Overview:

Gibank.online claims to be an online digital bank and cryptocurrency exchange platform based in United States. However, several red flags indicate that it is not a legitimate financial services provider. The website's recent domain registration, lack of regulation, questionable operating history, and poorly designed website with spelling errors and duplicated content raise serious doubts about its legitimacy. Multiple user complaints and warnings about account lockouts after depositing funds further suggest that gibank.online is likely a scam operation. Engaging with this platform poses a significant risk of financial loss and identity theft. It is strongly advised to avoid gibank.online entirely to protect personal and financial security.

The website for gibank.online is currently inaccessible or down, further adding to the suspicion surrounding its legitimacy.

Regulation:

No regulation.

Gibank.online operates without any regulatory oversight, which raises serious concerns about its legitimacy and trustworthiness as a financial institution. The absence of regulation means that the platform has not undergone the necessary scrutiny, compliance checks, and licensing requirements to ensure the safety of its customers' funds and personal information. This lack of oversight leaves users vulnerable to potential fraud, financial exploitation, and the risk of unauthorized access to their sensitive data.

The absence of regulation also indicates that gibank.online does not adhere to established industry standards and best practices. Regulatory bodies play a crucial role in ensuring that financial institutions operate transparently, responsibly, and in the best interests of their clients. Without regulatory oversight, there are no safeguards in place to protect users from unfair practices, inadequate security measures, or potential fraudulent activities. As a result, individuals should exercise extreme caution and avoid interacting with gibank.online to mitigate the risks associated with unregulated and potentially fraudulent entities.

Market Instruments:

Gibank.online claims to provide a range of trading instruments encompassing various markets. One of the featured instruments is forex, which typically involves the trading of currency pairs. Forex trading allows individuals to speculate on the fluctuations in exchange rates between different currencies. However, given the platform's lack of regulatory oversight, it is uncertain whether gibank.online truly offers access to the forex market or if these claims are merely part of their facade.

Additionally, gibank.online purports to facilitate cryptocurrency trading. Cryptocurrencies have gained significant popularity in recent years, and traders often engage in speculation and investment within this volatile market. However, it is crucial to exercise caution when considering trading cryptocurrencies on an unregulated platform like gibank.online, as there are potential risks associated with the lack of oversight and security measures.

The platform also claims to offer trading in stocks, which generally involves buying and selling shares of publicly listed companies. Stock trading provides opportunities for investors to participate in the growth and performance of specific businesses. However, without proper regulation, traders may face heightened risks such as price manipulation or inadequate transparency.

In addition to stocks, gibank.online asserts that it provides access to indices. Indices represent a basket of stocks from a specific market or sector, offering investors a way to track the overall performance of a particular market. However, the absence of regulation raises concerns about the accuracy and reliability of the indices offered on gibank.online.

Lastly, gibank.online claims to facilitate trading in commodity contracts for difference (CFDs). CFDs allow traders to speculate on the price movements of commodities without owning the underlying assets. Commodity trading covers a wide range of assets, including precious metals, energy products, agricultural goods, and more. However, engaging in commodity CFD trading on an unregulated platform carries significant risks, including potential fraud or manipulation.

It is important to emphasize that the descriptions provided above are based on the claims made by gibank.online and may not accurately represent the actual market instruments they offer. Due to the platform's lack of credibility and regulatory oversight, engaging in any trading activities on gibank.online is strongly discouraged. It is advisable to seek out reputable, regulated brokers that provide transparent and secure trading environments.

Account Types:

Gibank.online claims to offer a range of account types, including basic, silver, gold, and premium accounts. However, the platform provides limited information about these account types, making it difficult to provide a detailed description. Notably, there is no mention of specific differentiation or minimum deposit requirements associated with each account tier.

The lack of clear details and transparency surrounding the account types offered by gibank.online raises concerns about the platform's legitimacy and credibility. Without specific differentiations, it is challenging for traders to understand the features, benefits, or trading conditions associated with each account type. This lack of information makes it difficult to assess which account tier may be suitable for individual trading needs.

In a reputable and regulated trading environment, account types typically come with specific features and benefits tailored to different levels of trading experience or investment capital. These may include lower spreads, dedicated account managers, access to educational resources, or priority customer support. However, without credible information, it is impossible to determine if gibank.online's account types offer such benefits or if they are merely vague claims.

