Overview of Inefex

Inefex, a broker operating in the financial industry, has faced scrutiny due to the absence of valid regulation and a suspicious regulatory license. Without proper oversight from governing bodies or regulatory authorities, concerns arise regarding the transparency and accountability of the broker. Investors should exercise caution and thoroughly assess the potential drawbacks before engaging with an unregulated entity like Inefex.

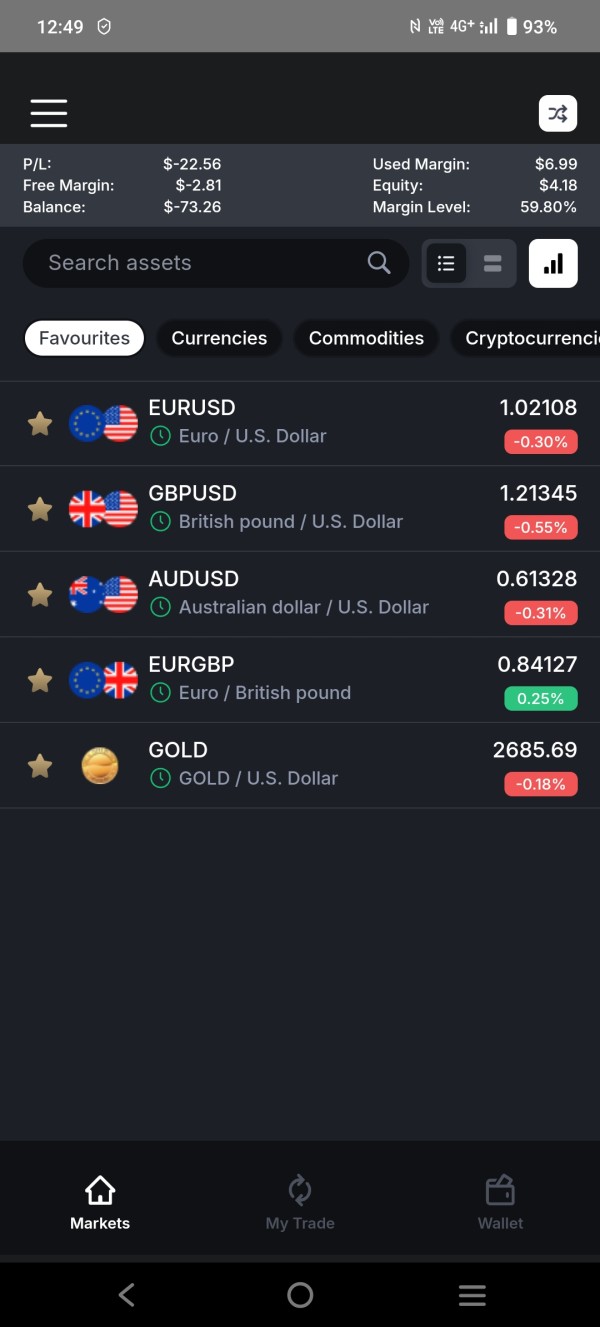

In terms of market instruments, Inefex offers trading in stocks, cryptocurrencies, currencies, commodities, and indices. These instruments provide opportunities for investors to speculate on the value and movement of various assets. However, it is important to note that the lack of regulation raises potential risks associated with trading through Inefex.

Inefex provides different account types, including Basic, Gold, Platinum, and VIP, catering to traders with varying levels of experience and capital. Each account type has its own minimum deposit requirement and offers different trading conditions. Traders should carefully consider the account type that aligns with their needs and risk tolerance.

