Overview of CYTBF

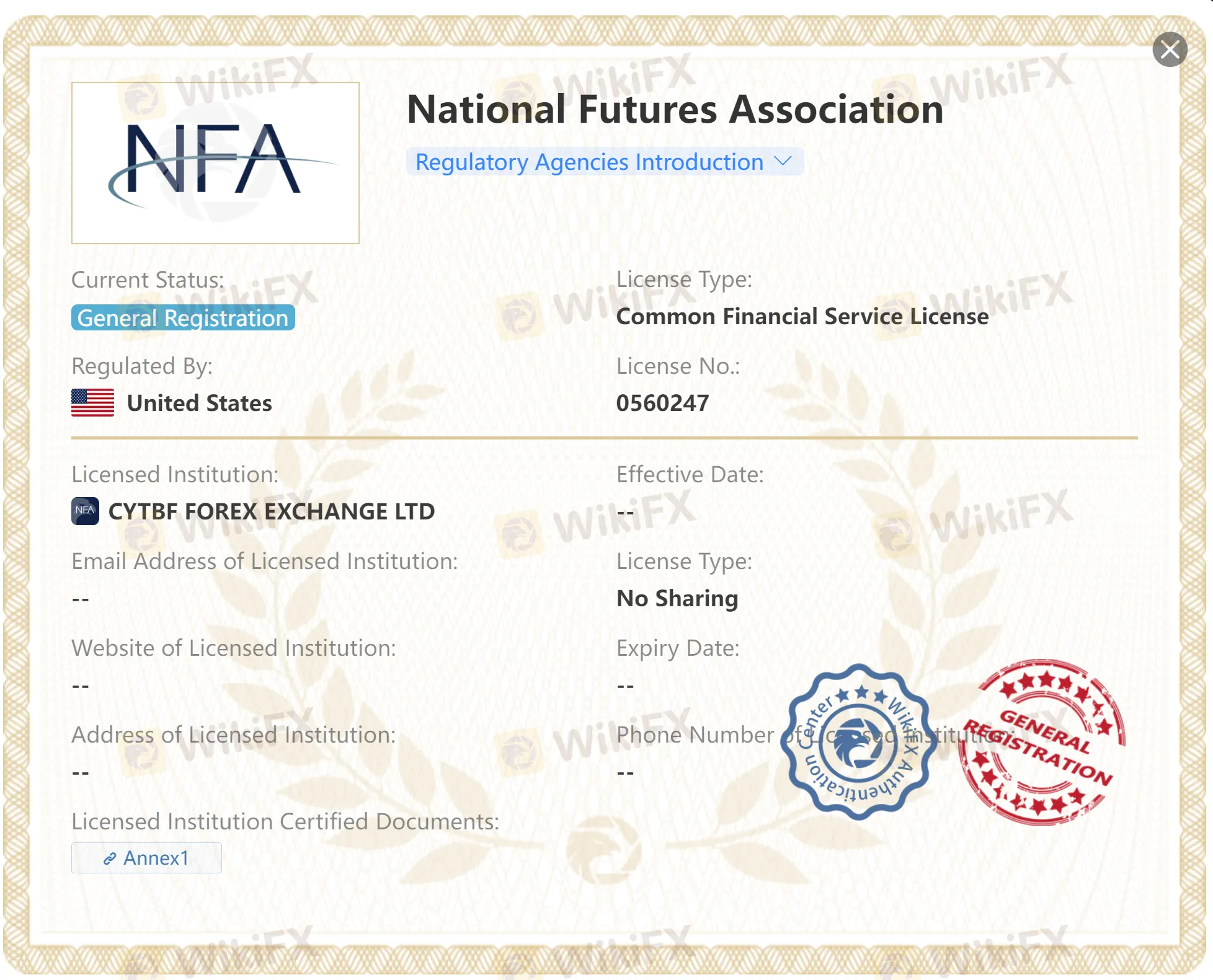

CYTBF is a newly established investment firm in the United States, founded in 2023 and regulated by the National Futures Association (NFA), which underscores its commitment to regulatory compliance and investor protection.

