Overview of OneUp Trader

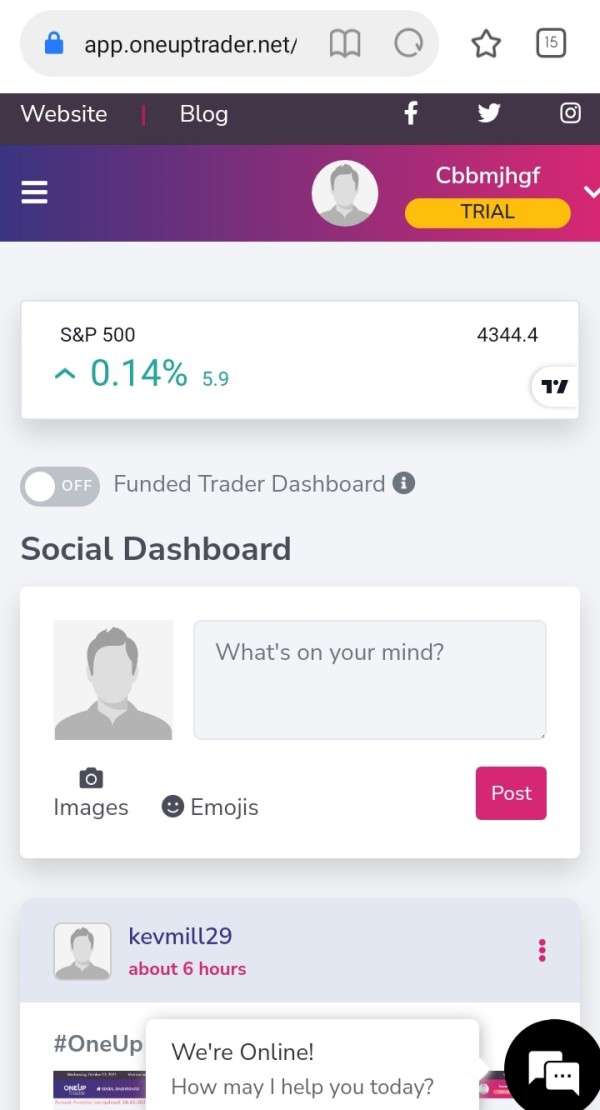

OneUp Trader, established in 2018 and headquartered in the United States, offers Funded Trading Accounts with multiple funding levels. Operating without regulatory oversight, the platform provides traders with a maximum leverage of up to 1:500, accompanied by no data fees or hidden costs in its spreads. Traders can utilize various platforms, including NinjaTrader, Sierra Chart, Agena Trader, and more.

Despite the advantage of 24/7 customer support through phone and email, the absence of regulatory backing poses a potential drawback for those seeking a regulated trading environment. The platform facilitates deposits and withdrawals exclusively through bank wire, limiting payment options. Various educational resources are available, covering evaluation guides, billing, and more.

Is OneUp Trader legit or a scam?

OneUp Trader operates without regulation from any supervisory authority, prompting issues about the exchange's transparency and oversight. Unregulated platforms lack the safeguards and legal protections provided by regulatory authorities, increasing the risk of fraud, market manipulation, and security breaches.

The absence of proper regulation will pose challenges for users seeking recourse or dispute resolution. Furthermore, the lack of regulatory oversight contributes to a less transparent trading environment, making it challenging for users to assess the exchange's legitimacy and reliability.

Pros and Cons

Pros:

No Hidden Fees: OneUp Trader boasts a transparent fee structure with no hidden charges. Traders can engage in their activities without the worry of unexpected costs, enhancing the overall appeal for cost-conscious users.

24/7 Trader Support: The platform provides round-the-clock support for funded traders. This continuous assistance ensures that traders can seek help or resolve issues at any time, contributing to a smoother trading experience.

A Simple 1-Step Evaluation: OneUp Trader offers a straightforward one-step evaluation process. This simplicity can be advantageous for traders looking for a streamlined and accessible way to enter the evaluation program.

