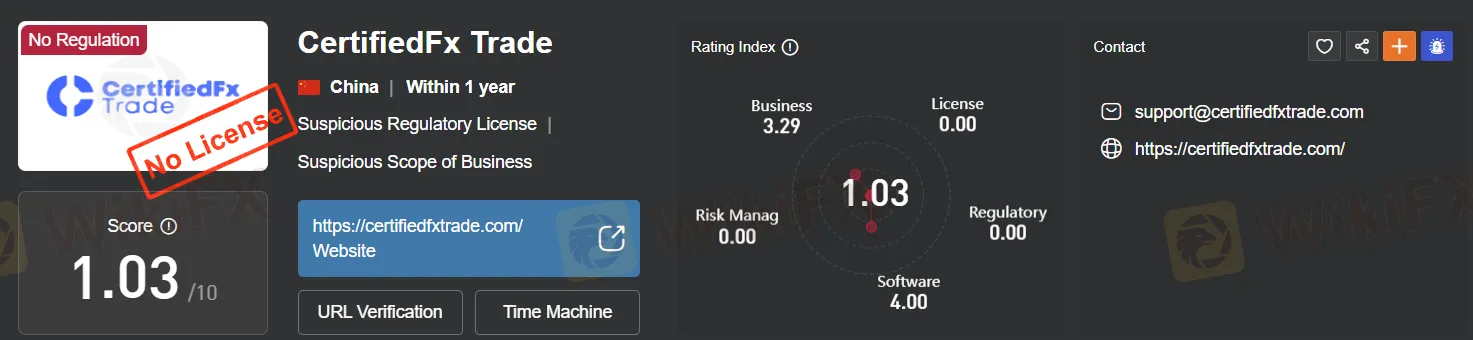

Score

CertifiedFx Trade

China|2-5 years|

China|2-5 years| https://certifiedfxtrade.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

China

ChinaUsers who viewed CertifiedFx Trade also viewed..

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

certifiedfxtrade.com

Server Location

United States

Website Domain Name

certifiedfxtrade.com

Server IP

191.101.79.201

Company Summary

| Aspect | Description |

| Regulation | Unregulated. Classified as “Suspicious Regulatory License” with concerns about the scope of business. |

| Market Instruments | Offers leveraged trading on Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP). |

| Account Registration | Encounters HTTP ERROR 500 during registration; users advised to wait for issue resolution or contact support. |

| Spreads and Commissions | Information not provided on the website |

| Deposit Range | Minimum deposit: $500. Maximum deposit per day: $100,000. |

| Interest Earnings | Deposits start earning interest the next business day. Interest rate varies based on deposit and fund terms. |

| Withdrawals | Processed daily, with large withdrawals taking up to 2 business days. Tax-free payments. |

| Customer Support | Limited contact options (email only), unclear response times, no dedicated support form, and no information on support hours. |

| Educational Resources | No educational materials or content |

Overview

CertifiedFx Trade's unregulated status, coupled with concerns about its “Suspicious Regulatory License” and the ambiguous nature of its business operations, cast a shadow over its credibility. While the platform offers leveraged trading on popular cryptocurrencies, the absence of detailed information on spreads and commissions, along with frequent HTTP ERROR 500 issues during account registration, create frustration and uncertainty for users. The minimum deposit requirement of $500 and the extended processing time for large withdrawals further limit accessibility and convenience. Moreover, the lack of transparency in interest rates and terms, combined with minimal customer support options and a complete absence of educational resources, underscores the platform's inadequacy and leaves potential investors with significant reservations.

Regulation

Unregulated.CertifiedFx Trade's regulation status is categorized as “Suspicious Regulatory License” and it raises concerns about its “Suspicious Scope of Business.” These classifications indicate potential irregularities in the company's licensing and the nature of its business operations, which may pose risks for investors. Caution and thorough due diligence are advisable when considering involvement with CertifiedFx Trade or similar entities.

Pros and Cons

CertifiedFx Trade presents a mixed picture, with both advantages and disadvantages to consider. On the positive side, the platform offers leveraged trading on popular cryptocurrencies, providing traders with opportunities for potential gains. However, significant concerns arise due to its unregulated status and the classification of a “Suspicious Regulatory License,” which raises questions about its legitimacy and business operations. The absence of detailed information on spreads and commissions adds to the uncertainty. Account registration issues, limited customer support options, and a complete lack of educational resources further detract from the platform's overall appeal. Traders should exercise caution and conduct thorough due diligence when contemplating involvement with CertifiedFx Trade.