The company offers a broad spectrum of trading opportunities, including stocks, futures, commodities like crude oil and gold, cryptocurrencies such as Bitcoin, and various fiat currencies, making it a versatile platform for diverse investment strategies.

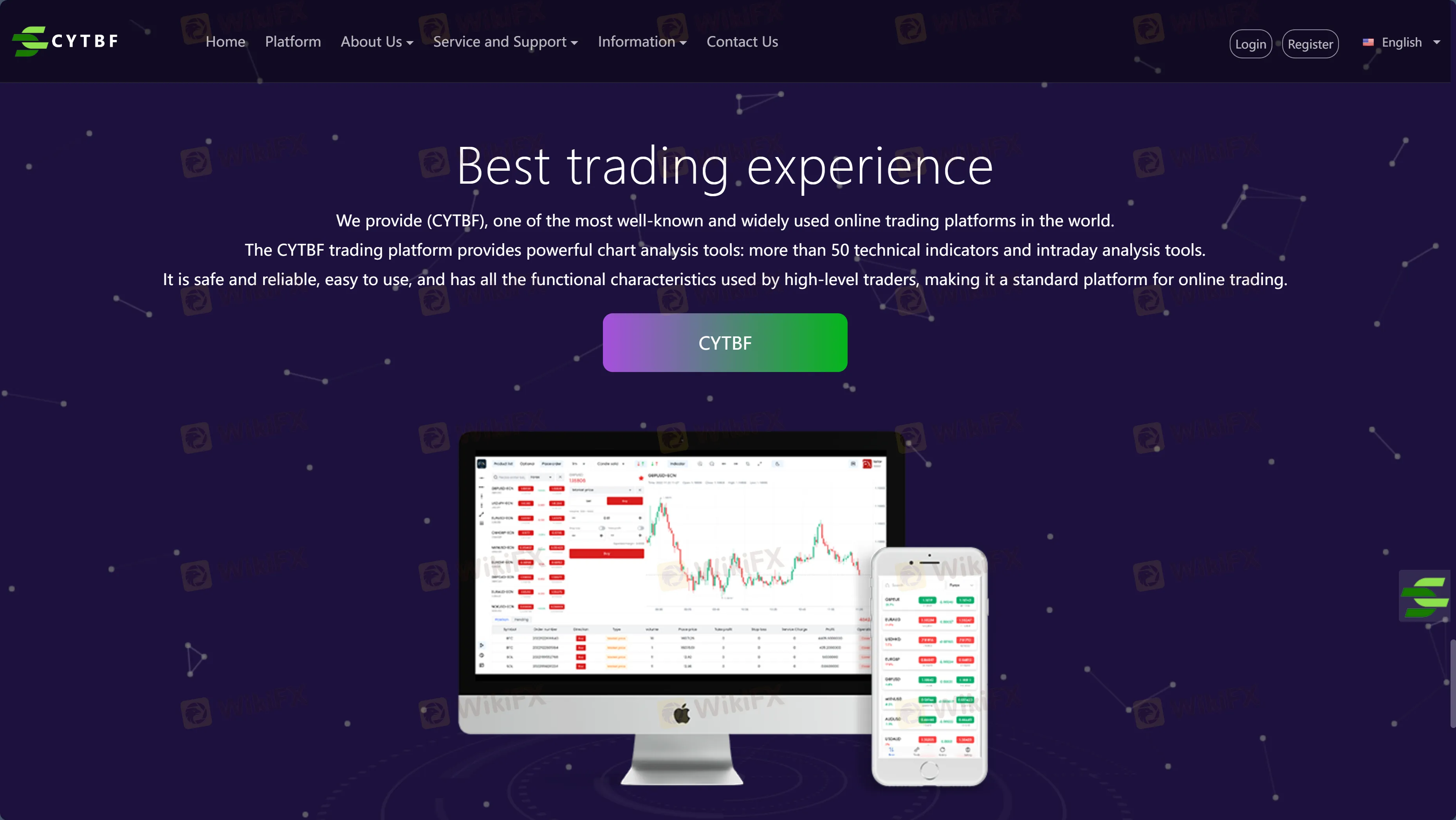

CYTBF's proprietary trading platform, the CYTBF App, enhances the trading experience with its user-friendly interface and comprehensive functionality. Traders looking to hone their skills can take advantage of the demo account, which provides up to $100,000 in virtual capital for practice.

