Score

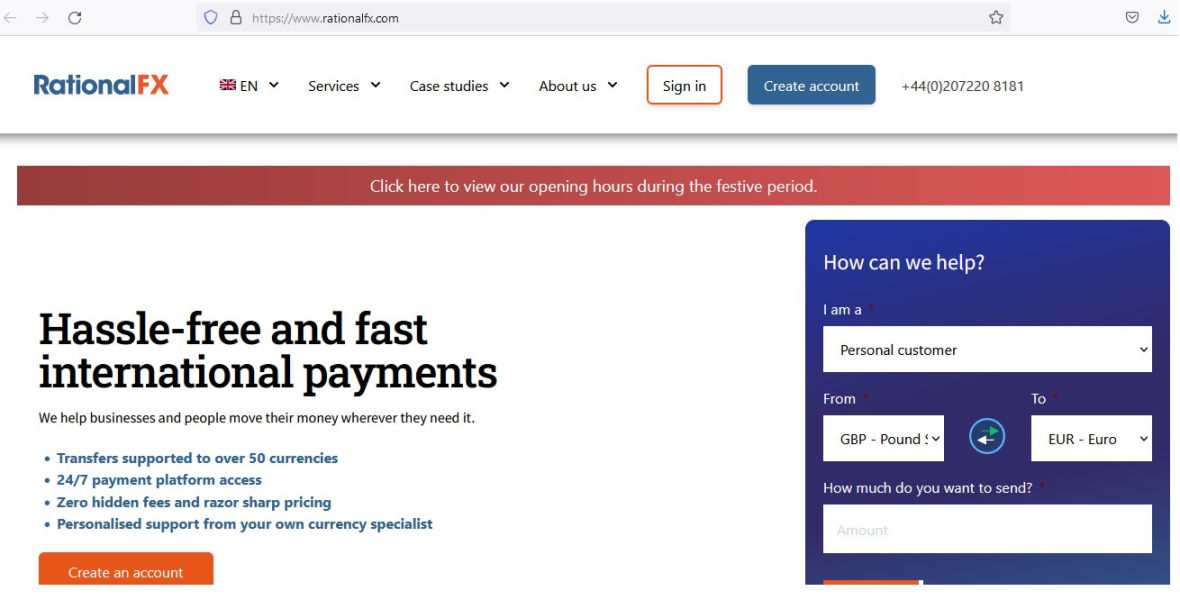

RationalFX

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://www.rationalfx.com/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Bulgaria 4.47

Bulgaria 4.47Contact

Licenses

Licenses

Licensed Entity:Rational Foreign Exchange Limited

License No. 507958

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

Basic Information

United Kingdom

United KingdomUsers who viewed RationalFX also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

rationalfx.de

Server Location

Ireland

Website Domain Name

rationalfx.de

Server IP

52.211.214.11

rationalfx.fr

Server Location

Ireland

Website Domain Name

rationalfx.fr

Server IP

52.211.214.11

rationalfx.com

Server Location

Ireland

Website Domain Name

rationalfx.com

Website

WHOIS.ENOM.COM

Company

ENOM, INC.

Domain Effective Date

2004-11-09

Server IP

34.248.35.186

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded year | 2-5 years |

| Company Name | RationalFX |

| Regulation | Regulated in the United Kingdom by the UK Financial Conduct Authority (FCA) |

| Spreads | Exchange rates provided with spreads |

| Trading Platforms | RFXConnect |

| Tradable assets | Over 50 currencies and transfers to 170+ countries |

| Account Types | Not specified |

| Customer Support | Available during specific opening hours |

| Payment Methods | Bank transfer, debit/credit card |

General Information

Founded in 2005 by its two founders, Rjesh Agrawal and Paresh Davdra, RationalFX has processed over £10 billion of payments on behalf of its clients since its inception. In 2014, RationalFX Premier was founded with a focus on providing white-glove services for high net worth individuals. In 2015, the company took a different approach by setting up Xendpay, an online platform dedicated to low-value remittances. RationalFX is headquartered in London, UK, with offices in France, Germany, and Spain.

