Score

Exclusive Markets

Seychelles|5-10 years|

Seychelles|5-10 years| https://www.exclusivemarkets.com/

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

ExclusiveMarkets2-Live 2

Influence

B

Influence index NO.1

Spain 3.63

Spain 3.63MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomInfluence

Influence

B

Influence index NO.1

Spain 3.63

Spain 3.63Contact

Licenses

Licenses

Licensed Entity:Exclusive Markets Ltd

License No. SD031

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

Basic Information

Seychelles

SeychellesAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

- All Servers 3

- MT4

- MT5

Users who viewed Exclusive Markets also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

globalexclusivemarkets.com

Server Location

United States

Website Domain Name

globalexclusivemarkets.com

Server IP

104.21.58.213

exclusivemarkets.com

Server Location

United States

Website Domain Name

exclusivemarkets.com

Server IP

172.67.128.53

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Exclusive Markets Review Summary in 10 Points | |

| Founded | 2020 |

| Registered Country/Region | Seychelles |

| Regulation | FSA (offshore regulatory) |

| Market Instruments | Forex, Metals, Commodities, Indices, CFDs on Stocks, Equities, Bonds, ETFs, Cryptos |

| Demo Account | N/A |

| Leverage | 1:2000 |

| EUR/USD Spread | From 1.5 pips (Standard) |

| Trading Platforms | MT4/5 |

| Minimum deposit | $0 |

| Customer Support | Live chat, phone, email, WhatsApp, Line |

What is Exclusive Markets?

Exclusive Markets is a financial services provider founded in 2020, offering trading services in various financial markets, including forex, commodities, indices, stocks, bonds, ETFs, and cryptocurrencies with different account types through the leading MT4/5. As for regulation, Exclusive Markets operates in Seychelles and is registered with the Financial Services Authority (FSA) of Seychelles (License No. SD031), however, it is offshore.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

Exclusive Markets offers a wide range of trading instruments and multiple account types with low minimum deposits, making it accessible to traders of different levels. The availability of high leverage options and competitive spreads, including raw spreads on certain accounts, can be advantageous for experienced traders. However, the lack of regulation and the offshore license raise concerns about the safety of client funds.

| Pros | Cons |

| • Multiple trading assets and account types | • Offshore regulated by FSA |

| • Low minimum deposit requirement | • Regional restrictions |

| • MT4 and MT5 supported | • Residents of Canada, Cuba, Iraq, North Korea, Sudan, Syria, The United States, Russia, and Belarus are excluded |

| •Various deposit and withdrawal methods with no fees | • Limited trading tools and educational resources |

Exclusive Markets Alternative Brokers

CMC Markets - A reputable broker with a wide range of tradable instruments and advanced trading platforms.

RoboForex - A reliable broker offering multiple account types and competitive trading conditions.

Tickmill - A trusted broker known for its low spreads, fast execution, and strong regulatory framework.

There are many alternative brokers to Exclusive Markets depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is Exclusive Markets Safe?

As an unregulated broker, Exclusive Markets carries inherent risks for traders. The offshore regulatory license from the Seychelles Financial Services Authority (FSA, License No. SD031) is not as robust as licenses from reputable financial regulatory bodies. Traders should exercise caution when considering trading with an unregulated broker, as the lack of regulatory oversight may expose them to potential scams or fraudulent activities. It is important for traders to thoroughly research and assess the credibility and reliability of a broker before engaging in any financial transactions.

Market Instruments

Exclusive Markets offers investors access to 30,000+ trading instruments, covering various financial markets. Traders have the opportunity to engage in Forex trading, allowing them to trade major and minor currency pairs. Additionally, Exclusive Markets offers trading in precious metals like gold and silver, providing investors with exposure to these valuable commodities. Commodities such as oil, natural gas, and agricultural products are also available for trading.

