Overview of Retela

Retela Crea Securities, with a robust legacy, provides a reliable platform for investors interested in both domestic and foreign stocks, bonds, and various other financial instruments. With a focus on client-centric services like family assistance and customer referral discounts, Retela strives to offer value-driven services to its clientele. Its regulatory framework under the FSA and a diverse portfolio establish it as a reputable entity in the financial market.

Is Retela Legit or a Scam?

Retela Crea Securities operates under strict regulation by the Financial Services Agency (FSA) of Japan, lending it a high level of credibility. The existence of a regulatory certificate number reinforces its legitimacy. While this does not entirely eradicate the inherent risks associated with financial transactions, it does significantly mitigate concerns of illicit activities or fraudulent practices.

Pros and Cons

Pros:

Regulated Security: Regulated by the Financial Services Agency, ensuring a secure and compliant environment for investments.

Diverse Investment Options: Offers a wide range of financial instruments, catering to different investment preferences.

Customer-Centric Services: Provides valuable services like family assistance and customer referral discounts.

Educational Resources: Offers educational seminars and video content to empower investors with knowledge.

Cons:

Complex Fee Structure: Features various commissions and fees, which can be confusing for some investors.

Market Focus: Primarily centered on the Japanese market, potentially limiting global investment opportunities.

Language Barrier: Non-Japanese speakers may face language challenges when dealing with the company.

Limited Online Support: The company may not fully support online transactions, which can be inconvenient for busy individuals.

Market Instruments

Retela Crea Securities offers a plethora of market instruments encompassing domestic and international stocks, investment trusts, personal government bonds, and foreign currency bonds. This diversity allows investors to have a well-rounded portfolio, ensuring a balance between risk and reward.

How to Open an Account?

Opening an account with Retela Crea Securities is made simple, even for first-time users, with their guidance and support.

Contact Retela: Reach out to Retela Crea Securities by calling 03-6385-0611 to begin the account opening process.

Prepare Documents: Gather identity verification documents, such as a driver's license, passport, or resident card (with personal number), with your name, address, and date of birth.

My Number: Ensure you have your My Number ready, which can be found on documents like the individual number card (back side) or notification card.

Contact Sales Staff: Get in touch with Retela's sales staff to either schedule a visit, visit a branch in person, or send your application by mail.

Complete Application: Depending on your preference, complete the application process face-to-face with their staff or by sending it via mail. During this process, they will guide you through the paperwork, explain terms, and address any questions you may have.

Leverage

Retela Crea Securities offers competitive leverage options to cater to a diverse range of investors. Depending on the type of account and financial instrument, leverage can vary from 1:50 to 1:500.

This means that with a relatively small initial investment, traders can control larger positions, potentially amplifying both gains and losses. It's important for traders to carefully consider their risk tolerance and trading strategy when selecting their preferred leverage level.

Spreads & Commissions

The spreads at Retela Crea Securities are market-competitive, with major currency pairs typically starting as low as 0.1 pips. This low spread structure helps traders minimize their trading costs and potentially enhance their profitability.

Commissions vary depending on the type of account and trading activity. For example, on standard accounts, there are no commissions for forex trading, while on premium accounts, a small commission fee is applied to each trade. Additionally, for other financial instruments like CFDs and indices, Retela charges competitive commission rates.

