Overview of RC Global

RC Global, established in 2014 and based in the United States, operates as an unregulated entity in the loan sector, offering a variety of services tailored to meet diverse financial needs.

Their portfolio includes purchase loans, FHA loans, VA loans, refinancing options, and reverse mortgages, attracting a wide range of borrowers looking for both residential and investment property financing solutions. Customer support is readily accessible via phone at (877) 724-5622.

Is RC Global Limited Legit or a Scam?

RC Global operates within the loan industry as an unregulated entity, meaning it has not been formally authorized or overseen by any financial regulatory bodies.

Pros and Cons

Products & Services

RC Global offers a diverse array of loan services tailored to address the unique financial needs and goals of various clients:

- Purchase Loans: RC Global's purchase loans are designed to facilitate the home buying process for individuals and families. Whether clients are in the market for their first home, upgrading to a larger space, or investing in real estate, RC Global provides customized financing solutions. These loans are structured to meet the buyer's financial situation, offering competitive interest rates and terms that align with their long-term homeownership goals.

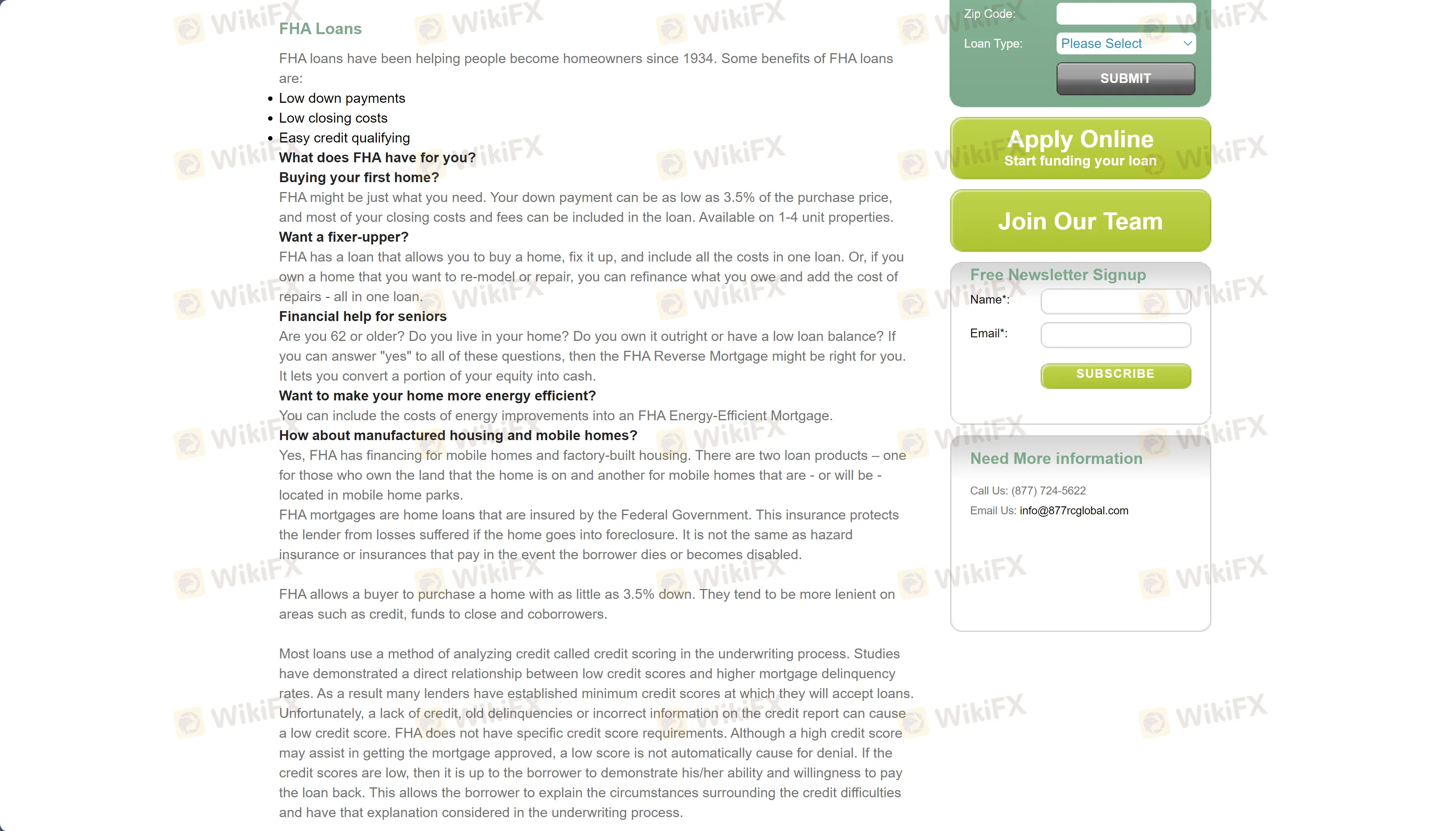

- FHA Loans: Federal Housing Administration (FHA) loans are a cornerstone of RC Global's offerings, aimed at making homeownership more accessible. These government-backed loans are ideal for borrowers who may not qualify for conventional mortgages due to lower credit scores or limited savings for down payments. FHA loans come with the security of government backing, reduced down payment requirements, and more lenient lending standards, making them an attractive option for first-time homebuyers and those with modest incomes.

