What is PayPay Securities?

PayPay Securities, formerly known as One Tap BUY Co., Ltd, is a financial services company based in Japan. Established in 2013 as My Banker, the company has undergone several name changes and expansions in its offerings. PayPay Securities is licensed by the FSA to operate as a retail foreign exchange provider, allowing it to offer trading services in the foreign exchange market. The company has introduced various services over the years.

Pros & Cons

Pros:

FSA Regulation: PayPay Securities is regulated by the Japan Financial Services Agency, providing a level of regulatory oversight and consumer protection.

Diverse Investment Options: The platform offers a variety of investment options, including Japan stocks, U.S. stocks, investment trusts, Japan stocks CFDs, and 10x CFDs, allowing for diversification in a portfolio.

User-Friendly Apps: PayPay Securities offers several user-friendly apps for trading and investment management, making it convenient for users to access and manage their investments.

Cons:

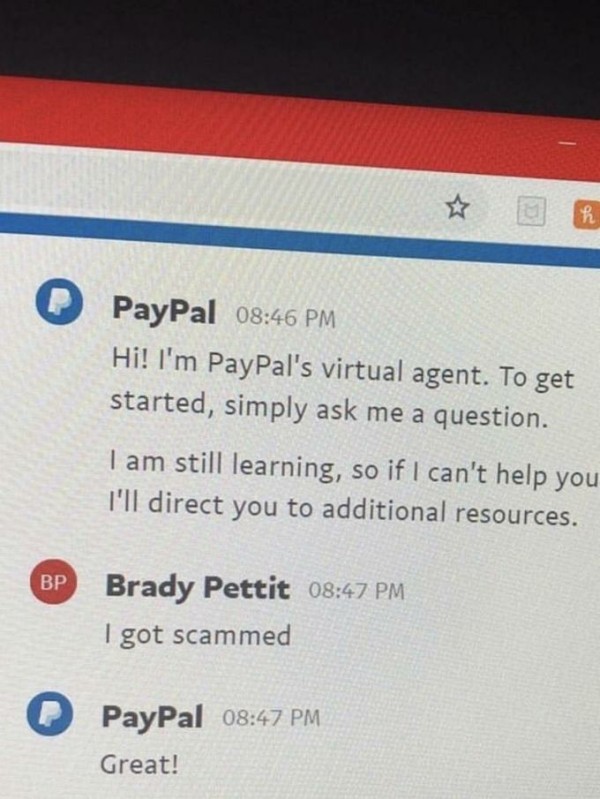

Limited Customer Support Options: While the platform offers customer support through social media channels like Twitter and Facebook, it lacks other traditional customer support options such as phone or email support.

Is PayPay Securities Safe or Scam?

PayPay Securities is highly likely not a Scam. Founded in 2013 (originally named My Banker), it has been operating for over a decade. It currently holds a retail foreign exchange license from the Japan Financial Services Agency under license number 3010001156746. As a regulated entity, PayPay Securities is required to comply with strict regulatory standards, which include maintaining adequate capital reserves, implementing robust security measures, and providing transparent and fair trading practices.

Products

PayPay Securities offers a range of products and services to its clients.

Japan Stocks: Trading services for stocks listed on Japanese exchanges, allowing investors to buy and sell shares in Japanese companies, including Individual Stocks, ETFs, and REITs.

U.S. Stocks: Access to trading U.S. stocks listed on major American exchanges, providing investors with exposure to the U.S. market, including Individual Stocks and ETFs

Investment Trusts: Investment options in various investment trusts, offering diversification and professional management of funds, including HSBC India Ope, PayPay Asset Management Nikkei 225 Index, Sompo Japan Green Open Nickname: Bunanomori, and more.

Japan Stocks CFDs: Trading contracts for difference (CFDs) on Japanese stocks, allowing investors to speculate on price movements without owning the underlying asset. Japan stock CFDs can be traded 5 times the amount of funds.

10x CFDs: Trading CFDs with leverage up to 10 times the initial investment, amplifies gains (but also losses) for investors. 10x CFDs can be traded 10 times the amount of your funds.

Services

PayPay Securities offers a variety of services to its clients.

Buy as it is: This service allows you to buy stocks and mutual funds without transferring money to your brokerage account. It offers convenience and flexibility in your investment process.

Point Investment: With PayPay Points, you can invest in stocks, including popular stocks. This service provides a unique way to use your points for potential investment gains.

Tsumitate Investment: This investment method allows you to regularly purchase financial products at the time and amount you decide. It helps you build your investment portfolio over time in a systematic manner.

Investment Information: PayPay Securities provides information to help you make investment decisions. This includes market analysis, stock research, and other relevant information to guide your investment choices.

Apps

PayPay Securities offers a variety of apps and tools. These apps and tools provide a range of features and options for managing and investing your assets through PayPay Securities.

PayPay Asset Management (PayPay App): Allows you to manage your assets, including buying investment trusts and stocks for 100 yen. You can also use PayPay points to invest at 1 point = 1 yen.

PayPay Securities App: Enables trading from 1,000 yen, with features like Buyout as it is for settling purchase prices without remittance procedures. You can also purchase investment trusts and stocks for 1,000 yen.