Easy-to-Use Platform: The platform is user-friendly, making it accessible for traders of various experience levels. An easy-to-navigate interface can contribute to a more efficient and enjoyable trading experience.

Cons:

Not Regulated: One significant drawback is the lack of regulatory oversight. The absence of regulation raises issues about the platform's adherence to industry standards and the protection of user interests.

Limited Market Analysis and Insights: The platform provides limited market analysis and insights, which can be a drawback for traders who rely heavily on comprehensive market information for informed decision-making.

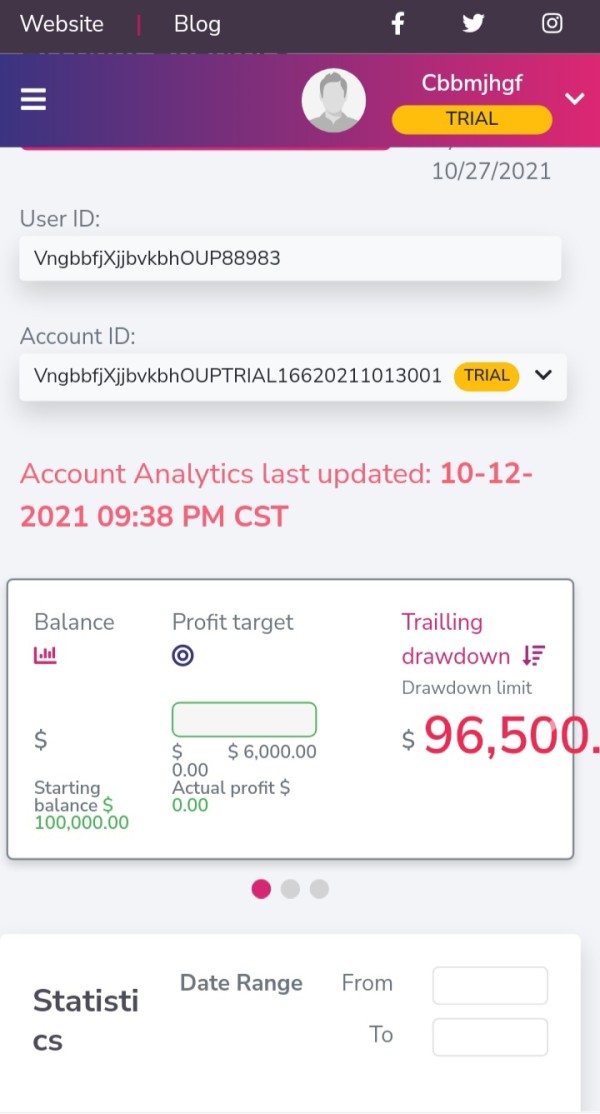

Account Types

OneUp Trader provides a range of funded trading accounts tailored to different capital levels. The $25,000 account is designed for traders with a moderate starting capital, offering the opportunity to trade up to 15 contracts and reach a $9,000 profit target. It features a $5,000 trailing drawdown, no daily loss limit, and the benefit of the first $10,000 profits being free. This account allows unlimited balance resets, a 90% profit split, a free NinjaTrader license, and complimentary market data/level 2 access. Additionally, it includes 24/7 customer support. This account type is suitable for traders looking for a comprehensive package with a moderate capital commitment.

For traders with a higher risk appetite and a larger capital base, the $50,000, $100,000, $150,000, and $250,000 accounts offer progressively increased opportunities and benefits. These accounts come with higher contract limits, profit targets, and trailing drawdowns for more experienced traders seeking greater exposure and profit potential. The features, including the absence of a daily loss limit, free profits up to a certain amount, balance resets, profit splits, and additional perks like a free NinjaTrader license and market data/level 2 access, make these accounts suitable for individuals looking for more extensive trading capabilities and rewards. The varying capital levels allow traders to choose an account that aligns with their risk tolerance and trading objectives.

