Score

Xprestrade

Marshall Islands|2-5 years|

Marshall Islands|2-5 years| https://xprestrade.com/Home

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Marshall Islands

Marshall IslandsAccount Information

Users who viewed Xprestrade also viewed..

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM)

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Website

xprestrade.com

Server Location

United States

Website Domain Name

xprestrade.com

Server IP

23.254.225.51

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| Registered Country/Area | Marshall Islands |

| Founded year | 1-2 years |

| Company Name | Signix LTD |

| Regulation | No valid regulatory information, potential high risk |

| Minimum Deposit | $250 |

| Maximum Leverage | 1:100 - 1:400 |

| Spreads | High, with a spread of 3 pips for EUR/USD currency pair |

| Trading Platforms | Webtrader |

| Tradable assets | Social Trading, Stocks Trading, FX Trading, Indices Trading, Cryptocurrencies Trading, Commodities Trading |

| Account Types | Classic Account, Silver Account, Gold Account, VIP Account, Black Account |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Phone: +44 2033186900, Email: info@xprestrade.com |

| Payment Methods | Credit cards, Debit cards, Bank transfers, E-wallets |

| Educational Tools | Not specified |

General Information

Xprestrade is a forex broker registered in Marshall Islands, an unregulated brokerage platform that offers a range of market instruments to traders and investors. The platform provides opportunities for diversification through social trading, stocks trading, FX trading, indices trading, cryptocurrencies trading, and commodities trading. Social trading allows novice traders to observe and copy the trades of experienced traders, while stocks trading enables clients to buy and sell shares of various companies. FX trading allows participation in the foreign exchange market, while indices trading involves trading contracts based on the performance of specific market groups. Cryptocurrencies and commodities trading provide opportunities for speculating on the price movements of digital currencies and physical assets, respectively.

However, Xprestrade's lack of regulatory oversight is a significant drawback. Regulatory bodies ensure fair and transparent operations, protecting investors from fraudulent activities and financial misconduct. Regulated brokers adhere to specific standards and guidelines, offering better investor protection and dispute resolution options. Xprestrade's unregulated status poses risks for investors and raises doubts about the legitimacy of the platform.

