Note: CPT Markets' official site - https://www.citypointtrading.com is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

What is CPT Markets?

CPT Markets is a financial services provider that offers trading services in various instruments such as Forex, precious metals, Oil, Indices, and CFDs under a suspicious clone license from the Financial Conduct Authority (FCA). It offers many types of accounts, the Standard Account, Platinum Account, Islamic Accounts, Retail and Professional accounts with different features. CPT Markets also provides a maximum leverage of 1:200 and offers MetaTrader 4 platform and Vertex platform.

Pros & Cons

Pros:

Multiple Market Instruments: The platform offers diverse Market Instruments, including Forex, Precious Metals, Oil, Indices, CFDs, catering to various trading needs and experience levels.

Multiple Customer Support Channels: CPT Markets provides various customer support channels including phone, email, and address, enhancing accessibility and assistance for clients.

Cons:

Suspicious Clone FCA License: The lack of valid regulation raises significant safety and trust concerns, as regulatory oversight is crucial for ensuring customer protection and platform transparency. It's very likely to be a scam.

Lack of Information: The company's website is non-functional, suggesting a lack of transparency and reliability. The lack of comprehensive information about trading instruments, fees, and account details hinders informed decision-making and fuels suspicion.

Is CPT Markets Legit or a Scam?

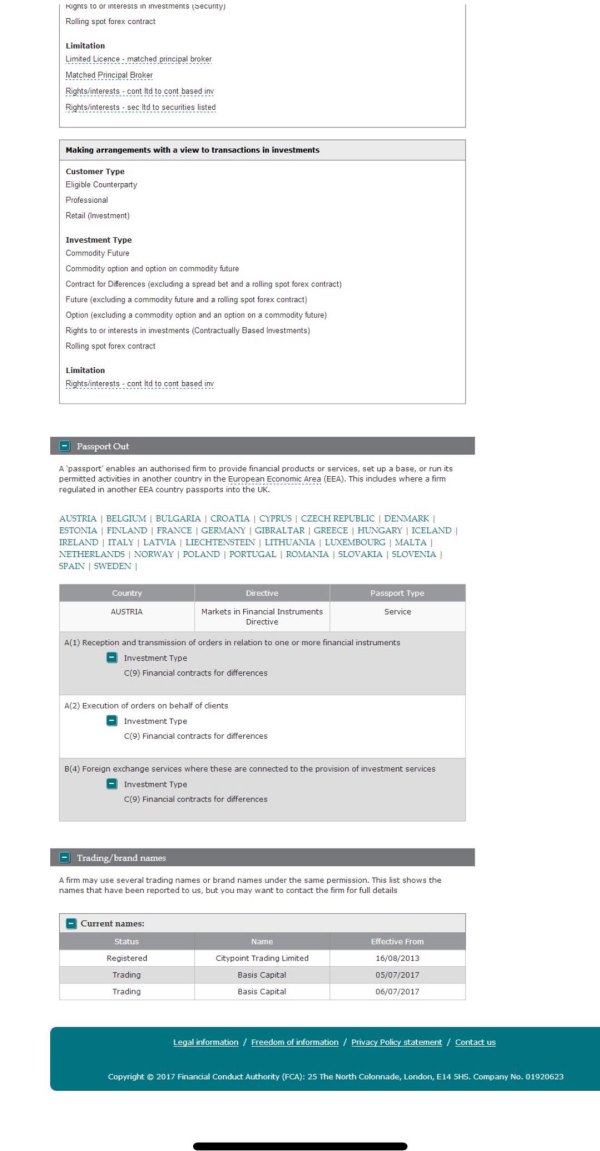

Regulatory sight: Presently, CPT Markets has the sole authority of a suspicious clone license under the Market Making(MM) of the Financial Conduct Authority (FCA), bearing license number 606110 in the United Kingdom. This type of license, which allows a company to mimic the services of a legitimate financial entity, raises concerns about the legitimacy and trustworthiness of the company's operations.

