with CapHouse is a straightforward process that can be completed in a few simple steps:

- Registration: Visit the CapHouse website and click on the “Register” button. You will be directed to the registration page, where you need to provide some basic personal information, such as your name, email address, and phone number.

- Account Type Selection: Choose the type of trading account that best suits your trading preferences. CapHouse typically offers different account types, each with its own set of features and trading conditions.

- Deposit Funds: You can deposit the account with the most secure payment methods CapHouse offers.

- Start Trading: With your account funded, you can now access global markets and start your trading journey.

Leverage

Regardless of the chosen account type, traders at CapHouse can enjoy the advantage of leverage up to 1000:1. This high leverage allows traders to control larger positions with a relatively smaller initial investment, amplifying potential profits.

Spreads & Commissions

CapHouse boasts low spreads and competitive pricing, with spreads as tight as 0.0 pips, combined with low commission. To be specific, Zero account may incur a commission ranging from $0 to $10, while the other accounts have no commission.

Trading Platform

CapHouse has selected MetaTrader 5 to facilitate trading across various instruments, offering numerous advantages to clients. MT5 enables rapid trade execution through one-click trading, providing convenient access for trading via phone or internet at any time. It offers flexible buy and sell orders to effectively manage positions and improve trading comfort.

Deposit & Withdrawal

CapHouse makes it simple to move your money from place to place. They provide a range of account funding and account withdrawal options in multiple base currencies, including mastercard, local transfer, maestro, skrill and so on. However, the specific information is not mentioned on the page.

Customer Support

CapHouse aims to provide the best service to clients by resolving any issues and questions that arise as a matter of priority. Our professional support team is available via LiveChat or phone to assist you.

Email: Customers can contact CapHouse via email at support@caphouse.com.

Messenger: Customers can get in touch whenever they need help and we will answer their questions and problems 24/7.

Social media: Customers are welcome to follow us on social media.

Educational Resources

CapHouse offers the Economic Calendar to assist traders in making informed decisions.The Economic Calendar is a crucial tool for traders as it provides a schedule of key economic events and indicators from around the world. Understanding the potential market-moving events can help traders plan their trading strategies and manage their positions effectively.

Conclusion

In conclusion, CapHouse is a CFD broker and has several advantages, including providing diverse range of tradable assets, wide range of payment options, comprehensive customer support and competitive spreads and leverage.

However, there are some drawbacks: the broker is unregulated which poses risks for clients and it doesn't provide demo accounts. Traders should carefully consider these factors when choosing to trade with CapHouse and conduct thorough research to ensure a secure and informed trading experience.

FAQs

Q: What can you say about CapHouse Ltd.'s regulatory status?

A: CapHouse Ltd. operates in a non-regulated status.

Q: What types of accounts are available at CapHouse Ltd. for traders?

A: CapHouse Ltd. delineates four distinct types of trading accounts: Standard Account, Fixed Account, Zero Account, and VIP Account.

Q: Can you elaborate on the spread & commission structure at CapHouse Ltd.?

A: CapHouse Ltd. takes pride in offering tight spreads as narrowed as 0.0 pips, along with competitive commissions. Specifically, the Zero account may carry a commission ranging from $0 to $10, while other accounts are commission-free.

Q: How does the deposit and withdrawal process function at CapHouse Ltd.?

A: CapHouse Ltd. streamlines financial transference with an assortment of account funding and withdrawal options in various base currencies, including mastercard, local transfer, maestro, skrill and others.