Pros and Cons Table:

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In summary, CertifiedFx Trade offers potential trading opportunities but is marred by significant drawbacks, including regulatory concerns, account registration issues, and limited support and educational resources. Traders should proceed with caution and carefully evaluate the platform's suitability for their needs and risk tolerance.

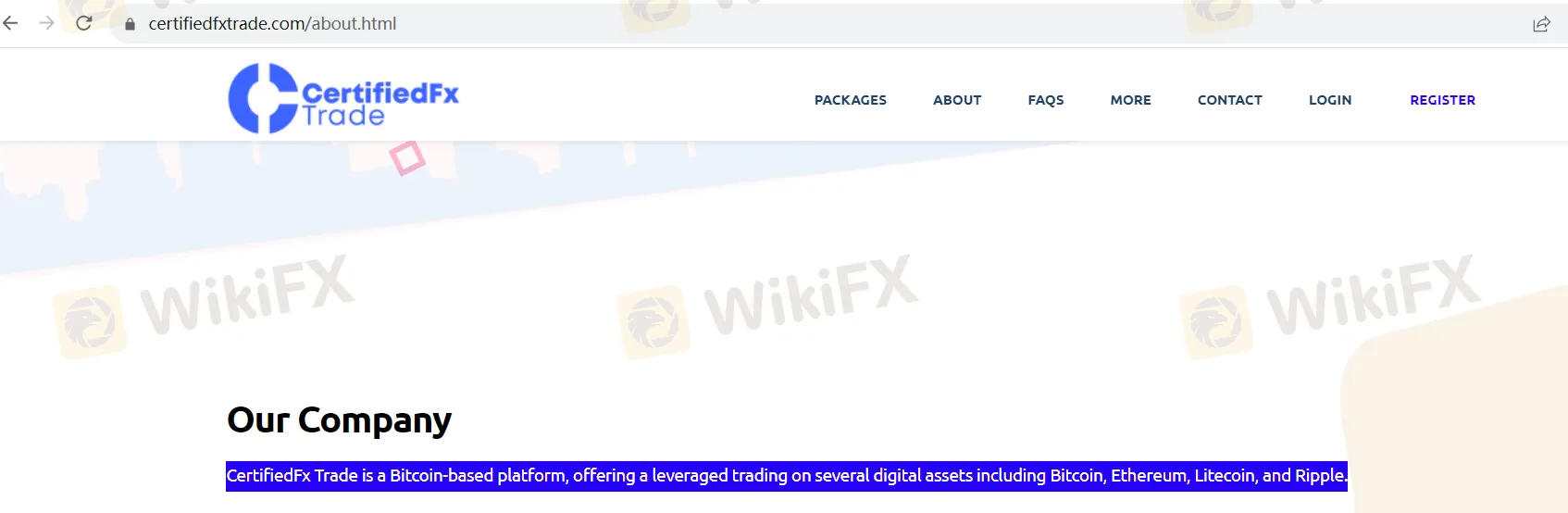

Market Instruments

CertifiedFx Trade is a Bitcoin-based platform that offers leveraged trading on various digital assets, including Bitcoin, Ethereum, Litecoin, and Ripple. Let's describe the market instruments it provides in more detail.

Bitcoin (BTC): CertifiedFx Trade allows traders to speculate on the price movements of Bitcoin. Bitcoin is the most well-known and widely traded cryptocurrency, often referred to as digital gold. Traders can go long (betting on price increases) or short (betting on price decreases) with leverage on this asset.

Ethereum (ETH): Ethereum is another popular cryptocurrency that the platform offers for trading. It is known for its smart contract capabilities and decentralized applications. Traders can use leverage to take positions on Ethereum's price movements.

Litecoin (LTC): Litecoin is a cryptocurrency that is often considered a “silver” counterpart to Bitcoin's “gold.” CertifiedFx Trade allows traders to leverage their positions in Litecoin, enabling them to potentially profit from its price fluctuations.

Ripple (XRP): Ripple, represented as XRP, is a cryptocurrency that is designed for fast and low-cost cross-border payments. Traders can engage in leveraged trading on Ripple's price movements through the platform.

