Score

Hantec

Australia|15-20 years|

Australia|15-20 years| https://www.hantecfinancial.com/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

Japan

JapanContact

Licenses

Single Core

1G

40G

Contact number

+886 0080 185 3044

Other ways of contact

Broker Information

More

亨达国际金融

Hantec

Australia

- https://www.hantecfinancial.com/

- https://www.hantecfinancial.com/0-home-page.html

- https://www.hmlvanua.com/en/

- https://www.hantec-v.com/en/

- https://www.hantecv.com/en/

- https://www.hantec-vu.com/en/

- https://www.hantecvu.com/en/home.html

- https://www.hantecvanuatu.com/en/home.html

- http://www.hantec.com/int_l/en/index.html

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The Vanuatu VFSC regulation with license number: 40318 is an offshore regulation. Please be aware of the risk!

WikiFX Verification

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Hantec also viewed..

XM

IC Markets Global

CPT Markets

EC Markets

Total Margin Trend

- VPS Region

- User

- Products

- Closing time

Taipei

Taipei- 713***

- BITCOIN

- 11-03 05:19:38

Hongkong

Hongkong- 720***

- BITCOIN

- 11-03 06:41:05

Tokyo

Tokyo- 682***

- BITCOIN

- 11-03 05:21:03

Stop Out

0.91%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

Hantec · Company Summary

Company Summary

Company profile

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| Hantec Review Summary in 10 Points | |

| Founded | 1990 |

| Registered Country/Region | Australia |

| Regulation | ASIC, VFSC (offshore) |

| Market Instruments | Forex, Commodities, Stocks & Indices |

| Demo Account | Available |

| Leverage | 1:400 |

| EUR/USD Spread | 0.6 pips |

| Trading Platforms | MT4 |

| Minimum deposit | $0 |

| Customer Support | 24/5 live chat, email |

What is Hantec?

Hantec is a brokerage firm that provides online trading services for various financial instruments, including forex, stocks, indices, CFDs, and commodities. The company was founded in 1990 and is headquartered in Hong Kong, with additional offices in mainland China, Taiwan, and the United Kingdom. Hantec is regulated by the Australian Securities & Investments Commission (ASIC) and is also offshore regulated by the Vanuatu Financial Services Commission (VFSC). The company offers various account types and MT4 trading platform, as well as educational resources and 24-hour customer support services.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

When it comes to brokers, Hantec Markets stands out as a well-established, reliable option. It is regulated by Australia Securities & Investment Commission (ASIC). The site facilitates trade in a wide variety of instruments. Customized offering that includes the industry-standard MT4 trading platform, extensive educational resources, and in-depth market analysis suitable for both novices and seasoned traders.

However, the lack of transparency on trading conditions and deposit/withdrawal, as well as reports of withdrawal issues in the past, are potential drawbacks to consider. Ultimately, it is important for traders to thoroughly research and evaluate any potential broker before investing their funds.

| Pros | Cons |

| • ASIC Regulation | • Offshore regulated by VFSC |

| Wide range of trading assets | • Clients from USA, Canada, Hong Kong, Macau, Iran and North Korea are not accepted |

| • Free demo account | • Reports of difficulty with withdrawals |

| • Low spreads | • Limited information on trading conditions and deposit/withdrawal |

| • No minimum deposit requirement | |

| • MT4 supported | |

| • Rich educational resources | |

| • Provides 24-hour customer support |

Is Hantec Safe or Scam?

Being regulated by Australia Securities & Investment Commission (ASIC, License No. 326907) and offshore regulated by Vanuatu Financial Services Commission (VFSC, License No. 40318), Hantec appears to be a legitimate broker which has been in operation for several years. However, it's important to note that offshore regulation may not provide the same level of protection as other major regulatory bodies. It is also important to exercise caution and do thorough research before investing with any broker.

Market Instruments

The main financial instruments offered by Hantec to investors are Forex, Stocks, Indices, CFDs, and Commodities. Forex trading is available in major, minor, and exotic currency pairs. Investors can also trade Stocks from some of the largest corporations in the world. Hantec offers CFDs on Indices and precious metals such as Gold and Silver, as well as energy commodities such as Brent and WTI crude oil. Overall, Hantec offers a diverse range of financial instruments to its clients to trade on its platform.

EURUSD, buy at 1.09721 and sell at 1.09715, calculate the spread

Accounts

Hantec offers demo accounts to new traders who want to practice trading without risking their own money. The demo account is free for 30 days and comes with $50,000 in virtual funds to help traders get familiar with the platform and practice their strategies.

On the other hand, live accounts are designed for experienced traders who want to trade with real money. It seems that only one Standard live account type offered, but there is no minimum deposit requirement.

Leverage

Hantec offers leverage up to 1:400, which is a high level of leverage compared to some other brokers. This means that traders can open larger positions with a smaller amount of capital, which can potentially lead to higher profits.

