Score

OrcaraGold Exclusive

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://www.orcaragoldexclusive.com

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

Singapore

SingaporeContact

Licenses

Licenses

Licensed Entity:Orcara Gold Exclusive LLC

License No. 31000282297635

Basic Information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed OrcaraGold Exclusive also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

orcaragoldexclusive.com

Server Location

Thailand

Website Domain Name

orcaragoldexclusive.com

Server IP

123.253.61.236

orcaragold.com

Server Location

United States

Website Domain Name

orcaragold.com

Server IP

216.239.34.21

Company Summary

General Information

| ORCARA GOLD Review Summary in 10 Points | |

| Founded | 2021 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Regulated by FinCEN |

| Services | Loan Investment, Financial Consulting, Insurance Consulting, Education Planning, Investment Management, Protection Planning, Retirement & Income, Estate Planning, Taxes Preparation |

| Demo Account | Available |

| Leverage | Up to 1:1000 |

| EUR/USD Spread | Start from 0.1 pips |

| Trading Platforms | MT5 |

| Minimum Deposit | USD 10 |

| Customer Support | Email, Address, Social media |

What is ORCARA GOLD?

Judging from their official website, ORCARA GOLD is a brokerage firm registered in the Saint Vincent and the Grenadines but actually located in Thailand, which indicates that it might be an offshore operated, the mode of which diminishes customer trust and confidence in the company's operations. It claims to provide traders with access to financial services including Loan Investment, Financial Consulting, Insurance Consulting, Education Planning, Investment Management, Protection Planning, Retirement & Income, Estate Planning, and Taxes Preparation.

Pros & Cons

| Pros | Cons |

| • Various account types to suit different trading needs | • Low minimum deposit |

| • Wide range of trading instruments across multiple asset classes | • Not accept clients from some countries |

| • Flexible leverage ratios | • Poor official website content and confusing information |

| • Regulated by FinCEN | • Poor official website content and confusing information |

| • Commissions charged | |

| • Limited customer support channels | |

| • No information for payment methods |

Is ORCARA GOLD Safe or a Scam?

ORCARA GOLD operates under the regulation of FinCEN, with the license number of 31000282297635.

Market Instruments

- Currencies: As the worlds largest market, ORCARA GOLD provides currency trading with competitive spreads starting from 0 pips, allowing traders to engage in forex trading efficiently.

- Cryptocurrencies: The platform offers 24/7 swap-free trading on major cryptocurrencies such as Bitcoin, accommodating traders interested in the dynamic crypto market.

- Stocks: Traders can invest in global companies without incurring overnight fees, and benefit from low spreads starting from 0.1 pips. This makes it an attractive option for those looking to invest in company shares.

- Indices: ORCARA GOLD enables traders to capitalize on major indices, which include the biggest names in technology and other industries, providing a gateway to broad market exposure.

- Metals: The platform also offers trading on popular safe-haven assets like gold and silver, allowing traders to diversify their portfolios with metals which are often sought after during times of economic uncertainty.

- Energies: For those interested in commodity markets, ORCARA GOLD provides the opportunity to invest in energy resources such as oil and natural gas with leverage up to 1:200.