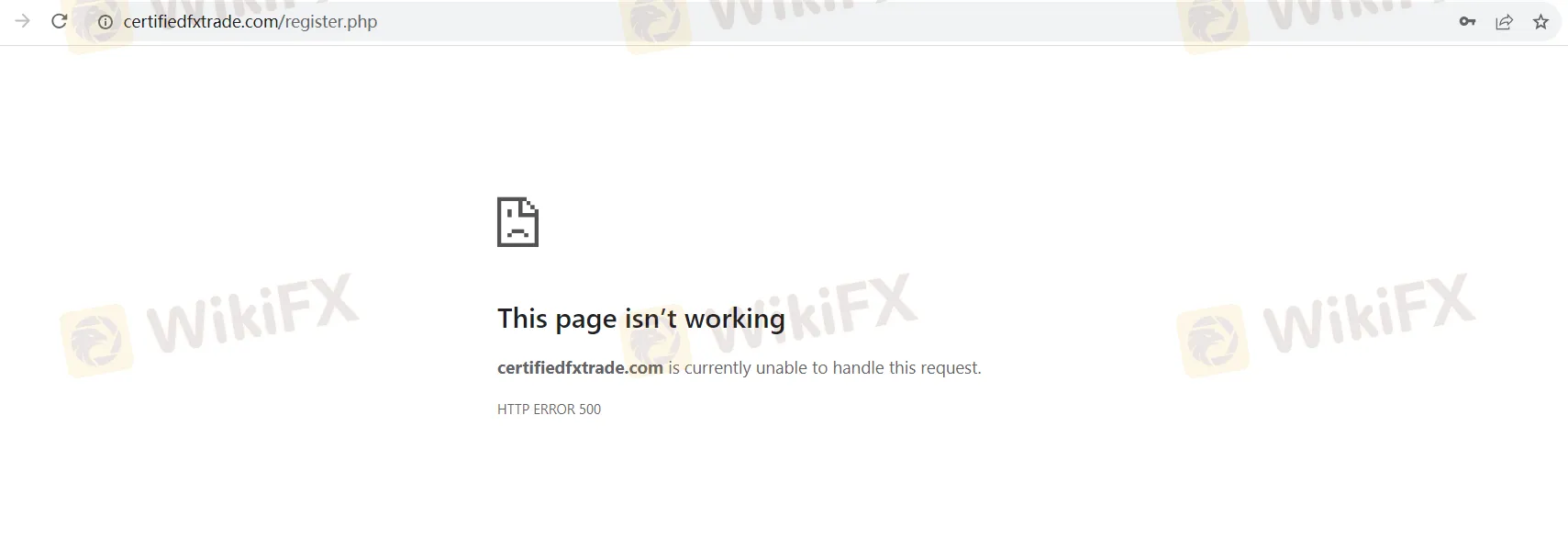

Account Register

When attempting to register an account on certifiedfxtrade.com, an HTTP ERROR 500 is displayed. This error indicates that there is an issue on the website's server, preventing new account registrations at the moment. Users experiencing this error are advised to wait for the issue to be resolved by the website administrators or to contact their support team for further assistance.

Spreads and Commissions

The absence of specific spreads and commissions on the website, coupled with the unavailability of the registration function, raises suspicions regarding the transparency and legitimacy of the platform. It's essential to exercise caution when dealing with financial services that do not provide clear and accessible information about their fees and services, as this lack of transparency can be indicative of potential risks or issues. It is advisable to seek alternatives or conduct thorough research and contact customer support before considering any financial transactions with such a platform.

