Overview of SafeCap

SafeCap, established in 2019 and based in Saint Vincent and the Grenadines, serves a wide audience with its unregulated trading services. This broker provides forex pairs, commodities, stocks, indices, and digital currencies, and fulfill the needs of various trader skill levels with accounts that start at €250 for Trainees up to €100,000 for Business-level traders.

Pros and Cons

SafeCap presents comprehensive market instruments that appeal to both traditional and contemporary investors including a suite of digital currencies.

However, the broker's lack of regulation is a substantial drawback. Furthermore, the high minimum deposit threshold could deter smaller investors from using SafeCap's services. Additionally, while offering multiple cryptocurrency transaction options, the absence of conventional payment methods could limit accessibility for some traders. Another point of concern is the non-transparency regarding non-trading fees, which could introduce unexpected costs for traders. Finally, the customer support hours are limited to standard business hours, which might not align with the round-the-clock nature of trading.

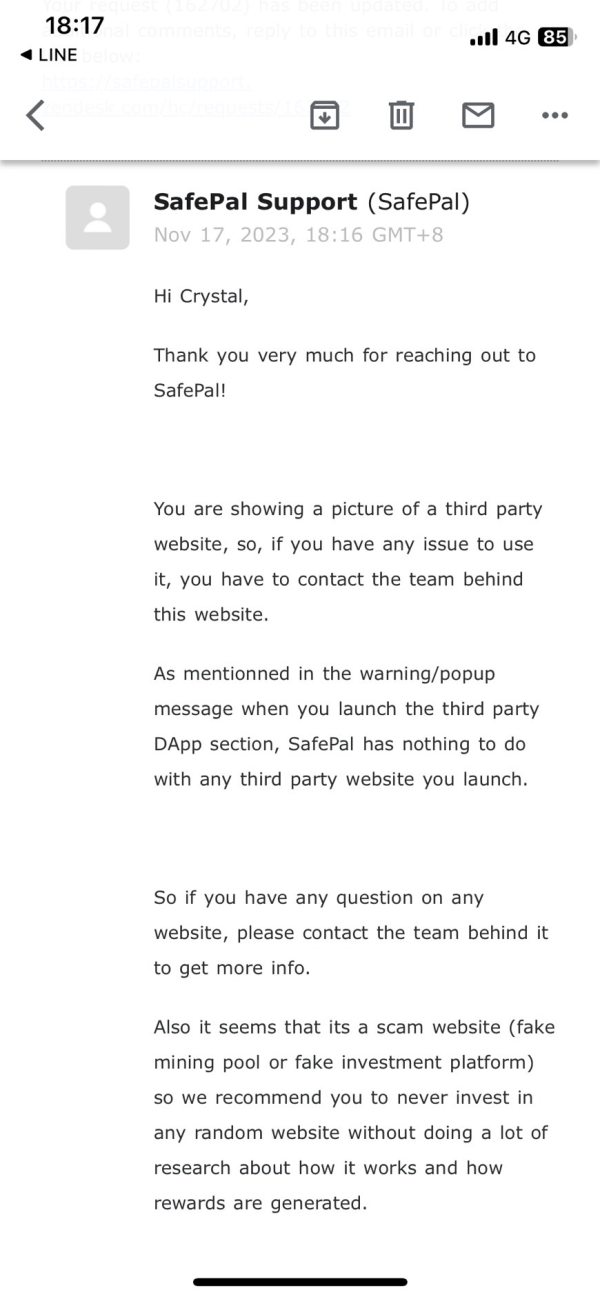

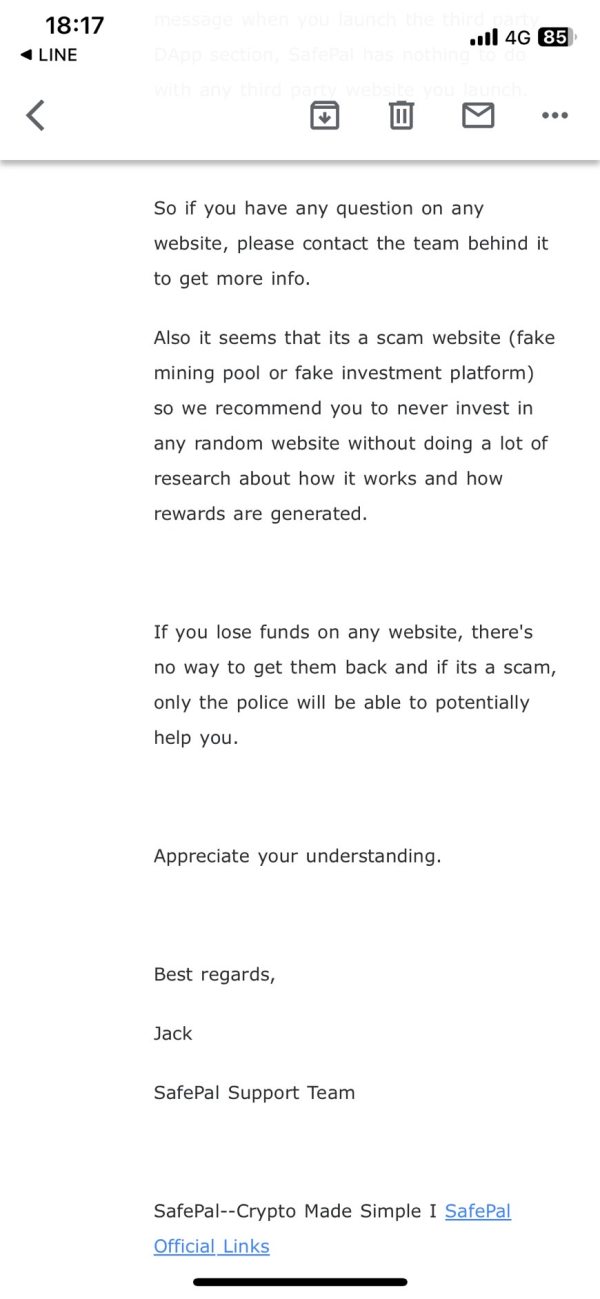

Is SafeCap legit or a scam?

SafeCap is presently unregulated, lacking oversight from any established financial regulatory bodies.

Market Instruments

SafeCap provides Forex, Commodities, Stocks, Indices, and Digital Currencies.

Forex:

Traders have the option to engage with a variety of currency pairs including major ones like EUR/USD, EUR/GBP, and GBP/USD.

Commodities:

Investment opportunities in commodities are ample with SafeCap offering some of the most actively traded commodities including Crude Oil, Gold, Silver, and Natural Gas.

Stocks:

For those interested in equity markets, SafeCap provides access to shares from various companies, allowing traders to buy, sell, and trade stocks as part of their investment strategy.

Indices:

Indices are also available and serve as a gauge for sectors of the stock market. This can help traders make informed decisions aligned with market fluctuations.

