Overview of SDstar FX

SDstar FX, established in 2023, is an emerging online trading platform headquartered in Mauritius. Despite being relatively new to the financial scene, SDstar FX offers a comprehensive range of trading instruments, including stocks, indices, forex, and commodities. The platform distinguishes itself by providing three distinct account types—PRO, ECN, and STANDARD—tailored to accommodate the diverse preferences and experience levels of traders.

One notable feature is the leverage options available, with the PRO account offering 1:400, the ECN account at 1:300, and the STANDARD account boasting a high 1:500 leverage. SDstar FX supports various trading platforms, including the widely acclaimed Metatrader 5, web-based platforms, and dedicated applications for Android, Windows, and Mac OS. While the website lacks detailed information on deposit and withdrawal methods, it specifies minimum deposit requirements for each account type, catering to a range of investment levels. Despite its unregulated status, SDstar FX aims to provide a user-friendly trading experience with educational resources, customer support through email and phone, and an enticing 50% deposit bonus for traders looking to enhance their capital.

Is SDstar FX Legit?

SDstar FX is not regulated. It is important to note that this broker does not have any valid regulation, which means it operates without oversight from recognized financial regulatory authorities. Traders should exercise caution and be aware of the associated risks when considering trading with an unregulated broker like SDstar FX, as there may be limited avenues for dispute resolution, potential safety and security concerns regarding funds, and a lack of transparency in the broker's business practices. It is advisable for traders to thoroughly research and consider the regulatory status of a broker before engaging in trading activities to ensure a safer and more secure trading experience.

Pros and Cons

SDstar FX presents a promising yet evolving platform in the competitive landscape of online trading. On the positive side, the broker offers a diverse array of trading instruments, including stocks, indices, forex, and commodities, providing traders with ample opportunities for portfolio diversification. The availability of three distinct account types, each catering to different trading styles, demonstrates a commitment to accommodating a broad spectrum of users. The leverage options, ranging from 1:400 to 1:500, provide flexibility for traders with varying risk appetites. The support for popular trading platforms, such as Metatrader 5, ensures a familiar and robust trading experience. However, it's important to exercise caution due to the lack of regulatory oversight, posing potential risks for traders. The absence of detailed information on deposit and withdrawal methods on the website may raise transparency concerns. While SDstar FX offers a 50% deposit bonus, traders should carefully consider the associated risks and conduct thorough research before engaging with this relatively new and unregulated platform.

Trading Instruments

Certainly, here's a structured description of the trading instruments offered by SDstar FX, with numbered sections:

1. Stocks:

SDstar FX provides a robust platform for trading individual stocks, offering users the opportunity to buy and sell shares in publicly-listed companies. This category is well-suited for investors looking for direct ownership in specific enterprises, with the potential for capital gains and dividends based on the company's performance.

2. Indices:

Traders on SDstar FX can engage in index trading, allowing them to speculate on the overall performance of a basket of stocks rather than individual securities. Indices represent the combined value of selected stocks, providing a broader market perspective. Investing in indices can offer diversification benefits and exposure to general market trends.

3. Currency Pairs (Forex):

SDstar FX facilitates trading in the foreign exchange (Forex) market, offering a wide range of currency pairs. Forex trading involves the buying and selling of currency pairs, providing opportunities to profit from fluctuations in exchange rates. The Forex market operates 24 hours a day, five days a week, allowing for continuous trading and flexibility for traders across different time zones.

4. Commodities:

SDstar FX includes a comprehensive selection of commodities for trading. This category encompasses precious metals, energies, and agricultural products. Trading commodities enables users to speculate on the price movements of physical goods in the global market. It is an appealing option for diversifying investment portfolios and capitalizing on trends in commodity markets.

This structured overview highlights the key trading instruments available on SDstar FX, providing users with a diverse array of options to tailor their investment strategies according to their financial objectives and risk preferences.