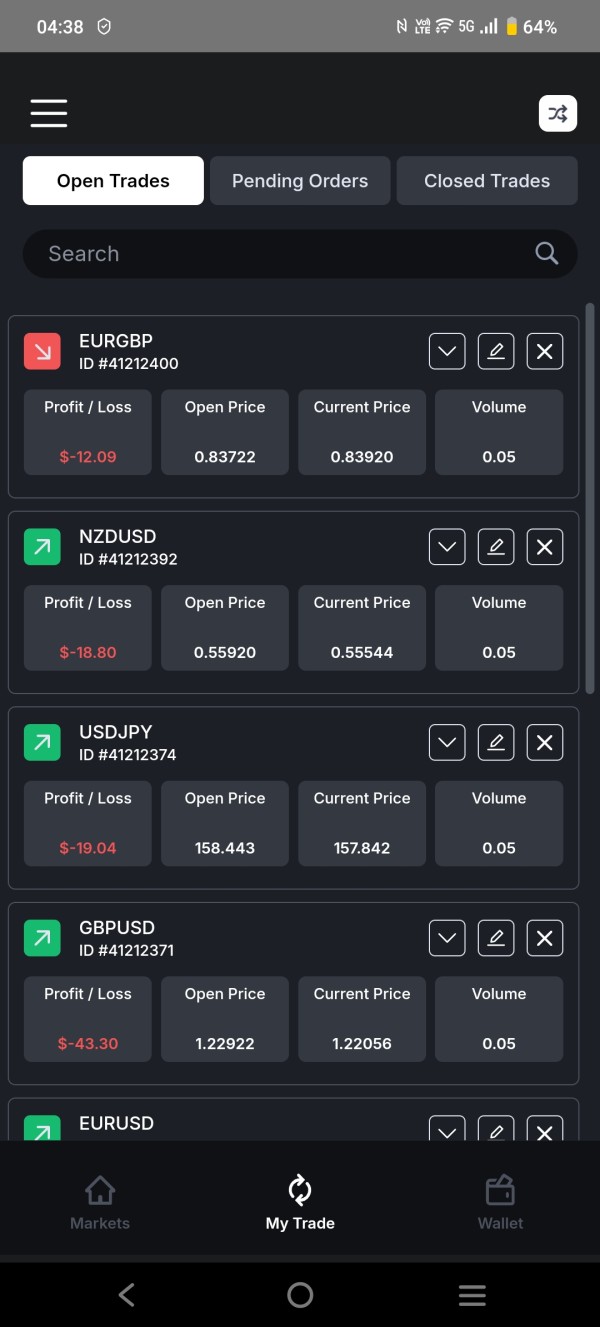

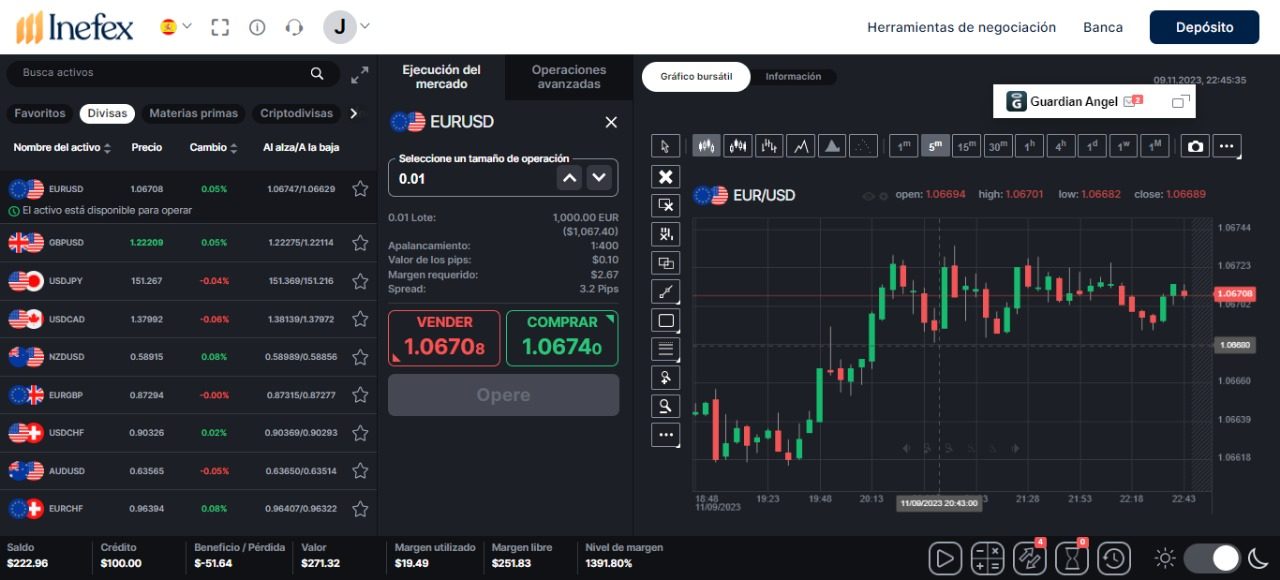

While Inefex offers the popular MetaTrader 4 (MT4) trading platform and a web-based platform called Inefex Web Trader, the absence of regulation and suspicious nature of the broker raise concerns about the reliability and security of the trading platforms.

Pros and Cons

Inefex presents a range of pros and cons for traders to consider. On the positive side, Inefex offers a diverse selection of market instruments, including stocks, cryptocurrencies, currencies, commodities, and indices. They also provide different account types with various features and benefits, catering to traders with different needs and preferences. High leverage of up to 1:500 is available, allowing traders to control larger positions with a smaller capital investment. Inefex utilizes the popular MetaTrader 4 (MT4) trading platform, known for its user-friendly interface and comprehensive tools. Positive user reviews on WikiFX further indicate some satisfaction among users. On the other hand, Inefex's lack of valid regulation raises concerns about transparency and accountability. They impose an inactivity fee on dormant accounts and have varying spreads depending on the account type and trading instrument. A minimum deposit requirement of $250 may also be a limitation for some traders. Withdrawal charges and limited customer support channels are additional factors to consider. While they offer educational resources and a cost calculation tool, the user reviews are mixed and lack detailed feedback. Traders should weigh these pros and cons before making a decision regarding Inefex.

Is Inefex Legit?

Inefex, a broker operating in the financial industry, has come under scrutiny due to the absence of any valid regulation. This means that there are no governing bodies or regulatory authorities overseeing its operations and ensuring compliance with industry standards. The lack of regulation raises concerns about the transparency and accountability of the broker, exposing investors to potential risks. It is crucial for individuals to exercise caution and thoroughly assess the potential drawbacks before engaging with an unregulated entity like Inefex.

Market Instruments

Stocks: Inefex offers trading in stocks or shares, which represent ownership in a corporation. By trading stock CFDs, investors speculate on the future value of these stocks. Popular stocks that are often traded include major names like Apple (AAPL), Amazon.com (AMZN), Microsoft (MSFT), Facebook (FB), Disney (DIS), Netflix (NFLX), and Tesla (TSLA).

Cryptocurrencies: Inefex provides access to the cryptocurrencies market, which consists of digital or virtual currencies. Cryptocurrencies use blockchain technology and are decentralized, theoretically immune to government interference. Bitcoin is the most well-known cryptocurrency, followed by a group of major coins that constitute the majority of the crypto-market capitalization.