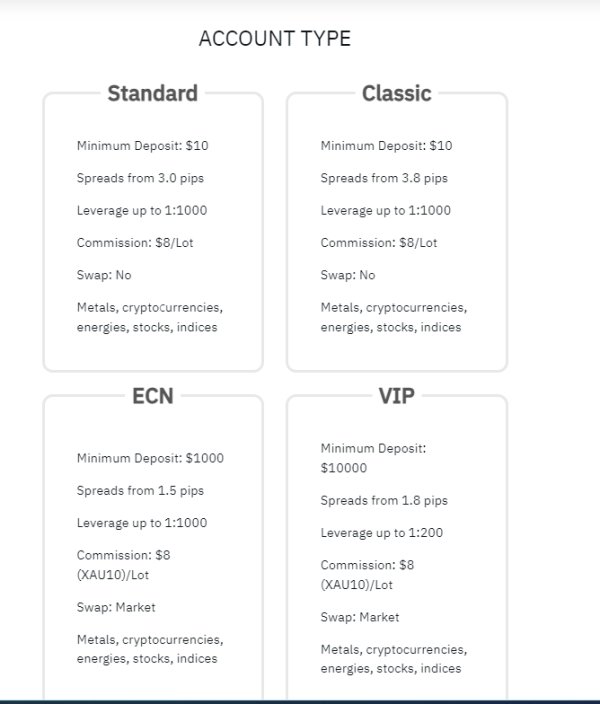

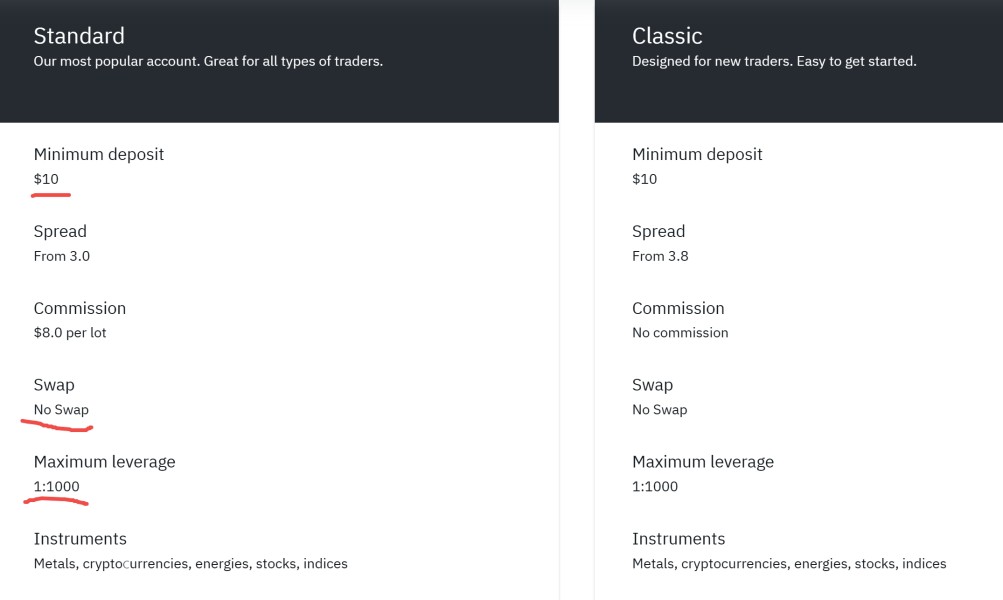

Accounts

ORCARA GOLD provides a diverse range of trading accounts, each tailored to meet specific trader needs and preferences:

The Standard Account is ORCARA GOLD's most popular option, requiring a minimum deposit of $10. It features spreads starting from 3.0 and a commission of $8.0 per lot. This account offers maximum leverage of 1:1000 and does not include swap fees. It supports a variety of instruments including metals, cryptocurrencies, energies, stocks, and indices, making it suitable for all types of traders.

For newcomers to trading, the Classic Account is an ideal choice with its easy-to-understand setup. Like the Standard Account, it requires a minimum deposit of $10 but offers slightly higher spreads starting from 3.8 and no commission charges. This account also benefits from no swap fees and provides maximum leverage of 1:1000, covering the same range of instruments.

Experienced traders might prefer the ECN Account, which is designed for those seeking market execution with the lowest possible spreads starting from 1.5. This account requires a minimum deposit of $1000 and charges a fixed commission of $8 (XAU10) per lot. It also offers maximum leverage of 1:1000 and includes market rate swaps.

The VIP Account caters to high-volume traders who demand the best conditions, including low spreads starting from 1.8 and no commission on the top 30 instruments. This account requires a significant minimum deposit of $10,000 and offers reduced maximum leverage of 1:200 but maintains no swap fees. It supports trading in metals, cryptocurrencies, energies, stocks, and indices with market execution and no requotes.

| Feature | Standard | Classic | ECN | VIP |

| Minimum Deposit | $10 | $10 | $1,000 | $10,000 |

| Spread | From 3.0 | From 3.8 | From 1.5 | From 1.8 |

| Commission | $8.0 per lot | No commission | $8 (XAU10) per lot | No commission |

| Swap | No Swap | No Swap | Market swaps | No Swap |

| Maximum Leverage | 1:1000 | 1:1000 | 1:1000 | 1:200 |

| Instruments | Metals, cryptocurrencies, energies, stocks, indices | Metals, cryptocurrencies, energies, stocks, indices | Metals, cryptocurrencies, energies, stocks, indices | Metals, cryptocurrencies, energies, stocks, indices |

Leverage

ORCARA GOLD offers its Classic, Standard, and VIP Accounts with different leverage levels to suit varying risk preferences and trading styles.

The Classic and Standard Accounts both feature a high leverage of 1:1000. On the other hand, the VIP Account comes with leverage of 1:200.

Spreads & Commissions

ORCARA GOLD provides traders with a choice of three distinct account types, each offering unique trading conditions tailored to different preferences.

The Classic Account features a spread starting from 1.2 pips with a commission of $8 per Lot.