Here is a comparison table of trading instruments offered by different brokers:

Account Types

Certainly, here's a brief description of the account types offered by SDstar FX, including key features:

1. PRO Account:

- Minimum Deposit: $2500

- Spread: 0.9

- Commission: No

- Leverage: 1:400

- Swap Free: 21 Days

- Trading Platform: MT5

The PRO account at SDstar FX is designed for traders seeking competitive spreads without incurring additional commissions. With a minimum deposit requirement of $2500, users can enjoy a favorable spread of 0.9, leverage up to 1:400, and a 21-day swap-free period. The account operates on the popular MT5 trading platform.

2. ECN Account:

- Minimum Deposit: $10,000

- Spread: Raw

- Commission: $5 Per lot

- Leverage: 1:300

- Swap Free: 21 Days

- Trading Platform: MT5

The ECN account caters to more advanced traders looking for raw spreads and direct market access. With a minimum deposit of $10,000, users benefit from a commission-based structure at $5 per lot, leverage up to 1:300, and a 21-day swap-free period. The ECN account is also supported on the MT5 trading platform.

3. STANDARD Account:

- Minimum Deposit: $250

- Spread: 1.4

- Commission: No

- Leverage: 1:500

- Swap Free: 21 days

- Trading Platform: MT5

The STANDARD account is tailored for entry-level traders, requiring a minimum deposit of $250. While offering a spread of 1.4 with no additional commissions, this account provides higher leverage at 1:500 and a 21-day swap-free period. Traders using the STANDARD account can execute trades on the MT5 platform.

SDstar FX aims to accommodate a diverse range of traders by providing these three account types, each catering to different preferences and trading styles. Whether traders prioritize low spreads, direct market access, or beginner-friendly features, SDstar FX seeks to offer a suitable account type for their needs.

How to Open an Account?

To open an account with SDstar FX, follow these steps.

Visit the SDstar FX website. Look for the “OPEN ACCOUNT” button on the homepage and click on it.

2. Sign up on websites registration page.

3. Receive your personal account login from an automated email

4. Log in

5. Proceed to deposit funds to your account

6. Download the platform and start trading

Leverage

PRO Account:

The PRO account at SDstar FX offers a competitive leverage of 1:400. This means that for every unit of capital, traders can control positions in the market up to 400 times that amount. This higher leverage can amplify both potential profits and losses, requiring traders to exercise careful risk management strategies.

ECN Account:

The ECN account comes with a leverage of 1:300. This leverage ratio allows traders to have increased market exposure compared to the PRO account but still requires a cautious approach due to the inherent risks associated with higher leverage.

STANDARD Account:

The STANDARD account type offers a leverage of 1:500, providing the highest multiplier effect among the three account types. Traders opting for this account should be mindful of the increased risk and volatility that comes with higher leverage.

Leverage is a crucial factor in forex trading, and traders should choose the leverage level that aligns with their risk tolerance, trading strategy, and overall financial goals. It's recommended to use leverage responsibly and be aware of the potential impact on trading positions.

Here is a comparison table of maximum leverage offered by different brokers:

Spreads and Commissions (Trading Fees)

Let's provide a brief description of the Spreads and Commissions for each account type at SDstar FX:

1. PRO Account:

The PRO account at SDstar FX features a low spread of 0.9 pips. Importantly, this account type does not charge any commissions per lot traded, making it an attractive option for traders who prefer a straightforward fee structure.

2. ECN Account:

The ECN account offers Raw spreads, meaning that traders have access to the interbank market spread with no markup. While the spread is not specified, the account incurs a commission of $5 per lot traded. This commission-based model may be suitable for traders who prioritize lower spreads and are comfortable with a per-trade commission structure.

3. STANDARD Account:

The STANDARD account type comes with a spread of 1.4 pips. Similar to the PRO account, the STANDARD account does not charge any commissions per lot traded. This account type provides a balance between spread costs and commission-free trading.

Choosing the right account type depends on individual trading preferences, risk tolerance, and the desired fee structure. Traders should carefully consider factors such as spreads, commissions, and overall trading costs when selecting the most suitable account type for their trading strategy.

