Overview of Match CFD

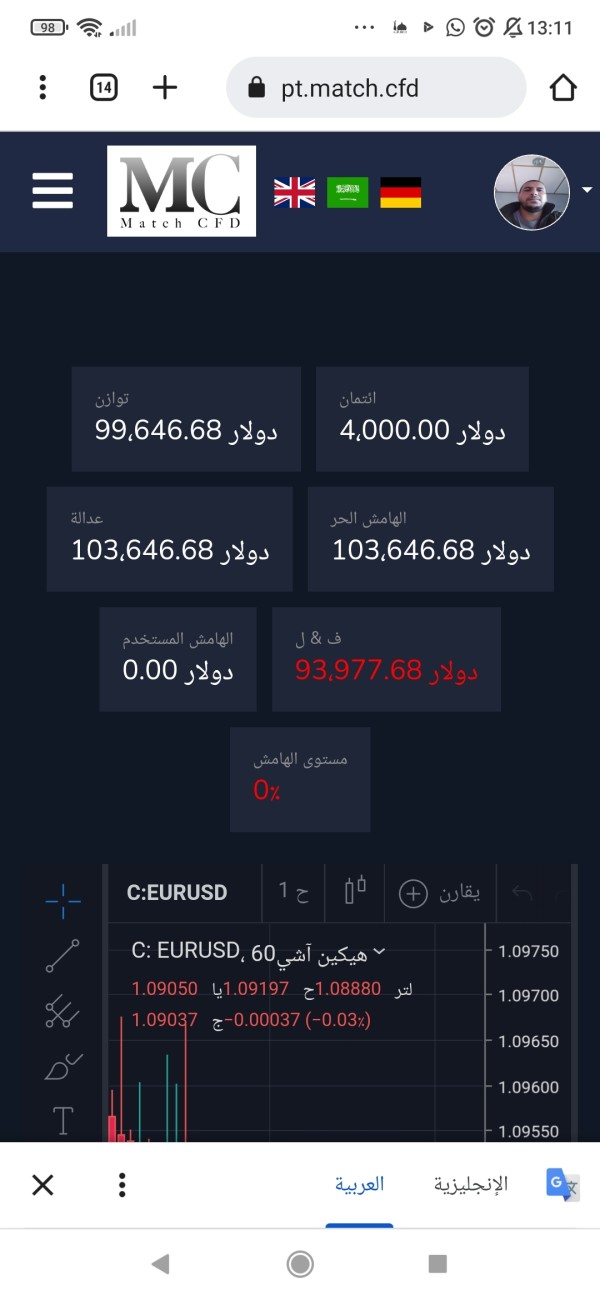

Match CFD is an online trading platform that offers services in the field of Contracts for Difference (CFDs). The platform allows users to trade CFDs on multiple assets, providing a wide range of trading options. Clients can access their accounts and trade from various devices such as desktops, tablets, and mobile devices. Match CFD emphasizes the safety of clients' funds and ensures segregated accounts in Tier 1 banking institutions.

They offer a range of trading tools, including nine timeframes and an unlimited number of charts, allowing users to customize their workspace according to their needs.

They provide educational resources to help traders enhance their knowledge and skills in the financial markets.

It's important to note that there are some concerns regarding Match CFD's regulatory status. Match CFD does not have a valid regulatory license. This lack of regulation raises potential risks for traders, and it is advised to exercise caution when dealing with the platform. Match CFD provides contact options through email and phone numbers with two different country codes: +97142750687 and +442030539005.

Pros and Cons

Is Match CFD legit or a Scam?

There are some concerns and red flags regarding the legitimacy of Match CFD. Match CFD does not have a valid regulatory license. This lack of regulation raises potential risks for traders, and it is advised to be cautious when dealing with the platform.

Additionally, WikiFX gives Match CFD a low score and warns users to stay away from it. The platform is flagged as a suspicious broker with a suspicious scope of business and a high potential risk. These factors contribute to the overall skepticism surrounding Match CFD.

Considering the absence of valid regulation and the warning from WikiFX, it is advisable to exercise extreme caution and conduct thorough research before engaging with Match CFD or depositing any funds. It's always important to choose a reputable and properly regulated trading platform to ensure the security of your investments.