Market Instruments

CPT Markets boasts a diverse selection of trading instruments across various asset classes, catering to the diverse needs and preferences of traders. From traditional Forex pairs to Precious Metals like gold and silver, and Oil, traders have access to a wide range of opportunities to capitalize on market movements.

Additionally, CPT Markets offers trading in Indices, allowing traders to speculate on the performance of major stock indices worldwide. Furthermore, CFDs (Contracts for Difference) are available, providing flexibility for traders to engage in leveraged trading across a diverse range of financial instruments.

Account Types

Standard Account: As a UK-based company, CITY POINT TRADING offers a Standard account tailored for traders new to financial markets. It provides access to a range of trading instruments, low spreads, and educational resources. While it requires a minimum deposit, it offers limited leverage, suitable for those aiming to test trading strategies with lower risk levels.

Premium Account: Catering to more experienced traders, the Premium account offers advanced features such as higher leverage, competitive spreads, and priority customer support. With a higher minimum deposit compared to the Standard account, it provides access to more sophisticated trading tools and resources.

Forex Islamic Accounts: Also known as swap-free accounts, these cater to traders adhering to Islamic principles, offering no swap or rollover interest on overnight positions.

CITY POINT TRADING also offers Retail and Professional accounts, each tailored to different trading needs and preferences. The minimum initial deposit required for the Professional account is $20,000.

Leverage

CITY POINT TRADING provides varying leverage ratios across different accounts and instruments.

For Forex trading, the Retail Account offers a leverage ratio of 1:30, while the Professional Account provides a more flexible leverage of 1:200.

When it comes to Indices trading, the Retail Account offers a leverage ratio of 1:20, whereas the Professional Account provides a higher leverage of 1:200.

For trading Commodities, the Retail Account offers a leverage ratio of 1:20, while the Professional Account provides a leverage of 1:100, offering more leverage for professional traders.

Trading Platforms

CPT Markets provides its clients with access to a variety of advanced trading platforms, ensuring a seamless and versatile trading experience. Among these platforms is MetaTrader 4 (MT4), a widely acclaimed platform known for its robust charting tools, technical indicators, and automated trading capabilities.

Additionally, CPT Markets offers the Vertex platform, which provides traders with a user-friendly interface and advanced features tailored to suit their trading needs. With these platforms, traders can execute trades efficiently, analyze market trends comprehensively, and manage their portfolios effectively.

Deposits & Withdrawals

CPT Markets offers convenient and efficient deposit and withdrawal options to ensure a seamless trading experience for its clients. Traders can fund their accounts or withdraw profits through transfers and credit cards, providing flexibility and accessibility in managing their funds.

Additionally, CPT Markets prioritizes prompt processing of withdrawal requests, aiming to complete them on the same day if received by 12:00 GMT. This commitment to fast and efficient withdrawals reflects the company's dedication to customer satisfaction and ensures that traders have timely access to their funds when needed.

Customer Service

CPT Markets provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Phone: 44(0) 203 988 2277 (From 07:00 till 22:00 Monday to Friday)

Email:info@cptmarkets.co.uk

Address: 40 Bank Street, 30th Floor Canary Wharf, London England E14 5NR

Conclusion

In conclusion, CPT Markets provides an assortment of trading opportunities, suitable for various types of traders. It offers many account types with different leverage, a broad range of market instruments, and multiple customer support channels.

