Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

What is TRADESKA?

TRADESKA presents itself as an STP trading broker giving their clients access to a series of trading instruments, including Forex, Commodities, Shares, Indices, Cryptocurrencies through the MT5 platform. With TRADESKA, investors need to fund at least $500 to open a real account and the maximum trading leverage is up to 1:500. However, it should be noted that TRADESKA is unregulated, and there are concerns about the legitimacy of their license.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

TRADESKA has several advantages, including a variety of trading instruments, access to high leverage, and the MT5 trading platform. However, the lack of regulation, along with the high minimum deposit requirement and lack of specific information on spreads & commissions and deposits & withdrawals, raise concerns. Therefore, investors should exercise caution when considering TRADESKA as a potential broker.

TRADESKA Alternative Brokers

There are many alternative brokers to TRADESKA depending on the specific needs and preferences of the trader. Some popular options include:

HotForex - With competitive trading conditions and a range of account types, HotForex is a good option for traders of all levels.

ThinkMarkets - With a strong focus on customer service and a variety of trading platforms, ThinkMarkets is a solid choice for traders looking for a reliable broker.

Windsor Brokers - With a long history in the industry and a strong reputation for customer service, Windsor Brokers is a good choice for traders looking for a trustworthy broker.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is TRADESKA Safe or Scam?

Trading with TRADESKA is unsafe. Though the broker claims to offer various protection measures , such as the state-of-the-art Secure Sockets Layer (SSL) network security protocol, risk management and client fund segregation, the fact that they are unregulated and their National Futures Association (NFA, License No. 0549794) license is unauthorized raises significant red flags. It is essential to exercise caution when investing with any broker, and it may be best to look for a more reputable and regulated alternative.

Market Instruments

TRADESKA offers a variety of trading instruments across different asset classes, including Forex, Commodities, Shares, Indices, and Cryptocurrencies. However, as TRADESKA is unregulated and their license is unauthorized, it is advised to exercise caution and avoid trading with them.

Accounts

TRADESKA seems to only provide one type of live trading account, the Pro account, and it asks for a minimum deposit of $500. The maximum leverage available for trading is up to 1:500, with a minimum order size of 0.01 lot and a maximum order size of 20 lots. The broker has set the margin call level at 100% and the stop-out level at 50%. In addition, risk-free €10,000 demo accounts is also available.

Leverage

Trading balance determines trading leverage: the maximum leverage is 1:500 for accounts with balance under $30,000, 1:300 for accounts with balance from $30,000 to $50,000, 1:200 for accounts with balance from $50,000 to $100,000 and the leverage 1:100 for account with balance from $100,000.

TRADESKA enables its clients access to the maximum trading leverage up to 1:500, which is significantly greater than appropriate amount set by many regulatory authorities, with 1:30 for major currency pairs in the U.K. and Australia, 1:50 for major currency pairs in the U.S. and Canada.

Since leverage can amplify both gains and losses, it can result in devastating losses for investors who lack experience. If you're just starting out in the trading world, it's best to stick with the lower size, no more than a 1:10.

Spreads & Commissions

TRADESKA claims to offer spreads from 0.0 pips, with an average spread of 0.00067 for forex trading. It appears that no commission is charged, which suggests that the company's revenue may come from the spread markup. However, there is limited information on the specific spreads and commissions for other trading instruments such as commodities, shares, indices, and cryptocurrencies. As such, potential traders may need to further research or contact TRADESKA directly for more information on spreads and commissions for these assets.

Below is a comparison table about spreads and commissions charged by different brokers:

Trading Platforms

What TRADESKA provides is the industry leading MT5 trading platform, which is available on Desktop, Web, and Mobile devices. MT5 offers a range of features including advanced charting tools, numerous technical indicators, and the ability to create and use automated trading strategies through Expert Advisors (EAs). It also allows for multiple order types, including market, limit, stop, and trailing stop orders. Additionally, MT5 supports multiple timeframes, and traders can monitor multiple accounts and execute trades from a single platform.

Overall, MT5 is a comprehensive and flexible platform that can cater to the needs of both novice and experienced traders.

See the trading platform comparison table below:

Trading Tools

TRADESKA offers a range of trading tools to assist traders in making informed trading decisions. Their market analytics feature provides daily market analysis, weekly market reviews, and technical analysis reports. In addition, they offer an economic calendar, which displays upcoming economic events and their expected impact on the market. This can be a valuable resource for traders who want to stay informed about important events that could affect their trades. Finally, TRADESKA provides access to up-to-date forex news to keep traders informed about the latest developments in the markets.