- VA Loans: Dedicated to serving the needs of veterans and active military personnel, VA loans offer significant benefits as a token of gratitude for their service to the country. With features like no down payment, no requirement for PMI, and lenient credit requirements, VA loans from RC Global provide a pathway to homeownership that acknowledges the sacrifices made by military members and their families. These loans also offer favorable terms for refinancing, further enhancing their appeal to eligible borrowers.

- Refinance: For homeowners looking to optimize their existing mortgage, RC Global's refinancing services offer a solution. Whether the goal is to secure a lower interest rate, reduce monthly mortgage payments, switch from an adjustable-rate to a fixed-rate loan, or access home equity for major expenses, refinancing can provide financial relief and flexibility. RC Global works closely with clients to assess their current financial situation and long-term goals, offering refinancing options that best suit their needs.

- Reverse Mortgages: Tailored specifically for seniors, reverse mortgages from RC Global offer a financial tool to enhance retirement planning. By allowing homeowners aged 62 and older to convert part of their home equity into cash without the need to sell their home, reverse mortgages provide a source of income that can supplement retirement funds, cover healthcare costs, or fund home improvements. RC Global ensures that clients fully understand the terms and potential implications of a reverse mortgage, guiding them through the process with expert advice and support.

How to Open an Account?

Opening an account with RC Global can be a straightforward process, typically involving the following steps:

Step 1: Provide Personal and Financial Information

Start by visiting the RC Global website or contacting their office directly. You'll need to provide personal details such as your name, address, and contact information, as well as financial information, including your income, employment history, and any existing debts.

Step 2: Select the Desired Loan Service

Choose the loan service that best suits your financial goals, whether it's a purchase loan for a new home, an FHA or VA loan, refinancing options, or a reverse mortgage. RC Global may provide guidance and advice to help you make an informed decision based on your eligibility, financial situation, and long-term objectives.

Step 3: Submit Application and Await Approval

Complete and submit your loan application along with any required documentation, such as proof of income, asset information, and identification. Once submitted, RC Global will process your application, conduct the necessary credit and financial checks, and inform you of their decision.

Customer Support

RC Global is dedicated to providing exceptional customer support to ensure a smooth and satisfactory experience for its clients.

For any inquiries, assistance, or support, clients can easily reach out to the RC Global team by calling (877) 724-5622.

Alternatively, for those who prefer written communication or need to send documents, emailing info@877rcglobal.com is a convenient option.

Additionally, for in-person consultations or services, clients can visit the RC Global office located at 3949 Clairemont Dr, Suite 15, San Diego, CA 92117, where the staff is prepared to assist with a wide range of loan-related needs.

