Score

KIWOOM SECURITIES

South Korea|2-5 years|

South Korea|2-5 years| https://www.kiwoom.com/h/ir/en/main

Website

Rating Index

Influence

Influence

A

Influence index NO.1

South Korea 9.15

South Korea 9.15Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

South Korea

South KoreaUsers who viewed KIWOOM SECURITIES also viewed..

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

PU Prime

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

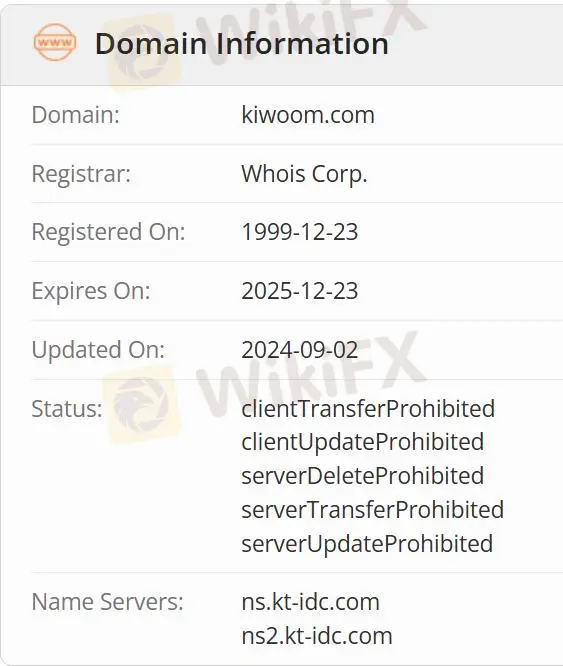

kiwoom.com

Server Location

South Korea

Website Domain Name

kiwoom.com

Website

WHOIS.YESNIC.COM

Company

WHOIS NETWORKS CO., LTD.

Domain Effective Date

1999-12-23

Server IP

112.175.65.11

Company Summary

| KIWOOM SECURITIES Review Summary | |

| Founded | 2000 |

| Registered Country/Region | South Korea |

| Regulation | No regulation |

| Trading Products | Stocks, bonds, debt, securities, futures, options, derivatives, mezzanine, private equity, arbitrage |

| Demo Account | ✅ |

| Trading Platform | Heroic Gate-Series (PC), Heromoon S#-Series (mobile) |

| Min Deposit | / |

| Customer Support | Tel: +82-2-3787-5236 |

| Fax: +82-2-3787-5136 | |

| Email: ir@kiwoom.com | |

| Company address: 96 Uisadang-daero, Yeongdeungpo-gu, Seoul, Korea (TP Tower) | |

Founded in 2000, KIWOOM SECURITIES is an unregulated Korean securities company, offering trading services in stocks, bonds, debt, securities, futures, options, derivatives, mezzanine, private equity, and arbitrage with multiple trading platforms to choose from.

Pros and Cons

| Pros | Cons |

| Diverse trading products | No regulation |

| Demo accounts | Korean reading threshold |

| Clear fee structure | Unclear minimum deposit |

| Multiple trading platforms |

Is KIWOOM SECURITIES Legit?

No, although KIWOOM SECURITIES has a variety of businesses, there is no information to prove that international or local financial institutions regulate KIWOOM SECURITIES.

What Can I Trade on KIWOOM SECURITIES?

Kiwoom Securities provides online brokerage services in Korea and internationally.

The company offers online trading services, including domestic and international equities, futures, foreign exchange margin trading, equities, futures and options trading, and is also involved in financial derivatives, equity capital market services, debt capital market services, and banking and financial services for local residents and small and medium-sized businesses.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| Debt | ✔ |

| Securities | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Derivatives | ✔ |