Given the lack of transparency and credibility surrounding gibank.online, it is strongly recommended to seek out reputable, regulated brokers that provide clear and well-defined account types. Choosing regulated brokers ensures that traders have access to transparent account structures with clearly outlined features, minimum deposit requirements, and associated benefits.

In summary, gibank.online claims to offer basic, silver, gold, and premium accounts, but the lack of specific details and differentiation between these account types raises concerns about the platform's legitimacy. Traders should exercise caution and opt for regulated brokers that offer transparent and well-defined account types to ensure a safer and more trustworthy trading experience.

Leverage:

Gibank.online claims to offer leverage ratios of up to 1:500. Leverage is a common feature in trading that allows traders to amplify their exposure to financial markets with a smaller amount of capital. A leverage ratio of 1:500 means that for every unit of capital, traders can potentially control 500 units of trading volume.

However, it is important to note that the information provided by gibank.online regarding leverage should be approached with caution. Due to the lack of credible information and regulatory oversight, the actual availability and conditions of leverage on the platform cannot be verified.

High leverage ratios, such as 1:500, can offer the potential for increased profits, but they also carry a higher level of risk. Trading with high leverage amplifies both gains and losses, which means that even small market movements can result in significant profit or loss. It is crucial for traders to have a thorough understanding of leverage and the associated risks before engaging in leveraged trading.

In regulated trading environments, leverage is typically offered with certain limitations, and brokers are required to provide adequate risk warnings and educational materials to ensure traders make informed decisions. However, without credible regulation, the safety and responsible use of leverage on gibank.online can not be assured.

Given the lack of transparency and regulatory oversight, it is strongly recommended to choose regulated brokers that provide clear information about leverage ratios, associated risks, and appropriate risk management tools. Engaging with unregulated platforms like gibank.online poses significant risks to traders' capital and financial well-being.

Spreads & Commissions:

Based on the available information, it is not possible to provide a detailed description of the spreads and commissions offered by gibank.online. The platform claims that spreads and commissions vary depending on the trading accounts, but without credible details or regulatory oversight, it is challenging to ascertain the specific pricing structure or the level of competitiveness offered.

The lack of transparency surrounding spreads and commissions raises concerns about the platform's legitimacy and reliability. In regulated trading environments, brokers typically provide clear and comprehensive information about their spreads, which are the differences between bid and ask prices, and commissions, which are fees charged on trades. This transparency allows traders to assess the cost of trading and make informed decisions.

Without verified information on spreads and commissions, traders cannot determine the overall cost of trading on gibank.online or compare it to other reputable brokers. This lack of clarity makes it difficult to evaluate the platform's competitiveness and assess whether it offers fair pricing in line with industry standards.

Given the absence of specific details and regulatory oversight, it is highly recommended to seek out regulated brokers that provide transparent and well-defined spreads and commissions. Reputable brokers typically disclose their pricing structure, allowing traders to understand the costs involved in their trades and make informed decisions based on accurate information.

In summary, the lack of credible information regarding spreads and commissions offered by gibank.online prevents us from providing a detailed description. Traders should exercise caution and choose regulated brokers that offer transparent pricing structures to ensure fair and competitive trading conditions.

Deposit & Withdraw:

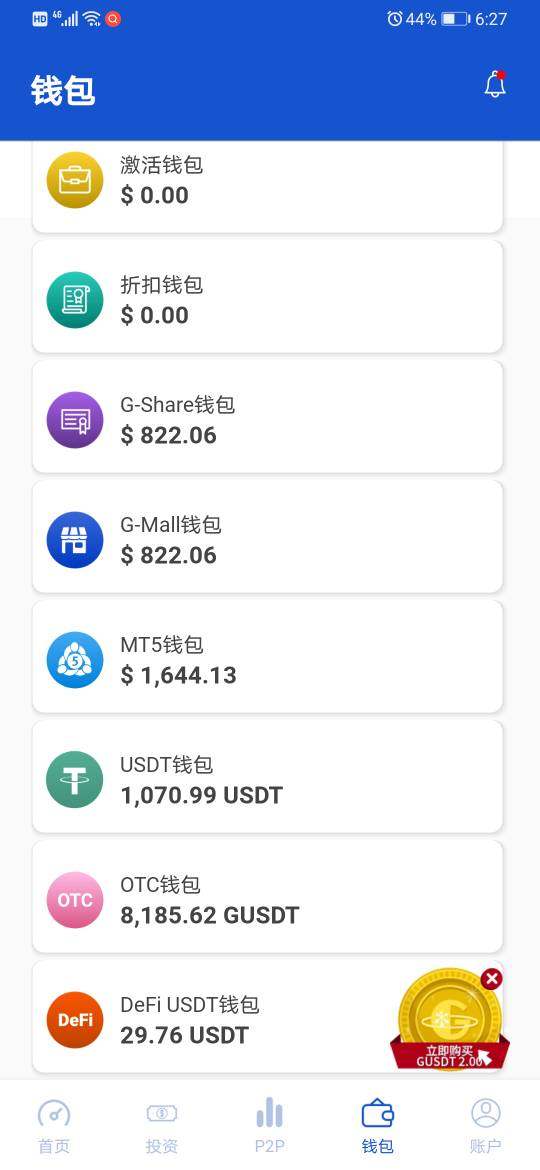

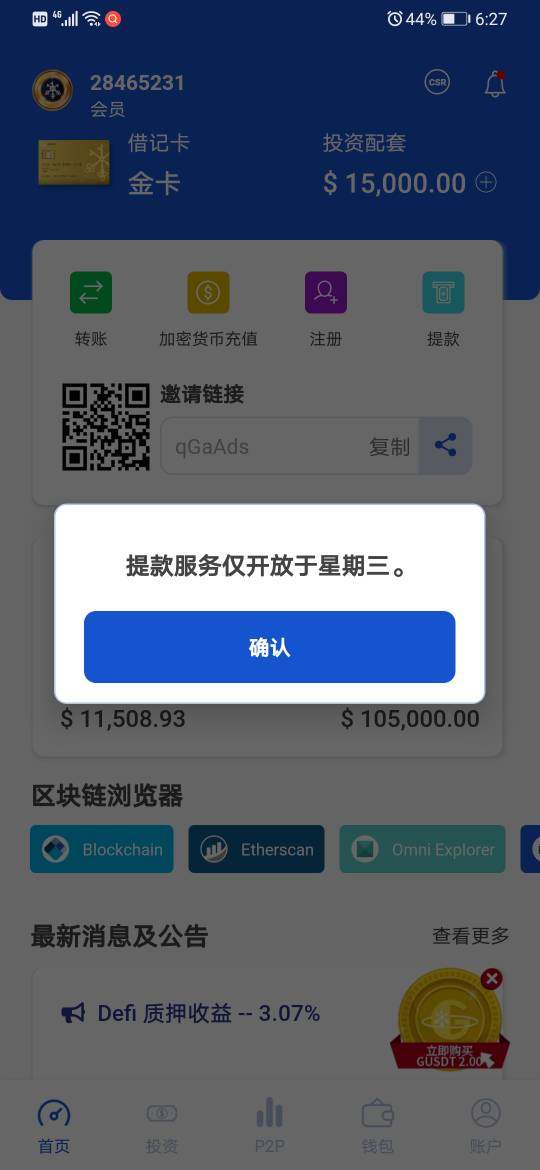

Based on the information provided earlier, there are some details about the deposit and withdrawal methods offered by gibank.online. The platform claims to support deposits through cards, bank transfers, and cryptocurrencies. However, it is important to note that there have been user complaints indicating issues with withdrawals being frozen or accounts being locked after depositing funds.

The lack of regulatory oversight and the numerous warnings about gibank.online being a potential scam operation raise concerns about the reliability and security of the deposit and withdrawal processes. Users may face difficulties in accessing their funds or experience delays and complications when attempting to withdraw funds from their accounts.

Without credible information and a reliable track record, it is difficult to assess the efficiency, reliability, and safety of the deposit and withdrawal procedures on gibank.online. The lack of transparency and user complaints indicate potential risks associated with engaging in financial transactions on the platform.

