Overview

IQ Option, founded in 2013 and based in Saint Kitts and Nevis, operates as IQ Option LLC and is not regulated by major financial authorities. The platform offers a maximum leverage of up to 1:1000 and competitive spreads starting at 0.06 pips. Traders can access a diverse range of tradable assets, including Forex, Stocks, Crypto, Commodities, Indices, and ETFs. Account options include Practice Accounts for demo trading and Real Accounts for live trading. Customer support is available via email, and the platform provides various payment methods such as Visa, MasterCard, Local Bank Options, Neteller, and Skrill. IQ Option offers educational resources in the form of video tutorials to assist traders in their learning journey across multiple trading platforms, including a full version for Windows and macOS and a lightweight IQ Lite version for Android users.

Regulation

IQ Option operates without regulation, which means it lacks oversight from major financial authorities like the SEC, FCA, or ESMA. This absence of regulatory oversight can raise concerns about the safety of funds, fairness of the trading platform, and dispute resolution. Traders should exercise caution and conduct thorough research before considering IQ Option or any unregulated broker, as they may not offer the same level of protection and transparency as regulated counterparts.

Pros and Cons

IQ Option is a trading platform with its own set of advantages and disadvantages. Understanding these can help you make an informed decision about whether it's the right platform for your trading needs.

In summary, IQ Option provides a diverse array of trading opportunities with competitive spreads, commission-free trading, and a range of educational resources. However, traders should be aware of the lack of regulation, the potential risks associated with high leverage, and the variation in withdrawal processing times.

Market Instruments

IQ Option offers a diverse range of trading instruments, catering to a wide spectrum of traders with varying interests and strategies. These market instruments include Forex, Stocks, Crypto, Commodities, Indices, and ETFs, providing traders with ample opportunities to diversify their portfolios and take advantage of market movements in various asset classes.

Forex: Forex, or foreign exchange, is the largest and most liquid market globally, involving the trading of currency pairs. IQ Option allows traders to participate in the Forex market, enabling them to speculate on the exchange rate fluctuations of major and minor currency pairs, such as EUR/USD, GBP/JPY, or USD/JPY.

Stocks: IQ Option provides access to a selection of stocks from well-known companies, allowing traders to buy and sell shares of these companies. This enables traders to invest in the performance of individual businesses across different industries.

Crypto: The platform offers a variety of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and many altcoins. Traders can take advantage of the volatility in the cryptocurrency market and trade these digital assets against other currencies or assets.

Commodities: Commodities include assets like gold, oil, and agricultural products. IQ Option offers the opportunity to speculate on the price movements of these commodities, providing exposure to the global commodity markets.

Indices: Traders can access various stock market indices, such as the S&P 500 or NASDAQ, through IQ Option. These indices represent the performance of a group of stocks and provide insight into the broader market sentiment.

ETFs: Exchange-Traded Funds (ETFs) are investment funds that hold a diversified portfolio of assets. IQ Option allows traders to invest in ETFs, providing exposure to a wide range of asset classes, sectors, or regions in a single trade.

Account Types

IQ Option offers traders a tiered account system designed to cater to the diverse needs of traders, whether they are just starting or have more experience. These account types include Practice Accounts and Real Accounts, providing users with a choice to simulate trading or engage in live trading with real capital.

Practice Accounts: IQ Option offers Practice Accounts, also known as demo accounts, which are invaluable for novice traders. These accounts allow users to practice and hone their trading skills without risking real money. Traders are provided with virtual funds to simulate real market conditions, enabling them to test different strategies, understand the platform's functionality, and gain confidence in their trading abilities. Practice Accounts are an excellent way for beginners to learn the ropes of trading before transitioning to live trading.

Real Accounts: IQ Option's Real Accounts are for traders ready to commit real capital to the markets. These accounts enable users to access the full range of trading instruments, including Forex, Stocks, Crypto, Commodities, Indices, and ETFs, and execute real trades with actual money. Traders can deposit funds into their Real Accounts and start trading based on their strategies and risk preferences. Real Accounts offer the opportunity to profit from market movements and are suited for experienced traders looking to engage in the financial markets actively.

