What is Barclays?

Barclays operates in Japan with three affiliates: Barclays Securities Corporation, Barclays Bank Tokyo Branch, and Barclays Investment Management Co., Ltd. Each affiliate serves different asset classes and investor groups.

Barclays Securities Corporation offers financing, asset management, risk management solutions, and advisory services. Barclays Bank Tokyo Branch specializes in foreign exchange, derivatives trading, and fund transactions. Barclays Investment Management Co., Ltd. focuses on mutual funds.

However, the lack of valid oversight from recognized regulatory entities should be a significant concern for investors.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the broker's services and offerings. We encourage interested readers to delve further into the article for valuable insights. In conclusion, we will provide a concise summary that highlights the distinct characteristics of the broker for a clear understanding.

Pros & Cons

Pros:

Barclays Japan offers diversified financial services through its various affiliates, catering to different customer needs and preferences. As a branch of a world-renowned financial body with extensive industry experience, clients can benefit from the expertise and global network of Barclays.

Cons:

The unregulated status of Barclays Japan raises concerns about oversight and consumer protection. Furthermore, a reported fraud exposure on WikiFX casts doubt on the broker's commitment to regulatory compliance and client security, undermining trust and confidence among investors.

Is Barclays Safe or Scam?

When considering the safety of a bank like Barclays or any other platform, it's important to conduct thorough research and consider various factors.

Regulatory sight: Taking into account the operations of Barclays, there are serious concerns due to their lack of legitimate regulations. This absence of regulatory oversight raises questions about the firm's legality and responsibility, you should proceed with your financial transactions with great caution.

User feedback: There is one report on WikiFX regarding fruad that should be taken into consideration as a potential red flag. We recommend interested traders to do thorough research of the company before engaging with any broker or investment platform.

Security measures: Barclays enforces a privacy policy and Anti-Money Laundering (AML) policy for security. These measures aim to safeguard client information, prevent identity theft, and deter illegal financial activities.

In the end, choosing whether or not to engage in trading with Barclays is an individual decision. It is advised that you carefully balance the risks and returns before committing to any actual trading activities.

Services

Barclays Japan offers a diverse range of financial services through its subsidiaries.

Barclays Securities Corporation:

Barclays Securities Corporation provides comprehensive financial solutions, including financing, asset management, risk management, and advisory services. Catering to financial institutions, international organizations, government agencies, and corporations, its professionals leverage global expertise and a network spanning over 40 countries to offer tailored solutions for clients' financial and operational needs.

Barclays Bank Tokyo Branch:

As the primary access point to the wholesale market for the Barclays Group, Barclays Bank Tokyo Branch specializes in financial services such as foreign exchange, derivatives trading, and fund transactions. Serving institutional investors, financial institutions, corporations, and international organizations in Japan and abroad, it also offers global information on corporate banking-related products.

Barclays Investment Management Co., Ltd.:

Registered as a financial instruments business operator, Barclays Investment Management Co., Ltd. focuses on investment management business since July 2008. Leveraging global risk management and management capabilities, it sets up and manages mutual funds for various asset classes, catering to the diverse needs of investors in Japan and beyond.