Deposits & Withdrawals

While TRADESKA claims to accept MasterCard, Maestro, Bank Wire, and Bitcoin as deposit methods, no other specific information can be found regarding deposit fees or processing time. The same applies to withdrawals. It's important to note that lack of transparency on deposit and withdrawal terms may cause inconvenience and uncertainty for traders, and they should always consider the potential risks and costs associated with funding their accounts and withdrawing their funds.

TRADESKA minimum deposit vs other brokers

Customer Service

TRADESKA appears to have a decent customer service offering. The website is available in 15 languages, indicating the broker's commitment to serving an international client base. Customer support is available 24/7 via live chat, phone, email, and online messaging, which is a positive feature for traders who need immediate assistance. A FAQ section is also available for clients seeking answers to common questions. Furthermore, the broker has provided its registered address, which adds to its credibility.

However, the broken social media icons on the official website, particularly the inability to navigate to the relevant web links, suggests that the social media presence might not be active or reliable.

Note: These pros and cons are subjective and may vary depending on the individual's experience with TRADESKA's customer service.

Education

TRADESKA provides some basic educational resources for traders, including articles on topics such as STP, margin, and forex. The broker also offers a learning center on its website, although the specifics of what is included in this section are not clear. While it is always beneficial for traders to have access to educational resources, it would be helpful if TRADESKA provided more detailed information on what exactly is included in their learning center and how it can benefit traders.

Conclusion

Based on the available information, TRADESKA is an unregulated forex broker with some potential red flags. While it offers a wide range of trading instruments, it only has one type of trading account and its leverage levels are significantly higher than those set by many regulatory authorities. The lack of specific information on spreads & commissions and deposits & withdrawals is also a concern. However, it offers the popular MT5 trading platform and 24/7 multi-channel customer support. All of these factors should be carefully considered before deciding to trade with TRADESKA.

Frequently Asked Questions (FAQs)

