Overview

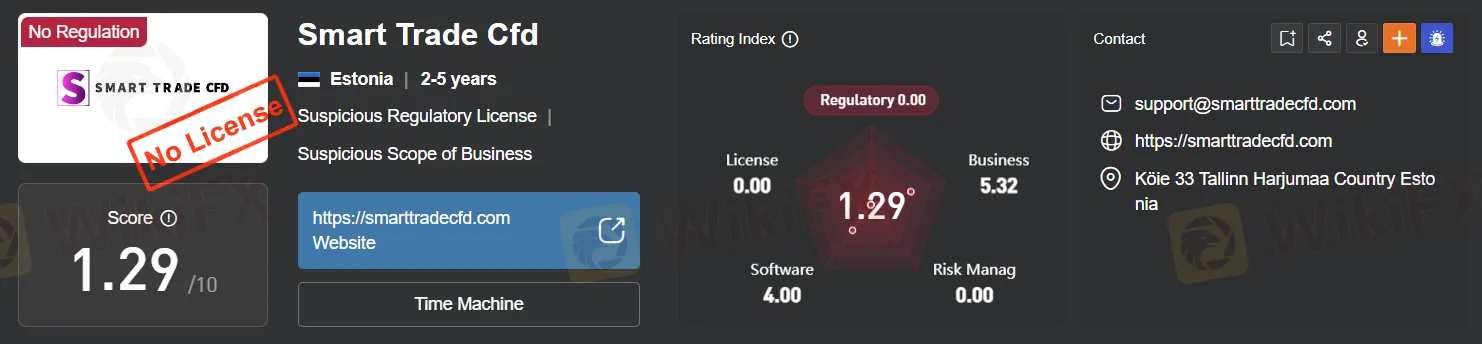

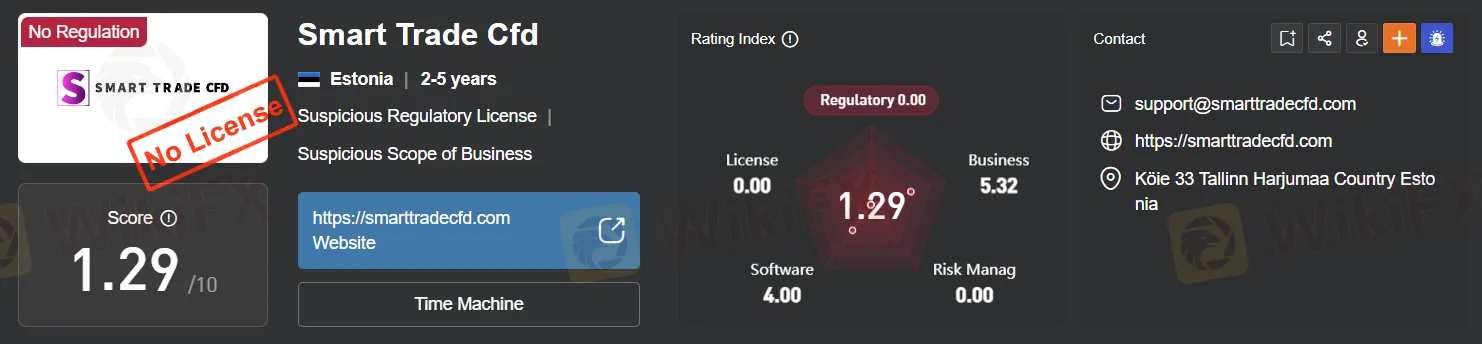

Smart Trade CFD, established in 2020 and registered in Estonia, presents a concerning picture as an unregulated brokerage firm. Despite offering a range of tradable assets like Forex, indices, shares, commodities, and cryptocurrencies across various account types (Micro, Standard, Premium), the absence of regulation casts a significant shadow over its operations. The minimum deposit is relatively low at $200 for the Micro Account, but the high leverage of up to 1:1000 amplifies financial risks. Spreads vary between 0.0 to 1 pip, and while the broker provides access to popular platforms like MT4 and MT5, the lack of demo and Islamic accounts limits its accessibility.

Customer support, only available via email, has been criticized for its lack of responsiveness, adding to client frustrations. Payment methods include bank wire, credit cards, and cryptocurrencies, but these do not mitigate the risks associated with the broker's reliability. The website's current downtime further erodes trust, and allegations of being a scam by some users severely tarnish its reputation. Overall, Smart Trade CFD's lack of regulatory oversight and negative feedback suggest a high-risk proposition for potential traders.

Regulation

Smart Trade CFD operates as a brokerage firm, offering various trading services and instruments. However, it's crucial to note that this broker is not regulated by any financial regulatory authority. This lack of regulation raises concerns about the safety and security of the investments made through them. Investors are advised to exercise caution and conduct thorough research before engaging with unregulated brokers like Smart Trade CFD. The absence of regulatory oversight means that clients may not have the same level of protection and recourse in case of disputes or financial irregularities, as they would with a regulated entity. Therefore, understanding the risks associated with trading through unregulated brokers is essential for anyone considering using their services.