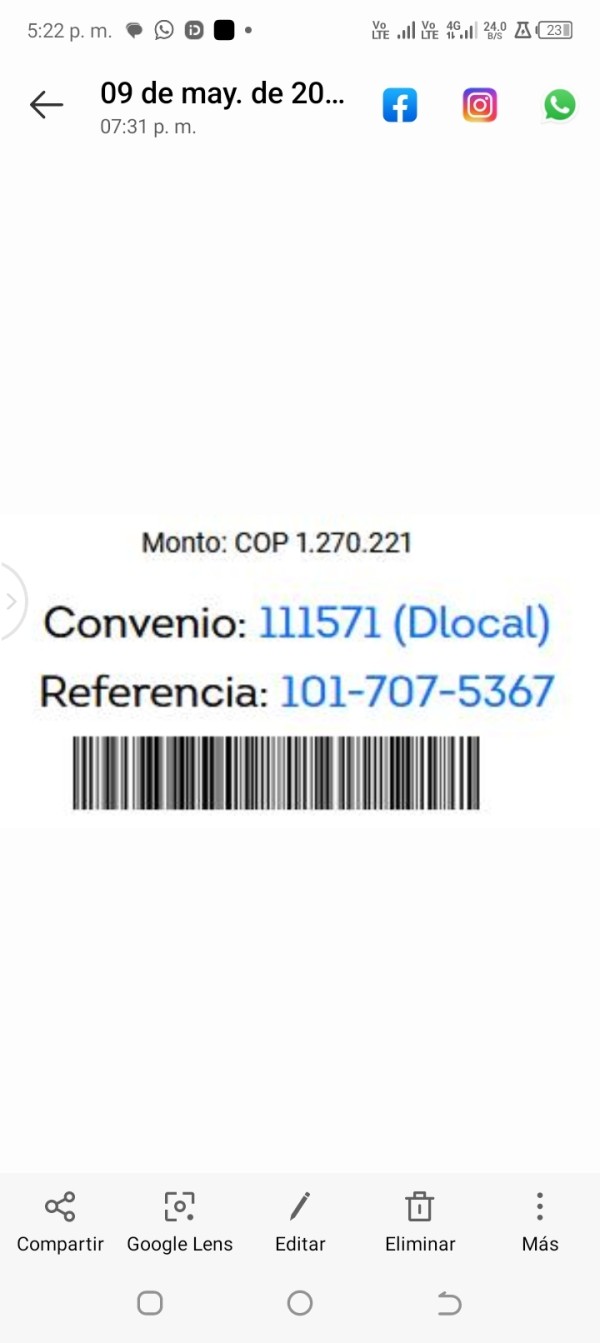

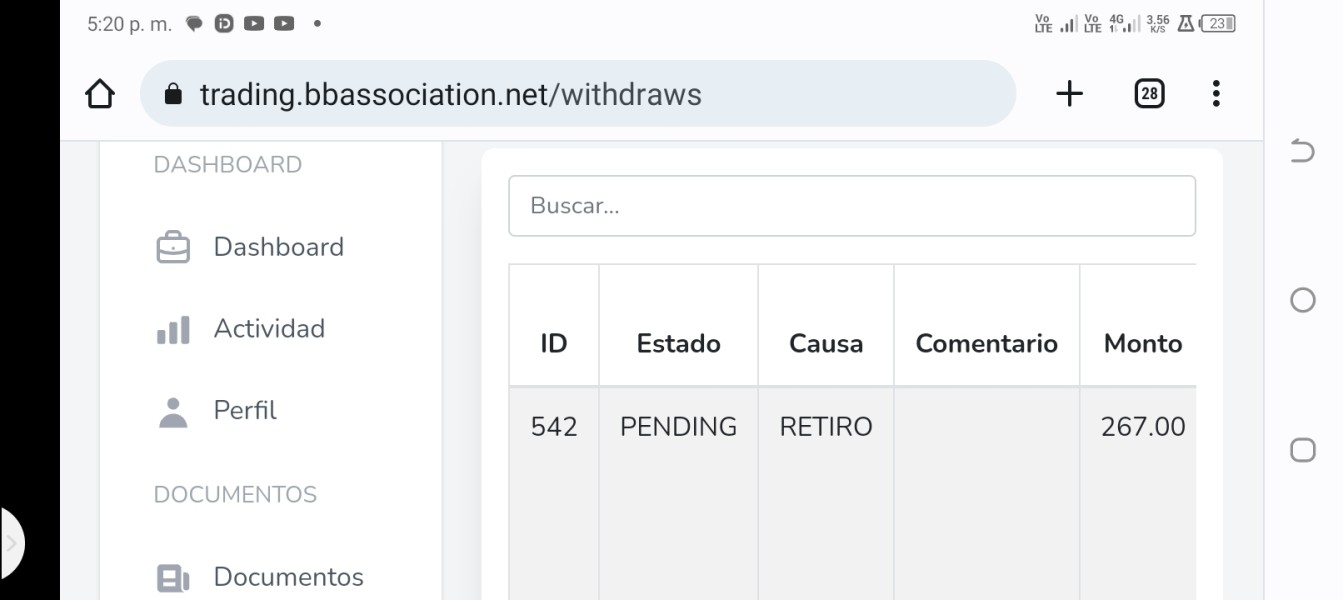

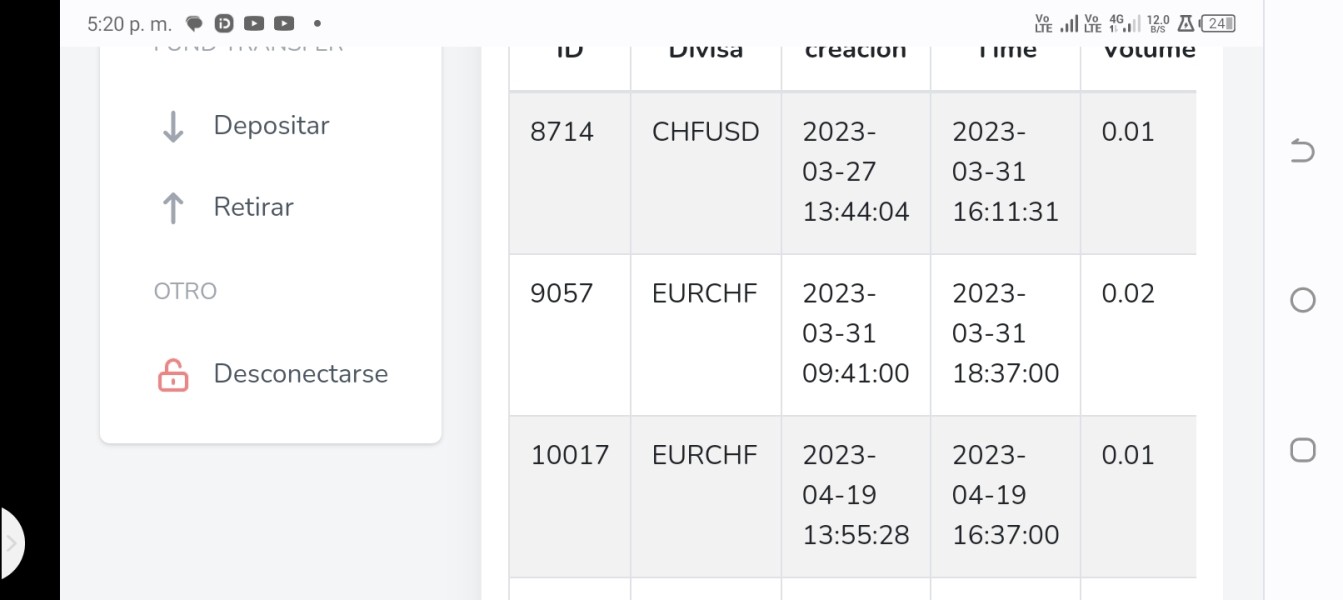

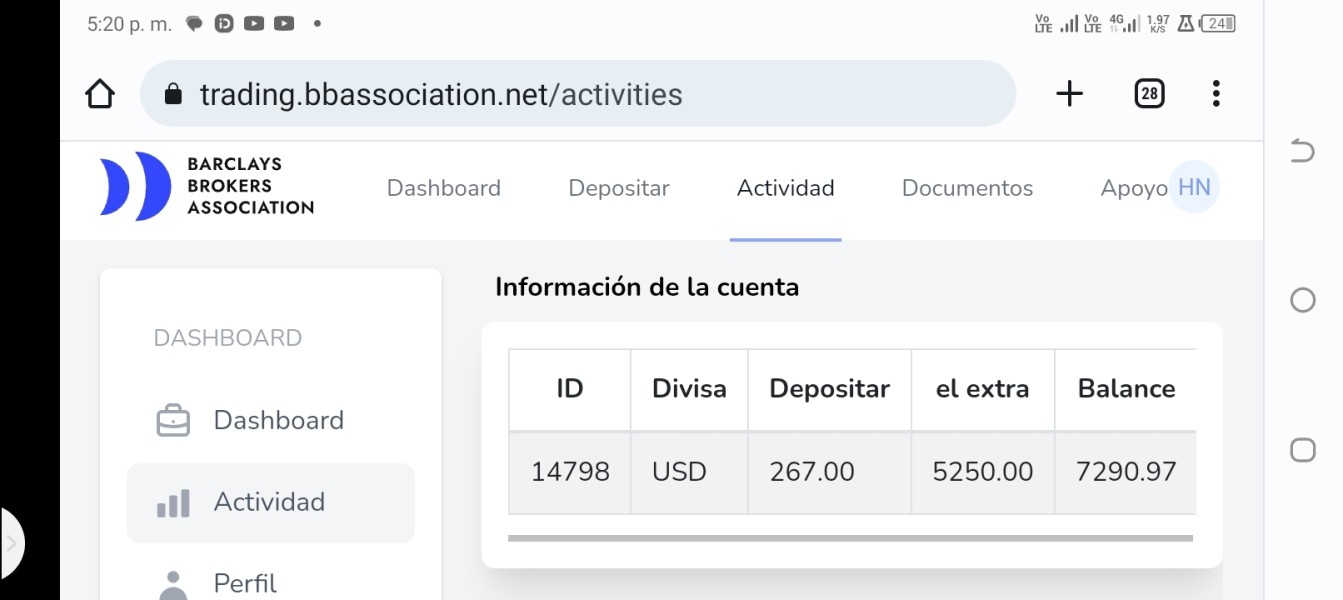

User Exposure on WikiFX

On our website, you can see that one exposure of fraud reported by client,which should be marked as red flag. Traders are encouraged to carefully review the available information. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section. We would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Barclays provides comprehensive customer support through phone, physical address and email.

Address: 31st floor, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131

Tel:

Barclays Securities Co., Ltd.: 03-4530-1100.

Bank, Tokyo Branch: 03-4530-5100. Investment Management Co., Ltd.: 03-4530-2400.

Media Inquiries (Public Relations Department) Tel: 03-4530-5623.

Email: fundsadvisory@barclays.com.

Additionally, you can also approach a contact us form after you choose the topic you want to inquire, the form will be directed to related department for following up.

Conclusion

In conclusion, Barclays Japan operates with three affiliates: Barclays Securities Corporation, Barclays Bank Tokyo Branch, and Barclays Investment Management Co., Ltd., offering a range of financial services to diverse customer groups such as financing, asset management, risk management solutions, advisory services, among them.

However, caution is advised due to the alarming unregulated status of the company. Compounded by a reported fraud exposure on WikiFX, concerns arise regarding regulatory compliance and client security. Given these considerations, exploring alternative brokers prioritizing transparency, regulatory adherence, and professionalism is recommended.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.