Furthermore, traders can access a wide selection of global indices, enabling them to participate in the performance of major stock markets worldwide. CFDs on individual stocks, equities, bonds, and ETFs offer further opportunities for investment diversification.

Lastly, Exclusive Markets caters to the growing interest in cryptocurrencies, allowing traders to trade popular digital assets such as Bitcoin, Ethereum, and more. The extensive range of trading instruments offered by Exclusive Markets provides investors with the flexibility to explore different markets and diversify their investment portfolios.

Accounts

Exclusive Markets offers 5 kinds of account types to cater to the diverse needs of investors. The Cent account is designed for those who prefer to trade with smaller volumes and lower risk, with a minimum deposit requirement of just $5. The Standard and Standard Plus accounts are suitable for traders who are looking for a more traditional trading experience, with a minimum deposit requirement of $5. The Exclusive account is tailored for experienced traders or those who wish to access exclusive features and benefits, requiring a minimum deposit of $500.

Lastly, the Shares account is designed for investors interested in trading individual stocks, but the specific minimum deposit requirement is not specified. By offering different account types, Exclusive Markets aims to provide options that suit the preferences and trading goals of a wide range of investors, ensuring accessibility and flexibility in account selection.

How to register with Exclusive Markets

Opening an account with exclusive Markets is a simple and straightforward process, and below is a reference video for traders to follow:

Keywords

- 5-10 years

- Regulated in Seychelles

- Retail Forex License

- MT4 Full License

- White label MT5

- High potential risk

- Offshore Regulated

View More

Disclosure

Unauthorized use of websites (the “unlawful website”)

Country/Region

SC FSA

Disclosure time

2023-08-14

Disclose broker

Blocking 218 Website Domains, CoFTRA Reminds Investment Risks in Illegal Entities

Country/Region

ID BAPPEBTI

Disclosure time

2023-04-20

Disclose broker

Bappebti Blocks 760 Website Domains, Reminds of the Risk of Transactions in Unlicensed PBK Entities

Country/Region

ID BAPPEBTI

Disclosure time

2022-09-20

Disclose broker

News

Exposure Warning against Exclusive Markets

Recently, the Securities Commission Malaysia warned against an unauthorized broker called Exclusive Markets. The authority stated that the firm is carrying on unlicensed capital market activities dealing in securities. This move is aimed at protecting investors and promoting a more inclusive and competitive market environment.

2024-10-11 09:59

News Exclusive Markets offers chance to win gold coins

Exclusive Markets Launches a new contest called Exclusive Golden Clash. Trading participants have the chance to earn gold coins in exclusive markets. All skill levels of traders, from seasoned pros to novices, are welcome to take advantage of this offer. The contest began on February 8, 2024, and it will run until March 31, 2024.

2024-02-13 12:14

Comment 14

Content you want to comment

Please enter...

