What is AdmiralTraders?

AdmiralTraders, an international brokerage headquartered in the United Kingdom, provides a diverse range of financial instruments, encompassing Forex, Indices, CFDs, Metals and Energies, Cryptocurrency, Futures and Shares. However, its noteworthy that the broker is currently operating with no valid regulation from any recognized regulatory bodies.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the broker's services and offerings. We encourage interested readers to delve further into the article for valuable insights. In conclusion, we will provide a concise summary that highlights the distinct characteristics of the broker for a clear understanding.

Pros & Cons

Pros:

Diversified instruments: This indicates a wide array of trading instruments available, giving the trader flexibility to choose from a variety of options.

Multiple account types: Seven account types plus a demo account allows traders to select an account that best suits their trading needs and preferences.

MT5 trading platform: An advanced and user-friendly trading platform increasing trading efficiency.

Flexible leverage ratios: These can maximize potential trading revenue, but they should be handled with care due to associated risks.

Security measures such as stop-out, margin call: These measures help manage risks and prevent significant losses.

Demo account available: This allows traders to practice and understand trading mechanics without risking real money.

Cons:

Is AdmiralTraders Safe or Scam?

When considering the safety of a brokerage like AdmiralTraders or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: Considering the operation of AdmiralTraders, significant apprehensions exist due to the absence of valid regulations. This lack of regulatory oversight brings the organization's legitimacy and accountability into question, causing potential investors to carry out their financial transactions with substantial caution.

User feedback: To get a deeper understanding of the brokerage, it is suggested that traders explore reviews and feedbacks from existing clients. These shared insights and experiences from users can be accessed on reputable websites and discussion platforms.

Security measures: AdmiralTraders employs stringent security measures like Margin Calls and Stop-Outs to manage trading risks. In addition, its comprehensive privacy policy emphasizes data security, ensuring personal information privacy.

In the end, choosing whether or not to engage in trading with AdmiralTraders is an individual decision. It is advised that you carefully balance the risks and returns before committing to any actual trading activities.

Market Instruments

AdmiralTraders claims to offer 200+ tradable instruments across 6 asset classes for its traders. This includes Forex, allowing global currency trading; Indices, for trading on the performance of specific groups of stocks; CFDs (Contracts for Difference) enabling traders to speculate on the rise or fall of underlying assets without owning them.

Metals and Energies offer commodity trading options, including gold, silver, oil, and gas. The platform also includes Cryptocurrencies like Bitcoin and Ethereum, and Futures contracts, allowing traders to buy or sell assets at a later date. Shares trading is another facility offered by AdmiralTraders where traders can buy and sell ownership in specific companies.

Account Types

AdmiralTraders offers a diverse variety of account types, each designed to fit different trading experiences and financial capabilities, starting with a demo account for practice.

For actual trading, it provides the Basic account with a minimum deposit of USD 200, the Premium account with USD 2,500, the Elite account with USD 5,000, the Professional account with USD 10,000, the VIP account with USD 20,000, and the Investors Gold account and Investors Platinum account requiring a deposit of USD 30,000 and USD 50,000 respectively.

These minimum deposits offer multiple options for investors of differing financial capacities.

Leverage

AdmiralTraders offers an array of account types to cater to different trading requirements, each with differing leverage ratios.

Starting off with the Basic account designed for novice traders, it offers a leverage of 1:200.

The Premium account, tailored for more experienced traders, provides a leverage ratio of 1:500.

The Elite account and Professional account, catering to seasoned traders, offer leverages of 1:1000 and 1:1500 respectively.

Moving on to high-capacity accounts, the VIP account and Investors Gold account allow a substantial leverage of 1:2000.

Lastly, the Investor Platinum account, created for high-volume traders, also maintains the leverage ratio at 1:2000.

However, leverage can significantly amplify both profits and losses in trading, so it's crucial to approach it with caution and an understanding of the inherent risks.

Trading Platform

AdmiralTraders reportedly offers the MT5 trading platform according to their official website. However, potential traders should take note that no direct download link for the platform could be found on the website. It's highly recommended for interested individuals to verify this information directly with AdmiralTraders. This would ensure that all details regarding their trading platform are factual and current.

Trading Tools

AdmiralTraders brings sophistication to trading by providing an economic calendar as a trading tool. This tool allows traders to stay updated on major economic events that could significantly affect market movements.

By having access to this economic calendar, traders can be informed about live market updates, government reports, and economic indicators in real time. Incorporating such economic events can help traders plan their strategies effectively around these potentially market-moving events.

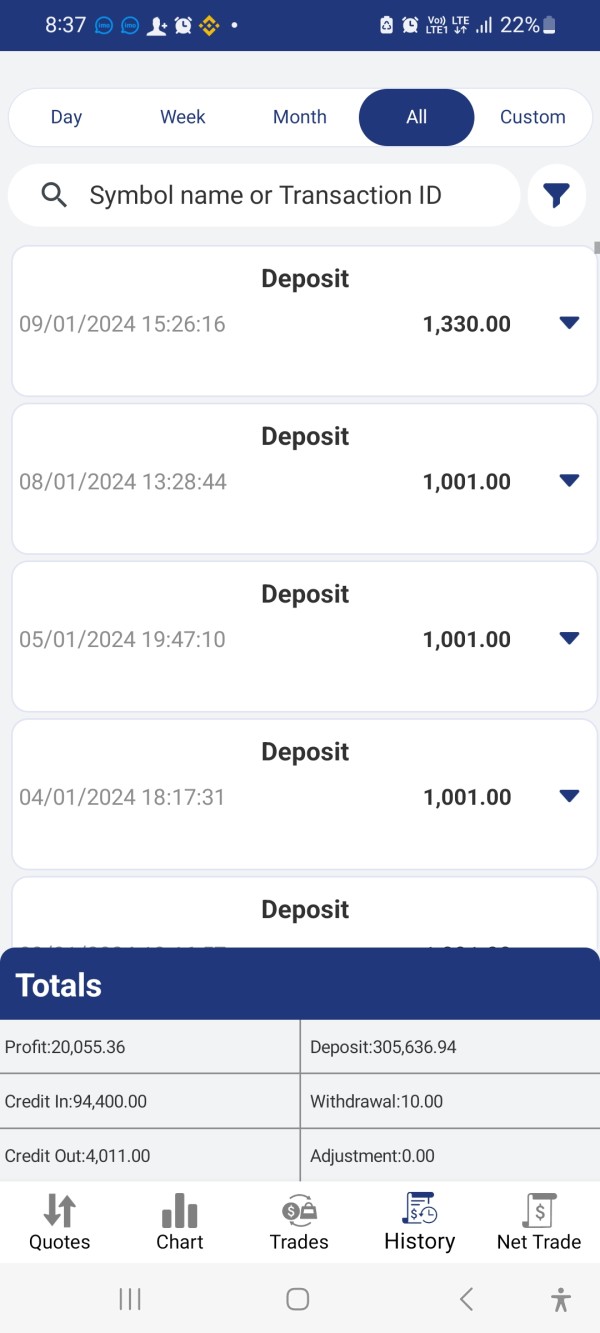

Deposits & Withdrawals

AdmiralTraders provides its users with a broad array of payment methods for depositing and withdrawing funds, catering to a variety of trader preferences.

These include conventional methods like Visa and Mastercard debit or credit cards, and Bank Wire Transfer—often appreciated for their wide acceptance and security features.

For those preferring digital methods, e-wallet options such as Skrill, Neteller, and Perfect Money are available.

Additionally, AdmiralTraders also embraces modern technology by accepting Bitcoin as a payment method, making it an accessible trading platform for cryptocurrency enthusiasts.

Customer Service

While AdmiralTraders provides its address and Email as customer support channels, plus online live chat for immediate response to customer inquiries and solutions offering. The customer service is available 24 hours 5 days a week.

Address: leadenhall street,london EC3V.

Email: support@admtrades.com.