Leverage

IQ Option offers traders a significant leverage option, with a maximum trading leverage of up to 1:1000. This level of leverage allows traders to control a much larger position size in the market compared to their initial capital.

Leverage can amplify both potential profits and losses. When used wisely, high leverage can enhance trading opportunities, enabling traders to make more substantial gains with a smaller initial investment. However, it's crucial to exercise caution when utilizing such high leverage, as it also magnifies the risk of substantial losses.

Traders should have a solid understanding of leverage and risk management strategies before taking advantage of the maximum leverage offered by IQ Option. It's advisable to use leverage judiciously, considering one's risk tolerance, trading strategy, and market conditions, to maintain a healthy balance between potential rewards and risks.

Overall, the availability of up to 1:1000 leverage on IQ Option provides traders with flexibility in their trading approach, but it's essential to approach this feature with prudence to safeguard their capital and mitigate potential downsides.

Spreads & Commissions

When trading with IQ Option, traders can expect a fee structure that offers flexibility and choice. The key components to consider are spreads and commissions, both of which can vary depending on the specific trading account selected.

Spreads: IQ Option provides spreads starting from as low as 0.06 pips. Spreads represent the difference between the buying (ask) and selling (bid) prices of a financial instrument. Lower spreads are generally more favorable for traders as they can reduce the overall cost of trading. The option to access spreads as tight as 0.06 pips demonstrates the competitive nature of IQ Option's pricing and can be appealing to traders seeking cost-efficient trading.

Commissions: IQ Option offers commission-free trading, which means that traders do not incur additional charges for executing trades. This is particularly advantageous for traders who prefer to avoid commissions, as it helps keep their trading costs predictable and transparent. However, it's important to note that while IQ Option may not charge commissions on trades, other fees, such as overnight financing fees or withdrawal fees, may still apply depending on the specific trading activity and account type.

In summary, IQ Option provides traders with a range of options when it comes to spreads and commissions. Spreads can be as low as 0.06 pips, making it cost-effective for traders to execute their strategies, and the absence of commissions simplifies the fee structure. Nevertheless, traders should carefully review the terms and conditions, as well as the fee schedule associated with their chosen account type, to fully understand the cost implications of their trading activities.

Deposit & Withdrawal

IQ Option provides a wide range of deposit and withdrawal options, ensuring convenience and flexibility for traders managing their funds.

Deposit Options: IQ Option allows traders to fund their accounts using various methods, including Visa, MasterCard, Local Bank Options, Neteller, and Skrill. This selection caters to different preferences, whether traders prefer using credit or debit cards or opt for e-wallets and bank transfers.

Withdrawal Process: Withdrawals from IQ Option accounts vary in processing times depending on the chosen method. Withdrawals can be processed either instantly or take up to 3 business days. The specific timing depends on the selected method and the processing times of the involved financial institutions.

In summary, IQ Option aims to provide traders with flexibility in managing their funds by offering multiple deposit options and varying withdrawal processing times. Traders are encouraged to review the platform for specific details and any associated fees related to deposits and withdrawals, ensuring well-informed financial decisions.

Trading Platforms

IQ Option offers two distinct trading platforms to cater to the diverse needs of its users:

Full Version Trading Platform: This platform is designed for Windows and macOS users. It offers a comprehensive trading experience with a size of 74 MB. It requires a minimum of 2 GB of RAM (4 GB recommended) and specific video card compatibility. It provides all the tools and features needed for in-depth analysis and trading execution.

IQ Lite: For Android users, IQ Lite is a streamlined and efficient solution with a small size of just 1.6 MB. It focuses on essential trading features and is compatible with Android 5.1 or later. IQ Lite offers a lightweight option for traders prioritizing simplicity and efficiency.

Both platforms are available for download from various sources, ensuring accessibility. IQ Option also provides guidance for resolving common technical issues that users may encounter, enhancing the overall user experience.

Customer Support

IQ Option provides accessible customer support to assist users with their inquiries and concerns. Users can reach out to IQ Option via email at support@iqoption.com for assistance related to various aspects of their trading experience.