Comment 14

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

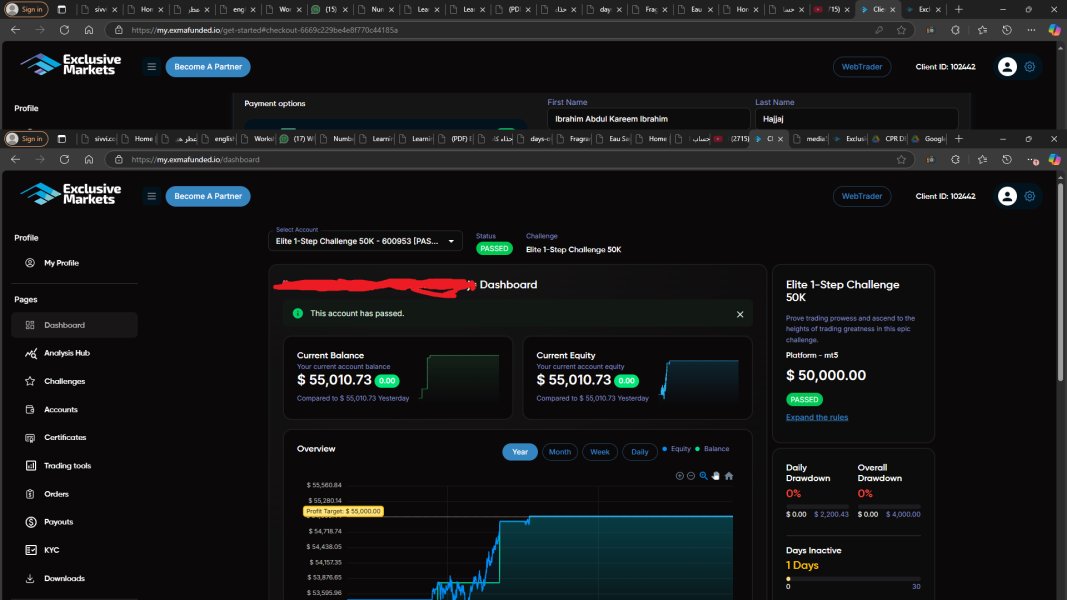

FX4065223712

Saudi Arabia

We bought a challenge account more than once until we achieved the goal, and then they stopped responding like that 😡

Exposure

01-05

Dreams come True

United States

Exclusive Markets has its perks – low deposits, a variety of instruments, and MT4/5 support. But, the lack of regulation makes me nervous. It's a gamble, so tread carefully!

Neutral

2023-12-05

Cocowu

Peru

The trading platforms, especially MT5, are pretty solid, and the fixed spreads are clear. Customer support is decent, and they're available when I need them. All in all, Exclusive Markets is in my good books.

Neutral

2023-12-04

媛乐

Hong Kong

Honestly, I benefited from Exclusive’s social trading a lot, and I did make some profits. One issue needs to be pointed out: they process withdrawal requests so slow. Averagely, it takes one week to get your money withdrawn.

Neutral

2023-02-15

Um Lamar

Cyprus

بصراحة بروكر ممتاز وانا استغرب

Positive

01-09

Quket

Netherlands

Exclusive Markets offers traders excellent leverage options, making it easy to amplify your trading potential. Plus, their minimum deposit is very reasonable, making it accessible to traders of all levels.

Positive

2024-07-16

bobo1

Australia

At Exclusive Markets, I appreciate their top-notch customer service, especially Nec's expertise. Their platform is well-organised, making trading seamless. Their execution is quick, perfect for scalping traders. Efficient handling of transactions and timely customer support only add to their reliability. Exclusive Markets provides a professional and satisfying trading experience.

Positive

2024-04-19

David4833

United Kingdom

I've been trading with Exclusive Markets for 2 years, and I must say, it has been an exceptional experience from day one. Here's why I highly recommend them Transparency: Exclusive Markets shines in terms of transparency. They provide real-time market data, accurate spreads, and a clear fee structure. No hidden surprises, ever. Customer Support: Their customer support team deserves applause. They are available 24/5, responsive, and knowledgeable. They've helped me through various trading challenges with patience.

Positive

2023-09-14

Ja5344

Thailand

สะดวกในการทำธุรกรรม ฝาก-ถอนได้เร็ว การถอนได้ในเวลา 2-3 ชั่วโมง OK

Positive

03-26

我

South Africa

I love using Exclusive Markets’ VPS, which offers me the optimal execution speed, reducing latency and slippage. I strongly recommend that your guys should have a try.

Positive

2023-02-21

姚先生141319

Mexico

esta empresa exclusive markets parece muy bien regulada y que ofrece servicios satisfactorios en su página web.

Positive

03-26

Hamzah Shahrin

Hong Kong

This platform’s trading conditions seem pretty good, rich trading assets, low initial investment amount… advanced mt5 trading platform, its demo account trading experience is also good, I haven’t made my decision yet, anybody give me some advice?

Positive

2022-11-23