RationalFX's personal services include spot contracts, forward contracts, recurring payments, limit orders, and stop-loss orders. These services cater to individuals' international money transfer needs, providing flexibility and convenience. RationalFX allows transfers to over 170 countries in more than 50 currencies, accessible through their online platform or with assistance from currency specialists.

For businesses, RationalFX offers services such as international payments, FX risk management, global bulk payments, international payroll solutions, and white-label/API integration options. These services enable companies to streamline their international payment processes, manage currency risks, and expand their service offerings.

RationalFX's trading platform, RFXConnect, allows businesses to integrate RationalFX's online payment platform into their systems. This API integration enables businesses to offer foreign exchange and international transfer services to their customers, creating an additional revenue stream.

Exchange rates provided by RationalFX are subject to fluctuations and include the spread, representing the transaction cost. Various fees may apply, such as transfer fees and debit/credit card payment fees, which vary depending on the service and currency involved.

Payment methods offered by RationalFX include bank transfers and debit/credit card payments, with specific requirements and fees associated with each method. Customer support is available to address inquiries and provide assistance during specified opening hours.

Pros and Cons

RationalFX is a financial services company that offers international money transfer and currency exchange solutions. While it provides several benefits and features that make it an attractive choice for individuals and businesses, it also has certain limitations to consider. In this overview, we will examine the pros and cons of RationalFX to provide a comprehensive understanding of its strengths and weaknesses.

| Pros | Cons |

| Regulated by the UK Financial Conduct Authority (FCA) | Concerns about potential regulatory limitations of the license |

| Wide range of personal and business services | Exchange rates and fees are subject to fluctuations and may vary |

| Access to over 170 countries and 50+ currencies | Certain services may have transaction fees and additional card payment surcharges |

| User-friendly online platform and personalized support | External fees charged by intermediary banks or institutions |

Is RationalFX Legit?

According to the information provided, RationalFX holds a payment license from the UK Financial Conduct Authority (FCA) with Regulation. This suggests that RationalFX is regulated by the FCA in the United Kingdom. However, the statement also mentions that the license is suspected of operating beyond its limits, implying a potential regulatory concern. It's important for users to exercise caution when using the platform and consider the associated risks. To obtain the most accurate and up-to-date information regarding RationalFX's regulatory status, it is recommended to visit the FCA's official website or contact RationalFX directly.

Personal Services

The main products offered by RationalFX for individuals are spot contracts (to determine the exchange rate for payment within two business days), forward contracts, recurring payments, limit orders, and stop-losses. Users can send money to more than 170 countries worldwide in more than 50 currencies.

1. Spot Contracts: RationalFX provides spot contracts, allowing individuals to secure an exchange rate for their payment that will be executed within two business days.

2. Forward Contracts: RationalFX offers forward contracts, which allow individuals to secure an exchange rate for a future date. This is beneficial for those who want to protect themselves from potential currency fluctuations and plan their finances in advance.

3. Recurring Payments: RationalFX enables users to set up recurring payments, making it convenient for regular transfers such as mortgage payments, pension contributions, or tuition fees. This feature helps automate the payment process and ensures timely and consistent transfers.

4. Limit Orders: With limit orders, individuals can set a specific exchange rate at which they want their transfer to be executed. Once the market reaches that desired rate, the transfer will be initiated. This tool allows users to take advantage of favorable exchange rate movements.

5. Stop-Loss Orders: RationalFX offers stop-loss orders, which allow individuals to set a minimum exchange rate threshold. If the market drops to or below that threshold, the transfer will be automatically executed, helping users minimize potential losses.