| Mezzanine | ✔ |

| Private Equity | ✔ |

| Arbitrage | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

KIWOOM SECURITIES Fees

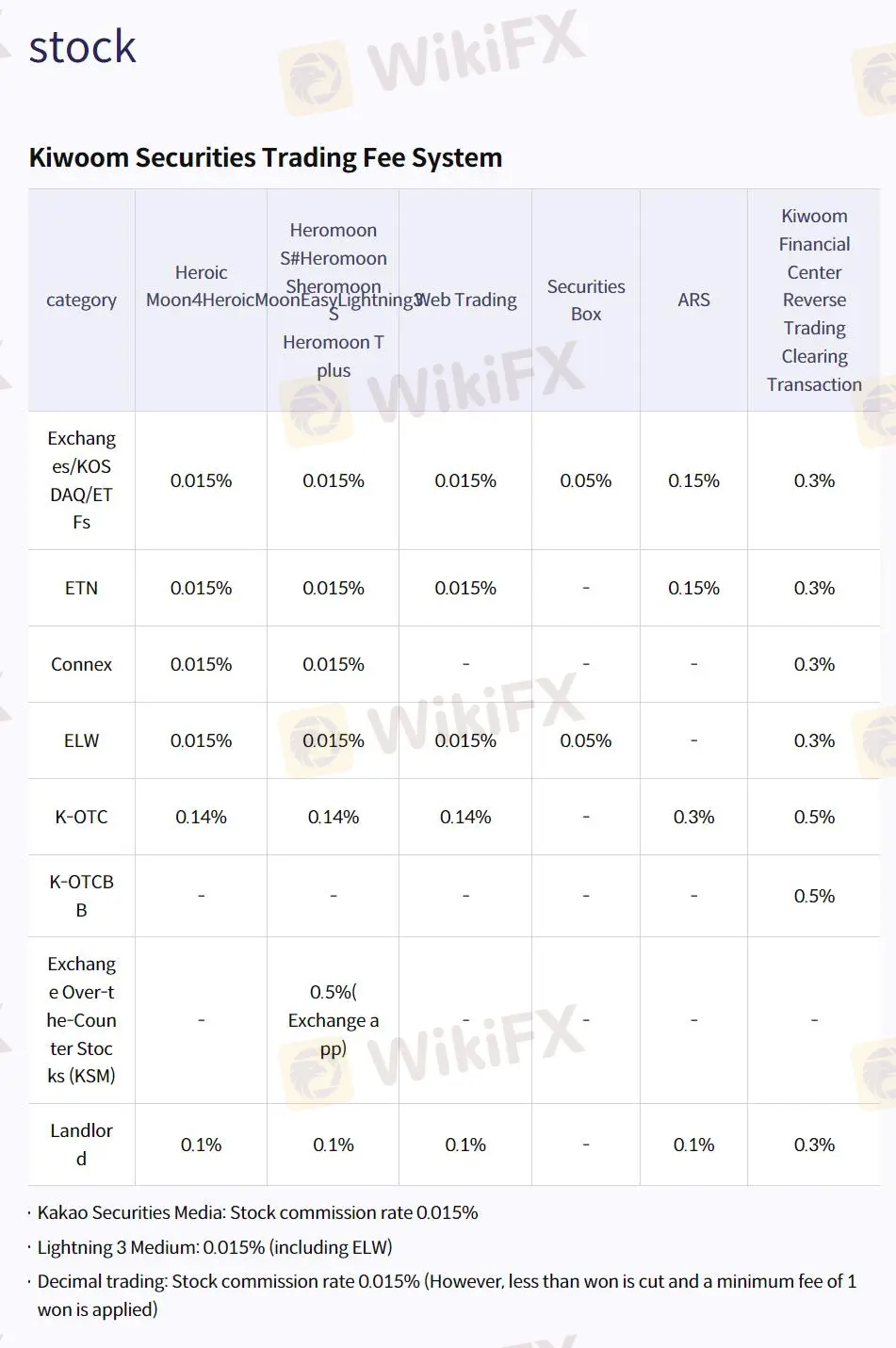

Stock Fee

Kiwoom Securities offers a range of trading services with fees varying from 0.015% to 0.5% for stocks, 0.5% for futures, 0.0051949% for bond transactions, and additional taxes and fees for sales, with special discounts for new and visually impaired customers, and a tiered margin collection rate.

