Score

NGL

Hong Kong|5-10 years|

Hong Kong|5-10 years| http://www.nglfx.com/zh-cn/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Hong Kong

Hong KongUsers who viewed NGL also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

PU Prime

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

nglfx.com

Server Location

Hong Kong

Website Domain Name

nglfx.com

Server IP

156.255.2.244

Company Summary

| Key Information | Details |

| Company Name | NGL / New Goba International Investment Limited |

| Years of Establishment | 2-5 years |

| Headquarters | Hong Kong |

| Office Locations | N/A |

| Regulation | Unregulated |

| Account Types | N/A |

| Minimum Deposit | N/A |

| Trading Platforms | MetaTrader 4 |

| Customer Support Options |

Overview of NGL

New Goba International Investment Limited (NGL) is a company that has been operating in the financial services industry for 2-5 years. Based in Hong Kong, NGL is associated with the MetaTrader 4 trading platform. It is important to note that NGL operates without regulation, as it is unregulated. While specific information about their tradable assets, account types, minimum deposit, and deposit/withdrawal methods is not available, NGL offers customer support through QQ contact. Educational content and bonus offerings are not provided by the company.

Regulation

NGL's current status with the NFA is unauthorized. The National Futures Association (NFA) is the regulatory agency associated with New Goba International Investment Limited (NGL). NGL is labeled as unauthorized by the United States, under license number 0533158.

When a company is “Unauthorized” by the NFA, it means that it does not have the necessary approval or authorization to operate under the supervision of this regulatory body. This lack of authorization entails certain risks for clients and investors. It is important to note that the absence of NFA regulation means that the company is not subject to the oversight and compliance standards mandated by the NFA, potentially exposing clients to higher risks and potential lack of investor protection.

Risk Warning

New Goba International Investment Limited (NGL) operates as an unregulated broker, it is crucial to be aware of the inherent risks and disadvantages associated with such a company. Operating without regulatory oversight exposes clients to uncertainties and potential vulnerabilities. The absence of regulation means that NGL may lack accountability, transparency, and investor protection measures that regulated brokers adhere to. This may increase the likelihood of fraudulent activities, unethical practices, and potential financial losses. Moreover, the limited information provided about account types, minimum deposit, leverage, spread, deposit/withdrawal methods, and market instruments creates a lack of clarity and transparency, making it challenging for potential clients to assess the risks involved accurately.

Pros and Cons

As a potential upside, New Goba International Investment Limited (NGL) uses the MetaTrader 4 trading platform, which is widely recognized and utilized by traders worldwide, offering them familiarity and ease of use. Additionally, NGL provides customer support through QQ contact, which allows for direct communication and potential assistance.

One significant drawback of NGL is its unauthorized status with the National Futures Association (NFA), indicating a lack of necessary approval and oversight. Operating without regulation exposes clients to increased risks and potential vulnerability, as the company is not subject to regulatory compliance standards and investor protection measures. Furthermore, the absence of specific information about tradable assets, account types, minimum deposit, and deposit/withdrawal methods limits transparency and may create uncertainty for potential clients. Lastly, the website is inaccessible which has several implications for the quality of NGL's service and commitment to professionalism.

| Pros | Cons |

| MetaTrader 4 usage | Unauthorized status with the NFA |

| Provides customer support through QQ | Limited transparency and information about services |

| Inaccessible Website |

Inaccessible Website

The website of New Goba International Investment Limited (NGL) provides limited descriptions regarding account types, minimum deposit, leverage, spread, and deposit/withdrawal methods. This lack of information undermines the clarity and transparency that potential clients seek when evaluating a company's offerings. Without clear details about account types, individuals may face difficulties in determining which option aligns best with their trading preferences and financial goals. The absence of minimum deposit information hinders potential investors from understanding the financial commitment required to start trading with NGL. Furthermore, the lack of specified leverage ratios and spread values prevents clients from accurately assessing the risk exposure and cost implications associated with trading on the platform. The limited information on deposit/withdrawal methods further obscures the accessibility and convenience of managing funds with the company. Overall, the scarcity of these essential details undermines the company's reputation and creates uncertainty for prospective clients who prioritize transparency and comprehensive information in their decision-making process.