RationalFX allows individuals to send money to more than 170 countries worldwide, supporting over 50 currencies. Users have the option to utilize RationalFX's 24/7 online platform, which offers competitive rates, or contact their currency specialists via phone for personalized assistance.

| Pros | Cons |

| Spot contracts allow securing favorable exchange rates for immediate transfers | Concerns about potential regulatory limitations of the license |

| Forward contracts enable planning and protection against currency fluctuations | Exchange rates and fees are subject to fluctuations and may vary |

| Recurring payments for convenient automation of regular transfers | Certain services may have transaction fees and additional card payment surcharges |

| Limit orders help take advantage of favorable exchange rate movements | External fees charged by intermediary banks or institutions |

| Stop-loss orders minimize potential losses in case of unfavorable market conditions | Transactions cannot be canceled once initiated |

RationalFX Business Services

RationalFX works with several companies to help them manage payments for international business. Its services for business include import/export solutions (spot payments, booking forward contracts, setting stop-losses, or utilizing currency exchange risk policies), global bulk payment solutions, international payment, and payroll solutions, etc.

1. International Payments: RationalFX helps businesses make international payments efficiently and securely. They provide services for import/export payments, allowing companies to send money to suppliers and partners in different countries.

2. FX Risk Management: RationalFX assists businesses in managing currency exchange risk. They offer solutions such as spot payments, forward contracts, stop-loss orders, and currency exchange risk policies. These tools help businesses protect themselves from adverse currency fluctuations and plan their financial strategies accordingly.

3. Global Bulk Payments: For businesses that need to make multiple payments to various recipients, RationalFX provides global bulk payment solutions. This allows companies to streamline their payment processes, saving time and effort.

4. International Payroll Solutions: RationalFX offers services for international payroll, enabling businesses to make payments to their employees located in different countries. This helps companies manage their global workforce efficiently and ensure timely and accurate salary transfers.

5. White Labels and APIs: RationalFX provides businesses with the option to offer their customers foreign exchange services using white labels or APIs. This allows companies to integrate RationalFX's services into their own platforms, providing added value to their clients.

| Pros | Cons |

| Option to offer foreign exchange services through white labels | Exchange rates and fees are subject to fluctuations and may vary |

| FX risk management tools to mitigate currency fluctuations | Certain services may have transaction fees and additional card payment surcharges |

| Global bulk payment solutions for streamlined processes | External fees charged by intermediary banks or institutions |

| International payroll solutions for managing global workforce | Limited information available about potential integration options (white labels, APIs, etc.) |

RationalFX Exchange Rates

The exchange rates offered by RationalFX are inclusive of spreads, which are essentially an invisible cost that is not disclosed to the user during the transaction. In addition to the spread, certain services charge a transaction fee, usually the fee quoted by the company to the user.

Trading Platforms

RationalFX offers a trading platform called RFXConnect, which is an API (Application Programming Interface) that allows businesses to integrate RationalFX's online payment platform into their own systems. By integrating RFXConnect, businesses can offer foreign exchange and international transfer services to their own customers, creating an additional revenue stream.

Here's how the RFXConnect trading platform works:

1. Get in touch: Businesses interested in using RFXConnect can contact RationalFX to discuss their requirements. A currency specialist will provide an overview of how the platform works and demonstrate how it can benefit the business.

2. Get integrated: Once the initial discussion is complete, the business can seamlessly integrate the RFXConnect API into their existing system. This integration process allows the business to start building their own international payment solution.

3. Get started: After the API integration is complete, the business's customers can begin making and receiving transactions using RationalFX's platform. The platform is available 24/7 and supports payments to over 170 countries in more than 50 currencies.

For businesses that are already connected to RFXConnect, RationalFX provides a Developer Centre, which offers tools and resources to facilitate the integration process and make the most out of the API.

Exchange Rates

RationalFX provides exchange rates for various currency pairs, including GBP to EUR, GBP to USD, GBP to INR, GBP to CAD, and more. These rates are displayed on their online platform, which features a currency converter and foreign exchange rates calculator.

For example, if you want to convert 1 British Pound (GBP) to Euro (EUR), the displayed exchange rate might be 1.14 Euro per 1 Pound Sterling. This rate is inclusive of the spread, which is the difference between the buy and sell rates in the foreign exchange market. The spread represents the cost of the transaction and is factored into the exchange rate provided by RationalFX.