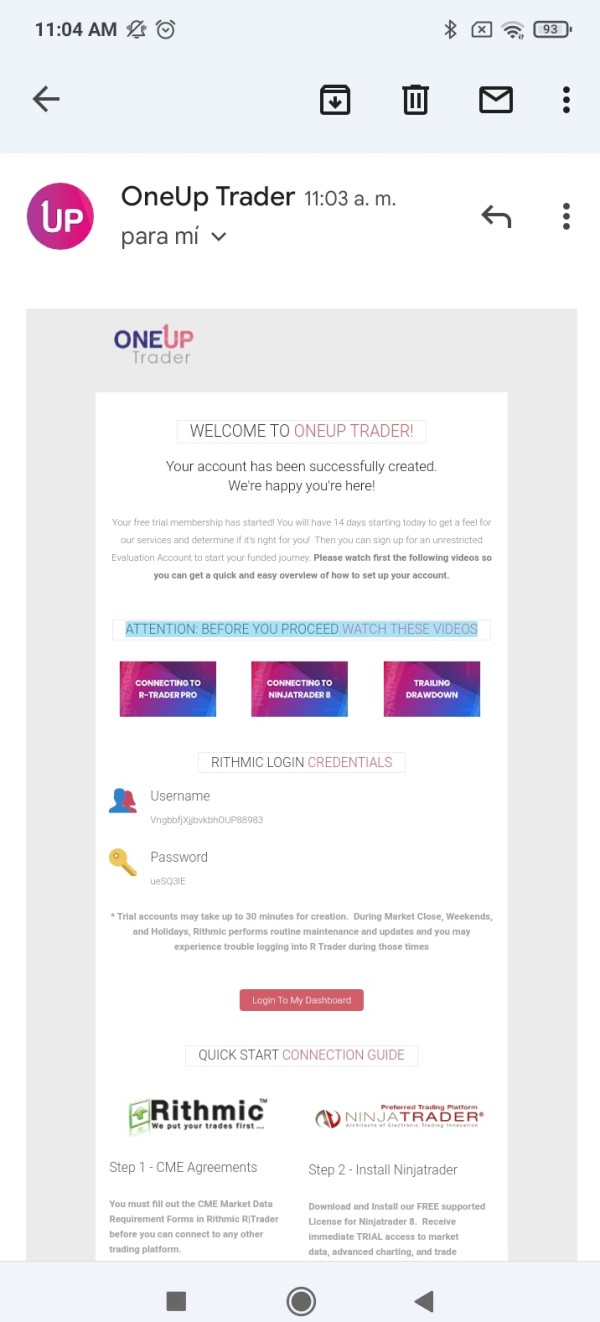

How to Open an Account?

Opening an account with OneUp Trader is a straightforward process. Here are the concrete steps to guide you through:

Choose Account Type:

Visit the OneUp Trader website and navigate to the account types section.

Select the funded trading account that suits your capital and trading preferences.

Submit Application:

Complete the online application form with accurate personal and financial information.

Ensure all required fields are filled out correctly to expedite the account approval process.

Review Terms and Conditions:

Carefully read and understand the terms and conditions associated with the chosen account type.

Ensure compliance with the trading rules and guidelines provided by OneUp Trader.

Fund Your Account:

Once your application is approved, fund your trading account with the required initial capital.

Follow the designated process for depositing funds, which includes various payment methods.

Download Necessary Software:

If applicable, download and install any necessary trading software provided by OneUp Trader.

Ensure compatibility with your preferred trading platform for a better experience.

Start Trading:

Access your funded trading account through the designated platform.

Begin trading according to the rules and parameters specified for your selected account type.

Trading Platform

OneUp Trader provides a variety of trading platforms, with NinjaTrader being a recommended option. During the evaluation period, NinjaTrader is available for free, but users are required to purchase a license afterward. The cost of the license ranges from $180 to $999, depending on the desired duration of use. Apart from NinjaTrader, several other platforms are supported by OneUp Trader, offering users a range of choices.

