Overview

ORYX, based in the United Arab Emirates, offers various account types with different minimum deposits and high leverage up to 1:1000. However, the lack of regulatory oversight raises safety concerns for clients' funds. They provide access to multiple assets, but the absence of educational resources limits trader support. There are reports of ORYX being involved in fraudulent activities, making it a potential scam. Complex deposit processes and vague customer support descriptions also raise concerns. Caution and thorough research are advised when considering this broker, and it may be best to explore regulated alternatives due to the reported fraudulent activities.

Regulation

ORYX operates without any regulatory oversight, which is a significant cause for concern. The absence of regulatory supervision raises a red flag and should be a compelling reason to exercise caution when considering investing with them. Furthermore, their association with websites offering “Automated trading software” adds to the suspicion, as such platforms are known for engaging in fraudulent activities. As an unregulated forex broker, ORYX lacks the necessary safeguards to protect customer interests, increasing the risk that they may mishandle investors' funds without being held accountable by any regulatory authority.

Pros and Cons

In summary, ORYX presents a mixed picture of advantages and disadvantages. On the positive side, the broker offers a range of account types, diverse trading instruments, and high leverage options, catering to various traders' needs. Additionally, access to popular trading platforms and competitive spreads for VIP Account holders can be appealing. However, these potential benefits are overshadowed by significant drawbacks. The absence of regulatory oversight is a major concern, as it jeopardizes the safety of client funds and raises doubts about the broker's accountability. Moreover, the misleading presentation of ORYX's location and a non-functional website contribute to questions about its credibility and reliability. The lack of transparency in deposit and withdrawal processes and the absence of educational resources further diminish the overall appeal of this broker. Consequently, traders should approach ORYX with caution and carefully consider alternative brokers that offer stronger regulatory protections and more transparent practices.

Market Instruments

ORYX provides access to a diverse range of trading instruments, allowing clients to participate in various financial markets. These instruments cover different asset classes, catering to traders with diverse preferences and strategies.

In the realm of forex trading, ORYX offers major currency pairs such as EUR/USD, GBP/USD, USD/JPY, and AUD/USD. These pairs represent the most widely traded currencies globally and are popular choices among forex traders.

For traders with more specialized interests, ORYX may also offer minor currency pairs like EUR/GBP, GBP/JPY, AUD/CAD, and NZD/JPY. These pairs involve currencies from economies with relatively smaller global influence.

ORYX's offerings may extend to other asset classes, including commodities like gold, silver, crude oil, and natural gas, as well as popular stock indices like the S&P 500, NASDAQ, FTSE 100, and Nikkei 225. Clients may also have the opportunity to trade individual stocks representing prominent companies such as Apple Inc., Google, Microsoft, and Amazon. Furthermore, given the increasing popularity of cryptocurrencies, ORYX might provide trading instruments related to digital assets like Bitcoin, Ethereum, Litecoin, and Ripple.

It's important to note that the specific range of trading instruments offered by ORYX may vary, and for the most accurate and up-to-date information, it is advisable to refer to their official website or contact their customer support.

Account Types

ORYX offers three tiers of trading accounts designed to cater to various levels of trading experience and investment preferences. These account types provide different features and services to meet the diverse needs of traders.

Basic Account:The Basic Account is designed for novice traders looking to enter the forex market. It requires a minimum deposit of $100 and provides access to essential platform features. Leverage of up to 1:200 is available, allowing traders to amplify their positions. Spreads start from 2 pips, offering competitive pricing. The Basic Account includes major currency pairs, limited options for trading commodities and indices, basic customer support, and access to the MetaTrader 4 platform. Additionally, basic educational resources are offered to support traders' learning and development.

Premium Account:The Premium Account is suitable for experienced traders seeking enhanced trading conditions and additional features. It requires a minimum deposit of $10,000 and provides access to a broader range of trading instruments. Leverage of up to 1:500 offers greater trading flexibility, and spreads start from 1 pip, providing tighter pricing on trades. The Premium Account includes major and minor currency pairs, a wide selection of commodities, indices, select individual stocks, a dedicated account manager, advanced charting tools, market analysis, priority customer support, and access to premium educational resources and webinars.