However, it is important to keep in mind that higher leverage also increases the potential risks and losses. Traders should ensure they have a good understanding of the risks involved in trading with high leverage and use risk management tools such as stop loss orders to help limit their potential losses.

Spreads & Commissions

While Hantec's website does not provide specific information about spreads and commissions, it is possible to calculate the spread for the EUR/USD pair based on the market instruments offered. The calculated spread is 0.6 pips, which is considered relatively low compared to other brokers in the industry.

It is important for potential investors to consider that the lack of transparency on spreads and commissions may be a red flag and they should inquire about these fees before deciding to open an account with Hantec.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Hantec | 0.6 pips | Not disclosed |

| AETOS | 1.8 pips | No commission |

| Darwinex | 0.5 pips | $6 per lot |

| Equiti | 0.6 pips | Not disclosed |

Note: Spreads can vary depending on market conditions and volatility.

Trading Platforms

Hantec offers the widely popular MetaTrader 4 (MT4) platform for both PC and mobile. The MT4 platform offers advanced charting and analysis tools, customizable indicators, and a variety of order types to cater to the trading strategies of different traders. The platform also supports automated trading through the use of Expert Advisors (EAs) and offers a user-friendly interface that is easy to navigate. The mobile version of the MT4 platform allows traders to access their accounts and trade on-the-go, providing flexibility and convenience.

Overall, the MT4 platform is a reliable and robust trading platform that is well-suited for traders of all levels of experience.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Hantec | MT4 |

| AETOS | MT4 |

| Darwinex | MT4 |

| Equiti | MT4, EquitiGO app |

Note: Some brokers may offer additional trading platforms not listed in this table.

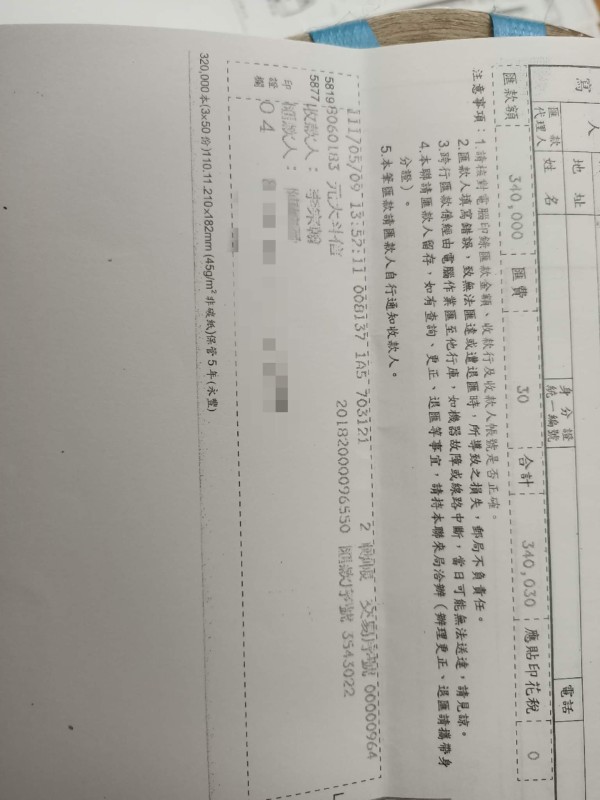

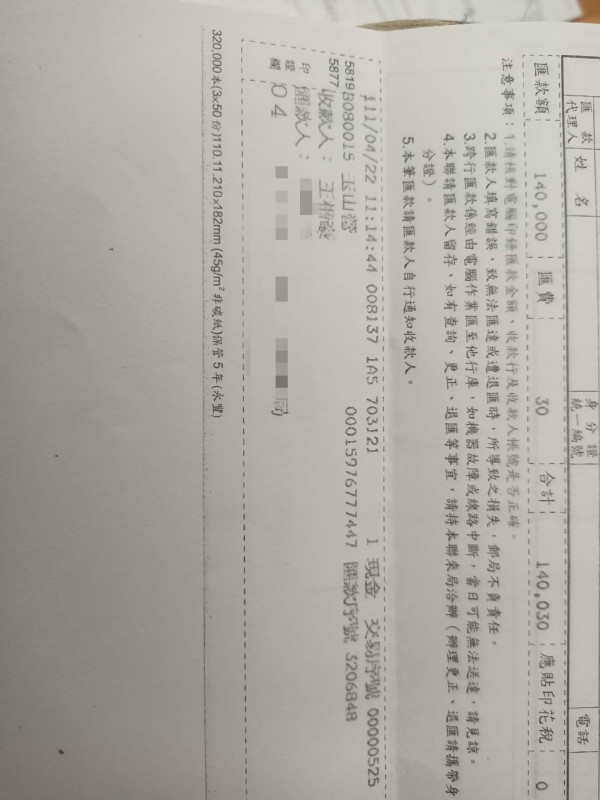

Deposits & Withdrawals

Hantec offers online payment platforms that allow customers to deposit funds using a bank card or credit card with the UnionPay logo. However, customers must have gone through the necessary formalities for online transfer business at the card-issuing bank.