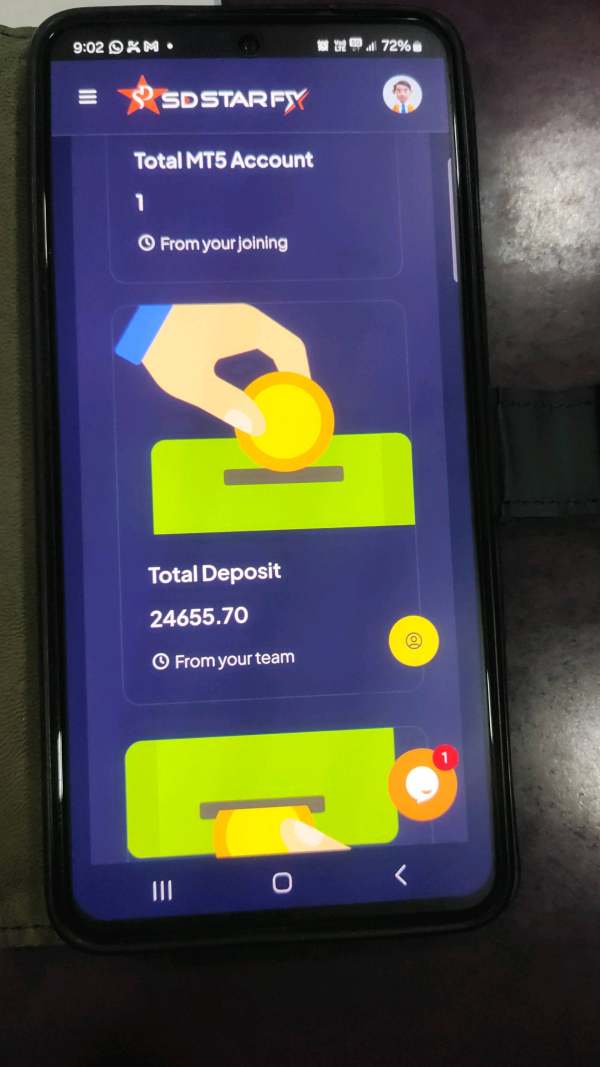

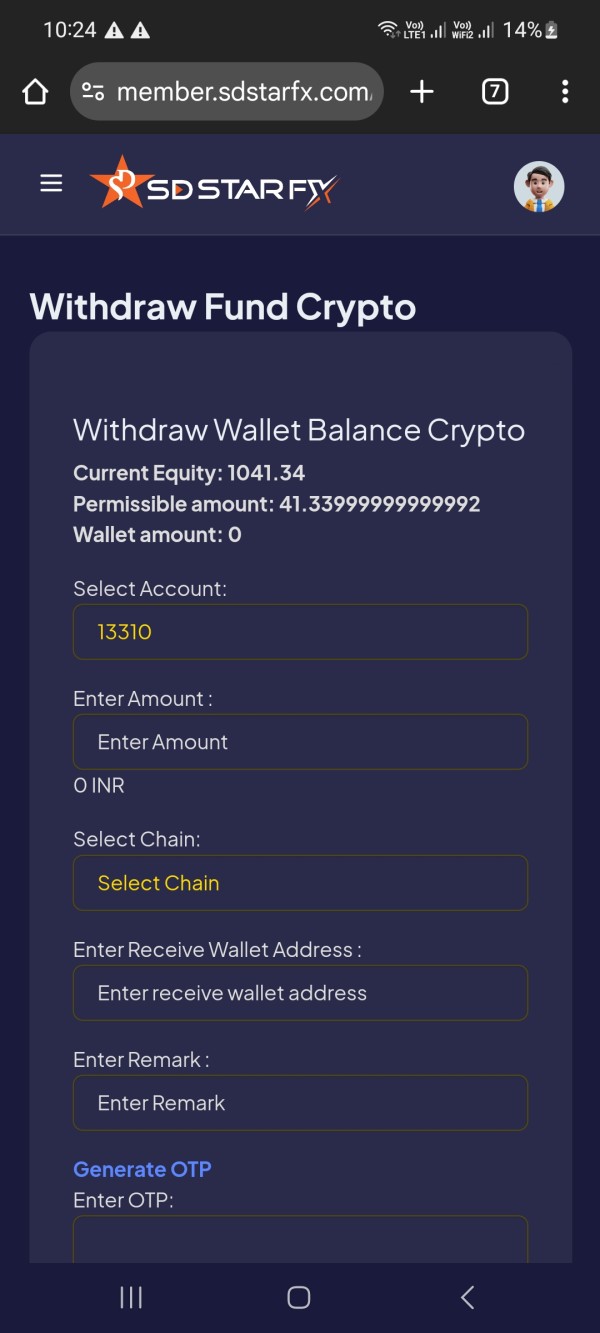

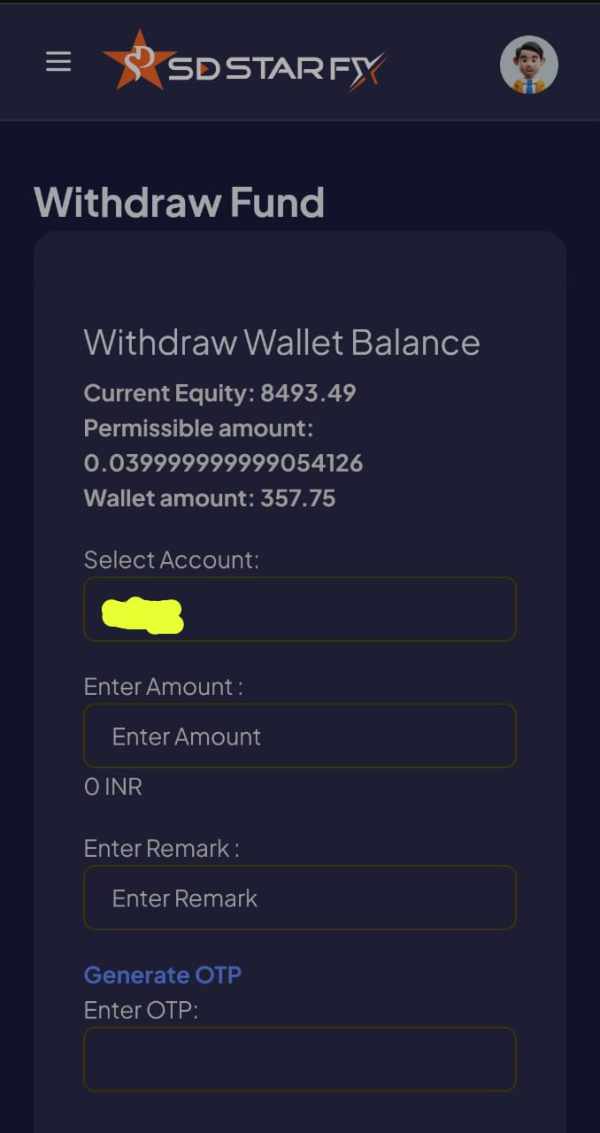

Deposit & Withdraw Methods

While the SDstar FX website does not explicitly specify the detailed deposit and withdrawal methods, it does outline the minimum deposit requirements for different account types. For the Standard account, the minimum deposit is $250, for the Pro account, it's $2500, and for the ECN account, a higher minimum deposit of $10,000 is required. Traders are encouraged to refer to the platform or contact customer support for specific information regarding the available methods for depositing and withdrawing funds. It's essential for traders to be aware of the platform's financial processes to make informed decisions about managing their accounts.

Trading Platforms

SDstar FX offers a versatile and comprehensive range of trading platforms to cater to the diverse needs of its clients. Here's a brief overview of the available trading platforms:

1. Metatrader 5:

SDstar FX provides access to the widely acclaimed Metatrader 5 (MT5) platform. MT5 is renowned for its advanced trading features, charting tools, and analytical capabilities. Traders using MT5 can execute a variety of order types, access a broad range of financial instruments, and benefit from automated trading through expert advisors (EAs). The platform is suitable for both beginners and experienced traders seeking a robust and user-friendly trading environment.