The platform also features a Trading Center for in-depth market analysis and offers educational resources including news updates and an economic calendar to keep traders informed.

For customer support inquiries, CYTBF has made provisions through their dedicated email at info@cytbf.email, ensuring clients have access to timely assistance.

Is CYTBF Limited Legit or a Scam?

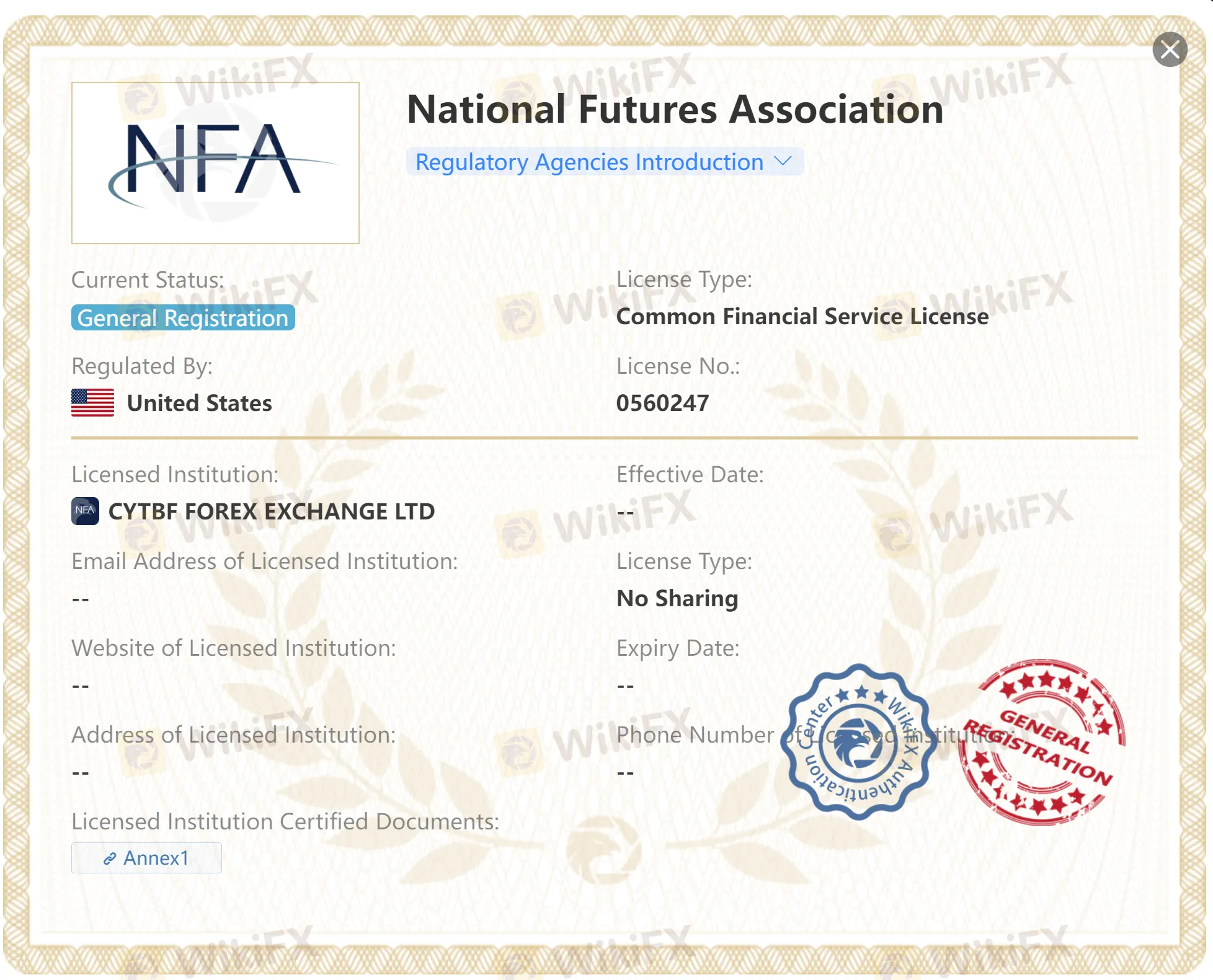

CYTBF holds a General Registration status with the National Futures Association (NFA) in the United States, under license number 0560247.