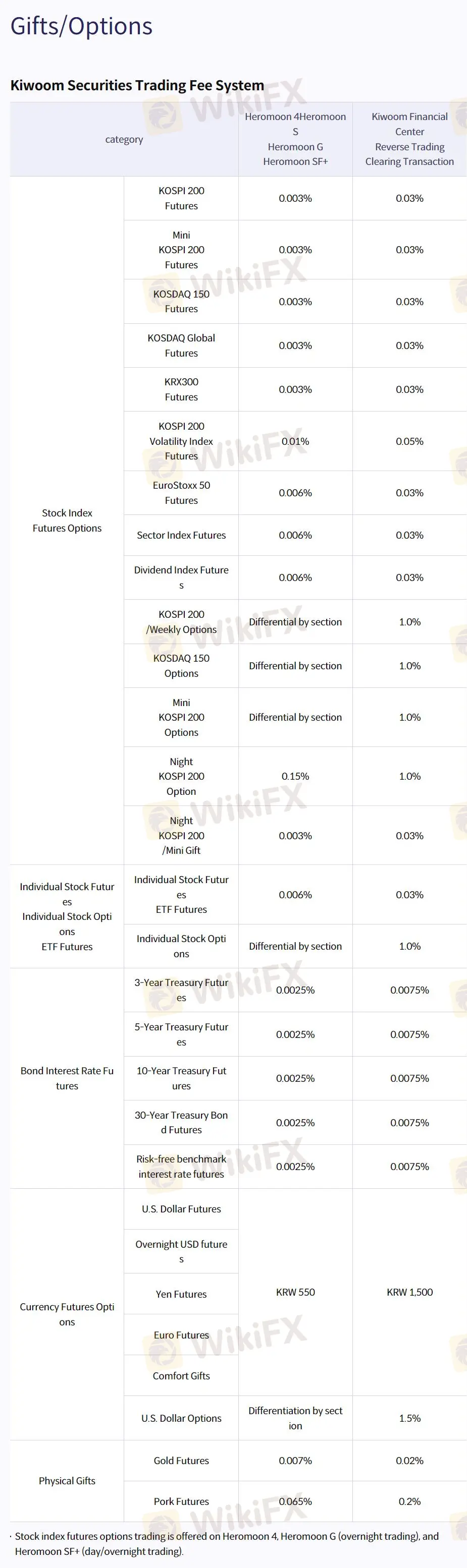

Options Fee

Kiwoom Securities charges varying option fees based on the price unit, with rates ranging from 0.14% to 0.2% plus additional won for KOSPI and KOSDAQ options, and a tiered fee structure for individual stock options and U.S. Dollar options.

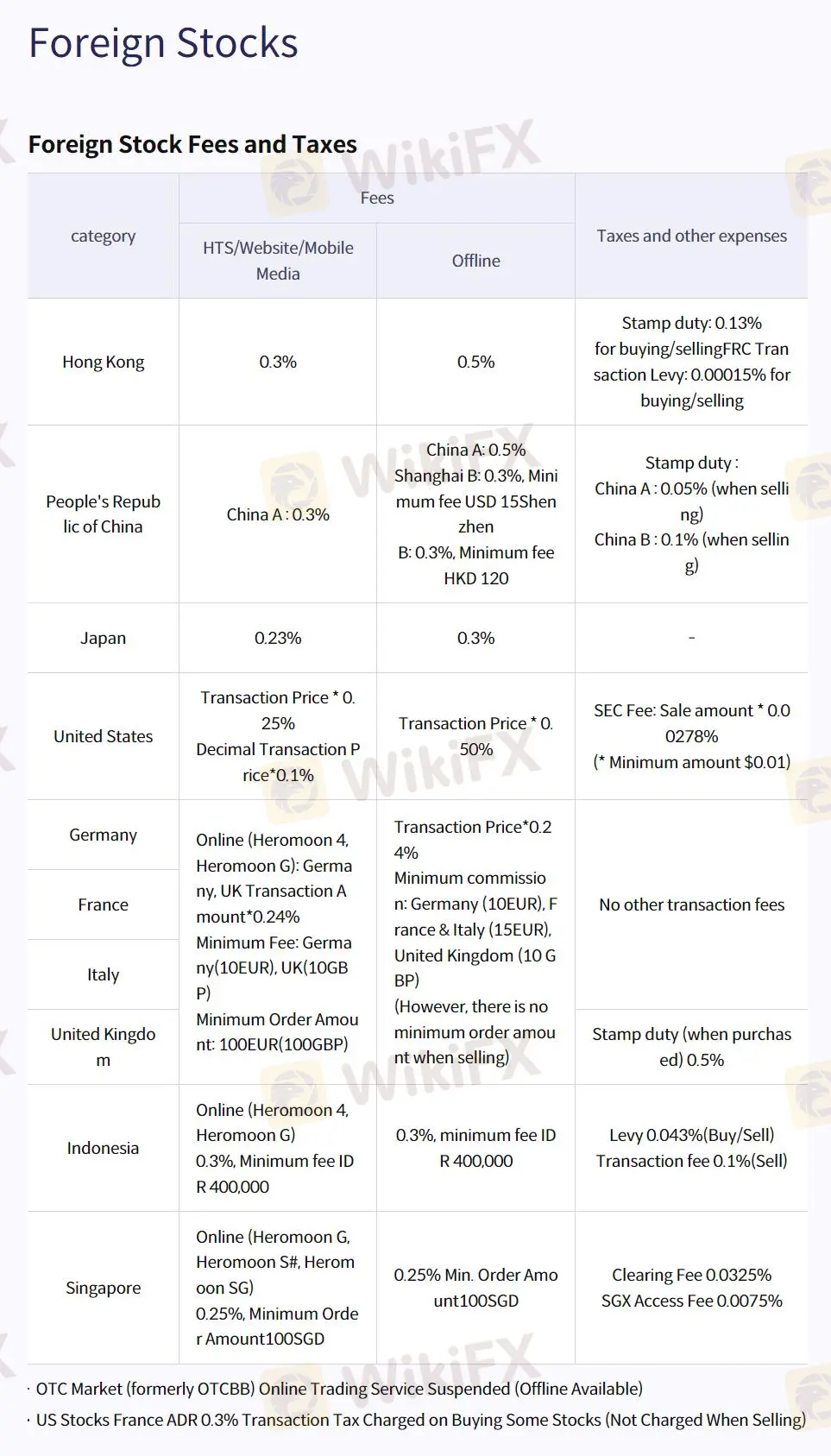

Foreign Stocks Fee

Kiwoom Securities offers foreign stock trading with varying fees depending on the country, ranging from 0.23% in Japan to 0.6% in Indonesia, and specific tax rates and minimum fees, with a consultation fee standard based on asset deposits and transaction amounts.