Additionally, users can find IQ Option on various social media platforms, making it easier to stay updated with the latest developments, news, and announcements. The broker offers a user-friendly interface for asking questions or seeking assistance with a designated section for submitting queries.

While the specific phone number for customer support is not provided in the information, users are encouraged to utilize the email contact or the online question submission feature to reach out to IQ Option's support team. The broker aims to provide timely and effective support to enhance the trading experience for its users.

Educational Resources

Discover a wealth of valuable video tutorials on trading by visiting https://capital-ok.com/en/tutorials. These tutorials cover a wide range of topics, from the basics to advanced strategies, making them suitable for traders of all levels. Explore concepts like trading strategies, technical analysis, and risk management through engaging and interactive video content. You can learn at your own pace, with the ability to pause, rewind, and replay as needed. These tutorials are designed to complement Capital-OK's platform tools and features, helping you make more informed trading decisions. Don't miss this opportunity to enhance your trading skills and knowledge.

Summary

IQ Option is an online trading platform offering a diverse range of market instruments, including Forex, Stocks, Crypto, Commodities, Indices, and ETFs. They provide a tiered account system with Practice and Real Accounts for traders of all levels. While they offer a significant leverage of up to 1:1000, users should exercise caution. IQ Option provides competitive spreads as low as 0.06 pips and offers commission-free trading. They support various deposit and withdrawal options, with processing times ranging from instant to 3 business days. Two distinct trading platforms, one for Windows and macOS and another lightweight option for Android, cater to different user preferences. Customer support is accessible via email, and educational resources are available for traders. Additionally, Capital-OK offers video tutorials for traders looking to enhance their skills and knowledge.

FAQs

Q1: Is IQ Option a regulated broker?

A1: No, IQ Option operates without regulation, which means it lacks oversight from major financial authorities.

Q2: What market instruments can I trade on IQ Option?

A2: IQ Option offers Forex, Stocks, Crypto, Commodities, Indices, and ETFs for trading.

Q3: What is the maximum leverage offered by IQ Option?

A3: IQ Option provides a maximum trading leverage of up to 1:1000.

Q4: Are there any fees for trading on IQ Option?

A4: IQ Option offers competitive spreads starting from 0.06 pips and commission-free trading, but other fees may apply depending on the trading activity.

Q5: How can I contact IQ Option's customer support?

A5: You can reach IQ Option's customer support via email at support@iqoption.com or find them on various social media platforms for updates and inquiries.

