BASIC INFORMATION

2011 saw the registration of NetoTrade in Belize (United Kingdom). This business, an international investment firm, offers a full range of services for trading on financial markets. Customers who work with NetoTrade receive the most recent online trading tools, educational resources, video courses, and qualified assistance. With NetoTrade, you can trade a variety of currency pairings, CFDs, stock indexes, and commodities. A forex broker company in the UK is called NetoTrade. A company that allows traders access to exchanges where they can buy and sell foreign currency is referred to as a forex broker.

LICENSES

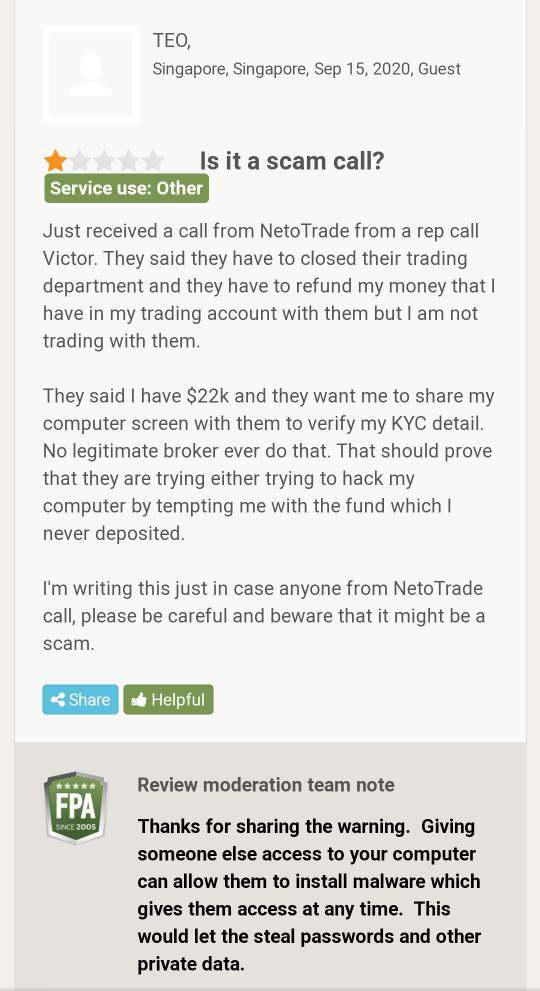

No valid regulatory information, please be aware of the risk

BUSINESS SCALE

Most brokers will offer a variety of trading products from the market. Cryptocurrency trading is a new trend that is gaining traction.

The numerous kinds of cryptocurrencies include the following: Bitcoin (BTC), the digital currency with the largest market capitalization and highest price levels since its launch in 2008, is the most well-known of them. It has half of the market capitalization of all cryptocurrencies.

The second-largest cryptocurrency after Bitcoin, Ethereum (ETH), allows programmers to build smart contracts on a platform.

Litecoin (LTC), a different cryptocurrency, is comparable to Bitcoin but has a different level of scalability. Another well-known alternative currency is Litecoin (LTCUSD), which forked off from Bitcoin (BTCUSD) with certain modifications and started a new project.

Large banks like Ripple (RPL) because of its next group real-time gross settlement technology and network. It offers traders fast, low-cost cross-border fund transfers.

Last but not least, Bitcoin Cash (BCH), a new version of the blockchain with different regulations, was created by the Bitcoin hard fork in 2017.

Commodity markets, which provide traders with a variety of asset opportunities, make up your other market instruments. During periods of inflation or economic unpredictability, investing in contract-based tradable products is a guaranteed strategy to reduce risk.

Another safe investment for traders is precious metals. This entails trading in hard commodities like gold and other precious metals.

Your energy goods are much riskier since they are impacted by political and environmental circumstances. However, the high supply and demand make it a well-liked trading option.

The typical currency exchange market, where people, businesses, and financial organizations exchange currencies for one another at variable exchange rates, is where currency trading, also known as Forex trading, currency trading, or FX trading, takes place.

ACCOUNTS WITH NETOTRADE

The broker often provides the trader with a forex account that is used only for trading various currencies and financial instruments.

The quantity and kind of accounts that a trader may open with a broker firm typically vary depending on the broker or nation in where they conduct business.

The regulatory authorities that the broker would fall under often come from their place of residency.

Types of Accounts and their Features

There are numerous options for accounts at NetoTrade:

Mini Account: This account type, which is accessible on all platforms and was created for novice traders, has a minimum deposit requirement of $500 USD, spreads that start at 3.3 pips, and a maximum leverage of 1:400.

Gold Account: This account type is for beginning traders who need more benefits than the small account provides.

The minimum deposit amount is 5000 USD, the minimum spread is 2.2 pips, and the highest leverage is 1:400. It also includes access to all trading platforms, a personal account manager, and all educational resources.

The ECN Account was created with experienced and professional traders in mind. It has a maximum leverage of 1:400, spreads that start at 0.3 pips, and a 5000 USD minimum deposit requirement.

Additionally, all platforms, learning resources, and technical analysis reports are at your disposal.

A personal account manager, access to all trading platforms, and all instructional and research tools, including technical analysis reports and real-time market updates, are all included with the Platinum Account, which was created specifically for experienced traders.

