Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

What is STV Global Limited?

STV Global Limited is a global brokerage firm based in the United States. It provides traders with access to market instruments including Forex, Commodities, Stock, Index. However, it is important to note STV Global Limited is currently not regulated well by any recognized financial authorities which may raise concerns when trading.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

STV Global Limited Alternative Brokers

There are many alternative brokers to STV Global Limited depending on the specific needs and preferences of the trader. Some popular options include:

IronFX- With a global presence and a wide range of trading instruments, IronFX offers a solid option for traders looking for a comprehensive brokerage service.

OANDA- Renowned for its reliable execution and extensive market research tools, OANDA is an excellent choice for traders seeking a reputable and feature-rich forex trading platform.

Pepperstone- Known for its competitive spreads, fast execution, and outstanding customer support, Pepperstone is a top-notch brokerage option for both beginners and experienced traders.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

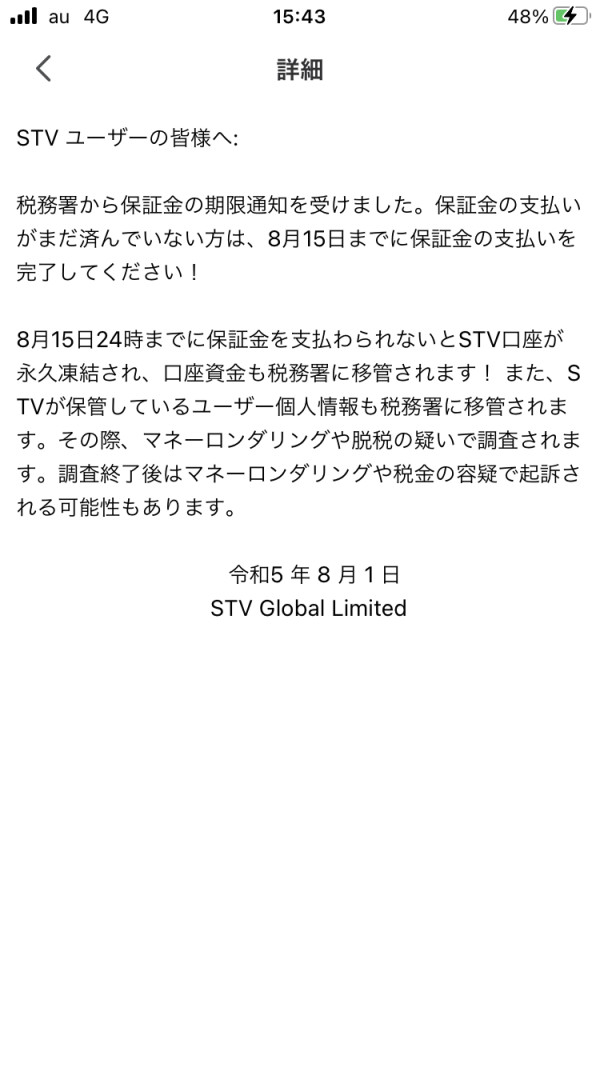

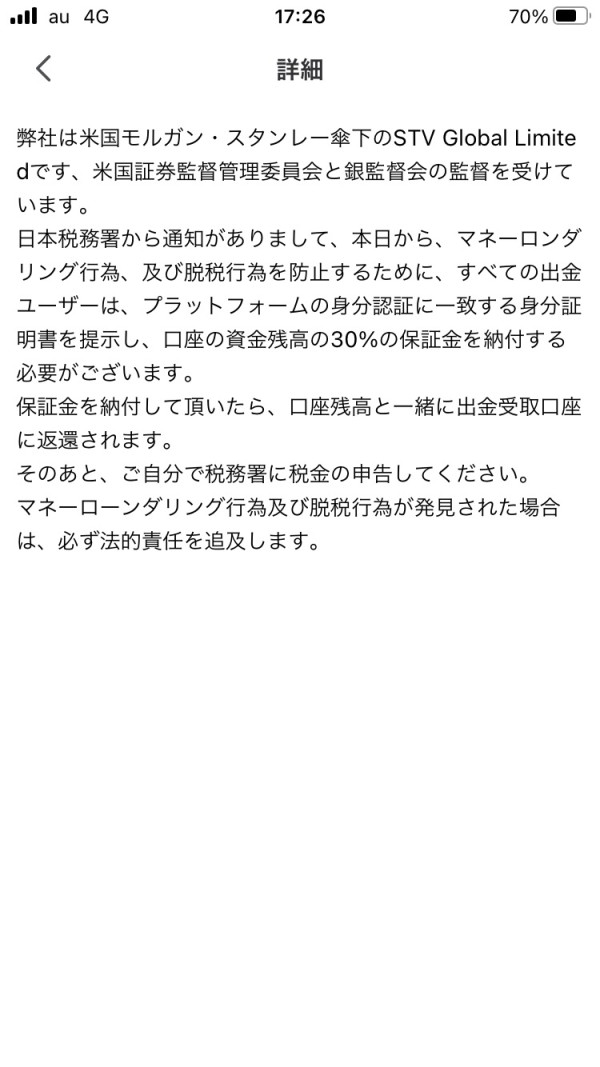

Is STV Global Limited Safe or Scam?

When considering the safety of a brokerage like STV Global Limited or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: The broker claims itself regulated by The American National Futures Association (NFA) with Regulatory ID 0557476. However, its been verified that the broker not regulated and the NFA regulation is unauthorized, which means that there is no guarantee that it is a safe platform to trade with.

User feedback: Read reviews and feedback from other clients to get an understanding of their experiences with the brokerage. Look for reviews on reputable websites and forums.

Security measures: STV Global Limited prioritizes fund safety by implementing segregated accounts, keep clients fund separate from the company's finances, reducing the risk of misappropriation and enhancing overall account security and safeguarding clients' funds from being used for operational purposes.

Ultimately, the decision of whether or not to trade with STV Global Limited is a personal one. You should weigh the risks and benefits carefully before making a decision.