pvan

Vietnam

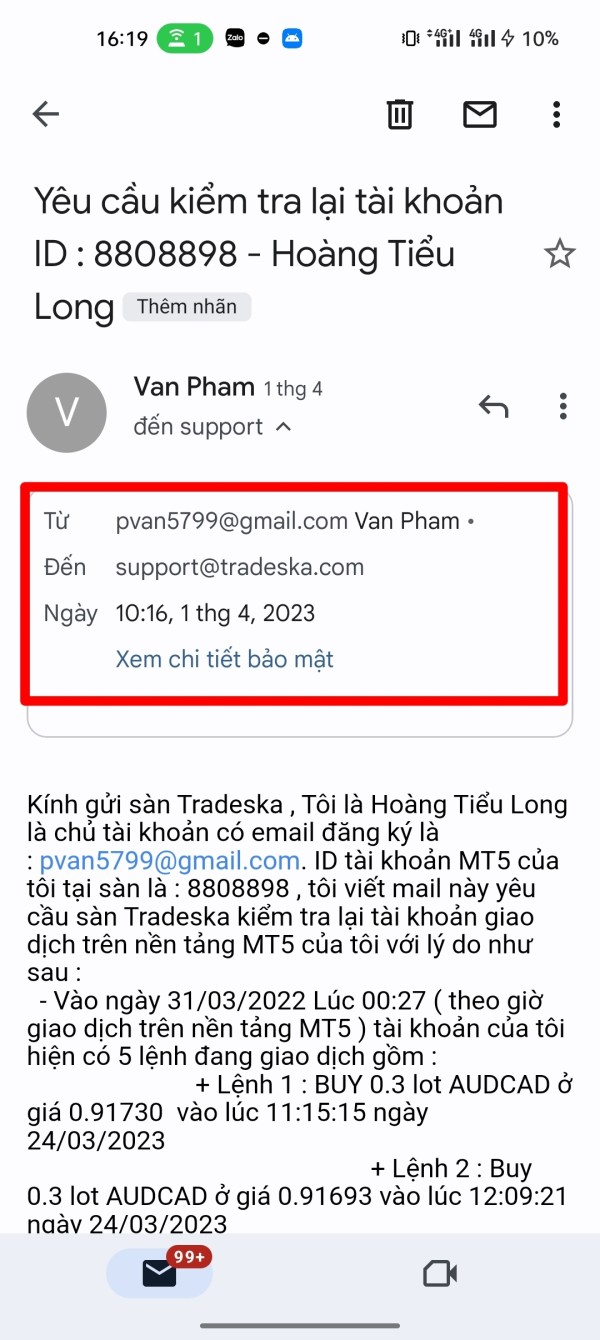

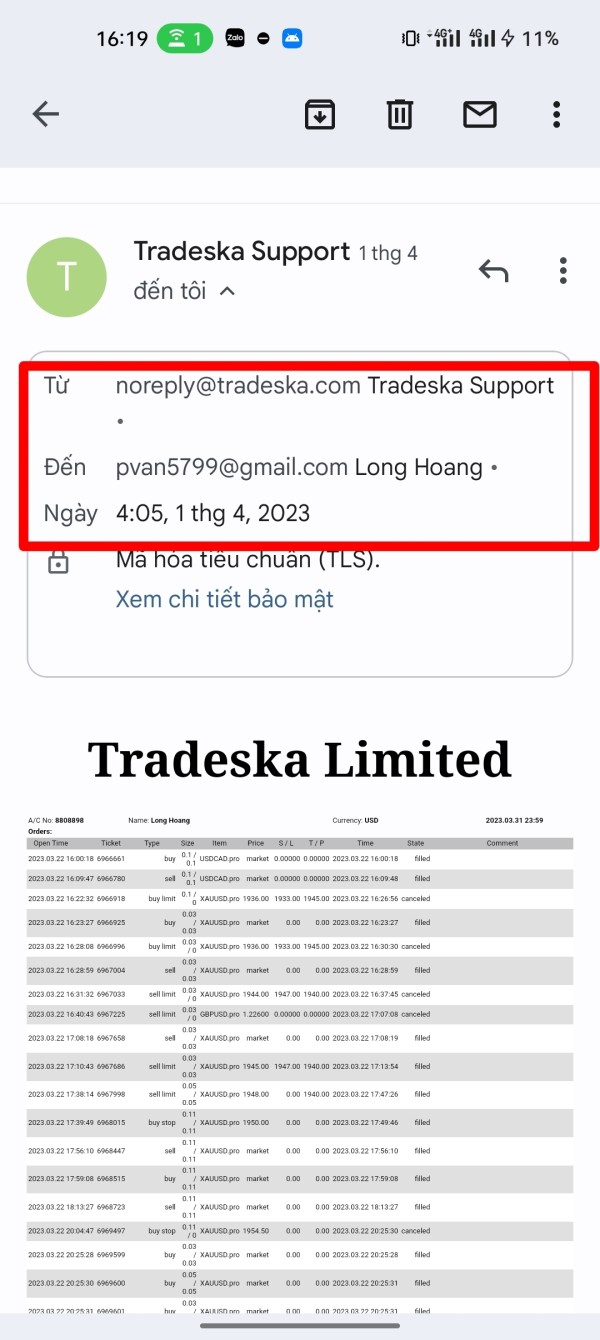

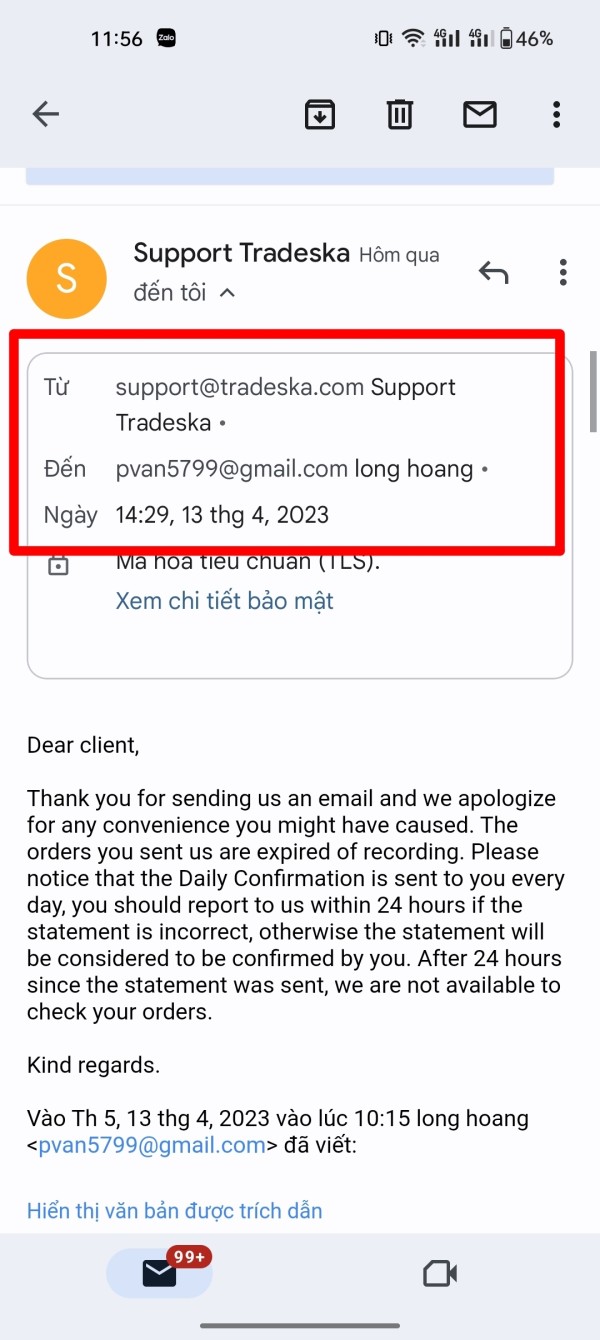

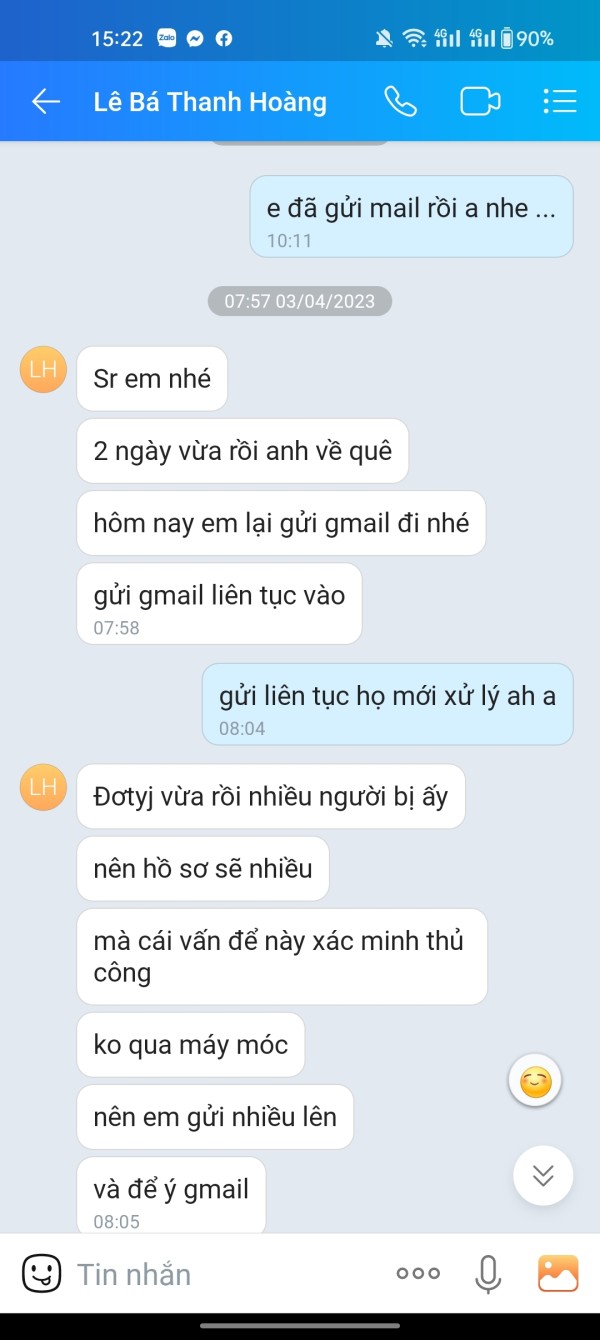

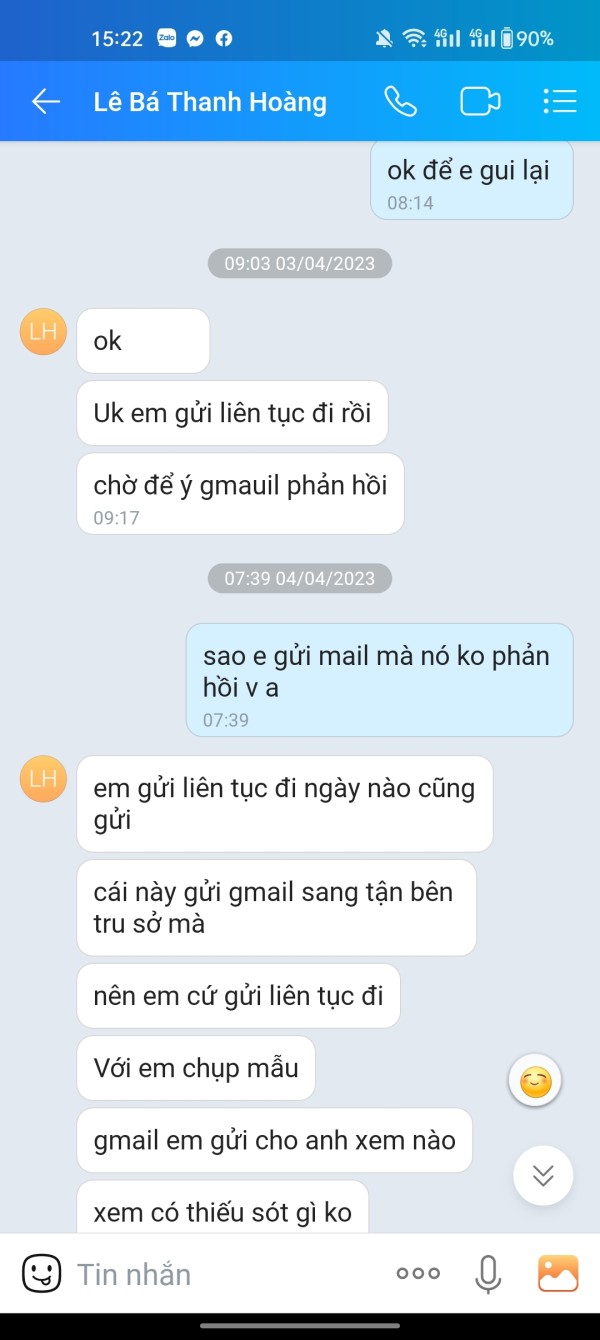

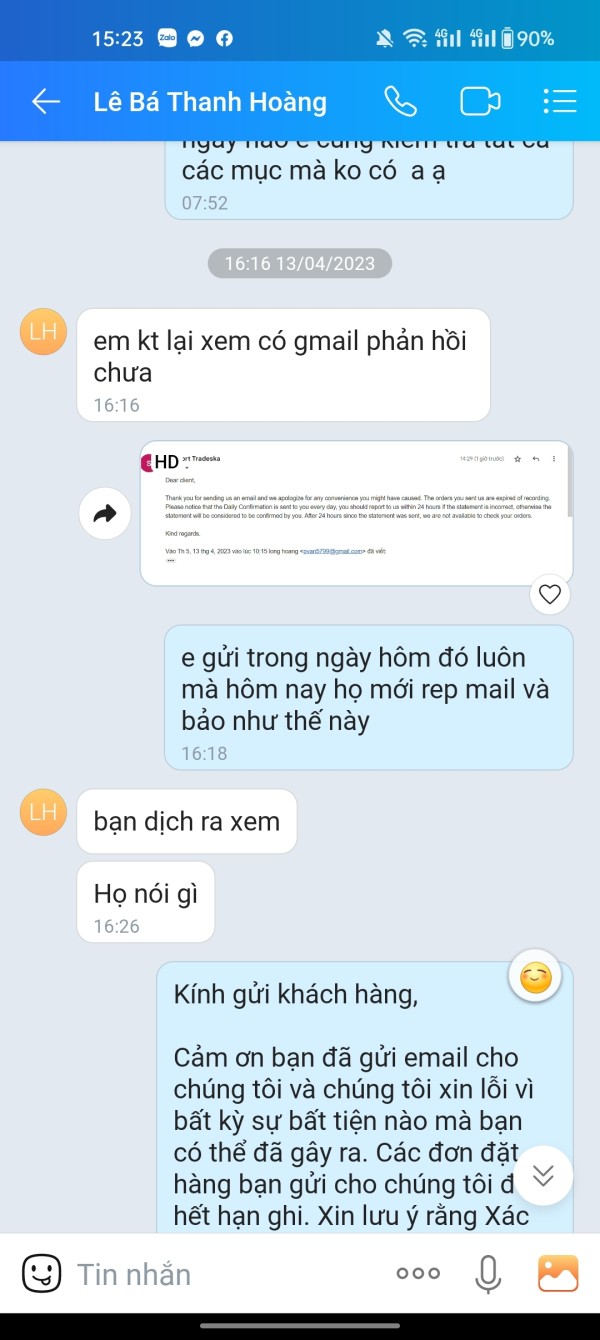