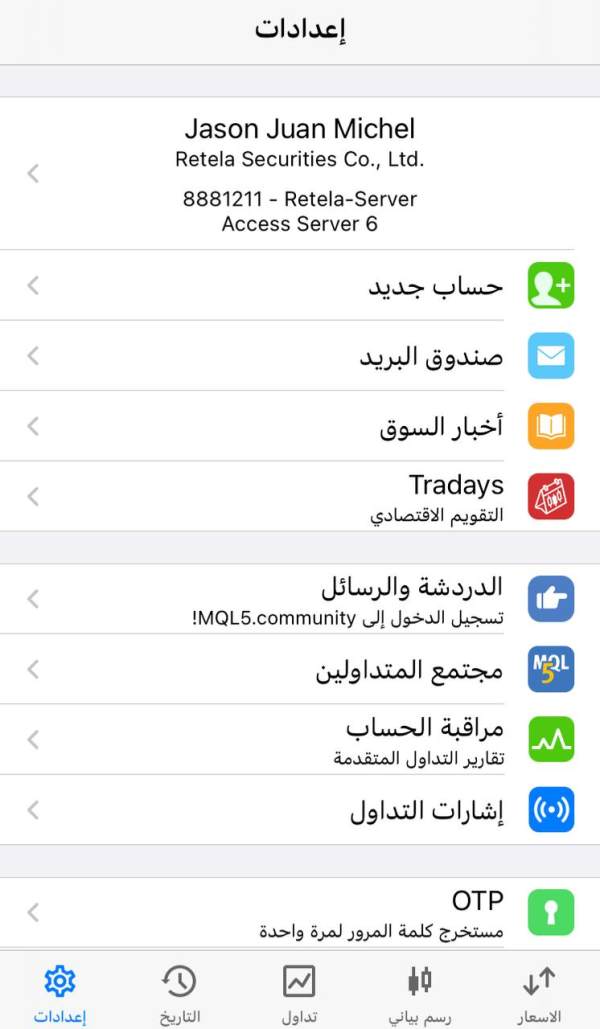

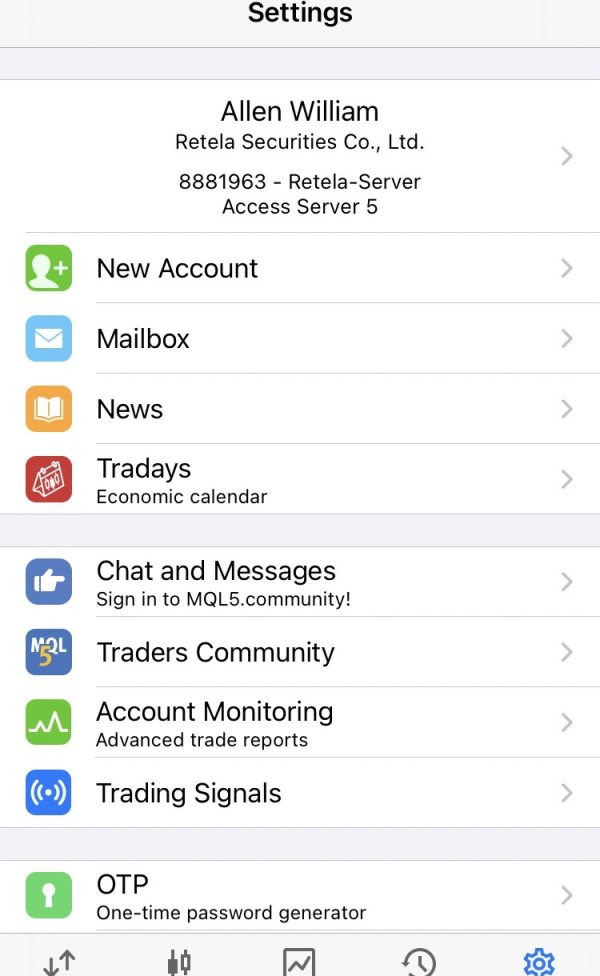

Trading Platform

Retela Crea Securities provides access to a cutting-edge trading platform designed to cater to the needs of both beginner and experienced traders. The platform offers a user-friendly interface with advanced charting tools, technical indicators, and customizable layouts. Traders can execute orders swiftly and efficiently, and the platform is accessible via web browsers, mobile devices, and desktop applications, ensuring seamless trading experiences across various devices.

Deposit & Withdrawal

Retela Crea Securities offers a wide range of secure and convenient deposit and withdrawal options to accommodate the needs of its clients. Clients can fund their accounts via bank transfers, credit/debit cards, and popular e-wallets like PayPal and Skrill.

Withdrawals are processed promptly, typically within 1-2 business days, and are facilitated through the same methods used for deposits. The company places a strong emphasis on the security and integrity of financial transactions, implementing robust encryption and authentication measures.

Customer Support

Retela Crea Securities offers comprehensive customer support through multiple contact points to address various needs. Their main store in Tokyo, Osaka Branch, Himeji Branch, Toyooka Branch, Tsuruga Branch, and Ageo Branch provide in-person assistance and bank transfer details, ensuring accessibility for clients across Japan. The Compliance Department and Recruitment-related inquiries can be directed to the main store as well.

Furthermore, for specific compliance-related concerns, the Compliance Department can be reached directly. In addition to these avenues, clients can contact the Japan Securities Dealers Association Personal Information Consultation Office for matters related to certified personal information protection organizations. This diverse and well-distributed network of support demonstrates Retela Crea Securities' commitment to serving its clients effectively.

Risk Warning

Retela Crea Securities, like all financial institutions, is subject to market risks arising from price, interest rate, and exchange rate fluctuations. The possible loss may exceed the investment principal depending on the product or transaction. Additionally, foreign currency bonds involve country risks which might cause losses due to political, economic, and social turmoil in the investee country. Investors should meticulously assess the risks and their risk tolerance before engaging in any financial transactions with Retela Crea Securities.

Educational Resources

Retela Crea Securities offers a robust array of educational resources to empower its clients with financial knowledge. Their educational initiatives encompass seminars and video content, designed to demystify the complexities of asset management, making it accessible even to newcomers. Moreover, they provide specialized guidance on NISA (Nippon Individual Savings Account), a tax-efficient investment option in Japan. These resources not only equip investors with essential information but also enable them to make informed decisions, fostering a deeper understanding of financial markets and strategies.

Conclusion

Retela Crea Securities, with its rich history and diverse portfolio of financial instruments, presents a regulated and credible platform for financial trading. The company offers varied financial instruments and is recognized for its customer-centric services. However, potential investors should be cognizant of the inherent risks and should carefully review the fee structure, account types, and leverage offered. For a comprehensive understanding and to address any uncertainties, it is always prudent to refer to the official communications of Retela Crea Securities or directly consult with their customer support representatives.

FAQs

Q: How can I open an account with Retela Crea Securities?

A: To open an account, please contact our sales staff, visit one of our branches, or send your application by mail. Our team will guide you through the process.

Q: What regulatory authority oversees Retela Crea Securities?

A: Retela Crea Securities is regulated by the Financial Services Agency (FSA) of Japan, ensuring a secure trading environment.

Q: What trading instruments are available at Retela Crea Securities?

A: We offer a diverse range of instruments, including domestic stocks, foreign stocks, investment trusts, personal government bonds, and foreign currency bonds.

Q: What is the minimum initial deposit required to start trading?

A: The minimum initial deposit varies based on the account type. For instance, our Standard Account requires a minimum deposit of $1,000, while our Premium Account necessitates $10,000.