Market Instruments

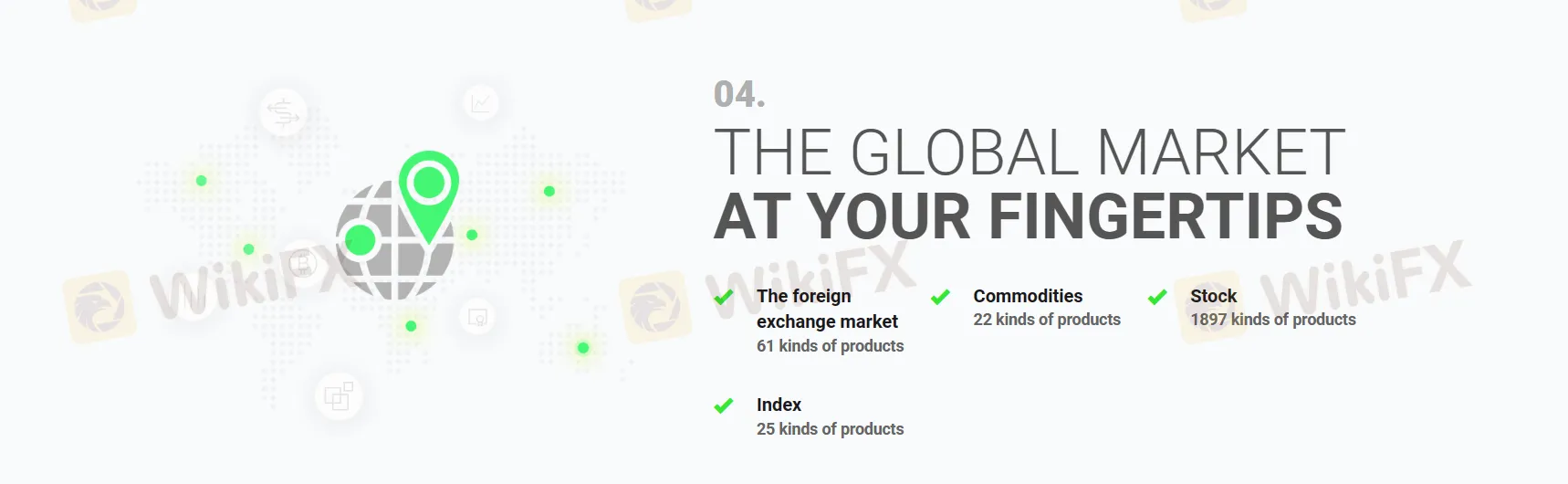

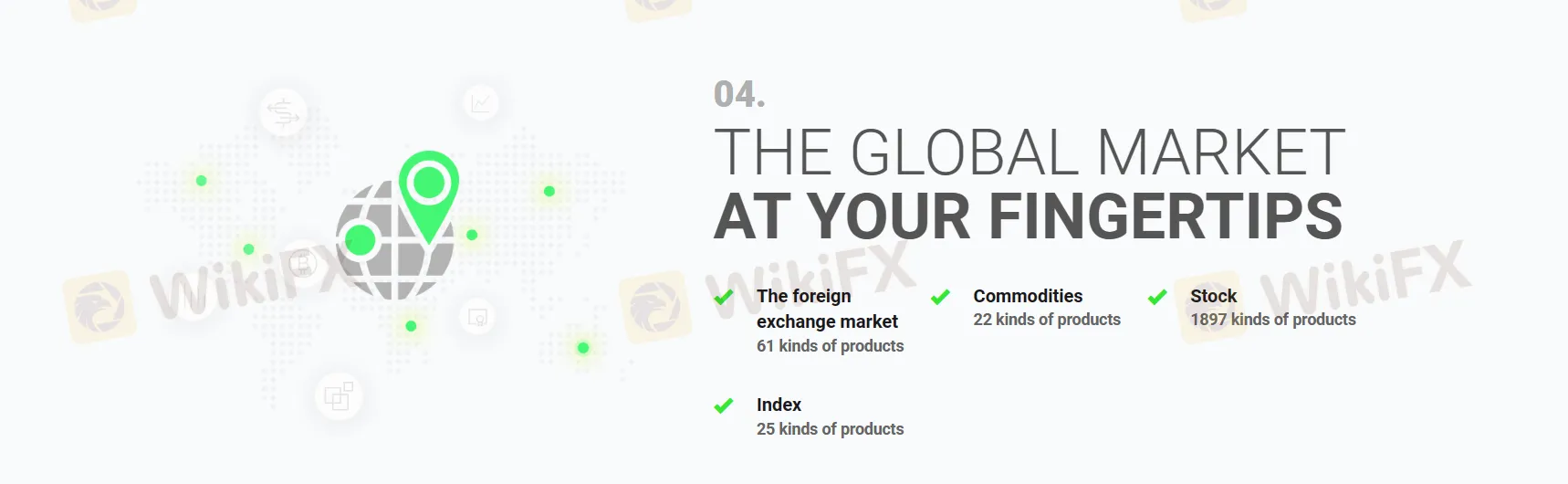

STV Global Limited offers a diverse selection of market instruments, catering to the trading interests of a wide range of investors.

Traders can access the dynamic world of Forex, participating in currency pairs to capitalize on global exchange rate fluctuations.

Moreover, STV Global Limited provides access to the Commodities market, allowing investors to venture into a variety of valuable resources such as gold, silver, oil, and other raw materials.

For those interested in the Stock market, the brokerage offers the opportunity to trade individual company stocks, giving investors exposure to specific companies' performance.

Additionally, traders can explore the Index market, gaining access to a broader perspective on the overall performance of various stock market indices.

STV Global Limited also offers Cryptocurrency CFDs, allowing traders to participate in the volatile and ever-growing cryptocurrency market without owning the actual digital assets.

With this comprehensive range of market instruments, STV Global Limited empowers traders to diversify their portfolios and pursue their financial goals effectively.