It's important to note that exchange rates can fluctuate due to various factors, such as market conditions, economic events, and liquidity. Therefore, the displayed rates on RationalFX's platform are subject to change.

In addition to the spread, certain services may have transaction fees associated with them. These fees are typically quoted by RationalFX to the user, and they may vary depending on the specific service and currency pair involved.

Fees

RationalFX is committed to being transparent about the fees associated with their services. Here is an overview of the main types of fees charged by RationalFX:

1. Transfer Fees:

Transfer fees are applicable to payments made through RationalFX's online platform. The exact fee amount varies depending on the currencies and countries involved in the transaction. RationalFX strives to keep these fees as low as possible. Currently, a small online transaction fee of £4 or €5 (or equivalent in your sending currency) is charged for transfers made via the online platform. However, this fee is waived when using their Regular Payment service. It's important to note that transfers made by phone or through recurring payment plans do not incur any transfer fees.

2. Debit/Credit Card Payment Fees:

For personal card payments from non-EU/EEA countries, there is an additional surcharge of 2.3%. This fee is applicable to the total transaction amount and is separate from the transfer fees.

3. External Fees:

In addition to RationalFX's fees, it's important to consider that there may be external fees charged by intermediary banks or financial institutions involved in the transfer process. These fees are not controlled by RationalFX and are determined by the respective banks or institutions. It is advisable to check with your bank or financial institution to understand if any external fees may apply.

Pros and Cons

| Pros | Cons |

| No transfer fees for phone or recurring payments | Transfer fees may apply for certain services and currency pairs |

| Low online transaction fee of £4 or €5 (or equiv.) | Additional surcharges for personal card payments from non-EU/EEA countries |

| Waived transfer fee for Regular Payment service | External fees charged by intermediary banks or financial institutions |

Payment methods

RationalFX offers two main payment methods for processing transactions:

1. Bank Transfer: RationalFX provides their account details for customers to make payments via bank transfer. If you are located in Europe, you may be able to use a SEPA bank transfer for faster processing. For customers outside of the UK, international bank transfers are required. The processing time for GBP payments is usually the same working day, while other major currencies may take 1-2 working days, depending on when the funds are received.

2. Debit or Credit Card: Customers have the option to make payments using a debit or credit card, but this method is only available through RationalFX's online platform. It's important to note that there is a maximum limit of £5,000 or equivalent for card payments. Additional fees may apply for card payments, depending on the type of card and the country from which the payment is being made. Card payments from non-EU/EEA countries are subject to an additional 2.5% surcharge, while personal card payments from non-EU/EEA countries have an additional 2.3% surcharge.

When making payments, it's essential to ensure that the chosen payment method is registered under the name of the RationalFX account holder. RationalFX also accepts third-party payments if they have been approved in advance, as stated in their terms and conditions.

| Pros | Cons |

| Multiple payment options including bank transfers | Transfer fees may apply for certain payment methods |

| SEPA transfers available for faster processing | Additional surcharges for debit/credit card payments from non-EU/EEA countries |

| Ability to make recurring payments for regular transfers | Potential external fees charged by intermediary banks or financial institutions |

| Quick processing times for GBP payments | Maximum limit of £5,000 (or equivalent) for card payments |

RationalFX provides customer support to assist individuals and businesses with their inquiries and transactions. Here are the details of RationalFX's customer support:

1. General Enquiries:

For general inquiries or assistance, you can contact RationalFX's customer support team at +44 (0)20 7220 8181. They will be able to address various queries and provide information regarding their services.

2. UK Corporate Team:

If you are a corporate customer based in the UK, you can reach out to the UK Corporate Team at +44 (0)20 7220 8182 or email them at ukcorporatedealers@rationalfx.com. This contact information is specifically dedicated to handling corporate-related matters.