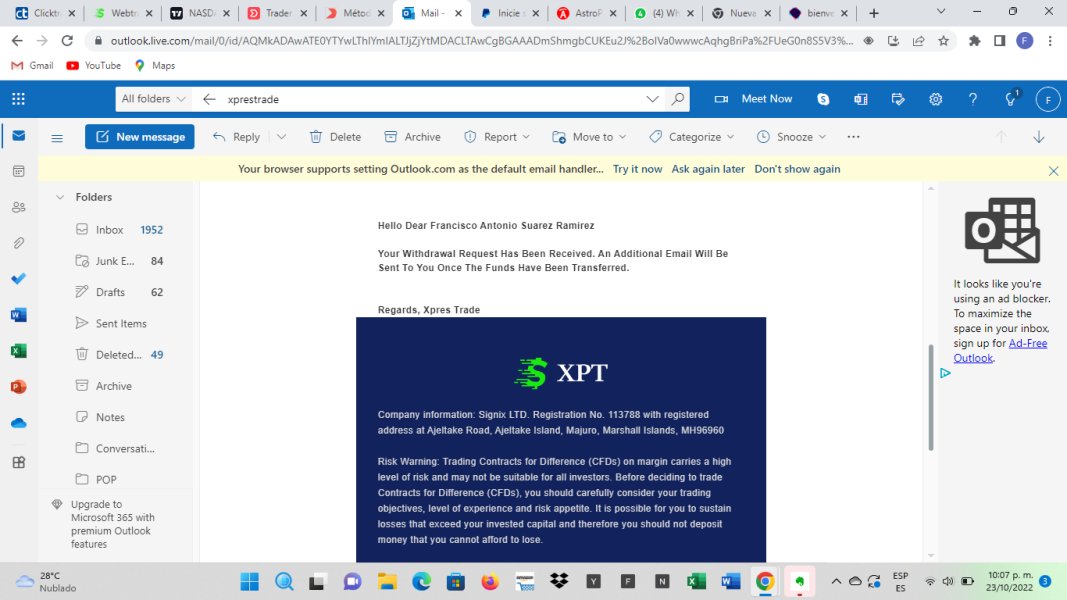

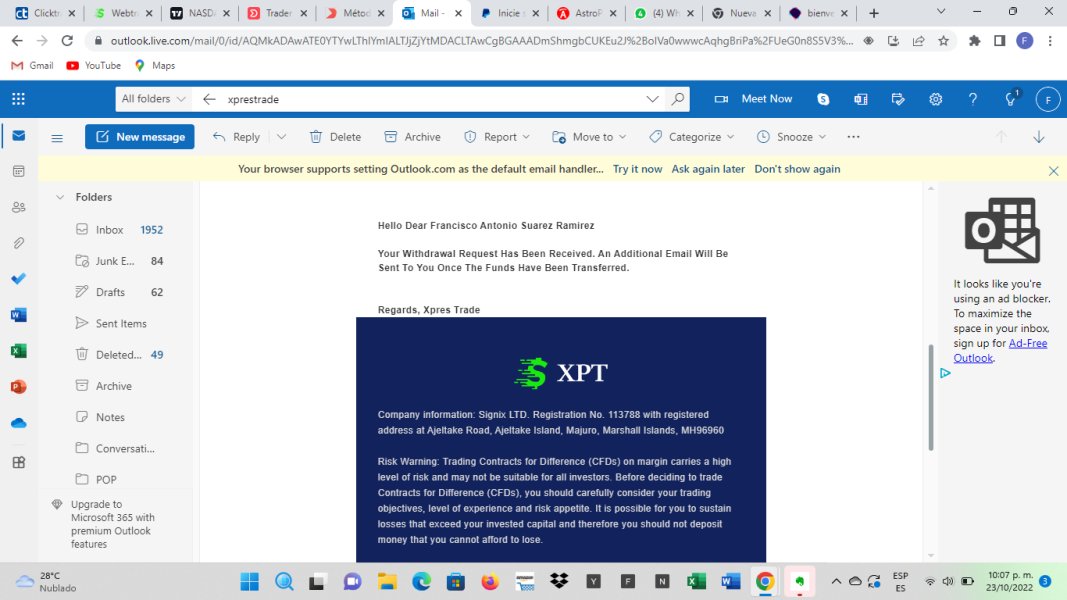

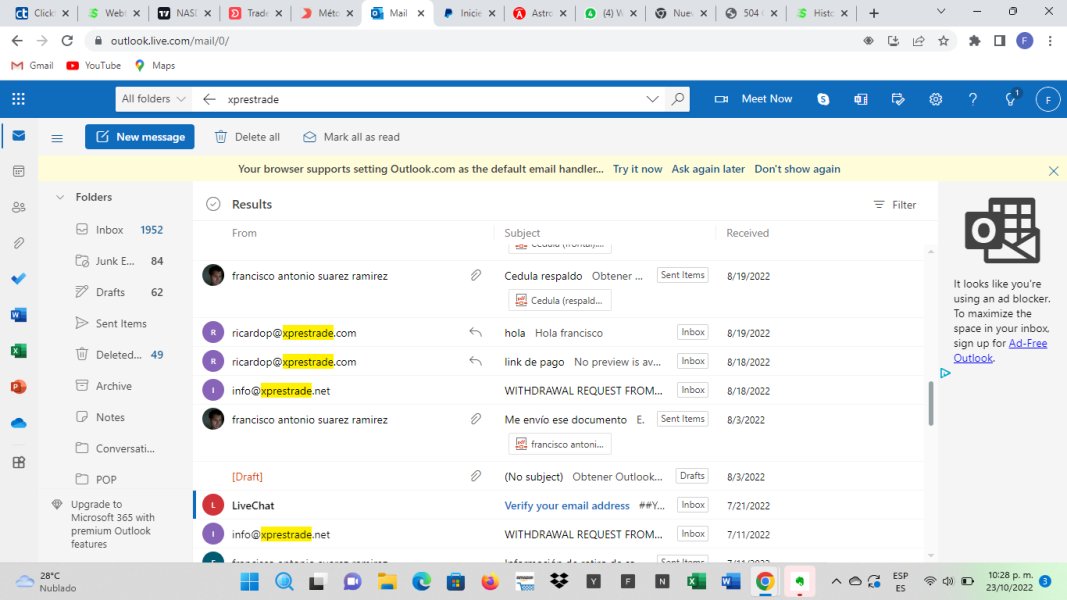

Here is the screenshot of Xprestrades official website:

Pros and Cons

Xprestrade offers a range of pros and cons that traders should consider when evaluating the platform. On the positive side, Xprestrade provides potential for diversification through access to various investment options, allowing traders to explore different markets and assets. The platform also offers a wide range of account options, catering to both novice and experienced traders. Multiple payment methods are available for convenient and flexible deposits, and there are various options for funding trading accounts. Xprestrade is suitable for both beginners and seasoned traders alike. However, there are also certain cons to consider. Market volatility poses a risk, as trading involves potential financial losses. There is also a risk of scams or fraud in the trading industry, which traders should be cautious of. Additionally, lower-tier accounts may have limited additional benefits, and higher-tier accounts may incur potential higher trading costs. Certain benefits may require maintaining higher account balances, which could impact traders' financial management. It is crucial for traders to carefully assess these pros and cons to make an informed decision about using Xprestrade as their trading platform.

| Pros | Cons |

| Potential for diversification | Market volatility |

| Access to various investment options | Risk of financial loss |

| Wide range of account options | Potential for scams or fraud |

| Multiple payment methods available | Limited additional benefits for lower-tier accounts |

| Various options for depositing funds | Potential higher trading costs for advanced accounts |

| Suitable for both novice and experienced traders | Requirement to maintain higher account balances for certain benefits |

Is Xprestrade Legit?

Xprestrade is a broker that is not regulated by any valid regulatory authority. Regulation plays a crucial role in the financial industry as it provides oversight and ensures that brokers operate in a fair and transparent manner, safeguarding the interests of investors. Without proper regulation, there is a significant risk involved when dealing with such brokers.

Regulated brokers are required to adhere to specific standards and guidelines set by regulatory bodies. These standards aim to protect investors from fraudulent activities, unethical practices, and financial misconduct. Regulated brokers typically undergo regular audits, maintain segregated client accounts, and provide recourse options for dispute resolution.

Market Instruments

With Xprestrade, clients are given access to Social Trading, Stocks Trading, FX Trading, Indices Trading, Cryptocurrencies Trading, as well as Commodities Trading.

Social Trading: Xprestrade enables clients to engage in social trading, which allows them to observe and copy the trades of experienced traders. This feature provides an opportunity for novice traders to learn from and replicate the strategies of successful traders, potentially improving their own trading outcomes.

Stocks Trading: Xprestrade allows clients to trade stocks, giving them access to a diverse range of companies listed on stock exchanges. Clients can buy and sell shares, aiming to profit from price fluctuations or earn dividends from their investments in individual stocks.

FX Trading: With Xprestrade, clients can participate in the foreign exchange (FX) market. This allows them to trade currency pairs, speculating on the fluctuations in exchange rates. FX trading provides opportunities for investors to profit from the movements in global currencies.

