Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

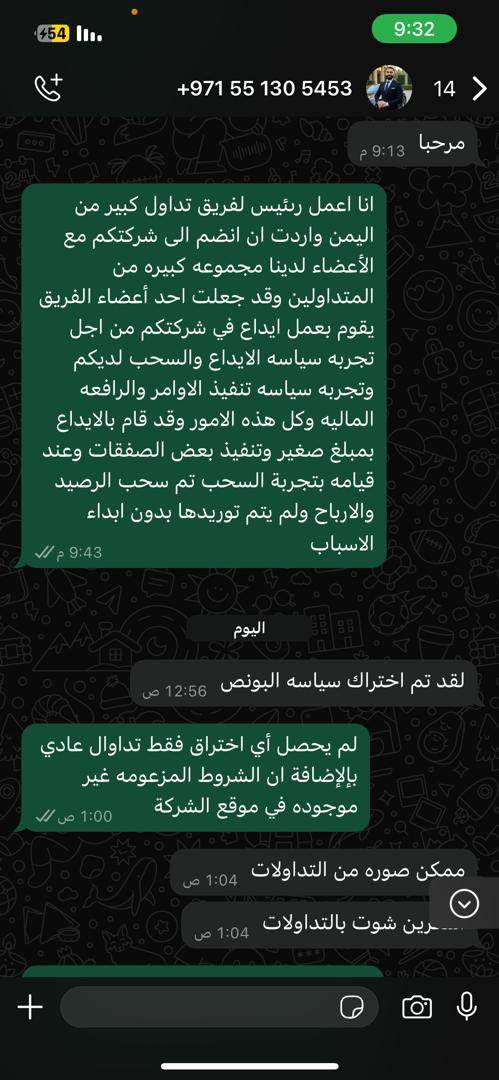

mazensaleh

Djibouti

TNFX Withheld My $532.80 Profits – Awaiting Your Response I am posting this review on Trustpilot to publicly address a serious issue with TNFX and to demand an immediate response from the company regarding the unjust withholding of my legitimate profits. I urge TNFX to resolve this matter promptly, as their lack of accountability is unacceptable, and I will not hesitate to escalate this further if ignored. On March 10, 2025, I deposited $450 into my TNFX account (Account Number: 5588753) and received a 50% bonus of $225. A company representative, Mr. Ahmed Wazeer, explicitly assured me in a recorded conversation that "there are no conditions for withdrawing profits," which gave me confidence to trade with them. I earned legitimate profits of $532.80 through my trading activities, bringing my total balance to $1,207.80 (deposit + bonus + profits). However, when I requested to withdraw my funds, TNFX began a month-long ordeal

Exposure

In a week

F845

United States

I made a deposit of US$30,000 on the Tnfx platform, and the profit was US$122. The withdrawal was deducted, and then it never credited the account. I contacted the account manager, who informed me that KYC certification is required on the the backend. Then I submitted the KYC certification information, but the platform never responded or gave out any money.

Exposure

2024-05-21

slah

Iraq

They stole my money, stay away from them.