Hantec minimum deposit vs other brokers

| Hantec | Most other | |

| Minimum Deposit | $0 | $100 |

To withdraw funds, customers must have a transaction margin equal to or greater than 50% of their total deposit. If not, Hantec will charge a 5% administrative fee. The withdrawal processing takes 2-5 working days depending on the bank.

See the deposit/withdrawal fee comparison table below:

| Broker | Deposit Fees | Withdrawal Fees |

| Hantec | N/A | N/A |

| AETOS | Free | $5 for bank transfer, free for others |

| Darwinex | Free | free for first monthly withdrawal, then $1 per withdrawal |

| Equiti | Free | free for debit/credit card, $15 for bank transfer |

Customer Service

You can reach out to Hantec Markets' support staff 24/5 via a variety of channels, including live chat, email, phone callback, and an FAQ section. The service is available during business hours from 8:00 a.m. on Monday to 7:00 a.m. on Saturday, Beijing Time. The FAQ section covers a range of topics, providing customers with helpful answers to common questions. Additionally, customers can follow Hantec on LinkedIn for updates and news.

Overall, Hantec appears to prioritize customer service and provides multiple ways for customers to seek help or information.

| Pros | Cons |

| • 24-hour customer support via live chat | • No 24/7 support |

| • Callback service available upon request | • No phone support |

| • Comprehensive FAQ section available | • Limited social networks support |

Note: This table is based on publicly available information and may not reflect the complete picture of Hantec's customer service. It is always recommended to conduct further research and due diligence before choosing a broker.