Tools

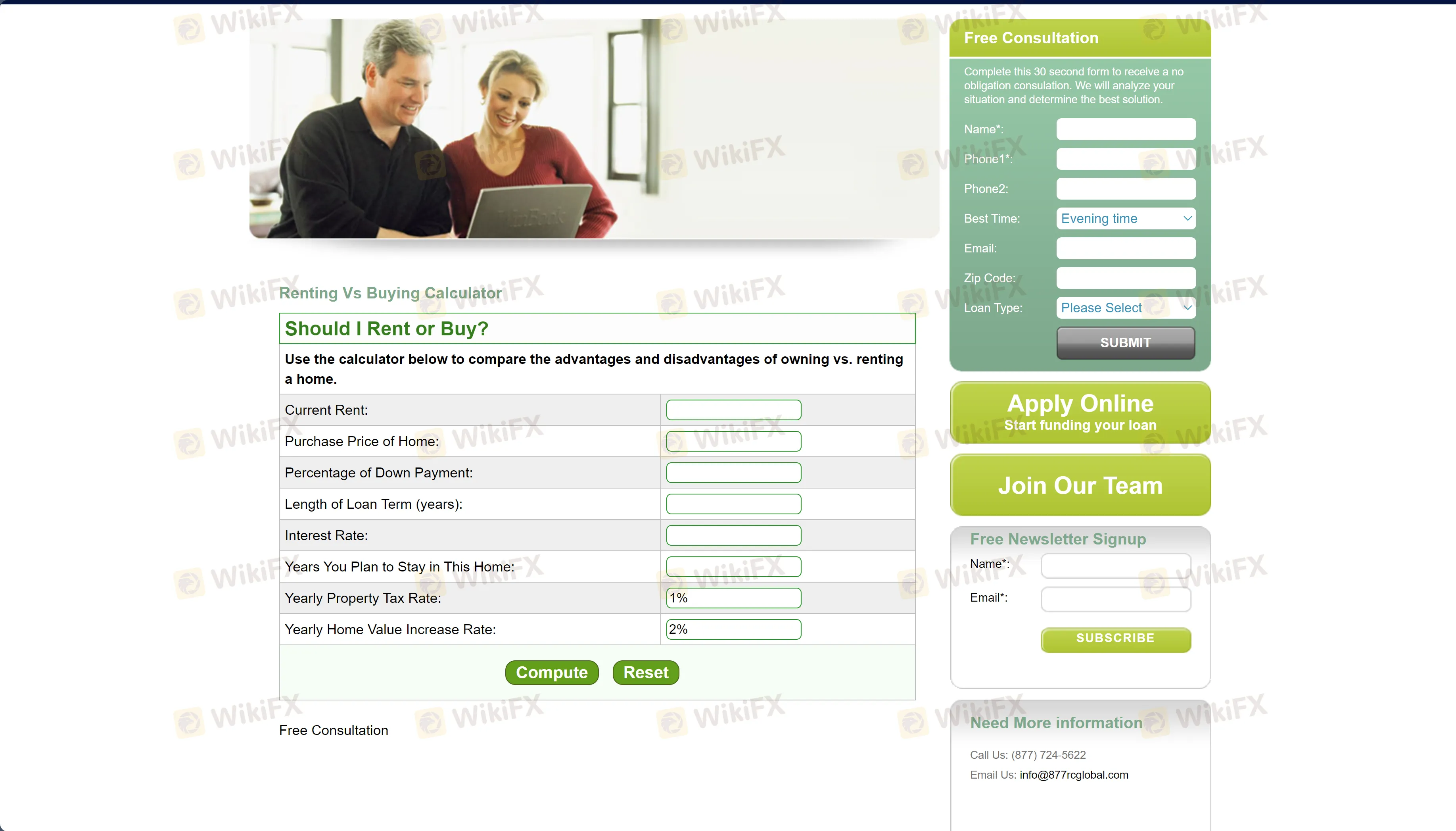

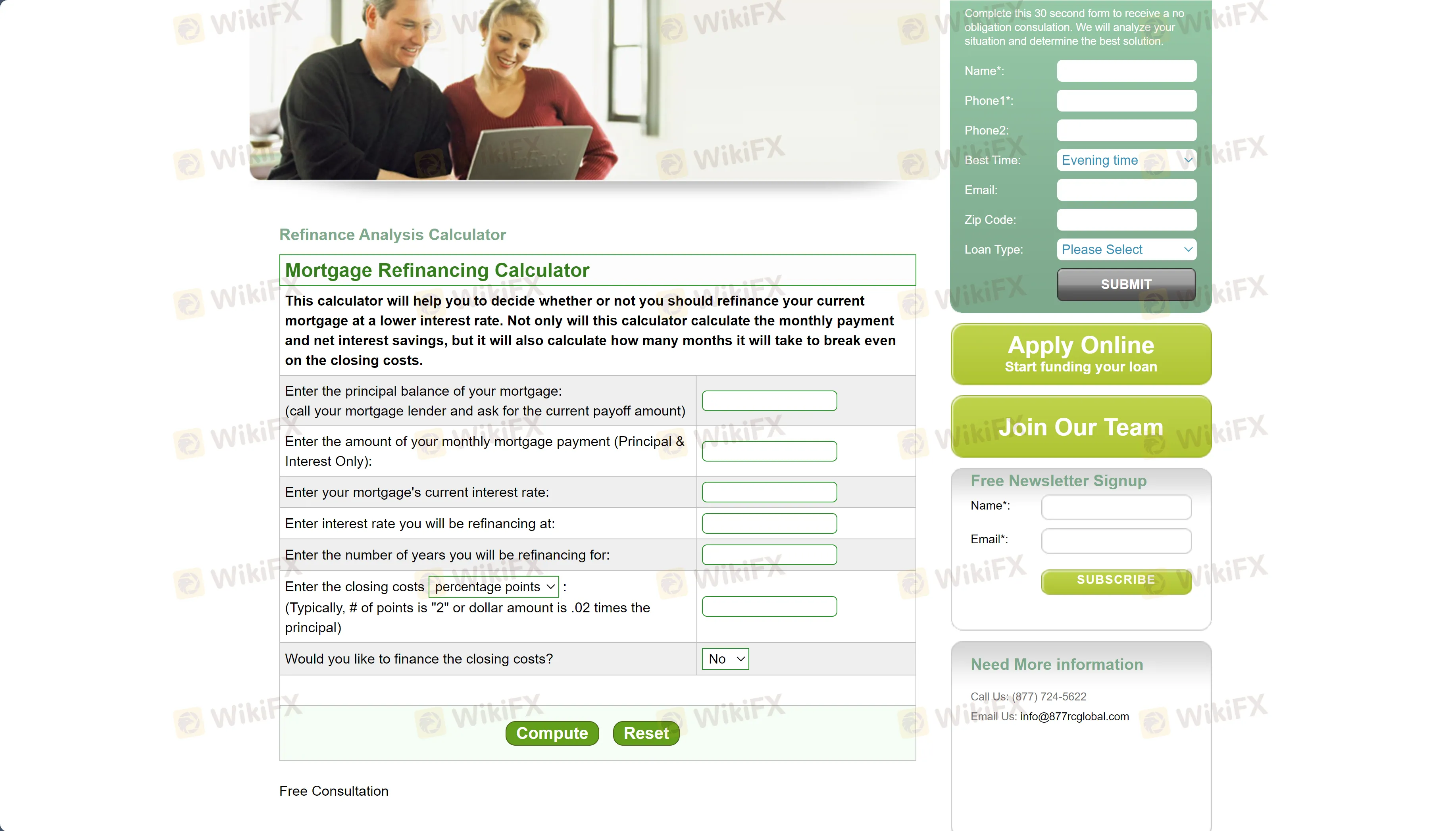