Exposure

2023-12-28

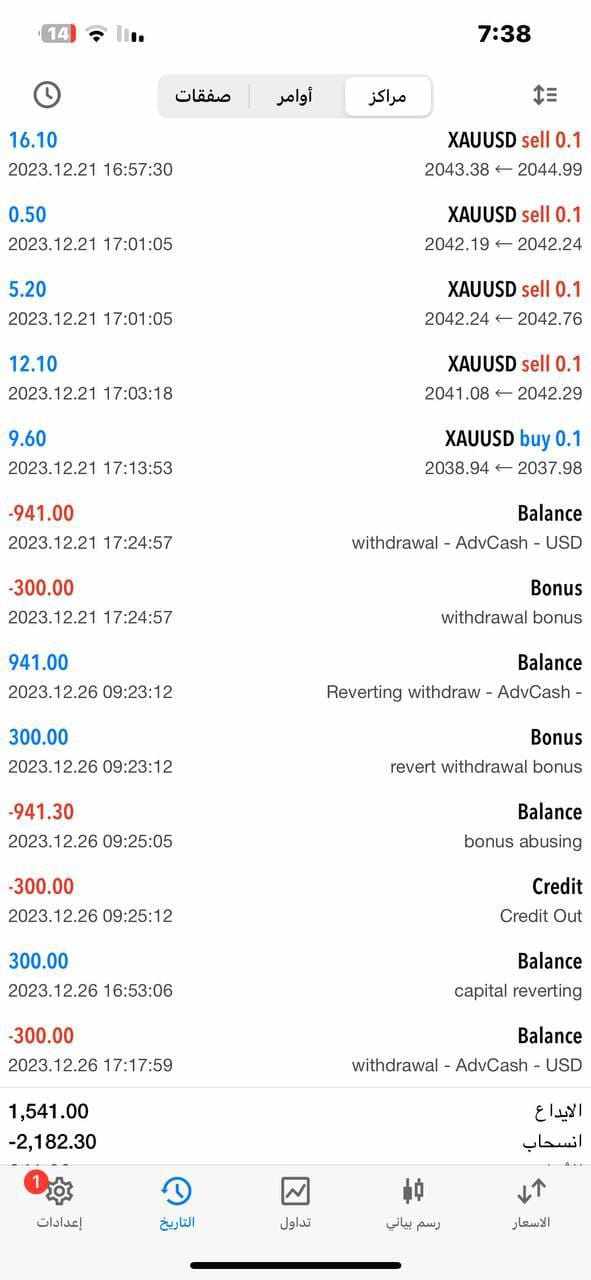

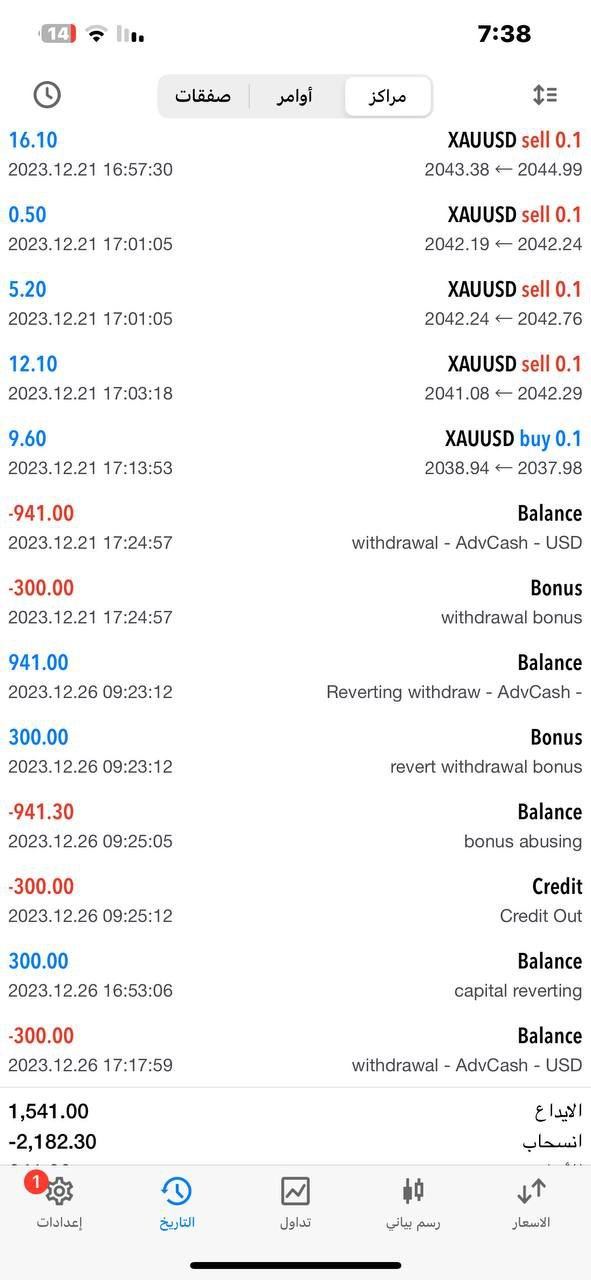

Qaisar926

United Arab Emirates

I deposit amount in my account, and do trade, make profit and put withdrawal and they deleted my profit. This is how they make money.