Conclusion

In summation, AdmiralTraders, a UK-based online brokerage, boasts an extensive array of trading instruments, encompassing Forex, Indices, CFDs, Metals, Energies, Cryptocurrency, Futures, and Shares, making it a globally accessible platform. Yet, despite its offerings, potential investors are advised to tread carefully due to the broker's unregulated status. This lack of regulation raises serious concerns about the broker's dedication to complying with regulations and ensuring the security of its clients.

Therefore, traders are strongly advised to consider alternative brokers who place a high emphasis on transparency, adherence to regulations, and professional integrity.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

FX4259975357

India

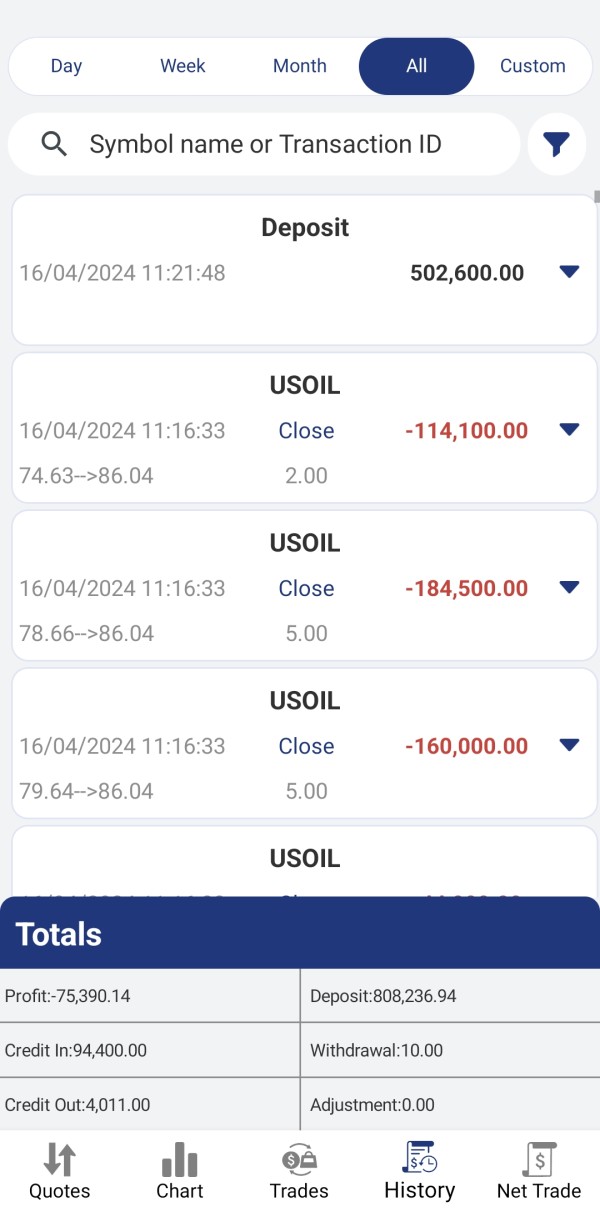

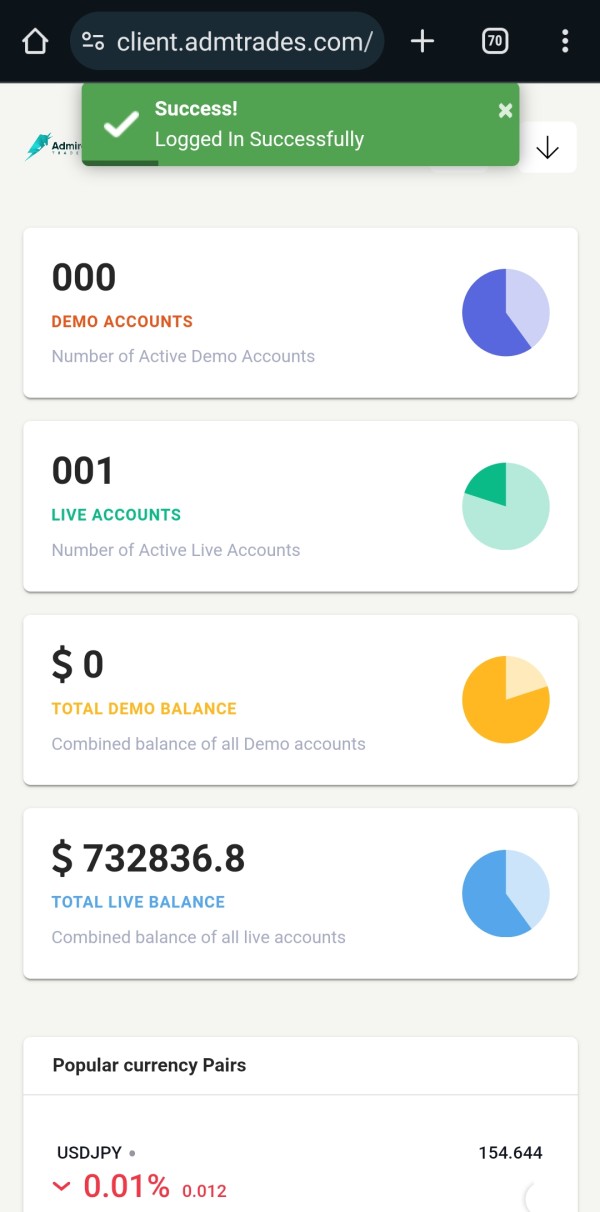

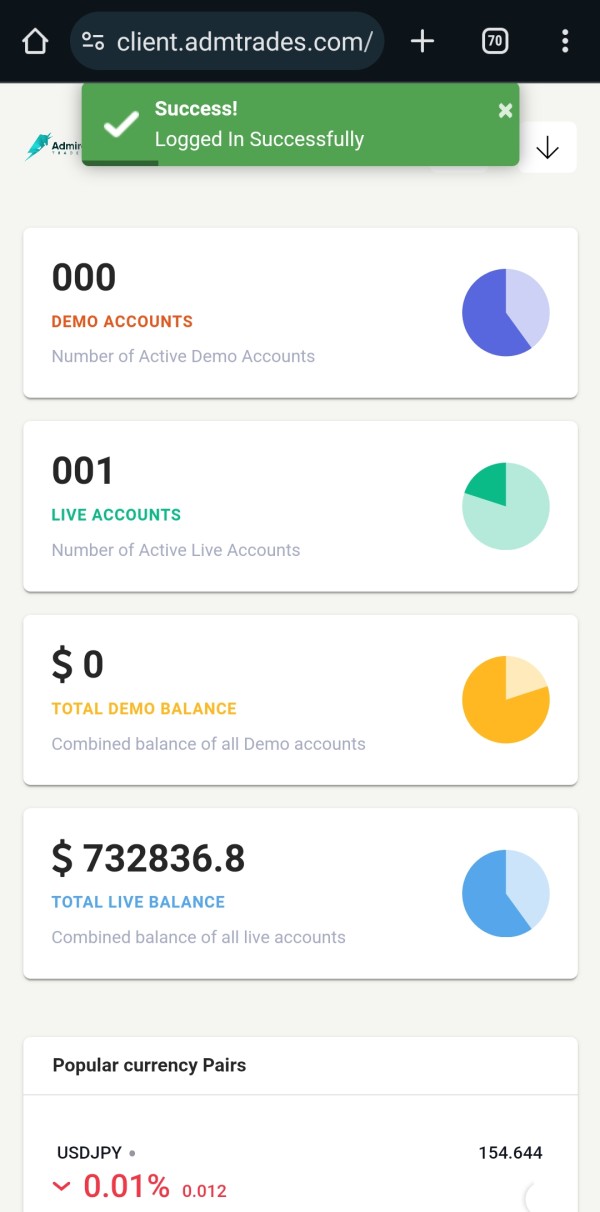