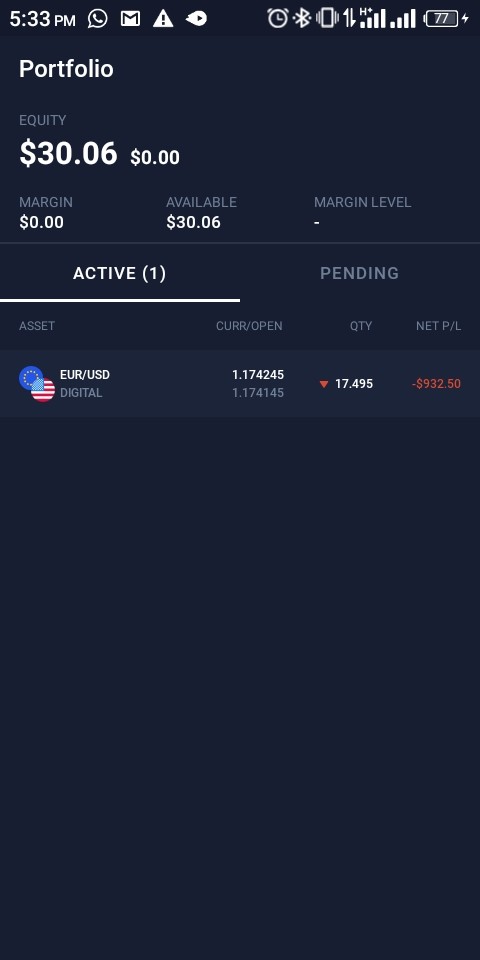

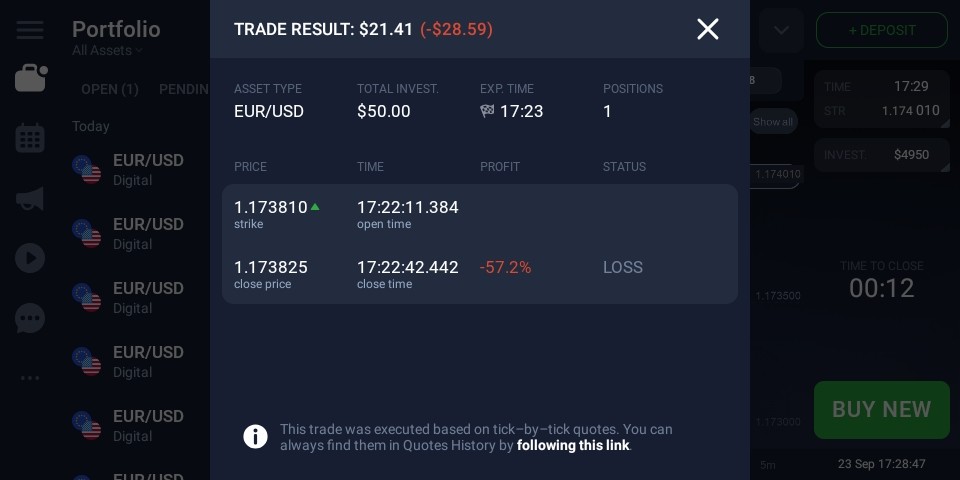

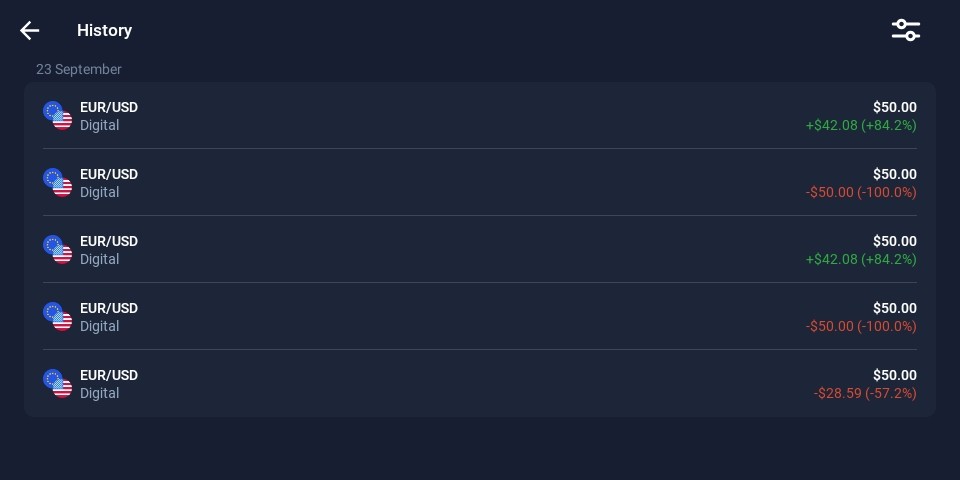

FX3218771864

Nigeria

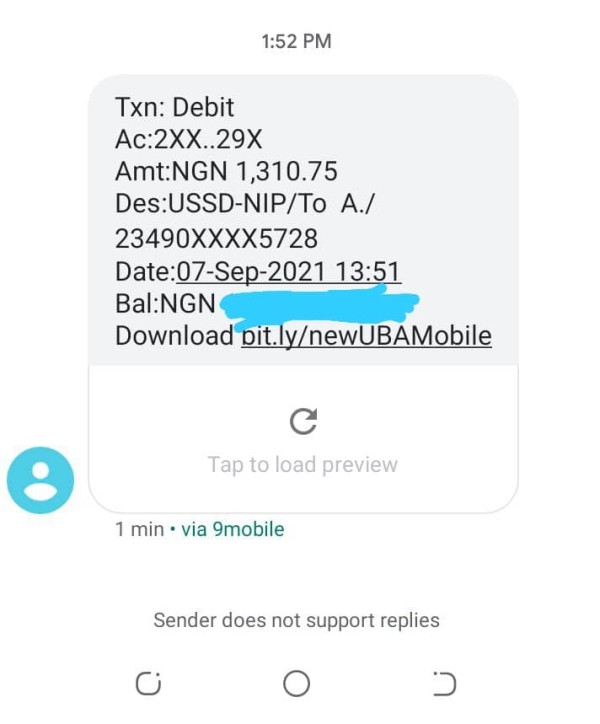

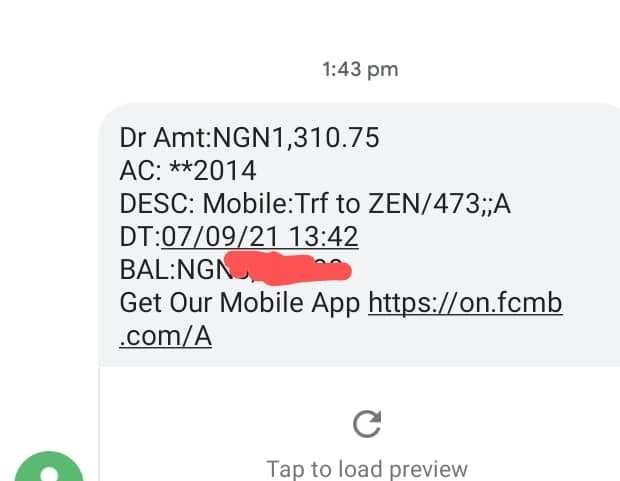

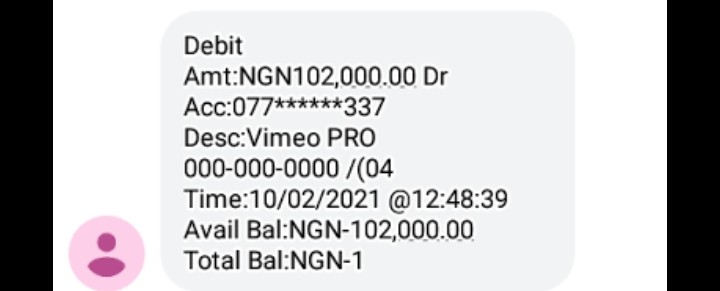

This broker are manipulating the chart, they are thieves.... please stay away. They maneuver the chart. check screenshots below

Exposure

2021-09-24

FX1772242963

Nigeria

the site closes anytime and also the demo account and the real account are not the same the demo account is not real the $10 demo account is fake