Tuankhangtrade

Vietnam

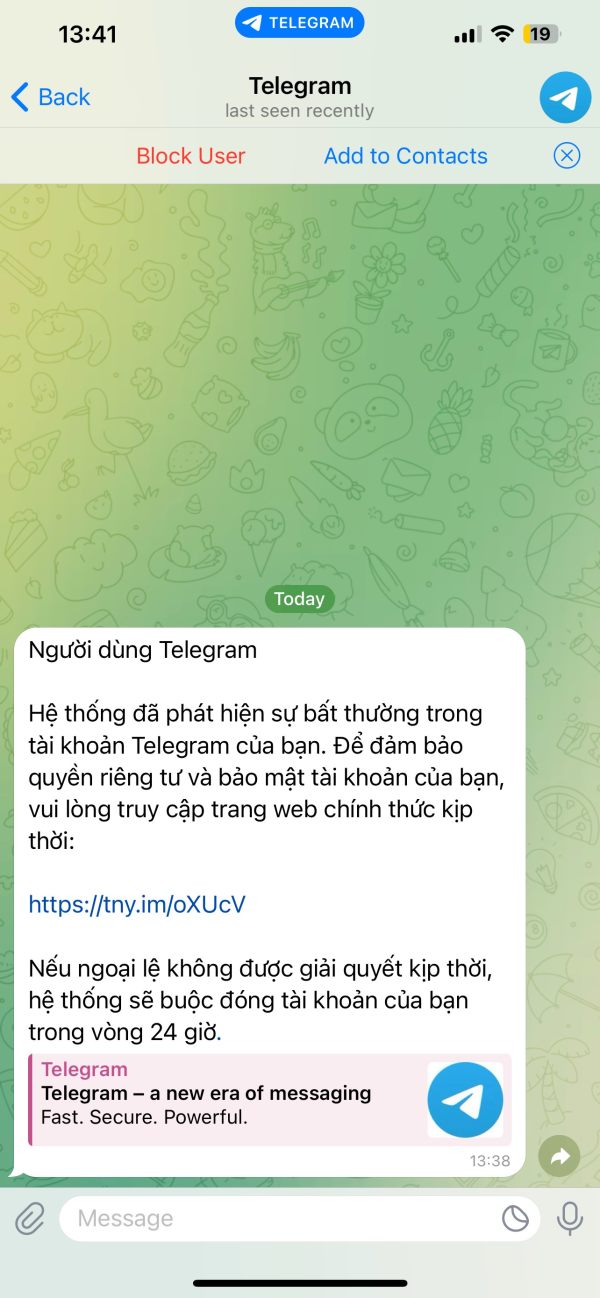

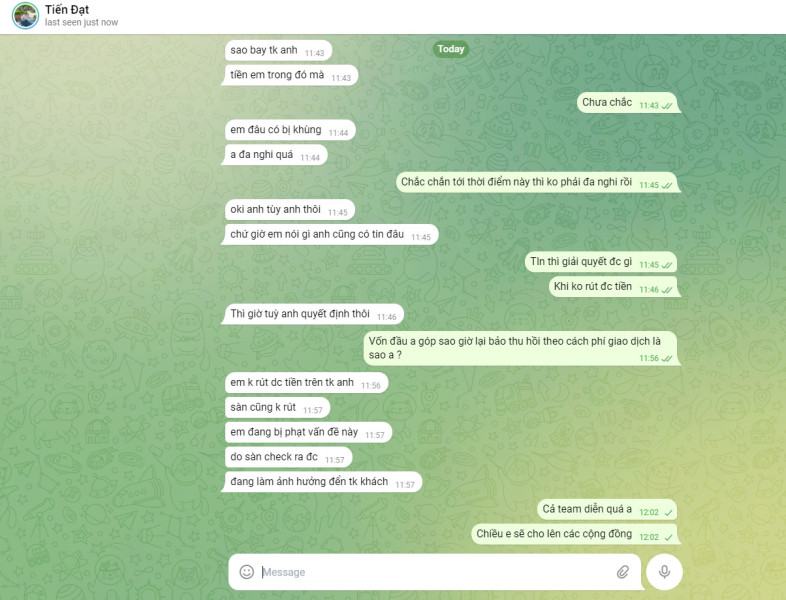

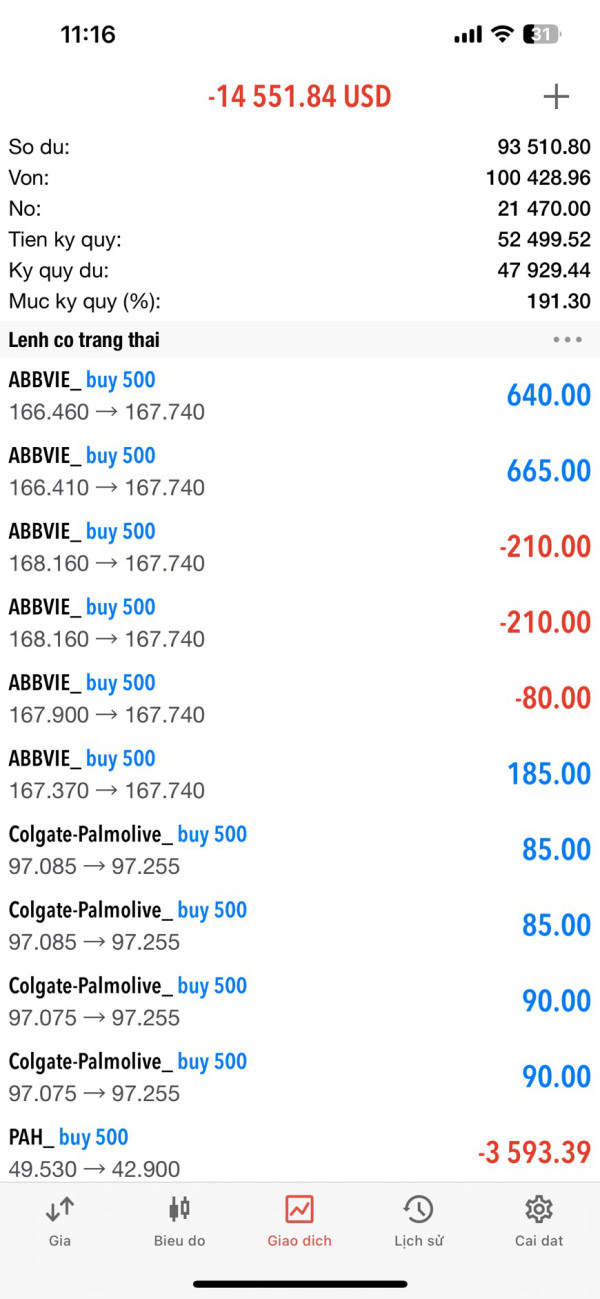

This platform is a complete scam. I originally invested a principal of 20k, and the total investment rose to over 90k, but I haven't received any money from withdrawals for a month. When calling customer support, they just pass the responsibility around and then block my account on Telegram and Zalo. I hope everyone will thoroughly research before investing to avoid losing money.