Digital Currencies:

Reflecting modern investment trends, SafeCap offers trading in digital currencies like Bitcoin, providing a platform for those looking to explore this relatively new market without traditional banking fees.

Account Types

This broker offers four distinct trading accounts: STANDARD, PREMIUM, BUSINESS, and a Trainee option for beginners.

The STANDARD account, with a minimum deposit of €5000, includes features like leverage up to 1:100 and low spreads from 0.1 pips.

The PREMIUM account demands a €25000 deposit and offers leverage up to 1:300 with spreads starting at 1.3 pips.

The BUSINESS account is tailored for seasoned traders, requiring a €100000 deposit and providing maximum leverage of 1:500 with spreads from 1.5 pips.

The Trainee account appeals to new traders, allowing entry at just €250, ideal for those looking to learn trading with realistic but safer account conditions.

How to Open an Account with SafeCap

To open an account with SafeCap, follow these steps:

Register: Visit the SafeCap website and sign up to create your new account. The registration process is created to be fast and efficient.

Fund: Activate your account by making a deposit using one of several available methods tailored to suit various user needs.

Trade: Begin trading by initiating your first trades on the SafeCap Webtrader, a platform known for its comprehensive tools and user-friendly interface.

Leverage

This broker offers different leverage options across its account types:

STANDARD Account: Up to 1:100

PREMIUM Account: Up to 1:300

BUSINESS Account: Up to 1:500

Spreads & Commissions

The STANDARD account offers notably low spreads at 0.1 pips without any commission charges, ideal for cost-sensitive traders.

The PREMIUM account, with spreads starting at 1.3 pips and a commission of €0.5 per 1.0 lots, appeals to experienced traders handling larger volumes.

The BUSINESS account, targeted at professional traders, features spreads from 1.5 pips and commissions ranging between €1.9 and €4.0 per 1.0 lots, accommodating high volume trading.