Nevertheless, their regulatory status raises concerns due to their 'suspicious' clone license under the Financial Conduct Authority (FCA). The lack of complete and transparent information hinders the traders' decision-making process.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

靳阳

Hong Kong

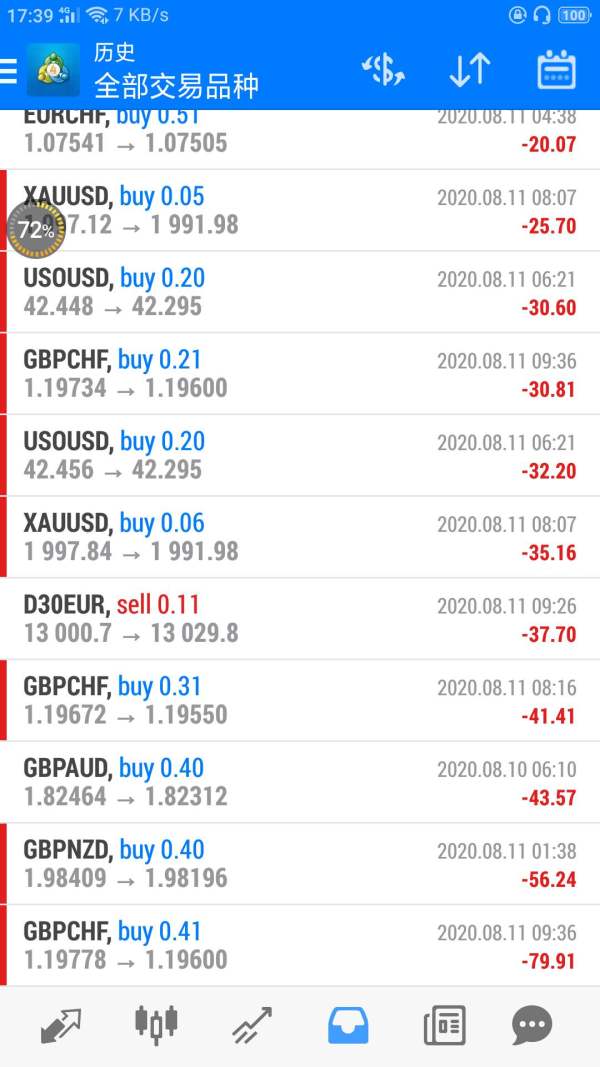

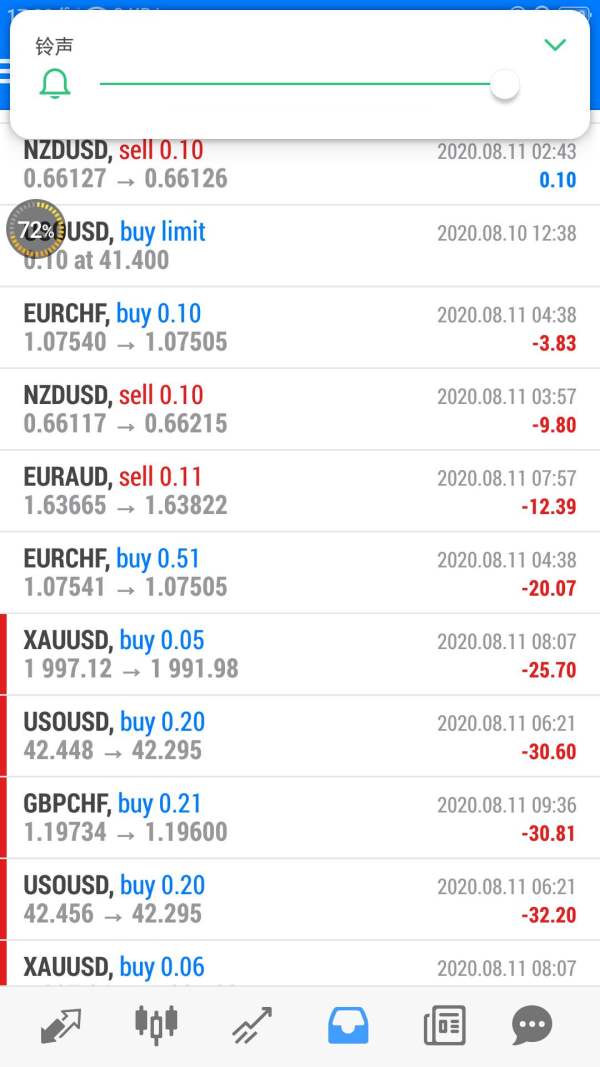

It induced me to get registered and manipulated on my account, which caused several hundred losses.