Exposure

2024-07-11

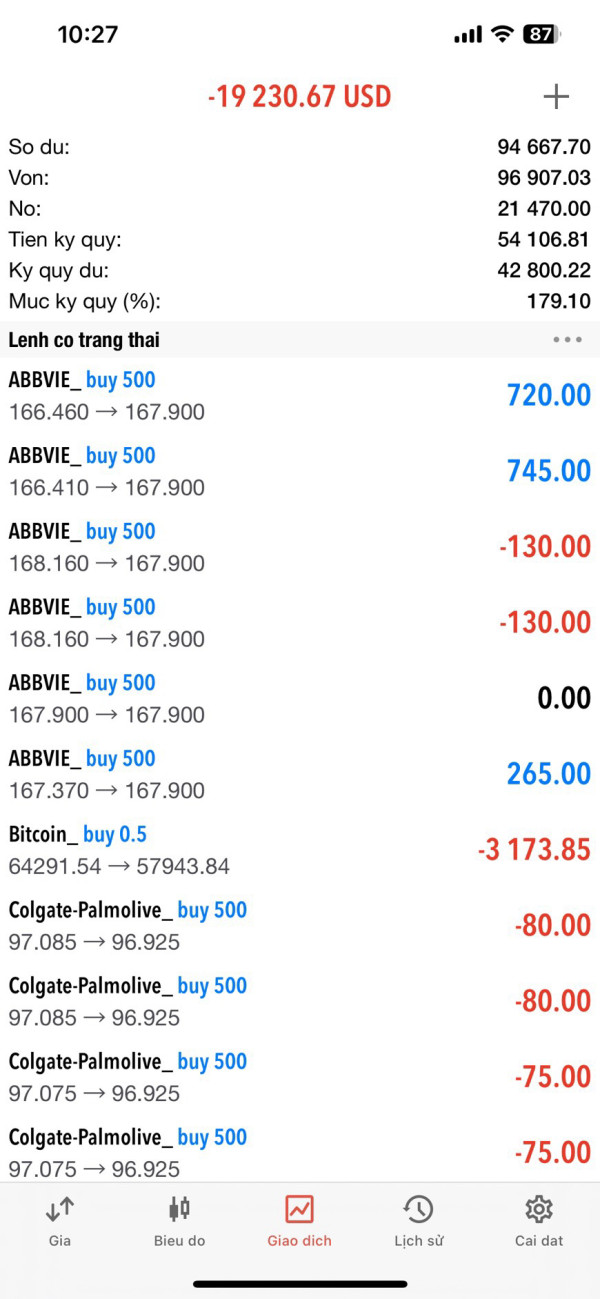

Tuankhangtrade

Vietnam

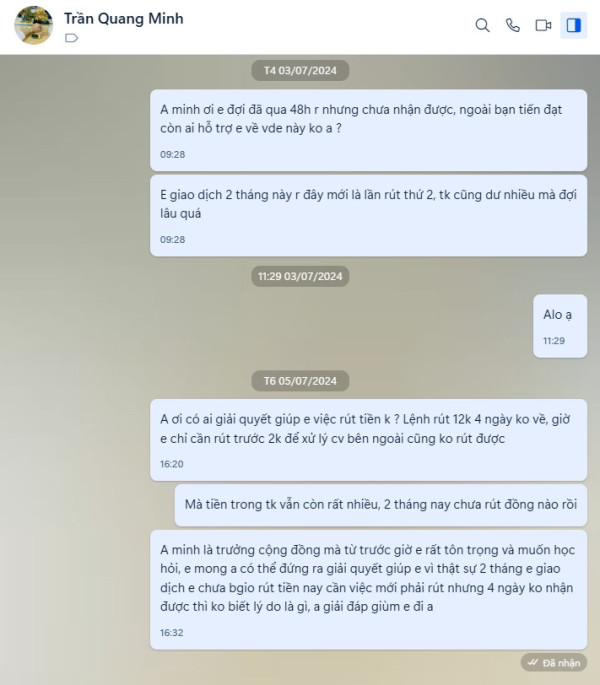

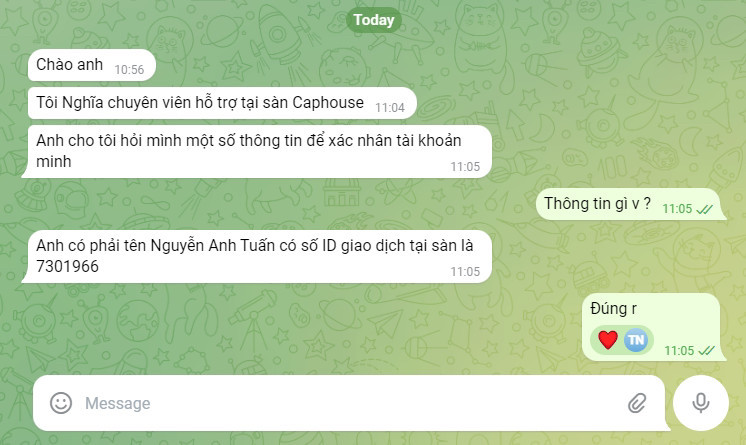

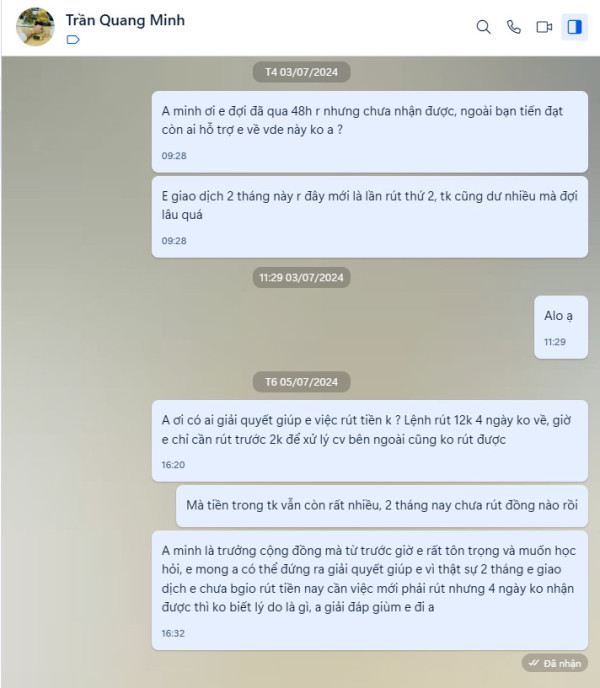

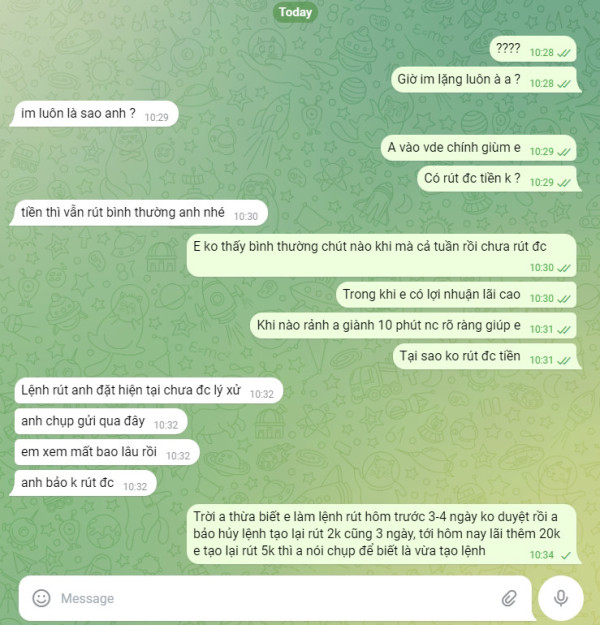

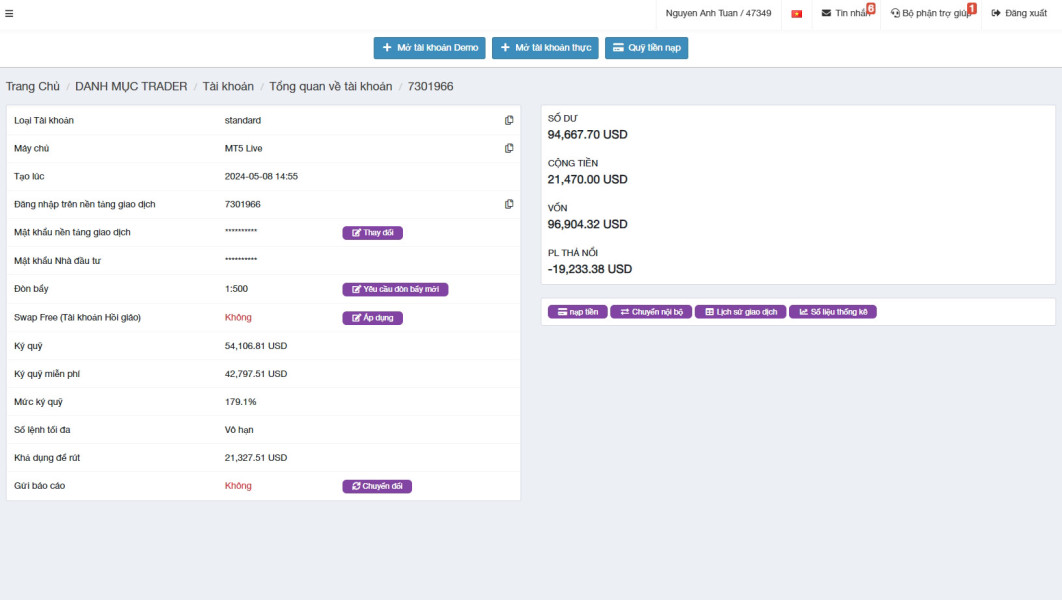

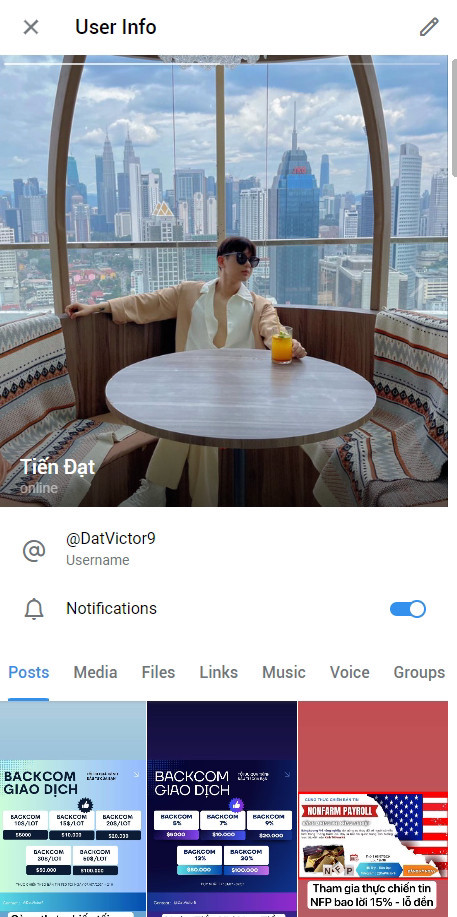

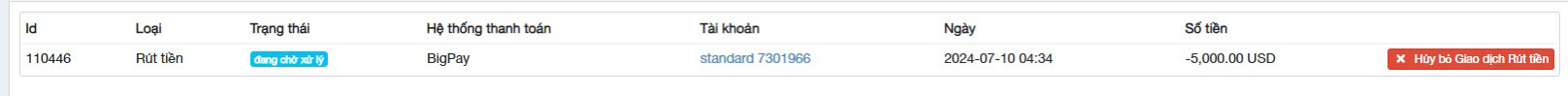

Currently, my account has a total balance of over $90k, with a negative status of $20k, and I am still trading some commodity stocks. The available withdrawal amount is over $20k, but when I tried to withdraw, it didn't come through after a week. When I contacted the support specialist, they gave evasive answers to delay time. I directly messaged the community group leader on Zalo, Tran Quang Minh, but did not receive any response and was kicked out of the group. This has made me realize that this platform is a scam. I have saved all relevant information and images, and I hope everyone can help me and please stay away from Caphouse to avoid losing money like I did.