Indices Trading: Xprestrade offers indices trading, which involves trading contracts based on the performance of a group of stocks that represent a specific market or sector. Clients can speculate on the overall direction of the index, such as the S&P 500 or the FTSE 100, without trading individual stocks.

Cryptocurrencies Trading: Xprestrade provides the option to trade cryptocurrencies, including popular digital currencies such as Bitcoin, Ethereum, and Litecoin. Clients can take advantage of the volatility in the cryptocurrency market to potentially generate profits.

Commodities Trading: Xprestrade enables clients to trade commodities, such as gold, silver, oil, or agricultural products. Commodities trading allows investors to speculate on the price movements of these physical assets, providing opportunities for diversification and potential profits.

| Pros | Cons |

| Potential for diversification | Market volatility |

| Access to various investment options | Risk of financial loss |

| Opportunities for profit generation | Lack of regulatory oversight |

| Potential for scams or fraud |

Account Types

Classic, Silver, Gold, VIP, and Black accounts are the available options for traders, making them accessible to both novice and experienced traders. The minimum deposit specifies the account type, with the Classic account from $250, the Silver account from $10,000, the Gold account from $25,000, the VIP account from $100,000, and the Black account from $200,000.

CLASSIC ACCOUNT:

The Classic account is the entry-level account offered by Xprestrade. It requires a minimum deposit of $250. This account type is suitable for novice traders who are just starting in the financial markets. It provides basic trading features and access to a range of tradable assets. However, it may have limited additional benefits compared to higher-tier accounts.

SILVER ACCOUNT:

The Silver account is designed for traders who are ready to invest a larger amount. It requires a minimum deposit of $10,000. This account type offers more features and benefits compared to the Classic account. Traders with a Silver account may enjoy enhanced trading conditions, additional educational resources, and possibly better customer support.

GOLD ACCOUNT:

The Gold account is tailored for experienced traders who are willing to invest a significant amount of capital. It requires a minimum deposit of $25,000. With a Gold account, traders may have access to advanced trading tools, personalized services, and exclusive market insights. The Gold account typically offers more competitive trading conditions compared to the lower-tier accounts.

VIP ACCOUNT:

The VIP account is designed for high-net-worth individuals and experienced traders who are looking for premium services and privileges. It requires a minimum deposit of $100,000. VIP account holders may enjoy personalized support, priority withdrawals, customized trading solutions, and potentially lower trading costs. This account type is suitable for those who require extensive support and personalized attention.

BLACK ACCOUNT:

The Black account is the highest-tier account offered by Xprestrade. It requires a minimum deposit of $200,000. This account type is tailored for elite traders and institutional clients. Black account holders may receive the highest level of benefits, including exclusive features, trading conditions, and account managers.

| Pros | Cons |

| Wide range of account options | Higher minimum deposit for advanced accounts |

| Accessible to both novice and experienced traders | Limited additional benefits for lower-tier accounts |

| Tailored services and benefits for each account type | Potential higher trading costs for advanced accounts |

| Potential access to advanced rading tools and features | Requirement to maintain higher account balances for certain benefits |

| Personalized support and account managers for higher-tier accounts | Limited information on specific features and benefits of each account type |

Spreads & Commissions

Xprestrade imposes high trading costs on its clients, particularly in terms of spreads and commissions. For the EUR/USD currency pair, the spread is set at 3 pips, which is significantly higher compared to the industry standard. Normally, traders would expect a spread of 1 pip or even lower for this pair, resulting in a cost of $10 or less per lot traded. In contrast, Xprestrade charges a hefty $30 for the same service, making it quite expensive.

Leverage

Maximum leverage for major forex is 1:30 in Europe and Australia, and 1:50 in the U.S. and Canada, while Xprestrade enables its clients to use leverage of up to 1:400. This is much higher than the proper amount considered appropriate by most regulators.

Since leverage can amplify both gains and losses, it can result in devastating losses for investors who lack experience. If you're just starting out in the trading world, it's best to stick with the lower size.

Trading Platforms

Xprestrade offers a trading platform called Webtrader, which they claim to be a high-end piece of software. However, upon closer examination, it becomes evident that this claim is misleading. The Webtrader provided by Xprestrade is basic and lacks the sophistication and functionality found in industry-leading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5).MT4 and MT5 offer a wide range of advanced tools and features, including automated trading options, analytical tools, a variety of complex indicators, and a marketplace with thousands of trading apps developed by traders for traders.

In contrast, Xprestrade's Webtrader fails to provide any of the advanced features and capabilities offered by MT4 and MT5. It lacks the necessary tools and functionalities that traders rely on for effective analysis and execution of trades. The Webtrader is unreliable and lacks the stability expected from a professional trading platform. Overall, it falls significantly short in comparison to the industry-standard platforms.