2. Web Platform:

For traders who prefer the flexibility of accessing the markets directly from their web browsers, SDstar FX offers a web-based trading platform. This platform eliminates the need for downloads or installations, providing a convenient and accessible option for traders on the go. The web platform retains essential trading features, ensuring a seamless trading experience without compromising functionality.

3. Android:

SDstar FX extends its trading capabilities to the Android platform, allowing users to trade from their mobile devices. The Android application offers a feature-rich experience with rapid trade execution, intuitive navigation, and essential tools for market analysis. Traders can manage their positions, access real-time market data, and stay connected to the markets while on the move, enhancing the flexibility of their trading activities.

4. Windows:

The Windows trading platform by SDstar FX is tailored for users operating on Windows-based systems. This platform is designed to provide a stable and efficient trading experience on desktop computers. With a user-friendly interface, customizable layouts, and advanced charting tools, the Windows platform empowers traders to make informed decisions and execute trades seamlessly.

5. Mac OS:

SDstar FX ensures compatibility with Mac OS, offering a trading platform specifically designed for users of Macintosh computers. The Mac OS platform maintains the same high standards of functionality and performance, providing a native trading experience for Mac users. Traders can access the full suite of features, including charting tools, order execution, and account management, while using their preferred operating system.

SDstar FX's commitment to offering diverse trading platforms ensures that clients can choose the option that best aligns with their preferences, devices, and trading styles. Whether on desktop or mobile, the platforms aim to provide a reliable and feature-packed environment for traders to engage with the financial markets.

Customer Support

SDstar FX provides customer support through various channels to address user inquiries, concerns, and general assistance. The company's registered office is under SD STAR FX LTD, located at MOHELI CORPORATE SERVICES LTD, P.B. 1257 BONOVO ROAD, FOMBONI, COMOROS UNION. You can contact them via email at info@sdstarfx.com or by phone at +971 4 451 9834. The official website, www.sdstarfx.com, serves as an online platform for information and communication.

In addition to the registered office, SDstar FX has a physical office at SDFX GLOBAL TECHNOLOGY LLC, situated at 2201, CHURCHILL TOWER, BUSINESS BAY, DUBAI. Similar to the registered office, you can connect with them through email at info@sdstarfx.com or by phone at +971 4 451 9834.

Educational Resources

SDstar FX offers a range of essential tools and resources under its Traders Instruments, Analytics, and Education sections to empower traders with knowledge and enhance their trading experience.

Traders Instruments:

1. Margin Calculator: The Margin Calculator is a crucial tool for risk management. It allows traders to calculate the required margin for their positions, ensuring they have a clear understanding of the financial commitment needed for their trades.

2. Profit Calculator: SDstar FX's Profit Calculator provides traders with the ability to estimate potential profits or losses based on different trade scenarios. This tool aids in decision-making by offering insights into the potential outcomes of trades, helping traders plan their strategies effectively.

Analytics:

1. Economic Calendar: SDstar FX understands the significance of economic events in the financial markets. The Economic Calendar keeps traders informed about upcoming economic events, announcements, and indicators, enabling them to anticipate and respond to market movements.

2. Market Analysis: The Market Analysis tools provided by SDstar FX go beyond basic trends. Traders can access detailed analyses of various factors influencing market movements. This comprehensive resource equips traders with valuable insights for making informed and strategic trading decisions.

Education:

1. Forex Trading for Beginners: SDstar FX recognizes the importance of providing educational resources for traders at all levels. The “Forex Trading for Beginners” section offers foundational knowledge, ensuring that novice traders can grasp the fundamental concepts of forex trading.

2. Glossary: The Glossary serves as a comprehensive reference, providing definitions and explanations for industry-specific terms. This resource helps traders navigate the sometimes complex terminology associated with forex and financial markets.

3. FAQ: The FAQ section addresses common questions and concerns that traders may have. By providing clear and concise answers, SDstar FX ensures that traders have access to essential information, fostering a better understanding of the trading platform and processes.

