Overview of Alpha Markets

Alpha Markets is an unregulated company based in Cyprus, operating without regulatory oversight. This lack of regulation raises concerns about transparency and accountability in their practices. Customers may face increased risks and potential exploitation without the protection of regulatory bodies. Alpha Markets offers a range of market instruments, including Contracts for Difference (CFDs), equity indices, precious metals, and energy commodities. However, individuals should exercise caution when engaging with Alpha Markets due to the absence of regulatory oversight.

The company provides different types of accounts with varying features and minimum deposit requirements. These include the Classic Account, Raw Spread Account, Alpha100 Account, and Alpha Micro Account. Each account type operates on the MetaTrader 5 (MT5) platform and offers leverage options up to 1:500. However, it is important to note that the absence of regulatory bodies may impact customer protection and support.

Customer support is available through various channels, including phone and email. Alpha Markets also has a physical address and a presence on social media platforms. However, the lack of regulatory oversight may affect the level of support and protection offered to customers. It is advisable for individuals to carefully consider the potential risks and uncertainties associated with trading through Alpha Markets before engaging with their services.

Pros and Cons

Alpha Markets offers a range of pros and cons for traders to consider. On the positive side, they provide a wide range of market instruments, allowing traders to access various financial markets. Additionally, they offer different types of accounts to cater to the diverse needs of traders, with leverage options of up to 1:500 and low spreads starting from 0.0 pips. Furthermore, Alpha Markets provides multiple deposit and withdrawal options, ensuring convenient transactions. They also offer the user-friendly MetaTrader 5 platform and provide customer support via phone, email, and social media. However, there are some drawbacks to consider, such as the lack of regulatory oversight and transparency, as well as the absence of a demo account. There is also limited information available on the trading platforms, and the commission charges for the Raw Spread Account may be a concern. Additionally, the minimum deposit requirements vary across account types, and there is a lack of educational resources and advanced trading tools. Traders should carefully weigh these pros and cons before making a decision.

Is Alpha Markets Legit?

Alpha Markets is a company that operates without being subject to regulation. This lack of oversight raises concerns about the transparency and accountability of their practices. As a result, customers may face increased risks and potential exploitation, as there are no regulatory bodies to ensure compliance with industry standards and protect their interests. It is advisable for individuals to exercise caution when engaging with Alpha Markets due to the absence of regulatory oversight.

Market Instruments

1. CFDS:

Alpha Markets offers a range of Contracts for Difference (CFDs) to its customers. These financial instruments allow traders to speculate on the price movements of various underlying assets without actually owning them. Examples of CFDs available through Alpha Markets include stock CFDs, allowing investors to trade on the price movements of individual company shares, and commodity CFDs, providing exposure to the price fluctuations of commodities like crude oil or natural gas.

2. Equity Indices:

Alpha Markets provides access to equity indices, enabling traders to speculate on the performance of stock market indexes from around the world. These indices represent the overall value of a specific stock market or sector and are comprised of a basket of stocks. Examples of equity indices offered by Alpha Markets include the S&P 500, FTSE 100, and Nikkei 225, allowing investors to take positions on the overall direction of these markets without trading individual stocks.

3. Precious Metals:

Alpha Markets allows traders to participate in the market for precious metals. This includes popular metals like gold, silver, platinum, and palladium. By offering trading opportunities in precious metals, Alpha Markets enables investors to take positions on the price movements of these commodities. Traders can benefit from potential price fluctuations in precious metals without the need to physically own and store the metals themselves.

4. Energies:

Alpha Markets provides trading options in various energy markets. This includes commodities like crude oil, natural gas, and other energy-related products. Through these instruments, traders can speculate on the price movements of energy commodities, allowing them to potentially profit from changes in global supply and demand dynamics. Alpha Markets offers a platform for individuals to participate in energy trading without the need for physical ownership or storage of these commodities.

Pros and Cons

Account Types

Alpha Markets offers different types of accounts to cater to the diverse needs of traders. The Classic Account has a minimum deposit requirement of $5 and spreads starting from 1 pip. It operates with zero commissions and utilizes the MT5 platform. Traders can enjoy leverage of up to 1:500 without any bonus incentives.

The Raw Spread Account is available. It requires a minimum deposit of $9 and offers spreads from 0 pips. However, there is a commission of $10 per standard lot traded. Similar to the Classic Account, it operates on the MT5 platform with a leverage of 1:500, but no bonus is provided.