Leverage

STV Global Limited provides its traders with a significant leverage option of up to 1:500. This high leverage allows traders to amplify their positions and potentially increase their trading potential. However, it is essential to exercise caution and consider the risks associated with such high leverage, as it can also lead to substantial losses. While the high leverage can be advantageous for experienced and well-prepared traders, it is crucial to use it wisely and prudently to avoid overexposure and protect one's capital in the dynamic financial markets. Traders should ensure they have a clear understanding of the risks and employ risk management strategies to make informed and responsible trading decisions.

Spreads & Commissions

STV Global Limited boasts highly competitive trading conditions with spreads that start from an impressive 0.0 pips, showcasing their commitment to providing cost-effective trading solutions. Moreover, traders can expect average spreads around 0.1 pips across various financial instruments, making STV Global a favorable choice for those seeking tight and transparent pricing. The absence of commissions further enhances the appeal of their offerings, enabling traders to execute trades without incurring additional charges and maximizing potential profits.

Below is a comparison table about spreads and commissions charged by different brokers:

Please keep in mind that spread values can vary depending on market conditions, account type, and other factors. Commission structures may also differ based on the broker's pricing model and the type of account being used. It's important to review the official websites or contact the brokers directly for the most accurate and up-to-date information on spreads and commissions.

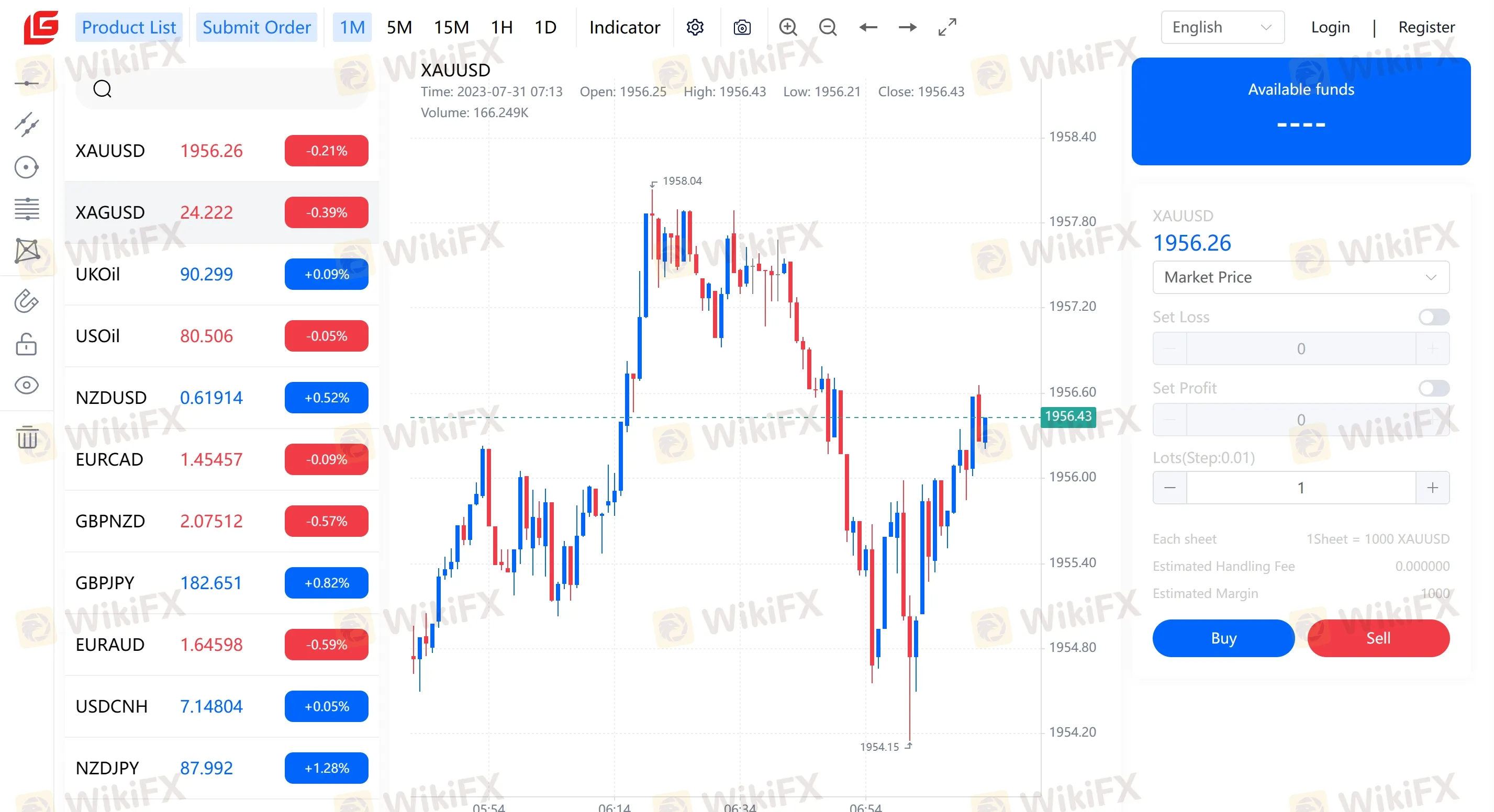

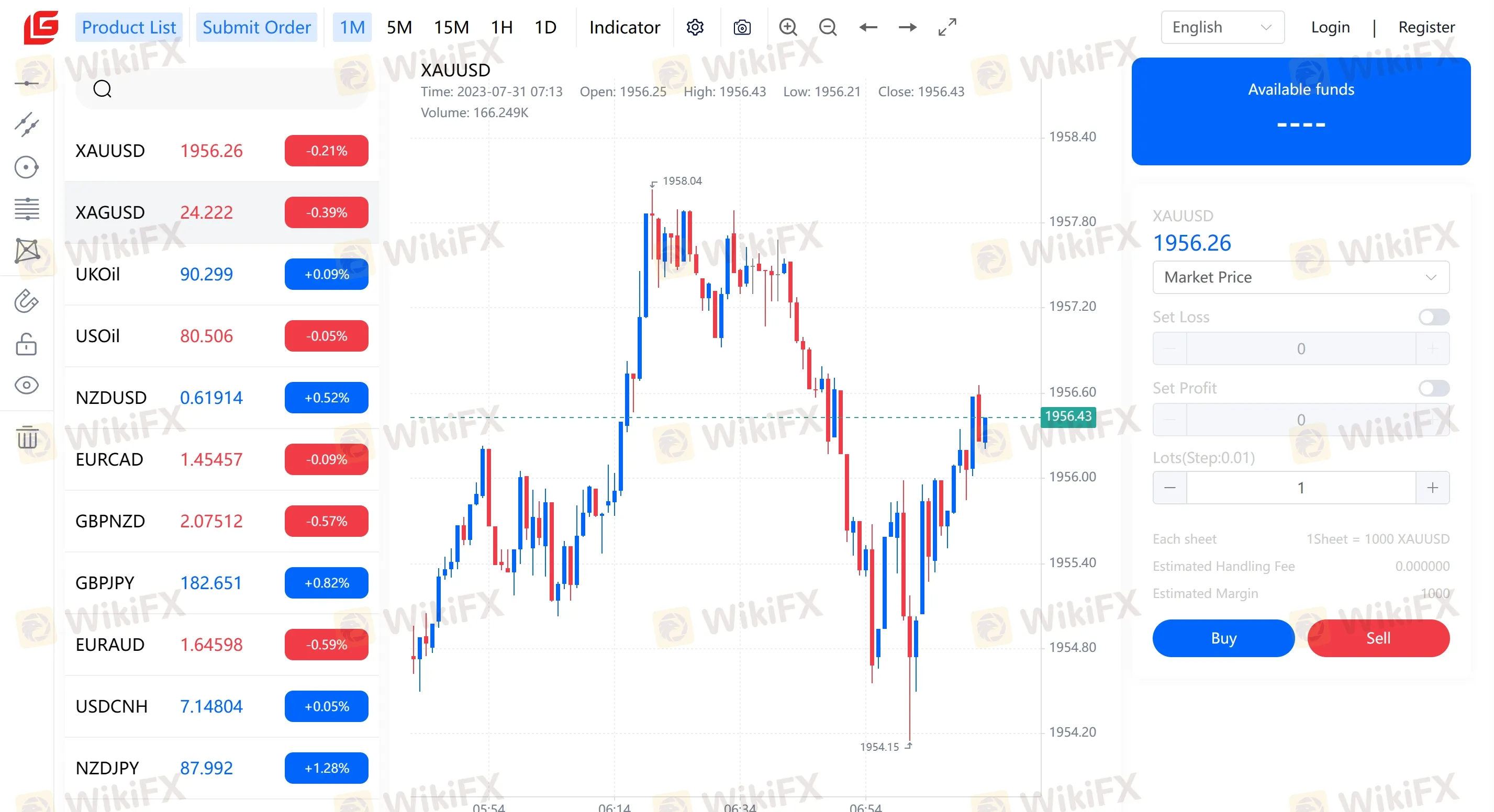

Trading Platforms