The Standard Account presents a more competitive spread starting from 0.3 pips, appealing to traders seeking tighter pricing and potentially reduced trading costs. Like the Classic Account, the Standard Account also charges $8 per Lot as commission.

For experienced traders seeking even tighter spreads and lower commissions, the VIP Account offers a highly attractive spread starting from 0.1 pips, paired with a reduced commission of $7 per Lot.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| ORCARA GOLD | From 0.3 (Standard Account) | $8 per lot (Standard Account) |

| Valutrades | From 0.1 | $3 per lot traded |

| RoboForex | From 0.0 | Variable (depending on account) |

| TigerWit | From 0.6 | Variable (depending on account) |

Trading Platforms

Based on the simple and crude one-page official website, it appears that ORCARA GOLD might offer MetaTrader 5 (MT5) as a trading platform to its traders. However, the website lacks comprehensive details about the platform's features, functionalities, and additional services.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| ORCARA GOLD | MT5 |

| Valutrades | MT4/5, ValuTrader |

| RoboForex | MT4, MT5, cTrader, WebTrader, R MobileTrader, R StocksTrader |

| TigerWit | TigerWit Platform, MT4 |

Deposit & Withdrawal

ORCARA GOLD offers a streamlined process for managing financial transactions, ensuring both efficiency and compliance. The platform processes deposits and withdrawals instantly, although external factors such as payment system providers can introduce delays, typically extending the withdrawal timeframe to 7 to 10 business days.

Customer Service

ORCARA GOLD provides customer service options to assist its clients in different areas. Customers can reach out to ORCARA GOLD through various channels to address their queries and concerns as below:

Email: support@orcaragold.com

Address: No.687, Village No.1, Lieng Mueang Road, (Asia Road), Kuan Lang Sub-district, Hat Yai District, Songkhla Province, Thailand.

ORCARA GOLD also maintains social Facebook account as supplementary customer support channel.

Direct and instant contact methods such as phone and live chat is not available which might be a problem for some traders who have higher demands for immediate response.

Conclusion

According to available information, ORCARA GOLD is a non-regulated Saint Vincent and the Grenadines-based brokerage firm while offshore operated in Thailand. While the firm offers a range of financial services such as Loan Investment, Financial Consulting, Insurance Consulting, Education Planning, Investment Management, Protection Planning, Retirement & Income, Estate Planning, and Taxes Preparation.

Frequently Asked Questions (FAQs)

| Q 1: | Is ORCARA GOLD regulated? |

| A 1: | Yes, it is regulated by the FinCEN. |

| Q 2: | Is ORCARA GOLD a good broker for beginners? |

| A2: | No. It is not a good choice for beginners. Its been verified the broker currently has no valid regulations from recognized regulatory authorities. |

| Q 3: | Does ORCARA GOLD offer demo accounts? |

| A 3: | No. |

| Q 4: | What is the minimum deposit for ORCARA GOLD? |

| A 4: | The minimum initial deposit to open an account is USD 10. |

| Q 5: | At ORCARA GOLD, are there any regional restrictions for traders? |

| A 5: | Yes. ORCARA GOLD does not provide services to people who live in the countries / jurisdictions including but not limited to, Australia, Belgium, France, Iran, North Korea, Japan and the United States. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

Keywords

- 2-5 years

- Regulated in United States

- Financial Service

- MT5 Full License

- Regional Brokers

Comment 4

Content you want to comment

Please enter...

Comment 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Ouangxb

South Africa

Don't say you offer copy trading in Australia, when clearly that is a lie. What a waste of time, spending a month trying to open a corporate account, and then you say,

Neutral

2024-06-14

wanzy

Thailand

This Orcaragold broker has a very stable running graph. You can place orders immediately without any graph delay or order execution issues. When there is news or trading during news time, the graph will not freeze and there are very few slip pages, almost no impact. Overall, it is much better than other well-known brokers.

Positive

2024-09-15

Wivide

Portugal

ORCARA GOLD is the gold standard when it comes to low spreads and accessible minimum deposits. Their platform is user-friendly and their service is top-notch. If you're looking for a reliable and affordable broker, ORCARA GOLD is the way to go!

Positive

2024-07-24

祯

Taiwan

Check out Orcaragold Exclusive! They've got their act together with online trading across varied markets, and their pricing? Stable and reliable. They've got this sweet feature of instant withdrawals and quick execution times. And the account types? Plenty to choose from. If you ask me, they've got all the makings of a top-tier trading platform. All things considered, it gets two thumbs up from me. 👍👍

Positive

2024-04-26