Exposure

2020-08-11

FX3062316454

Hong Kong

There was sever system stuck with CPT Markets ,which would last several minute or hours,causing unavailable login and losses!When it came to EUR/USD,the order couldn’t be dealt.Many scalping trading couldn’t be dealt and closed because of severe stuck.Until Early October,2019,I made a total loss of 100000 RMB.The client manager kept shirking and blocked me on Wechat and phone.Scam platform.

Exposure

2019-11-26

FX3062316454

Hong Kong

There was sever system stuck with CPT Markets ,which would last several minute or hours,causing unavailable login and losses!When it came to EUR/USD,the order couldn’t be dealt.Many scalping trading couldn’t be dealt and closed because of severe stuck.Until Early October,2019,I made a total loss of 100000 RMB.The client manager kept shirking and blocked me on Wechat and phone.Scam platform.

Exposure

2019-11-25

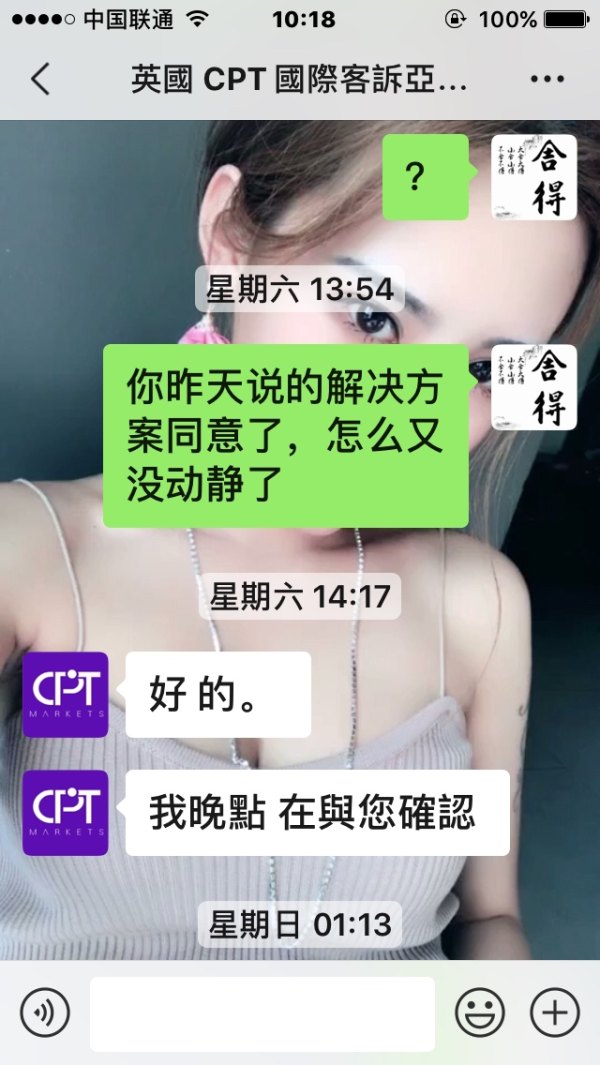

Shelly

Hong Kong

On August 23rd , I opened an account on cpt. The analyst in the headquarters said they could make trades for clients, securing stable profits with the technology support. And they normally add position once a month. They opened an account for me to view trading operations. After that, I though it was doable and deposited 8,000 dollars. Since they promise me small profits and no loss though position may not be added immediately, I rest assured to deposit money in the platform. So far, I have found that they have traded based on heavy positions without stop losses and they would close orders out when they can not bear with losses. They have traded EUR/CAD, the currency pairs with GBP, oil and gold, which harbor big losses, and promised me to take the lost money back. Yesterday, the balance only left hundreds of dollars. Now I only want to take my capital back.