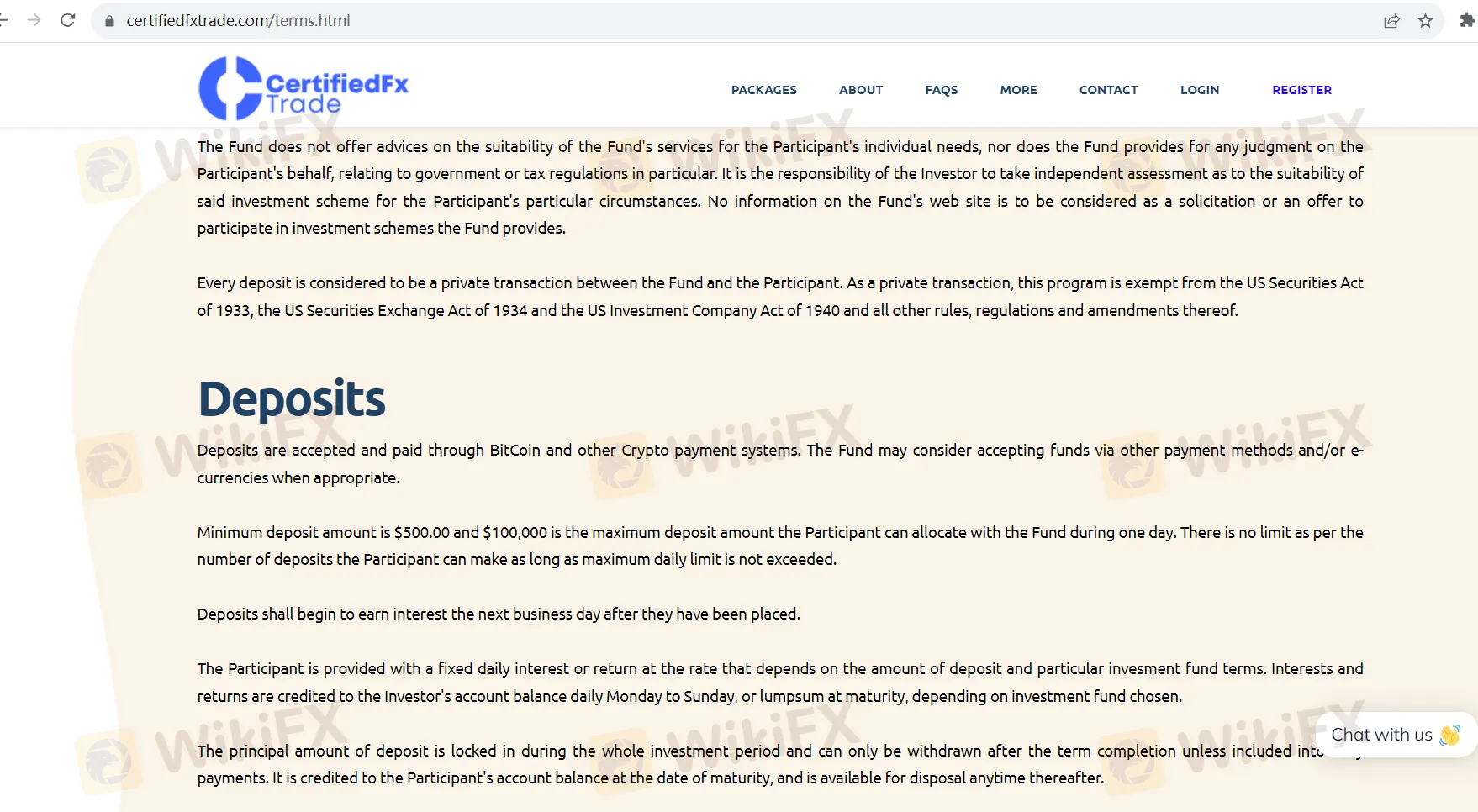

Deposit & Withdrawal

CertifiedFx Trade offers a clear and straightforward process for deposits and withdrawals, primarily utilizing BitCoin and other cryptocurrency payment systems. Here's a detailed description of their deposit and withdrawal procedures:

Deposits:

Accepted Payment Methods: CertifiedFx Trade accepts deposits through BitCoin and various other cryptocurrency payment systems. They may also consider alternative payment methods and electronic currencies as appropriate.

Deposit Range: The minimum deposit amount accepted is $500.00, while the maximum deposit amount for a participant within one day is $100,000. Participants can make multiple deposits as long as they do not exceed the daily maximum limit.

Interest Earnings: Deposits start earning interest the next business day after they are placed. The interest rate is fixed and depends on the deposited amount and the terms of the specific investment fund chosen by the participant.

Interest Crediting: Interests and returns are credited to the participant's account balance on a daily basis, seven days a week (Monday to Sunday), or as a lump sum at the end of the investment term, depending on the chosen investment fund.