Exposure

2023-12-21

vivian214

Hong Kong

I deposited $5,000 USDT for the first time two months ago. Generally, when I deposit money using Crypto, it will be credited to my account very quickly. I also received an email and official notification that I have made the deposit, but it has not arrived yet (I have been waiting for a week) and the banlance is still $0. I sent an email and asked the customer service but there was no reply. It wasn't until I asked for a refund that they replied and said they would help me follow up on the matter. Now they are shirking responsibility and saying that the financial department needs to verify it. It took almost a month and a half to verify the result. P.S. has provided HASH. Email Deposit notification, deposit address, official notification of deposit confirmation, suspected to be scammed.

Exposure

2023-12-04

FX3711770062

Iraq

Peace be upon you. I settled an account with Tiran Company. I deposited 500 dollars and they gave me 500 dollars Bonus I traded on news for two weeks. I made profits of 2352 thousand dollars. I submitted a withdrawal. The withdrawal was delayed for 3 days. Every day, they give me another excuse. I opened a hedge on two accounts, and this thing I swear by God, I did not know and they did not have any evidence, just words until they see an excuse and take the balance and the profits, and the account manager has been not responding for a week to me, and I am writing to support about solving my problem. They say they will contact you and they will communicate without any words or an answer. My profits and the two are not satisfied with giving them

Exposure

2023-08-18

Rebecca9212

United Kingdom

I cannot withdraw my money from tnfx it’s been some days now and I still haven’t gotten my money I got aided finasset, and so far this problem has not been resolved they have been sued by state security

Exposure

2023-07-09

Hussein Alasadi

Iraq

Hello, I have a problem with TNFX regarding my IB account, they refuse to upgrade it and ignoring my request and email. i Have achieved all the requirements to upgrade to level 2 ( silver / rebate 6$) [the level on the website in my dashboard is an error they said]. i have 6 verified accounts and approximately 200 standard lots traded, and $10,000 deposit. so as you see it's more than the requirements. now they say you need 3 more accounts to achieve the condition!!! fully scam. this problem nearly since February, and i can't withdraw the commissions.

Exposure

2023-07-08

FX2209507829

Japan

I have an account with TNFX (account no. 428941). I accumulated some gains in my account. However, when I applied to withdraw my money, my requst was rejected. Contacting the customer service is very difficult, even when I got connected, there was no clear answer on time to return my money; and there was no reason given about holding up my money. My mails fell to deaf ears. It is really frustrating. I think there are a lot of people facing the same difficulty and would like to call upon these victims to come forward to report them.

Exposure

2023-06-09

FX8470037020

Iraq

I cannot withdraw my money from Tiran Company and National Security arrested them on charges of money laundering and fraud, and so far this problem has not been resolved

Exposure

2023-05-15

FX2209507829

Japan

我的tnfx账号是428941 My withdrawal application was rejected by their company for unwarranted reasons. Even if I contacted customer service, They did not give a specific time and reason, and there was no reply to the email. It's really helpless. I hope that all the people I have encountered will stand up and can't let such an dishonest fraud company continue to have such bad behaviour!