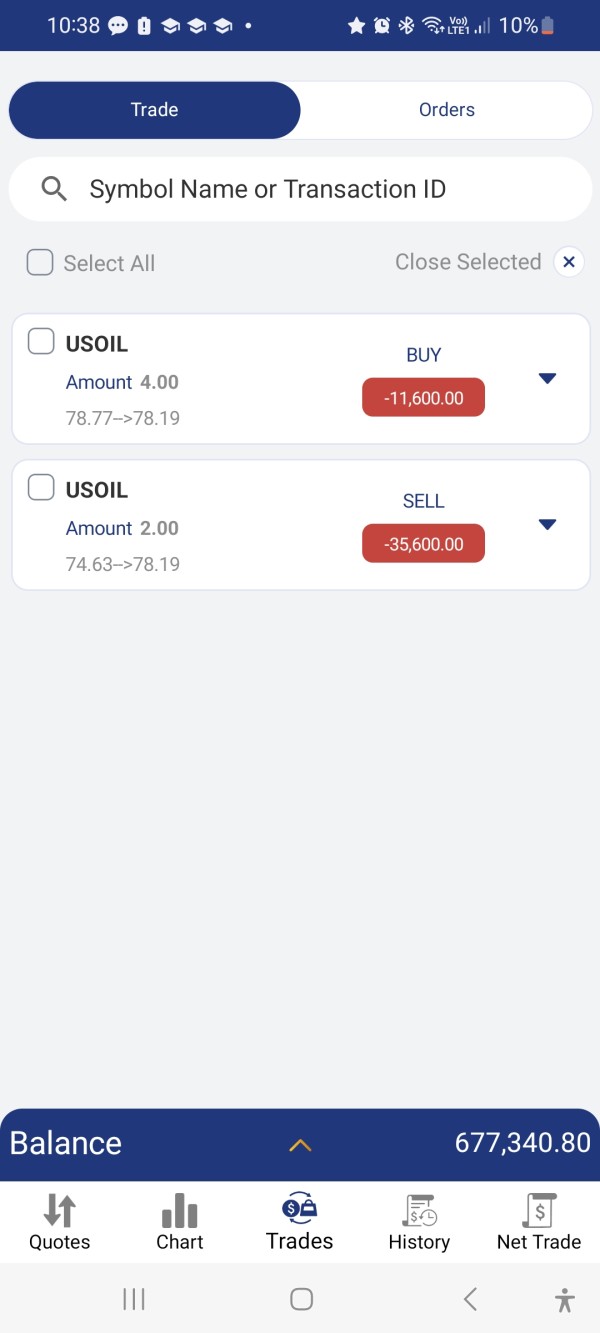

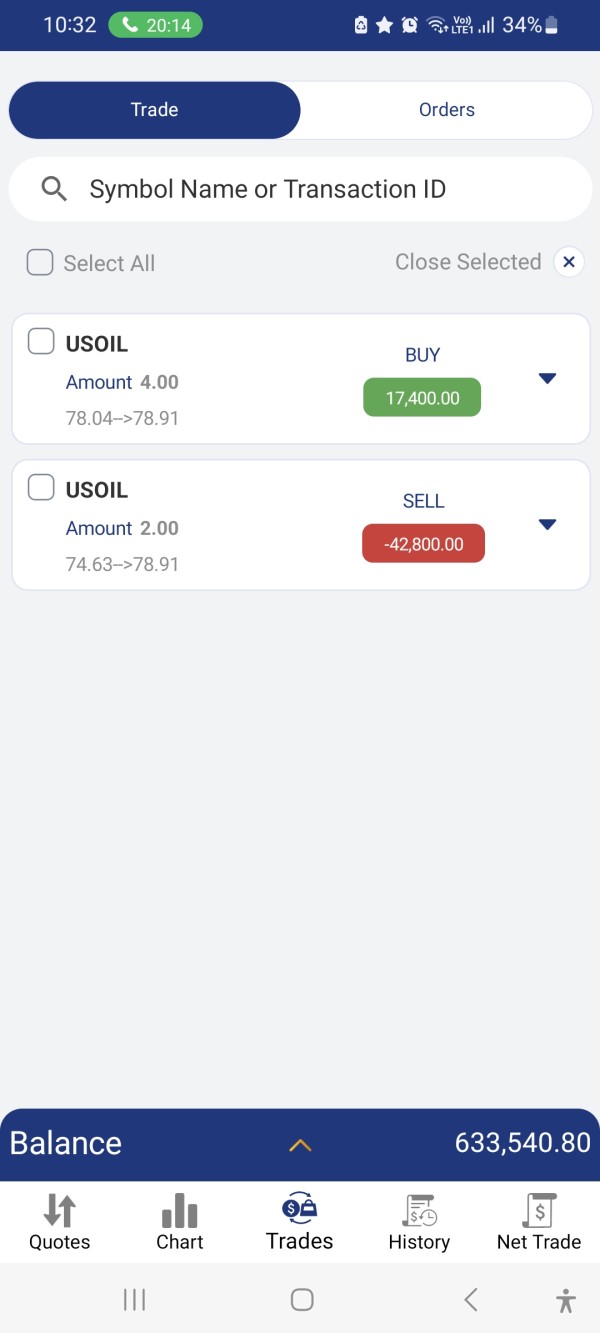

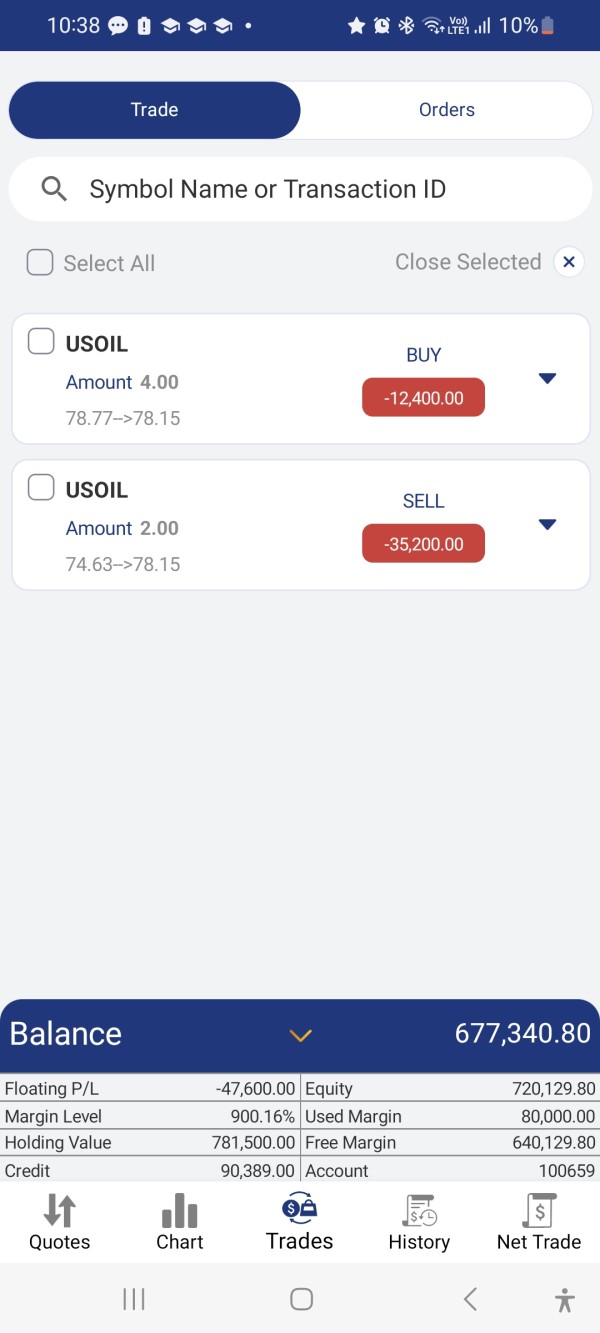

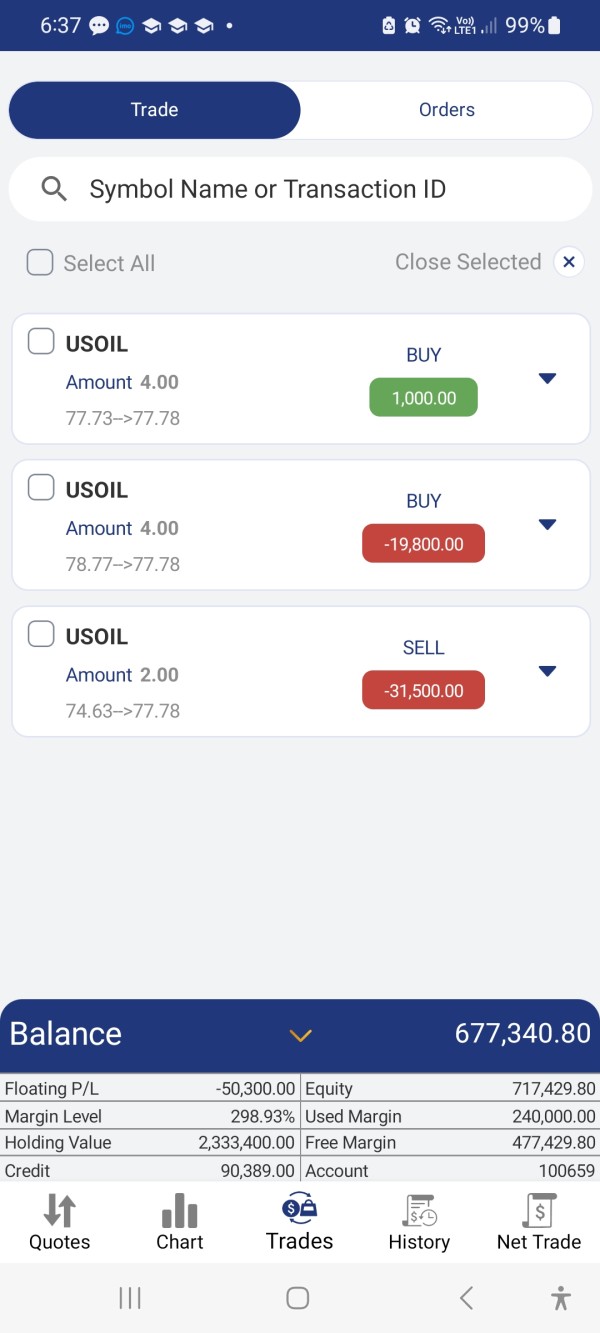

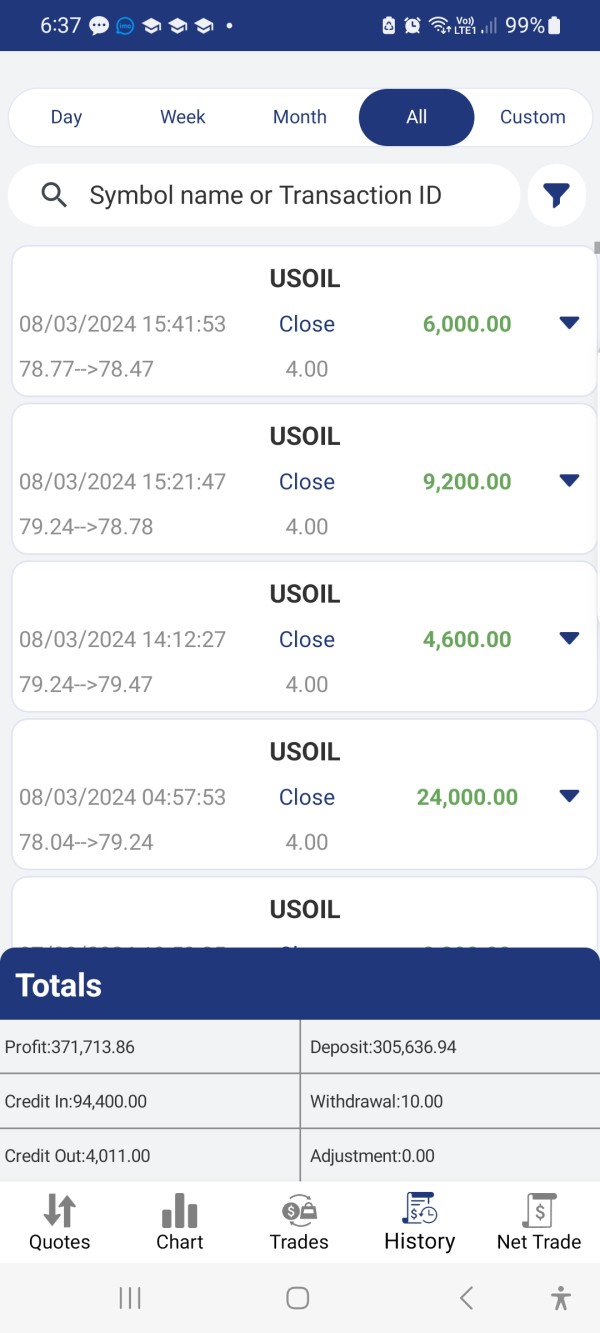

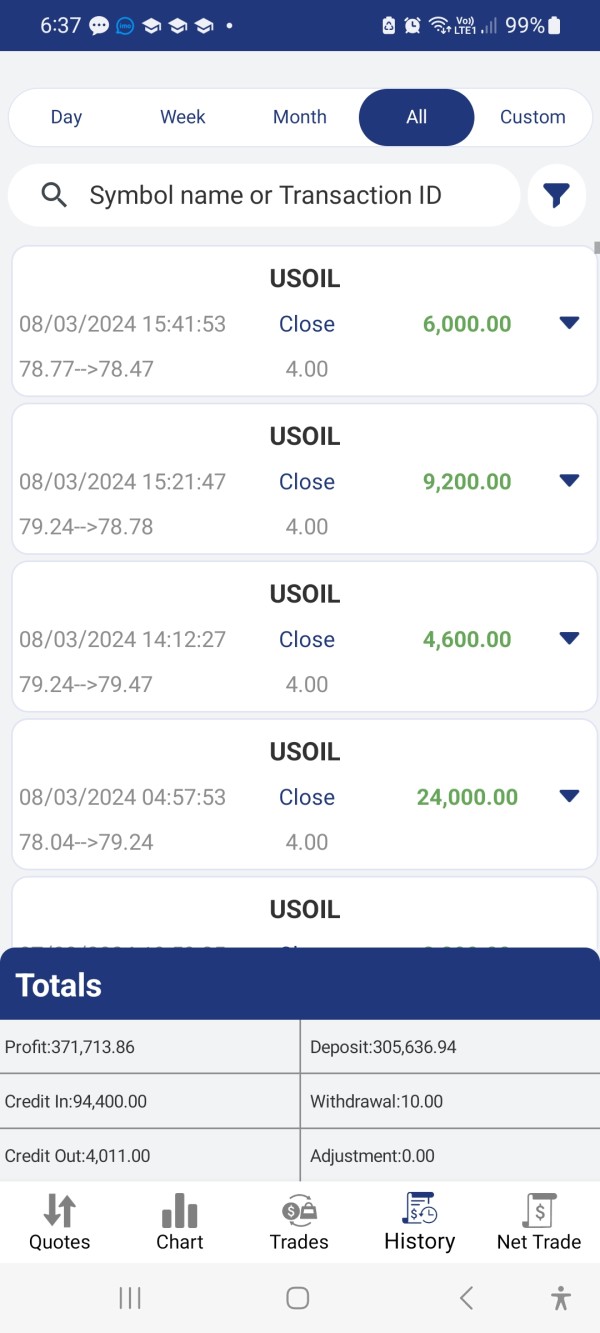

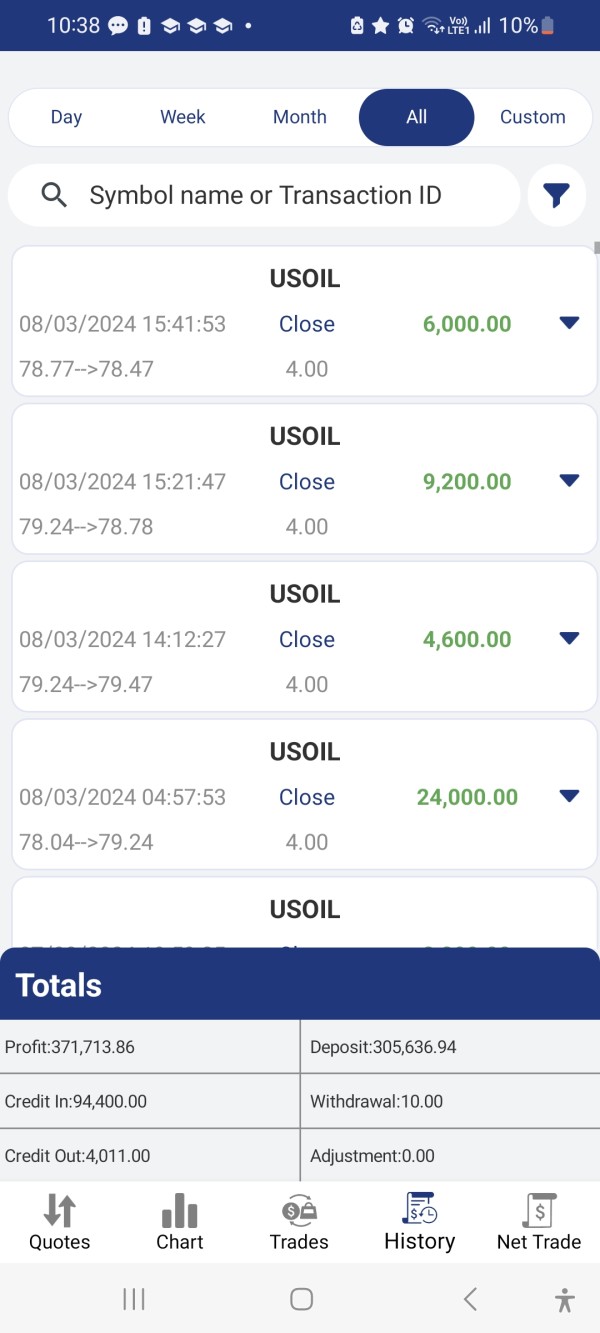

My self Noor Hasan Lodi watsapp no 9007046722 From , joined admtrades.com for trading under professional gold account of $20200 USDT on 13/11/2024 and complete my deposit via Binanance app within time after having lot of loan from bank , solded all golds, and under trading my account 100659and got major profits of $732836 and I apply withdrawal of $732836 on 23/12/2023 but I couldn't get withdrawal till now as information given to me that I have to again invevest $19000. Which was impossible for me. As my account manager He and Finance Director Mr Benjamin pressurize me to deposit another $19000 more to get withdrawal otherwise