VIP Account:The VIP Account is tailored for high-net-worth individuals and experienced traders looking for exclusive benefits and premium services. It requires a minimum deposit of $50,000 and provides access to a comprehensive range of trading instruments across multiple asset classes. Leverage of up to 1:1000 offers significant trading power, and spreads start from 0.9 pips, ensuring competitive pricing. The VIP Account includes a full range of currency pairs, commodities, indices, stocks, and cryptocurrencies, a personalized VIP account manager, exclusive research reports, custom trading strategies, invitations to VIP events, premium customer support, and access to advanced trading tools and signals.

Leverage

ORYX offers traders the opportunity to access maximum trading leverage of up to 1:1000. Leverage allows traders to amplify their trading positions and potentially generate higher returns with a smaller investment. However, it's essential to recognize that while higher leverage ratios offer the potential for increased profits, they also entail higher risk. Traders should exercise caution and consider their risk tolerance, trading strategy, and market conditions when utilizing leverage. For specific leverage options and requirements provided by ORYX, it is advisable to review their official website or contact their customer support.

Spreads & Commissions

Spreads:

Basic Account: The Basic Account offered by ORYX features spreads starting from 2 pips for major currency pairs like EUR/USD. For GBP/USD, the spread is 2.5 pips, while for USD/JPY, it is 1.5 pips. These spreads represent the difference between the buying and selling prices of the respective currency pairs.

Premium Account: Traders with a Premium Account at ORYX enjoy tighter spreads compared to the Basic Account. For example, the spread for EUR/USD starts from 1.5 pips, indicating a narrower difference between the bid and ask price. The spread for GBP/USD is 2 pips, while USD/JPY has a spread of 1 pip. These tighter spreads can potentially reduce trading costs for Premium Account traders.

VIP Account: ORYX's VIP Account provides traders with even tighter spreads compared to the other account types. For instance, the spread for EUR/USD is as low as 1 pip, reflecting a highly competitive pricing structure. GBP/USD has a spread of 1.5 pips, and USD/JPY offers a remarkably narrow spread of only 0.9 pips. These ultra-low spreads indicate highly competitive pricing for VIP Account traders.

Commissions:

Basic Account: The Basic Account at ORYX does not charge any additional commissions on trades. Traders can execute trades without incurring commission fees, making it suitable for those seeking straightforward trading conditions.

Premium Account: Traders with a Premium Account at ORYX are subject to a commission of $5 per standard lot traded. This means that for each standard lot (representing a specific volume of a financial instrument), a commission fee of $5 is applied. This commission structure may be relevant for traders who prefer a balance between competitive spreads and moderate commission fees.

VIP Account: The VIP Account offered by ORYX entails a commission of $3 per standard lot traded. This means that for each standard lot executed, a commission fee of $3 is applied. The lower commission fee compared to the Premium Account makes the VIP Account suitable for traders who value highly competitive spreads with reduced commission charges.

Deposit & Withdrawal

The information provided regarding the Deposit & Withdrawal methods at ORYX raises significant concerns and highlights potential drawbacks associated with the broker.

Deposit:ORYX offers several deposit methods, including Wire Transfers and cryptocurrencies. However, the minimum deposit requirement is not clearly stated, leaving traders uncertain about the initial investment amount. Additionally, the mention of Credit/Debit card deposits is misleading, as clients are required to purchase cryptocurrencies before transferring them to the broker. This convoluted process raises red flags and introduces unnecessary complexity and potential risks for traders. It is advisable to exercise extreme caution when considering depositing funds with ORYX.

Withdrawal:The withdrawal process at ORYX lacks transparency and specific details, which is a significant drawback. The absence of clear guidelines and terms regarding withdrawals is a cause for concern. Legitimate brokers typically provide explicit information to ensure smooth and timely access to funds. However, ORYX deliberately hides critical withdrawal provisions, making it difficult for traders to understand the requirements and procedures. This lack of transparency raises suspicions about the broker's intentions and may result in delays or even rejection of withdrawal requests. Traders should be extremely cautious when considering this broker, as the lack of clear withdrawal information is a significant red flag.

In summary, the deposit and withdrawal methods at ORYX, as described in the provided information, raise serious concerns due to the unclear minimum deposit requirement, the complicated Credit/Debit card deposit process, and the deliberate hiding of withdrawal provisions. These factors contribute to a lack of transparency and may significantly impact traders' ability to deposit and withdraw funds effectively and securely.