The Alpha100 Account is designed to provide traders with leverage of up to 1:500, alongside a 100% bonus incentive. It has a minimum deposit requirement of $5 and spreads starting from 1 pip. The trading platform used is MT5, and there are no commissions associated with this account.

Lastly, the Alpha Micro Account caters to traders who prefer lower risk and smaller trade sizes. It has a minimum deposit requirement of $5 and spreads starting from 1 pip. Like the other accounts, it operates on the MT5 platform with leverage of 1:500. There are no commissions associated with this account, and no bonus is offered.

How to Open an Account?

To open an account with Alpha Markets, follow these simple steps:

Visit the Alpha Markets website and click on the “REGISTER NOW” button.

Fill in the required registration details, including your title, first name, last name, country, and phone number.

Click on “CONTINUE” to proceed with the registration process.

Check your email inbox for a confirmation PIN sent by Alpha Markets.

Enter the PIN in the designated field on the registration page.

Once the PIN is entered, continue with the registration process to complete the account opening procedure.

Leverage

Alpha Markets provides leverage options to traders, with leverage ratios of up to 1:500 available across their account types. High leverage ratios can magnify potential gains or losses in trading, and traders should exercise caution and implement proper risk management strategies when using leverage.

Spreads & Commissions

Alpha Markets provides traders with spreads, starting as low as 0.0 pips. The brokerage offers different account types with varying commission structures. The Classic Account operates without any commissions, while the Raw Spread Account, charges a commission of $10 per standard lot traded.

Minimum Deposit

Alpha Markets provides a range of account types with different minimum deposit requirements to accommodate the needs of various traders. The Classic Account has a minimum deposit of $5, the Raw Spread Account requires a minimum deposit of $9, and both the Alpha100 and Alpha Micro Accounts have a minimum deposit of $5.