account will go in auction, I tried very hard to arrange but could not arrange money because i already in soo many loans from bajaj loan Gold loan and and asked from friend approx like 26 Lakhs of my all my hard work money scammed by admiraltrades their misguided people to by showing good trade to scam our money. I am continuously requesting them pls give my withdrawal but they are not responding as they are scammer , so I lost my deposited money my hard work money and lost earned profits , so admtrades.com is totally scamer company who initially talk with very sweet and good relation words and show godd advantage protective deal and at the time withdrawal they ask more money , it is totally trapped to scam money from us , so you all are requested to pls be away from Admiraltrades.com. website and caught scammers

Exposure

2024-10-13

FX4259975357

India

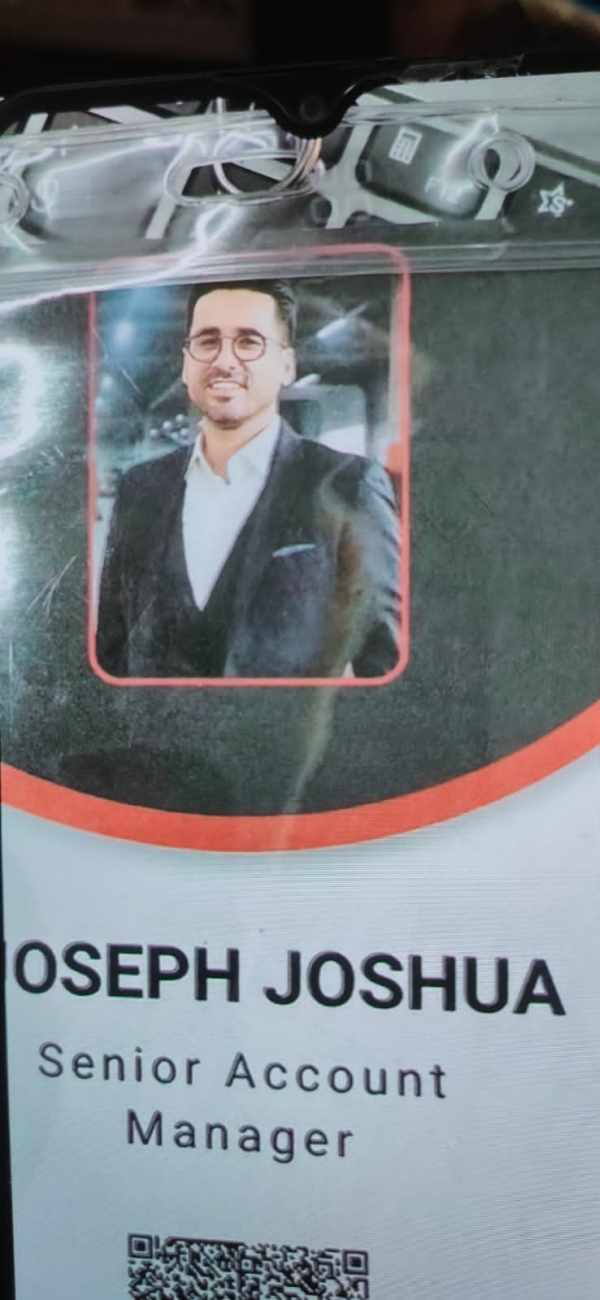

This is to inform you that m y self Noor Hasan Lodi from Sunny Park Malda On Dated between 02-Nov-23 14-02-Nov-2013Mr Krish Aaryan contacted Admiral Trades company and convinced for Education and training of Trading Purpose . For which they asked $200 for the registration and created my Live Trading Account Id:- 100659. And he said that you Profillio Manager will be Joseph Juha Started for the trading then he asked me to update the Account for better good plans and provided 4 No of plans. In which i asked for the lowest minimum plan of $5000 and paid after in a very difficult way by borrowing with my friends. After paying my trade went in profit and latter on somehow it went to loss in which Joseph Said on Dated 14.Dec.2023 that to recovery the loss and profit I have to upgrade the plan for $20000 Plan then all they can recovery all the loss & Profit and gave me huge peruser for arrange another $1