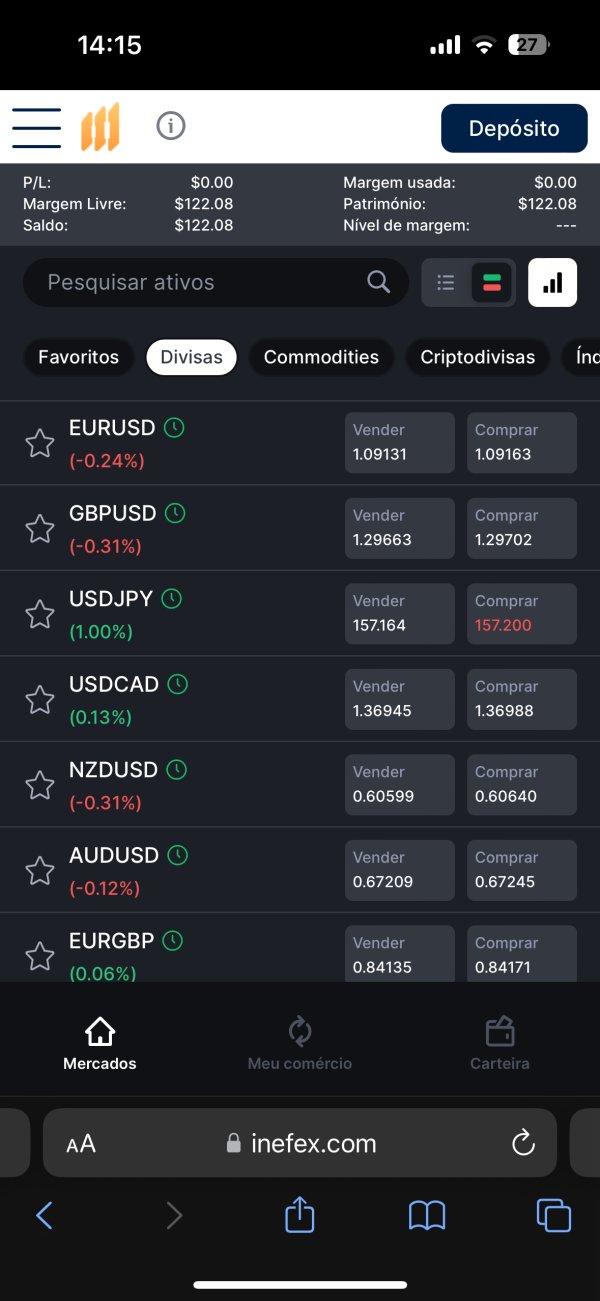

Currencies: Inefex allows trading in the foreign exchange market, where investors can speculate on the movement of one currency against another through leveraged trades on currency pairs. Popular currency pairs include the EUR/USD, USD/JPY, GBP/USD, and USD/CHF, which reflect the strength of different economies. Commodity pairs like AUD/USD, CAD/USD, and NZD/USD are also traded, along with cross currency pairs such as EUR/GBP, EUR/JPY, and EUR/CHF.

Commodities: Inefex offers trading in commodities, which are basic goods or raw materials. Popular commodities include Gold, Silver, US Crude Oil, Brent Crude, Copper, and Natural Gas. Commodities can serve as a diversification tool for investors, especially during periods of market uncertainty, as their prices often move in opposition to stock markets.

Indices: Inefex enables trading in indices, which measure the performance of a group of shares from an exchange. Indices represent the top shares of a specific market and provide a gauge of market health. Examples of major indices include the FTSE 100, Dow Jones Industrial Average, S&P 500, Nasdaq, CAC 40, and DAX 30. These indices act as benchmarks for evaluating the state of the market or its segments.

Pros and Cons

Account Types

BASIC:

The Basic account type offered by Inefex requires a minimum deposit of €250. This entry-level account provides traders with access to a leverage of up to 1:500, allowing them to amplify their trading positions. The Basic account features floating spreads, with examples including EUR/USD at 3.0 pips, GBP/USD at 3.4 pips, USD/JPY at 3.3 pips, and CRUDE OIL at $0.12. Traders opting for the Basic account can begin their trading journey with a relatively modest initial investment.

GOLD:

Inefex also offers the Gold account type, which caters to traders with a higher level of experience or a larger capital base. The Gold account requires a minimum deposit of €25,000. Similar to the Basic account, the Gold account provides leverage of up to 1:500. Traders with a Gold account can benefit from floating spreads, such as EUR/USD at 2.7 pips, GBP/USD at 3.1 pips, USD/JPY at 3.0 pips, and CRUDE OIL at $0.11. The Gold account is designed to accommodate the needs of traders who are looking for more extensive trading opportunities.

PLATINUM:

Inefex offers the Platinum account type for traders who have a substantial capital base and require enhanced trading conditions. To open a Platinum account, a minimum deposit of €100,000 is required. Like the other account types, the Platinum account allows traders to leverage their positions up to 1:500. With the Platinum account, traders can access floating spreads, including EUR/USD at 2.1 pips, GBP/USD at 2.5 pips, USD/JPY at 2.4 pips, and CRUDE OIL at $0.10. The Platinum account is tailored to meet the needs of experienced traders who are seeking a higher level of precision in their trading.

VIP:

For elite traders with significant financial resources, Inefex offers the VIP account type. This exclusive account requires a minimum deposit of €250,000. VIP account holders have access to the same leverage of up to 1:500 as the other account types. The VIP account boasts the low floating spreads, offering examples such as EUR/USD at 1.6 pips, GBP/USD at 2.0 pips, USD/JPY at 1.9 pips, and CRUDE OIL at $0.08. The VIP account is designed for high-net-worth individuals or institutions who require premium trading conditions and a tailored trading experience.

In addition to the various live trading account types, Inefex also offers a demo account for traders who want to practice their trading strategies or familiarize themselves with the platform.

Pros and Cons

How to Open an Account?

To open an account with Inefex, follow these steps:

Visit the Inefex website and click on the “Start Trading Now” button.

2. Choose between a Free Demo account or a Live account, depending on your preference.

3. Fill in your full name, email address, and phone number (including the country code, e.g., +44 for UK).

4. Confirm that you are over 18 years old and agree to the Legal Terms & Conditions and Privacy Policy.

5. If you wish to receive marketing materials, select the option accordingly.

6. Click on the “Start Trading” button or any similar prompt to complete the account creation process.

Leverage

Inefex offers high leverage of up to 1:500 to its clients. This level of leverage allows traders to control larger positions in the market with a smaller amount of capital. However, it is important to note that high leverage amplifies both potential profits and losses.

Spreads

Inefex offers variable spreads on its trading accounts. The spreads vary depending on the account type and the specific trading instrument. Examples of spreads include EUR/USD at 3.0 pips for the Basic account, 2.7 pips for the Gold account, 2.1 pips for the Platinum account, and 1.6 pips for the VIP account. These spreads reflect the difference between the bid and ask prices and impact the overall trading costs for traders.

