Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

What is FairMarkets?

FairMarkets is a brokerage firm headquartered in Mauritius that offers a wide range of trading instruments across various asset classes, including forex, indices, commodities, stocks, and cryptocurrencies. They provide different types of trading accounts, such as Standard fixed, Standard variable, VIP variable, and Raw zero accounts. FairMarkets offers leverage of up to 1:400 for all account types and supports popular trading platforms like MT4 and MT5. They accept deposits and withdrawals through credit cards, bank transfers, and e-wallets. However, it's important to note that FairMarkets operates without any valid regulatory oversight, and there has been a report of difficulties in withdrawing funds.

Pros & Cons

FairMarkets Alternative Brokers

There are many alternative brokers to FairMarkets depending on the specific needs and preferences of the trader. Some popular options include:

Ally Invest - A reputable broker providing competitive pricing, a robust trading platform, and valuable educational resources, making it a strong choice for self-directed investors.

Merrill Edge - A trusted broker backed by Bank of America, offering a seamless integration with banking services, making it convenient for clients looking for a combined investment and banking experience.

TradeStation - A feature-rich broker with advanced charting tools, algorithmic trading capabilities, and a wide range of tradable instruments, ideal for experienced traders and those seeking sophisticated trading technology.

Is FairMarkets Safe or Scam?

Considering the lack of valid regulation and the report of difficulties in withdrawing funds, it raises concerns about the safety of engaging with FairMarkets. Operating without proper regulation means that the brokerage firm is not subject to oversight from a reputable regulatory authority that ensures transparency and client protection. The reported issue regarding withdrawal adds further doubts about the reliability of the company.

Given these circumstances, it is advisable to exercise caution when considering FairMarkets. Traders should thoroughly research and assess the risks involved before deciding to trade with an unregulated brokerage. It is essential to prioritize the safety of funds and consider alternative regulated brokers that provide a higher level of protection for clients.

Market Instruments

FairMarkets offers a diverse selection of market instruments that cover a wide range of asset classes, providing traders with opportunities to participate in various financial markets.

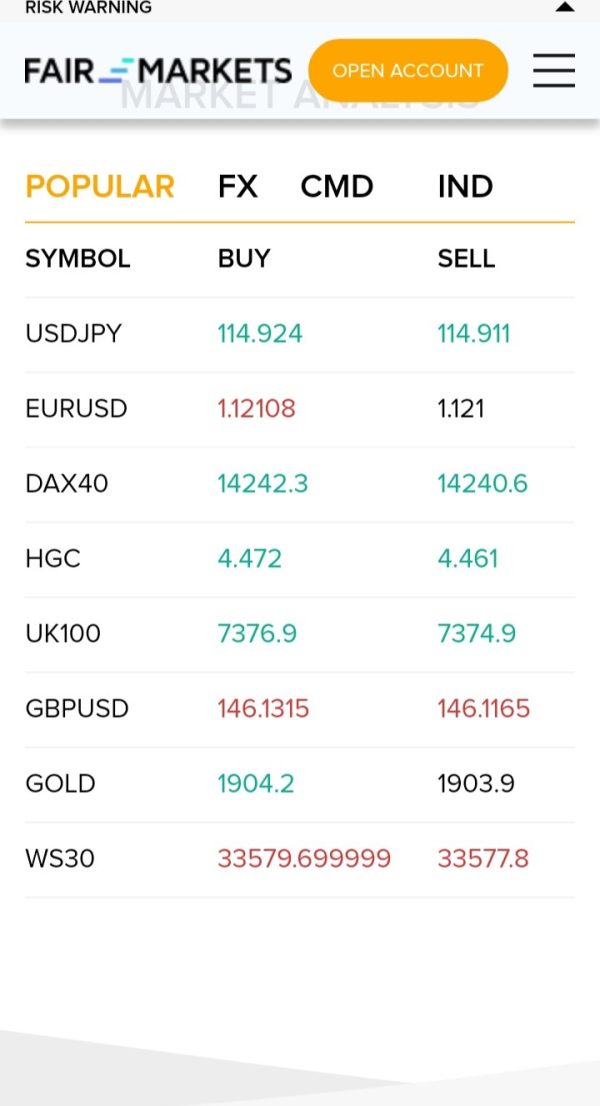

One of the key markets available is forex, which allows traders to engage in currency trading. Forex trading involves buying and selling currency pairs, such as EUR/USD or GBP/JPY, with the aim of profiting from fluctuations in exchange rates.