| Pros | Cons |

| Suitable for beginners | Limited functionality |

| Quick and easy setup | Lack of advanced features |

| Accessible from any web browser | Unreliable performance |

| Basic trading capabilities | No automated trading options |

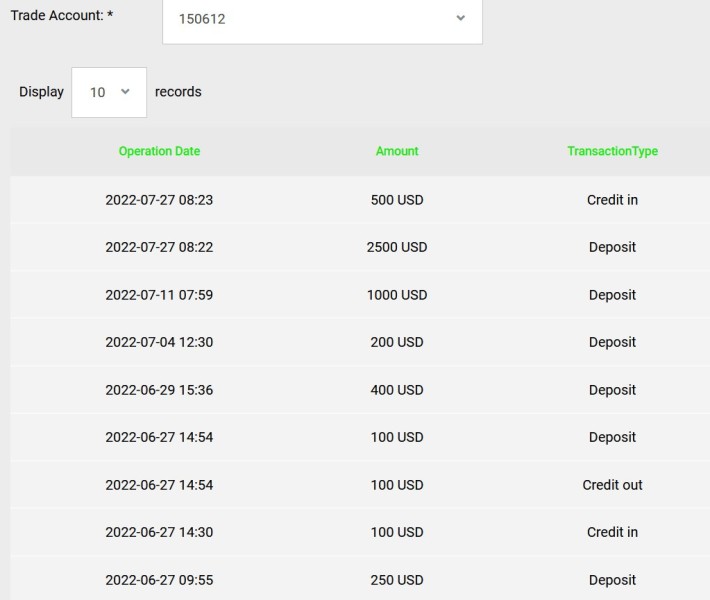

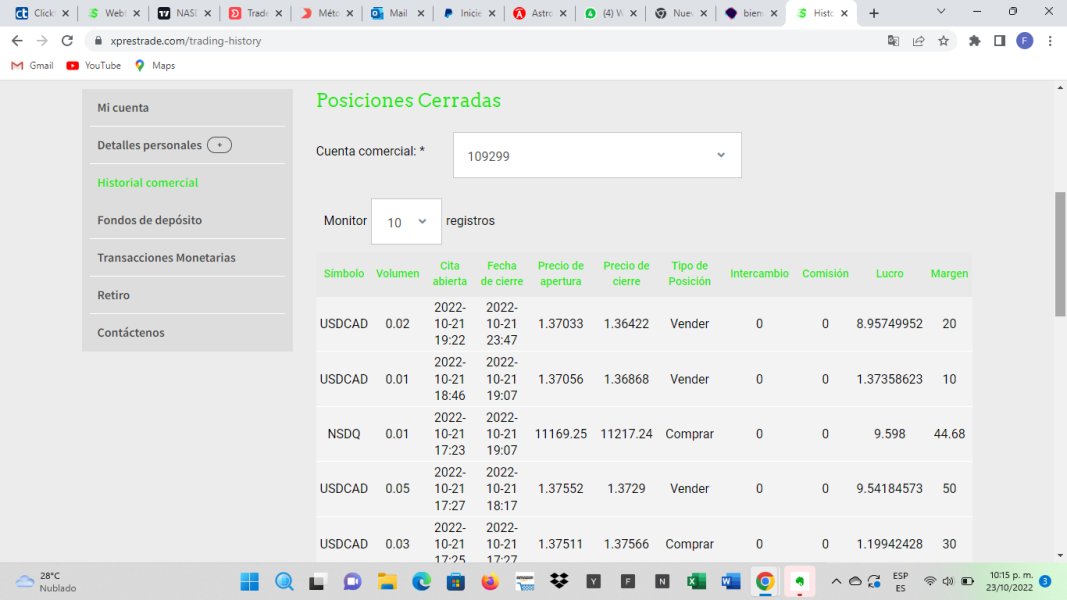

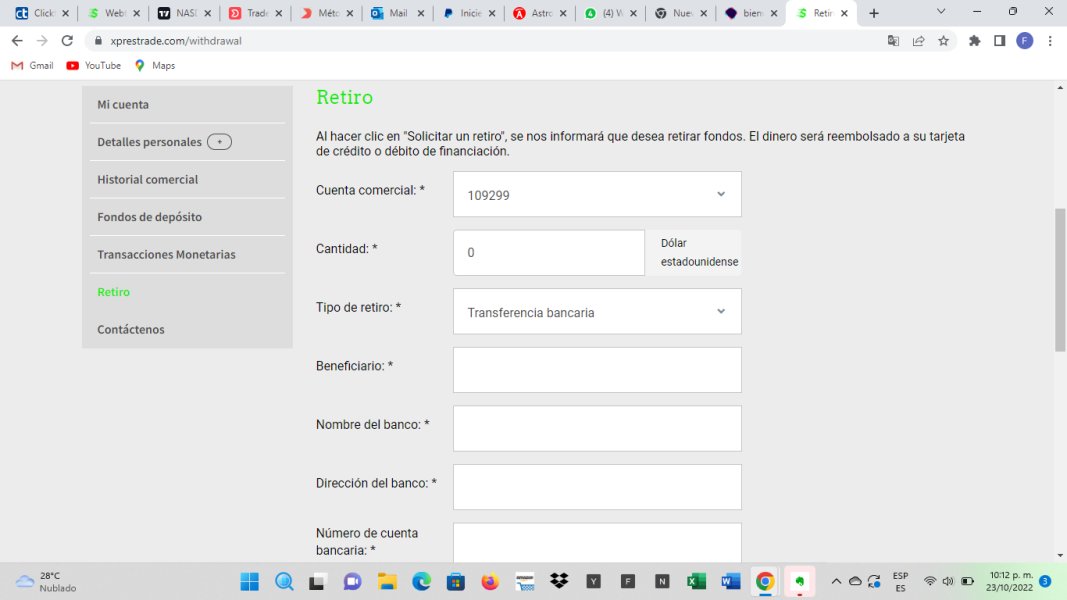

Deposits and Withdrawal

Xprestrade allows customers to deposit funds using credit cards, debit cards, bank transfers, and e-wallets. However, it is worth noting that a red flag is raised as an intermediary processor, “gate.shinepays.com,” is required to make the payment instead of allowing direct transactions with bank cards. This arrangement raises concerns about transparency and the potential for fraudulent activities.

The minimum deposit accepted by Xprestrade is $250, and customers can only withdraw amounts of $100 and above. This limitation is quite restrictive, as genuine companies usually do not impose such restrictions on withdrawal amounts. Dealing with such limitations on a platform with questionable credibility can be frustrating and raises doubts about the legitimacy of the website.