Minimum Deposit

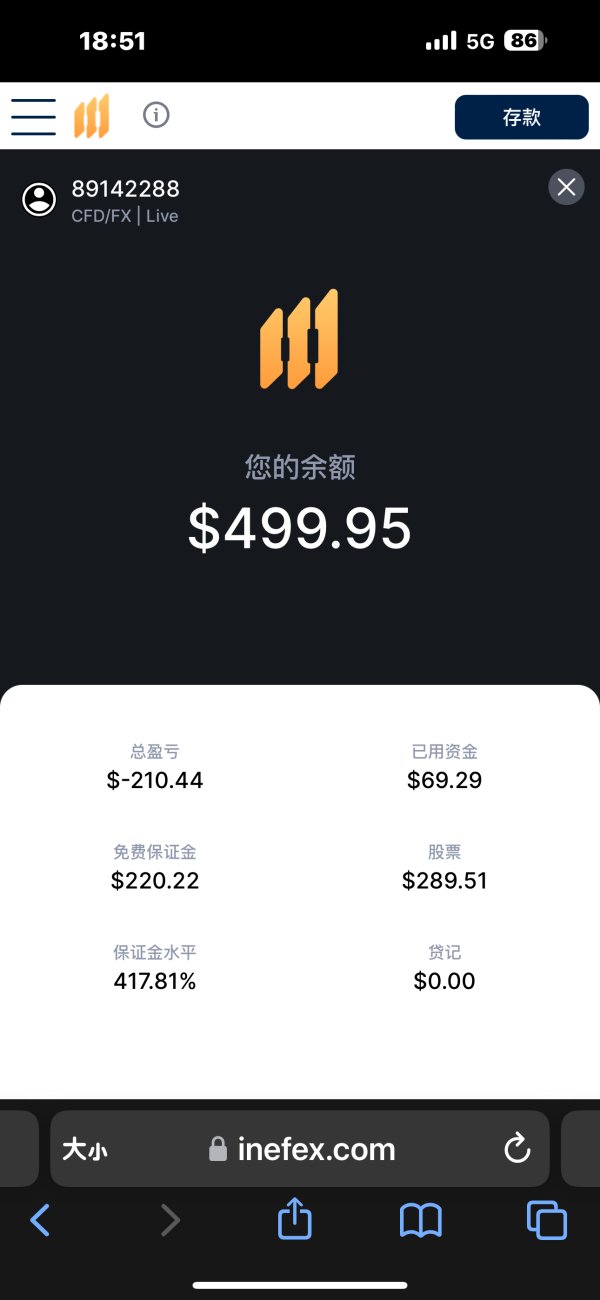

Inefex requires a minimum deposit of $250 for individuals looking to open an account with the broker. This entry-level requirement allows potential traders to get started with a relatively small amount of capital.

Fees

Inefex imposes an inactivity fee on trading accounts that remain inactive for a month or longer. This fee is levied as compensation for maintaining the availability of the trading account, and it applies when there are no transactions such as deposits, withdrawals, or trading activity. For detailed information regarding this fee, individuals can refer to the General Fees document located in the Legal section of Inefex's website.

On the other hand, when it comes to depositing funds into an account, Inefex does not charge any fees to its clients. This means that individuals can make deposits without incurring additional costs or fees from the broker.