In addition to forex, FairMarkets provides access to indices, which represent the performance of specific stock markets or sectors. Traders can trade on the price movements of major indices like the S&P 500, FTSE 100, or NASDAQ, allowing them to speculate on the overall direction of the stock market or specific industries.

FairMarkets also offers the opportunity to trade commodities, including precious metals like gold and silver, energy commodities like oil, and agricultural products such as wheat or corn. Trading commodities allows investors to take positions on the price movements of these physical goods, which are influenced by factors such as global supply and demand dynamics, geopolitical events, and economic indicators.

Moreover, FairMarkets enables traders to invest in stocks, providing access to shares of publicly traded companies. This allows traders to take advantage of price fluctuations in individual stocks, potentially benefiting from company-specific news, earnings reports, or market sentiment.

Furthermore, FairMarkets recognizes the growing popularity of cryptocurrencies and allows traders to engage in trading digital currencies like Bitcoin, Ethereum, and others. Cryptocurrency trading provides opportunities to capitalize on the volatility and price movements of these digital assets, which are driven by factors such as market demand, regulatory developments, and technological advancements.

Accounts

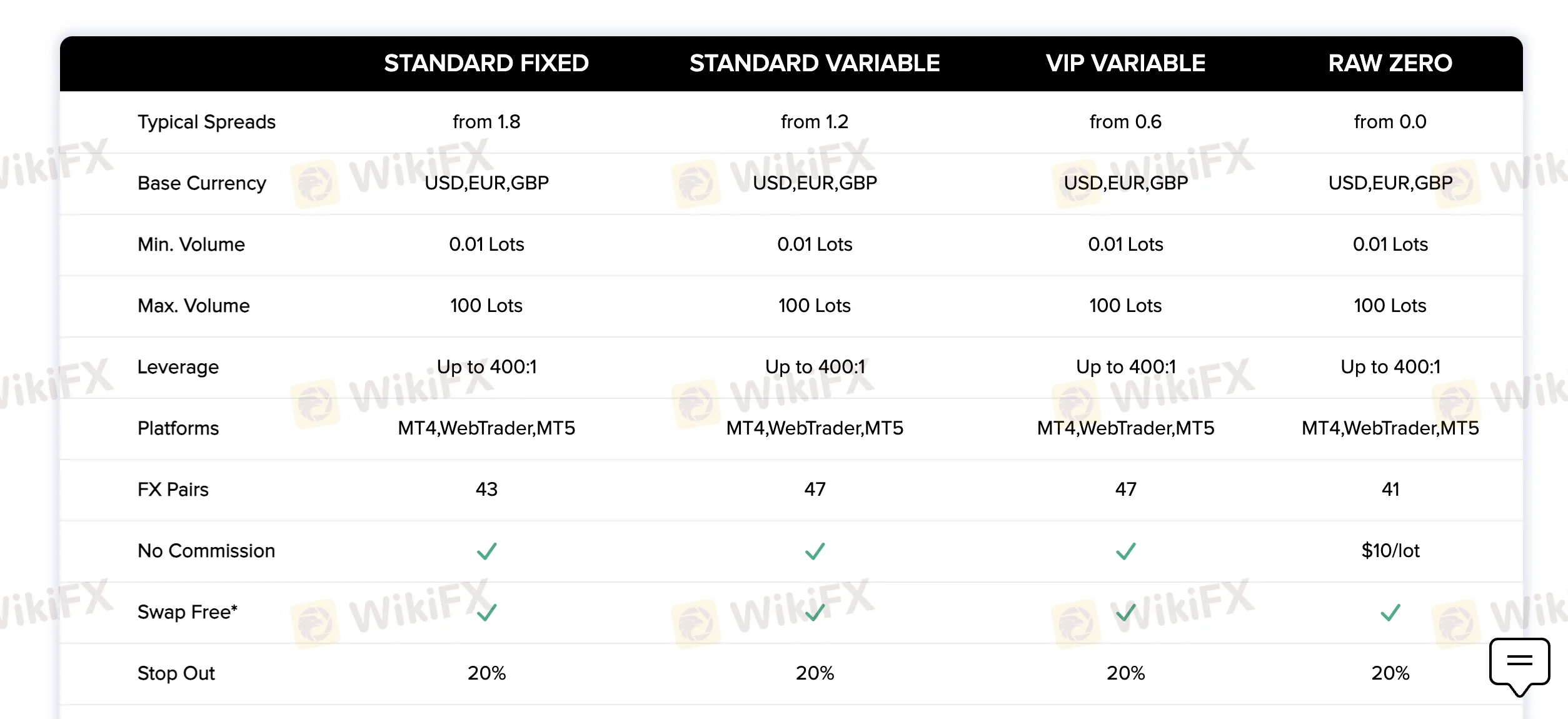

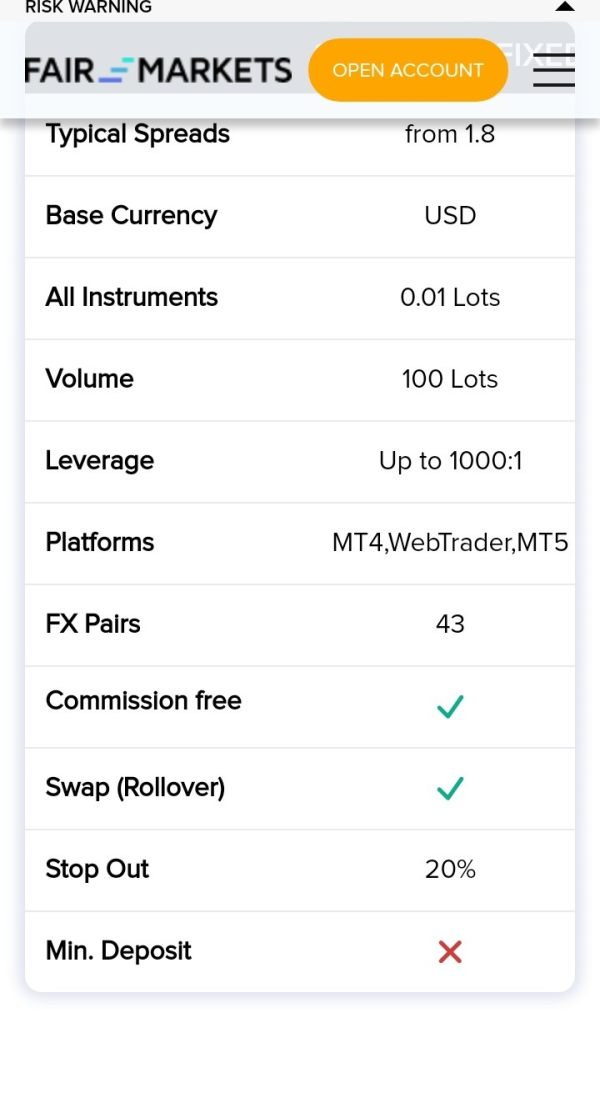

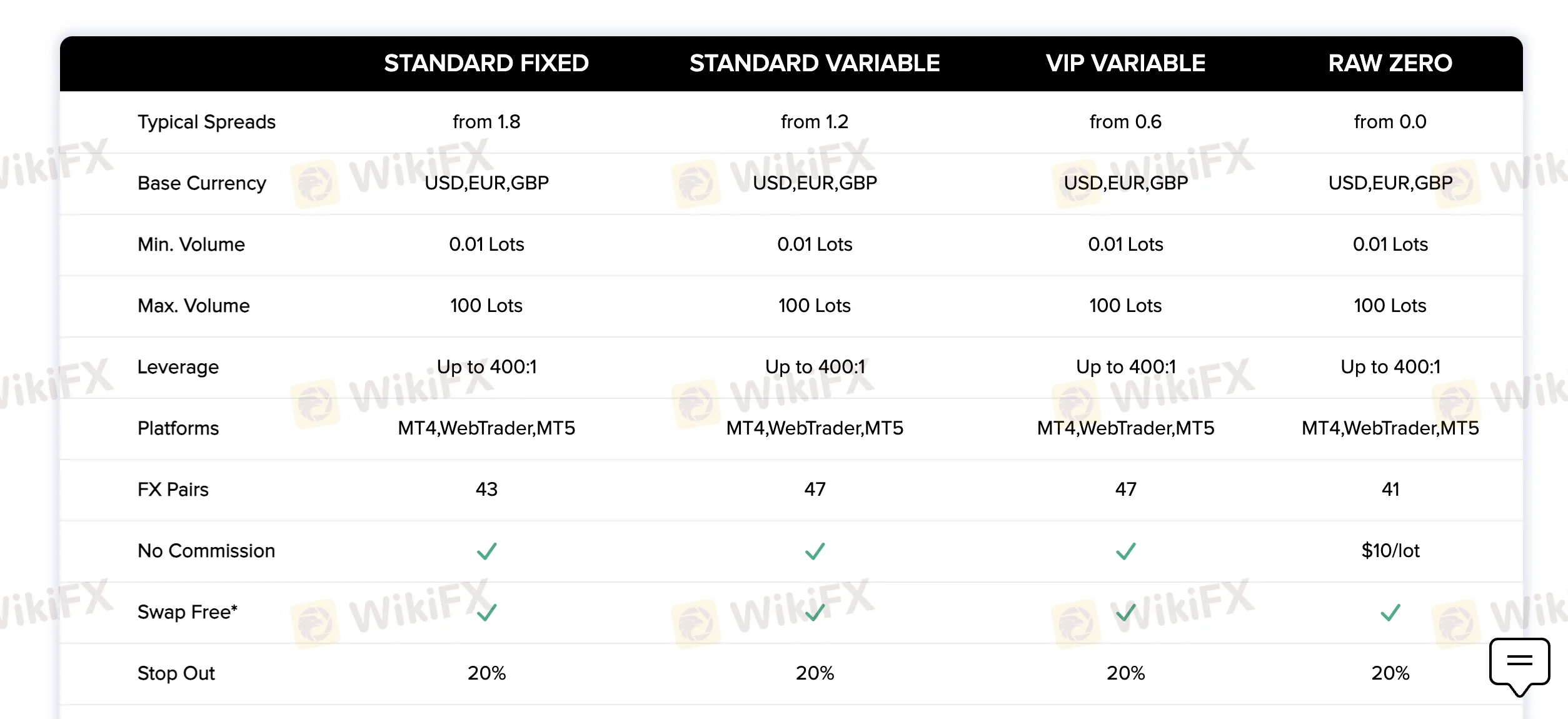

FairMarkets understands that traders have varying preferences and trading styles, which is why they provide different types of trading accounts to accommodate these needs. The account options offered by FairMarkets include the Standard fixed account, Standard variable account, VIP variable account, and Raw zero account.

The Standard fixed account is designed for traders who prefer a fixed spread model. With this account type, traders can benefit from a consistent spread, which remains fixed regardless of market conditions. This can be advantageous for traders who value stability and want to have a predictable trading cost.

The Standard variable account, on the other hand, offers a variable spread model. The spread in this account type may fluctuate depending on market liquidity and volatility. Traders who prefer flexible spreads that can potentially tighten during favorable market conditions might find the Standard variable account suitable for their trading strategies.

For more experienced traders or those with higher capital, FairMarkets provides the VIP variable account. This account type is specifically tailored to cater to the needs of seasoned traders who require advanced trading conditions and premium features. The VIP variable account typically comes with additional benefits such as lower spreads, priority customer support, personalized services, and access to exclusive trading resources.

FairMarkets also offers the Raw zero account, which is designed for traders seeking direct market access with raw spreads. This account type features zero pips spreads, which means that traders can access the interbank market prices without any mark-up from the broker. However, it's important to note that the Raw zero account has a commission of $10 per lot, which is applied to cover the costs of providing raw spreads.