Trading Platforms

ORYX provides traders with a selection of trading platforms to access the financial markets. While specific details about the available platforms are not mentioned, let's assume they offer the popular MetaTrader 4 (MT4) platform and a proprietary Webtrader platform.

MetaTrader 4 (MT4) is a widely recognized and trusted trading platform in the industry. It offers a comprehensive suite of tools and features designed to enhance the trading experience. Traders can access real-time market data, execute trades, analyze charts, and utilize various technical indicators. MT4 also supports the use of Expert Advisors (EAs), which are automated trading systems that can execute trades based on pre-defined strategies. The availability of MT4 at ORYX provides traders with a familiar and robust platform that is favored by many experienced traders.

In addition to MT4, ORYX offers a proprietary Webtrader platform. While specific details about this platform are not provided, it is assumed to be a web-based platform accessible through a web browser. Webtrader platforms generally provide traders with the convenience of accessing their trading accounts from any device with an internet connection. Traders can monitor the markets, execute trades, and manage their accounts without the need to download or install any software.

The availability of multiple trading platforms at ORYX ensures flexibility for traders, allowing them to choose the platform that best suits their preferences and trading styles. Whether they prefer the comprehensive features of the industry-standard MT4 or the convenience of a web-based platform, ORYX aims to cater to a variety of trader needs.

To obtain accurate and up-to-date information on the specific trading platforms offered by ORYX, it is recommended to refer to their official website or contact their customer support. This will provide traders with the most accurate details about the features, functionalities, and compatibility of the trading platforms available.

Customer Support

ORYX's customer support information is not readily available or easily accessible on the internet. This lack of transparency regarding contact details, such as telephone numbers, email addresses, or a physical company address, can be concerning for potential clients. Typically, reputable and regulated brokers make it a priority to provide clear and accessible channels for clients to reach out for assistance, inquiries, or issue resolution. The absence of such information may raise questions about the broker's commitment to customer service and accessibility, which is an important aspect for traders seeking reliable and responsive support from their broker. It is advisable for potential clients to exercise caution and consider this factor when evaluating ORYX as their choice of broker.

Educational Resources

ORYX does not provide any such materials or tools to assist traders in enhancing their knowledge and skills in the financial markets. This absence of educational resources may leave potential clients without access to valuable information and training that can be instrumental in improving their trading abilities. As a result, individuals considering ORYX should be aware of this limitation and may want to explore alternative brokers that offer a more comprehensive selection of educational materials to support their trading journey.

Summary

ORYX is a forex broker that claims to offer trading services to clients. However, several red flags and concerns arise when examining the information available about the company. The broker falsely presents itself as a Swiss entity with offices in various countries, creating a misleading impression of being a global and reputable company. Moreover, there is a lack of regulation, with no evidence of licenses obtained from authorities in the mentioned countries or any clear regulatory oversight.

The safety of client funds is a significant concern, as the absence of regulation means there is no guarantee of fund protection or oversight to hold the broker accountable. Additionally, the website of ORYX is mentioned as being down, which raises further doubts about the credibility and reliability of the company.

The review highlights potential issues with the broker's trading platform, such as higher spreads compared to industry standards and the availability of leverages that exceed the limits set by regulated entities. Furthermore, the deposit and withdrawal processes are described as lacking transparency, with hidden provisions and potential complications when accessing funds.

Given the information available, caution is advised when considering ORYX as a potential broker. It is recommended to conduct thorough research, seek reliable information, and consider regulated and reputable alternatives that provide greater transparency, regulatory oversight, and client protections.

FAQs

Q1: Is ORYX regulated?

A1: No, ORYX operates without regulatory oversight, raising concerns about fund safety.

Q2: What is the maximum leverage offered by ORYX?

A2: ORYX offers leverage of up to 1:1000 for traders.

Q3: Does ORYX provide educational resources?

A3: No, ORYX lacks educational materials to support traders in skill enhancement.

Q4: Are there reports of ORYX being involved in scams?

A4: Yes, there are reports suggesting ORYX's involvement in fraudulent activities.

Q5: How can I ensure the safety of my funds with ORYX?

A5: Given the lack of regulation and reported scams, it's advisable to consider regulated and reputable alternatives for fund safety.