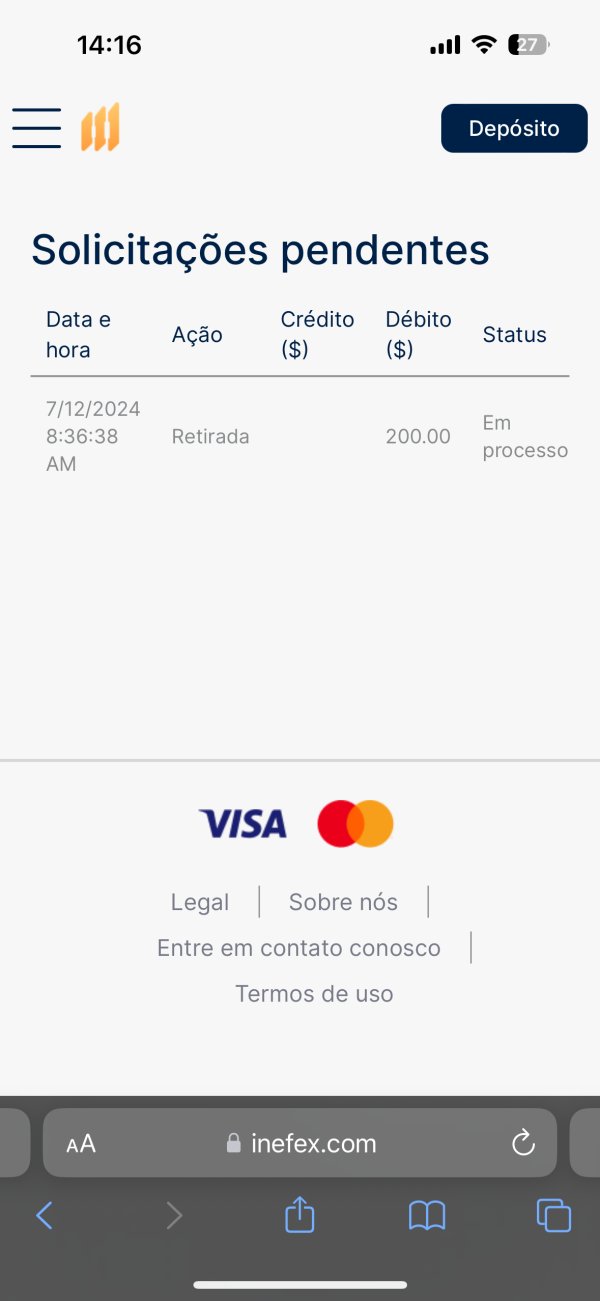

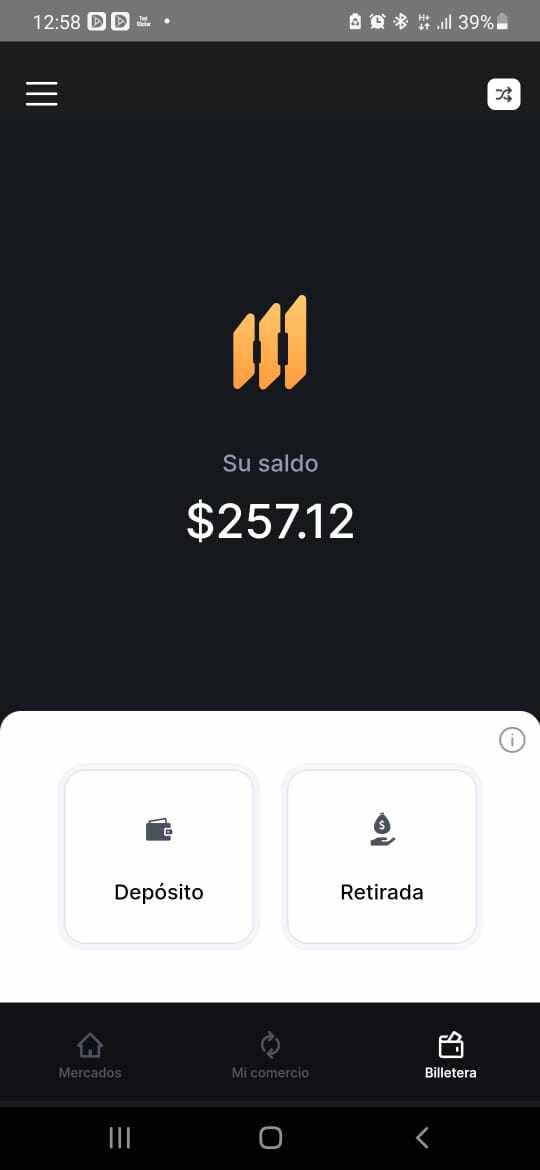

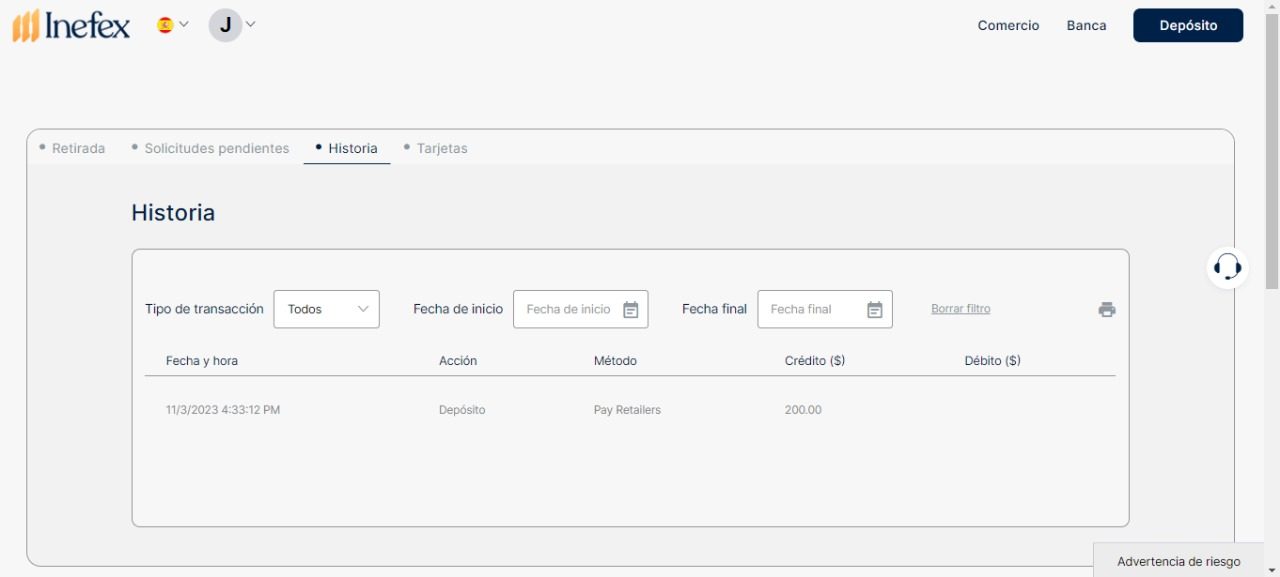

Deposit & Withdrawal

When it comes to depositing funds with Inefex, users have several options available to them. They can log in to their account and click on the Deposit button to initiate the process. Inefex supports various deposit methods, including credit cards, electronic payments, and wire transfers. Examples of credit cards accepted include Visa, Mastercard, and JCB. The security of banking transactions is prioritized, with Inefex employing a combination of security systems and firewalls, including SSL encryption, to safeguard users' account and banking details.

In terms of withdrawals, charges vary based on the account type. VIP account holders enjoy free withdrawals, while Platinum account holders can make three free withdrawals per month. Gold account members are entitled to one free withdrawal each month. Basic account holders are granted one free withdrawal, with subsequent withdrawals incurring charges. The minimum withdrawal amounts differ depending on the method chosen. There is no minimum amount for withdrawals made to credit cards, Skrill, or Neteller. However, for withdrawals made by wire transfer, minimum limits apply, such as ₣100, $120, €100, £80, or ₽7,000.

Pros and Cons

Trading Platforms

Inefex provides the popular MetaTrader 4 (MT4) trading platform to its clients. MT4 is a widely recognized platform in the industry known for its user-friendly interface and comprehensive trading tools. It offers features such as real-time market quotes, charting capabilities, and a wide range of technical indicators. Traders can execute trades, monitor their positions, and analyze market trends using this platform.

Additionally, Inefex also offers the Inefex Web Trader, a web-based platform that allows clients to access their trading accounts through a web browser without requiring any software downloads.

Pros and Cons

Trading Tools

Inefex provides a Cost Calculation Tool that allows users to assess the fees associated with their trades. By inputting details such as account type, account currency, asset selection, trade size, and position duration, users can obtain a breakdown of the costs involved. The tool offers a clear and straightforward way for traders to evaluate the potential expenses associated with their transactions.

Educational Resources

Inefex provides educational resources to its users, covering various aspects of trading. Their materials include information on trading Contracts for Difference (CFDs), explaining the concept and how it operates within the market. Additionally, Inefex offers insights into trading strategies, outlining different approaches that traders can consider when making investment decisions. They also provide technical and fundamental tools to assist users in analyzing market trends and making informed trading choices. Inefex offers resources on margin and leverage, providing an understanding of these concepts and their implications in trading. Moreover, they offer educational materials on Non-Farm Payrolls (NFP), helping users comprehend its significance and how it can impact the markets. Lastly, Inefex provides a glossary of trading terms, aiding users in understanding industry-specific terminology and jargon. These educational resources can equip traders with knowledge and insights, allowing them to make informed decisions while engaging in trading activities.