These include Sierra Chart, Agena Trader, R | Trader Pro, Inside Edge Trader, R Investor, Motive Wave, MultiCharts, Photon, QScalp, ScalpTool, Trackn Trade, Trade Navigator, Volfix.net, eSignal, and Jigsaw Trading. Users can select a platform that aligns with their preferences and trading requirements.

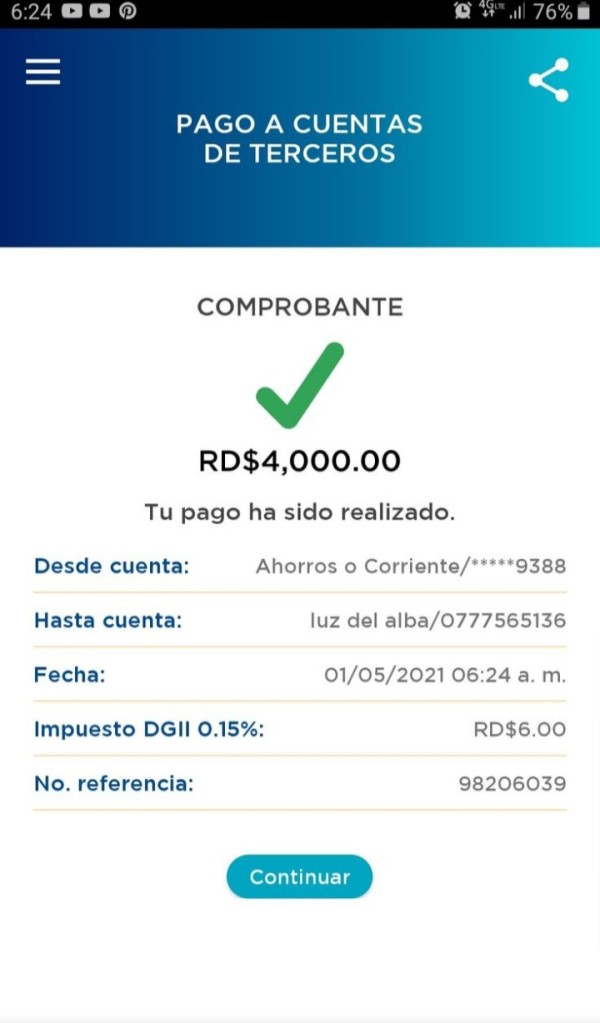

Deposit & Withdrawal

OneUp Trader offers payment methods primarily through bank wire for withdrawals, and it's important to note that ACH withdrawals are not supported. This limitation could be a trouble for users who prefer or rely on ACH transactions for fund withdrawals.

Additionally, users should be aware that there is a relatively high minimum withdrawal amount set at $1,000. This minimum threshold impacts those who wish to withdraw smaller amounts, potentially posing an inconvenience for traders with less substantial account balances.

Customer Support

OneUp Trader provides customer support through various channels, offering assistance 24/7. Users can reach out for general inquiries and trader support via phone at +1 302-231-0217 or send an email to support@oneuptrader.com. The platform's physical address is 1007 N. Orange St. 4th Floor, Wilmington, Delaware 19801. This multi-channel approach ensures accessibility for users seeking help or clarification, emphasizing responsiveness to user needs.