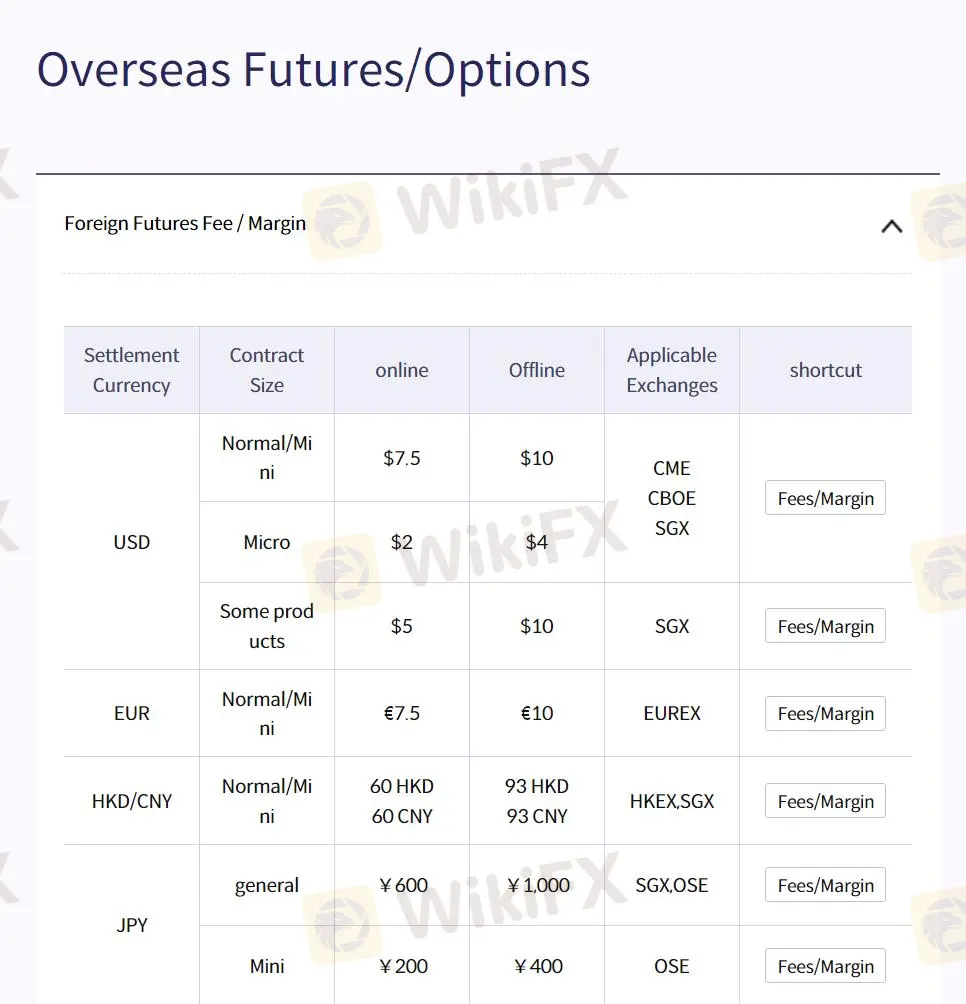

Overseas Futures & Options Fee

Kiwoom Securities charges overseas futures and options fees ranging from $2 to $10 online and $4 to $10 offline, depending on the currency and contract size, with specific margin requirements for each product.