Q: Can you provide information on leverage options?

A: Leverage varies by instrument; for example, Forex trading offers leverage of up to 1:500, while CFDs provide leverage up to 1:100.

Q: What trading platform does Retela Crea Securities offer?

A: Our trading platform is user-friendly and equipped with advanced charting tools. It's accessible via web browsers, mobile devices, and desktop applications for your convenience.

Q: What are the available deposit and withdrawal methods?

A: You can fund your account through bank transfers, credit/debit cards, and popular e-wallets like PayPal and Skrill. Withdrawals are processed promptly using the same methods used for deposits.

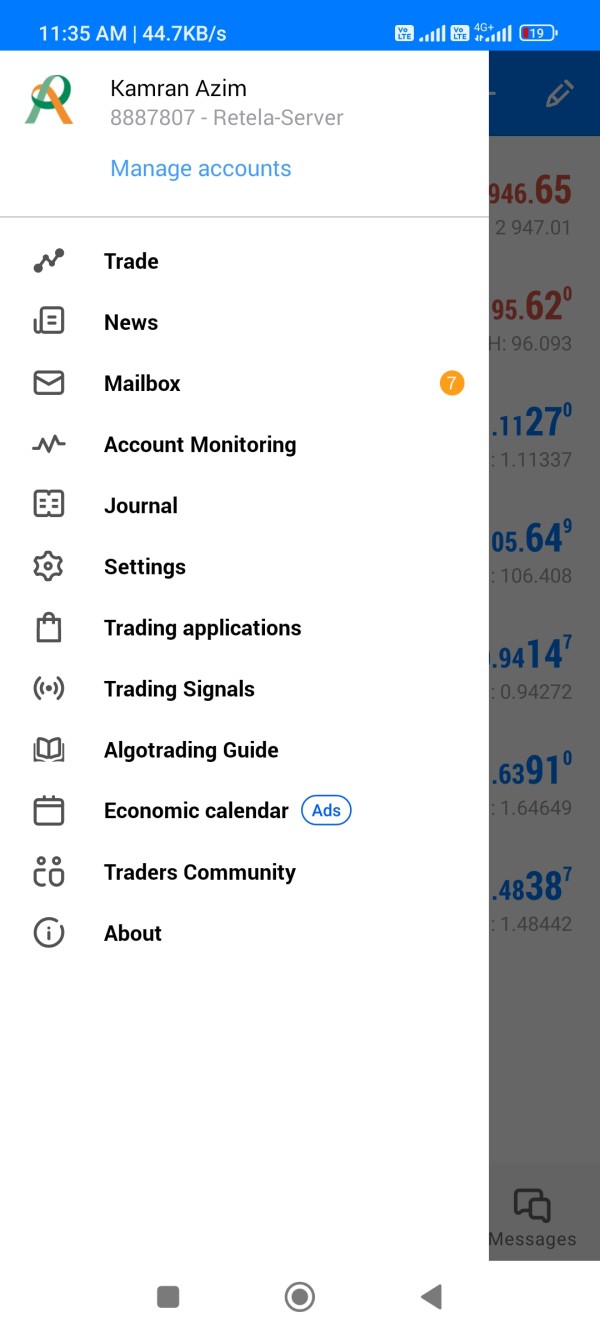