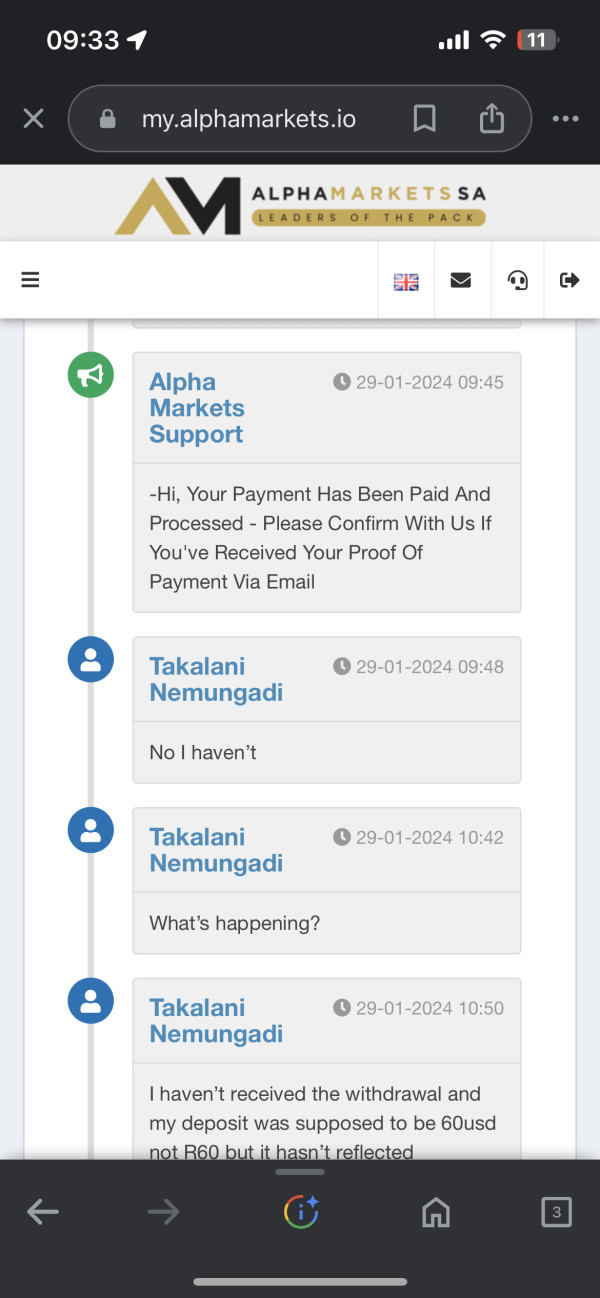

Deposit & Withdrawal

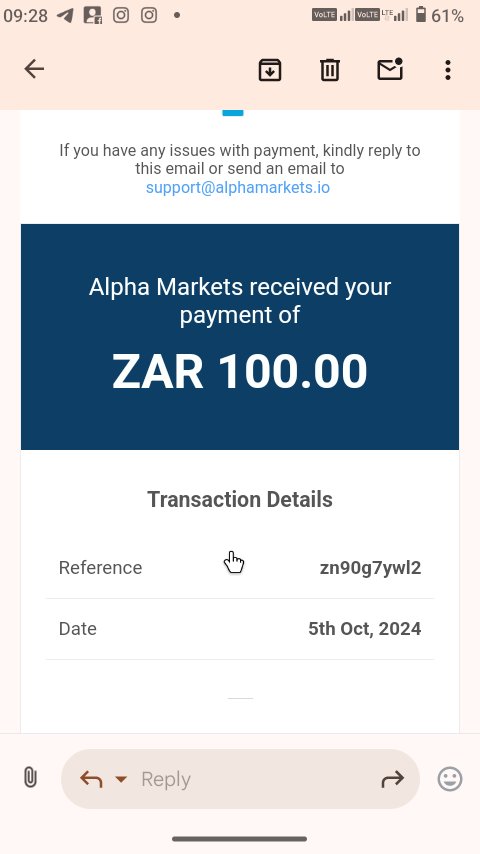

Alpha Markets offers a variety of Deposit & Withdrawal options to its users. For deposits, customers can choose from payment gateways like PayPal, Ozow, MasterCard, EFT, and Wire Transfer. Ozow is anonline payment service that allows instant smart EFT deposits with a minimum requirement of R100. Visa and MasterCard,as payment networks, facilitate electronic fund transfers between banks and financial institutions. Deposits made through Visa/MasterCard are processed instantaneously with a minimum amount of R100.

Trading Platforms

Alpha Markets offers traders the popular MetaTrader 5 (MT5) platform for their trading activities. With MT5, traders can access a wide range of financial instruments across various markets. The platform provides advanced charting tools, technical indicators, and order execution capabilities. Traders can enjoy leverage of up to 1:500 on all account types, allowing for potential amplification of trading positions. MT5 is known for its user-friendly interface, customizable features, and seamless integration with automated trading systems.