3. UK Private Team:

For private individuals seeking support, you can contact the UK Private Team at +44 (0)20 7220 8167 or email them at privatedesk@rationalfx.com. This team specializes in assisting private clients with their specific needs and concerns.

4. Partnerships:

If you have inquiries or are interested in establishing partnerships with RationalFX, you can contact their Partnerships team at +44 (0)20 7220 8165 or email them at partnerships@rationalfx.com. They will provide information and guidance regarding potential partnership opportunities.

RationalFX's customer support is available during the following opening hours:

- Monday to Friday: 8:30 am to 5:30 pm

- Saturday: Closed

- Sunday: Closed

Conclusion

In conclusion, RationalFX offers a range of services for individuals and businesses seeking international payment solutions. With its regulated status and convenient online platform, RationalFX provides users with various options for secure and efficient money transfers. However, it is important to consider the potential disadvantages such as transfer fees, surcharges for certain payment methods, and the possibility of external fees. Despite these drawbacks, RationalFX's advantages, including multiple payment options, recurring payment capabilities, and quick processing times, make it a viable choice for those in need of international payment services.

FAQs

Q: What is IR35 compliance?

A: IR35 compliance refers to the legislation that ensures proper tax payment by individuals who are employed by a company or person, such as contractors and freelancers. It is important for companies that handle payroll or provide payroll services.

Q: What costs may occur during the transaction?

A: There are several types of fees that may apply. Transfer fees are charged for payments made through our online platform, with the amount varying based on currencies and countries involved. We strive to keep transfer fees low and charge a small online transaction fee of £4 or €5 (or equivalent) which is waived when using our Regular Payment service. Additionally, personal card payments from non-EU/EEA countries have an additional surcharge of 2.3%.

Q: What does it mean to be registered by HMRC?

A: Being registered by HMRC means that RationalFX has fulfilled the necessary requirements and is recognized by Her Majesty's Revenue and Customs as a compliant entity.

Q: What are SEPA transfers?

A: SEPA transfers refer to Single Euro Payments Area, a method for cross-border euro bank transfers. These payments are available in all EU countries and countries that support euro transfers. There is no difference between a local and SEPA bank transfer, and RationalFX provides the necessary bank details for SEPA transfers. Typically, SEPA payments are free, but it's advisable to check with your bank to confirm if any charges apply.

Q: Can I cancel an online transaction?

A: Once initiated, online transactions generally cannot be canceled. It's important to ensure that you are ready to proceed before initiating the transaction.

Q: Do I have to pay immediately?

A: Yes, for transactions coordinated with our team, funds must be sent into our account on the specified date.

Q: Can I have more than one account?

A: No, for security reasons, only one account is offered per person.

Q: How do I change my password?

A: To change your password, log in to your online account, go to “Your settings,” and select “Login details.”

Q: How long will it take to verify my account?

A: Typically, it takes less than 24 hours to verify a business account if all required documents are provided. However, the verification process can take up to three working days if additional information is needed.

Q: How can I pay for my transfer?

A: Payments to RationalFX can be made via bank transfer or debit/credit card. Bank transfers require sending funds to RationalFX's designated account, and card payments are available through the online platform with a maximum limit of £5,000 or equivalent.

Q: How can I provide my beneficiaries' details?

A: Beneficiary details can be provided during the transaction process on RationalFX's online platform. This allows you to specify the recipient's information for the transfer.

Q: Which currencies are supported by RationalFX?

A: RationalFX supports more than 50 currencies for international transfers. The available currency options can be found on their online platform or by contacting their customer support.

Keywords

- 5-10 years

- Regulated in United Kingdom

- Payment License

- Suspicious Scope of Business

- Suspicious Overrun

- High potential risk

News

News Monthly Currency Market View August 2023

Even amid economic difficulties, the growth in Retail Sales has been noted at 0.7%, a significant increase from the upwardly adjusted 0.1% acceleration seen in the preceding month. This performance surpasses the market forecast of 0.2%.