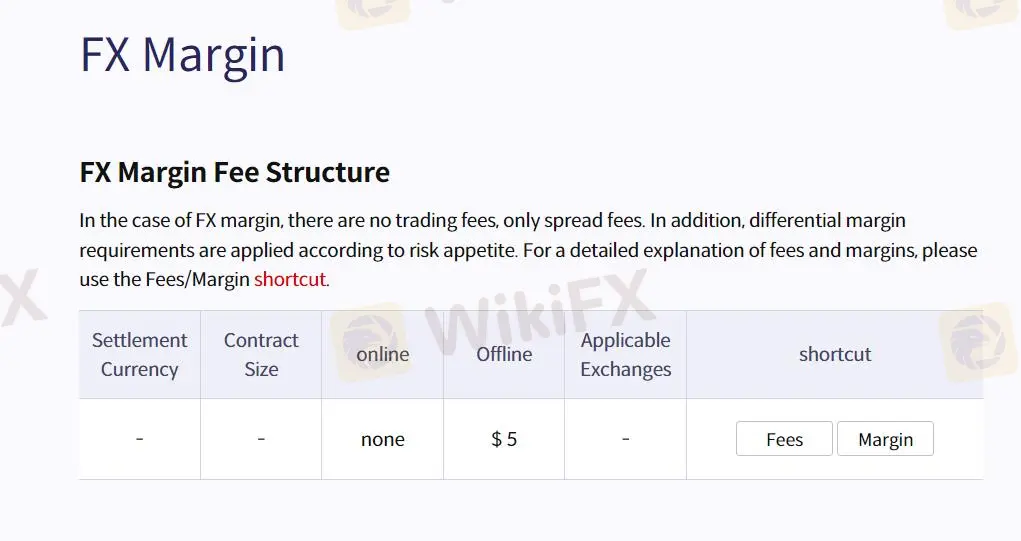

FX Margin Fee

Kiwoom Securities offers a FX margin fee structure with no trading fees, only spread fees, and a negotiable fee of up to USD 2.5 per contract for select customers based on factors like average commitment, customer grade, and profit contribution, with a minimum application period of 1 month and a maximum of 6 months.

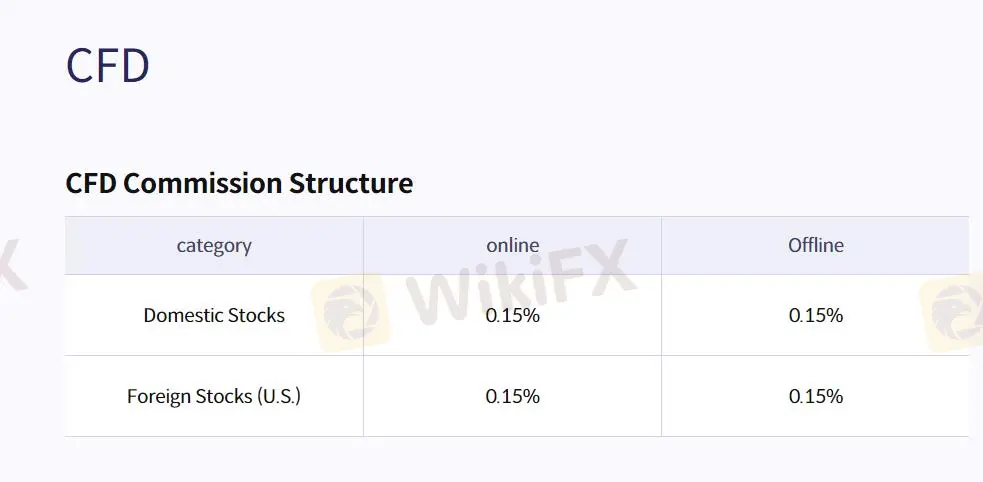

CFDs Fees

Kiwoom Securities' CFD service offers a commission structure with online and offline rates of 0.15% for domestic and foreign stocks, and a tiered consultation fee ranging from 0.11% to 0.15% based on the customer's base commitment, with additional position costs for buying off and selling.

Spot Gold Fee

Kiwoom Securities charges spot gold fees of 0.3% for Heroic Gate 4 and Heromoon S, with included VAT and additional small fees, and 0.5% for Kiwoom Financial Center transactions, also including VAT.