Financial Instruments

Match CFD offers a variety of financial instruments for trading. These instruments cover different asset classes and provide traders with opportunities to diversify their portfolios. Here are the main financial instruments available on Match CFD:

1. Forex Currency Pairs: Match CFD allows trading in various currency pairs, including major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs. Forex trading provides opportunities to speculate on the fluctuations in exchange rates between different currencies.

2. Commodities: Traders on Match CFD can trade commodities such as natural gas, platinum, and Brent crude oil. Commodities are physical substances or raw materials that can be traded on financial markets, and their prices are influenced by factors such as supply and demand dynamics and geopolitical events.

3. Indices: Match CFD offers trading in popular stock market indices like CAC 40, Dow Jones, and Nikkei 225. Indices represent a basket of stocks from a particular market and allow traders to speculate on the overall performance of the stock market.

4. Shares: Traders can also engage in trading individual company shares on Match CFD. Shares represent ownership in a specific company, and their prices can be influenced by company performance, industry trends, and market conditions. Match CFD offers shares of companies like Walt Disney, Deutsche Bank, and American Airlines.

5. Cryptocurrencies: Match CFD provides trading opportunities in cryptocurrencies like Bitcoin (BTC), Ripple (XRM), and Solana (SOL). Cryptocurrencies are digital assets that use cryptography for secure transactions. The cryptocurrency market is known for its volatility, offering potential opportunities for profit.

It's important to note that the availability of specific financial instruments may vary, and traders should check with Match CFD for the most up-to-date list of tradable assets. Additionally, as Match CFD is an unregulated broker, traders should exercise caution and conduct their own research before engaging in trading activities.

Pros and Cons

Account Types

Match CFD offers three different account types to suit the needs of traders with different levels of experience and preferences. Here is an overview of each account type:

1. Standard Account: This is the basic account type that is suitable for beginners who are new to trading or have limited experience. The account offers fixed spreads, access to the MT4 trading platform, and 24/5 customer support. The minimum deposit required to open a standard account is $250.

2. Premium Account: The premium account is designed for more experienced traders who require additional features and benefits. This account offers lower spreads, access to advanced trading tools, and a dedicated account manager. The minimum deposit required to open a premium account is $10,000.

3. VIP Account: The VIP account is the highest tier account offered by Match CFD and is designed for professional traders and high net worth individuals. This account offers the lowest spreads, access to exclusive trading tools, and personalized support from a senior account manager. The minimum deposit required to open a VIP account is $50,000.

Overall, Match CFD offers a range of account types to suit the needs of different traders. However, it's important to note that Match CFD is an unregulated broker, which may not be suitable for all traders. Additionally, the lack of a demo account and limited transparency about trading conditions and fees may be a drawback for some traders.

Pros and Cons

How to Open and Account?

To open an account for Match CFD, follow these steps:

1. Visit the official website of Match CFD or download their mobile app from a trusted source.

2. Look for the “Sign Up” or “Create Account” option on the homepage or landing page of the website/app and click on it.

3. You will be directed to the registration page. Fill in the required personal information, including:

· Personan Noun: Enter your given name or first name.

· Family Name: Enter your surname or last name.

· E-mail: Provide a valid email address that you have access to.

· Phone: Enter your phone number (include the country code).

·

4. Select your country from the provided dropdown menu or list. This is important for account verification purposes and to ensure compliance with local regulations.

5. Create a strong and secure password for your Match CFD account. It's recommended to use a combination of uppercase and lowercase letters, numbers, and special characters.

6. Review the terms and conditions, privacy policy, and any other legal agreements provided by Match CFD. Ensure that you understand and agree to their terms before proceeding.

7. If there are any additional steps or verification procedures, follow the instructions provided by Match CFD. This may include verifying your email address or phone number.

8. Once you have completed the registration process, submit your information and wait for your account to be approved. Match CFD may require some time to review your application.

9. Once your account is approved, you will typically receive a confirmation email or notification. Follow the instructions provided to log in to your account.

10. After logging in, you may need to complete further steps such as providing additional identification documents or setting up your account preferences.

Remember to keep your account information and login credentials secure. It's advisable to enable two-factor authentication if Match CFD offers this feature to add an extra layer of security to your account.