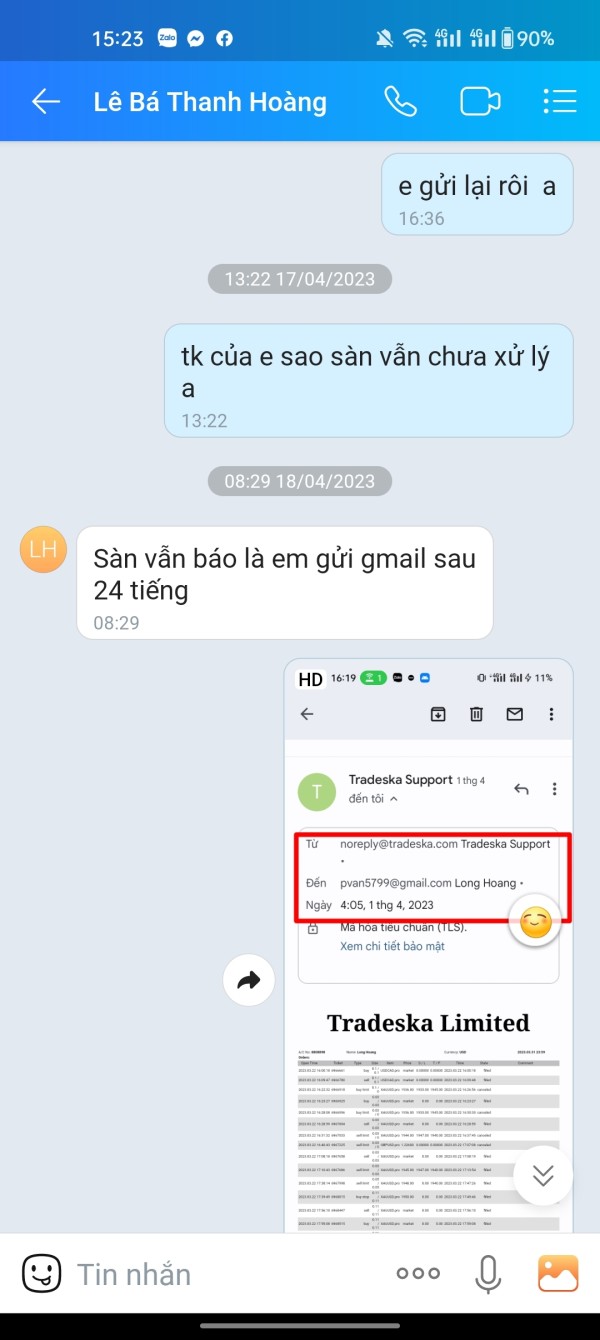

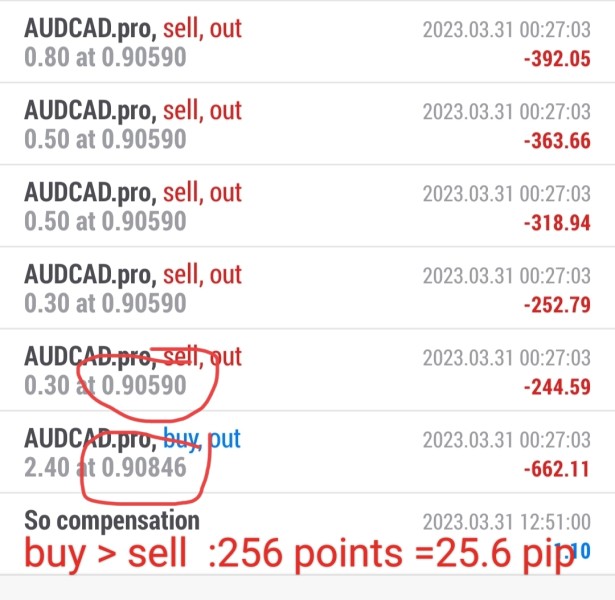

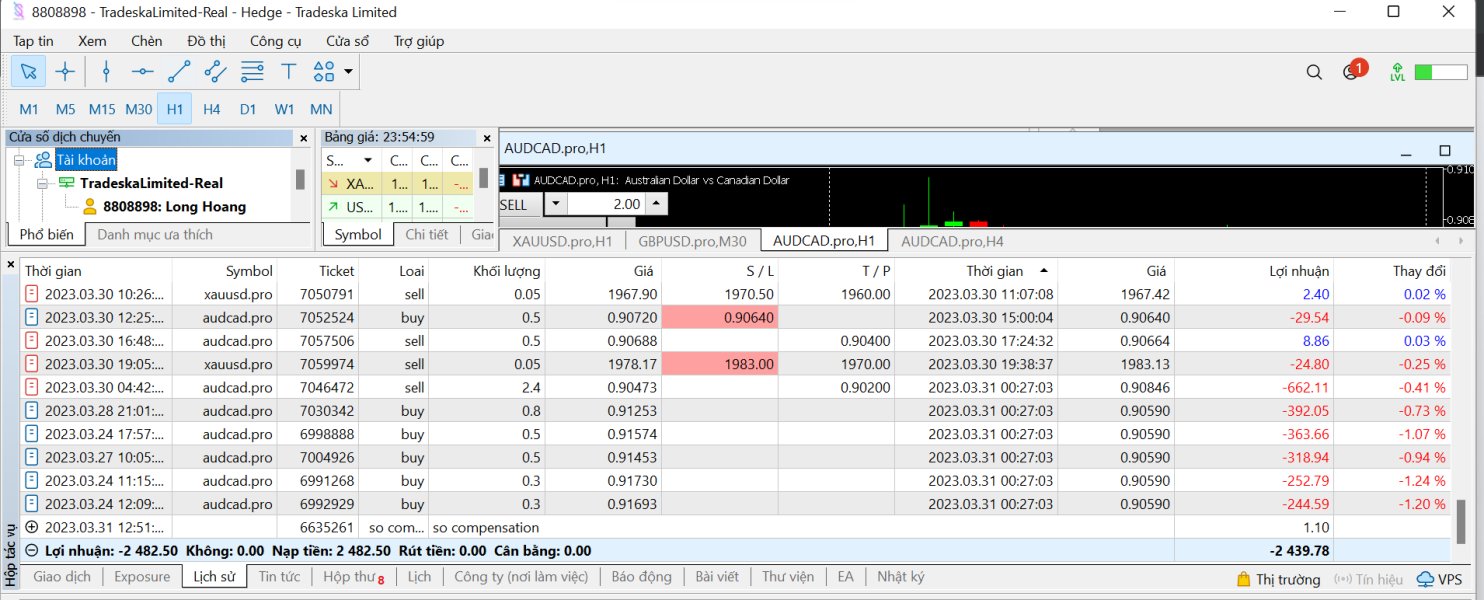

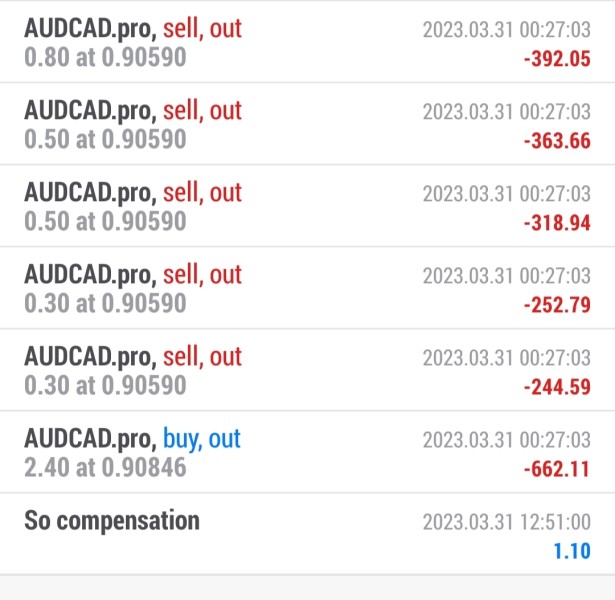

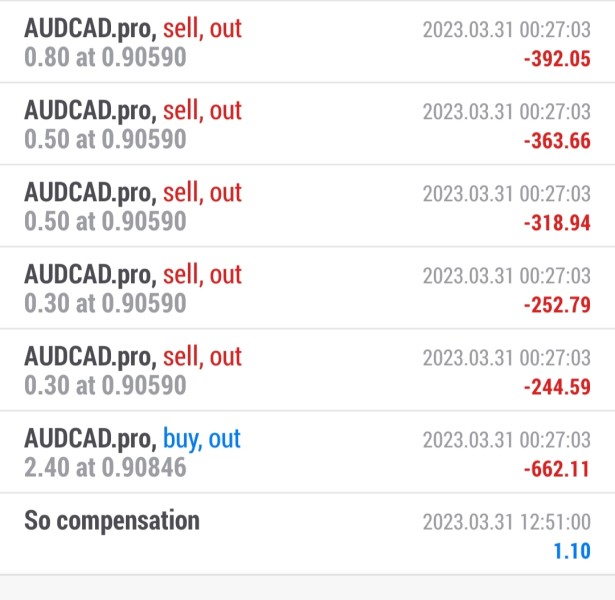

My account id 8808898 is open at the exchange TRADESKA. the exchange automatically cut off my order with a slippage of 256 pips at the time of the order cut off and my account burned. I immediately contacted the broker's support for instructions and emailed the complaint to the exchange. I emailed the exchange within 24 hours since I received the daily report email, I emailed 2 weeks in a row and the exchange TRADESKA just replied to me " After 24 hours since the exchange sent the report, so I couldn't check the order " even though I submitted the complaint within 24 hours. the exchange gave the wrong reason and didn't handle it for me, I think the exchange had intended to scam me, I asked to review and cancel the operation status of the exchange.