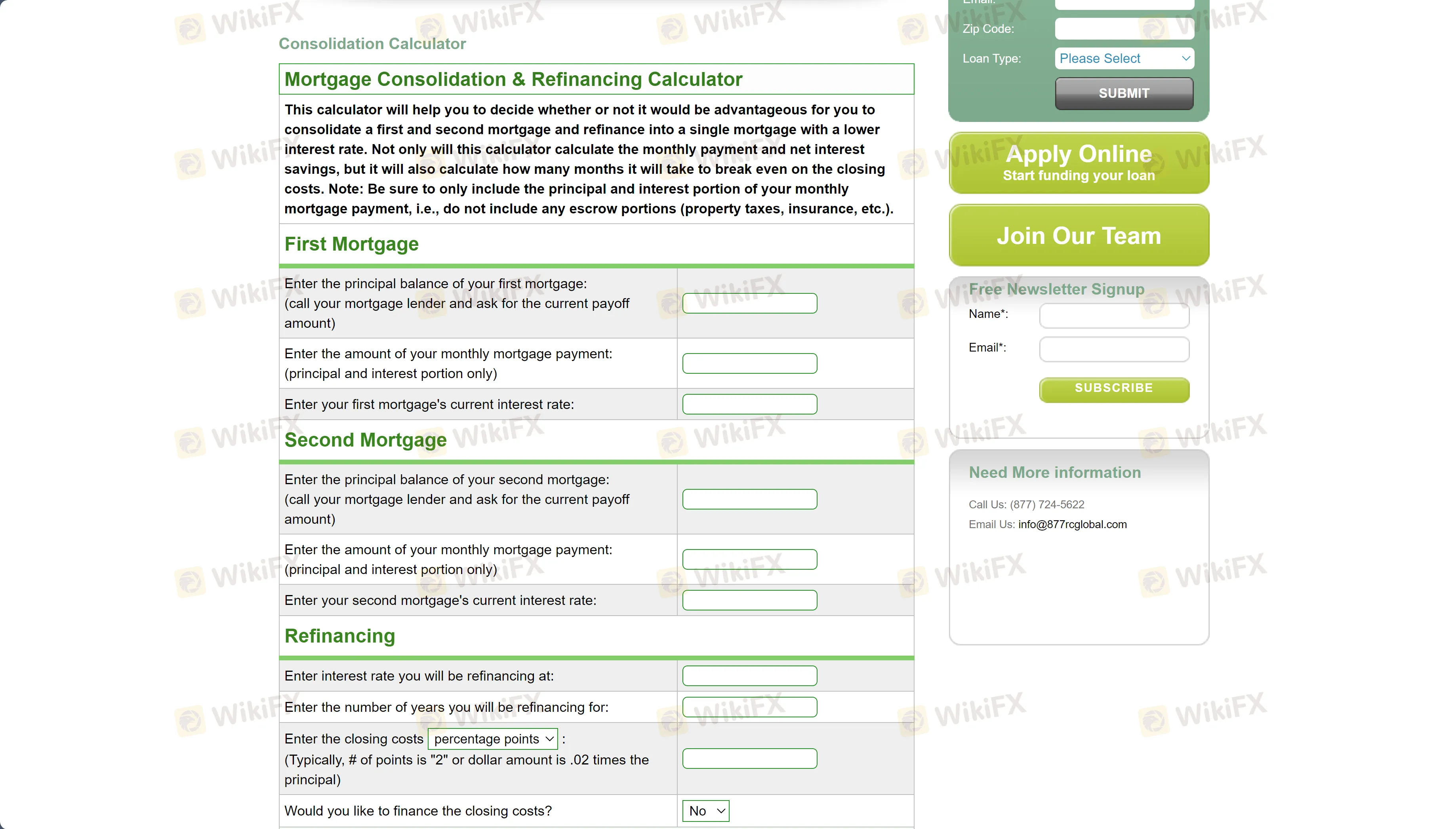

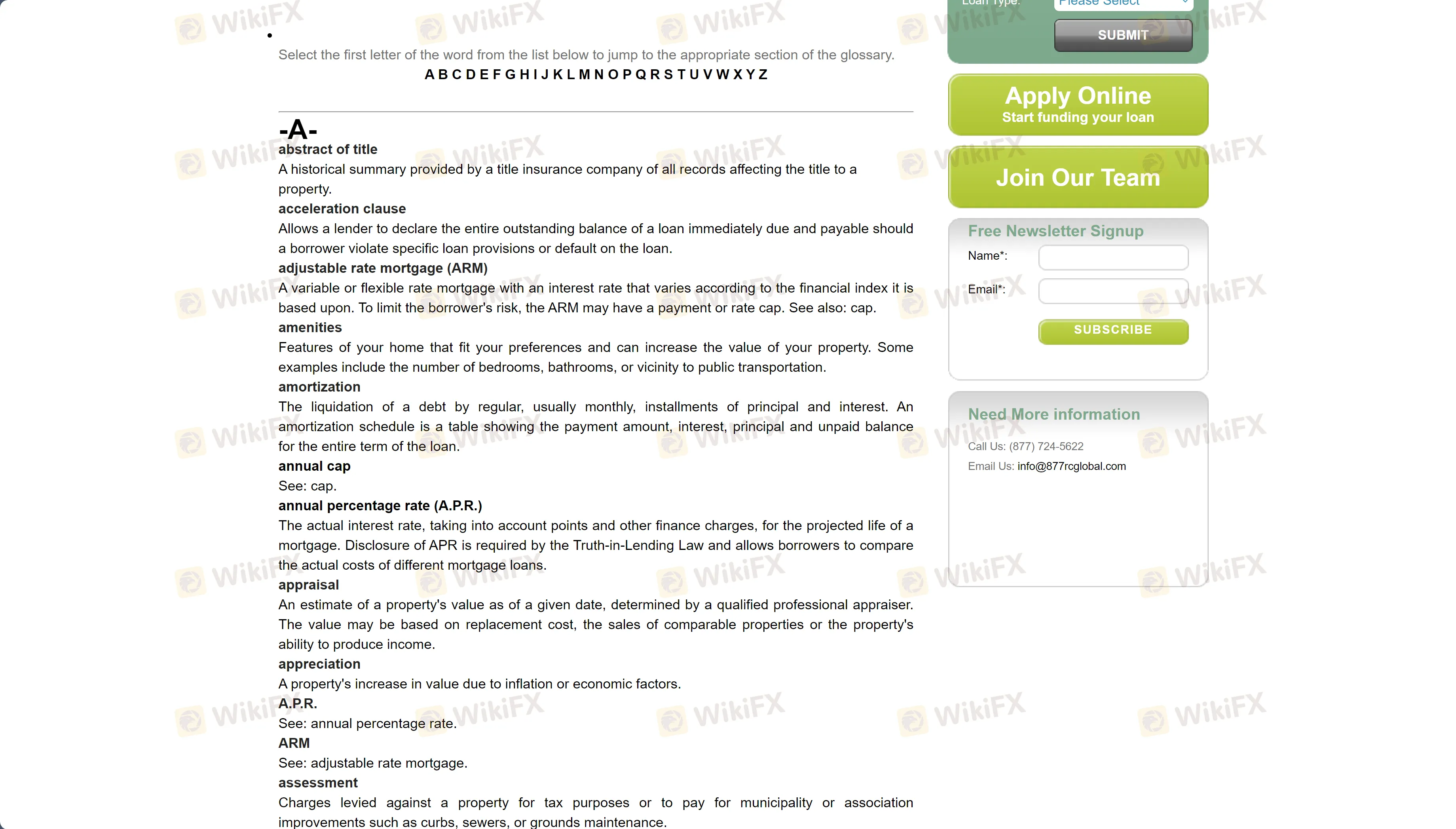

RC Global provides its clients with a suite of financial tools designed to assist in making informed decisions about their loan options:

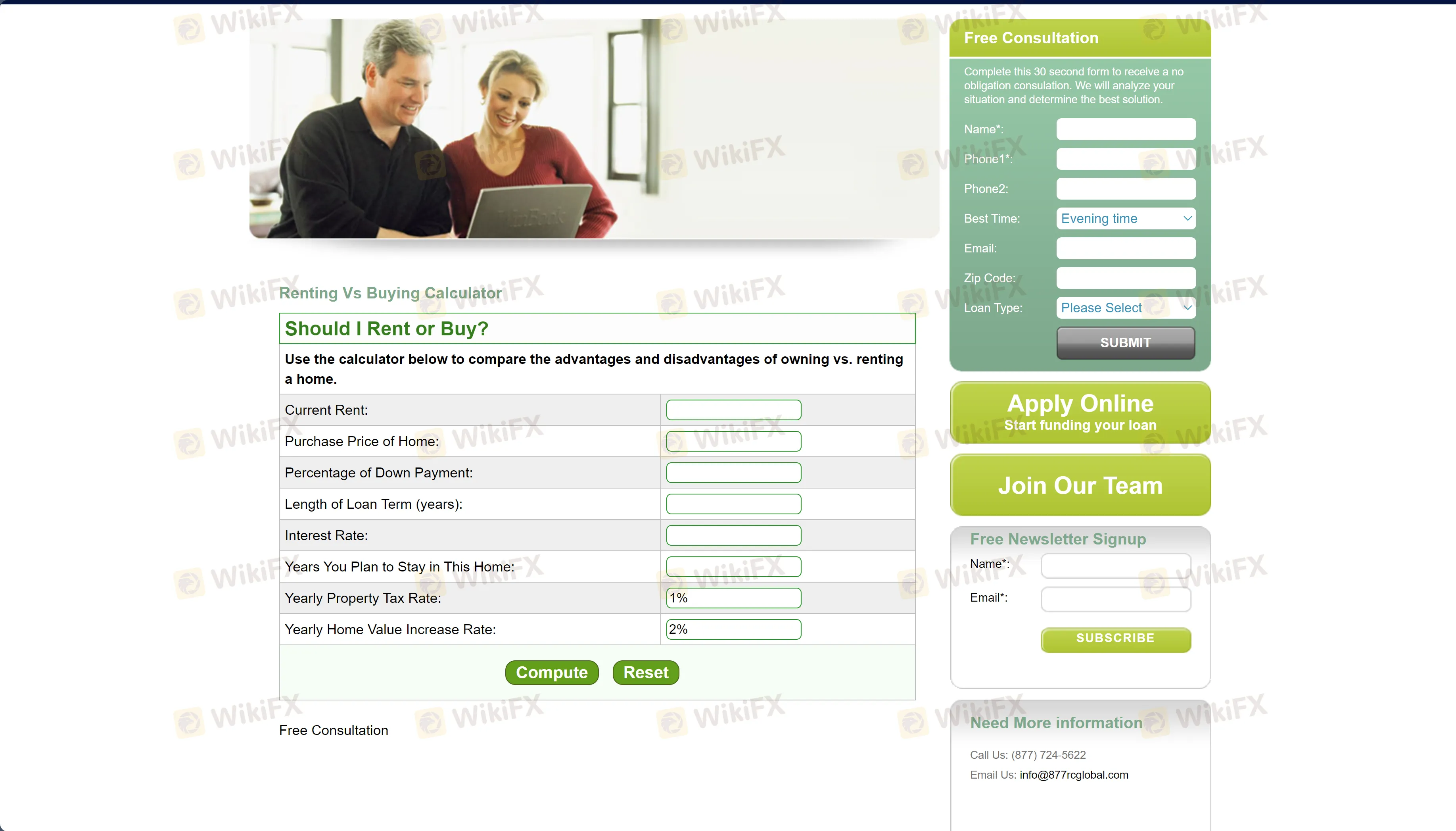

- Renting versus Buying Calculator: This tool helps potential borrowers weigh the financial implications of renting against buying a home. By inputting their current rental expenses and comparing them with potential mortgage costs, users can better understand the long-term benefits and costs associated with homeownership versus continuing to rent.