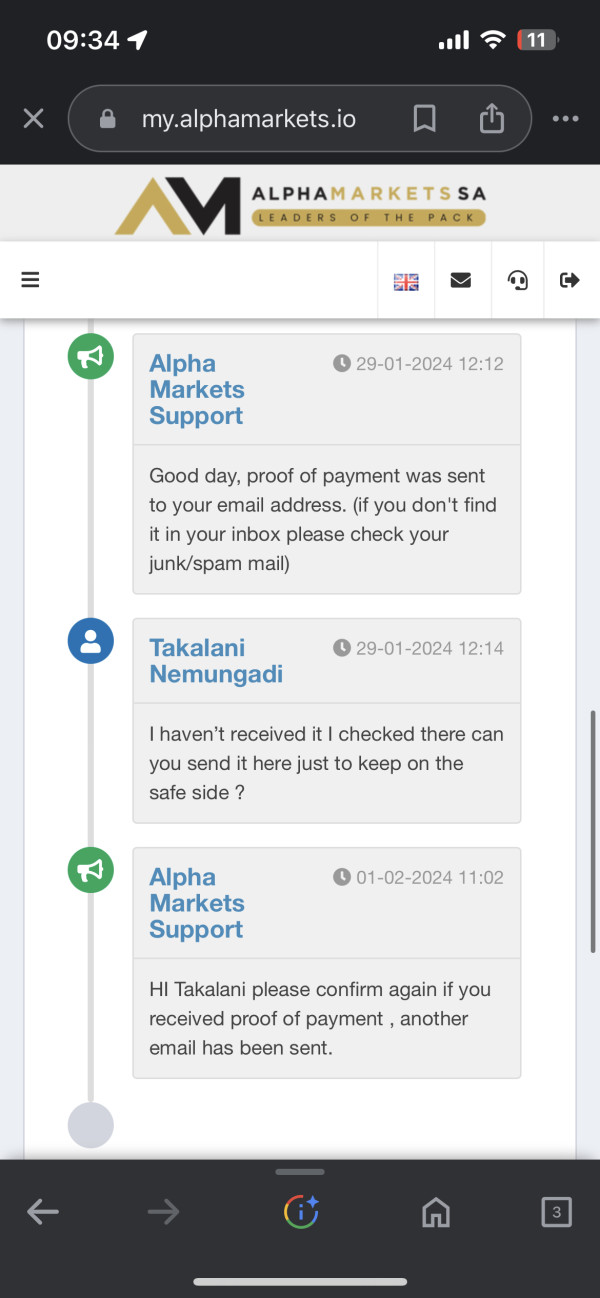

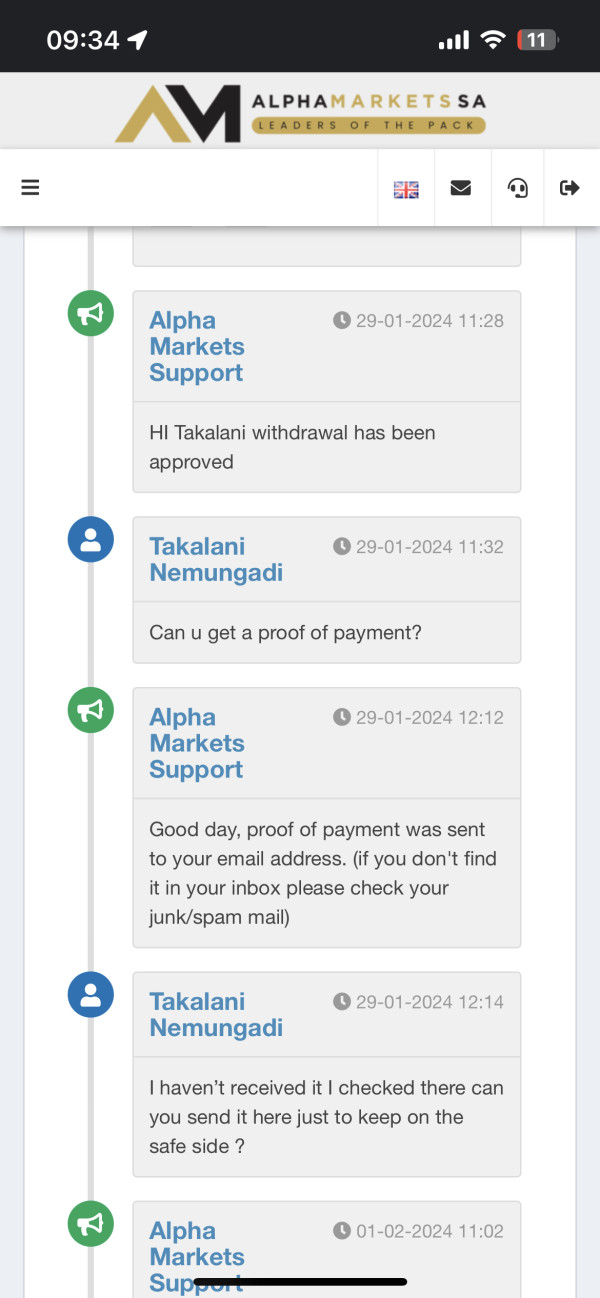

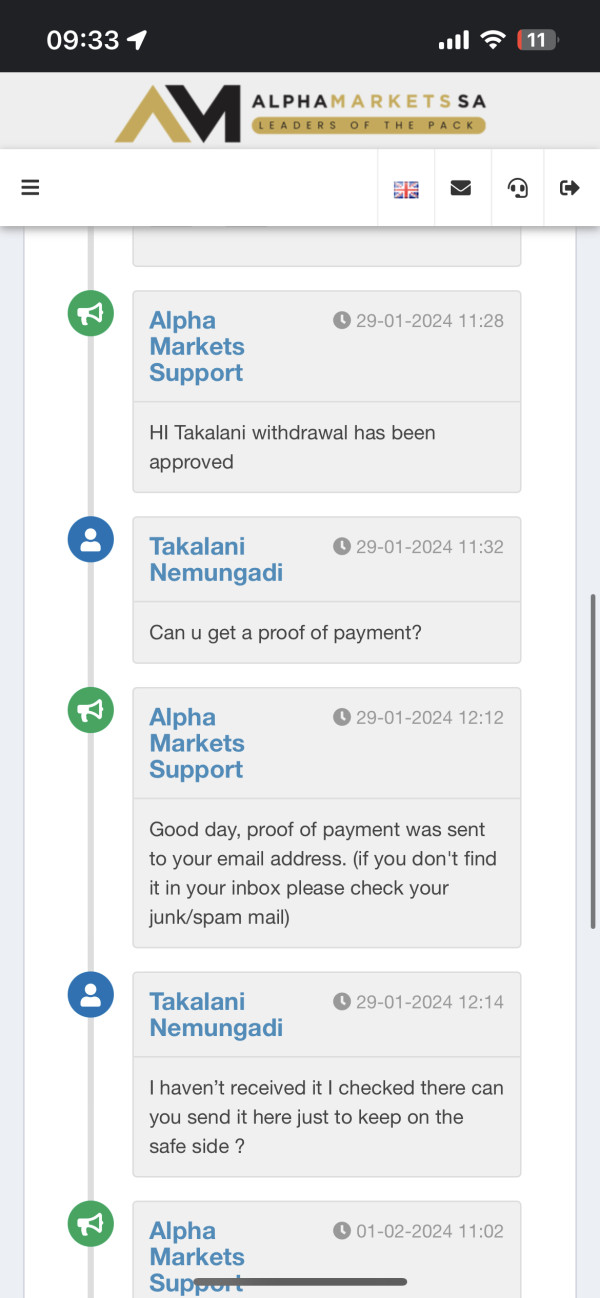

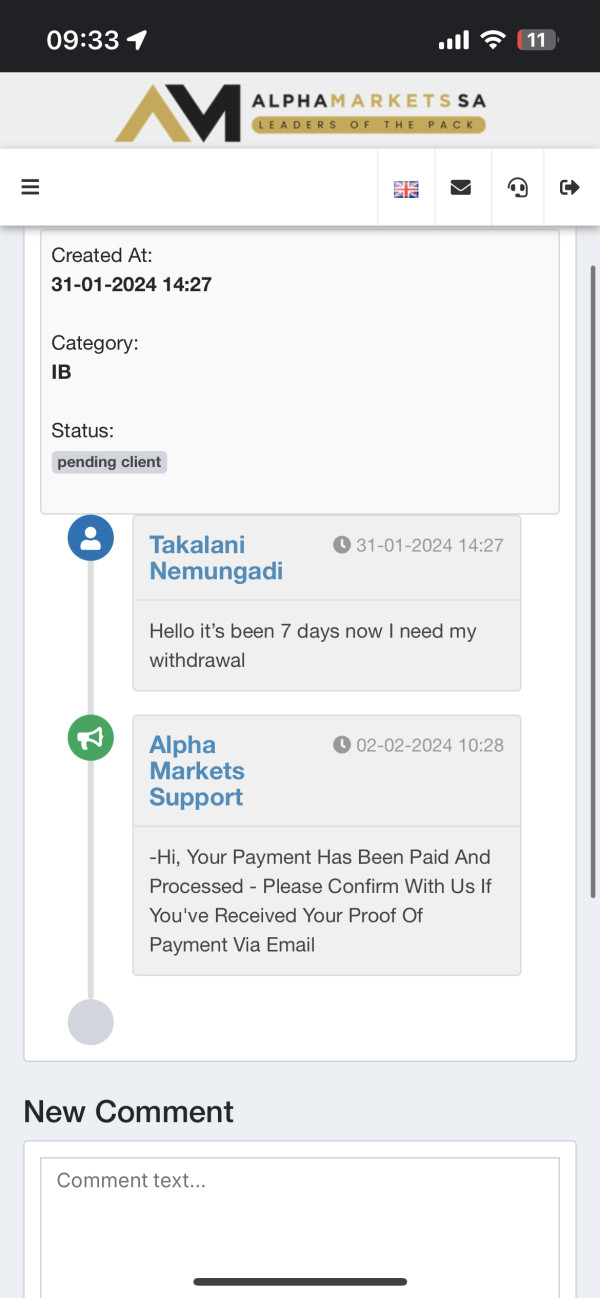

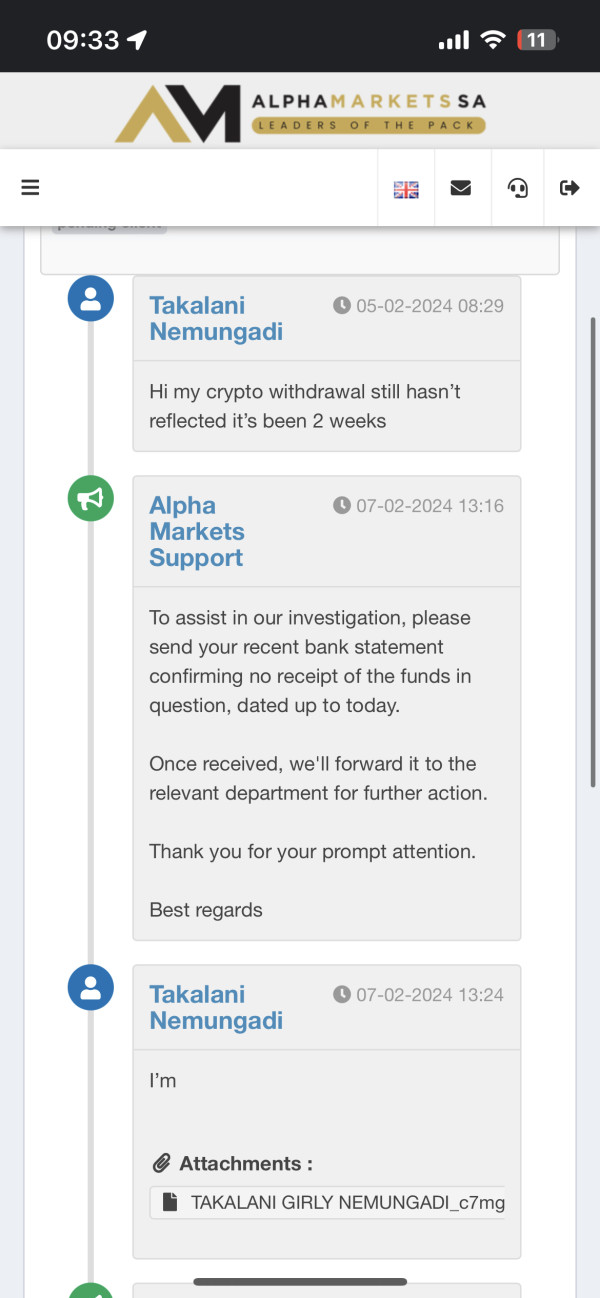

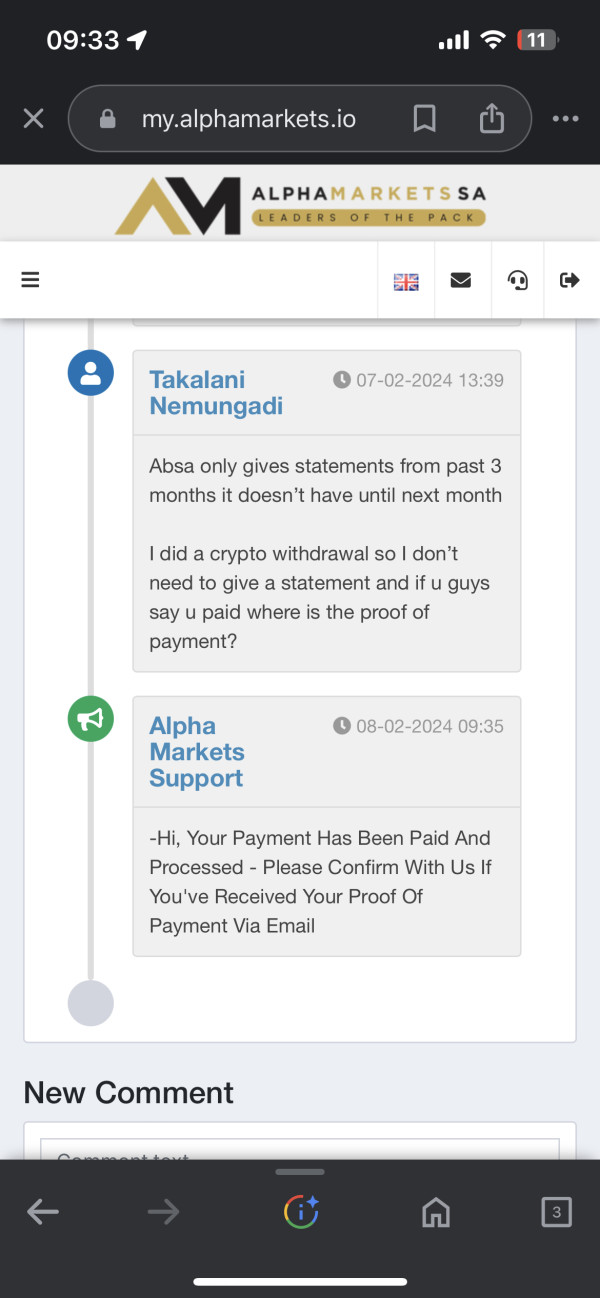

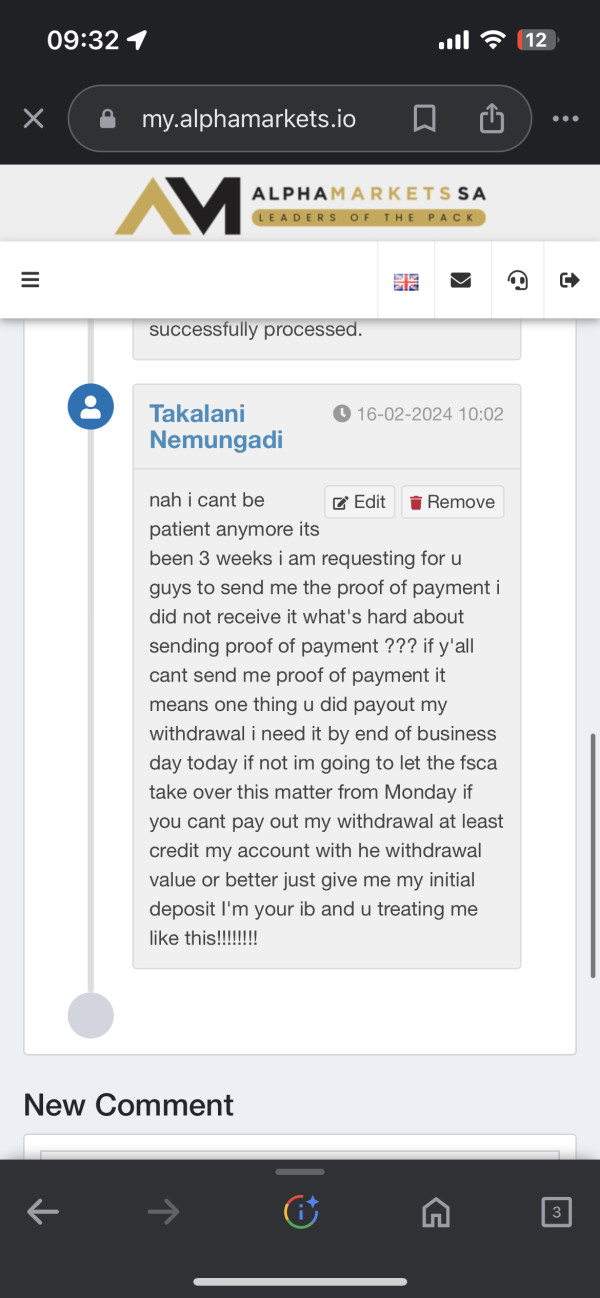

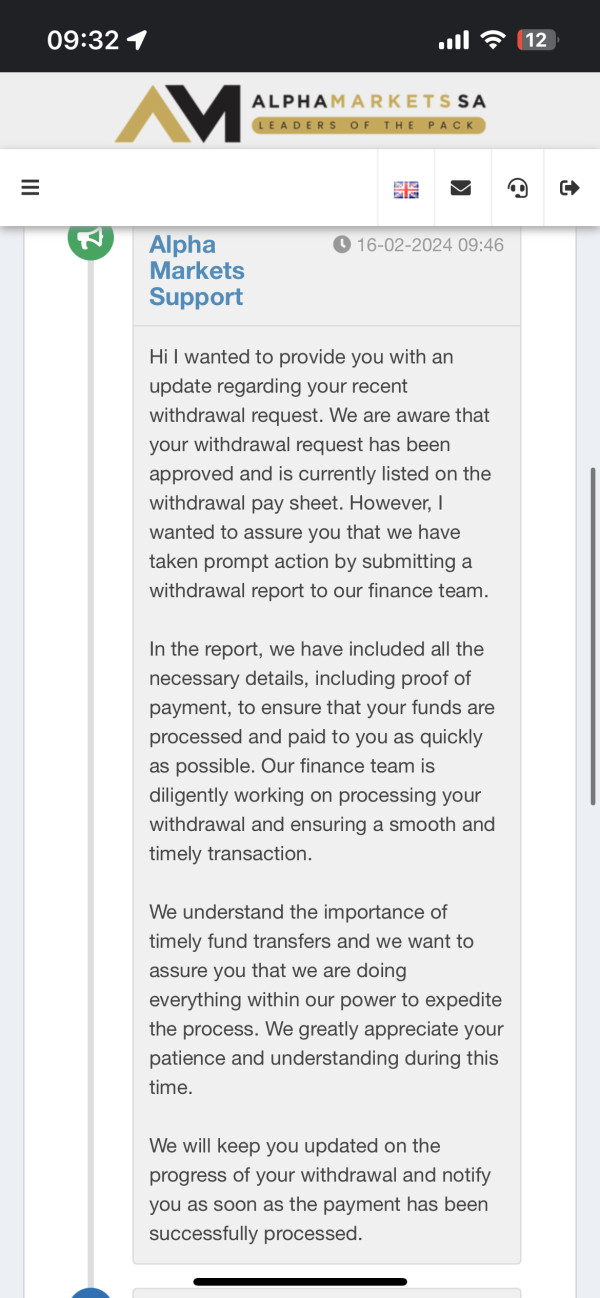

Customer Support

Alpha Markets provides customer support services to assist their clients. For any inquiries or assistance, customers can contact them via phone at +27 12 980 0035 or through email at Support@alphamarkets.io and info@alphamarkets.io. They also have a physical address located at Building B, 169 Corobay Ave, Menlyn, Pretoria, 0181. Additionally, customers can reach out to Alpha Markets through various social media platforms such as Facebook, Instagram, and