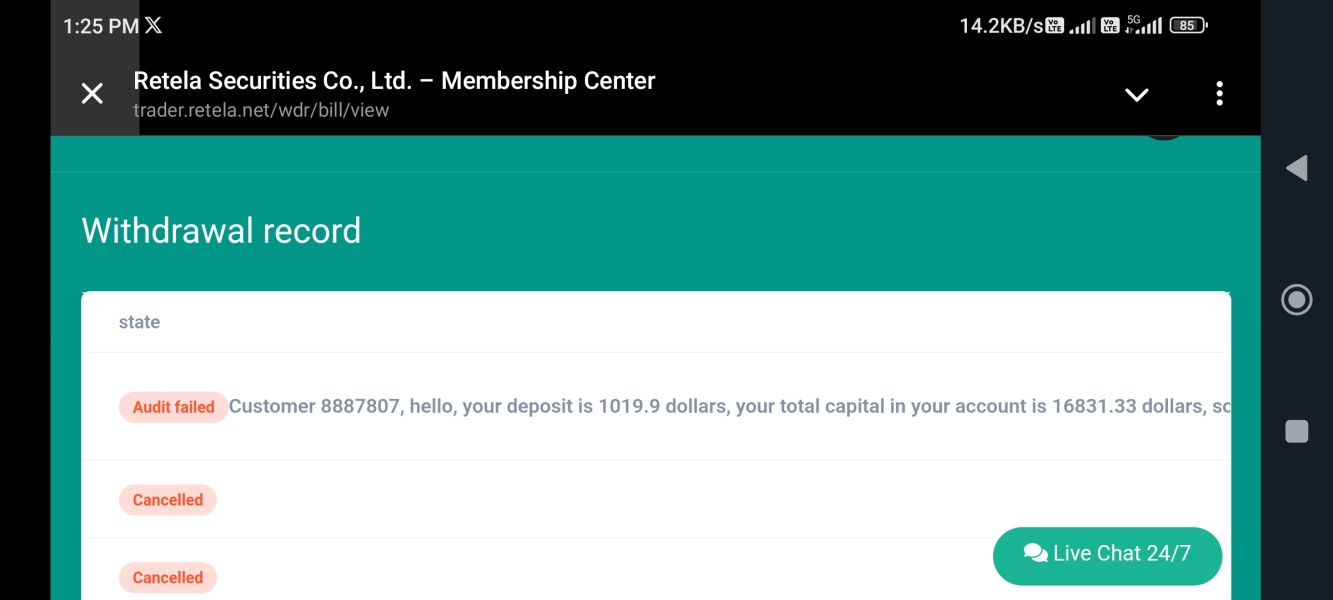

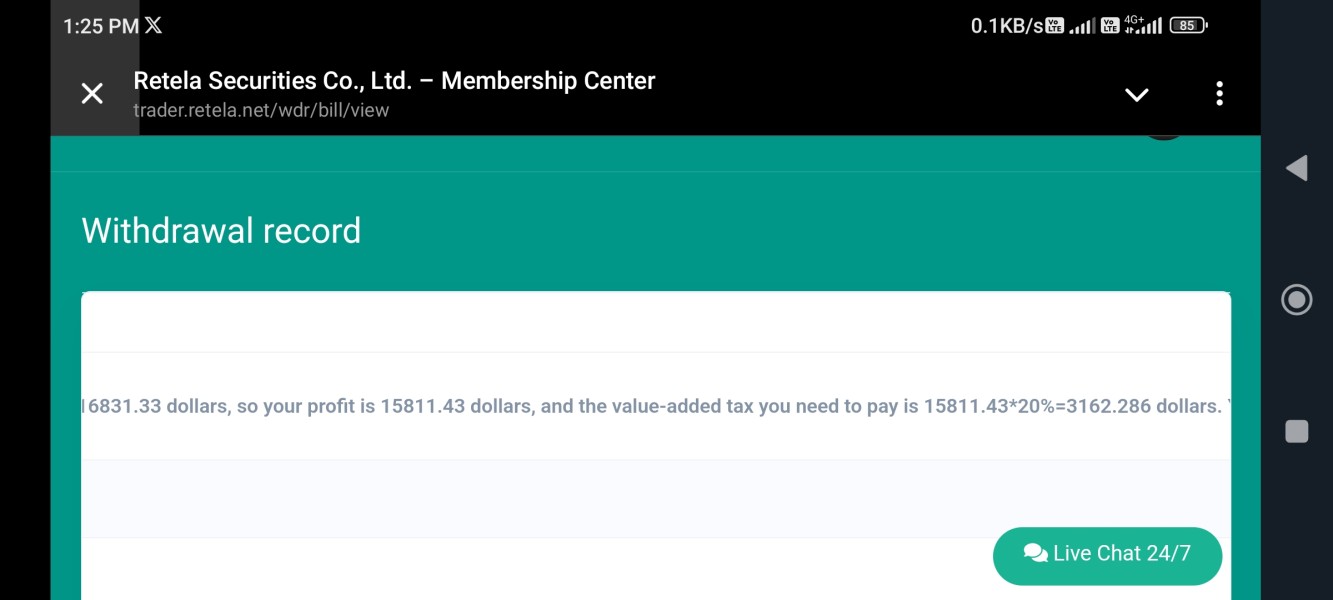

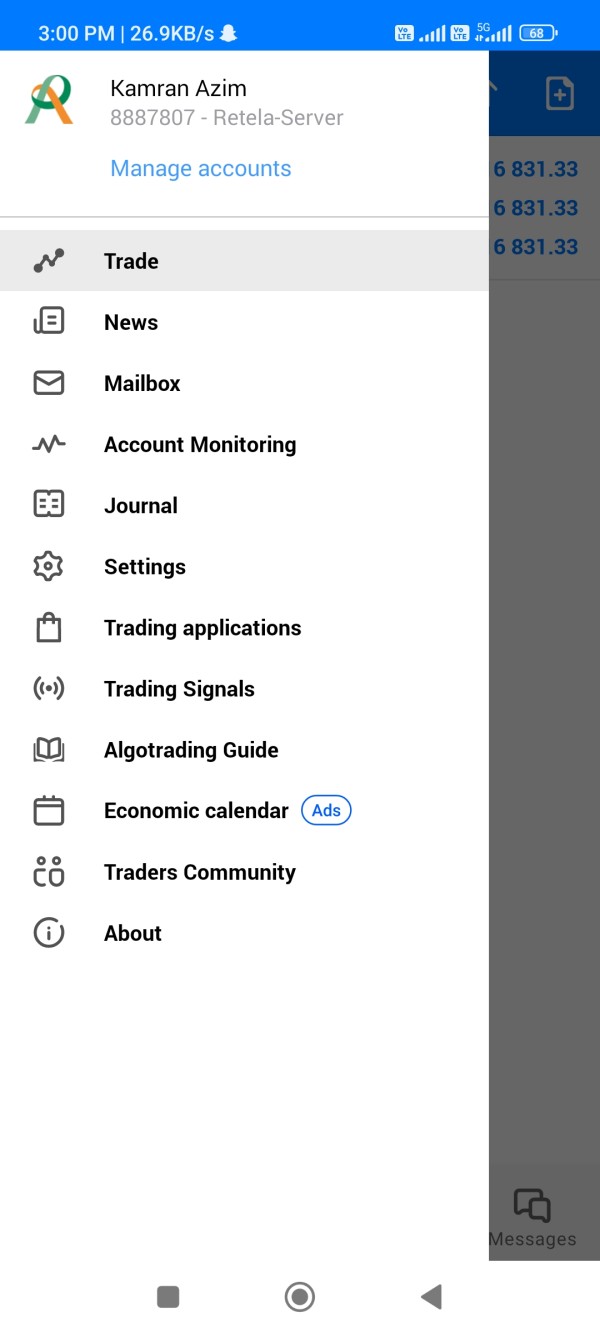

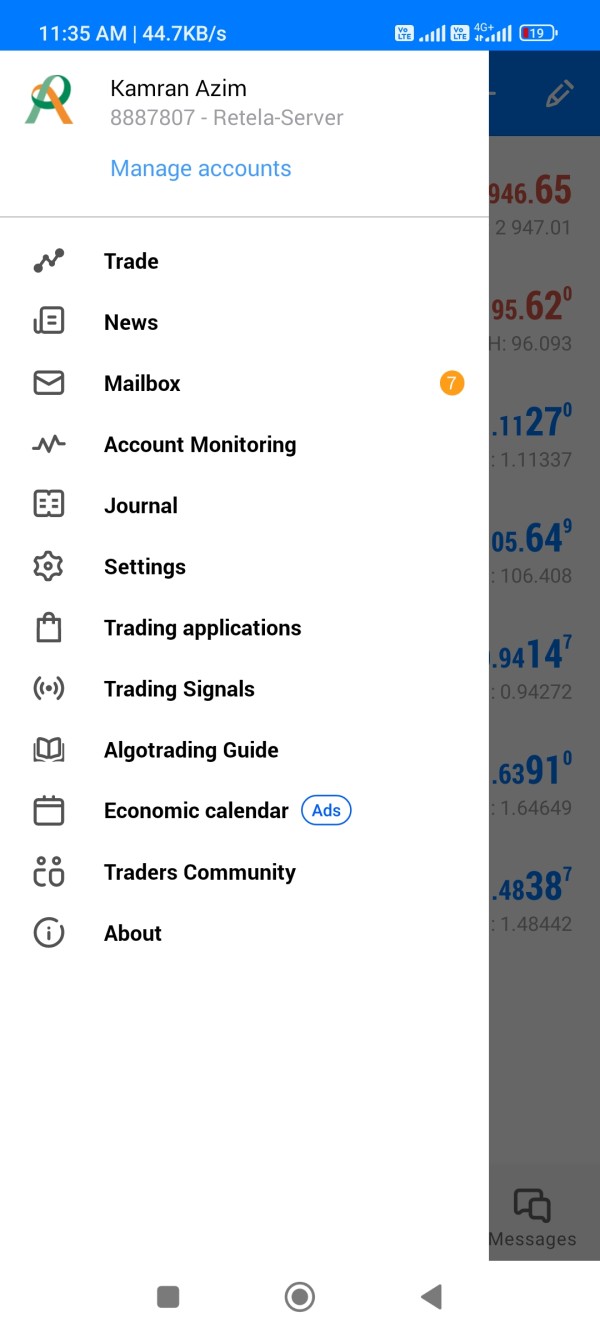

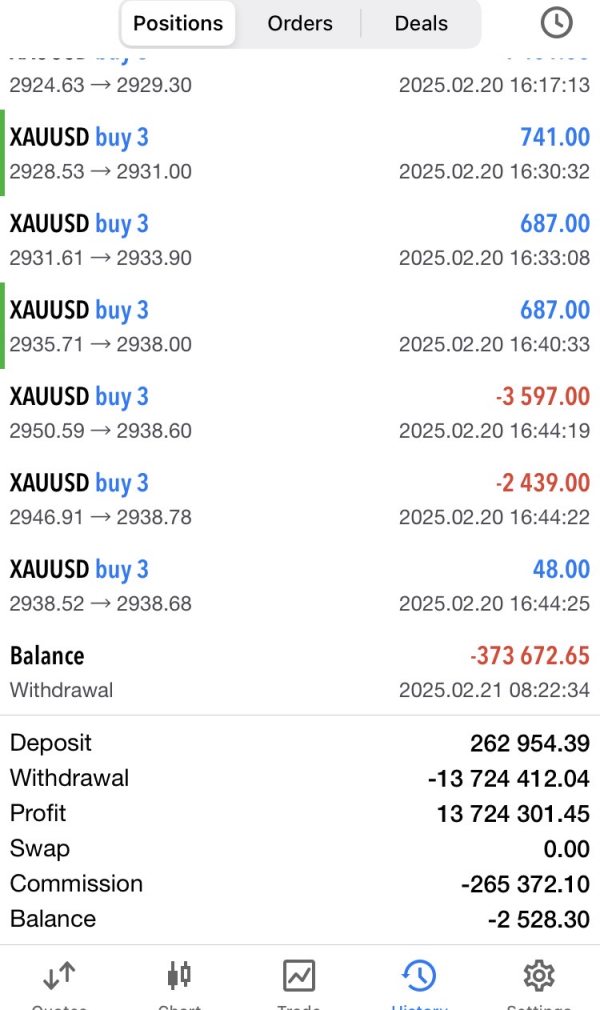

kamran azim

India

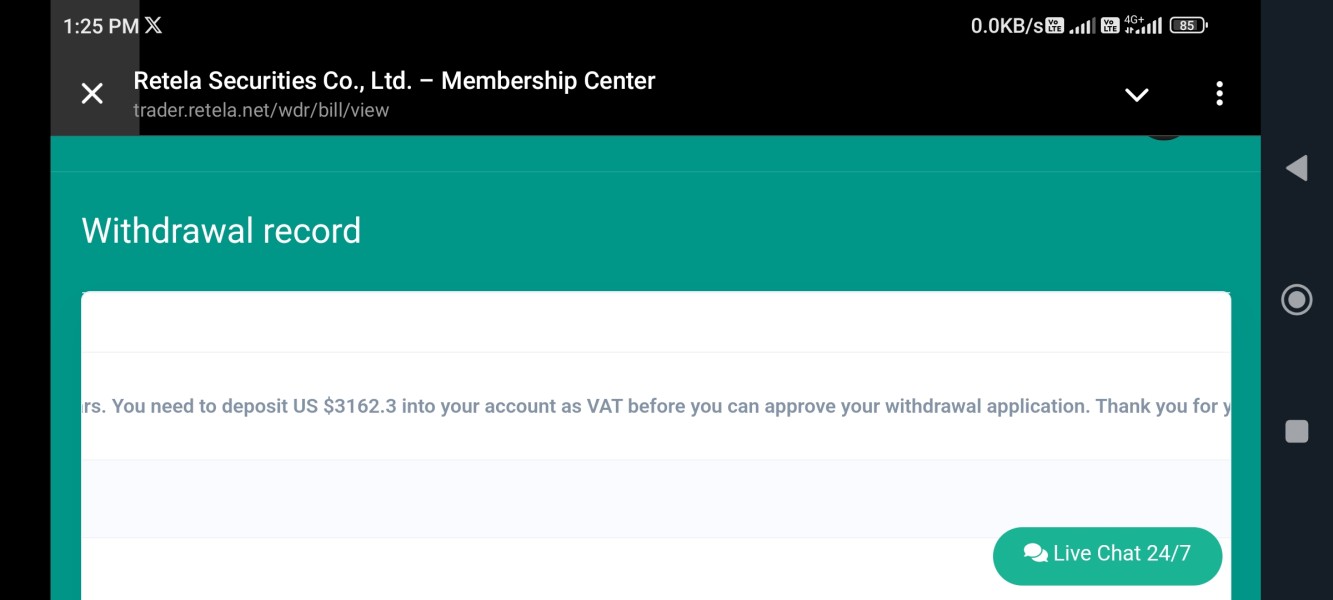

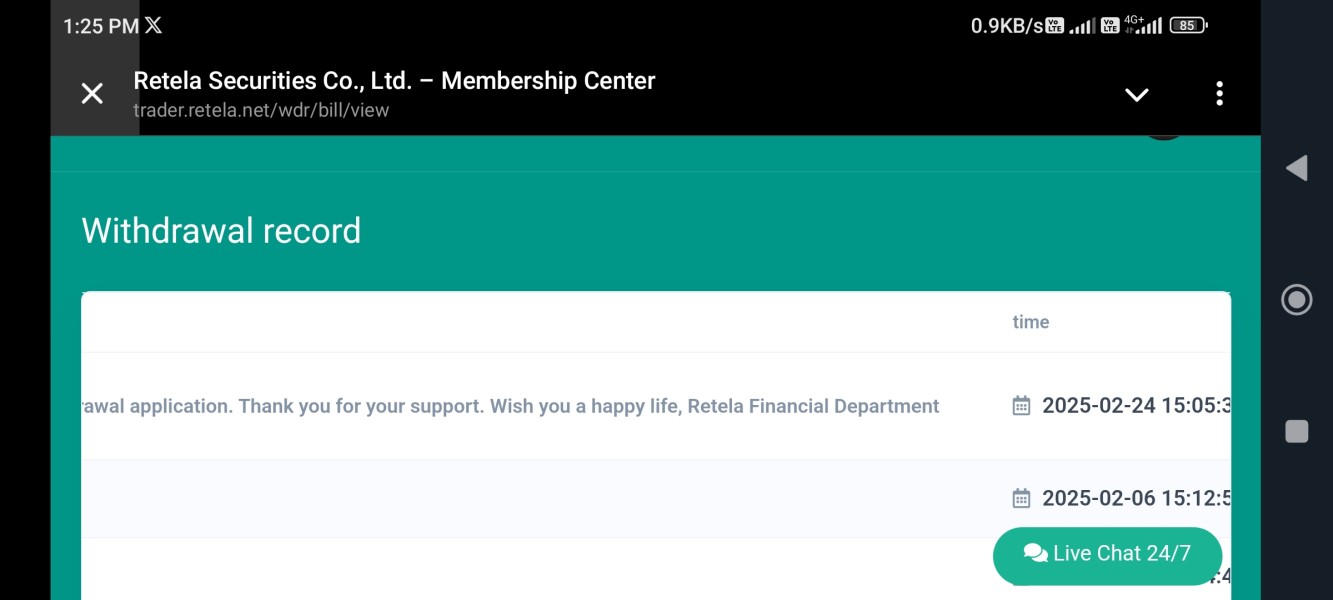

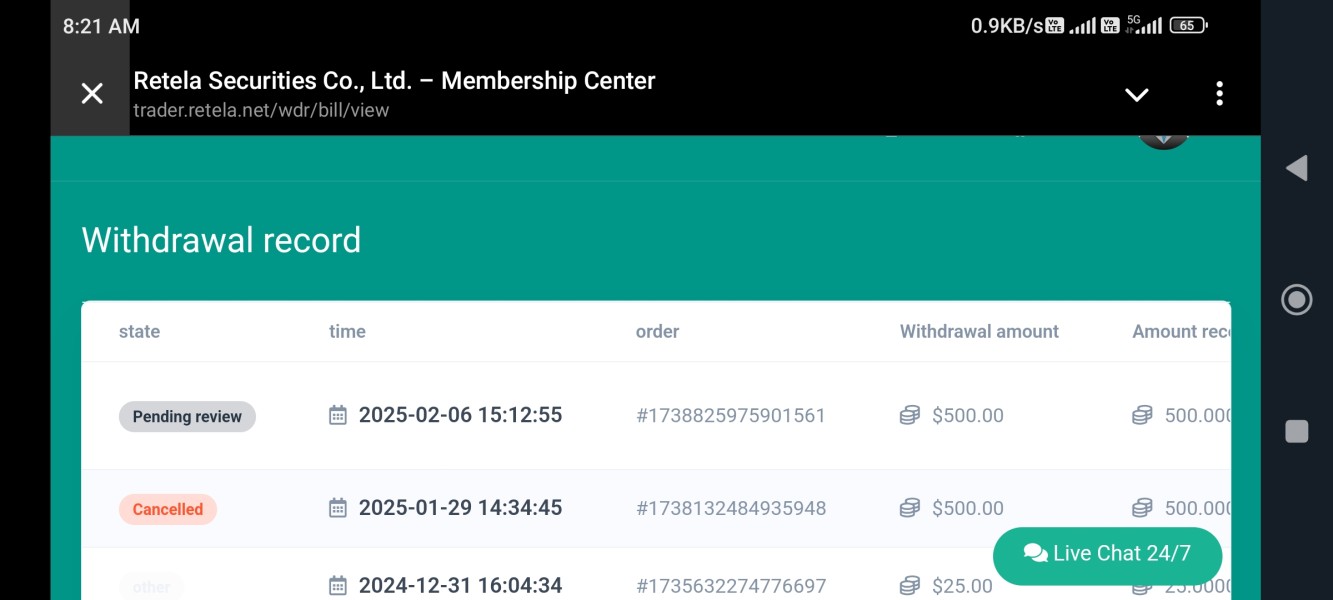

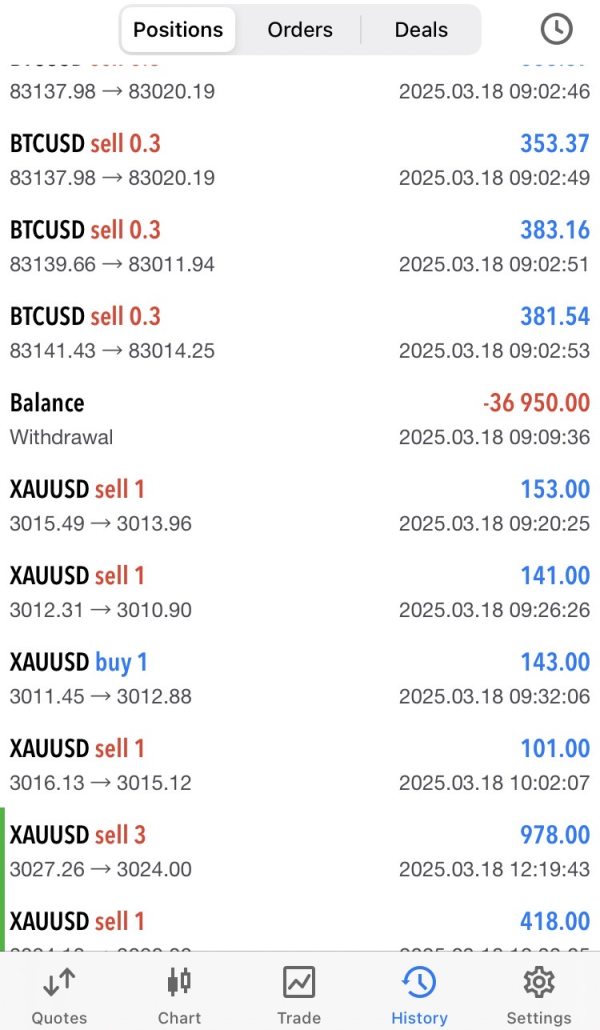

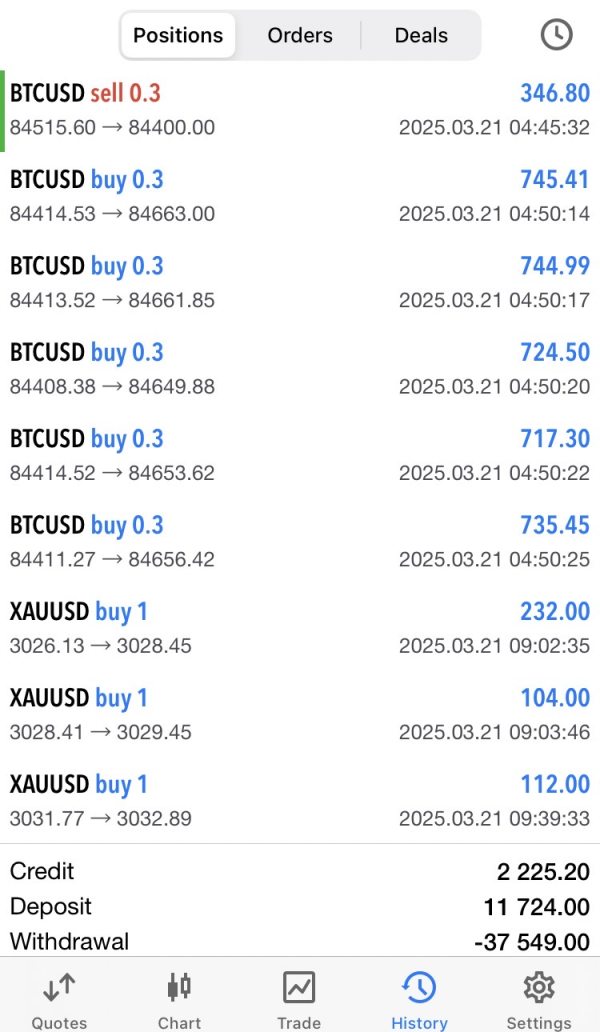

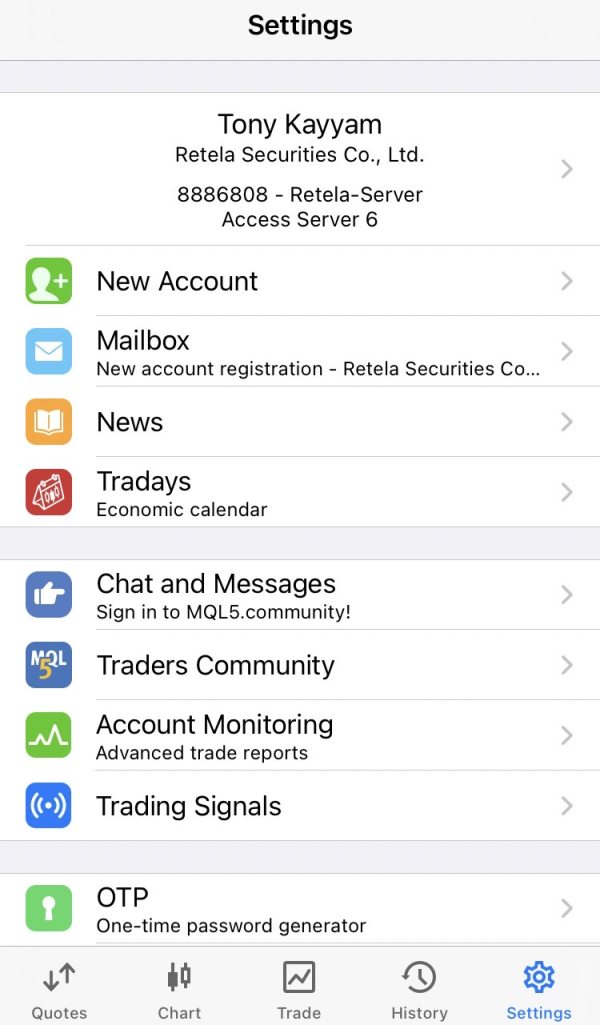

I hope this letter finds you well. I am writing to formally raise a complaint regarding persistent issues I have encountered with withdrawing my funds from my trading account with [RETELA BROKER JAPAN]. My account details are 8887807, Broker