General Information

SCHATZ is a Forex broker registered in the United Kingdom. With a history of 2-5 years, the company operates without any regulatory oversight, which is an important aspect to consider. The minimum deposit required to open an account with SCHATZ is $100, offering accessibility to traders of various levels. The broker provides a maximum leverage of up to 1:500, allowing for potential amplification of trading positions.

Traders using SCHATZ can choose from different account types, including Lite, Pro, Premium, and Islamic accounts, catering to various trading preferences. The broker offers competitive spreads, starting from as low as 0.2 pips for the Premium account, which can contribute to cost efficiency in trading activities.

SCHATZ provides access to popular trading platforms, namely MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms offer a wide range of tools and features to enhance the trading experience. Tradable assets at SCHATZ include Forex, Bullion, and Indices, providing opportunities for diversification.

For customer support, SCHATZ offers phone and email assistance. Additionally, the broker maintains an active presence on social media platforms such as Twitter, Instagram, YouTube, LinkedIn, and Facebook, allowing clients to engage and seek support.

Is SCHATZ legit or a scam?

When considering the regulation of SCHATZ, it is important to note that the broker currently operates without any regulatory oversight. SCHATZ is owned and operated by Schatz Marketz LLC, which claims to be registered in the United Kingdom. However, upon verification on the official website of the Financial Conduct Authority (FCA), the regulatory body responsible for overseeing financial services in the UK, no information pertaining to SCHATZ or Schatz Marketz LLC could be found.

The absence of regulation for SCHATZ raises concerns about the level of oversight and accountability the broker adheres to. Trading with an unregulated broker exposes traders to potential risks, such as inadequate protection of client funds, limited recourse in case of disputes, and questionable business practices.