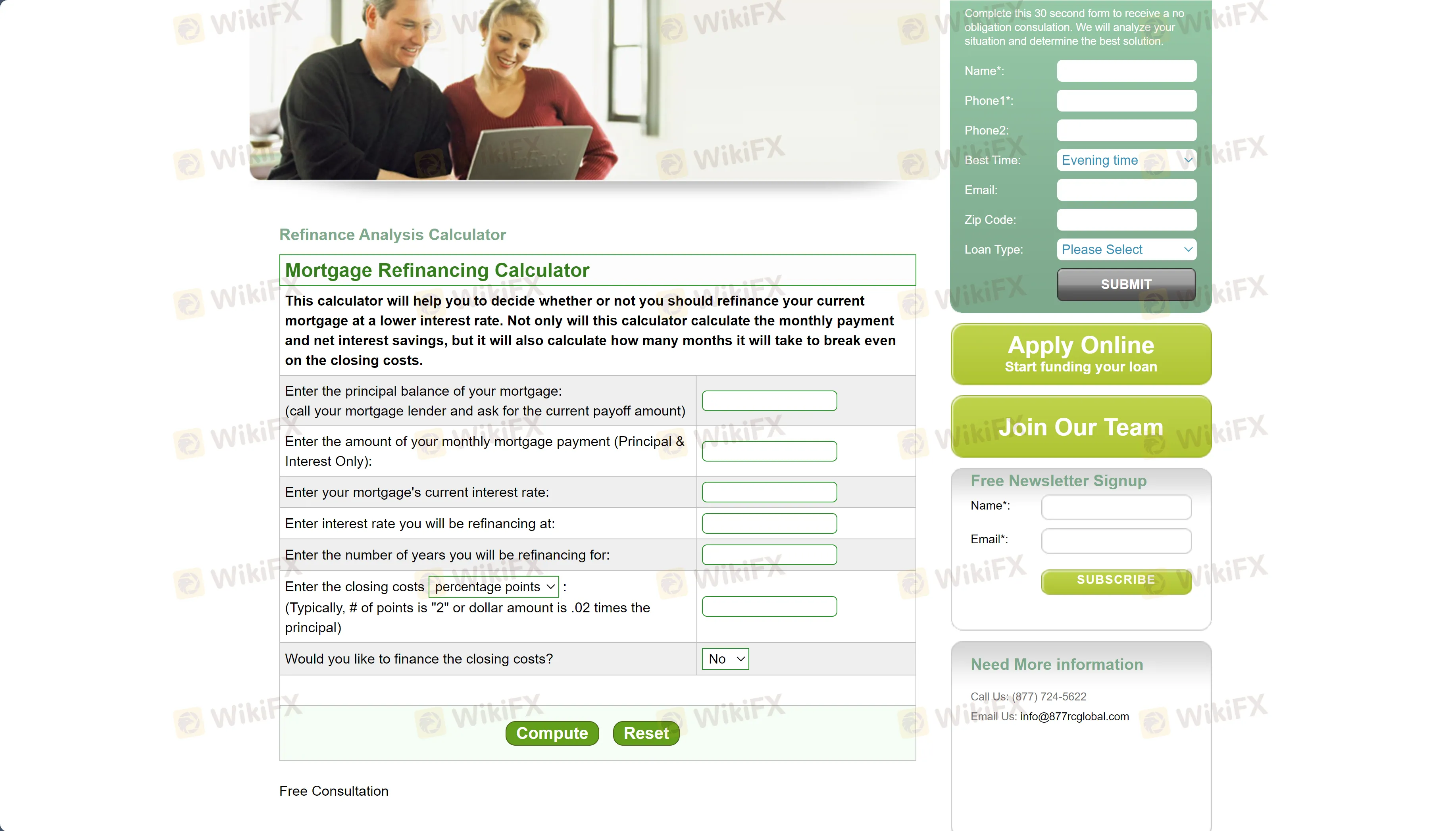

- Refinance Analysis Calculator: For those considering refinancing their existing mortgage, this calculator offers insights into how refinancing might affect their monthly payments, interest costs, and overall loan term. It helps users evaluate whether refinancing is a financially beneficial move based on their current loan terms and the prevailing interest rates.

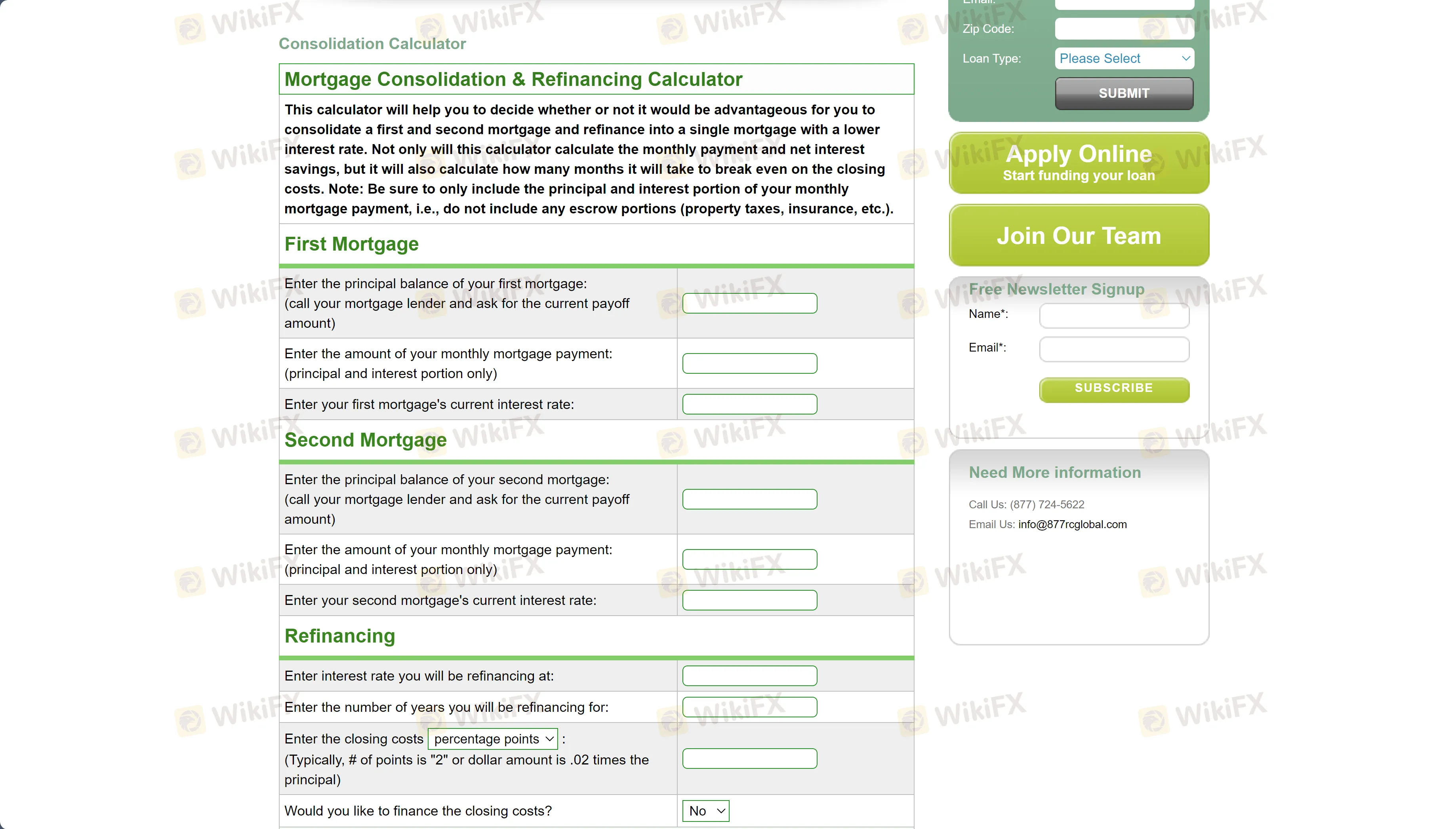

- Consolidation Calculator: This tool is designed for individuals looking to consolidate their debts, including multiple loans or credit card balances, into a single loan, potentially with a lower interest rate. By inputting their existing debts, interest rates, and monthly payments, users can assess the potential savings and simplification benefits of consolidation.