In summary, SDstar FX's commitment to trader empowerment is evident through the provision of practical and informative tools and resources across Traders Instruments, Analytics, and Education sections. These offerings contribute to a well-rounded and supportive trading environment for users of varying experience levels.

Bonus

SDstar FX offers a compelling bonus opportunity to traders – a 50% deposit bonus. By availing this bonus, traders can effectively double their deposit, providing an additional financial cushion for their trading activities. The bonus becomes accessible immediately after the deposit is made, enhancing the overall trading capital and potentially amplifying trading opportunities. This promotion is designed to provide traders with an extra edge and capitalize on the market's finest bonus offering.

Conclusion

In conclusion, SDstar FX presents a platform with diverse trading instruments, catering to different trading preferences through its three account types and flexible leverage options. The support for Metatrader 5 and various platforms adds to its accessibility. However, the absence of regulatory oversight poses a significant disadvantage, requiring traders to exercise caution. Additionally, the limited transparency on deposit and withdrawal methods raises concerns about financial processes. While the 50% deposit bonus is an enticing feature, traders should weigh the advantages against the potential risks associated with the broker's relatively new status and unregulated operations

FAQs

Q: Is SDstar FX a regulated broker?

A: No, SDstar FX is not regulated, and traders should be aware of the associated risks and potential limitations in terms of investor protection.

Q: What trading instruments are available on SDstar FX?

A: SDstar FX offers a diverse range of trading instruments, including stocks, indices, currency pairs (Forex), and commodities.

Q: What leverage options does SDstar FX provide?

A: SDstar FX offers flexible leverage options across its account types, ranging from 1:400 to 1:500.

Q: What platforms are supported by SDstar FX?

A: SDstar FX supports the widely acclaimed Metatrader 5 (MT5) platform, along with web-based, Android, Windows, and Mac OS platforms.

Q: Are there educational resources available on SDstar FX?

A: Yes, SDstar FX provides educational resources, including tools like margin and profit calculators, an economic calendar, market analysis, and educational content for beginners.