One notable aspect of FairMarkets' account offerings is that the Standard fixed, Standard variable, and Raw zero accounts have no minimum deposit requirement. This makes these accounts accessible to traders of all levels, including beginners who may have smaller capital to start with. On the other hand, the VIP variable account requires a minimum deposit of $5000, indicating its focus on accommodating more experienced traders or those with higher investment capabilities.

Leverage

FairMarkets offers traders a maximum leverage of 1:400 for all types of trading accounts. Leverage is a financial tool that enables traders to control positions in the market that are significantly larger than the capital they have in their trading accounts. With a leverage ratio of 1:400, for every dollar in the trading account, traders have the ability to control up to $400 in the market.

However, it's crucial to recognize that higher leverage also increases the risk of potential losses. While leverage can amplify profits, it can likewise magnify losses. If a trade moves against a trader's position, losses can accumulate quickly, potentially exceeding the initial investment. Therefore, it's essential for traders to exercise caution and have a clear risk management plan in place when utilizing leverage.

Spreads & Commissions

Regarding spreads and commissions, FairMarkets offers competitive rates. The spread is the difference between the buying and selling price of an asset, and FairMarkets provides different spreads for each account type. The Standard fixed account has a spread starting from 1.8 pips, the Standard variable account offers a spread starting from 1.2 pips, the VIP variable account provides a spread starting from 0.6 pips, and the Raw zero account offers a spread of 0.0 pips.

In terms of commissions, FairMarkets has a no-commission structure for the Standard fixed, Standard variable, and VIP variable accounts. However, for the Raw zero account, a commission of $10 per lot is charged. The commission is applied per lot traded, and it's important to consider this cost when calculating potential trading expenses.

Below is a comparison table about spreads and commissions charged by different brokers:

Trading Platforms

FairMarkets supports multiple trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4 and MT5 are widely used platforms known for their user-friendly interfaces, advanced charting capabilities, and a wide range of technical analysis tools. They also offer features like automated trading through expert advisors (EAs) and the ability to access the market through desktop applications, web-based platforms, and mobile apps, providing flexibility and convenience to traders.

See the trading platform comparison table below:

Deposits & Withdrawals

FairMarkets allows deposits and withdrawals through various methods, including credit cards, bank transfers, and e-wallets. Traders can use their credit cards to fund their accounts or withdraw funds directly to their card. Bank transfers provide a secure way to deposit or withdraw larger amounts of money. Additionally, FairMarkets supports e-wallets, which offer convenient and fast transactions.

And the minimum deposit is $5000.

User Exposure on WikiFX

On our website, you can see a report of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section. We would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

For customer service, FairMarkets provides several channels of communication. Traders can reach out to their customer support team via telephone at +44 146094 4002 or +230 460 8533. They also offer support through email at support@fairmarkets.mu and live chat, allowing traders to get assistance promptly.

The address is Silicon Avenue 40 The Cyberati Lounge | Cybercity Ebene MU, 72201, Mauritius.

Conclusion

FairMarkets is an offshore brokerage firm headquartered in Mauritius, offering a diverse range of trading instruments and various account types to cater to traders' needs. The company provides competitive spreads and leverage, which can be appealing to investors seeking favorable trading conditions.

However, it is important to note that FairMarkets operates without valid regulation. The lack of regulation means that the company is not subject to oversight by a reputable regulatory authority that ensures compliance with industry standards, customer protection, and transparency. The absence of regulatory supervision raises concerns about the safety and security of funds, as there may be a higher risk of fraudulent activities or mismanagement.

Frequently Asked Questions (FAQs)

Q1: Is FairMarkets a regulated brokerage firm?

A1: No, FairMarkets is not regulated.

Q2: What is the minimum deposit requirement for a VIP variable account?

A2: The minimum deposit requirement for a VIP variable account is $5000.

Q3: Which trading platforms are offered by FairMarkets?

A3: FairMarkets offers trading platforms such as MT4 and MT5.

Q4: What are the spreads and commissions for the Standard fixed account?

A4: The Standard fixed account offers a spread starting from 1.8 pips and has no commission.

Q5: How can I contact FairMarkets customer service?

A5: FairMarkets customer service can be reached via telephone at +44 146094 4002, +230 460 8533, through email at support@farimarkets.mu, or via live chat.