Exposure

2023-04-28

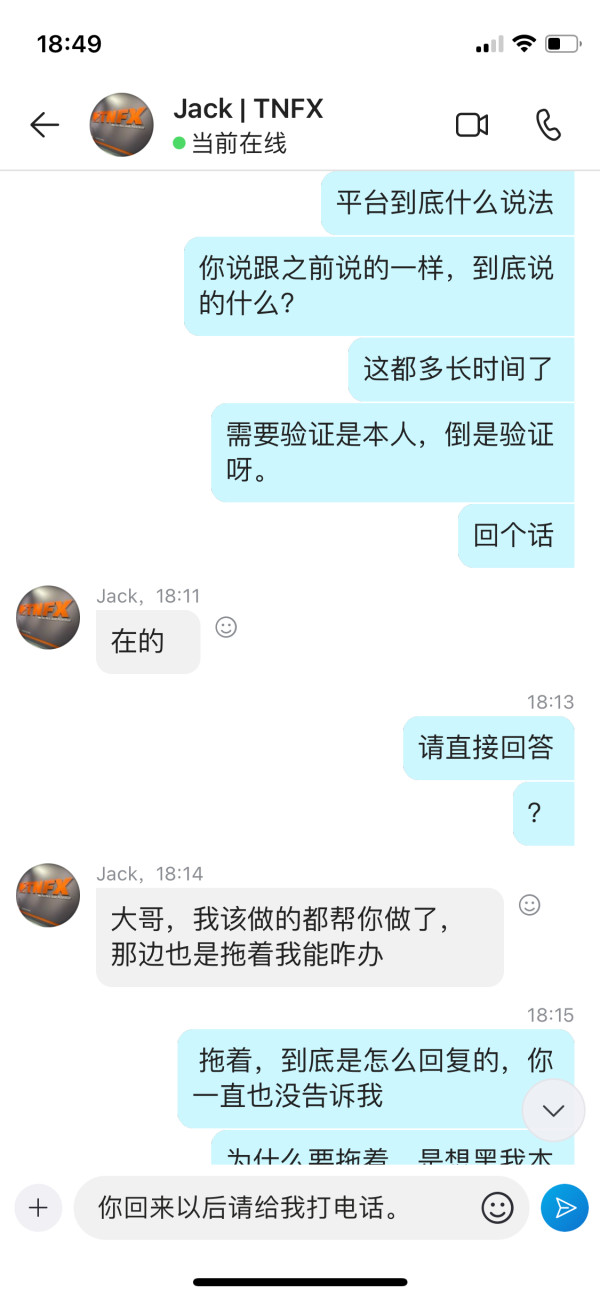

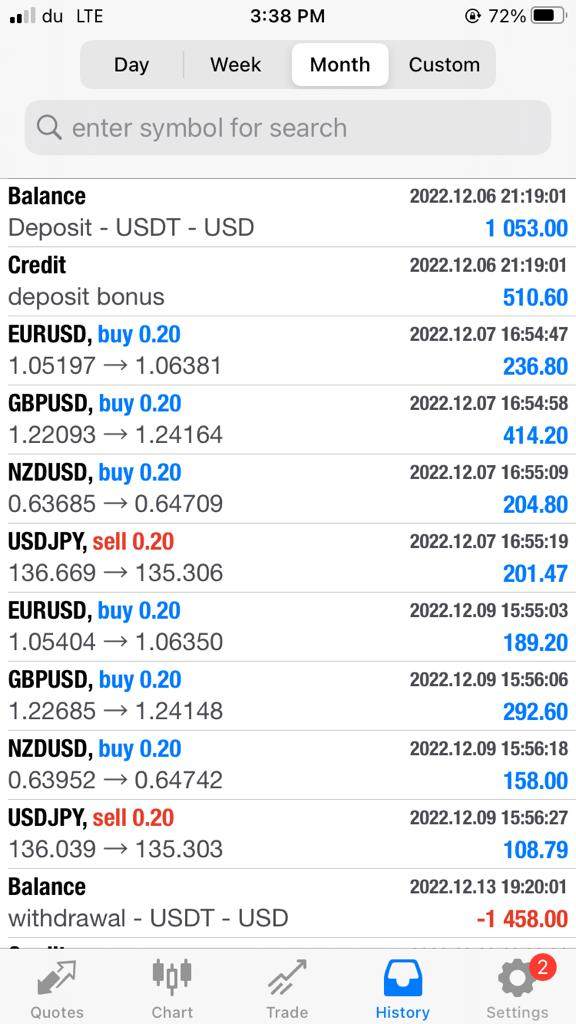

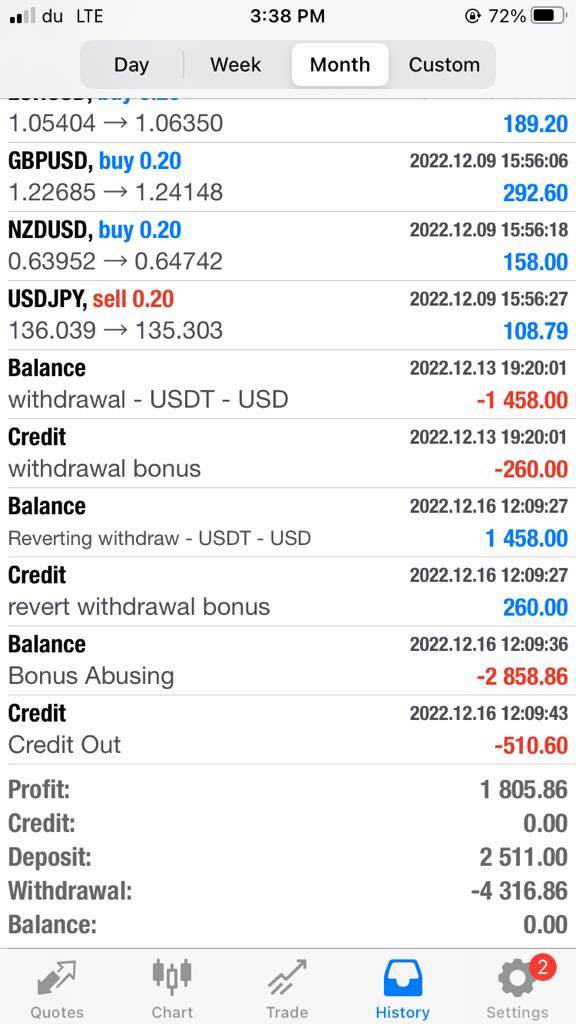

红浮

Hong Kong

In March, a friend introduced TNFX to deposit $4100. After the transaction, it generated profits and tried to withdraw money. TNFX directly slandered me for abusing the bonus and erasing all funds for a total of $9908. I asked them to provide evidence and they refused to provide it. I sent the transaction records to everyone have a look.

Exposure

2023-04-13

MrTrader

United States

TNFX is making me believe they are a SCAM company. Have made a deposit several weeks ago and even after i have check with their bank and also mine that the transfers has arrived they still claiming they dont have the money. Dont deposit here. I do not recommend. Have already reached to FSA Seychelles where they claim to be regulated regarding this matter and will proceed with any other necessary action against TNFX if they do not proceed and make my fund available to withdrawal as per at this point i dont even want to have any business with TNFX anymore.

Exposure

2023-04-04

Cornelia Van Drusen

Netherlands

TNFX is a mixed bag. Their array of trading instruments, including cryptocurrencies, is fantastic. The Cent account is a steal for beginners, letting you dip your toes with just $100. However, the lack of clear info on Standard account deposits is a downside. The Fix and Zero accounts have relatively high minimums, which might deter some traders. On the flip side, the VIP account is tailored for big shots. Despite some drawbacks, TNFX's asset variety and features across accounts make it worth considering.

Neutral

2023-12-06

FX1527844142

Netherlands