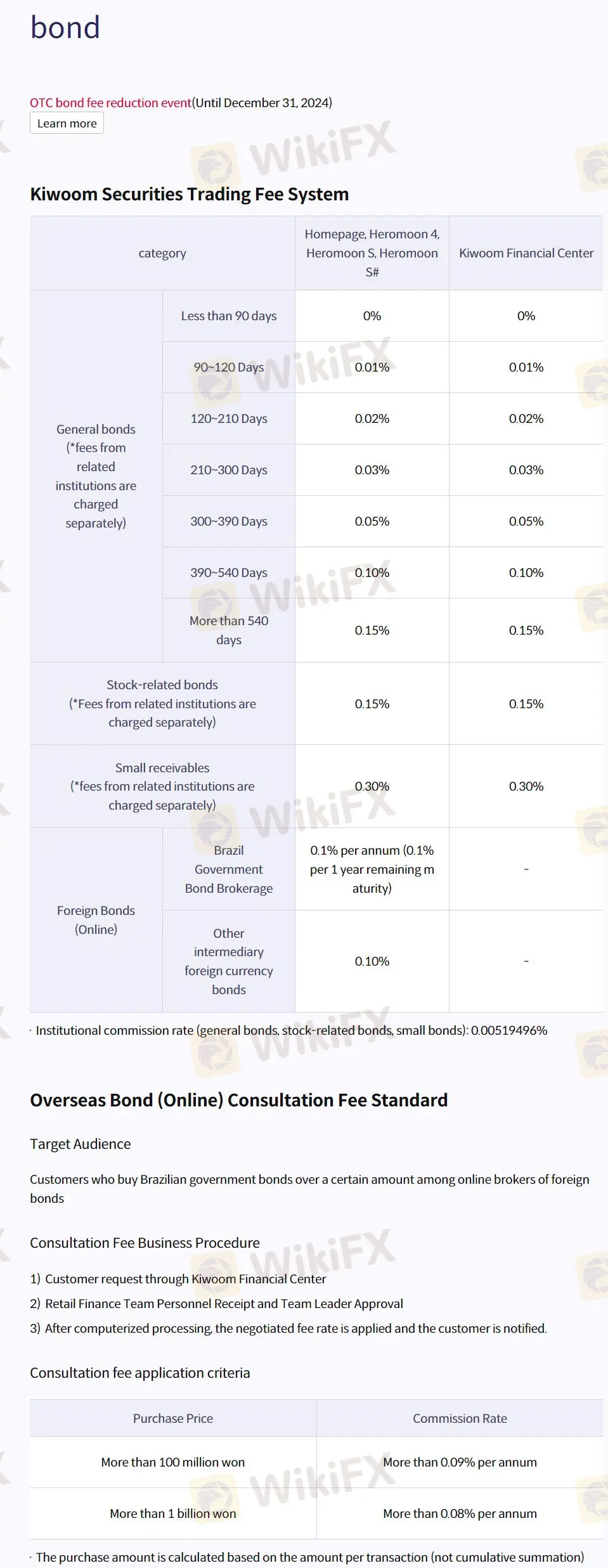

Bond Fee

Kiwoom Securities offers a reduced OTC bond fee system with rates from 0% to 0.15% depending on the bond's maturity, and a consultation fee for purchasing Brazilian government bonds online, with rates over 0.08% to 0.09% per annum based on the transaction amount.

