Overview

PTT, also known as PRO TECH TRADE, is a China-based company founded in 2022. However, it operates without regulation as a forex broker, raising concerns about client protection. The minimum deposit requirement is $100, and the company offers a maximum leverage of 1:500, which can be both enticing and risky for traders. The spreads on certain currency pairs and commodities may not be the most competitive, affecting overall trading costs.

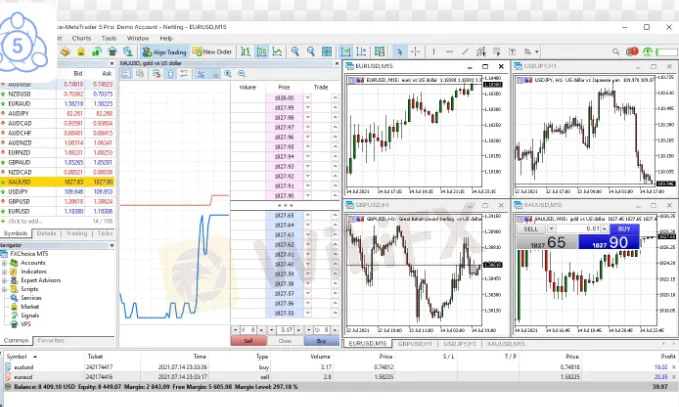

The company provides the popular MetaTrader 5 (MT5) trading platform for users, allowing access to various financial instruments, including forex, commodities, and cryptocurrencies. PTT offers both real and demo accounts, with a demo account available for practice. Unfortunately, Islamic accounts are not available.

One significant drawback is the slow and inefficient customer support, which can be frustrating for users seeking assistance. Moreover, PTT exclusively accepts cryptocurrency payments, potentially limiting options for clients.

The company's website frequently experiences downtime, affecting accessibility for users. Additionally, allegations of being a scam have cast doubt on PTT's reputation, making it a less favorable choice for traders and investors.

Regulation

PTT, as an entity, is not subject to regulation as a forex broker. Forex brokers are typically regulated by financial authorities and regulatory bodies in various countries to ensure compliance with industry standards, protect the interests of traders, and maintain the integrity of financial markets. However, PTT, which might refer to a wide range of businesses or organizations, may not necessarily fall under the regulatory purview of forex trading unless it specifically engages in forex brokerage services and operates within the jurisdiction of a regulatory body. It is essential for individuals and investors to exercise caution and conduct thorough research when dealing with financial services providers to ensure they are regulated and authorized to operate in the forex market to safeguard their investments and financial interests.

Pros and Cons

PTT presents a mixed picture with both advantages and drawbacks. It offers a diverse range of market instruments and high leverage potential but operates without regulatory oversight, which may pose risks for clients. Competitive spreads and access to MetaTrader 5 are positive aspects, but inconvenient cryptocurrency transactions and sluggish customer support can hinder user experiences. Additionally, website downtime and scam allegations cast a shadow over the company's reputation, making it a less appealing choice for traders and investors.

Market Instruments

PTT, which stands for PRO TECH TRADE, engages in trading a variety of market instruments, including forex, commodities, and cryptocurrencies. These market instruments encompass:

Forex (Foreign Exchange): PTT participates in the forex market, involving the trading of currencies from different countries. Forex trading is conducted in currency pairs, such as EUR/USD or GBP/JPY. PTT engages in currency trading for various purposes, including hedging against currency risks, speculating on currency price movements, or facilitating international business transactions.

Commodities: PTT is involved in trading commodities, which are raw materials or primary agricultural products that can be bought and sold, such as oil, gold, wheat, or coffee. These commodities are traded on commodity exchanges or over-the-counter (OTC) markets. PTT trades commodities for investment purposes, to hedge against price fluctuations, or as part of its business operations, depending on its specific industry.

Cryptocurrencies: PTT actively engages in cryptocurrency trading. Cryptocurrencies are digital or virtual currencies that use cryptography for security. Popular cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), and others. PTT participates in cryptocurrency trading for various purposes, including investment, as a payment method, or as part of its financial services if it operates as a cryptocurrency exchange. Cryptocurrency trading is known for its high volatility and is used for purposes such as speculation and diversifying investment portfolios.

The choice of market instruments and the extent of involvement in each market can significantly vary depending on the nature and objectives of PTT. It's essential for individuals and investors to conduct due diligence and verify the regulatory compliance of PTT when engaging in trading or investment activities involving these market instruments.

Account Types

PTT offers two main types of accounts to its clients: real accounts and demo accounts. These account types serve different purposes and cater to traders with varying levels of experience and objectives:

Real Account:

A real account, also known as a live account, is designed for traders who want to engage in actual trading with real money. To open a real account with PTT, clients are required to deposit real funds into the account. eal accounts provide access to the actual financial markets, allowing traders to execute real trades in forex, commodities, cryptocurrencies, or other instruments offered by PTT. Traders using real accounts have the opportunity to profit from their trades, but they also carry the risk of losing real money. Therefore, it is crucial for traders to manage their risk, use appropriate trading strategies, and adhere to prudent money management practices when using real accounts.

Demo Account:

A demo account, also known as a practice or simulation account, is intended for traders who want to gain experience and test their trading strategies without risking real money. PTT's demo accounts are typically funded with virtual money, allowing traders to execute simulated trades in real market conditions. This enables traders to familiarize themselves with the trading platform and assess the effectiveness of their strategies. Demo accounts are an excellent tool for beginners to learn the basics of trading and for experienced traders to refine their strategies. They provide a risk-free environment to practice and build confidence. While demo accounts offer valuable learning opportunities, it's essential for traders to keep in mind that trading with virtual funds does not replicate the emotional aspects and psychological challenges associated with real trading.