Withdrawal requests from Xprestrade take a lengthy period of 30 days to be processed, which is significantly longer than the time taken by legitimate companies, typically a few hours to a maximum of 2 days. This delay in honoring withdrawal requests is inconvenient for customers and indicates a lack of efficiency and professionalism on the part of the broker.

Furthermore, Xprestrade expects clients to meet a trading volume of $500,000. Failure to meet this requirement results in a charge of $120. These unfavorable fees and conditions imposed by the broker add further disadvantages to opening an account with the platform.

| Pros | Cons |

| Multiple payment methods available | Use of intermediary processor for payments raises concerns |

| Various options for depositing funds | Restrictive minimum withdrawal amount of $100 and above |

| Withdrawal processing time of 30 days is significantly longer than industry standards | |

| High trading volume requirement of $500,000 | |

| Imposition of $120 charge for failure to meet the trading volume requirement |

Customer Support

With no live chat supported, clients can only reach this broker through calling it at +442033186900, or dropping them a line through the email: info@xprestrade.com.

Accepted Countries

XpresTrade operates in Canada, Japan, South Korea, Brazil, and Colombia, allowing residents of these countries to engage in trading and investment activities. However, it is important to note that XpresTrade lacks regulatory oversight in certain countries, which can pose risks for investors. Additionally, variations in local market conditions, regulations, and potential language barriers may present challenges

Customer Support

Xprestrade provides customer support primarily through a phone number and email address. Clients can reach the broker by calling +442033186900 or sending an email to info@xprestrade.com. However, it is important to note that the lack of live chat support means that immediate assistance may not be available.

Reviews

According to the reviews on WikiFX, there are multiple complaints and negative experiences related to XpresTrade. One complaint mentions issues with withdrawing money, with delays and additional fees imposed on the withdrawals. Another review exposes a potential pyramid scheme and fraudulent activities, where the broker pressured the trader to deposit more money and discouraged withdrawals. The review highlights the inability to withdraw funds and the lack of transparency regarding fees. Another user warns others about the scam broker, mentioning that the broker appeared legitimate at first but later faced difficulties with withdrawals and encountered various managers asking for additional deposits. These reviews serve as a cautionary reminder to exercise caution when dealing with XpresTrade.

Conclusion

In conclusion, Xprestrade offers a range of market instruments and account types, providing opportunities for trading and investment. However, there are several disadvantages to consider. Xprestrade is not regulated by any valid regulatory authority, which raises concerns about investor protection and fair practices. The broker imposes high trading costs, particularly in terms of spreads and commissions, and has restrictive withdrawal policies and lengthy processing times. The trading platform provided by Xprestrade lacks advanced features and functionalities compared to industry-leading platforms. On the positive side, Xprestrade offers potential for diversification, access to various investment options, and opportunities for profit generation. Additionally, clients can benefit from social trading and different account types with tailored services and benefits. Nevertheless, the lack of regulation, high trading costs, withdrawal limitations, and platform limitations make it crucial for potential users to exercise caution and thoroughly research before engaging with Xprestrade.

FAQs

Q: Is Xprestrade a regulated broker?

A: No, Xprestrade is not regulated by any valid regulatory authority. Lack of regulation poses significant risks in terms of fair practices and investor protection.

Q: What market instruments does Xprestrade offer?

A: Xprestrade offers a variety of market instruments, including social trading, stocks trading, FX trading, indices trading, cryptocurrencies trading, and commodities trading.

Q: What are the different account types offered by Xprestrade?

A: Xprestrade offers several account types: Classic, Silver, Gold, VIP, and Black. Each account type has different minimum deposit requirements and offers varying features and benefits.

Q: Does Xprestrade provide leverage to its clients?

A: Yes, Xprestrade offers leverage ranging from 1:100 to 1:400, which is higher compared to the maximum leverage allowed in some other regions.

Q: What are the payment methods for depositing funds with Xprestrade?

A: Xprestrade allows customers to deposit funds using credit cards, debit cards, bank transfers, and e-wallets.

Q: What trading platform does Xprestrade offer?

A: Xprestrade offers a trading platform called Webtrader, which is basic and lacks the advanced features and functionalities of industry-leading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Q: Where does Xprestrade operate?

A: Xprestrade operates in Canada, Japan, South Korea, Brazil, and Colombia. However, regulatory oversight and market conditions may vary in these countries.

Q: How can I contact Xprestrade's customer support?

A: You can contact Xprestrade's customer support by calling +442033186900 or sending an email to info@xprestrade.com. Please note that live chat support may not be available.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 7

Content you want to comment

Please enter...