This registration grants CYTBF the authorization to operate within the regulatory framework set by the NFA, providing financial services under a Common Financial Service License.

The NFA's oversight ensures that CYTBF adheres to specific regulatory standards and practices designed to protect investors and maintain the integrity of the financial markets.

Pros and Cons

Pros of CYTBF:

Lower Transaction Costs: CYTBF offers competitive transaction fees with the advantage of dynamic variable financing leverage, which can significantly enhance trading income by minimizing the costs associated with trading activities.

Comprehensive Investment Market: The platform provides access to a broad range of global mainstream markets, allowing traders to diversify their portfolios by investing in stocks, gold, crude oil, Bitcoin, currency pairs, and more, all through a single account.

High-Quality Service: CYTBF prides itself on offering comprehensive, localized customer service available 24/7. The platform also features multiple deposit and withdrawal methods, ensuring convenience and accessibility for traders worldwide.

Fast Execution Speed: With execution speeds of less than 40 milliseconds, CYTBF ensures quick order placements, which is crucial for traders looking to capitalize on fast-moving market opportunities. The absence of repeat quotes and the use of top-tier servers like NY4 further enhance the trading experience.

Global Reach and Renown: CYTBF's global presence is supported by a client base from over 100 countries and a management team that actively engages with global markets, ensuring a deep understanding of diverse trading needs and preferences.

Cons of CYBTF:

Regulatory Clarity: While CYTBF mentions being regulated by the MSB in the United States, potential traders might seek more detailed information about its regulatory compliance, especially in relation to the specific protections offered to investors.

Complexity for Beginners: The wide range of products and services, while advantageous for experienced traders, may overwhelm beginners who are new to trading, making the platform potentially less accessible to novices without sufficient guidance.

Risk of High Leverage: While dynamic variable financing leverage can maximize trading income, it also increases the risk of significant losses, especially for those who might not fully understand leverage's implications or fail to manage their risk appropriately.

Market Volatility: Trading in a comprehensive investment market that includes high-volatility assets like cryptocurrencies and commodities can lead to substantial fluctuations in investment value, posing a higher risk for traders.

Investment Risk: As with all trading platforms, investing through CYTBF carries inherent risks, especially in CFDs and Forex trading. The high level of risk associated with margin trading may not be suitable for all investors, particularly those with a lower risk tolerance or less trading experience.

Products & Services

CYTBF offers a diverse range of trading products,meeting various interests and investment strategies of its clients. These products include:

Stocks: Traders have the opportunity to invest in shares of leading companies from various sectors, enabling them to participate in the equity markets. This includes high-profile stocks like Apple, Alphabet Inc. (Google), Microsoft Corp., and Facebook Inc., among others.

Futures: The platform provides access to futures contracts, which are agreements to buy or sell a particular commodity or financial instrument at a predetermined price at a specified time in the future, allowing traders to speculate on or hedge against price movements.

Crude Oil: As a key commodity in the global energy market, crude oil trading is available, offering traders the chance to speculate on one of the most actively traded commodities due to its significant impact on the global economy.

Gold: Recognized as a safe-haven asset, gold trading is an option for those looking to diversify their portfolio or hedge against inflation and market volatility.

Bitcoin: CYTBF includes cryptocurrency trading, with Bitcoin as a prominent option, allowing traders to engage in the dynamic and rapidly evolving digital currency market.

Currencies: The platform offers currency pair trading, enabling clients to speculate on the exchange rates between different fiat currencies in the Forex market, which is the largest and most liquid financial market in the world.

CFDs on Indices, Commodities, Metals, and Energy: Clients can also trade Contract for Differences (CFDs) on a variety of underlying assets, including major global indices, commodities beyond crude oil and gold, various metals, and energy products.