TikTok. With these multiple channels of communication, Alpha Markets ensures that their customers have convenient options to connect with their support team and address any concerns or questions they may have.

Conclusion

In conclusion, Alpha Markets is a company that operates without regulatory oversight, which raises concerns about transparency and accountability. Customers may face increased risks and potential exploitation due to the absence of regulatory bodies to protect their interests. While Alpha Markets offers a variety of market instruments, such as CFDs, equity indices, precious metals, and energies, individuals should exercise caution when engaging with the company. The different account types provided by Alpha Markets cater to the diverse needs of traders, but it's important to note that the company lacks regulatory backing. The leverage options, spreads, and commissions offered by Alpha Markets vary across account types, and traders should carefully consider the risks associated with high leverage and commission structures. The minimum deposit requirements for each account type are reasonable, but customers should be aware of the lack of regulatory oversight. Alpha Markets provides a variety of deposit and withdrawal options for convenience, but the absence of regulatory oversight may impact reliability. The trading platform offered, MetaTrader 5 (MT5), is user-friendly and provides access to a wide range of financial instruments. Customer support services are available through multiple channels, including phone, email, and social media platforms. In summary, while Alpha Markets offers market instruments and account options, individuals should exercise caution due to the lack of regulatory oversight and potential risks associated with trading with the company.

FAQs

Q: Is Alpha Markets a regulated company?

A: No, Alpha Markets operates without being subject to regulation, which raises concerns about transparency and accountability.

Q: What market instruments does Alpha Markets offer?

A: Alpha Markets offers CFDs, equity indices, precious metals, and energies for trading.

Q: What are the pros and cons of Alpha Markets?

A: Pros include diverse account types, leverage options, and access to the MT5 platform. Cons include lack of regulation and potential risks.

Q: What leverage options does Alpha Markets provide?

A: Alpha Markets offers leverage ratios of up to 1:500.

Q: What are the spreads and commissions at Alpha Markets?

A: Spreads start as low as 0.0 pips, and commission structures vary based on the account type.

Q: What is the minimum deposit at Alpha Markets?

A: Minimum deposit requirements range from $5 to $9, depending on the chosen account type.

Q: What are the deposit and withdrawal options at Alpha Markets?

A: Alpha Markets offers payment gateways like PayPal, Ozow, MasterCard, EFT, and Wire Transfer for deposits and withdrawals.

Q: What trading platform does Alpha Markets use?

A: Alpha Markets utilizes the MetaTrader 5 (MT5) platform, known for its user-friendly interface and advanced features.

Q: How can I contact customer support at Alpha Markets?

A: You can reach Alpha Markets via phone, email, or social media platforms for customer support.