STV Global Limited goes the extra mile to cater to traders' needs by offering the ST5 platform on iOS and Android devices, which should also be available on Windows 7 or higher devices. This mobile trading platform not only provides the convenience of trading on-the-go but also introduces valuable add-ons to enhance the trading experience. With features like a key trading module, market depth, and spread monitoring, traders gain deeper insights into the market and can make more informed decisions. The inclusion of trade risk calculation and advanced order types further empowers traders to implement sophisticated trading strategies and manage risk effectively.

See the trading platform comparison table below:

Trading Tools

STV Global Limited provides a comprehensive suite of trading tools to empower its clients with enhanced capabilities and insights. These tools include:

Market (DOM) Depth: The Market Depth tool offers a real-time view of the order book, displaying the current bid and ask prices, along with the volume of pending orders. Traders can assess market liquidity and potential price movements more accurately using this information.

Internal Market Spread Monitoring: With Internal Market Spread Monitoring, traders can keep track of the bid-ask spreads for various instruments in real-time. This enables them to identify favorable trading opportunities and make more informed decisions.

Ladder Trading Technology: Ladder Trading Technology allows for precise order placement and execution by displaying price levels vertically on a ladder interface. Traders can quickly enter and manage orders at specific price levels, facilitating faster and more efficient trading.

Automatic Liquidation Using Custom Templates: The Automatic Liquidation feature enables traders to implement predefined liquidation strategies based on custom templates. In the event of adverse market conditions, these templates can automatically execute predefined actions, helping traders manage risk more effectively.

Deposits & Withdrawals