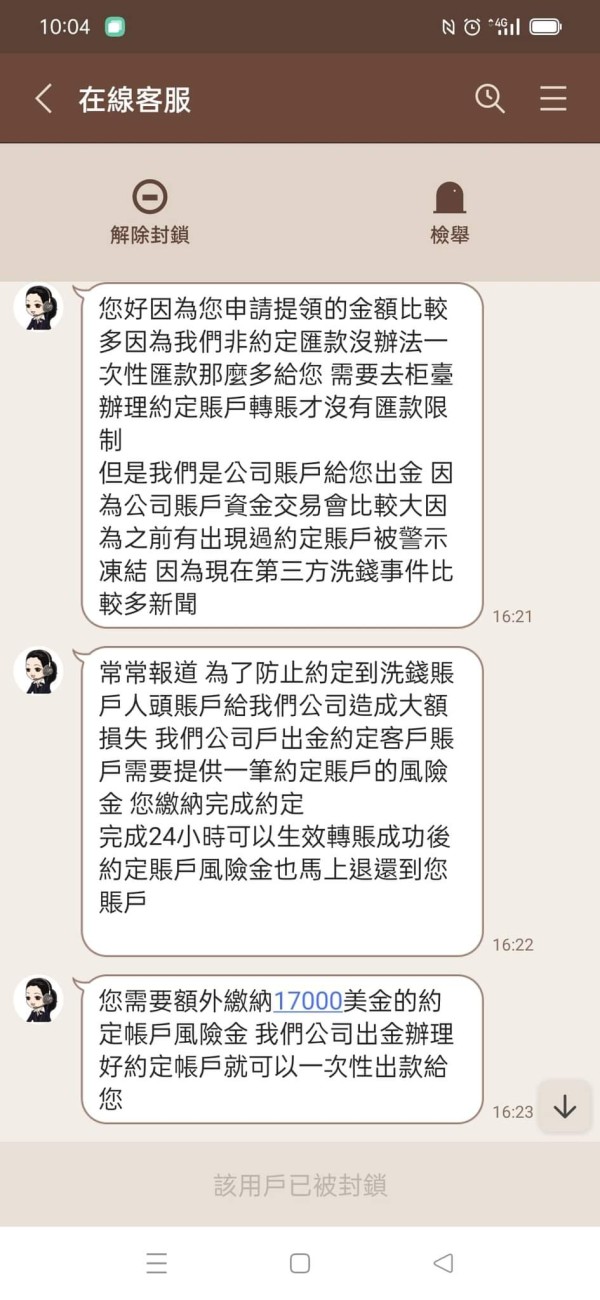

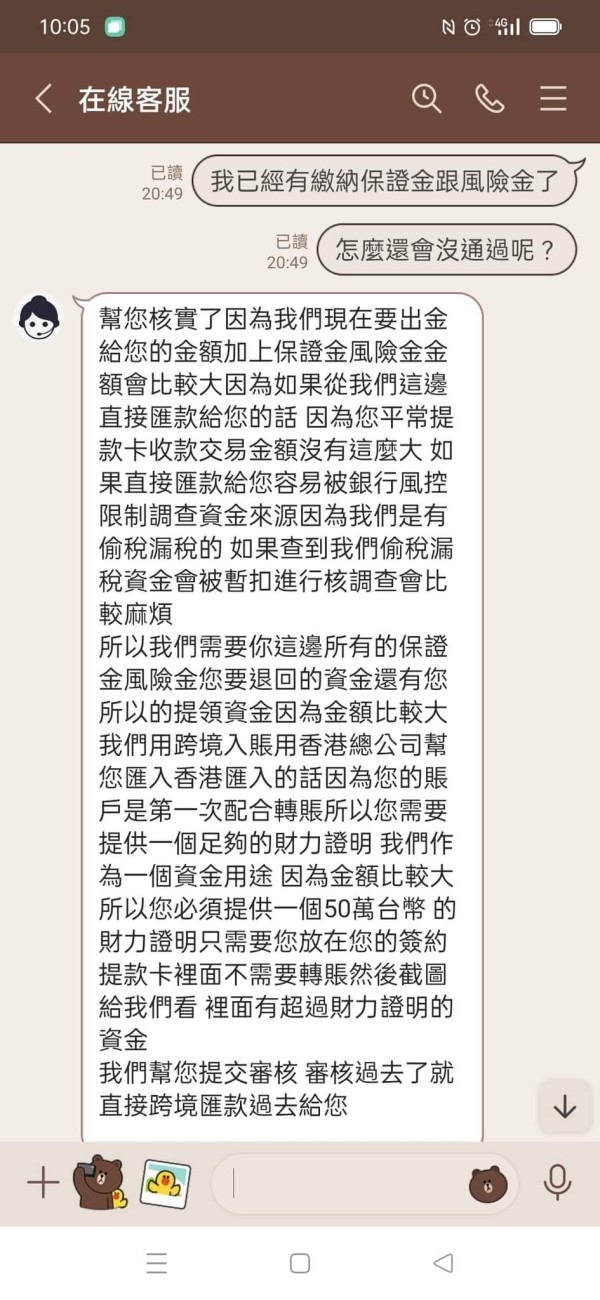

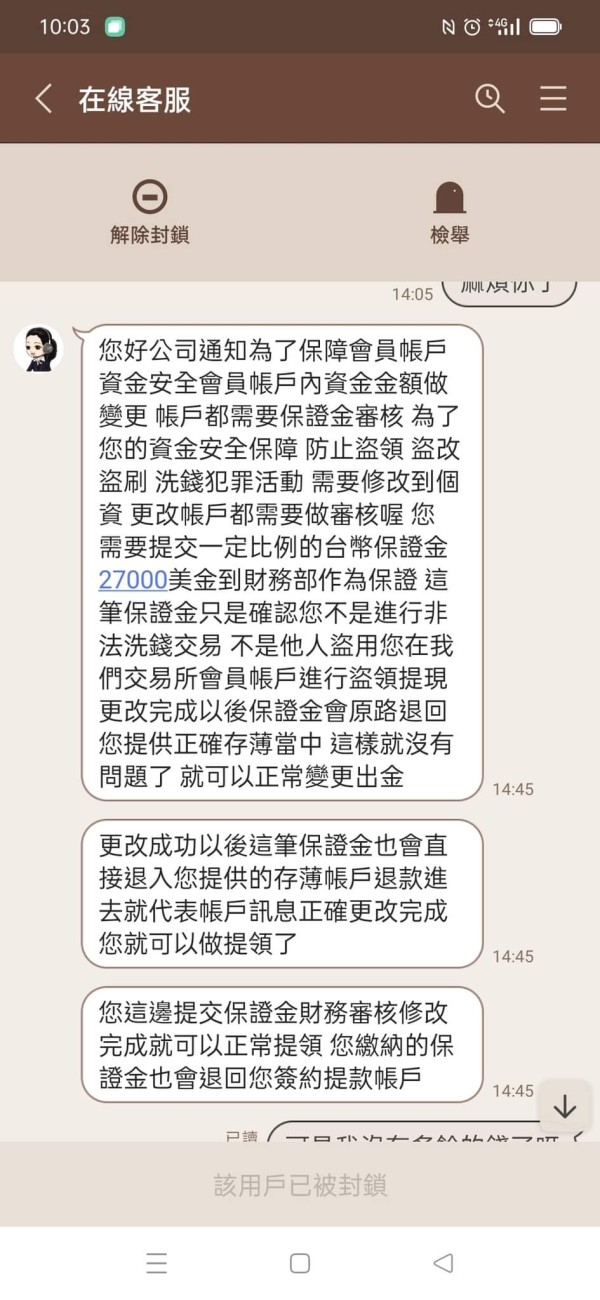

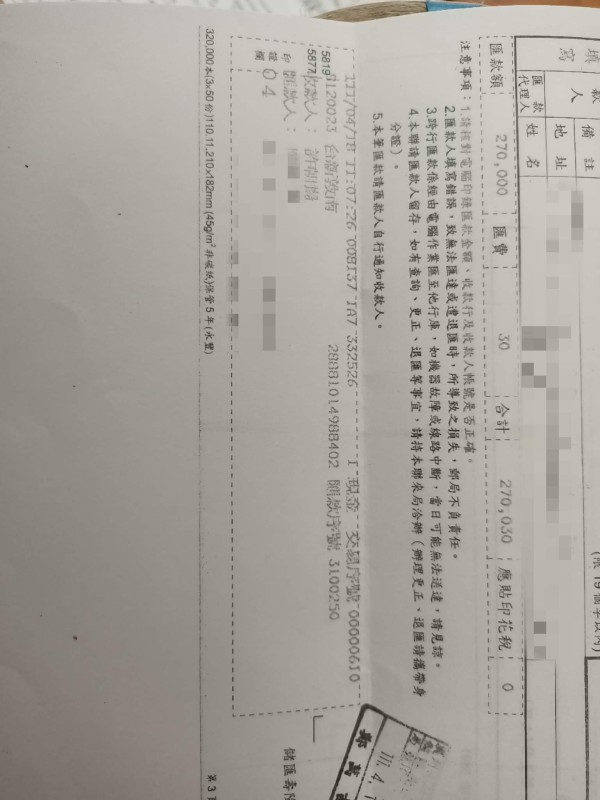

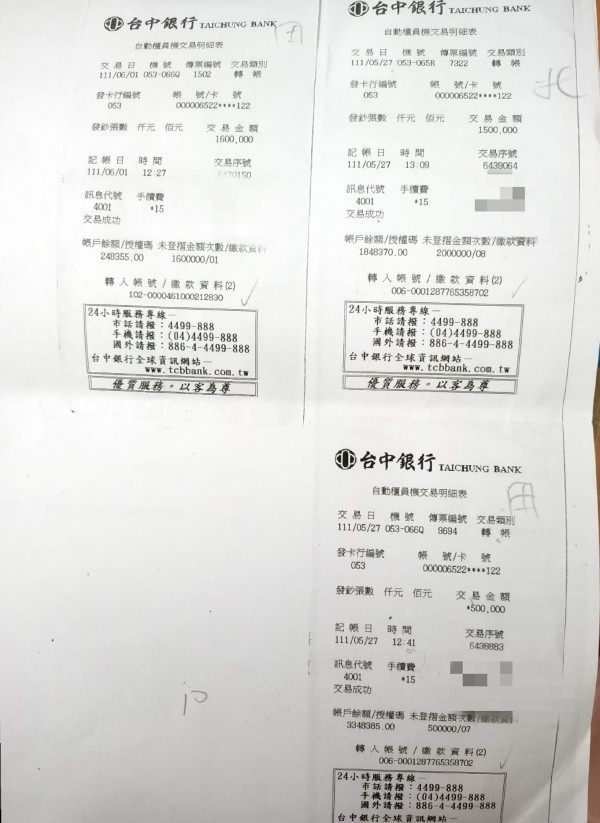

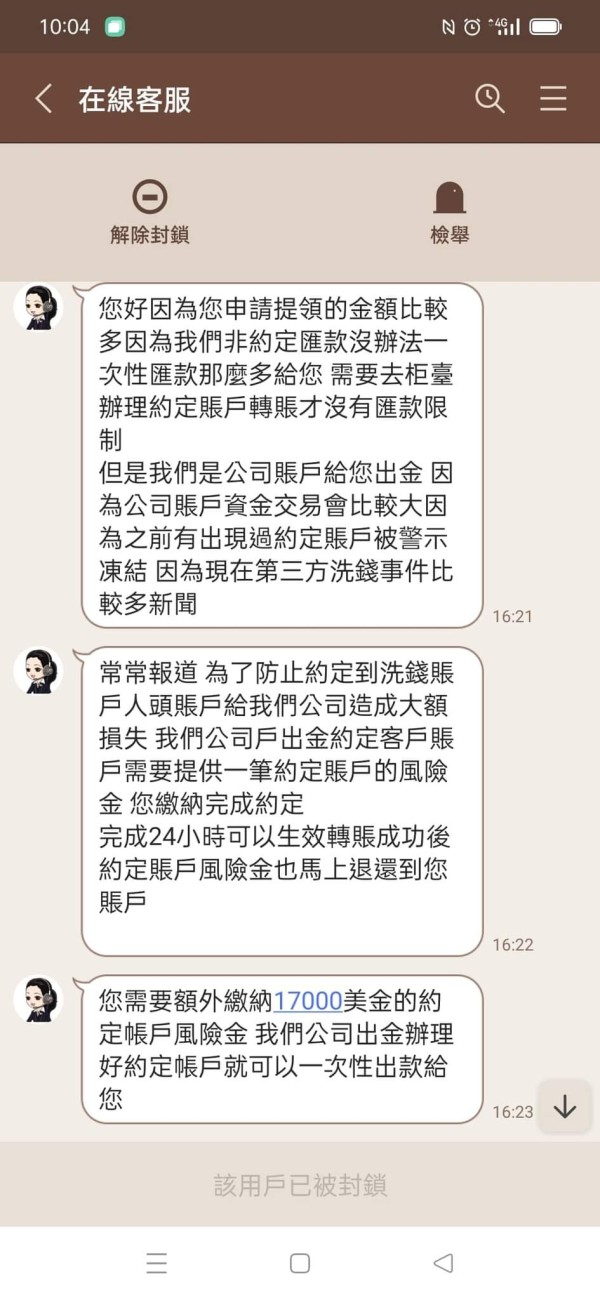

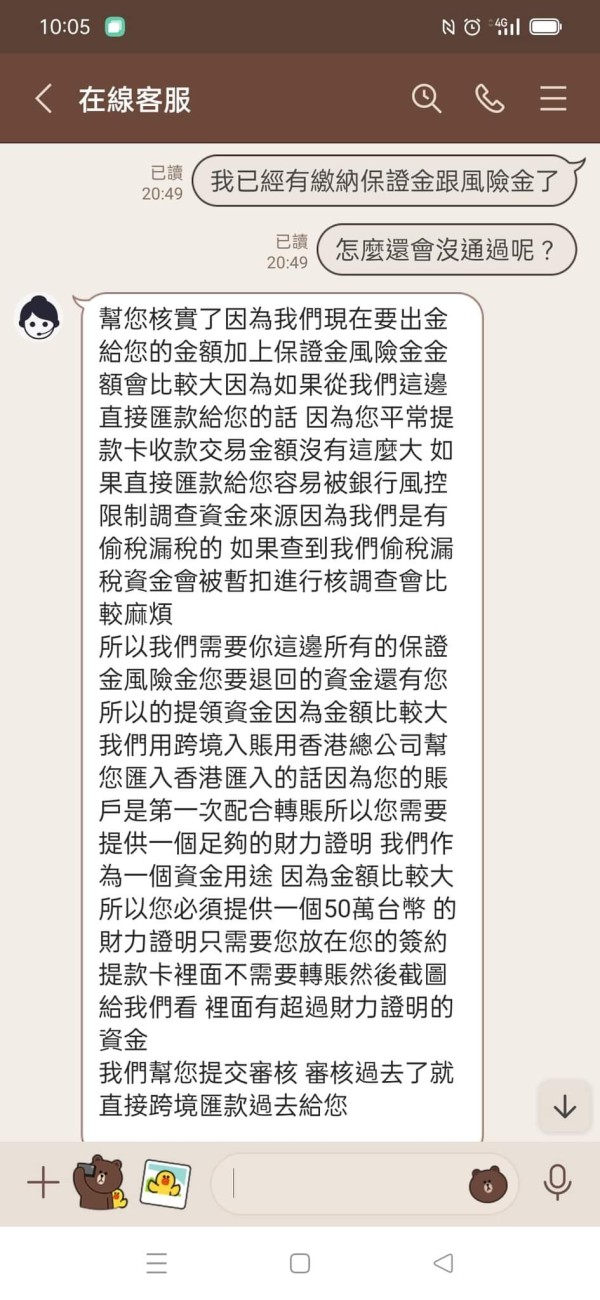

User Exposure on WikiFX

As with any investment, it's important to exercise caution when choosing a broker, including Hantec. While there have been some reports of difficulties with withdrawals, these issues appear to have been resolved. It's important to do your research and take precautions when investing. You can use our platform to access information about brokers before making a decision. If you encounter fraudulent brokers or have been a victim of one, please report it in the Exposure section. Our team of experts will do everything possible to help resolve the problem for you.

Education

Hantec's education section offers a wealth of resources for investors, providing them with the knowledge they need to make informed trading decisions. The free resources include detailed e-books on foreign exchange, daily/weekly marketing research reports, and a financial calendar to help investors stay up to date on market events. Hantec also offers professional market analysis, online foreign exchange courses, and webinars, which can be a great way for traders of all levels to improve their skills and knowledge. With Hantec's education resources, investors can learn how to navigate the markets, develop trading strategies, and make informed investment decisions.

Conclusion

In total, Hantec is a well-regulated broker that offers a range of financial instruments and MT4 trading platform, as well as rich educational resources for traders of all levels. The broker's leverage options are attractive, but caution should be exercised due to reports of hard-to-withdraw funds. Overall, Hantec is a reputable broker with both positive and negative aspects, and investors should carefully consider their needs and preferences before opening an account.