FX2265979438

India

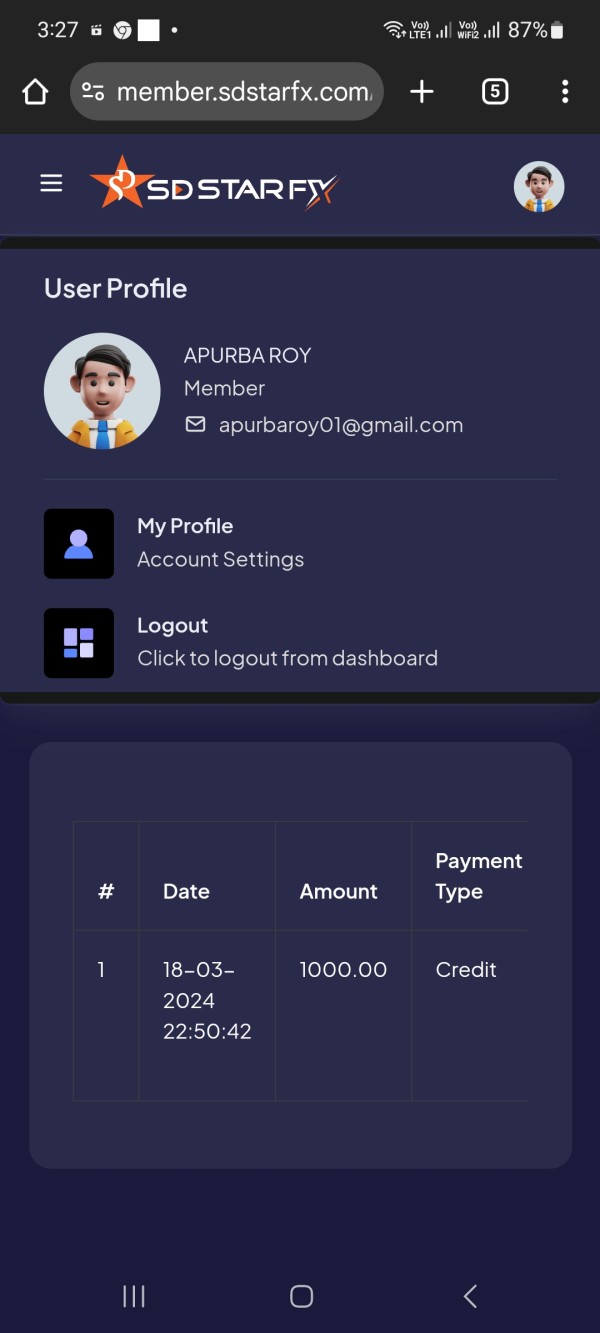

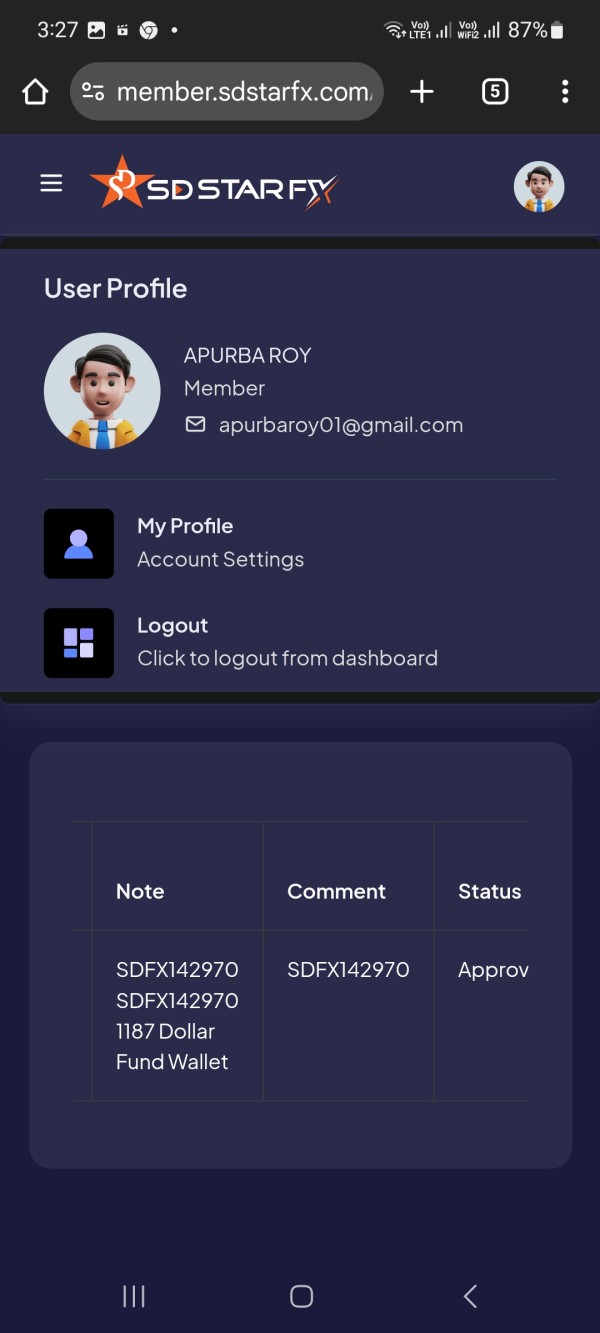

withdrawal not given from 1 year. this is fully scammed. i want my money return please help me...

Exposure

01-13

Bhola3655

India

SD star principal is not withdrawing they are using very badly and them

Exposure

2024-11-01

FX2156348195

India

The broker house not giving any kind of withdrawal, neither Profit nor principal.

Exposure

2024-10-27

Tapahi Mali

India

I can't principal withdrawal from sd star fx, also profit share because Dipankar Samanta is a chitar person.He is M.D of Sd Star Fx.

Exposure

2024-09-15

Mohan Jeet

India

super fast deposit and withdrawal. genuine spread .😍

Positive

01-18