Customer Support

Inefex offers customer support through various channels. They provide a phone number (+815030923008) that customers can use to reach out for assistance. Additionally, they offer an email address (info@inefex.com) where users can send their inquiries or concerns. Inefex also provides a chat feature on their website, enabling customers to engage in real-time conversations with their support team.

Reviews

The user reviews for Inefex on WikiFX are generally positive. Users express satisfaction with the company, stating that they enjoy making money and recommending it to others who want to earn money through investments. Some users specifically mention that the company is experienced and amazing, and they have had a good experience making money. However, there is one review from Hiroko Kei that mentions a salesman requesting a refund after four days, but no further details or rating are provided for this comment.

Conclusion

In conclusion, Inefex, an unregulated broker, operates without oversight from governing bodies, raising concerns about transparency and accountability. While it offers a range of market instruments, including stocks, cryptocurrencies, currencies, commodities, and indices, potential investors should carefully consider the risks associated with engaging with an unregulated entity. Inefex provides different account types, each with its own minimum deposit requirement and varying spreads. The broker offers high leverage, allowing traders to control larger positions, but it's important to note that high leverage amplifies both potential profits and losses. Inefex's trading platforms include the popular MetaTrader 4 and a web-based platform. The broker provides a cost calculation tool and educational resources to assist traders in evaluating fees and gaining trading knowledge. Customer support is available through phone, email, and chat. Overall, individuals should exercise caution and thoroughly assess the drawbacks before considering Inefex as a trading option.

FAQs

Q: Is Inefex a regulated broker?

A: No, Inefex operates without a valid regulatory license.

Q: What financial instruments can I trade with Inefex?

A: Inefex offers trading in stocks, cryptocurrencies, currencies, commodities, and indices.

Q: What leverage does Inefex offer?

A: Inefex offers leverage of up to 1:500.

Q: What are the spreads on Inefex's trading accounts?

A: Spreads vary depending on the account type, with examples ranging from 3.0 pips to 1.6 pips.

Q: What is the minimum deposit requirement for Inefex?

A: The minimum deposit is €250.

Q: Does Inefex charge any fees?

A: Inefex charges an inactivity fee for dormant accounts, but there are no fees for deposits.

Q: What are the options for depositing and withdrawing funds with Inefex?

A: Inefex supports credit cards, electronic payments, and wire transfers for deposits. Withdrawal charges vary based on the account type.

Q: What trading platforms does Inefex offer?

A: Inefex offers MetaTrader 4 (MT4) and Inefex Web Trader.

Q: Does Inefex provide educational resources?

A: Yes, Inefex offers educational materials on various trading topics.

Q: How can I contact Inefex's customer support?

A: You can reach Inefex's customer support via phone, email, or live chat.

Q: What do user reviews say about Inefex?

A: User reviews on WikiFX are mostly positive, mentioning satisfaction with the company.

FX3614974043

Malaysia

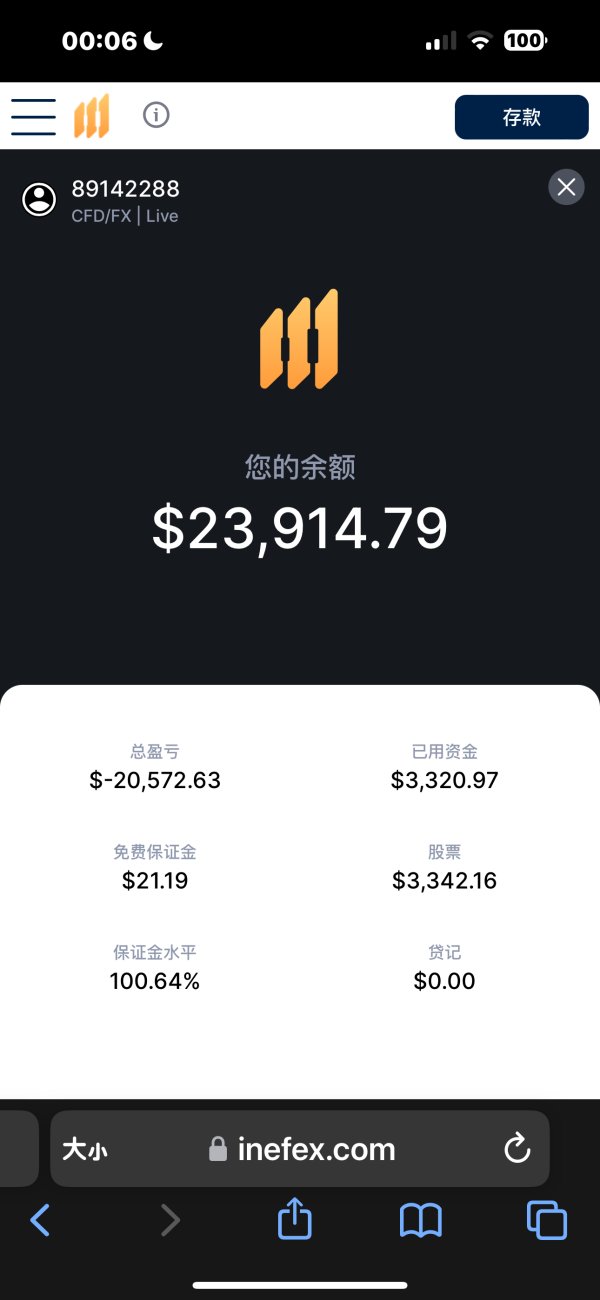

Inefex and the financial advisor are total scammer... can't withdraw money ... Stupid fucking inefex... Followed the advisor and made my money all lost... Lost my money there.. seriously a cheater...