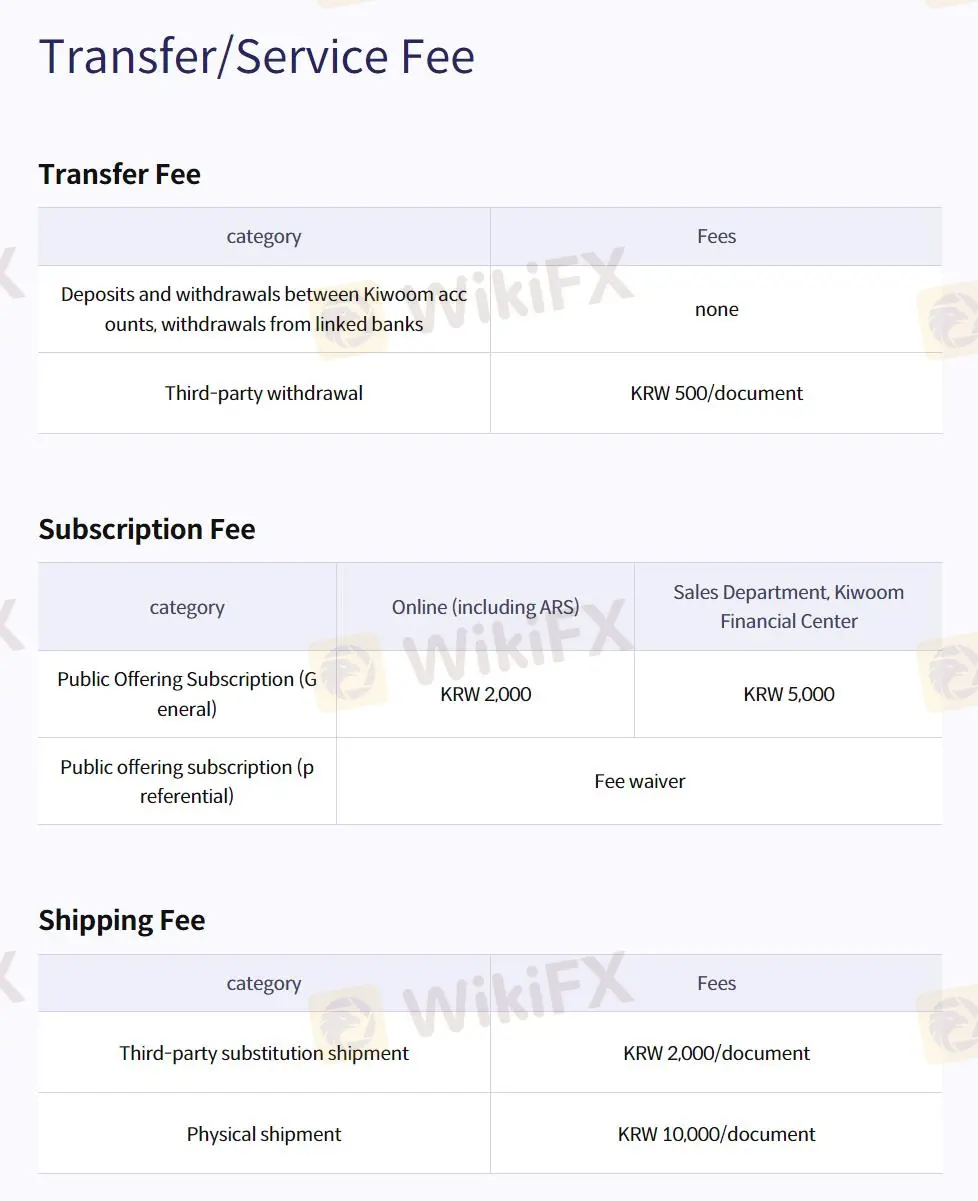

Kiwoom Securities offers free transfers within its network and charges KRW 500 for third-party withdrawals, KRW 2,000 to 5,000 for subscriptions, and KRW 2,000 to 10,000 for shipping and document services.