Exposure

2019-09-07

OATH

Hong Kong

Because of manipulation of market data by the platform and reverse order recommendation given by its teacher,I made a great loss.And the platform was verified as fraud platform.Evidence of illegal fraud:1, the result of domain survey. Description:The platform was set up on 28th,August,2017,which is new and inconsistent with the years-of-history claimed on its website.Picture 8&9 is the screenshots of its domain name. Evidence 2:it claims to be regulated Description:The platform claims that it is regulated by FCA606110,while there is no screenshots of Chinese-and-English regulatory page in its website. It also doesn’t make sense that its staff and customer service don’t give responds positively.The following screenshots 5&6&7 is my communication with the customer service. Evidence 3:The result of regulatory investigation Description:It is verified that the corresponding platform of FCA606 is Cinypoint. The registered regulation time is 2014 and the Cinypoint is a commercial company.Following is the digest of regulatory rules:Contract for Differences (excluding a spread bet and a roll spot forex contract)Future (excluding a commodity future and a roll spot forex contract)Option (excluding a commodity option and an option on a commodity future)Rights to or interests in investments (Contractually Based Investments)Rolling spot forex contract Future(excluding commodity future and roll spot forex contract)Option (excluding a commodity option and an option on a commodity future)Rights to or interests in investments (Contractually Based Investments)Rolling spot forex contract,excluding retail forex business,hasn’t joined the FSCA.The query results is as follows(picture1&2&3&4)

Exposure

2019-08-30

桶哥

Hong Kong

When I opened my account transaction on the CPT platform on February 19th, I set up an automatic order of 1.1276 lot in the account. At that time, the reference trend reached the 1.1274 lot more than 3 times in 30 minutes, but my order was not sold. So I closed order at 12:20 to open the trading interface and wait for the appropriate price to deal.I found the reference trend has become a KDJ at 12:25 and I bought long of EUR/USD 1.1281 at 12:27. However, my account appeared 1-standard-lot order of EUR/USD 1.1278 at 12:21. When I found out, I had already suffered a serious loss. The platform actually said that I personally placed it in! The evidence screenshot has been uploaded, as reference for you!!!

Exposure

2019-08-15

桶哥

Hong Kong

Exposure platform:CPT Agency Operating time:2019-06-04 16:42:07 From April 24, 2019, I lost all my money for $4,900 within ten days.I consulted how to trade from Mr Wu,who was the leader of NG and earned some money from his trading orders. I asked how he operate the order, he advised mt to open an account under his name in CPT platform, thus he can charge a commission. Having prepared all,he began operating my account,while just buying up and down according to the market.He claimed that trader has his own thoughts when I guessed about his operation.I made all loss of my fund within several days and he told me to calm down. Later, I wanted to learn the operation experience in the chatting group.I realized that I was deceived after seeing so many exposures.

Exposure

2019-08-15

OATH

Hong Kong

CPT fraud platform,please refund my withdrawal asap.ZhangYuan ,a salesman of the platform and opened the account for me.After cheating me more than 600 thousand RMB,he was denied by the platform and said to belong to the agent.Later,another staff in ShenZhen branch of the platform contacted me and wanted to sale to me.After calling the police,the platform said that the person is from the agent platform.In fact,this platform bought regulation and transferred money into private account,through controlling the leverage and changing data,for the purpose to profit.

Exposure

2019-08-04

FX2737621518

Hong Kong

Yongcheng He,from agent CPT platform, induced customers to deposit continuously,using the excuse of money management and preservation,whose operation led their accounts into forced liquidation.

Exposure

2019-07-20

FX1338079894

Hong Kong

The CPT salesman asked me for account, and traded by the opposite way in the evening. My account suffered a forced liquidation the next day. The picture shows that 1000 was deposited and the account balance is cleared the next day.

Exposure

2019-06-26