Overview of comdirect

Comdirect based in Germany, established in 2018, and noted as unregulated. It requires a minimum deposit of 700 euros to engage in trading activities that include a range of market instruments such as Forex, indices, stocks, loans, and financing.

The company offers various account types including Current account active, Current Account Extra, and Current Account Plus. A demo account is available for users. Customer support can be reached at the phone number 04106 - 708 25 00.

Options for deposit and withdrawal include credit/debit cards, Skrill, and NETELLER.

Is comdirect Limited Legit or a Scam?

Comdirect is listed as unregulated, which implies that it does not have any formal oversight by financial regulatory authorities.

Typically, regulation is an essential aspect for financial service providers, ensuring that they adhere to specific legal requirements and standards of operation. Being unregulated may raise concerns about the protection of investors and the company's adherence to financial laws and industry standards.

Pros and Cons

Pros of comdirect:

Convenience in Trading: The ability to trade better online on the website or with an app suggests ease of access and the convenience of managing trades from any location.

Range of Products: Offering a wide range of securities, including shares and certificates, both on-exchange and over-the-counter, indicates versatility and a broad selection for investors.

Accessibility: 24/7 customer service implies that support is available at any time, which is beneficial for traders who may operate in different time zones or need assistance outside of regular business hours.

User-Friendly: The promise of simple and quick ordering can be attractive to both experienced and novice traders, suggesting a user-friendly platform.

Personalized Support: Stating that the service is “competent and personal” implies a high level of customer care and potentially tailored support for individual customer needs.

Cons of comdirect:

Over-Reliance on Digital Platforms: Solely online or app-based trading may be a disadvantage for those who are not tech-savvy or prefer in-person interactions.

Risk of Unregulated Products: Trading a wide range of securities, especially if some are over-the-counter, can carry higher risks, particularly if the provider is unregulated as noted in the previous information.

Quality of Support: While 24/7 customer service is advertised, the actual quality and responsiveness of this support are not verified and could potentially be lacking.

Security Concerns: With the emphasis on quick online transactions, there may be concerns regarding the security measures in place to protect sensitive financial information.

Potential Hidden Fees: The advertisement does not mention fees or commissions, which will be significant and not as competitive as one would hope for an online trading platform.

Market Instruments

The following market instruments, products, and services offered by the company:

Trading Capabilities: The company enables customers to trade, suggesting a platform that supports the buying and selling of financial instruments.

Diverse Securities: It mentions a wide range of securities that customers can trade in, which likely includes traditional stocks, possibly bonds, and other financial instruments.

Shares: The ability to trade in shares indicates that customers can invest in publicly traded companies on various stock exchanges.

Certificates: Offering certificates could refer to a variety of financial instruments such as deposit certificates, certificate of deposits, or other fixed-income products.

On-exchange Trading: This suggests that the company facilitates trading on official stock exchanges, where listed securities are traded.

Over-the-counter (OTC) Trading: The mention of over-the-counter trading indicates that the company also enables trading of securities that are not listed on formal exchanges, which can include derivatives, bonds, and less common stocks.

Account Types

The company offers three types of accounts:

Current Account Active: This likely refers to a standard checking account that customers can use for daily transactions, with features tailored towards active traders or individuals who frequently engage in financial activities.

Current Account Extra: This account type offerd additional features or benefits beyond the basic current account, potentially including higher transaction limits, lower fees, or additional tools for managing finances.

Current Account Plus: This is a premium account offering that includes all the benefits of the other accounts with additional perks such as exclusive customer support, better trading conditions, or other value-added services designed for more serious investors or traders.

How to Open an Account?

Opening an account with the company could typically involve the following steps:

Choose the Account Type: Review the different account types offered—Current Account Active, Current Account Extra, and Current Account Plus. Select the one that best suits your trading needs and financial objectives.

Complete the Application: Visit the company's website or download the mobile app. Fill in the required information in the online application form, which may include personal details, financial information, and trading experience.

Verification: Submit any necessary identification documents for verification purposes. This could include a government-issued ID, proof of address, and possibly financial statements, depending on regulatory requirements.

Fund Your Account: Once your account is approved, make the minimum required deposit (as mentioned earlier, it's 700 euros). You may choose from the given deposit methods such as credit/debit card, Skrill, or NETELLER.

Deposit & Withdrawal

The company offers the following methods for deposit and withdrawal:

Credit/Debit Card: Customers can use their credit or debit cards to fund their accounts, which is a common and convenient method that typically allows for quick processing.

Skrill: This is an e-wallet platform that enables secure online transactions. Skrill is widely used for financial services and trading accounts due to its ease of use and fast transfer times.

NETELLER: Similar to Skrill, NETELLER is another e-money transfer service that provides a fast and secure way to transfer money online, which can be used for both deposits and withdrawals.

Customer Support

The company provides customer support :

Phone Support: There is a dedicated customer support phone number provided, 04106 - 708 25 00, which customers can call to receive assistance.

Availability: The customer support is available 24/7, indicating that help can be accessed at any time, which is beneficial for traders who will need assistance during non-standard business hours, including nights, weekends, and holidays.

Conclusion

In conclusion, comdirect is a Germany-based financial services company that offers a range of trading capabilities through an unregulated platform. Established in 2018, it provides a user-friendly online and app-based interface for trading a variety of securities, including shares and certificates, both on traditional exchanges and over-the-counter markets.