Exposure

01-13

Even Zh

Taiwan

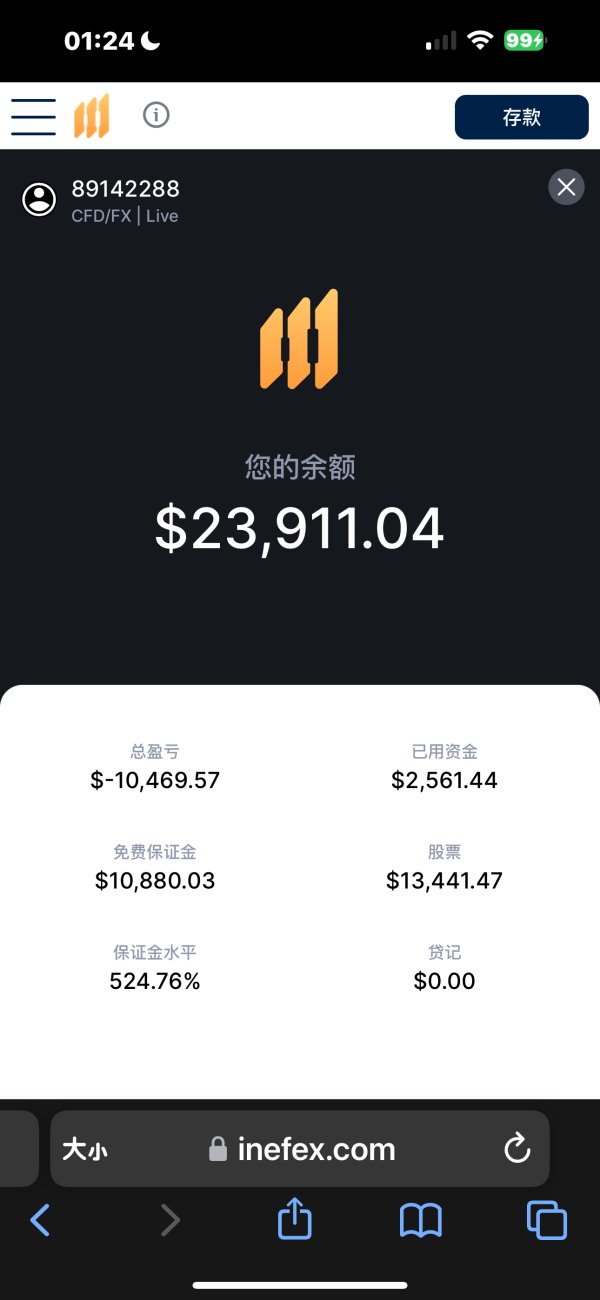

A small amount of money in the early stage will make you earn a lot, but you won't be able to claim any of your earnings. Within just two weeks, I kept urging you to invest and increase your savings, telling you that you would definitely make a profit, and then calling on you to increase your funds in order to increase your margin and invest in more things. In the mid-term, you suddenly realize a significant loss in profits, even increasing from $10000 to $20000 overnight. Then you will receive a notification from the system that you need to increase the deposit to protect your account, otherwise it will be frozen? Then you will receive their finance manager saying that you need to pay a 20% investment tax in order to return the original investment amount of $20000 to you? And I also told you: only you have this opportunity, others don't? But I refused... and then the financial manager will tell you: he has tried his best to fight for you, but there is no way because the company does not agree? Then he will turn around and blame you, saying: You were asked to increase the margin back then, but you didn't do that, so now your account is in this situation? I replied to him, 'I don't have any extra money to invest anymore, and I also told you back then that it's beyond my ability and there's no way to increase it. But now you're blaming me instead?'? Why don't you pay the transaction tax for me first, and then deduct it from my investment amount and give it to me? But he couldn't answer? Just asking me to give him time, asking me to wait? I have all my savings in cash, and I can't withdraw any money when I make money? Because the financial manager will only tell you: after holding on until the end of the month, you can come out with the surplus in early August. Just wait a little longer and there won't be any problems? But in the end, not only was the invested capital gone, but tonight when I looked at it, the entire official website was shut down? Even the email sent out was returned? It's really shocking and dumbfounded