Trading Platform

SafeCap provides its clients with the SafeCap Webtrader, a platform that combines ease of use with advanced trading functionalities. The platform is created with a clear, intuitive interface, making it accessible for both novice and experienced traders. It includes an extensive array of tools for interactive charting, technical analysis, and visual representation of financial data, helping traders make informed decisions.

Trading Tools

SafeCap offers several calculators—Pip, Profit, Pivot, Fibonacci, and Margin—that aid traders in making precise and informed decisions efficiently. Additionally, SafeCap provides a structured Trading Plan, which serves as a vital guide for traders to follow their strategies with discipline and consistency. The Strategies feature further complements this by providing robust methods to execute these plans effectively. Furthermore, live price feeds are available, offering a gate to understand market changes.

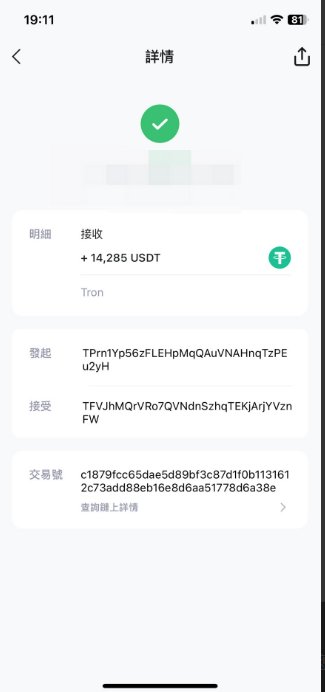

Deposit & Withdrawal

SafeCap provides several options for deposit and withdrawal, including major cryptocurrencies such as Ripple (XRP), Terra (LUNA), Tether (USDT), Dogecoin (DOGE), Solana (SOL), Ethereum (ETH), Cardano (ADA), and Bitcoin (BTC).

Customer Support

Technical Support Department:

Compliance Department:

Additional support is available through a general contact form where clients can describe their issues to receive tailored assistance.

Educational Resources

SafeCap offers educational resources centered around a comprehensive collection of news articles. These articles provide critical insights into ongoing financial events and market trends, essential for informed trading decisions. The news serves as a practical educational tool, helping traders understand and respond to economic dynamics effectively. By focusing on real-time news updates, SafeCap advertises that its clients are well-prepared to exploit market opportunities as they arise, thus improving their ability to navigate the complexities of various financial environments.

Conclusion

Established in 2019 and based in Saint Vincent and the Grenadines, SafeCap provides trading options including forex, commodities, stocks, indices, and digital currencies. This broker is suits various trading experiences with different account types and attractive spreads. However, it lacks regulatory oversight, and the requirement for high minimum deposits for some accounts could exclude less experienced or financially conservative traders. The exclusive use of cryptocurrencies for transactions and unclear non-trading fees, coupled with restricted customer support hours, could negatively influence the user experience.

FAQs

Q: What different account types are available at SafeCap?

A: SafeCap provides several account options: Trainee, STANDARD, PREMIUM, and BUSINESS.

Q: Does SafeCap operate under any regulatory authority?

A: No, SafeCap currently lacks regulation from any recognized financial authority.

Q: What are the minimum deposit levels required for each account type at SafeCap?

A: Deposits start at €250 for Trainee, €5000 for STANDARD, €25000 for PREMIUM, and €100000 for BUSINESS accounts.

Q: Can I engage in cryptocurrency trading on SafeCap?

A: Yes, trading in various cryptocurrencies like Bitcoin, Ethereum, and others is supported at SafeCap.

Q: What platform is used for trading at SafeCap?

A: The SafeCap Webtrader, a platform featuring comprehensive tools for analysis, is used for trading.

Q: How can I contact customer support at SafeCap?

A: Support can be reached via telephone, email, or through a contact form, but is only available during normal working hours, not 24/7.

Risk Warning

Online trading poses substantial risks, with the potential for complete loss of invested capital, rendering it unsuitable for all traders. It is imperative to comprehend the inherent risks and acknowledge that the information provided in this review is subject to change due to continuous updates in the company's services and policies.

Additionally, the review's generation date is a critical consideration, as information may have evolved since then. We strongly advise readers to verify updated details directly with the company before making any decisions, as the readers must be aware of and willing to accept the inherent risks involved in utilizing this information.