Deposit & Withdrawal

Deposit and Withdrawal Overview of Match CFD:

Match CFD provides users with convenient and secure options for depositing and withdrawing funds. Here is an overview of the deposit and withdrawal process:

Deposit:

1. Payment Methods: Match CFD supports various payment methods, including debit/credit cards, e-wallets, bank transfers, and Terrixa. Traders can choose the method that suits them best.

2. Minimum Deposit: Match CFD requires a minimum deposit of $500. Traders need to ensure that they meet this requirement to fund their trading accounts.

3. Transaction Processing: Deposits are typically processed promptly, allowing traders to start trading once the funds are credited to their accounts. The processing time may vary depending on the chosen payment method.

4. Fees: Match CFD may impose fees for certain deposit methods. It is advisable to review the fee structure provided by Match CFD or contact their customer support to obtain specific details on any applicable fees.

Withdrawal:

1. Withdrawal Methods: Traders can withdraw their funds through the same payment methods used for depositing, including debit/credit cards, e-wallets, bank transfers, and Terrixa.

2. Withdrawal Processing: However, the processing time may vary depending on factors such as the chosen withdrawal method and any additional verification requirements.

3. Withdrawal Fees: Match CFD may charge fees for processing withdrawal transactions. Traders should be aware of the potential fees associated with their chosen withdrawal method.

4. Withdrawal Limits: Match CFD may have specific withdrawal limits in place. It is essential for traders to familiarize themselves with these limits to ensure a smooth withdrawal process.

It is crucial for traders to carefully review Match CFD's terms and conditions regarding deposits and withdrawals. This ensures a clear understanding of the process, fees, and any additional requirements. Traders are advised to contact Match CFD's customer support for any specific inquiries or assistance related to deposits and withdrawals.

Pros and Cons

Trading Platforms

Match CFD offers a trading platform that is accessible through a web trader. While the platform provides basic trading functionalities, it lacks advanced features typically found in popular trading platforms like MetaTrader or cTrader.

The web-based platform allows traders to access their accounts and execute trades directly from their web browser without the need for additional software installation. This makes it convenient for traders to manage their investments from any computer with an internet connection.

The platform's interface is simple and user-friendly, making it suitable for beginner traders who prefer a straightforward trading experience. However, it may not meet the needs of more advanced traders who require advanced charting tools, indicators, and customization options.

One limitation of the Match CFD platform is the absence of a dedicated mobile app. Traders can only access the platform through their web browser, which may be less convenient for those who prefer to trade on-the-go using their mobile devices.

Pros and Cons

Trading Tools

Match CFD offers a range of trading tools to assist traders in their investment decisions. These tools are designed to provide relevant market information and analysis. Here are the trading tools provided by Match CFD:

1. Calendar: The calendar tool provides traders with important economic events, such as economic indicators, central bank meetings, and other significant events that can impact the financial markets. It helps traders stay informed about upcoming events that may affect their trading strategies.

2. Chart: Match CFD provides a charting tool that allows traders to analyze price movements and trends of various financial instruments. The charting tool offers different timeframes, technical indicators, and drawing tools to help traders perform technical analysis and make informed trading decisions.

3. Currency Exchange: Match CFD allows traders to trade in the foreign exchange (forex) market, where they can buy or sell different currency pairs. The platform provides real-time quotes and allows traders to monitor currency exchange rates and execute trades accordingly.

Pros and Cons

Payment Methods

Match CFD offers several payment methods for depositing and withdrawing funds. Here are the available payment methods:

1. Debit/Credit Cards: Match CFD accepts payments through major debit and credit cards such as Visa, Mastercard, and American Express. This method offers convenience and quick processing times.

2. E-wallets: Match CFD supports popular e-wallet services like EcoPays. E-wallets provide a secure and efficient way to transfer funds electronically.

3. Bank Transfers: Traders can choose to deposit or withdraw funds through traditional bank transfers. This method involves transferring funds directly from the trader's bank account to their Match CFD trading account.

4. Terrixa: Terrixa is another payment method available with Match CFD. It is a payment processing service that enables secure online transactions.

Each payment method may have its own processing times and fees, which may vary. It is recommended to check with Match CFD for specific details regarding payment methods, fees, and any additional requirements for depositing or withdrawing funds.