Frequently Asked Questions (FAQs)

| Q 1: | Is Hantec regulated? |

| A 1: | Yes. It is regulated by Australia Securities & Investment Commission (ASIC) and offshore regulated by Vanuatu Financial Services Commission (VFSC). |

| Q 2: | At Hantec, are there any regional restrictions for traders? |

| A 2: | Yes. Hantec does not offer its services to residents of certain jurisdictions including USA, Canada, Hong Kong, Macau, Iran and North Korea. |

| Q 3: | Does Hantec offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Hantec offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports MT4. |

| Q 5: | What is the minimum deposit for Hantec? |

| A 5: | There is no minimum initial deposit requirement. |

| Q 6: | Is Hantec a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

| Hantec Review Summary in 10 Points | |

| Founded | 1990 |

| Registered Country/Region | Vanuatu |

| Regulation | ASIC, VFSC (offshore) |

| Market Instruments | Forex, Bullion, Commodities CFDs, Stock CFDs, Indices CFDs |

| Demo Account | Available |

| Max. Leverage | 1:400 |

| EUR/USD Spread | Raw spreads from 0.1 pips (Standard account) |

| Trading Platforms | MT4, MT5 |

| Minimum Deposit | $100 |

| Customer Support | working hours: 24 hours service, 8:00 a.m. Monday - 7:00 a.m. Saturday (GMT+8) |

| Live chat, email, social media: Facebook and LinkedIn | |

| Registered Address: 1276, 1st Floor, Govant Building, Kumul Highway, Port Vila, Republic of Vanuatu | |

| Regional Restrictions | Residents of USA, Canada, Iran, North Korea, Hong Kong, and Macau are not allowed |

What is Hantec?

Hantec is a brokerage firm that provides online trading services for various financial instruments, including Forex, Bullion, Commodities CFDs, Stock CFDs, and Indices CFDs. Hantec is regulated by the Australian Securities & Investments Commission (ASIC) and is also offshore regulated by the Vanuatu Financial Services Commission (VFSC). The company offers various account types and MT4/5 trading platform, as well as educational resources and 24-hour customer support services.

Pros & Cons

When it comes to brokers, Hantec Markets stands out as a well-established, reliable option. It is regulated by Australia Securities & Investment Commission (ASIC). The site facilitates trade in a wide variety of instruments. Customized offering that includes the industry-standard MT4/5 trading platform and in-depth market analysis suitable for both novices and seasoned traders.

| Pros | Cons |

| • ASIC Regulation | • Offshore regulated by VFSC |

| Wide range of trading assets | • Clients from USA, Canada, Hong Kong, Macau, Iran and North Korea are not accepted |

| • Free demo accounts | • Reports of difficulty with withdrawals |

| • Low spreads | • Limited information on trading conditions and deposit/withdrawal |

| • MT4/5 supported | |

| • In-depth market analysis |

However, the lack of transparency on trading conditions and deposit/withdrawal, as well as reports of withdrawal issues in the past, are potential drawbacks to consider. Ultimately, it is important for traders to thoroughly research and evaluate any potential broker before investing their funds.

Is Hantec Legit?

Being regulated by Australia Securities & Investment Commission (ASIC, License No. 326907) and offshore regulated by Vanuatu Financial Services Commission (VFSC, License No. 40318), Hantec appears to be a legitimate broker which has been in operation for several years.

However, it's important to note that offshore regulation may not provide the same level of protection as other major regulatory bodies.

Market Instruments

Hantec provides a diverse range of market instruments that cater to various trading preferences and strategies, making it a versatile choice for traders. The offerings include Forex, which allows traders to engage in the dynamic and potentially lucrative currency exchange markets. For those interested in precious metals, Hantec offers Bullion trading, including gold and silver, which are often considered safe-haven assets.

Additionally, the platform provides opportunities to trade Commodities CFDs and Stock CFDs, enabling traders to speculate on the price movements of essential goods and prominent company stocks without the need to own the underlying assets. Indices CFDs are also available, offering a way to trade on the performance of specific sections of the stock market.

Accounts

Hantec provides two primary types of trading accounts that cater to both novice and experienced traders.

The demo account is an excellent option for beginners or those looking to refine their trading strategies without financial risk, offering $50,000 in virtual funds. This setup allows users to practice trading under real market conditions, helping them gain confidence and experience before committing real capital.

For more seasoned traders or those ready to engage with real funds, Hantec offers the Standard account, which can be opened with a minimum deposit of $100. This account type provides access to all the trading instruments available on Hantec, including Forex, commodities, indices, and more, making it a versatile choice for serious traders looking to capitalize on a broad range of opportunities in the financial markets.

Both account types are designed to provide users with flexibility and practical options tailored to their experience level and trading goals.

How to Open an Account?

Opening an account with Hantec is a straightforward and structured process designed to get traders set up and ready to trade as efficiently as possible.

To begin, prospective clients need to click the 'Open Account' button on the Hantec website. The initial step involves filling out account information, such as selecting a trading platform and setting the desired leverage.

Following this, personal details are required, including gender, full name, country and region, type of identification document (ID card or passport), ID number, date of birth, residential address, mobile phone number, email address, bank name, and bank account number.