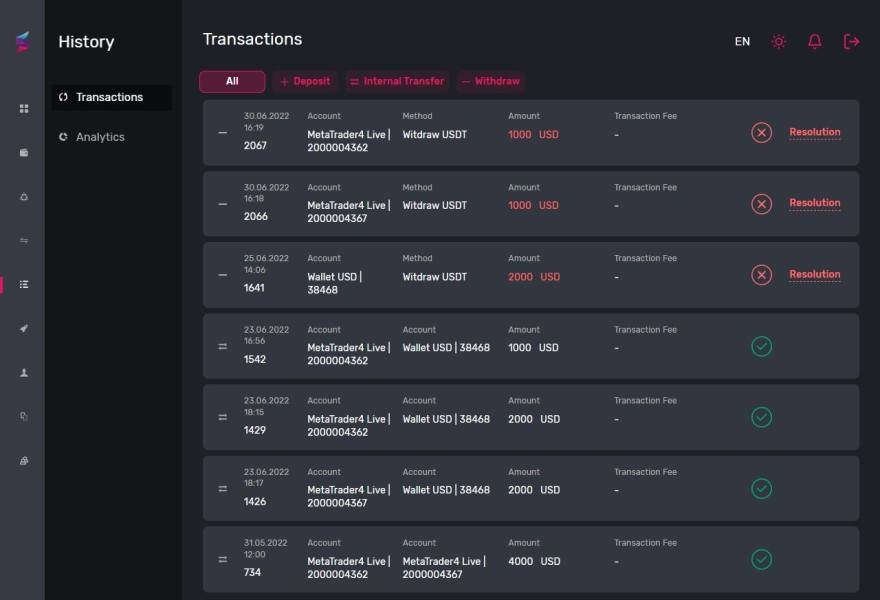

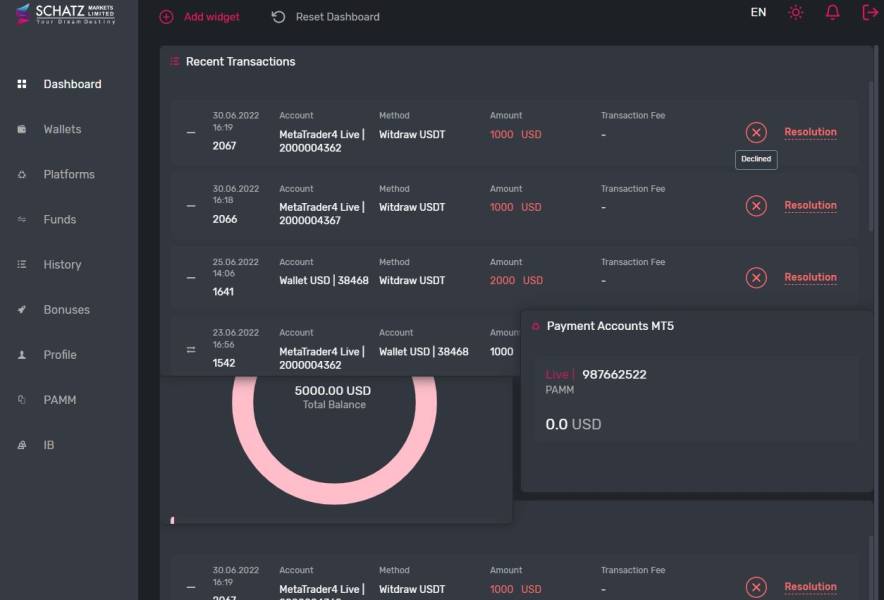

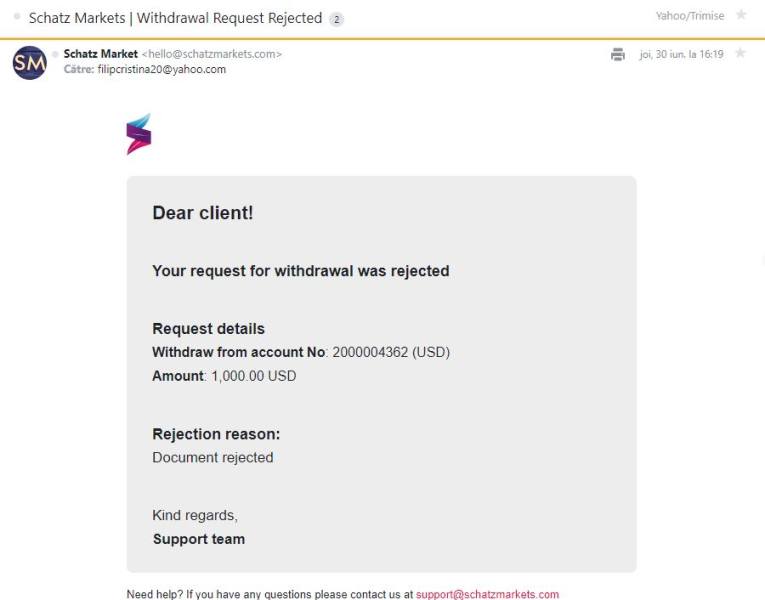

User Experience of SCHATZ

The user experience of SCHATZ has been a topic of discussion among traders, with mixed reviews and opinions. While some traders have reported positive experiences with the broker, others have expressed concerns and raised issues.

One common concern raised by users is the lack of regulation. As SCHATZ operates without regulatory oversight, it raises questions about the safety and security of client funds and the overall transparency of the broker's operations. Traders should be cautious when trading with an unregulated broker and carefully assess the associated risks.

Another aspect that has been mentioned in user feedback is the customer support provided by SCHATZ. While the broker offers phone and email support, some users have reported delays in response times and difficulties in reaching the support team. This can be frustrating for traders, especially when they need assistance with urgent matters.

Additionally, there have been mixed opinions about the trading conditions offered by SCHATZ. While some traders have found the spreads to be competitive and the leverage options to be appealing, others have expressed dissatisfaction with the execution quality and slippage experienced during trades.

Pros and Cons

SCHATZ provides the popular MetaTrader 4 and MetaTrader 5 trading platforms. It also offers a wide range of account types, including an Islamic account option. The broker accepts multiple payment methods and has an acceptable minimum deposit requirement for its Lite account.

However, there are notable drawbacks to consider. SCHATZ lacks regulatory oversight, which may raise concerns about the safety of funds. The educational resources provided by the broker are limited, and there are mixed user experiences and reviews. There is a potential for delays in customer support, and the available trading instruments are also limited.

Market Instruments

SCHATZ offers a focused selection of trading assets, primarily focusing on currencies, bullions, and indices. While these instruments provide trading opportunities in major financial markets, it is important to note that the asset offering of SCHATZ is relatively limited compared to some other brokers in the industry.

Some brokers may provide a broader range of instruments, including stocks, commodities, cryptocurrencies, and more. This expanded selection allows traders to diversify their portfolios further and potentially explore additional trading opportunities across different asset classes.

When choosing a broker, it is essential to consider your specific trading preferences, goals, and the availability of the desired trading assets. Conducting thorough research and comparing multiple brokers can help you make an informed decision that aligns with your trading requirements.