Exposure

2024-07-10

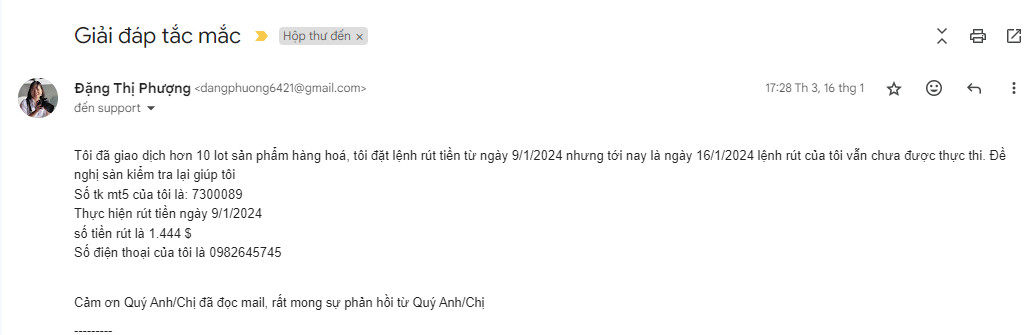

Dang Thi Phuong

Vietnam

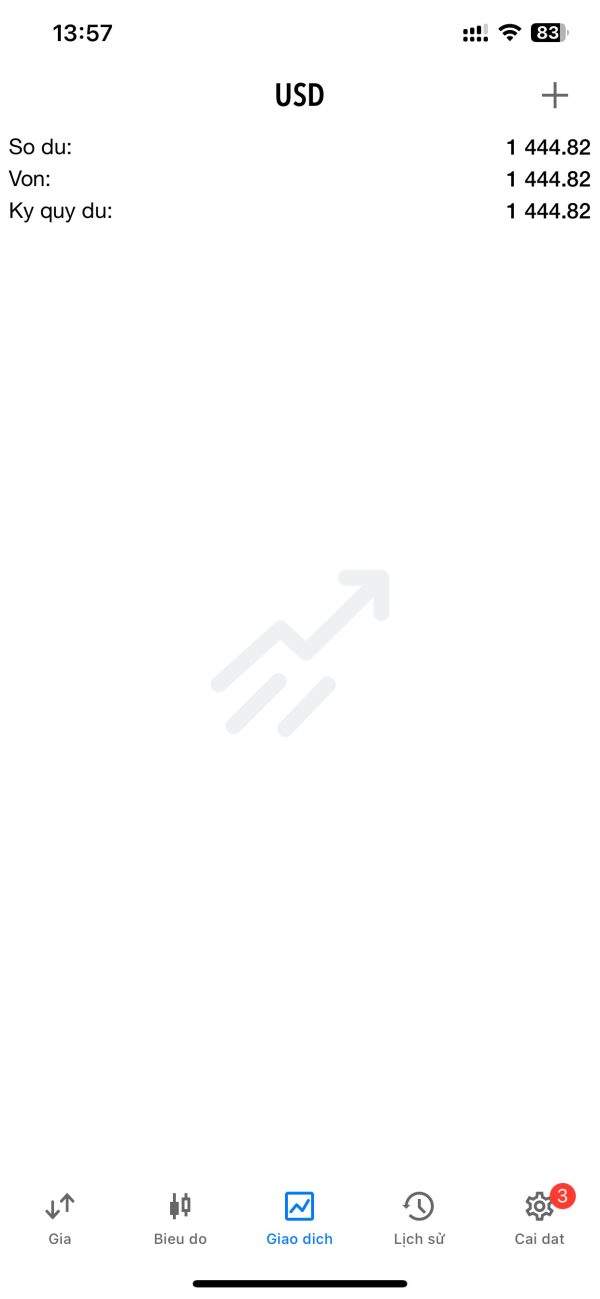

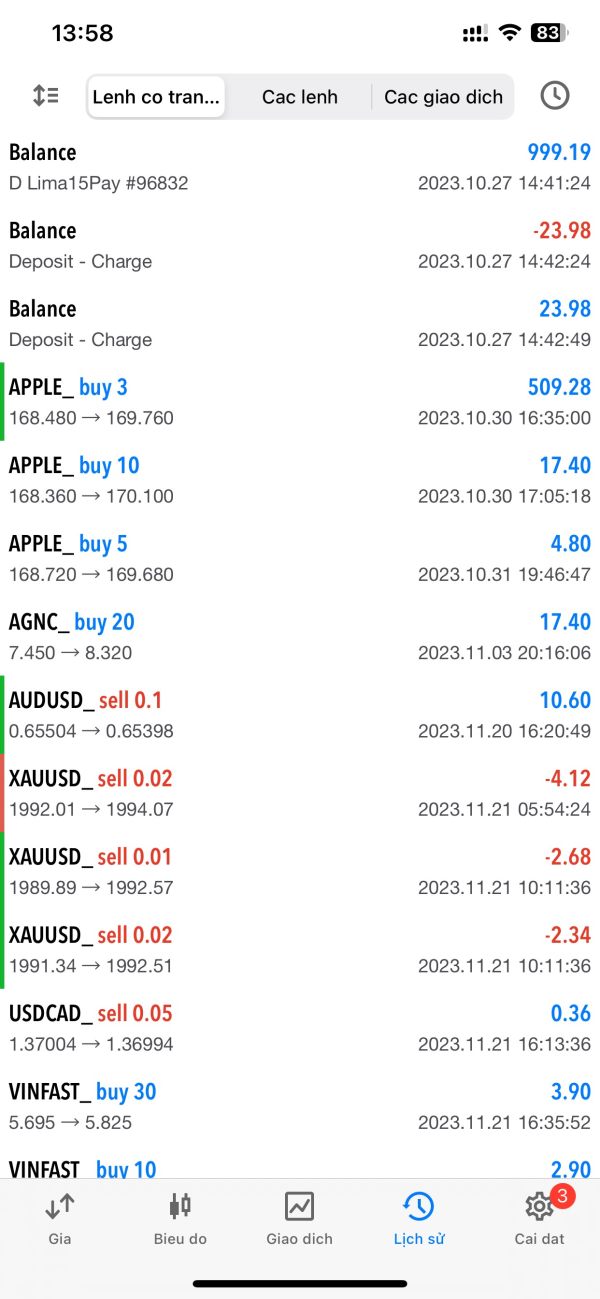

I invested in Caphouse on October 27, 2023 with a capital of $999.19, MT5 number is 7300089; I traded for a while and placed a withdrawal order but it didn't work. The exchange staff informed me that I had to trade 10 lots of the product to be able to withdraw money. Up to now, I have traded more than 10 lots and placed a withdrawal order for $1,444 on January 9, 2024 but it was not executed. I have emailed the exchange about this problem and contacted the switchboard many times. But they have not yet supported. Thanks admin for helping me, thank you very much.