Lack of Market Instrument Information

The lack of market instrument information provided by New Goba International Investment Limited (NGL) raises concerns about the credibility of the company as a brokerage. Without specific details about the tradable assets available on their platform, potential clients are left in the dark regarding the range of investment opportunities offered by NGL. This lack of transparency can be detrimental to the company's credibility, as investors typically prioritize a comprehensive understanding of the available markets and instruments before making informed decisions. The absence of this crucial information makes it challenging for traders to assess whether NGL can fulfill their investment needs and align with their trading strategies. Without a clear picture of the market instruments available, clients may be hesitant to trust NGL as a reputable brokerage, as transparency and the breadth of available assets are essential factors in establishing credibility and attracting clients in the competitive financial services industry.

Trading Platforms

New Goba International Investment Limited (NGL) offers only the MetaTrader 4 trading platform for its clients. MetaTrader 4 is a widely recognized and popular trading platform known for its user-friendly interface, advanced charting capabilities, and extensive range of trading tools and indicators. It provides traders with access to various financial markets, including Forex, commodities, indices, and more. The availability of MetaTrader 4 offers clients a familiar and robust platform to execute their trading strategies efficiently.

| Broker Name | Trading Platforms |

| New Goba International Investment Limited (NGL) | MetaTrader 4 |

| Alpari | MetaTrader 4, MetaTrader 5 |

| HotForex | MetaTrader 4, MetaTrader 5 |

| IC Markets | MetaTrader 4, MetaTrader 5, cTrader |

| RoboForex | MetaTrader 4, MetaTrader 5, cTrader |

Customer Support

The only available method of customer support from New Goba International Investment Limited (NGL) offers customer support through QQ contact by reaching out to the id of 522773267. QQ is a popular instant messaging platform widely used in China and other regions. QQ contact allows for direct communication with the company, enabling clients to seek assistance or address any concerns they may have.