Leverage

This broker offers a maximum trading leverage of 1:500, which means traders can control a position worth up to $500 with just $1 of their own capital. High leverage can amplify profits but also comes with significant risk, so traders should use it cautiously and have a robust risk management strategy in place to protect their investments. Regulations and available leverage levels may vary by broker and jurisdiction, so it's essential to verify the specific terms and conditions of the chosen broker.

Spreads and Commissions

Spreads:

For forex trading, the broker offers spreads of 1.2 pips on the EUR/USD currency pair and 0.8 pips on the USD/JPY pair. These spreads represent the difference between the bid and ask prices and are a key factor in determining the cost of entering and exiting forex trades. Additionally, the broker provides spreads of $0.30 for Gold (XAU/USD) and $0.05 for Crude Oil (WTI). These spreads are essential considerations for traders looking to engage in commodities trading and can impact their overall profitability.

Commissions:

The broker charges commissions on various asset classes. For forex pairs, traders are subject to a commission of $7 per standard lot traded per side. This fee structure is a common practice among brokers and is typically applied separately for opening and closing positions. For commodities like Gold and Oil, the broker charges a commission of 0.02% of the trade size per side. Lastly, for cryptocurrency trading, clients incur a commission of 0.1% of the trade size per side. Commissions are additional costs to consider when trading, and they can affect the overall profitability of a trader's positions.

It's essential for traders to thoroughly understand the specific spreads and commissions offered by their chosen broker, as these fees can significantly impact their trading strategies and overall trading costs. Additionally, traders should factor in these costs when developing their risk management and profit-taking strategies to make informed and profitable trading decisions.

Deposit & Withdrawal

PTT's cryptocurrency deposit and withdrawal methods often prove cumbersome and frustrating for users. Delays, withdrawal limits, high fees, and security concerns plague these processes. Additionally, the lack of regulatory clarity in many regions raises legal and tax uncertainties for users, making cryptocurrency transactions a source of inconvenience and risk.

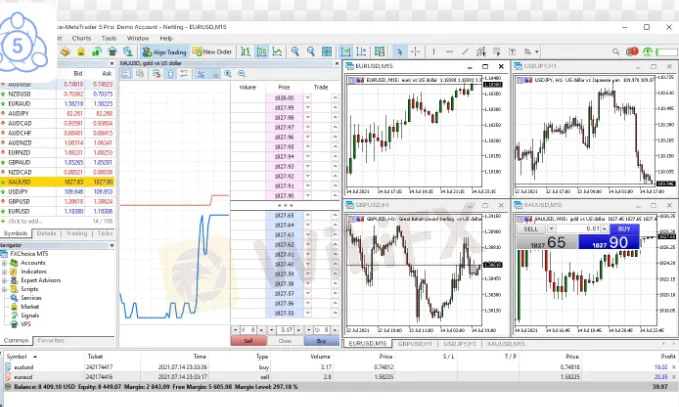

Trading Platforms

PTT provides its clients with the popular trading platform MetaTrader 5 (MT5). MT5 is a robust and versatile trading software that offers a wide range of tools and features for traders to analyze markets, execute trades, and manage their portfolios efficiently. With MT5, PTT clients can access a variety of financial instruments, including forex, commodities, and cryptocurrencies, and benefit from advanced charting capabilities, technical indicators, automated trading strategies, and real-time market data. The platform's user-friendly interface and compatibility with multiple devices make it a valuable resource for traders looking to engage in a diverse range of markets and trading styles.

Customer Support

PTT's customer support can be frustratingly challenging to reach. Many users encounter significant difficulties when attempting to contact the company for assistance or inquiries. Response times are often slow, and there is a lack of responsiveness and efficiency in addressing customer concerns. This inadequate customer support experience can lead to frustration and dissatisfaction among clients who rely on timely and helpful assistance when dealing with various trading-related issues or account inquiries.

Summary

PTT presents a concerning profile with several issues that can severely impact users' trading experiences. It operates without regulation in the forex market, raising doubts about its credibility and client protection. The frustratingly high leverage of 1:500 poses significant risks to traders, while spreads, commissions, and cumbersome cryptocurrency deposit and withdrawal methods can dent profitability. Moreover, the lackluster customer support further compounds users' dissatisfaction. To make matters worse, the company's website downtime and allegations of being a scam only add to the negative sentiment surrounding PTT, making it an unattractive choice for potential traders and investors.

FAQs

Q1: Is PTT a regulated forex broker?

A1: No, PTT operates without regulation as a forex broker, raising concerns about client protection.

Q2: What is the maximum leverage offered by PTT?

A2: PTT offers a high maximum leverage of 1:500, which can amplify both profits and risks for traders.

Q3: What are the spreads for popular currency pairs at PTT?

A3: PTT offers spreads of 1.2 pips on EUR/USD and 0.8 pips on USD/JPY, impacting the cost of forex trading.

Q4: Are there commissions for trading commodities with PTT?

A4: Yes, PTT charges commissions for trading commodities like Gold and Oil, affecting overall trading costs.

Q5: Is PTT's customer support responsive?

A5: No, PTT's customer support is often slow and inefficient, leading to frustration among users seeking assistance.