Exposure

2024-01-31

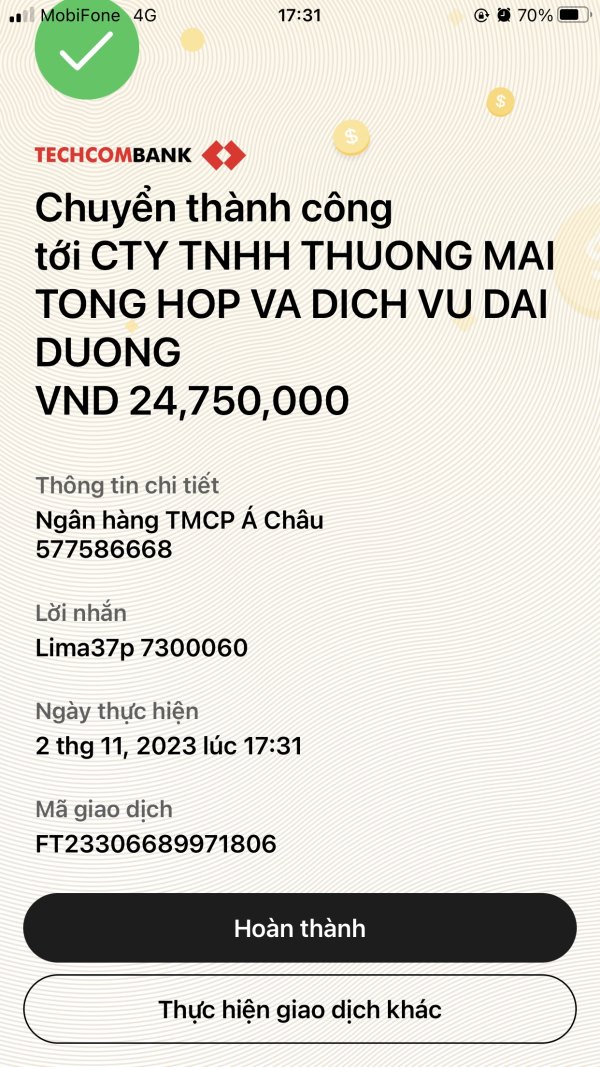

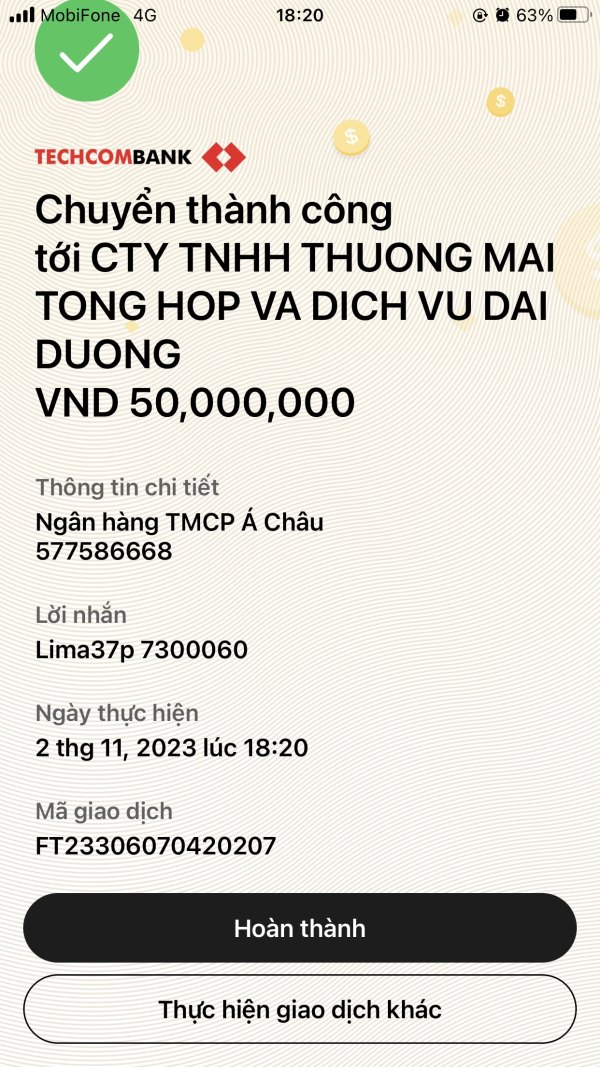

Vũ Quý

Vietnam

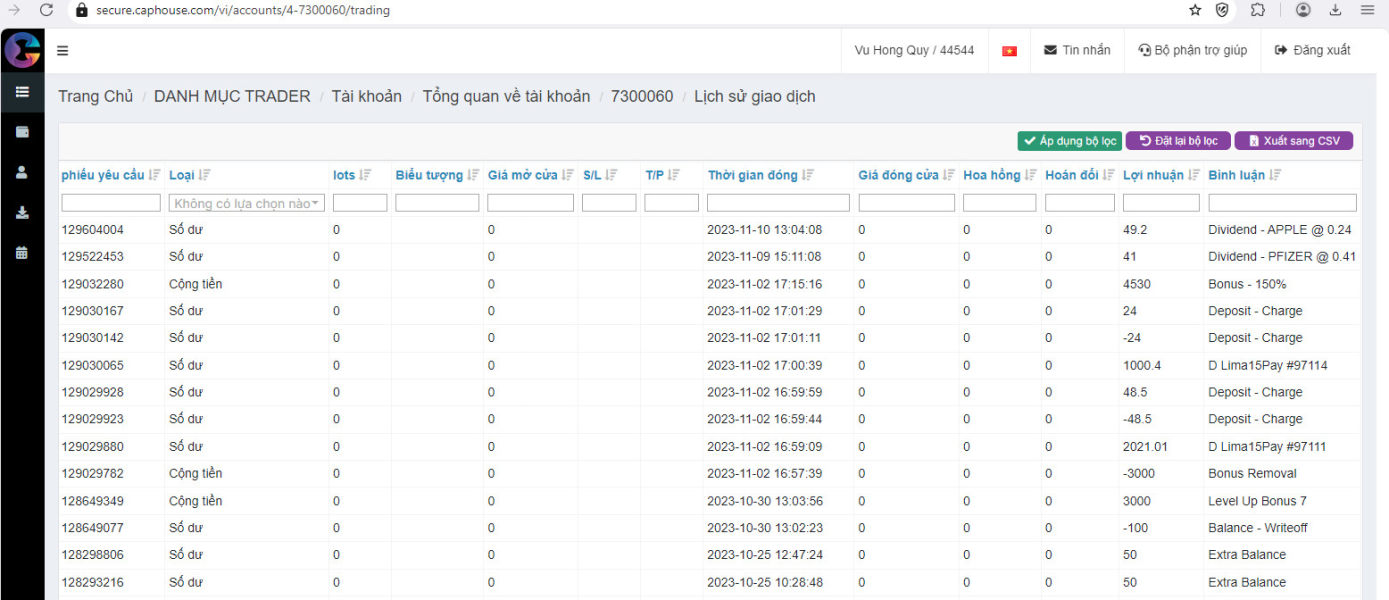

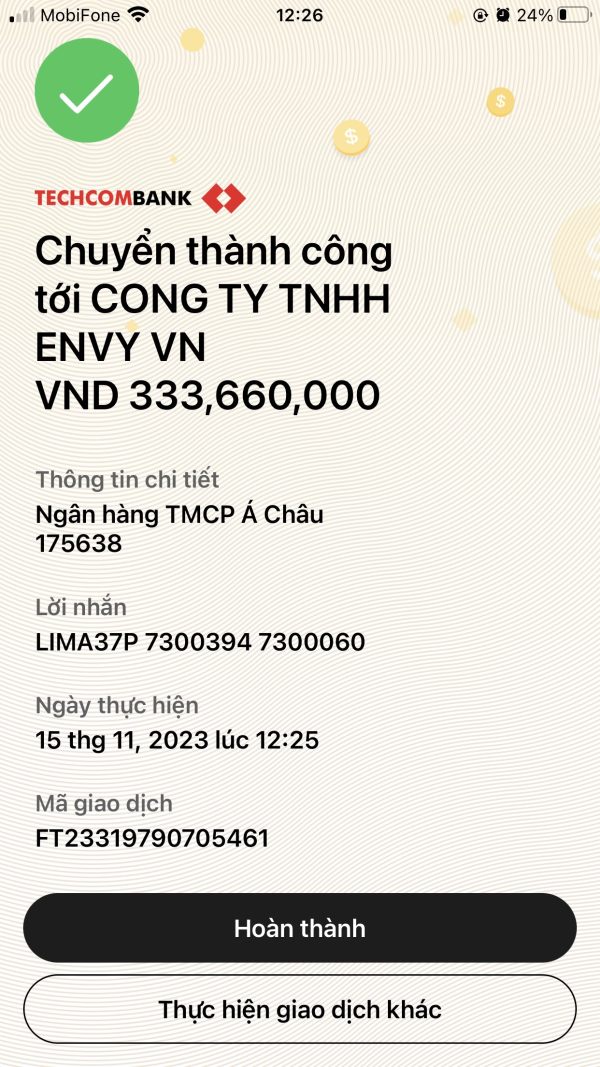

CAPHOUSE trading platform (https://caphouse.com/) scammed customers and did not allow them to withdraw money. I participated in investing when I received support from a staff member named Khanh Ngoc on November 2, 2023, and I deposited a total of 2 times with the amount of 74 million 750 thousand VND. And will be supported by our support experts from November 6, 2023. By November 14, 2023, I had a profit of about 31k and after making a withdrawal order of 20k there was no response. I asked My Van's support specialist for help, but he asked me to pay 45% of the Bot fee. I asked for it to be deducted directly from my account, but it didn't work, and I told him right from the beginning that I was not allowed to disclose the bot fee. I should ask you to ask for support from the floor. On November 15, 2023, My Van replied that because I didn't know, the platform offered a 5% discount and asked me to deposit 333 million,660 thousand to pay the bot fee. I asked Khanh Ngoc and he told me that it was a bot fee due to Mr. and Ms. My Van's transaction, so I couldn't intervene. I also advise you to deposit to withdraw the above amount. Because sometimes I need to borrow a large amount of money to withdraw that profit. On the night of November 15, 2023, someone called and said that the caphouse floor employee in charge of balancing cash flow said he was placing an order to balance cash flow to