Exposure

2024-08-26

FX2001456156

India

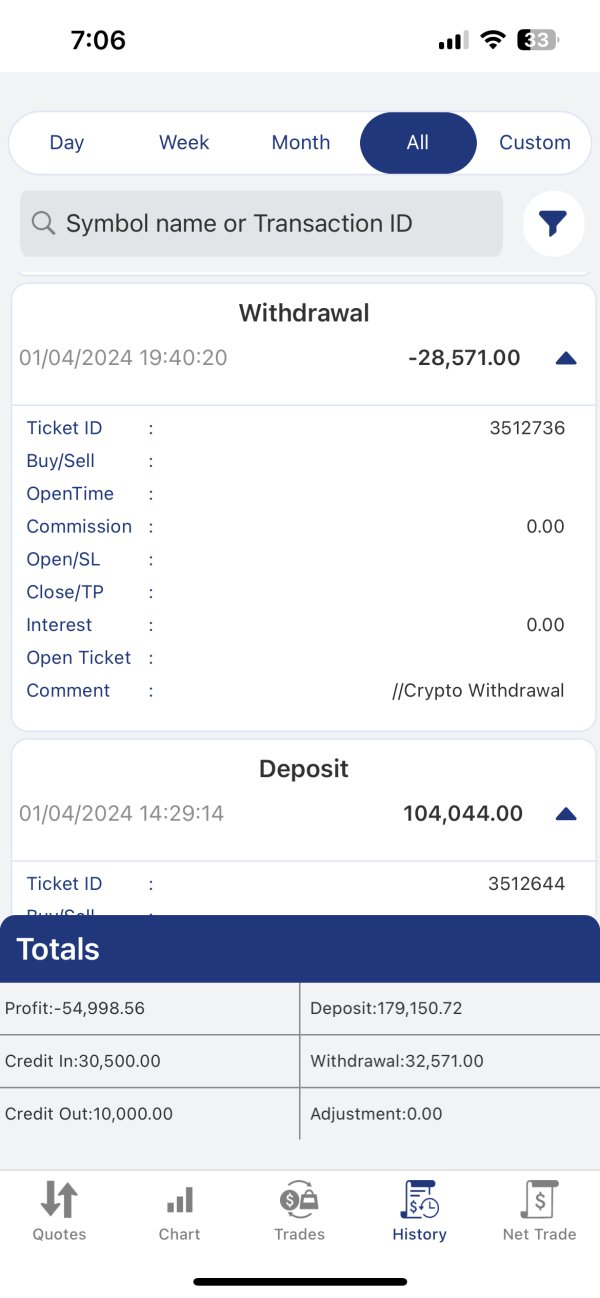

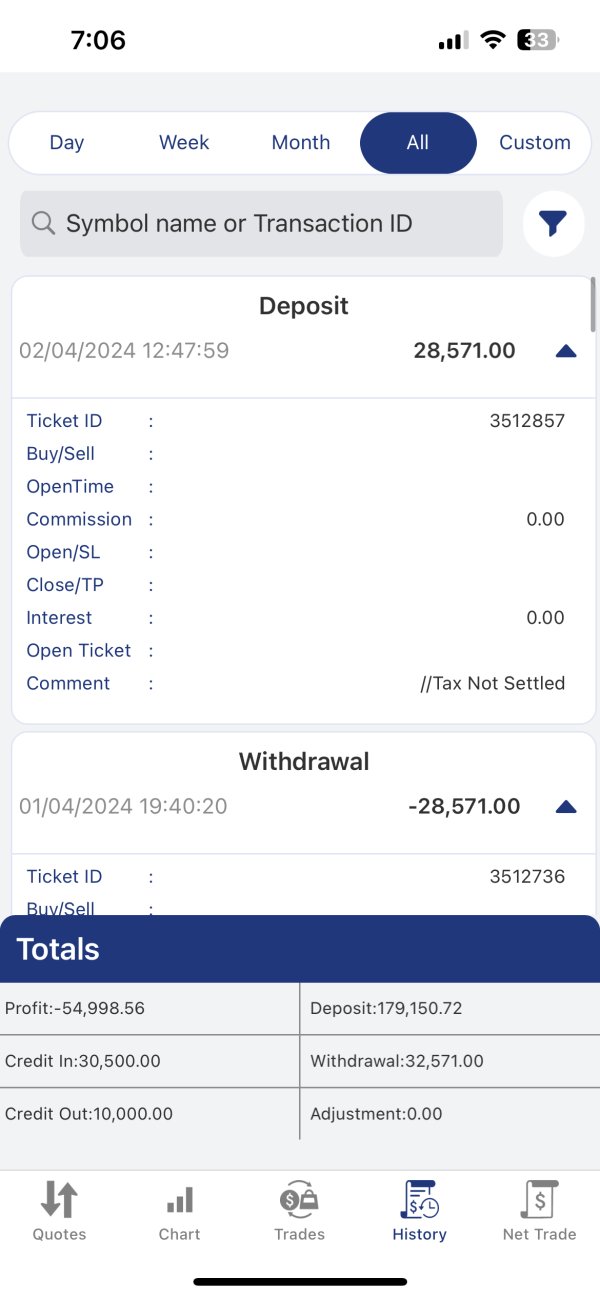

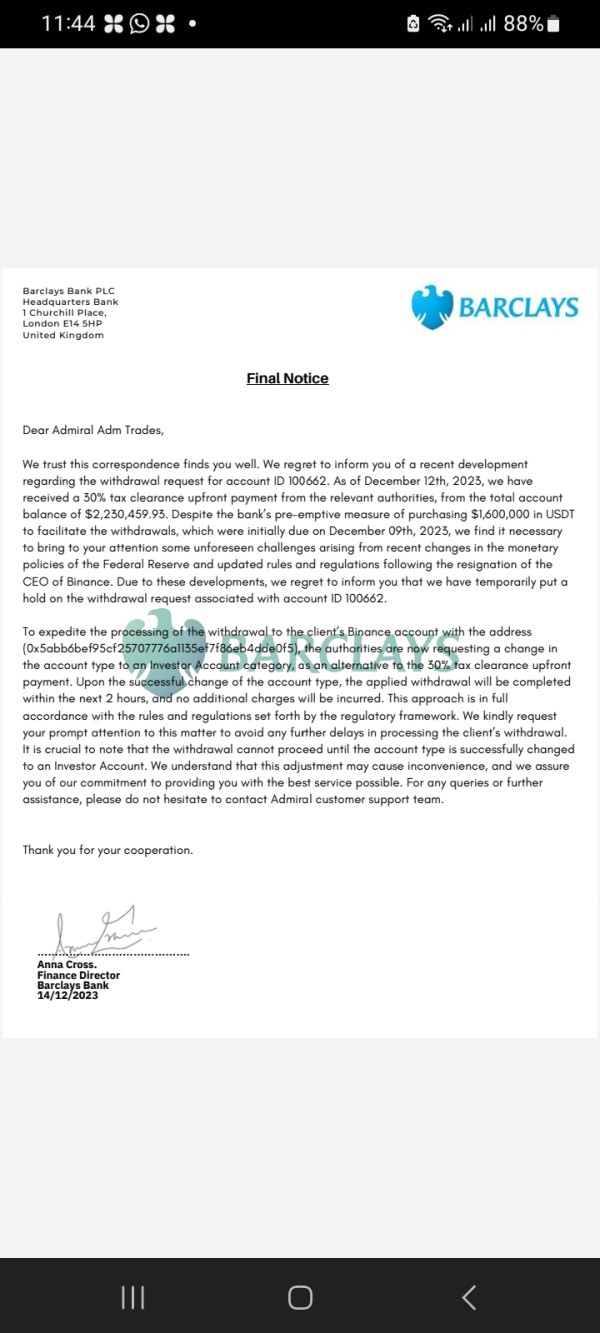

joined admtrades.com for trading under professional gold account of $10000 usdt on 28/02/2024 and complete my deposit via Binanance app within time after taken loan from friend of 8 percent , under trading my account 101119 and got major profits of $86581 and I apply withdrawal of $28571 on 1/04/2024 but I couldn't get withdrawal till now . In this regard Barkley bank given letter to admiral and want 30% upfront tax of crypto currency tax from Admiral but they informed to me that I have to switch in investor account .But as agreement clause no more money I have to deposit. As my account manager mr Kris Aaryan on my behalf he is deposited 10000$ but remaining 28571 $ is balance , He and Finance Director to deposit at least $20000 more to get withdrawal otherwise account will go in auction, I tried very hard to arrange but could not arrange money because i already in loan so they sent my account in auction on 04/04/2024 . I am continuously requesting them ple give my withdrawal then i will deposit remaining balance, but they don't agree and my account sent to auction, so I lost my deposited money and earned profits , so admtrades.com is scamer company who initially talk very sweet and give protective deal bla bla and at the time withdrawal ask more money , it is totally trapped to scam money from us , so ple give away from it. In indian government should block website and caught scammers. If they are not scamer they can withdrawal to me and take again from me, but they will ñot give because they are scamer, my amount I very low against my profits