Pros and Cons

he examination of Smart Trade CFD's services reveals a mix of advantages and disadvantages. On the positive side, the broker offers a diverse range of market instruments and multiple account types, catering to different trading styles and experience levels. The provision of popular trading platforms like MT4 and MT5 enhances the trading experience. However, the lack of regulation is a significant drawback, raising concerns about the security of funds and the integrity of the brokerage. Additionally, the limited customer support and high leverage options present risks, especially for less experienced traders.

Market Instruments

Smart Trade CFD offers a diverse range of trading products across multiple asset classes, catering to various investment preferences and strategies. Their portfolio includes:

Forex: They provide the opportunity to trade in major and exotic currency pairs. This includes popular pairs like EUR/USD, which represents the exchange rate between the Euro and the U.S. Dollar, and GBP/AUD, the British Pound against the Australian Dollar. They also offer more exotic pairs like NOK/ILS, the Norwegian Krone versus the Israeli Shekel, catering to traders interested in less commonly traded currency markets.

Indices: Smart Trade CFD offers trading in several major global indices, allowing traders to speculate on the performance of broader market segments. This includes the DJIA (Dow Jones Industrial Average), a key indicator of the U.S. stock market's performance, the DAX30, which is a blue-chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange, and AU200, an index that tracks the top 200 companies listed on the Australian Securities Exchange.

Shares: They provide access to trading in shares of well-known companies. This includes tech giants like Alibaba, a major player in the e-commerce and technology sector, Nvidia, known for its graphics processing units for gaming and professional markets, and Intel, a leader in semiconductor and chip manufacturing.

Commodities: Smart Trade CFD offers the ability to trade in various commodities, which can be a way to diversify a trading portfolio. This includes precious metals like gold, agricultural commodities such as corn, and energy commodities like natural gas.

Cryptocurrencies: Recognizing the growing interest in digital assets, they also offer trading in popular cryptocurrencies. This includes SHIBA, a meme coin that has gained significant attention, MATIC, the native token of the Polygon network known for its scalability solutions, and ADA, the cryptocurrency of the Cardano platform.

Account Types

Smart Trade CFD offers three different types of trading accounts, each designed to cater to the varying needs and experience levels of traders. Here's a detailed look at each account type:

Micro Account:

Deposit Requirement: Starts from $200.

Base Currency: USD.

Spreads: Begins at 1 pip.

Commission: No commission (0s).

Leverage: High leverage of 1:1000.

Trading Instruments: Includes Forex and Metals.

Extra Trading Instruments: Not available for this account.

Margin Call / Stop Out: Set at 100% for margin call and 60% for stop out.

SWAP: Swap is enabled.

Hedging: Hedging is permitted.

Standard Account:

Deposit Requirement: Minimum deposit of $1000.

Base Currency: USD.

Spreads: More competitive spreads starting from 0.7 pip.

Commission: No commission charge.

Leverage: Offers leverage of 1:500.

Trading Instruments: Access to Forex and Metals.

Extra Trading Instruments: Available upon request.

Margin Call / Stop Out: The margin call is at 80%, and the stop out is at 40%.

SWAP: Swap is supported.

Hedging: Hedging is allowed.

Premium Account:

Deposit Requirement: A significant minimum deposit of $25,000.

Base Currency: USD.

Spreads: Extremely low spreads, starting from 0.0 pip.

Commission: A commission of $8 is applicable.

Leverage: Lower leverage of 1:100 compared to the other accounts.

Trading Instruments: Includes Forex and Metals.

Extra Trading Instruments: Available upon request, offering more trading options.

Margin Call / Stop Out: Margin call is at 90%, and stop out is at 40%.

SWAP: Swap feature is available.

Hedging: Hedging is permitted.

Leverage

The broker offers a maximum trading leverage of up to 1:1000. This high leverage ratio means traders can control a position worth $1000 for every $1 of their own capital. While this can significantly increase potential profits, it also greatly amplifies risks, as small market movements can lead to large gains or losses. High leverage trading requires careful risk management and is more suitable for experienced traders who understand the risks, especially when trading with an unregulated broker like Smart Trade CFD.

Spreads and Commissions

Spreads: The spread, which is the difference between the bid and ask prices, ranges from 0.0 to 1 pip across different account types. A lower spread (as low as 0.0 pip) is typically offered on more premium accounts like the Premium account, while higher spreads (up to 1 pip) might be found in basic accounts like the Micro account.

Commissions: For the Premium account, there is a commission of $8 per lot traded. This fee is specific to this account type and is not applicable to the Micro and Standard accounts, which are commission-free.

Scam Alert: It's important to note that while these fees may seem favorable or competitive, scammers often use attractive trading conditions as a lure. Their primary goal might not be to collect fees or spreads but rather to entice customers to deposit funds, which they then intend to steal. In the case of an unregulated broker like Smart Trade CFD, the risk of such fraudulent activities is higher. Traders should be cautious and thoroughly research the broker's legitimacy and track record before investing.