How to Open an Account?

Opening an account with CYTBF involves a straightforward process designed to quickly integrate new clients into the trading environment. Here are the steps to get started:

Step 1: Choose Your Trading Package

Begin by reviewing the various trading packages offered by CYTBF. Each package is tailored to suit different investment needs and goals, from entry-level options for beginners to more comprehensive plans for experienced traders.

Step 2: Complete the Registration Form

Navigate to the CYTBF website and locate the registration section. Fill out the registration form with your personal information, including your name, email address, contact details, and any other required information. Ensure that all details are accurate and up-to-date to avoid any delays in the account verification process.

Step 3: Verify Your Account

After submitting the registration form, you'll likely need to undergo a verification process to confirm your identity and comply with regulatory requirements. Follow the instructions provided by CYTBF to complete this step efficiently.

Step 4: Fund Your Account

Once your account is verified, you can proceed to fund it using one of the payment methods available on CYTBF. Choose from options like bank wire transfers, credit/debit cards, or digital wallets, and decide on the amount you wish to deposit, keeping in mind the minimum deposit requirement for your chosen trading package.

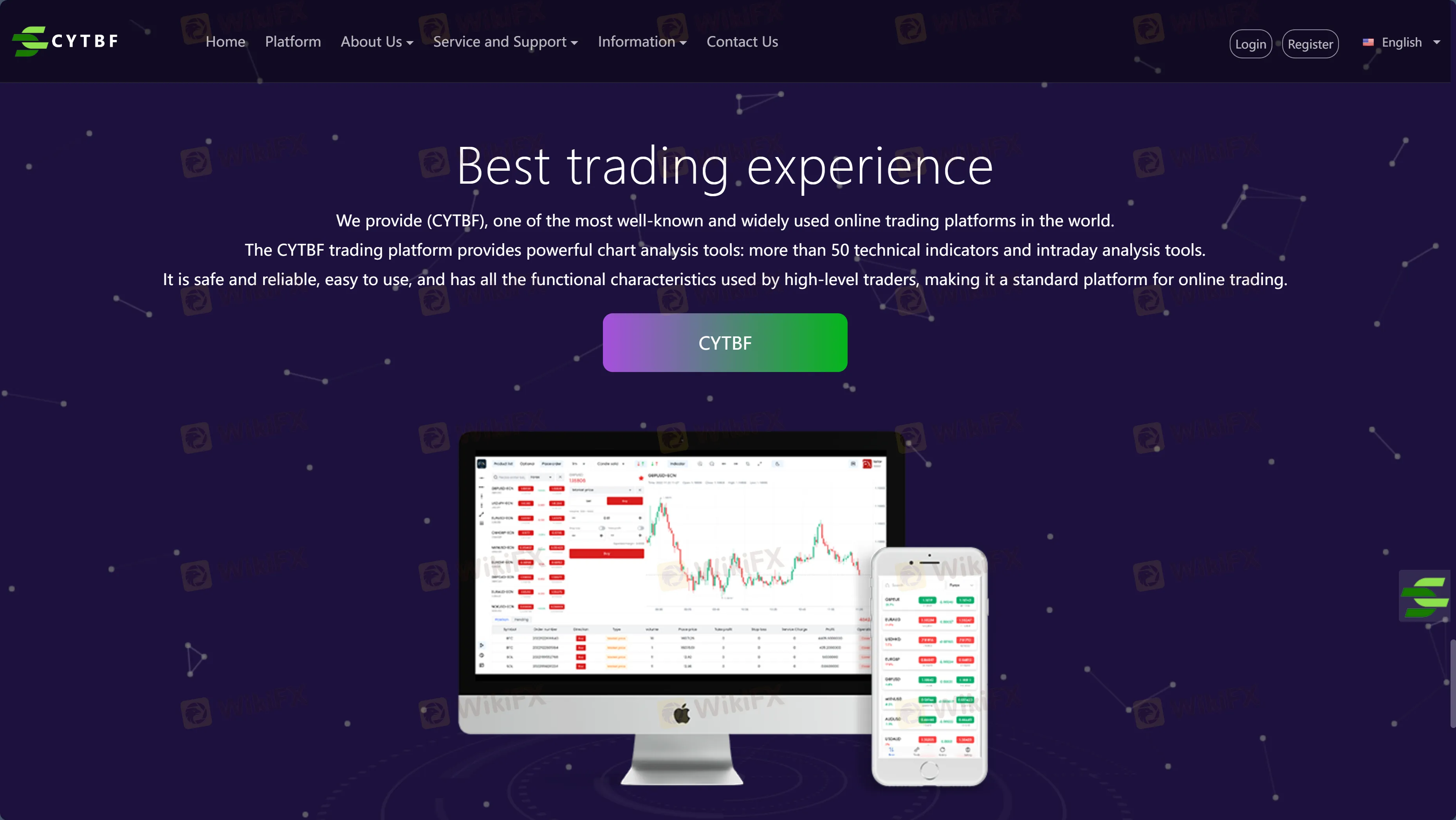

Trading Platform

CYTBF offers a world-class trading platform renowned for its comprehensive features and user-friendly interface, attracting traders across the globe. This platform is accessible on various devices, including Windows computers, iPhones, and Android smartphones, ensuring traders can monitor their investments and execute trades from virtually anywhere.

Key features of the CYTBF trading platform include:

Original Spread Quotes: Traders receive real-time spread quotes, allowing for transparent and informed trading decisions based on current market conditions.

High-Speed Order Execution: The platform is engineered for rapid order execution, minimizing latency and ensuring that traders can take advantage of market movements as they happen.

High-Quality Service: CYTBF emphasizes a high standard of service, ensuring that traders have a smooth and reliable trading experience.

Safe and Reliable: Security and reliability are paramount, with the platform designed to protect traders' information and investments.

Ease of Use: Despite its advanced features, the platform is user-friendly, satisfying both novice traders and experienced professionals.