Exposure

2023-04-24

pvan

Vietnam

The exchange cut off my order, with a price difference of up to 256. The price was too high, and my account caught fire. I contacted for half a month, but Tradeska did not reply to the email.. The exchange defrauded me of 65 million Vietnamese dong ($2500) in assets. Everyone should be careful with this Tradeska platform.

Exposure

2023-04-20

pvan

Vietnam

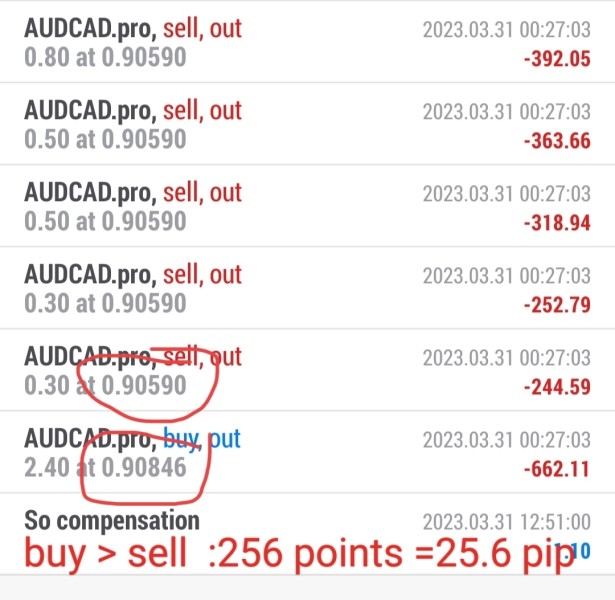

Time to cut all orders is: 00:27:03 on 03/31/2023 for both buy and sell orders, however sell orders are cut at: 0.90846, while buy orders are cut at 0.90590, the difference up to more than 256 points (25.6pip) between buy and sell orders, although buy and sell orders will cut differently at buy and sell orders but slippage never goes up to more than 256points (25.6pip) of market price Also, while the loss was locked by the balance between the buy and sell orders, I suspect there was a problem in the stoppage by either the broker scanning the sell order price or the buy order didn't match the market price at that time. now the total of 2 orders is not balanced and my account has all orders cut off and my account is burnt. If true, the loss has been locked and my Account still has a balance.

Exposure

2023-04-05

pvan

Vietnam

I traded at tradeska with a slippage of AUDCAD 26pip and the broker cut off all my orders and made my account burn.. I emailed sang's support to handle it but it's been 5 days and I still haven't received a reply email.... Average slippage for AUDCAD currency pair is 3pip to 4pip but the broker increased the slippage to 26pip causing the account to be burned.Please contact me and handle it for me.

Exposure

2023-04-04

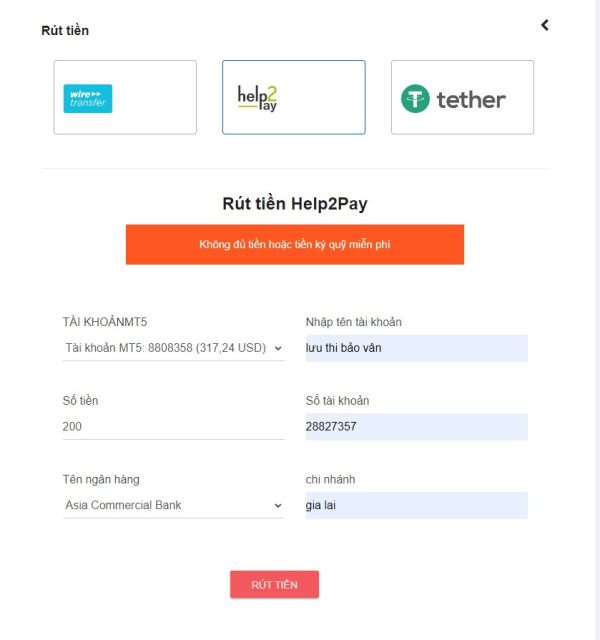

Elena Luu

Vietnam

no withdrawal, complaints no one solves

Exposure

2023-03-24

manhtuong

Vietnam

On August 13, 2022, I loaded into the platform $890 but the platform deducted $32, it's too ridiculous. and I have withdrawn my money for 2 days and have not receive. Texting support, but the platform did not reply. Scam platform does not allow withdrawal, please stay away.

Exposure

2022-08-15

&

United States

The company is less than a year old and my browser alerts me that the site has been reported as unsafe. I thought, to be on the safe side, I shouldn't invest here.

Positive

2022-12-16