wants extra money Deposit Than Withdrawal, Despite making several attempts to withdraw my funds, I have experienced significant delays and have yet to receive the requested funds. I have followed all necessary procedures for withdrawal and provided any requested documentation. However, the situation remains unresolved, and I have received minimal or no communication explaining the reasons for these delays.

Exposure

02-26

kamran azim

India

I had placed a withdrawal request on February 6 but my request has not been approved yet, Customer care support is very bad. I keep asking questions all day long. I keep sending messages. There is no response from the support team.

Exposure

02-20

FX2634640402

Ireland

I have joined this broker for more than a month, the profit is very considerable, and there is no problem in withdrawing money. I will increase the capital investment later, a very good broker.

Positive

03-21

FX3030633912

United States

The rumor ends with the wise, and practice is the only criterion for testing the truth. Investment is risky, it is necessary to be careful to enter the market, choose professional and formal channels to invest, and doubling profits is not a dream.

Positive

03-14

Tolouei Mohammed

United Kingdom

This broker was recommended to me by Chen, a very professional gold trader. She said that the spread was very low, which was especially suitable for trading bitcoin and gold. I held the attitude of trying. The profit was very considerable. After I successfully withdrew the commission, I increased the funds of my account. I have been working with her for more than a year. During this period, there is also a need to increase funds to ensure the security of the account. In the end, there is a very good return. Thank you very much, Chen. There is no handling fee for withdrawals. When my business cash flow, I will continue to cooperate with her, and will introduce my friends to join us. Thank God.

Positive

03-13

FX3986917554

Ireland

I withdrew many times without any problem, without any fee, a very reliable broker.

Positive

03-12

无名小卒

Hong Kong

I have been used it for more than half a year and withdraw no fees.it’s very quickly and trust broker with lower spreads

Positive

03-10

FX1393969403

Malaysia

Retela is great. Remember that investing always carries risks, and it's essential to understand those risks before making any investment decisions. It's also important to have a well-diversified investment portfolio and to seek professional advice from a financial advisor before investing in any company or financial instrument.

Positive

2023-03-17

不€灭

New Zealand

Retela seems like a solid company, but the website is only available in Japanese, which prevents me from trading here. Can anyone recommend similar companies that offer English? I want to trade securities.

Positive

2023-03-10