After entering these details, users will click the 'NEXT' button to proceed to the next stage where they will provide information about their investment experience to ensure suitability for trading.

The final step involves uploading necessary documents for verification purposes. Once all steps are completed and the information is verified by Hantec, the account will be activated and ready for trading.

Leverage

Hantec offers leverage up to 1:400, which is a high level of leverage compared to some other brokers. This means that traders can open larger positions with a smaller amount of capital, which can potentially lead to higher profits.

Spreads & Commissions

Hantec's Standard account offers exceptionally competitive trading conditions, particularly appealing for traders looking for cost-effective access to the markets. One of the standout features of this account is the offering of raw spreads starting from as low as 0.1 pips, which allows traders to execute their trades at very close to the underlying market prices without significant spread costs adding to their trading expenses.

Additionally, the Standard account benefits from zero commission on trades, further enhancing its appeal by reducing the overall cost of trading.

Trading Platforms

Hantec provides its clients with the highly acclaimed MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, ensuring a versatile and powerful trading experience across multiple devices.

MT4 is particularly favored for its user-friendly interface and strong analytical capabilities, making it ideal for both novice and experienced traders. MT5 offers all the advantages of MT4 but with additional features such as more time frames, advanced financial trading functions, and better tools for price analysis. Hantec makes these platforms accessible on various devices including iPhone, Android, Web, and PC.

Tools & Analysis

Hantec equips its traders with a comprehensive suite of tools and analytical resources designed to enhance trading effectiveness and market understanding.

For planning and strategy, Hantec provides an Economic Calendar and access to Trading Central, which offers insightful technical analysis and trading recommendations. These tools are invaluable for staying updated on important economic events and market movements that can impact trading decisions.

Additionally, Hantec's robust analysis features include Daily Reviews and Market Analysis, offering detailed evaluations of market conditions to help traders identify potential opportunities. The Trader Life section adds a unique perspective by exploring lifestyle aspects of trading, while the Academy offers educational resources that cater to both new and experienced traders, aiming to broaden their knowledge and improve their trading skills. Together, these tools and resources form a dynamic support system that empowers Hantec's clients to navigate the financial markets more effectively.

Deposits & Withdrawals

Hantec maintains a somewhat opaque approach regarding the specifics of its deposit and withdrawal processes, providing limited information publicly. However, it is known that Hantec offers a 24/5 withdrawal service, suggesting that clients can initiate withdrawals during the business week with the expectation of timely processing.

Additionally, the minimum deposit requirement for opening a Standard account is set at $100, which is relatively accessible for most traders and provides an entry point for those looking to start trading without a significant initial investment.

Hantec minimum deposit vs other brokers

| Hantec | Most other | |

| Minimum Deposit | $100 | $100 |

Customer Support

Hantec offers comprehensive customer support designed to cater to traders around the globe with a 24-hour service from 8:00 a.m. Monday to 7:00 a.m. Saturday (GMT+8), ensuring that assistance is readily available almost any time it is needed. Traders can reach out via various channels including live chat, email, and social media platforms such as Facebook and LinkedIn, providing multiple avenues for support according to the user's preference.

Registered Address: 1276, 1st Floor, Govant Building, Kumul Highway, Port Vila, Republic of Vanuatu.

User Exposure on WikiFX

As with any investment, it's important to exercise caution when choosing a broker, including Hantec. While there have been some reports of difficulties with withdrawals, these issues appear to have been resolved. It's important to do your research and take precautions when investing. You can use our platform to access information about brokers before making a decision. If you encounter fraudulent brokers or have been a victim of one, please report it in the Exposure section. Our team of experts will do everything possible to help resolve the problem for you.

Frequently Asked Questions (FAQs)

Is Hantec regulated?

Yes. It is regulated by ASIC in Australia and offshore regulated by VFSC.

At Hantec, are there any regional restrictions for traders?

Yes. Hantec does not offer its services to residents of certain jurisdictions, including USA, Canada, Hong Kong, Macau, Iran and North Korea.

Does Hantec offer the industry-standard MT4 & MT5?

Yes. Both MT4 and MT5 are available.

What is the minimum deposit for Hantec?

The minimum deposit is $100.

News

NewsHantec Markets Revamps its Brand, Introduces Benefits

A well-known broker, Hantec Markets unveiled its most recent efforts to improve the trading experience for partners and clients globally.

WikiFX

WikiFX

NewsHantec Markets launches offshore prop trading unit Hantec Trader

This article explores the key features of Hantec Trader and its potential impact on the market.

WikiFX

WikiFX

NewsWikiFX Reviews Hantec in Depth

In this article, we'll examine Hantec's key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service.

WikiFX

WikiFX

NewsHantec announced the Launch of Hantec Financial in Africa

Hantec Group, a well-known global Forex trading firm, has announced the official launch of Hantec Financial in Africa, which will serve the African continent from its new regional headquarters in Rwanda.

WikiFX

WikiFX

Review 17

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now