The company requires a minimum deposit of 700 euros and offers three types of accounts to meet different levels of traders. Deposits and withdrawals can be made via credit/debit cards, Skrill, or NETELLER, facilitating a convenient transaction process.

Moreover, comdirect emphasizes customer service with a 24/7 support line that promises competent and personal assistance. However, as an unregulated entity, potential clients consider the risks and conduct thorough due diligence before engaging in trading activities with the company.

FAQs

Q:Is comdirect regulated?

A: No, comdirect is listed as an unregulated company, which means it does not have formal oversight by financial regulatory authorities.

Q: What is the minimum deposit required to open an account with comdirect?

A: The minimum deposit required to open an account with comdirect is 700 euros.

Q: What types of accounts does comdirect offer?

A: comdirect offers three types of accounts: Current Account Active, Current Account Extra, and Current Account Plus, each with different features and services.

Q: Can I trade over-the-counter (OTC) products with comdirect?

A: Yes, comdirect offers trading of a wide range of securities, including on-exchange and over-the-counter products.

Q: How can I deposit funds into my comdirect account?

A: Funds can be deposited into a comdirect account via credit/debit card, Skrill, or NETELLER.

Q: Does comdirect provide a demo account?

A: Yes, comdirect offers a demo account, which is available for users to practice trading without risking real money.

Q: What is the customer support contact number for comdirect?

A: The customer support contact number for comdirect is 04106 - 708 25 00.

FX4150390052

Hong Kong

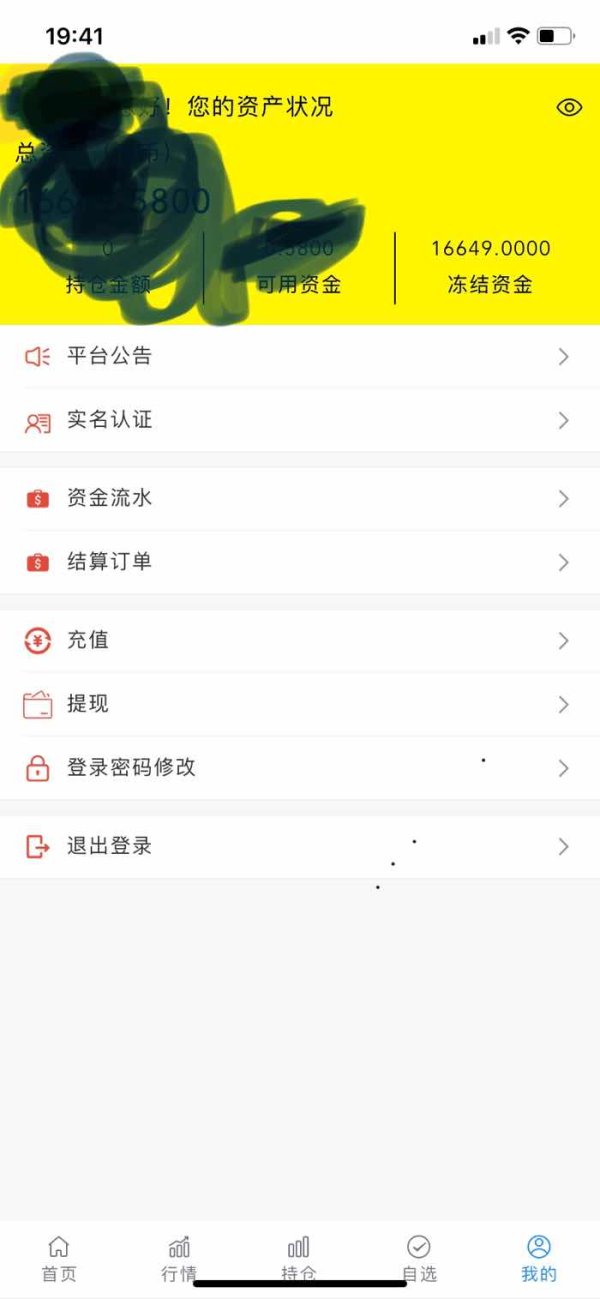

Mu Li,g, a teacher and YaShuang Zhou, an assistant, both of whom pretend to be a member of the ChinaAMC, and unable to withdraw

Exposure

2020-09-20

Y89277

Hong Kong

After an introduction I started trading Hong Kong stocks. The assistant asked me to deposit continuously and then I can't withdraw. My QQ was blacklisted and their live streaming was set a password. The withdrawal has been in audit all along. It's said that the withdrawal can arrive withing two working days, but it can't arrive!

Exposure

2020-09-17

FX4086934300

Hong Kong

The so-called teacher Mu Li and his assistant taught a group people to invest and offered a software. The teacher kept urging people to deposit but we can’t withdraw

Exposure

2020-09-15

FX3194662122

Hong Kong

I met the fraud called Mu Li in the beginning of August who said he published a book about stock and taught people how to invest. However, the stock he recommended didn’t profit. Then he said he would lead us to invest and asked us to download this software which we can withdraw easily. But now, we can’t withdraw at all.

Exposure

2020-09-14

Chin Vun Boke

South Korea

This sick broker ripping off their customer on forex trading by widening their spreads at the top and bottom of the day’s ranges. I have already seen through their tactics. Very bad back office service. The staff don’t seem to have any idea how the share market or share registry system work.

Neutral

2023-03-21

FX1356629517

Nigeria

Comdirect has become my go-to place for trading 10 months ago. It meets all my requirements. The software doesn’t lag, which is important. Another good thing is strong security, which is something not a lot of people pay attention to.

Neutral

2023-03-10