Comment 7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Trader CHIU

Taiwan

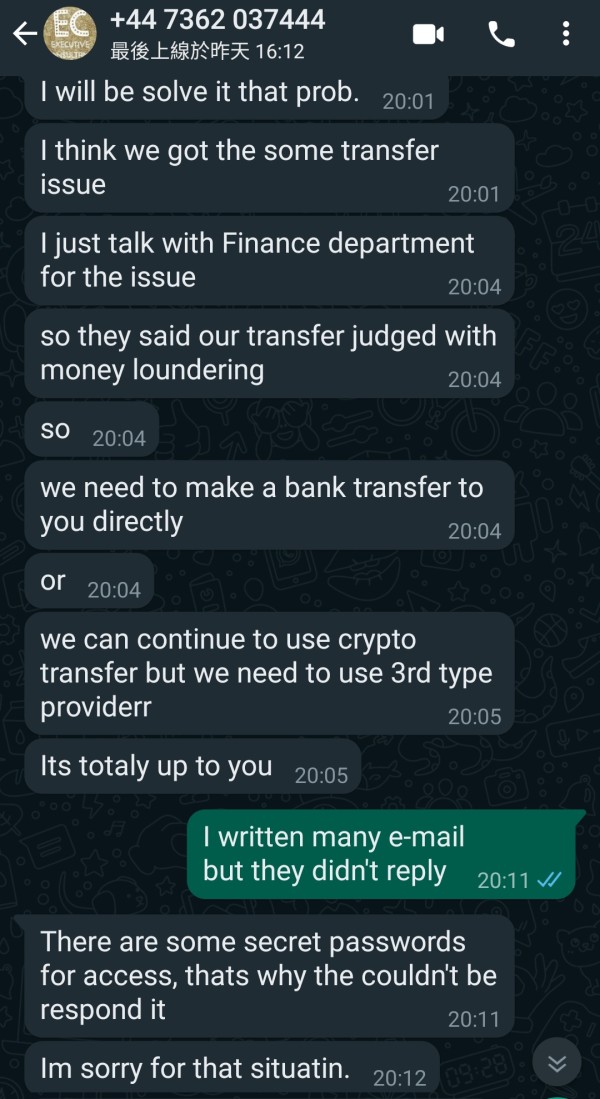

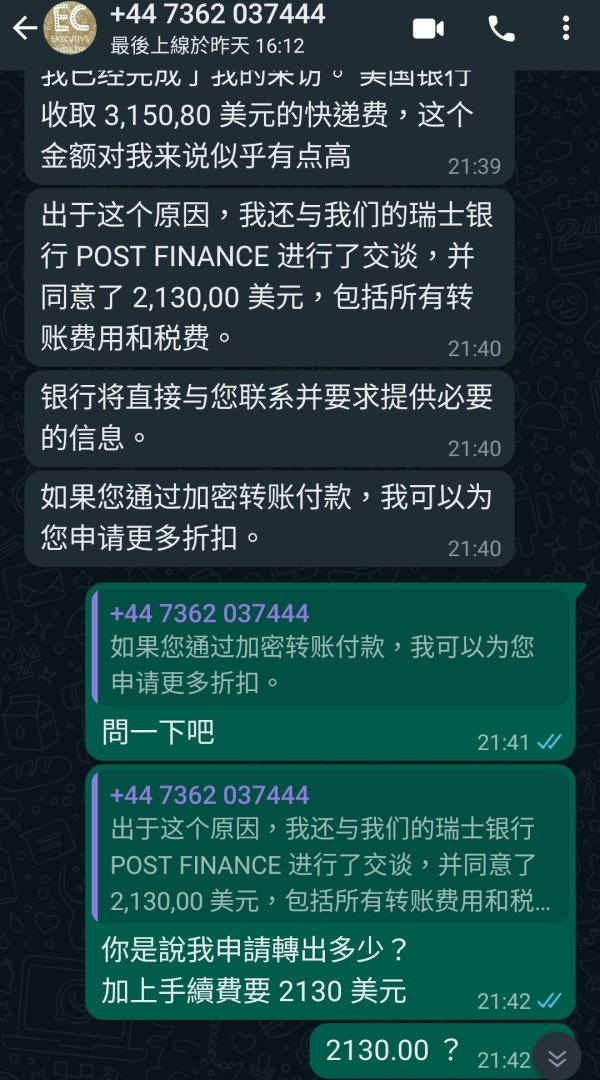

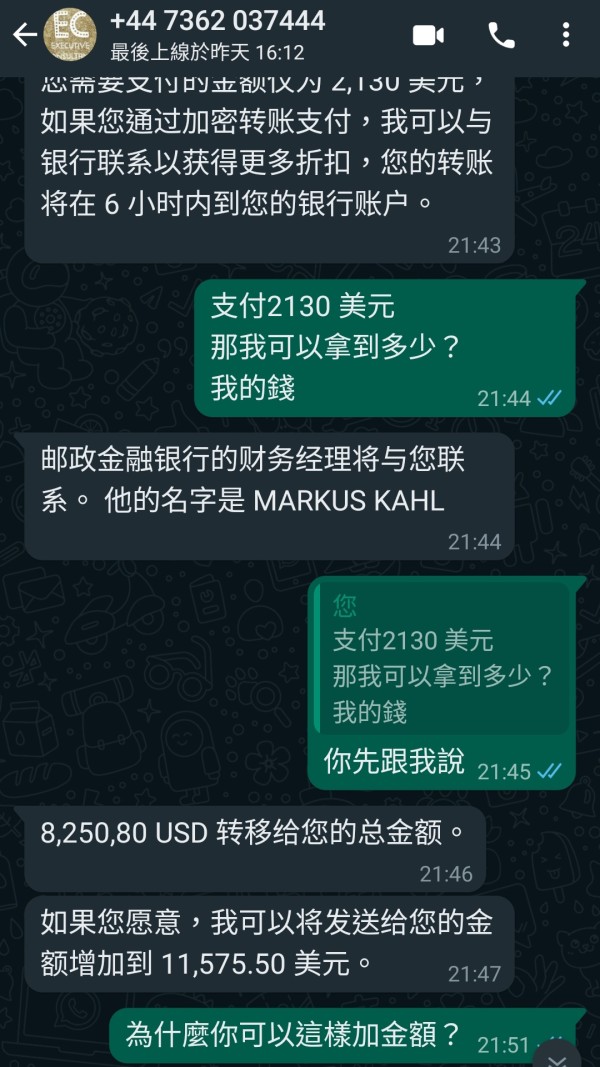

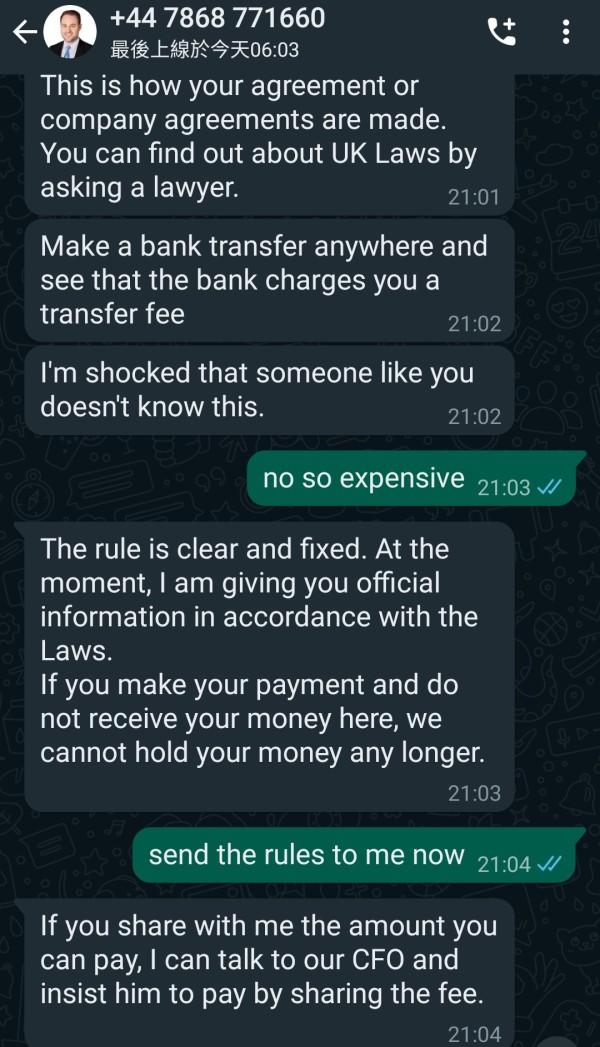

In June 2022, I received a call from the UK, saying that I was in Xprestrade registered on this platform, as long as I deposit 250 dollars, there will be a special financial consultant who will operate the account on my behalf, and promise to make you money. no matter how you refuse, he will always deny you, just ask you to deposit. after depositing, this senior consultant claims that john will please use WhatsApp to contact him, and then please give him the account password; download any desk and say that while he is operating, you can monitor it. after a few operations, it will make money, and then he asks me to put more money into it, it can be operated to earn more, I doubt whether I can withdraw money, when I asked for a withdrawal, john first gave me 100 us dollars, and there was indeed a withdrawal. after that, he encouraged me to put more money, and after depositing more money, the value of the account also increased because of his transactions, so he continued to encourage me to put more money, and when I felt that I wanted to withdraw money, I directly applied for withdrawal. after waiting for 2 weeks, I still haven't returned to the bank, and I have been applying for withdrawals since then, but there is no follow-up, only a system letter saying that I have received a withdrawal application. I told john about this matter, and he said that because of the international shipping fee, he charged an extra fee of 2,310 us dollars for the withdrawal, so I found that there is a problem with this platform