Exposure

2024-07-29

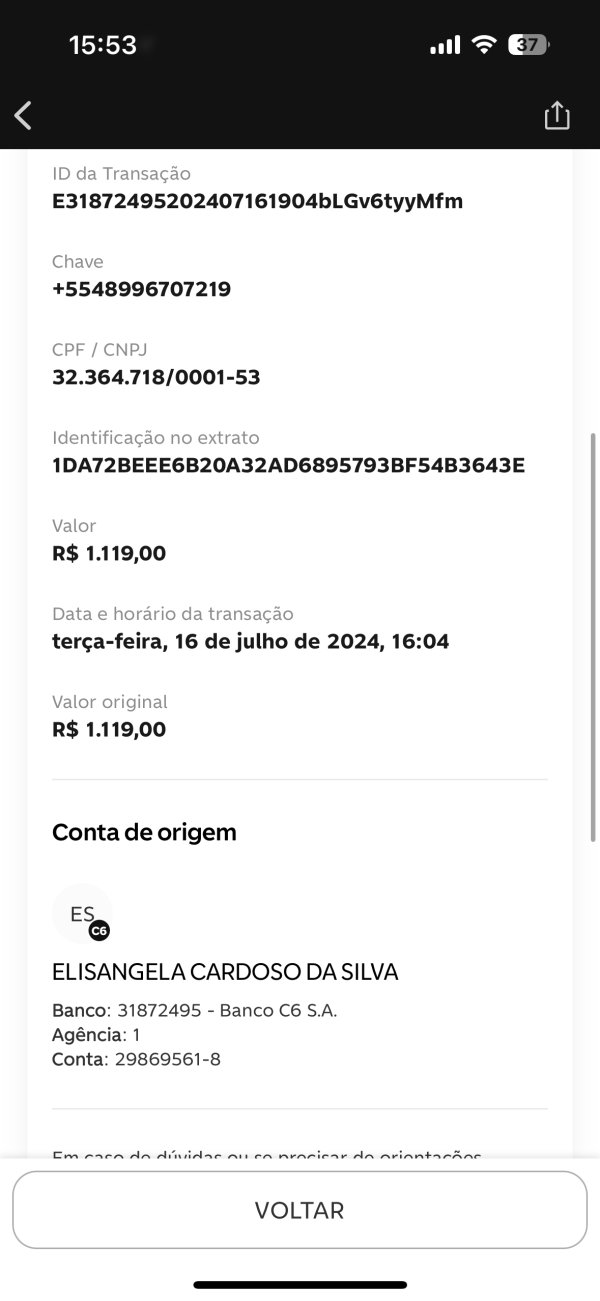

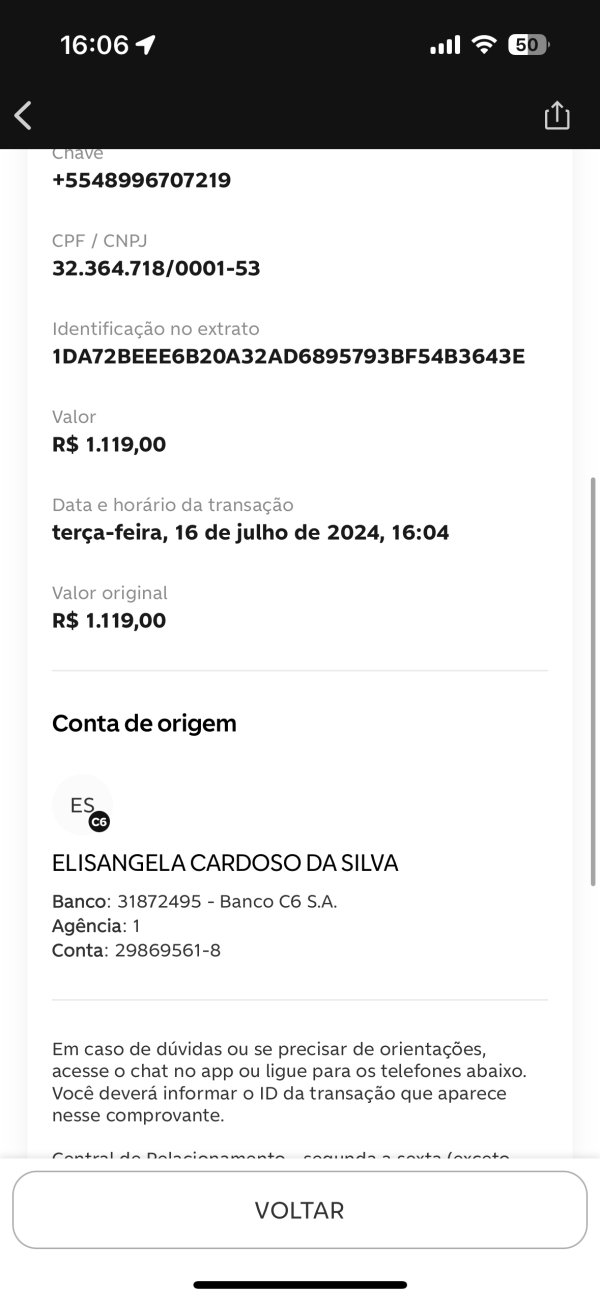

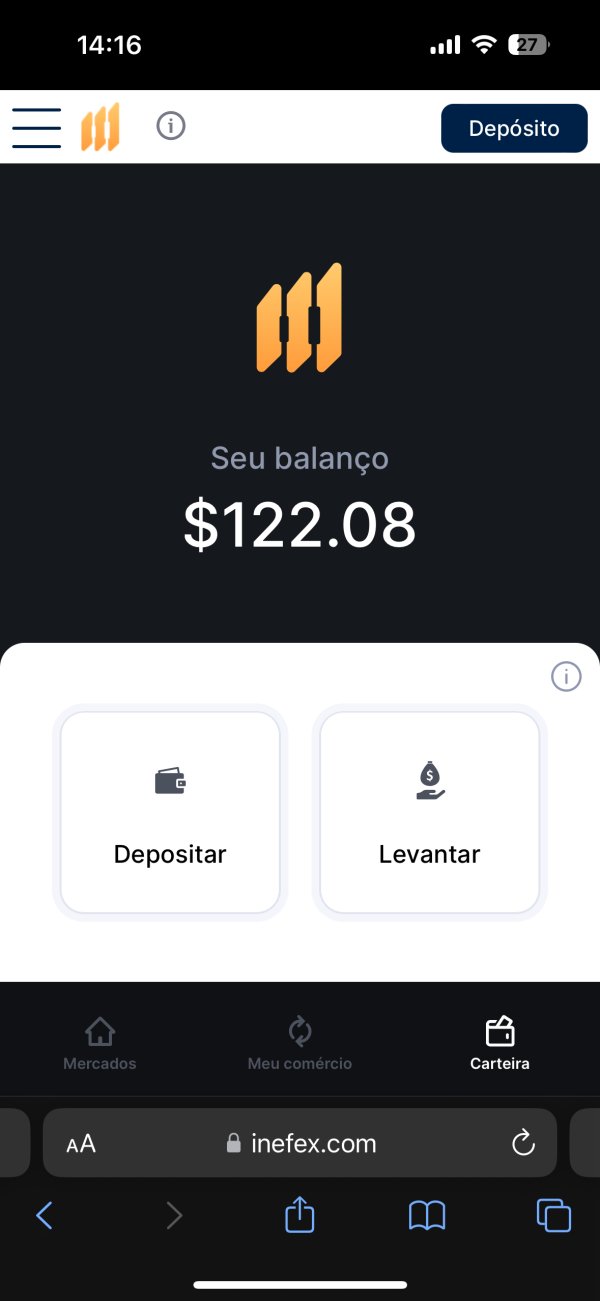

FX6807822552

Brazil

A friend had posted something about the company, and I did some research, and soon they called me. I joined the chat and gave a testimonial for 200 dollars; I even earned 1.79 on my own because I didn't have anyone's attention! I tried to withdraw the 201.79 dollars that were in my account! On 07/12/2024 and until today, 07/18/2024, I have had no response to anything, and they say it takes 3 days. Finally, someone named Anderson called me and said he was my consultant and asked inappropriate questions, but I ended up answering if I was married, but anyway, I ended up depositing more than 200 dollars with the hope of winning something! He said that. Netflix was hot and highly anticipated! I did everything he taught me, and when I went to sell, I ended up losing money, and the rest that was left in the Inefex account I couldn't withdraw! Because the first withdrawal has been stopped. Look, don't fall for that. I hope this testimonial helps someone!

Exposure

2024-07-19

jose489

Peru

I made an investment of 200 dollars and then an analyst called me and stopped calling me and they even downloaded all my investment balances in inefex and then they left me without any dollars and they still want to deposit more, it is a scam, don't fall for it.

Exposure

2023-12-11

FX3164455661

Turkey

I really suggest this company people who are want to earn money from investment. You can trust them

Positive

2023-05-18