2023-08-21 13:41

News Slowdown in UK inflation eases pressure on Bank of England

British inflation fell by more than expected in January and there were signs of cooling price pressure in parts of the economy watched closely by the Bank of England, adding to signs that further hefty interest rate hikes are unlikely.

2023-08-02 15:23

News UK wages grew 6.4% in the autumn said ONS

Average weekly earnings, including bonuses in the UK, increased by 6.4% year-on-year to GBP 629 in the three months to November of 2022, the most since the same period to May, above an upwardly revised 6.2% gain in the three months to October, and topping market estimates of 6.2%.

2023-01-30 10:25

News UK inflation data beats market expectations rising to 11.1%

British inflation has accelerated to the highest level for 41 years, driven by soaring energy, food and transport prices in a worsening cost-of-living crisis, according to official data. The Consumer Prices Index hit 11.1 percent in October, reaching the highest level since 1981, the Office for National Statistics (ONS) said in a statement on Wednesday.

2022-11-17 16:38

Comment 5

Content you want to comment

Please enter...

Comment 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

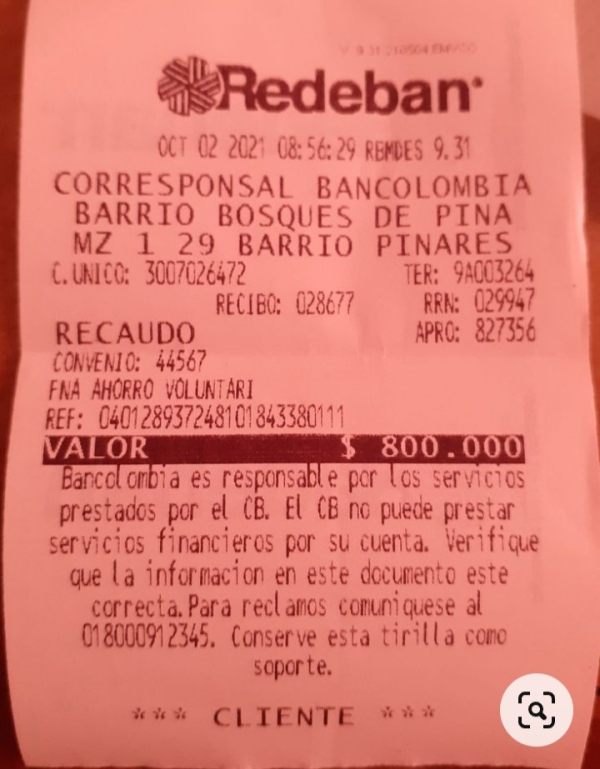

FX3864798834

Argentina

The worst nightmare. The truth is I do not want to report but I have no other choice. My investment was $800 and a service tax went there. The person told me that I would earn 15% of my daily investment, but it was not.

Exposure

2021-12-22

Erí Kínn

Argentina

I really agree with some opinions of several people that I have seen. When the market has changed, instead of assimilating losses, they cover their losses with your deposit. So anyone who sells exchange insurance is never going to lose. You don't have to be very smart. I have no words. We have to get to understand this matter with the lawyer and file a complaint, but that is why they register the company in the UK. They are going to end up stealing more than €5000 from us, yes ... they are very nice.

Exposure

2021-12-20

野浪猫

Thailand

Honestly, RationalFX’s payment services are not good as Wise’s. It took a long time to transfer my money to Australia, and they asked me for additional service fees.

Neutral

2023-03-02

鸣来乒乓球俱乐部薛浩毅

Singapore

It would have been simpler and cheaper to use Wise, my mistake, if I could realize this earlier! Total costs were nearly $200 than using Wise. Except for high service fees, their customer support also terrible, during their busy hour, no one answers you at all. Overall, I don’t recommend you to use this company’s payment services.

Neutral

2022-11-23

Denny W

South Africa

Excellent customer support service. Their customer services are very nice and friendly. Whether it is a phone call or an email, they can answer my questions in a timely manner. Very efficient and professional!

Positive

2022-11-23