TNFX is a trading gem! With a plethora of assets, from forex pairs to cryptocurrencies, they've got it all. I'm a fan of their Cent account – perfect for beginners with a $100 minimum deposit. It's a playground for testing strategies without the risk. The variety of account types is impressive, but transparency on Standard account deposits could be better. Still, the diverse range of assets and features make TNFX a solid choice for traders!

Neutral

2023-12-05

Busopy

Belarus

There's no hard minimum deposit, it's all about how much you wanna put in based on the price of the NFTX tokens or the underlying NFTs. They've got two kinds of funds: D1 and D2. D1 is like a straight-up investment in a single NFT, while D2 is a mix of different D1 funds, so you can spread your money around a bit.

Positive

2024-07-22

Ali4045

Iraq

So far, a good anal, knowing that they must be tested with withdrawals in high amounts of 10 thousand or more, in order for them to be classified as sponsors and mediators in the open … and listen They say it is offline, meaning imaginary trading, and God knows best

Positive

2023-01-26

Melvin Kwang

Peru

I have been trading with this company for 5 months and I am satisfied and will continue to trade. It is effectively regulated by the FSA. I like its leverage, up to 1:400, which allows me to trade more positions. When I trade, I tend to choose a platform that provides MT4 services, and TNFX satisfies this point.

Positive

2022-12-05

FX1080226572

Malaysia

Customer service is top-notch! It was a pleasure chatting with them! And after a couple of hours on the broker's website, researching and opening demo accounts to get first-hand experience, I have been a client since.

Positive

2022-11-29