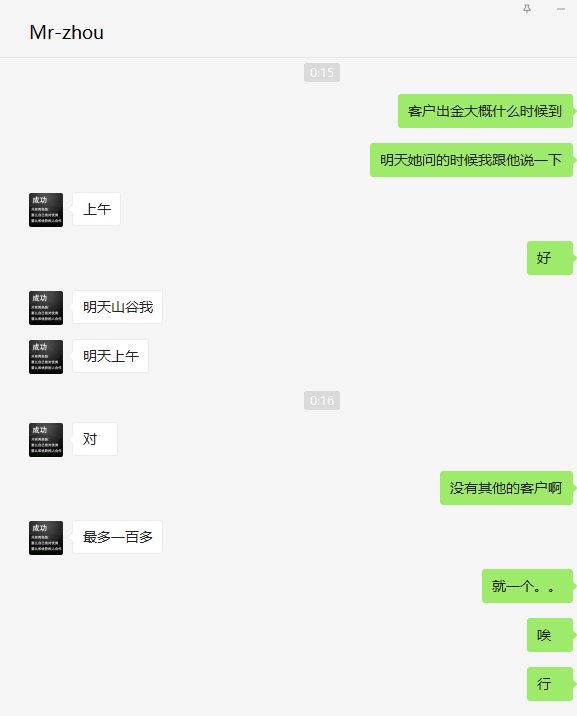

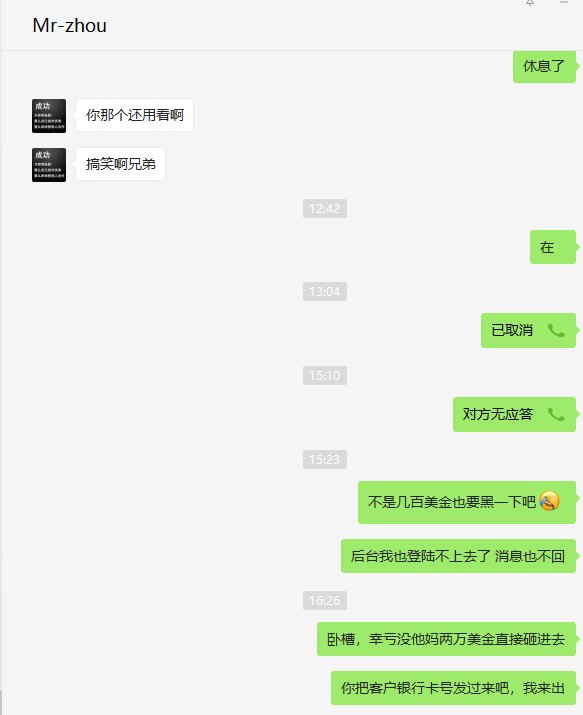

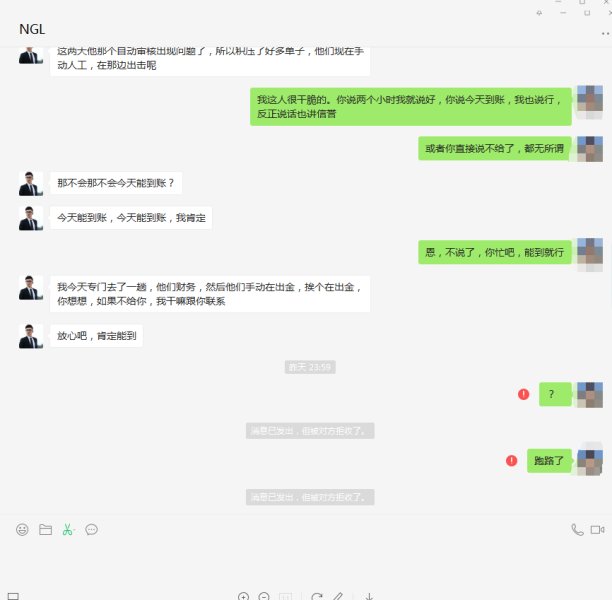

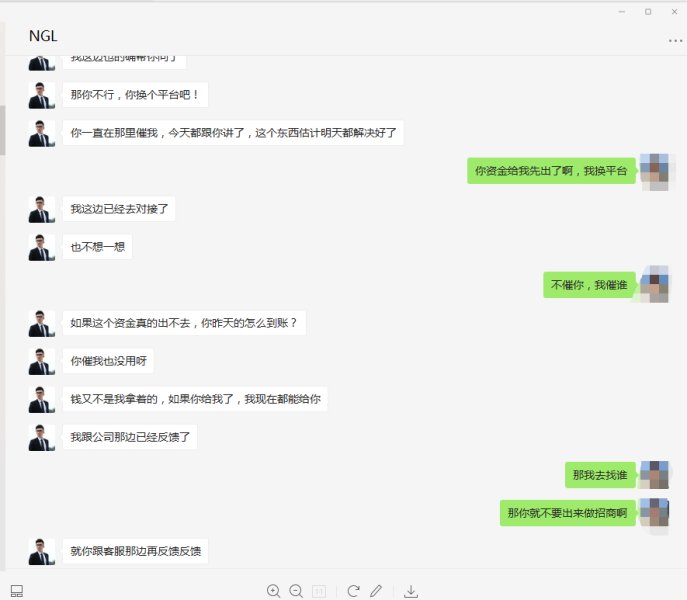

Customer Feedback

There are mixed reviews regarding New Goba International Investment Limited (NGL). Some clients have reported negative experiences, mentioning difficulties with withdrawals and expressing concerns about the authenticity of the company. They have highlighted instances of absconding and fraudulent behavior, with fake profiles and misleading information being utilized. These reviews advise caution and urge potential investors to be vigilant due to the prevalence of investment advertisements across various group chats. It is important for individuals to carefully consider and evaluate this feedback when making decisions related to engaging with NGL.

Conclusion

New Goba International Investment Limited (NGL) is a company that has been operating in the financial services industry for a period of 2-5 years. Based in Hong Kong, NGL is associated with the MetaTrader 4 trading platform, offering clients a familiar and widely-used platform for their trading activities. However, it is important to note that NGL operates without regulation, as it is unauthorized by the National Futures Association (NFA) in the United States. This lack of regulatory oversight raises concerns about the company's transparency and investor protection measures.

In conclusion, the information available about NGL highlights certain risks and disadvantages that potential clients should consider. Additionally, the limited information provided about account types, minimum deposit, leverage, spread, deposit/withdrawal methods, and market instruments may hinder transparency and create uncertainty for prospective clients. Furthermore, customer feedback indicates negative experiences related to withdrawals and concerns about the authenticity of the company.

FAQs

Q: What is the regulatory status of New Goba International Investment Limited (NGL)?

A: NGL is currently unauthorized by the National Futures Association (NFA).

Q: What trading platform is associated with NGL?

A: NGL is associated with the widely recognized MetaTrader 4 trading platform.

Q: How long has NGL been operating in the financial services industry?

A: NGL has been operating for a period of 2-5 years.

Q: Does NGL provide comprehensive information about account types and minimum deposit?

A: Unfortunately, specific details about account types and minimum deposit are not available.

Q: What market instruments are available to trade by NGL?

A: There is no information about market instruments on any available NGL information bases.

Q: What are some concerns raised in customer feedback about NGL?

A: Customer feedback highlights concerns regarding difficulties with withdrawals and doubts about the company's authenticity.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 2

Content you want to comment

Please enter...

Comment 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now