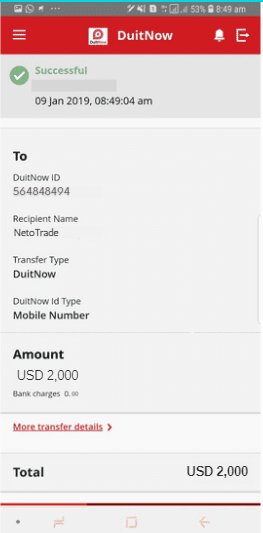

DEPOSIT AND WITHDRAWAL

You will discover that each Forex broker offers several options for depositing money and withdrawing it after you establish an account with them.

Visa, Mastercard, CashU, and Wire Transfer are the available deposit and withdrawal options at NetoTrade.

There is a maximum deposit per week of 20,000 USD and the minimum amount that can be deposited or withdrawn is 100 USD at a time.

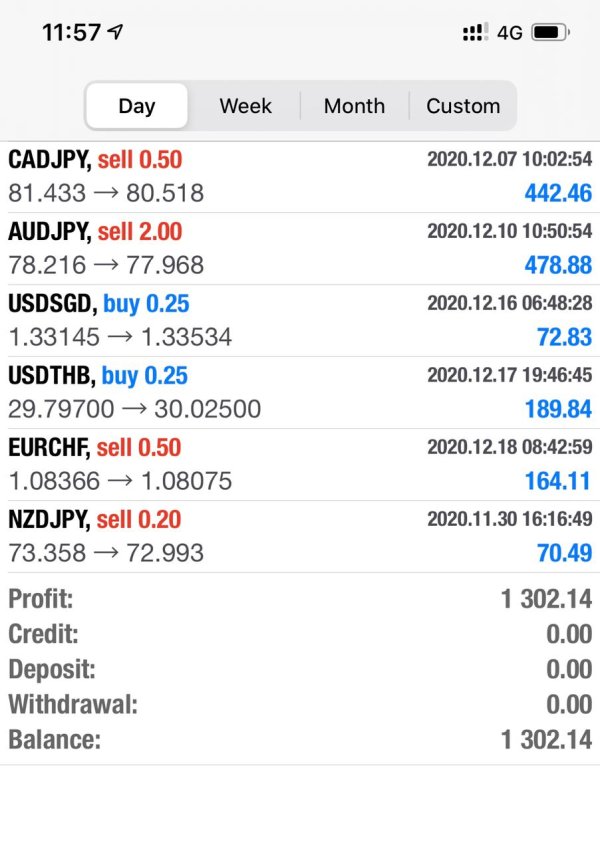

Cost and Fees, Commissions and Spreads

Each broker levies a unique set of fees, including commissions, spreads, and margins. Before choosing to trade with a broker, traders should be aware of the specific costs involved.

The definitions of a spread, margin, and commissions are as follows: The difference between the bid and asking rates is the spread of a currency pair.

The smallest change in an exchange rate is measured in pip. For currency pairs with the JPY as the term currency, a pip is 0.01; for all other pairs, it is 0.0001.

A margin denotes the sum of money required in your account to open a location.

The amount of margin to be used is determined by the exchange rate of the base currency to the US dollar, the size (volume) of the position, and the amount of leverage being used on your trading account.

The fees a broker charges a client for executing trades on the client's behalf are known as commissions. The commission rates charged by different brokers will vary, and it will also depend on the various services, accounts, and trades that brokers do.

However, there are brokers who merely handle transactions; they do not provide direct advice on individual investments. These brokers have substantially lower commission fees, but the traders are completely responsible for their market-trading decisions.

Trading in contracts for differences (CFDs) enables traders to wager on the increasing or decreasing prices of swiftly varying international financial markets. Commission is paid when shares are traded in this manner.

The market price of a certain item is wrapped in a spread even if CFD trading on various markets carry no commission. Depending on the type of account you have, NetoTrade offers a variety of spreads:

The spreads for the Mini Account begin at 3.3 pip, for the Gold Account at 2.2 pip, for the ECN Account at 0.3 pip, and for the Platinum Account at 1.8 pip. NetoTrade does not impose a commission fee on trades.

Trading Platforms, Software, and its Features

Different trading software is offered to customers by brokers. It is utilized to execute deals and is sometimes referred to as a trading platform.

A platform may support many asset classes, enabling customers to trade not only forex but also CFDs on equities, stock indices, precious metals, and cryptocurrencies.

When picking a broker, one of the criteria is the platform, which is mostly determined by the type of trading a client wants to do.

Both its own web-based platform and MetaTrader4 are available to NetoTrade's clients.

Leverage

Leverage is the ability that will enable a trader to gain greater exposure to the market than the sum a trader deposited to begin a trade. Leveraged products increase a traders prospective revenue – yet also create a risk for loss.

The sum of leverage is conveyed as a ratio, for instance, 50:1, 100:1, or 500:1. For example, if a trader has $1,000 in his trading account and is trading ticket sizes of 500,000 USD/JPY, this leverage will compare to 500:1.

NetoTrade offers its clients maximum leverage of up to 1:400

Customer Support

Prospective traders have to be assured that whoever they choose to invest with will give them the required support and assistance whenever and wherever they might need it.

You can reach the NetoTrade customer support team via email, telephone, or through the live chat available on their website. They are available to the public 24 hours a day, seven days per week.