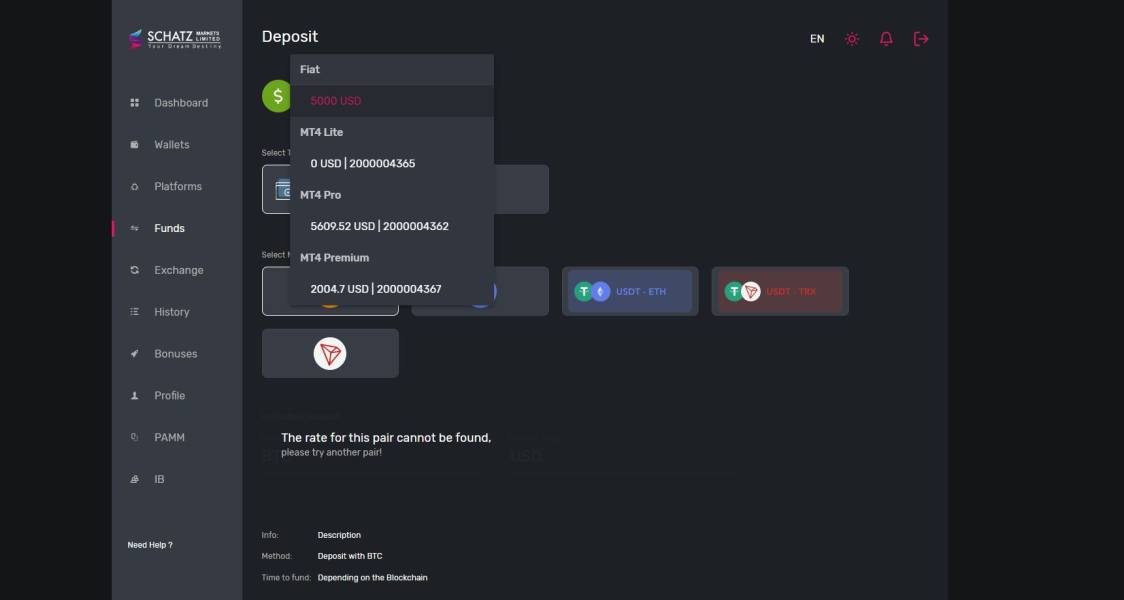

Account Types

SCHATZ offers a range of account types to accommodate diverse trading preferences and requirements. Let's explore each account type in more detail:

SCHATZ LITE: This account is suitable for traders who prefer lower leverage levels, with a maximum leverage of 1:100. The minimum deposit requirement is $100, allowing traders to start with a modest investment. Spreads start from 0.8 pips, providing competitive pricing. Traders can engage in trading various instruments such as currencies, bullions, and indices.

SCHATZ PRO: Designed for traders seeking higher leverage, the SCHATZ PRO account offers a maximum leverage of 1:500. The minimum deposit requirement for this account is $1000, allowing for larger trading volumes. With spreads starting from 0.4 pips, traders can benefit from tighter pricing. Similar to the LITE account, it supports trading in currencies, bullions, and indices.

SCHATZ PREMIUM: Traders looking for even tighter spreads can opt for the SCHATZ PREMIUM account. With a minimum spread starting from 0.2 pips, this account type provides more competitive pricing. The maximum leverage is set at 1:100, striking a balance between risk management and trading power. The minimum deposit requirement for the PREMIUM account is $2000, appealing to traders with a larger capital base. It offers trading opportunities in currencies, bullions, and indices.

SCHATZ ISLAMIC: For traders adhering to Islamic finance principles, SCHATZ offers the ISLAMIC account. This account ensures compliance with Islamic regulations by providing a maximum leverage of 1:100. The minimum deposit requirement is $1000, enabling Islamic traders to participate in the markets. Spreads start from 0.4 pips, offering competitive pricing. Like other account types, it supports trading in currencies, bullions, and indices.

The following table provides a summary of the account types offered by SCHATZ, including the maximum leverage, minimum deposit requirement, minimum spread, and the products available for trading.

How to open an account?

Visit the SCHATZ Website. Start by visiting the official website of SCHATZ. You can access the website through a web browser on your computer or mobile device.Look for the “Open an Account” or similar button on the website's homepage. Click on it to initiate the account opening process.

Fill out the Account Registration Form. You will be directed to an account registration form. Fill out the required information accurately and completely. This typically includes personal details such as your name, email address, phone number, and country of residence. You may also need to provide additional information such as your date of birth and preferred account type.

Read the terms and conditions. Ensure that you carefully read and understand the terms and conditions, risk disclosure, and any other legal agreements provided by SCHATZ. If you agree to the terms, check the appropriate box and proceed with the registration.

Submit the form. Once you have completed the form, click on the “Submit” or similar button to submit your application.

Account Verification. After submitting your account registration form, SCHATZ may require you to complete an account verification process. This is a standard procedure to ensure the security and compliance of the platform. You may be asked to provide supporting documents such as identification proof (passport, driver's license, etc.) and proof of address (utility bill, bank statement, etc.).

Account Approval. Once your account registration and verification process is complete, SCHATZ will review your application. They will assess the provided information and documents to determine the eligibility of your account. This process may take some time, and you will receive a notification regarding the status of your account approval.

Fund Your Account. Upon successful account approval, you will need to fund your trading account with SCHATZ. They will provide you with various payment methods such as bank transfer, credit/debit card, or online payment processors. Choose the preferred payment method and follow the instructions to deposit funds into your account. Ensure that you are aware of any minimum deposit requirements specified by SCHATZ.