Customer Support

CYTBF is committed to providing exceptional customer support, ensuring that traders have access to assistance whenever needed. T

he support team can be reached via email at info@cytbf.email, offering a direct line of communication for any inquiries or issues that may arise.

This dedicated support ensures that clients receive timely and professional help, reflecting CYTBF's focus on customer satisfaction and its effort to maintain a high standard of service across its global client base.

Tools

CYTBF enhances its trading platform by integrating tools from Trading Central, a globally recognized analysis agency, to offer clients advanced investment analysis and research capabilities.

This collaboration brings award-winning tools such as the Analyst View (AOI), which provides expert insights and forecasts; the Adaptive Candle Diagram (AC), offering a dynamic visual representation of market trends; and the Adaptive Trend Indicator (AIX), designed to identify and follow market movements accurately.

These tools empower CYTBF users to make informed trading decisions by leveraging comprehensive, automated analysis.

Conclusion

In conclusion, CYTBF is a comprehensive trading platform regulated by the MSB in the United States, offering a wide array of trading products including Forex, stocks, indices, commodities, and cryptocurrencies.

It is known for its collaboration with Trading Central to provide advanced analytical tools, ensuring clients can make informed decisions.

The platform is accessible across various devices, emphasizing user-friendliness, high-speed execution, and reliability. With a commitment to transparency, fairness, and customer-centric service, CYTBF stands out as a competitive choice for global traders.

FAQs

Q: What types of trading products does CYTBF offer?

A: CYTBF offers a range of trading products including Forex, stocks, indices, commodities, Bitcoin, metals, and energy.

Q: Is CYTBF regulated?

A: Yes, CYTBF is regulated by the MSB in the United States, ensuring compliance with financial regulations.

Q: What analytical tools does CYTBF provide?

A: CYTBF offers analytical tools in collaboration with Trading Central, including the Analyst View, Adaptive Candle Diagram, and Adaptive Trend Indicator.

Q: How can I contact CYTBF customer support?

A: You can reach CYTBF customer support via email at info@cytbf.email for any inquiries or assistance.

Q: Does CYTBF offer services to international clients?

A: Yes, CYTBF serves clients from over 100 countries, with a management team that has a global outreach to understand diverse customer needs.