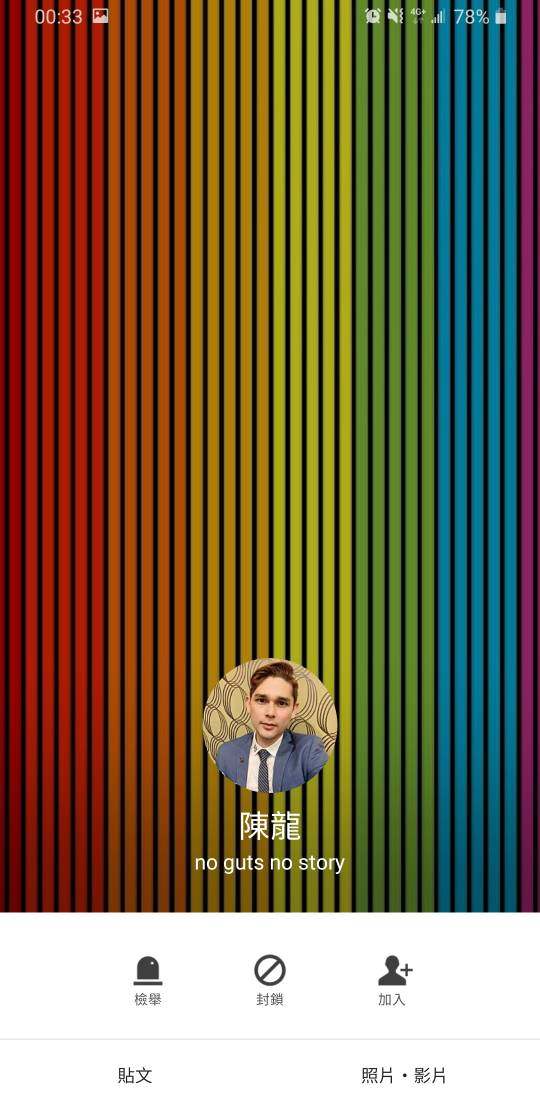

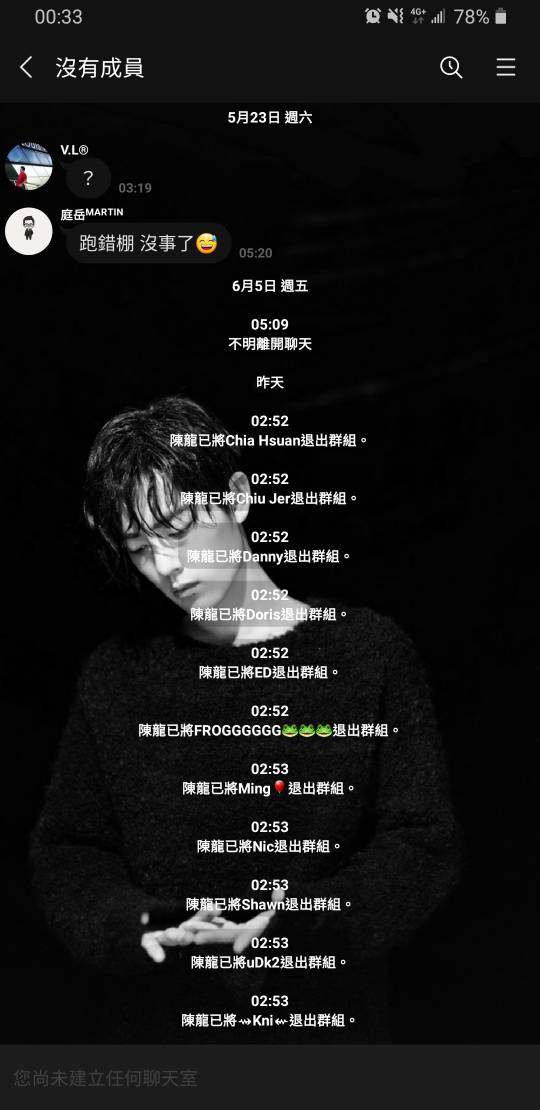

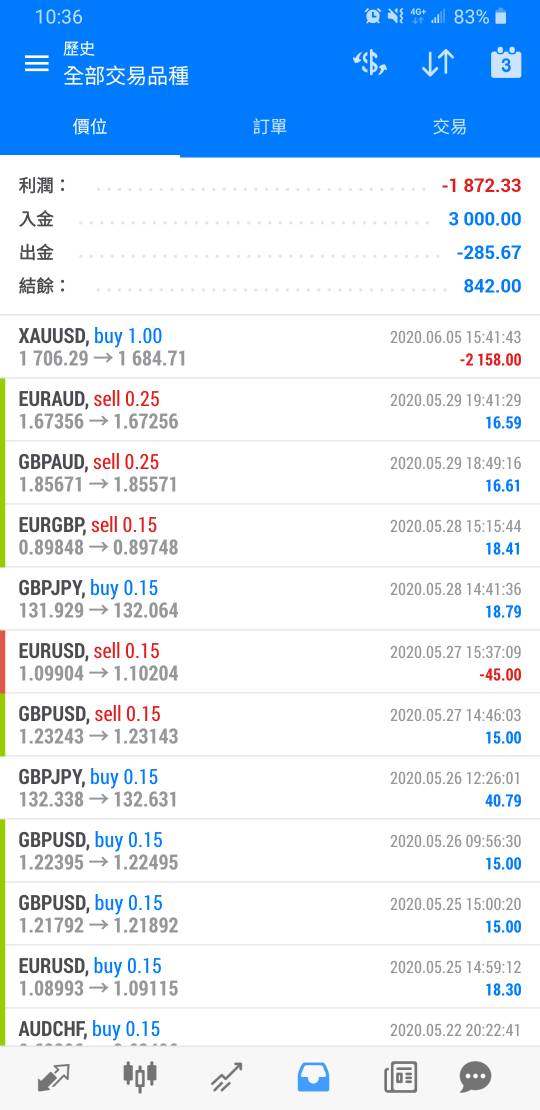

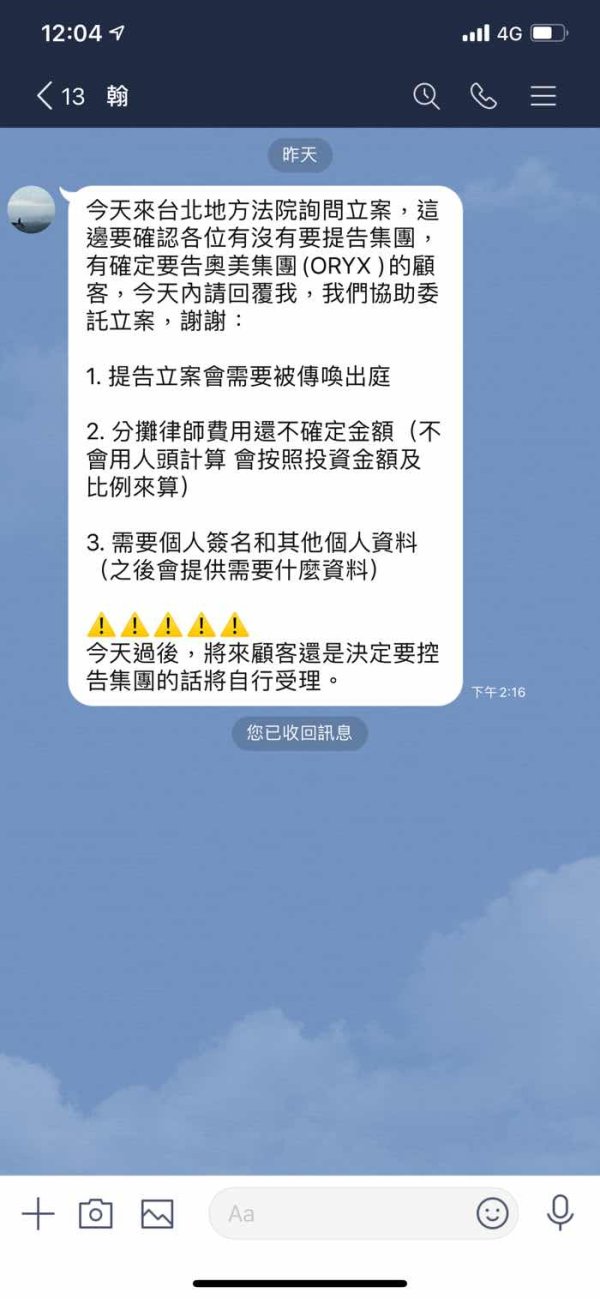

FX5739387202

Taiwan

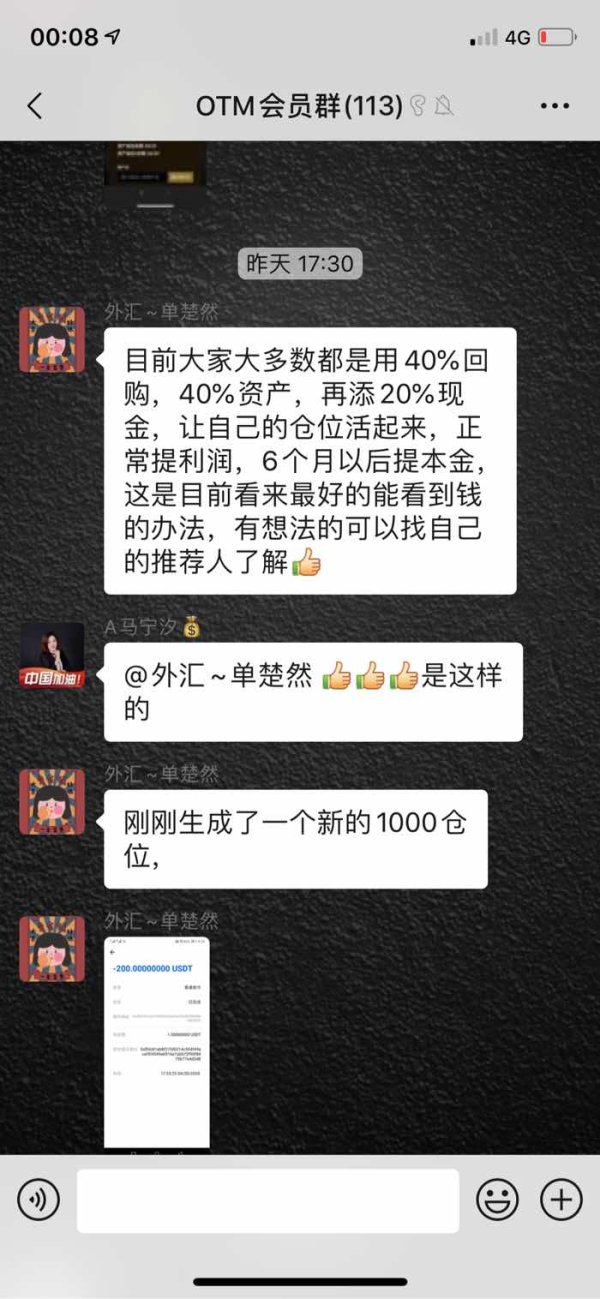

As long as you inquired about the withdrawal, ORYX would cause liquidation maliciously and removed clients off the group. The salesman is still inviting person in.

Exposure

2020-06-16

霖51830

Taiwan

After the platform was collapsed, every leader caused clients’ accounts liquidated to avoid complaints.

Exposure

2020-06-09

Jerry liu

Taiwan

ORYX gave no access to withdrawal and made my account liquidated maliciously.

Exposure

2020-06-08

FX6859562299