Exposure

2023-02-23

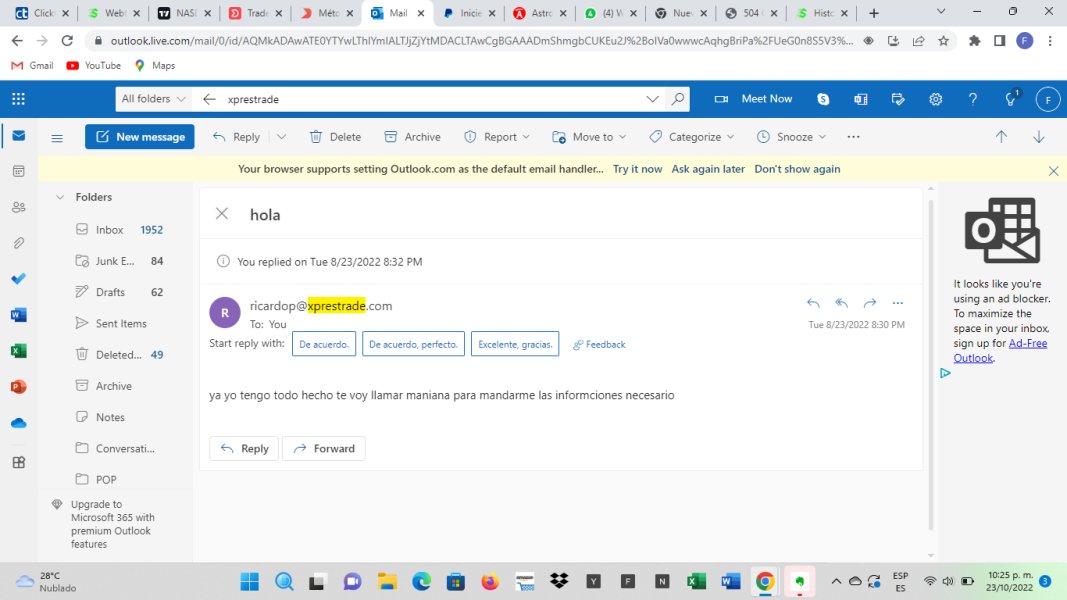

Francisco9036

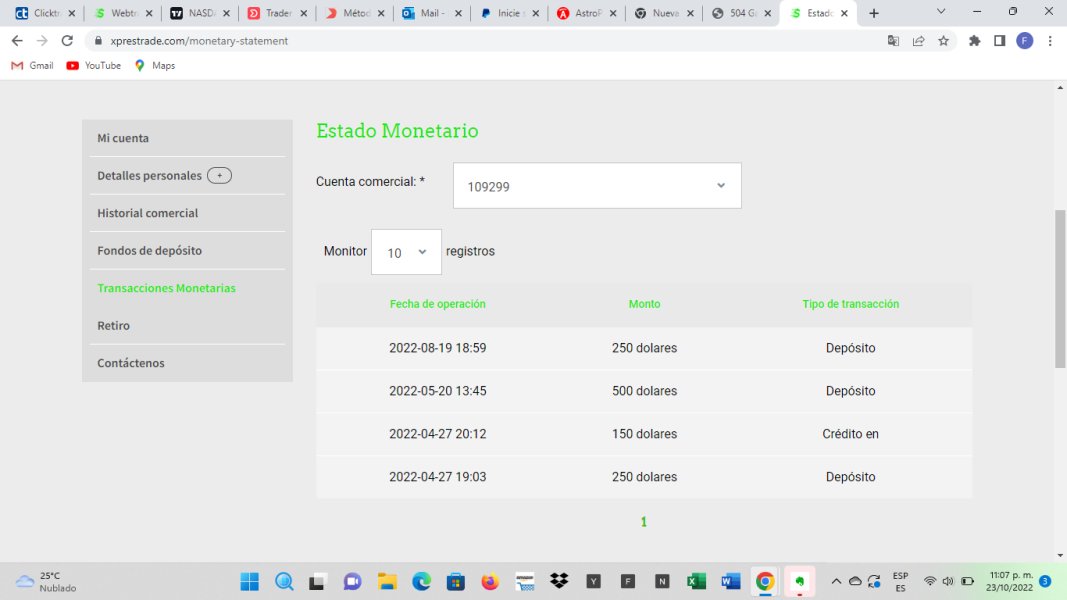

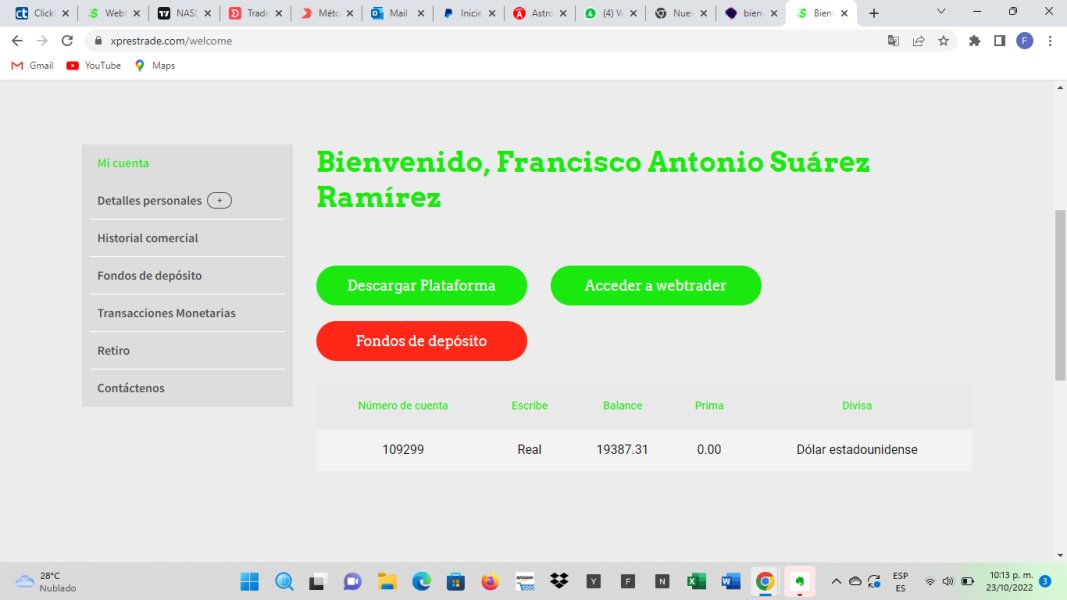

Colombia

I expose this public complaint to warn others that the same thing could happen to them, this supposed broker has all the setup of a normal broker, advisory calls, everything normal. At that time I did not know very well about the subject and I made the mistake of not investigating it well, I was advised at the beginning for a couple of months by Mrs. Maria Martinez, I left the tests of conversations via WhatsApp, when I already had some idea they assigned me another manager called esteban cardona who taught me a little more and configured me a very efficient internal boots that I supervised apart from the orders that I entered, little by little in a matter of 4 months I was uploading my account I started with a deposit of 250 usd then I entered 500 usd advised by maria to be able to risk a little more in my entry orders, conclusion with the help of the boots that made some very good orders of 7,400 with gold, 3,000 and 4,000 in oil, the account was raised in the last month to 19,000 usd , there I already requested withdrawal because they kept me waiting longer to manage a withdrawal when I raised the issue at the beginning due to lack of experience it was not abnormal, I could never make a withdrawal they always told me a something or other that I had to pay some commissions to download partial payments, they assigned me a last manager called ricardo, with many calls and explanations to make a minimum deposit of 250 usd to withdraw 5000 usd which never happened, be careful with this scam broker Don't keep cheating.

Exposure

2022-10-24

Trader CHIU

Taiwan

I have waited for a month to withdraw the money and it has not arrived yet. The customer service also said that the remittance will be charged an extra fee of more than 2,000 US dollars. This must be a scam, don’t fall into it

Exposure

2022-08-29

고주망타

South Korea

Could it be that the above website is gone, and I can’t connect to the website. I have about USD$680 on me, but I can’t connect to the website.

Neutral

2023-04-21

고주망타

South Korea

I can't access my current account, what could be the reason?

Neutral

2023-03-30

李国东

Philippines

I just cannot understand why they requires so high minimum deposit? It looks scaring! While other offerings seem quite average, spreads, leverage, educational contents failing to arise my interest…

Neutral

2022-12-19

struggle11307

Colombia

This company was established less than a year ago and does not have any regulatory license. I don't think it should be traded with it just for security reasons.

Positive

2022-12-20