Leverage

SCHATZ offers leverage options ranging from 1:100 to 1:500, a common practice observed among unregulated brokers in the industry. Leverage allows traders to amplify their trading positions and potentially increase their profits. However, it's crucial to recognize that higher leverage levels also entail greater risks. While it can magnify gains, it can equally amplify losses, making risk management an essential aspect of trading. Traders should exercise caution and ensure they have a solid understanding of leverage and its potential impact on their trades. It's worth noting that regulated brokers often impose stricter leverage limits to safeguard traders and promote responsible trading practices.

Spreads & Commissions

When it comes to spreads and commissions, SCHATZ follows a standardized pricing structure that offers different spreads depending on the type of trading account. The Lite account presents spreads starting from 0.8 pips, while the Pro account provides spreads from 0.4 pips. The Premium account boasts even tighter spreads, starting from 0.2 pips. Traders opting for the Islamic account can expect spreads starting from 0.4 pips.

However, the absence of detailed information on commissions may cause some inconvenience when evaluating the total trading costs. It is advisable to contact SCHATZ directly or consult their customer support to obtain comprehensive information regarding any applicable commissions or additional charges associated with specific trading activities.

Trading Platform

SCHATZ offers traders the flexibility to choose between two highly regarded trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are known for their reliability, comprehensive features, and user-friendly interfaces.

MetaTrader 4 (MT4) is a widely recognized and widely used trading platform in the industry. It provides stability, advanced charting capabilities, and a wide range of technical analysis tools. Traders can customize their strategies, utilize various order types, and access a vast library of indicators and expert advisors. With its intuitive interface and efficient trade execution, MT4 is a popular choice for traders of all levels.

MetaTrader 5 (MT5) is the successor to MT4 and offers additional functionalities and asset classes. In addition to currencies, SCHATZ provides access to bullions and indices on the MT5 platform. MT5 offers enhanced charting tools, a broader range of order types, and advanced analytical capabilities. Traders can also take advantage of automated trading and easily access global financial markets.

Both MT4 and MT5 platforms offered by SCHATZ ensure seamless access to real-time market data, quick order execution, and a wide array of technical analysis tools. Traders can make informed decisions using customizable charts, multiple timeframes, and a comprehensive selection of indicators. The platforms cater to traders of all experience levels and trading styles.

Demo accounts

Demo accounts are available with the MT4 and MT5 trading platform, which is good news. Demo accounts allow new beginners to test the environment and practice their trading strategy without risking their real money.

Educational Resources

While specific details about the educational resources offered by SCHATZ are not readily available, it is important to note that comprehensive educational materials can play a vital role in helping traders understand various aspects of the financial markets and improve their trading strategies.

Customer Support

The Schatz Markets customer support can be reached through email: support@schatzmarkets.com, telephone at: +971543067128, and there is also a contact form for you fill out some problems you encounter during your trading. You can also follow this broker via some social media platforms including Facebook, Linkedin, Twitter, Instagram, and Youtube.

Conclusion

In conclusion, SCHATZ is a forex broker that offers a range of enticing features for traders, providing availability of the popular MetaTrader 4 and MetaTrader 5 platforms. However, it is important to note that SCHATZ operates without regulatory oversight, which raises concerns about the security and protection of client funds. Traders should exercise caution and carefully consider the potential risks associated with trading with an unregulated broker.

FAQs

Q: Is SCHATZ a regulated broker?

A: No, SCHATZ currently operates without any regulatory oversight.

Q: What trading platforms does SCHATZ offer?

A: SCHATZ offers both the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

Q: What are the minimum deposit requirements for opening an account with SCHATZ?

A: The minimum deposit requirements vary depending on the type of account. For example, the minimum deposit for the SCHATZ LITE account is $100, while the SCHATZ PRO and SCHATZ PREMIUM accounts require minimum deposits of $1000 and $2000 respectively.

Q: What is the maximum leverage offered by SCHATZ?

A: SCHATZ offers maximum leverage of 1:100 for the SCHATZ LITE and SCHATZ PREMIUM accounts, and maximum leverage of 1:500 for the SCHATZ PRO account.

Q: What trading instruments are available for trading with SCHATZ?

A: SCHATZ provides a range of trading instruments including currencies, bullions, and indices.

Q: How can I contact SCHATZ's customer support?

A: SCHATZ can be contacted through phone at +971 50 333 8217, or via email at support@schatzmarkets.com. They are also present on various social media platforms such as Twitter, Instagram, YouTube, LinkedIn, and Facebook.

Q: What are the available payment methods for deposits and withdrawals?

A: SCHATZ allows clients to deposit and withdraw funds using bank wire transfers, credit/debit cards, and popular e-wallets such as Skrill and Neteller.