Deposit & Withdrawal

Smart Trade CFD offers various methods for depositing and withdrawing funds, each with its own characteristics:

Bank Wire Transfer:

Deposit and Withdrawal: This traditional method allows for the transfer of funds directly from a bank account to the trading account and vice versa.

Processing Time: Withdrawals might take several business days to process.

Security: Generally secure, but depends on the reliability of the banking institutions involved.

Fees: May involve fees from the bank, especially for international transfers.

Credit Card:

Deposit and Withdrawal: Enables the use of major credit cards for funding and withdrawing from the trading account.

Processing Time: Deposits are usually quick, often instant, while withdrawals can take a few business days.

Security: Credit card transactions are generally secure, with additional protections offered by card issuers.

Fees: There could be fees for transactions, and interest charges may apply if the credit balance is not paid in full.

Cryptocurrencies:

Deposit and Withdrawal: Allows for transactions using various cryptocurrencies.

Processing Time: Typically faster than traditional banking methods, often processed within minutes or hours.

Security: Depends on the security of the wallet and the blockchain being used. It's generally considered secure, but irreversible if sent to the wrong address.

Fees: Can have lower transaction fees compared to traditional methods, but network fees apply and can vary widely depending on the cryptocurrency and network congestion.

Trading Platforms

Smart Trade CFD provides its clients with access to two of the most popular and advanced trading platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4 is renowned for its user-friendly interface, robust technical analysis tools, and automated trading capabilities through Expert Advisors (EAs). It is widely favored by traders for Forex trading. On the other hand, MT5, being the newer version, offers all the features of MT4 but with additional capabilities such as more timeframes, more indicators, an economic calendar, better back-testing functionalities, and the ability to trade a wider range of markets including stocks and commodities. Both platforms are highly customizable and are designed to cater to traders of all experience levels, offering sophisticated tools and features that can enhance trading strategies and execution.

Customer Support

The customer support at Smart Trade CFD, which can be reached through their email addresses support@smarttradecfd.com and info@smarttradecfd.com, has raised some concerns. There have been criticisms regarding their responsiveness and effectiveness in addressing client issues. Clients often report slow response times when reaching out via email, leading to frustrations, especially in a field where timely support can be crucial. Furthermore, the lack of multiple channels of communication, such as a live chat or a 24/5 hotline, can be seen as a significant drawback in providing comprehensive customer support. This limited approach to customer service may not adequately meet the needs of traders who require immediate and direct assistance. Consequently, this aspect of their service could negatively impact client satisfaction and trust, particularly important for a broker operating in the competitive and fast-paced world of online trading

Summary

The overview of Smart Trade CFD reveals several alarming issues that cast doubt on its reliability and integrity as a brokerage firm. Notably, the broker is not regulated by any financial authority, a significant red flag indicating a lack of oversight and protection for investors. Despite offering a range of trading products and various account types, the favorable conditions such as low spreads and high leverage could be deceptive, potentially luring traders into a trap. The commission structure, especially for the Premium account, and the variety of deposit and withdrawal methods, while seemingly convenient, might mask hidden risks associated with unregulated entities.

Concerns are further heightened by reports of inadequate customer support, with slow response times and limited communication channels, suggesting a disregard for client needs and issues. The use of advanced trading platforms like MT4 and MT5 doesn't offset these drawbacks.

Moreover, the fact that the broker's website is currently down adds to the suspicion, undermining its credibility. This, combined with negative user feedback labeling it as a scam, suggests that Smart Trade CFD might be more interested in deceiving clients rather than providing a legitimate trading service. Such signs strongly advise potential traders to approach this broker with extreme caution, if not to avoid it altogether.

FAQs

Q1: Is Smart Trade CFD a regulated broker?

A1: No, Smart Trade CFD is not regulated by any financial regulatory authority, which raises serious concerns about the safety and security of investments made through them.

Q2: What types of trading accounts does Smart Trade CFD offer?

A2: Smart Trade CFD offers three types of accounts: Micro, Standard, and Premium, each with varying minimum deposits, leverage, and spreads.

Q3: Can I trade cryptocurrencies with Smart Trade CFD?

A3: Yes, Smart Trade CFD offers trading in popular cryptocurrencies like SHIBA, MATIC, and ADA, in addition to Forex, indices, shares, and commodities.

Q4: What are the deposit and withdrawal methods available at Smart Trade CFD?

A4: Smart Trade CFD allows deposits and withdrawals via bank wire transfer, credit card, and cryptocurrencies, each with varying processing times and security measures.

Q5: How does Smart Trade CFD's customer support fare?

A5: Smart Trade CFD's customer support, accessible via email, has been criticized for slow response times and a lack of multiple communication channels, leading to potential dissatisfaction among clients.