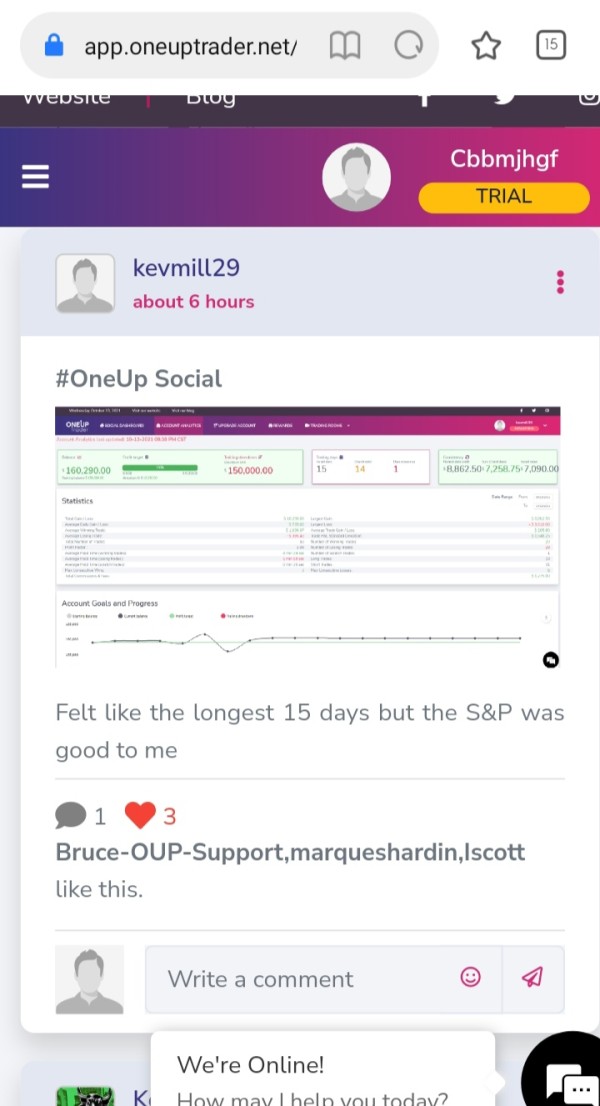

Educational Resources

OneUp Trader offers a set of educational resources to assist users in various aspects of their trading journey. The platform provides articles under categories such as “Express Funding,” offering insights into funding options, and “What's New?” with step-by-step guides for setting up an account in six simple steps. Featured articles cover a range of topics, ensuring users have access to relevant and timely information.

A dedicated section on “General Overview” provides foundational knowledge, while resources under “Billing and Membership” offer insights into the financial aspects of using OneUp Trader. “Funded Traders Rules and Guidelines” provide guidelines for users participating in the funded trader program.

For users exploring the evaluation platform, there are specific guides under “Evaluation Platform Connection Guides.” Rules, guidelines, and frequently asked questions related to the evaluation process are also covered extensively, ensuring users have a comprehensive understanding of the platform's features and requirements. The various range of educational articles serves traders at different stages of their journey.

Conclusion

In conclusion, OneUp Trader presents a mix of advantages and disadvantages for traders to consider. On the positive side, the platform offers a transparent fee structure with no hidden costs, coupled with 24/7 trader support, ensuring assistance is readily available. The straightforward one-step evaluation process and an easy-to-use platform for users seeking simplicity in their trading journey.

However, the absence of regulatory oversight is a notable issue, potentially impacting user trust and security. Additionally, the platform's limited market analysis and insights pose challenges for traders who heavily rely on comprehensive data. Prospective users should weigh these factors to determine if OneUp Trader aligns with their trading preferences and risk tolerance.

FAQs

Q: What trading platforms are recommended by OneUp Trader?

A: OneUp Trader suggests NinjaTrader as the primary platform, while other options include Sierra Chart, Agena Trader, R | Trader Pro, and more.

Q: How much is the license fee for NinjaTrader recommended by OneUp Trader?

A: The NinjaTrader license fee varies from $180 to $999, depending on the duration of usage.

Q: What is the minimum withdrawal amount on OneUp Trader?

A: Withdrawals on OneUp Trader can only be made via bank wire, with a minimum withdrawal amount of $1,000.

Q: What payment methods are available for deposits on OneUp Trader?

A: OneUp Trader supports various payment methods, including bank wire.

Q: Does OneUp Trader offer a demo account?

A: No, there is no mention of a demo account being offered by OneUp Trader.

Q: What are the support channels for OneUp Trader?

A: OneUp Trader offers 24/7 support through phone (general inquiries/trader support) at +1 302-231-0217 and email at support@oneuptrader.com.