Exposure

2024-04-04

Sushil654

India

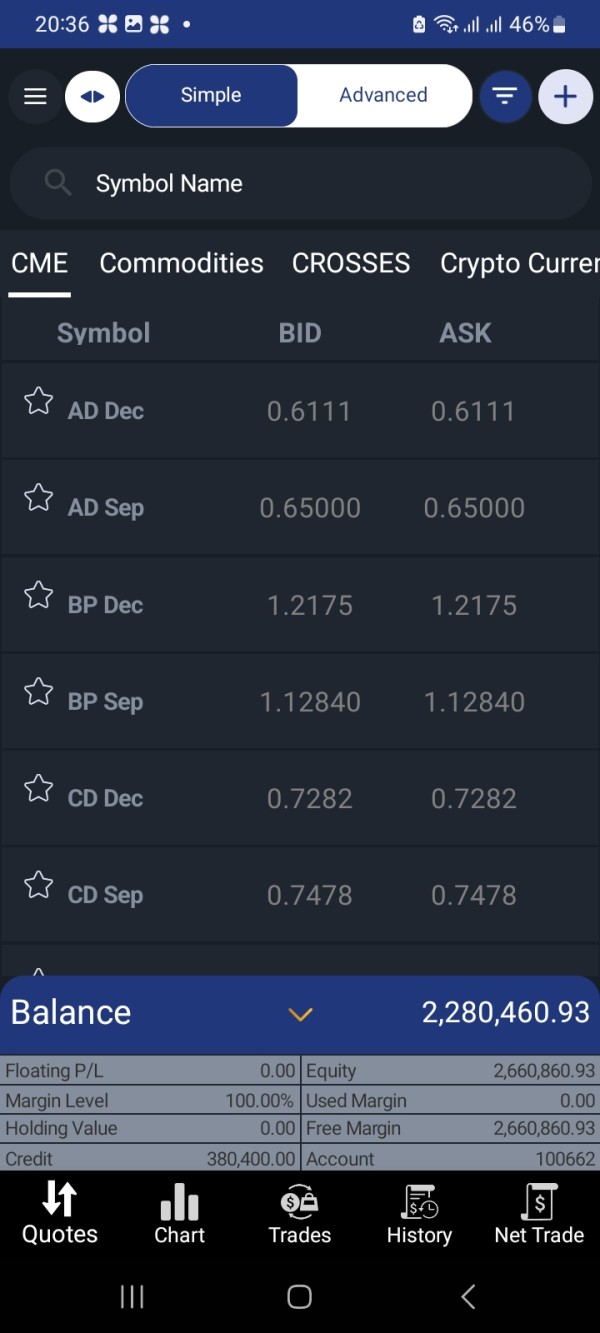

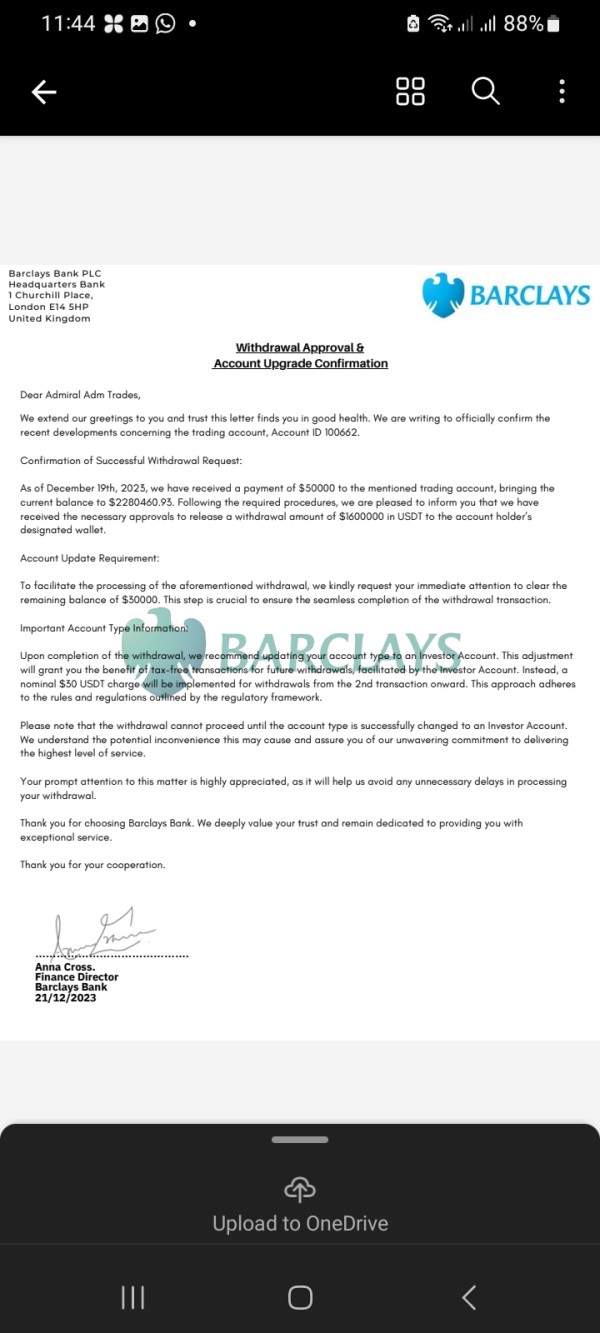

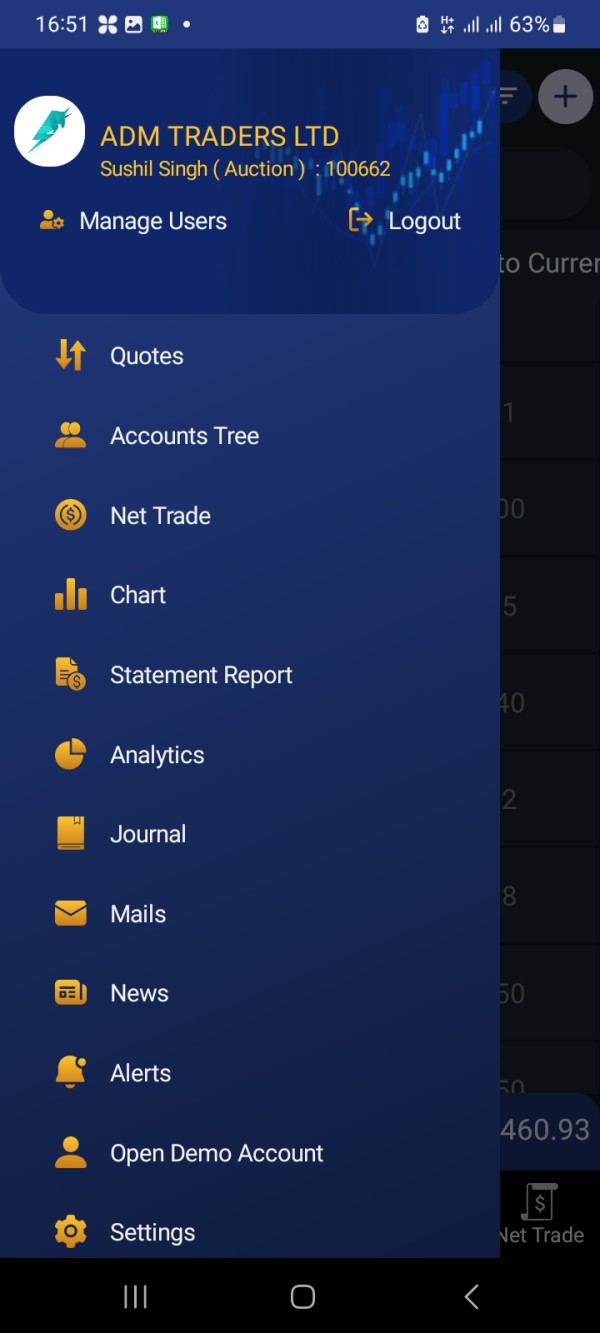

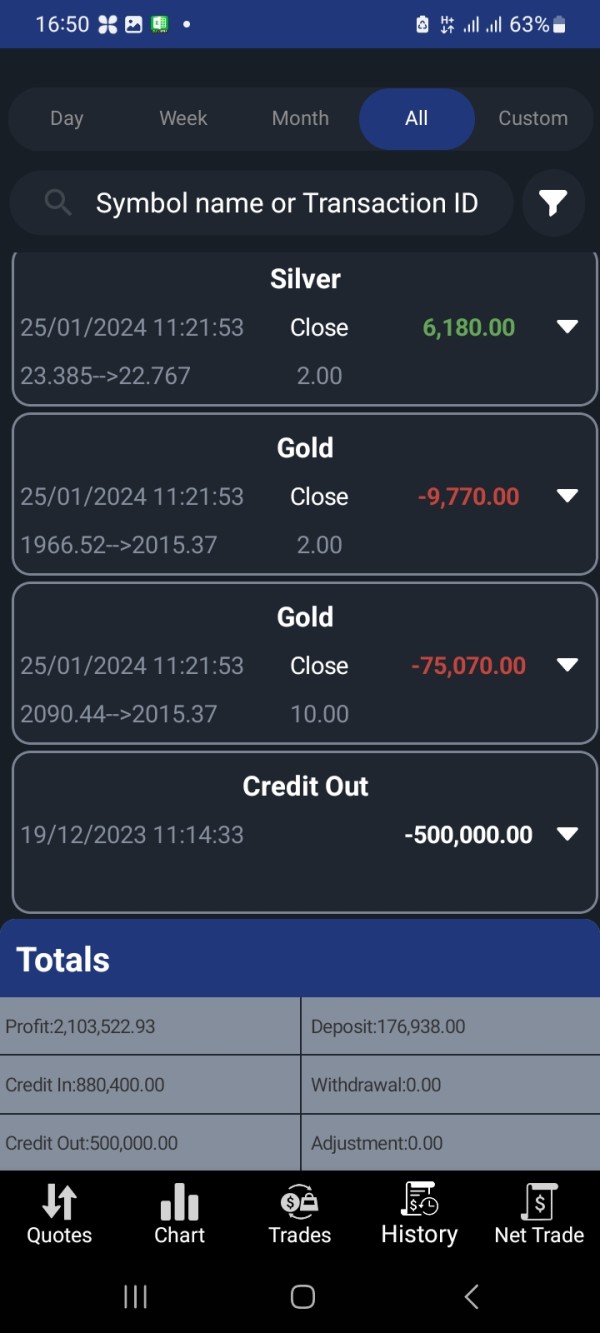

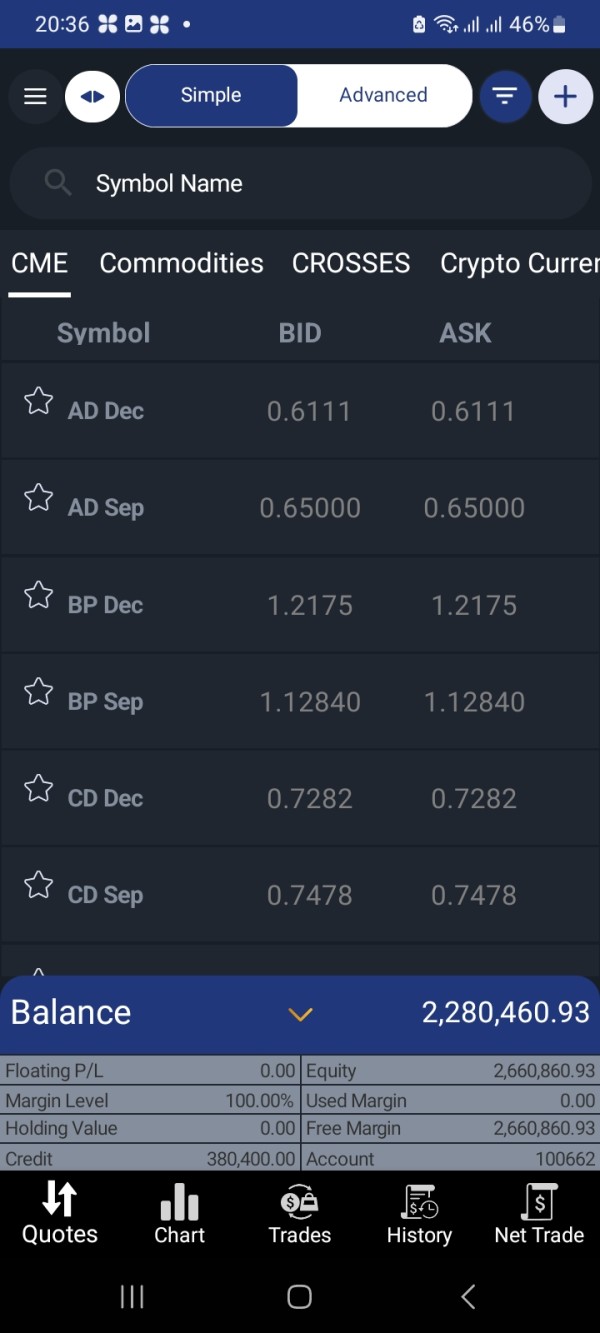

I sushil Kumar Singh 917587208558 From India, email: sushil27061975@gmail.com , joined admtrades.com for trading under professional gold account of $20000 usdt on 3/11/2023 and complete my deposit via Binanance app within time after taken loan from Bank , under trading my account 100662 and got major profits of $2280460.93 and I apply withdrawal of $1600000 on 9/12/2023 but I couldn't get withdrawal till now . In this regard Barkley bank given letter to admiral and want 30% upfront tax of crypto currency tax from Admiral but they informed to me that I have to switch in investor account because my account is minor and i got major profit But as agreement clause no more money I have to deposit. As my account manager mr Joseph Joshua on my behalf he is deposited 50000$ but remaining 30000$ is balance , He and Finance Director Mr Benjamin walter pressurize to deposit at least $20000 more to get withdrawal otherwise account will go in auction, I tried very hard to arrange but could not arrange money because i already in loan so they sent my account in auction on 12/01/2024 . I am continuously requesting them ple give my withdrawal then i will deposit remaining balance, but they don't agree and my account sent to auction, so I lost my deposited money and earned profits , so admtrades.com is scamer company who initially talk very sweet and give protective deal bla bla and at the time withdrawal ask more money , it is totally trapped to scam money from us , so ple give away from it. In indian government should block website and caught scammers. If they are not scamer they can withdrawal to me and take again from me, but they will ñot give because they are scamer, my amount I very low against my profits

Exposure

2024-02-02

Sushil654

India

I sushil Kumar Singh 917587208558 From India, email: sushil27061975@gmail.com , joined admtrades.com for trading under professional gold account of $20000 usdt on 3/11/2024 and complete my deposit via Binanance app within time after taken loan from bank , under trading my account 100662 and got major profits of $2280460.93 and I apply withdrawal of $1600000 on 9/12/2023 but I couldn't get withdrawal till now as information given I have to switch in investor account because my account is minor and i got major profit But as agreement clause no more money I have to deposit. As my account manager mr Joseph Joshua on my behalf he is deposited 50000$ but remaining 30000$ is balance , He and Finance Director Mr Benjamin walter pressurize to deposit at least $20000 more to get withdrawal otherwise account will go in auction, I tried very hard to arrange but could not arrange money because i already in loan so they sent my account in auction on 12/01/2024 . I am continuously requesting them ple give my withdrawal then i will deposit remaining balance, but they don't agree and my account sent to auction, so I lost my deposited money and earned profits , so admtrades.com is scamer company who initially talk very sweet and give protective deal bla bla and at the time withdrawal ask more money , it is totally trapped to scam money from us , so ple give away from it. In india government should block website and caught scammers.

Exposure

2024-01-30