Exposure

2021-09-15

FX3521411557

Nigeria

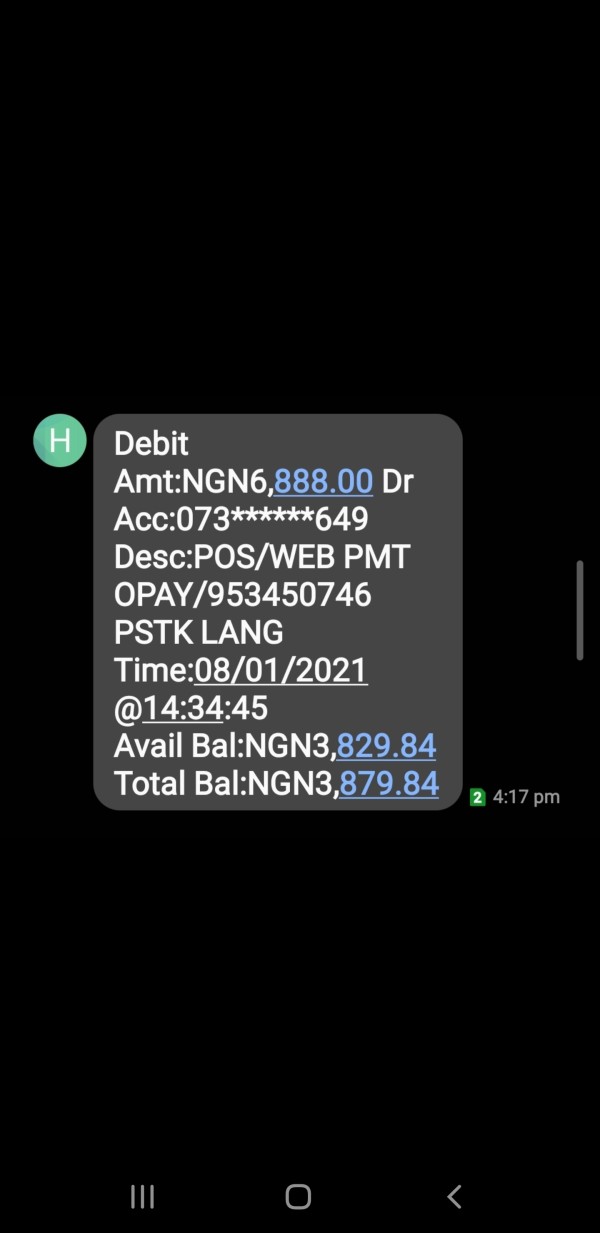

lost 6,800 naira with IQOPTION this the second time

Exposure

2021-09-14

RachelDamilolaSamuel

Nigeria

guys pls let stay away from IQ options,I invested d sum of 1000 naira 2 time,after that i was told 2 invest more 4 me 2 have a higher capital which i invested d sum of 2000 naira again 2 time after a couple of day i tried logging into d website but it keep writting website unable 2 connect,that was how i was scammed,and was unable 2 withdraw my hard earn money,pls let all stay away 4rm IQ option,they re fraud.

Exposure

2021-09-10

Davidade

Nigeria

I was introduced to this app by several people, I initiated the app and started using it but to my surprise the app was a total fraud, I tried withdrawing from them but it wasn't working, I can't even login again. so then I left the app.

Exposure

2021-09-07

FX9131715182

Nigeria

THEY SCAMMED ME THE RECORD AND THE SIGNAL IS FAKE SIGNAL AND I TRY TO RENEW IT BUT ITS SHOWING ME UNAVAILABLE

Exposure

2021-09-07

Ajibade Peace oluwadarasimi

Nigeria

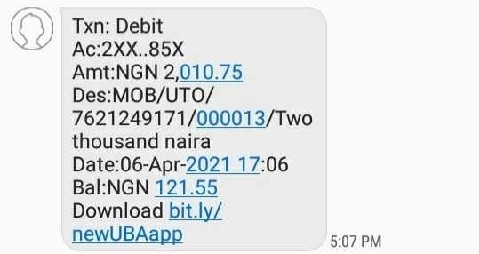

I was introduced to this platform and i was asked to deposit 2000naira Ever since have make the deposit i did not get my money back Pls is this scam

Exposure

2021-09-04

FX2630413316

Nigeria

My Case is: Problems with IQOption started in the late December 2016 when I had some issues with latency in order execution and impossibility to close early an option. As a result, the amount of $100 was lost. After several talks with my account manager and sending some proves, he managed to recover just around $40. I was assured that problems have been resolved as well. Because of this, I didn't find any reason to complain officially. Unfortunately, the same problems occured on 23 March 2017

Exposure

2021-08-31

Mira Omaa

Nigeria

Got an invitation from a friend on a FOREX &BINARY TRADING Also on Telegram.With its promises to help trade I got scammed and he also.with over $5000 lost to these men.Please be careful do not trust them,you will get no money out.

Exposure

2021-08-31

FX1634461262

Nigeria

A MASSAGE ME ABOUT IQ OPTION INVESTMENT PACKAGES AND HE CLAIMED TO BE A LADY HIS PROFILE PIC AND NAME ARE CHANGED. I TRUST HIM AND INVESTED 20,000 FOR AN INVESTMENT AFTER HE RECIEVED THE PAYMENT HE STARTED MISBEHAVING TAKE NOTE DONT INVEST WITH FAKE BROKER

Exposure

2021-08-24

FX3690287516

Nigeria

Unprofessional emails we got from the "company stay away from such scammers they will finish you and leave you in sadness

Exposure

2021-08-23

woundedlion

Nigeria

I can't withdraw my profit of $100 for close to 1 month now......iq was my best broker but not anymore....I quit

Exposure

2021-08-16

Rey

Philippines

Unable to withdraw. It left me. Please help me get my money back. Thanks.