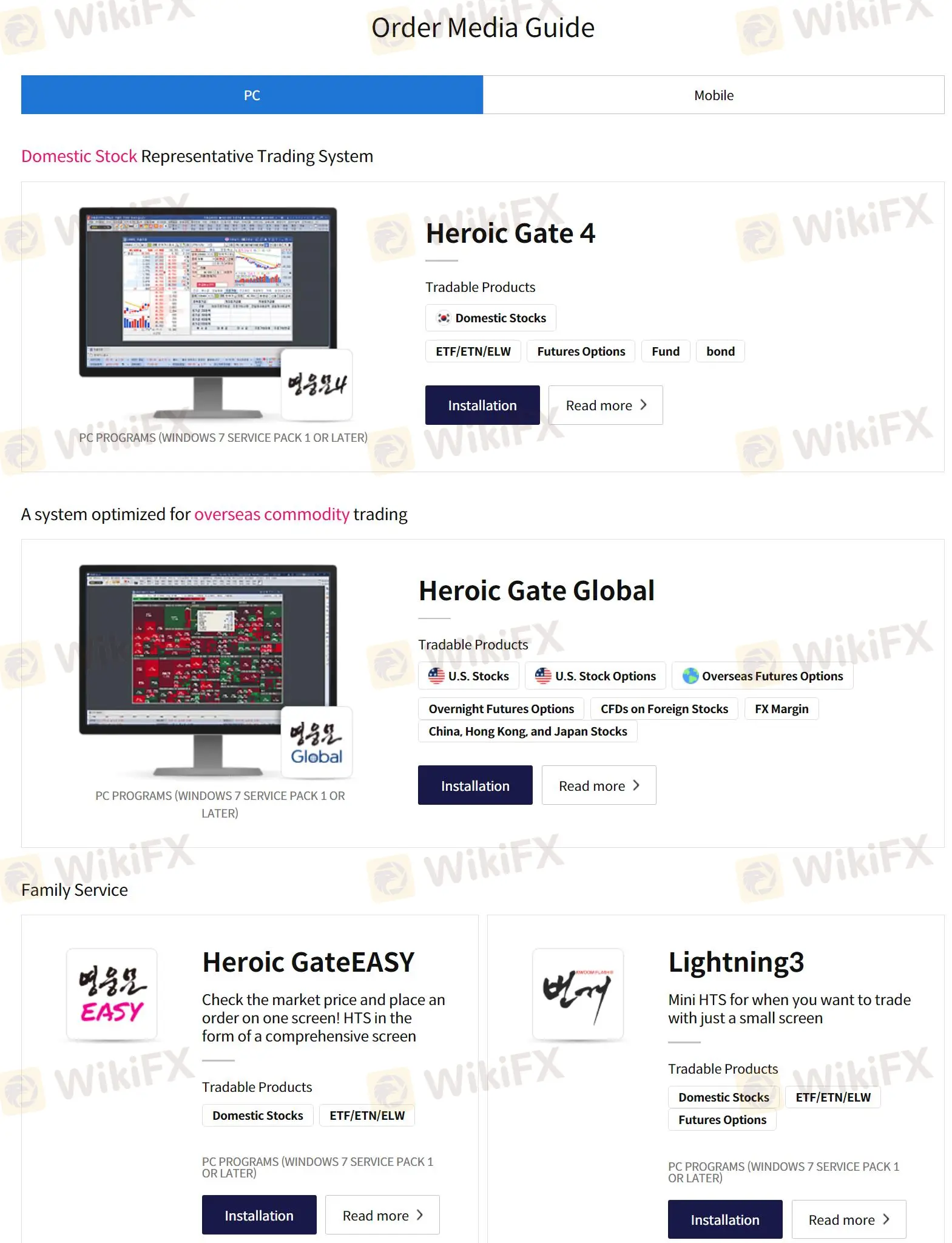

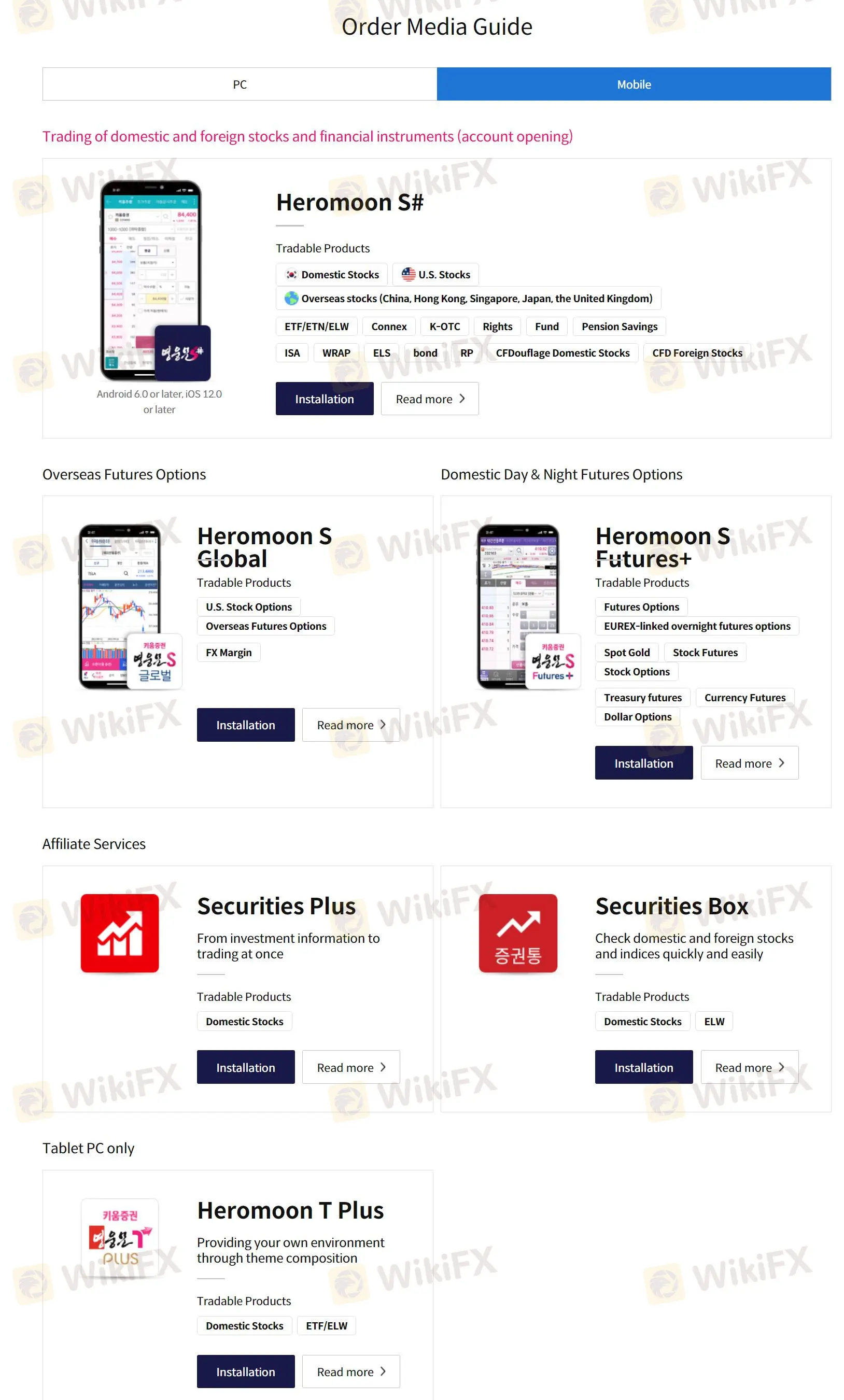

Trading Platform

Kiwoom Securities provides multiple trading platforms including Heroic Gate 4 for domestic stocks, Heroic Gate Global for international commodities, Heroic Gate EASY and Lightning3 for simplified trading interfaces, and Heromoon S# and T Plus for mobile and tablet access, respectively, along with Securities Plus and Securities Box for investment information and quick stock checks.

Keywords

- 2-5 years

- Suspicious Regulatory License

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now