Score

OpenTrading

Anguilla|5-10 years|

Anguilla|5-10 years| https://opentrading.org/?lang=en

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Germany 2.58

Germany 2.58Contact

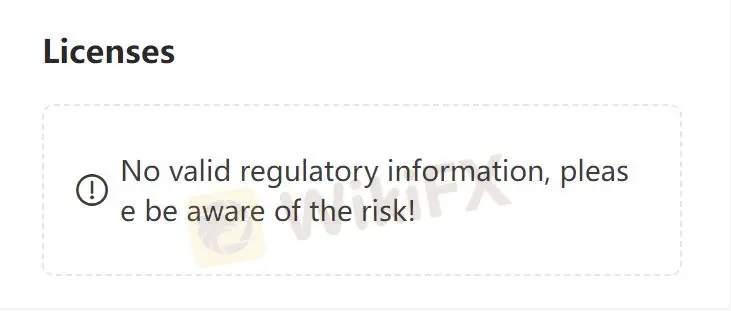

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Anguilla

AnguillaUsers who viewed OpenTrading also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Taurex

- 5-10 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

opentrading.org

Server Location

United States

Website Domain Name

opentrading.org

Server IP

104.197.131.194

opentltd.com

Server Location

United States

Website Domain Name

opentltd.com

Server IP

192.64.119.233

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

MARC HANCOCK

United Kingdom

Secretary

Start date

2005-03-17

Status

Employed

NET SYSTEMS SOLUTIONS LIMITED(United Kingdom)

MARC HANCOCK

United Kingdom

Director

Start date

2005-03-17

Status

Employed

NET SYSTEMS SOLUTIONS LIMITED(United Kingdom)

STEPHEN MICHAEL JONES

United Kingdom

Director

Start date

2005-03-17

Status

Employed

NET SYSTEMS SOLUTIONS LIMITED(United Kingdom)

Company Summary

| OpenTradingReview Summary | |

| Founded | 2016-12-18 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Forex/Shares/Commodities/Index/Cryptocurrency/ETFs/ADRs |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | MT5(PC/iOS/iMac/Android/Web) |

| Min Deposit | / |

| Customer Support | Email: info@opentrading.org |

| Facebook/Twitter/Instagram | |

OpenTrading Information

OpenTrading is a broker with more than 10 years of experience in the online trading business. The tradable instruments include CDFs on forex, shares, commodities, index, cryptocurrencies, ETFs, and ADRs. The broker also provides a demo account and a live account. OpenTrading is still risky due to its unregulated status.

Pros and Cons

| Pros | Cons |

| Demo account available | Unregulated |

| 24/5 customer support | Unspecific fees information |

| MT5 available | |

| Various tradable instruments |

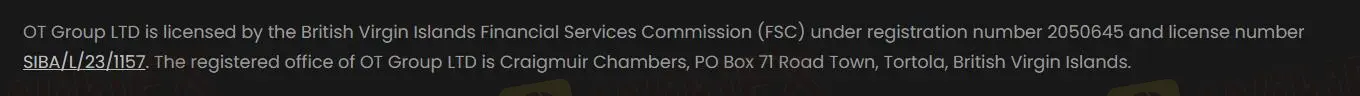

Is OpenTrading Legit?

OpenTrading is not regulated, even though it claims to be regulated by FSC. However, an unregulated broker is not as safe as a regulated one.

What Can I Trade on OpenTrading?

OpenTrading offers a wide range of market instruments, including CDFs on forex, shares, commodities, index, cryptocurrency, ETFs, and ADRs.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Shares | ✔ |

| Commodities | ✔ |

| Index | ✔ |

| Cryptocurrency | ✔ |

| ETF's | ✔ |

| ADR's | ✔ |

| Precious Metals | ❌ |

| Stocks | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

OpenTrading has two account types: a demo account and a live account. The demo account is predominantly used for familiarizing traders with the trading platform and for educational purposes only.

| Account Type | Supported |

| Demo account | ✔ |

| Live account | ✔ |

Trading Platform

OpenTrading cooperates with the authoritative MT5 trading platform available on PC, iOS, iMac, Android, and Webto trade. Traders with rich experience are more suitable for using MT5. MT5 not only provides various trading strategies but also implements EA systems.

| Trading Platform | Supported | Available Devices |

| MT5 | ✔ | PC/iOS/iMac/Android/Web |

Customer Support Options

OpenTrading provides 24/5 customer support. Traders can communicate via email instead of phone, decreasing consulting efficiency.

| Contact Options | Details |

| info@opentrading.org | |

| Social Media | Facebook/Twitter/Instagram |

| Supported Language | Spanish/English |

| Website Language | Spanish/English |

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 3

Content you want to comment

Please enter...

Comment 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now