Customer Service

Match CFD provides customer service support to assist clients with their trading needs and inquiries. Here is an overview of the customer service features provided:

1. Contact Information: Clients can reach Match CFD's customer service through various contact channels, including phone and email. The phone numbers provided are +97142750687 and +442030539005. For general inquiries or support, clients can send an email to info@match.cfd.

2. Address: Match CFD has two addresses listed for their offices. One is located at 7 Westferry Circus, E14 4HD, London, United Kingdom. The other address is Shaikh Zayed Road, Dubai World Trade Center, 9292 Dubai, United Arab Emirates. Clients can potentially visit or send mail to these addresses for specific matters or in-person assistance.

3. Assistance: The customer service team at Match CFD is available to provide assistance and support to clients. They can help with inquiries related to account management, trading platforms, technical issues, and other general questions or concerns.

4. Response Time: Match CFD strives to provide timely responses to client inquiries. While response times may vary based on the volume of requests, the customer service team aims to address and resolve issues promptly.

5. Multi-Language Support: Match CFD may offer customer service support in multiple languages to cater to their diverse clientele. This can enhance communication and understanding for clients who are more comfortable in languages other than English.

It's important to note that the availability and quality of customer service can vary between different brokers. Clients should refer to the official Match CFD website or contact their customer service directly for specific information, operating hours, and any additional support features offered.

Please be aware that the information provided above is a general overview, and it's advisable to verify the contact details and customer service information directly with Match CFD for the most accurate and up-to-date information.

Conclusion:

In conclusion, Match CFD offers a range of advantages as a trading platform. It provides users with access to a variety of financial instruments, including contracts for difference (CFDs), allowing for diversification and potential profit opportunities. The platform often offers competitive pricing, advanced trading tools, and educational resources to support traders of different skill levels. However, it's important to consider some disadvantages, such as the inherent risks associated with leveraged trading and the potential for significant financial losses. Additionally, Match CFD's availability and regulatory compliance may vary across different countries, limiting access for some individuals. It's crucial for users to thoroughly understand the risks involved, exercise caution, and make informed decisions while using Match CFD or any trading platform.

FAQs

1. Q: Is Match CFD a legitimate platform or a scam?

A: There are concerns and red flags regarding the legitimacy of Match CFD. As of the latest verification date, Match CFD does not have a valid regulatory license, and it has been flagged as a suspicious broker with a high potential risk. It is advised to exercise caution and conduct thorough research before engaging with the platform.

2. Q: What financial instruments are available for trading on Match CFD?

A: Match CFD offers a variety of financial instruments, including forex currency pairs, commodities, indices, shares of individual companies, and cryptocurrencies such as Bitcoin, Ripple, and Solana. However, it's important to note that the availability of specific instruments may vary, and traders should check with Match CFD for the most up-to-date list of tradable assets.

3. Q: What types of accounts does Match CFD offer?

A: Match CFD offers three different account types: Standard Account, Premium Account, and VIP Account. Each account type is designed to suit the needs of traders with different levels of experience and preferences. The minimum deposit required varies for each account type.

4. Q: How can I open an account with Match CFD?

A: To open an account with Match CFD, you need to visit their website and follow the account opening process. You will be required to provide personal information and complete the necessary verification steps. It's important to note the regulatory concerns associated with Match CFD before opening an account.

5. Q: What are the deposit and withdrawal options on Match CFD?

A: Match CFD supports various payment methods for depositing and withdrawing funds, including debit/credit cards, e-wallets, bank transfers, and Terrixa. The minimum deposit requirement is $500, and the processing time for deposits and withdrawals may vary depending on the chosen method. Match CFD may impose fees for certain deposit and withdrawal methods.

6. Q: What trading platform does Match CFD provide?

A: Match CFD offers a web-based trading platform accessible through a web trader. The platform allows users to access their accounts and execute trades directly from their web browsers without the need for additional software installation. However, the platform may lack advanced features typically found in popular platforms like MetaTrader or cTrader.

7. Q: What trading tools are available on Match CFD?

A: Match CFD provides several trading tools, including an economic calendar to track important market events, a charting tool for price analysis and trend identification, and a currency exchange feature for trading in the forex market. These tools aim to assist traders in making informed investment decisions.