Japan Stocks CFD App: This lets you trade CFDs on individual Japan stocks, offering advantages like starting trading by selling and trading with leverage for a small amount.

10x CFD App: Allows trading of two CFDs: Japan 225 and USA 500. You can start trading by selling, trade with leverage in small amounts, and trade almost 24 hours a day.

Tsumitate Robo Savings: Automatically invests in U.S. stocks based on your chosen schedule, starting from 1,000 yen, suitable for investment beginners.

Anyone can IPO: Enables you to apply for the purchase of an IPO from 1 share, allowing you to buy IPOs popular with individual investors for a small amount.

Deposits & Withdrawals

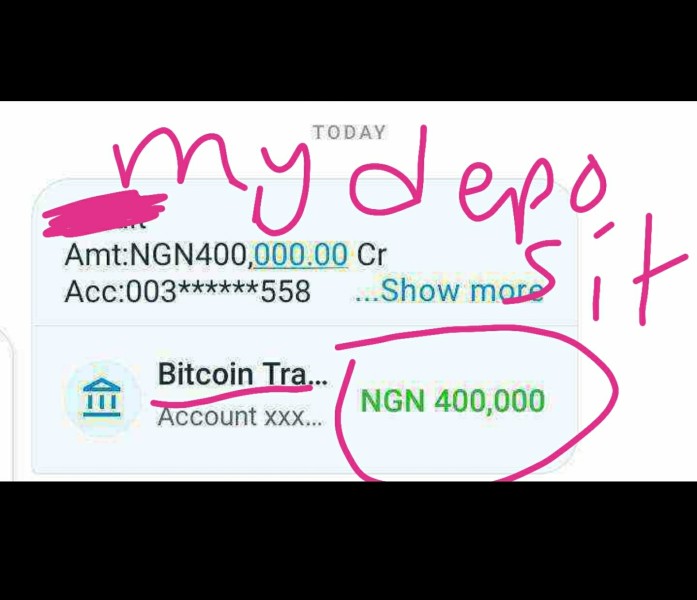

Deposits and withdrawals for PayPay Securities and PayPay Asset Management can be made through various methods.

Deposits: You can deposit funds into your brokerage account by transferring money from your bank account to your designated transfer account. You can also use the “Buy as it is” feature, which allows you to buy stocks and mutual funds without transferring money to your brokerage account.

Withdrawals: To withdraw funds from your PayPay Securities account, you can transfer the funds to your designated bank account.

Deposits: You can deposit funds into your PayPay Asset Management account using PayPay Money, PayPay Points, or your registered financial institution account balance (if using the “Buy as it is” feature).

Withdrawals: To withdraw funds from PayPay Asset Management, you can sell your investments and withdraw the proceeds to your PayPay account. From there, you can transfer the money to your bank account or use it for other purposes within the PayPay app.

In terms of withdrawal fees, for withdrawals to Mizuho Bank, the fee is 110 yen for amounts less than 30,000 yen and 220 yen for amounts of 30,000 yen or more. For withdrawals to a company other than Mizuho Bank, the fee is 275 yen for amounts less than 30,000 yen and 385 yen for amounts of 30,000 yen or more.

Fees

Here's a summary of the fee structure for various products and services.

Investment Trusts:

Japan Stocks:

Transaction fee during Tokyo Stock Exchange operating hours: 0.5% of the base price

No additional fee is charged, as the transaction price includes the transaction fee

U.S. Stocks:

Transaction fee during local time 9:30-16:00: 0.5% of the base price

Transaction fee at other times: 0.7% of the base price

Exchange fee: Determined by the company based on foreign exchange market trends, plus 35 yen per U.S. dollar

Tsumitate Robo Savings:

Spread: 0.5% of the transaction price

Exchange fee: Determined by the company based on foreign exchange market trends, plus 35 yen per U.S. dollar

Japan Stocks CFD / 10x CFD:

Other Expenses:

Account Management Fee: Free

Fees for issuing certificates of balance, etc.: 1,100 yen per document if sent by mail

Customer Service

PayPay Securities offers several social media options for their clients. You can reach them through their official Twitter account. Additionally, they have a Facebook page where you can find information and engage with their community. They also have a Note page.

If you prefer direct communication, you can use the contact form available on their website to submit your questions.

Conclusion

In conclusion, PayPay Securities offers a range of investment products and services, regulated by the FSA, with user-friendly apps for convenient trading. They provide diverse investment options and are safe, but their customer support options are somewhat limited. Overall, PayPay Securities is a reputable choice for you to invest in the global market.

Frequently Asked Questions (FAQs)

Q: Is PayPay Securities regulated?

A: Yes, PayPay Securities operates with the regulation of FSA.

Q: What products does PayPay Securities offer?

A: PayPay Securities offers Japan stocks, U.S. stocks, investment trusts, Japan stocks CFDs, and 10x CFDs.

Q: What services does PayPay Securities provide?

A: PayPay Securities provides services such as Buy as it is, Point Investment, Tsumitate Investment, and Investment Information.

Q: What are the fees for investment trusts at PayPay Securities?

A: The purchase fee for investment trusts at PayPay Securities is 0 yen. Trust fees and other fees vary by product.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.