STV Global Limited ensures convenience and accessibility for its clients by offering a wide array of payment methods.

Traders can fund their accounts using Credit cards and Debit cards, providing a seamless and secure way to make transactions. The availability of e-wallet options like Skrill, Neteller, and Webmoney further facilitates quick and efficient fund transfers. For local traders, the option of Local Bank Transfer allows for convenient transfers from home banks to receiving banks.

Additionally, wire transfer and bank counter deposit offer traditional payment methods for those who prefer them. UnionPay serves as a reliable option for clients in specific regions, while FasaPay and Bpay provide alternative electronic payment solutions. STV Global Limited's inclusion of inter-dealer transfer enables smooth internal fund transfers between traders within the platform.

Customer Service

STV Global Limited provides customer support exclusively through email, which may not offer instant responses like phone or live chat channels. However, the broker claims to offer 7x24 h customer service, ensuring that inquiries and concerns are addressed promptly, albeit without the immediate real-time interaction offered by phone or live chat support. Traders should consider this aspect when choosing their preferred means of communication.

E-mail:support@stvgloballimited.com.

Conclusion

According to available information, STV Global Limited is a non-regulated US -based brokerage firm. The claimed American National Futures Association (NFA) Regulatory ID 0557476 is verified to be unauthorized. While the firm offers a range of market instruments such as Forex, Commodities, Stock, Index, Cryptocurrency CFDs, it is important to consider certain factors such as lack of regulations that may raise concerns. It is critical that potential clients exercise caution, conduct thorough research and seek up-to-date information directly from STV Global Limited before making any investment decisions.

Frequently Asked Questions (FAQs)