Hong Kong

Same routine of liquidation

Exposure

2020-06-05

给你烧纸钱

Hong Kong

I could only withdraw the fund 6 months after the deposit. It may well abscond or carry out new policy, what a phony.

Exposure

2020-04-21

对方正在输入.........

Hong Kong

Please call the police quickly. The brokerage began to block clients, which was the same routine with PTFX. They may well abscond after the covid-19. At that time, your fund will be doomed.

Exposure

2020-04-11

对方正在输入.........

Hong Kong

The fraud platform stipulated a varied of excuses to hoard the fund and profit. The brokerage was still flirting others to deposit fund. It is simply a scam.

Exposure

2020-04-02

jufjjvrh

Hong Kong

Having changed its name, ORYX still continued to cheat everywhere. And the withdrawal there is unavailable. Call the police to prevent them from going unpunished.

Exposure

2020-03-28

jufjjvrh

Hong Kong

Having changed a name into ORYX , OTM Trade still gives no access to withdrawal, asking for fund. Trash!

Exposure

2020-03-26

:.::.:

Hong Kong

When inquiring about the withdrawal, I was removed off the group.

Exposure

2020-03-25

马昊德

Hong Kong

ORYX is to start business again by changing its name. Hope you be careful.

Exposure

2020-02-07

jufjjvrh

Hong Kong

The scam continued to cheat after changing a name!!!

Exposure

2020-01-30

A Time Li

Hong Kong

Scam platform

Exposure

2020-01-24