process the morning withdrawal order. This caused me to lose 13k in negative. I quickly cut the order. And request support to withdraw the remaining amount of 21k. I placed an order on November 15, 2023, and until now, still not supported. The next day, My Van informed me that I had to transact the full initial amount to withdraw or pay the remaining 30%. I asked for support but got no response. Write an email to the exchange and the exchange will contact you for support or call the switchboard. The support staff is not responding. When I called the switchboard, the response was quick and said that the automatic order would take 24 to 48 hours to process. But up to now I still have not received any money or any satisfactory answer from the exchange. I couldn't contact the support specialists My Van or Khanh Ngoc, the team that I joined to invest were all kicked out of the group. Feeling cheated. Do any of you invest in the Caphouse floor like me? EVERYONE RECORDS TOGETHER TO SPEAK UP TO COLLECT THE ACCUSATION AT THE SAME TIME. Brothers and sisters who are researching, you should think again and study carefully.

Exposure

2023-11-29

HJBNM

Nigeria

I'm a new member at Cap House. Today I encountered a problem with my trading live account. So, I connected to live chat and connected with Erasmia. She made service for me very respectfully and best. Accordingly, I am happy with your live chat service. Thank you guys :)

Positive

2024-07-04

jianghua

South Africa

It's genuine trading and investing site,i do trading for last 5 years,this is great site for beginners.

Positive

2024-06-27