Exposure

2021-08-09

CROWN

Nigeria

unable to withdraw fund

Exposure

2021-08-08

FX2672640156

Nigeria

This guy uses different account on facebook to scam people, he got over 150$ from a friend. Pls beware of him. he's a scam, posting the same thing everyday to get his victims

Exposure

2021-08-07

FX1367892350

Nigeria

Do not open account in scam brokers because at the end you lose your nerve and money im very sad and in a trauma for my hard work and trades that has not a good end because this broker is Scam

Exposure

2021-08-07

Viral Fix

Nigeria

After Investing A lot on IQ Option, I was unable to withdraw my own money ever since.

Exposure

2021-08-06

FX1164424090

Nigeria

After I fund with this company i try trading but the market is just so volatile and will always go the wrong direction of my prediction. It's FAKE

Exposure

2021-08-06

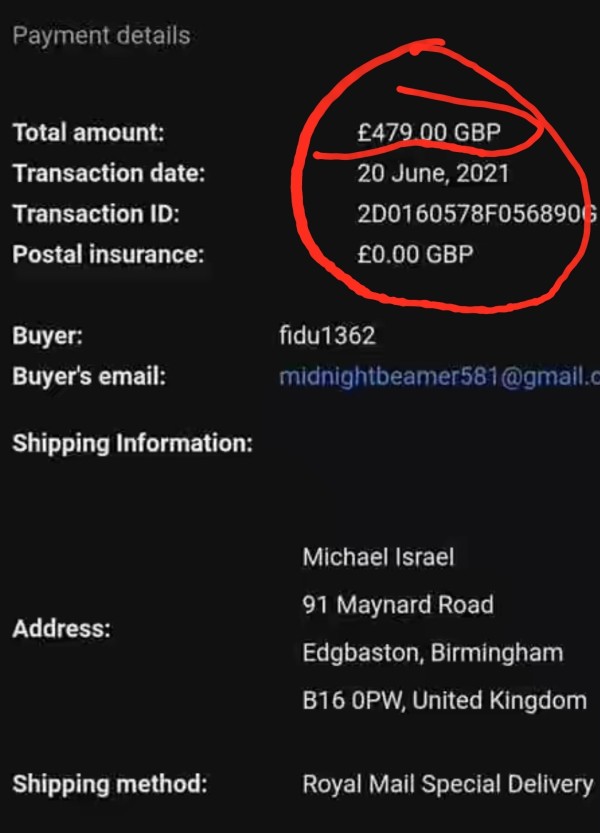

FX2597413962

Nigeria

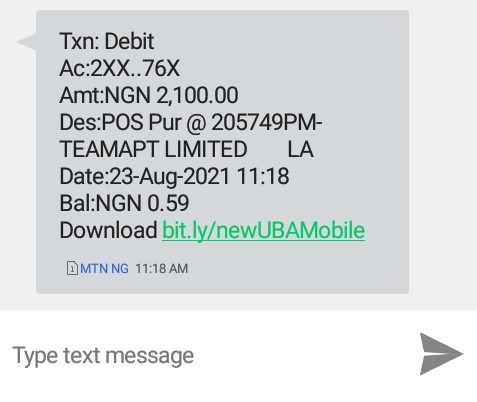

SCAM ALERT IQ OPTION SIGNAL TRADING - A client paid 200 USD yesterday for a investment package. Once payment is made he is blocked through all contact methods. See the screenshots above! Lets help eachother and and report the channel and the owner as many times as possible!

Exposure

2021-08-05

FX2083853158

Nigeria

SCAM ALERT IQ Option Daily Signals. - FOR SURE one of the biggest scams I have ever seen. I get messages on daily or weekly base about clients that lose their entire capital with them. They offer investment packages but once paid, you will be blocked! They have many subscribers but most of them or bought. Please never invest with them you will guaranteed lose ALL your money!

Exposure

2021-08-05