Principal Lock-In: The principal amount of the deposit remains locked in for the entire investment period. It can only be withdrawn after the completion of the specified term unless it is included in the daily interest payments. The principal amount becomes available for withdrawal on the maturity date and can be disposed of at the participant's discretion.

Account Balance: Funds available in the participant's account balance do not earn interest but can be withdrawn or reinvested at the participant's discretion.

Withdrawals:

Processing Frequency: Withdrawals are processed daily, from Monday to Sunday. When a withdrawal request is submitted, the funds are transferred directly to the participant's e-currency account within 24 hours.

Processing Time for Large Withdrawals: Large withdrawals of both interest and principal may take up to 2 business days to process. The processing time may be subject to the availability of correspondent e-currency reserves.

Tax-Free Payments: All interest payments and principal withdrawals are paid tax-free at the source. However, participants are responsible for complying with any local laws or regulations regarding their account and any associated interest and withdrawals in their respective jurisdictions.

In summary, CertifiedFx Trade provides a platform for participants to deposit funds using cryptocurrencies, earn daily interest, and withdraw funds as needed. They offer flexibility in terms of deposit amounts and withdrawal frequency while ensuring that participants have the option to reinvest or access their principal upon the completion of the investment term. Additionally, they emphasize tax-free payments but advise participants to be aware of any legal requirements in their jurisdiction.

Customer Support

CertifiedFx Trade's customer support leaves much to be desired. There are several significant shortcomings that can hinder users seeking assistance:

Limited Contact Options: The only provided contact option is through email (support@certifiedfxtrade.com). There is no indication of live chat, phone support, or any other immediate means of communication. This lack of options can be frustrating for users who require quick assistance.

Lack of Response Time: The website does not specify an estimated response time for email inquiries. Users are left in the dark, unsure of when they might receive a reply to their queries. This lack of transparency can lead to frustration and uncertainty.

No Dedicated Support Form: The “Contact Us” section only includes a basic form with fields for name, mobile number, email, and message. It lacks features commonly found on customer support forms, such as the ability to attach files or select a specific department for inquiries.

Unclear Support Hours: The website does not provide information about the operating hours of their customer support team. Users are left wondering whether they can expect assistance during weekends or outside of regular business hours.

Inadequate Information: The website does not offer any alternative means of contacting support in case of urgent issues. This lack of backup options can be frustrating for users experiencing critical problems.

In conclusion, CertifiedFx Trade's customer support falls short in several areas, including limited contact options, uncertainty about response times, and a lack of transparency regarding support hours. Users may find it challenging to obtain timely and comprehensive assistance when needed.

Educational Resources

CertifiedFx Trade's educational resources are noticeably lacking. There is a complete absence of educational materials or content that can assist users in understanding the financial markets, trading strategies, or investment principles. This lack of educational resources is a significant drawback for individuals who are new to trading or seeking to enhance their knowledge in the field.

Summary

CertifiedFx Trade, characterized by its unregulated status and “Suspicious Regulatory License,” presents a troubling landscape for potential investors. The platform's lack of transparency, frequent HTTP ERROR 500 issues during account registration, and high minimum deposit requirement create a cumbersome and uncertain user experience. Furthermore, the absence of comprehensive customer support options and educational resources compounds the platform's inadequacies, leaving traders with significant reservations about its credibility and reliability. Caution and thorough due diligence are paramount when considering involvement with CertifiedFx Trade.

FAQs

Q: Is CertifiedFx Trade a regulated broker?

A: No, CertifiedFx Trade is an unregulated broker, and it is categorized with a “Suspicious Regulatory License,” raising concerns about its legitimacy and the nature of its business operations.

Q: What cryptocurrencies can I trade on CertifiedFx Trade?

A: CertifiedFx Trade offers leveraged trading on popular cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP).

Q: Are there any issues with account registration on CertifiedFx Trade?

A: Yes, some users have reported encountering HTTP ERROR 500 during account registration, preventing new registrations. They are advised to wait for issue resolution or contact support.

Q: What is the minimum deposit requirement on CertifiedFx Trade?

A: The minimum deposit amount accepted on CertifiedFx Trade is $500. However, this relatively high minimum may limit accessibility for some users.

Q: Does CertifiedFx Trade offer educational resources for traders?

A: No, CertifiedFx Trade lacks educational materials or content to assist users in understanding financial markets, trading strategies, or investment principles.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now