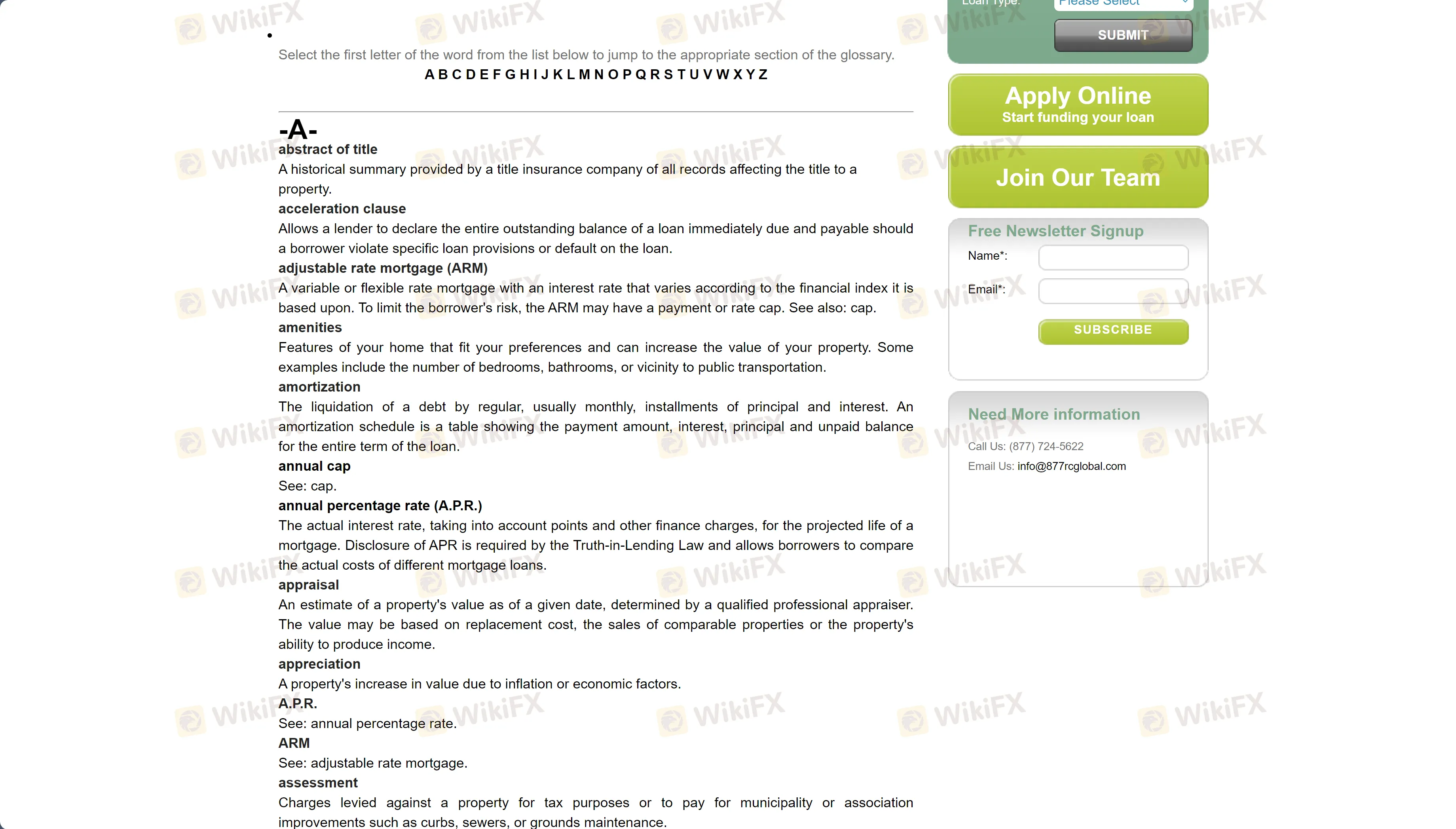

- Glossary of Mortgage Terms: Understanding mortgage terminology can be challenging for many borrowers. RC Global offers a comprehensive glossary of mortgage-related terms, providing clear and concise definitions to help clients navigate the complex language of the loan industry, enhancing their understanding and confidence in making loan-related decisions.

Conclusion

In conclusion, RC Global is an unregulated loan service provider that offers a range of loan options including purchase loans, FHA loans, VA loans, refinancing, and reverse mortgages.

FAQs

What types of loans does RC Global offer?

RC Global provides various loan services including purchase loans, FHA loans, VA loans, refinancing options, and reverse mortgages.

Is RC Global a regulated entity?

No, RC Global operates as an unregulated loan service provider.

How can I contact RC Global for support?

You can reach RC Global's customer support by calling (877) 724-5622 or via email at info@877rcglobal.com.