To ensure the safety of funds and a reliable deposit and withdrawal process, it is highly recommended to choose regulated brokers with a proven track record and transparent policies. Reputable brokers typically provide clear information about the deposit and withdrawal methods available, processing times, and any associated fees or requirements.

In summary, the deposit and withdrawal processes on gibank.online are associated with significant risks due to the lack of regulatory oversight and user complaints. It is advisable to exercise caution and opt for regulated brokers with transparent and reliable deposit and withdrawal procedures to protect funds and ensure a smoother and more secure trading experience.

Trading Platforms:

Based on the information provided, gibank.online claims to offer the popular trading platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely recognized and utilized in the trading industry for their comprehensive features, user-friendly interfaces, and advanced charting tools.

MT4 and MT5 provide traders with access to various financial markets, including forex, cryptocurrencies, stocks, indices, and commodities. These platforms offer a range of technical analysis tools, customizable indicators, and automated trading capabilities through expert advisors (EAs). Traders can also access real-time market data, place trades, and manage their positions efficiently.

However, it is important to note that despite gibank.online claiming to offer these trading platforms, the lack of regulatory oversight and credibility raises concerns about the actual availability and functionality of these platforms on the website. The platform's legitimacy and the reliability of the trading experience cannot be guaranteed.

In regulated trading environments, brokers often provide access to reputable and well-established trading platforms like MT4 and MT5. These platforms are trusted by traders worldwide due to their reliability, extensive features, and support from the trading community.

Considering the uncertainties surrounding gibank.online's legitimacy, it is strongly recommended to choose regulated brokers that offer the confirmed availability of reliable trading platforms. This ensures a safer trading environment and access to reputable trading tools and resources.

In summary, gibank.online claims to offer the widely used trading platforms MT4 and MT5, known for their extensive features and user-friendly interfaces. However, the lack of regulatory oversight and credibility surrounding the platform raises concerns about the actual availability and functionality of these platforms. It is advisable to opt for regulated brokers that provide access to verified and reputable trading platforms for a more secure and reliable trading experience.

Customer Support:

Based on the information available, gibank.online provides customer support through an online chat function. However, user complaints and reviews suggest that the quality of customer support offered by the platform is questionable. Users have reported poor and evasive responses from the customer service team, indicating a lack of professionalism and inadequate assistance.

The platform does not provide specific details regarding the availability of customer support or the channels through which they can be reached, apart from mentioning an online chat function. This lack of transparency raises concerns about the platform's commitment to addressing customer inquiries, concerns, and issues effectively.

In reputable and regulated trading environments, brokers typically offer multiple channels of customer support, such as phone, email, and live chat, with dedicated support teams available during specified hours. They prioritize prompt and reliable assistance to ensure that traders' queries are addressed in a timely and satisfactory manner.

Given the reported issues with gibank.online's customer support, it is important to exercise caution and be aware of potential difficulties in seeking assistance. Engaging with a broker that offers reputable and responsive customer support is crucial for a positive trading experience and for resolving any concerns or issues that may arise during the trading journey.

In summary, gibank.online's customer support appears to be lacking in quality and responsiveness based on user complaints and reviews. The platform's limited information and the reported poor customer service experiences raise concerns about the effectiveness and reliability of their support channels. Traders are encouraged to choose regulated brokers that provide transparent information about customer support and are known for their prompt and helpful assistance to ensure a better overall trading experience.

Summary:

Gibank.online is an online digital bank and cryptocurrency exchange platform based in Gibraltar. However, multiple red flags and lack of credible information suggest that the platform is likely a scam operation. Pros cannot be identified due to the platform's questionable legitimacy and lack of verifiable features. However, there are several cons that should be highlighted.

Cons:

Lack of Regulation: Gibank.online operates without any regulatory oversight, indicating a lack of official authorization or compliance with financial regulations. This raises concerns about the safety and security of user funds.

Limited Information: The platform lacks transparency and fails to provide detailed information about key aspects such as account types, trading instruments, spreads, commissions, and customer support. This lack of transparency makes it difficult for traders to make informed decisions.

Poor Website Design and Content: The website exhibits amateurish design, spelling errors, questionable grammar, and duplicated or stock content. This unprofessional presentation adds to the overall doubts about the platform's legitimacy.

User Complaints and Warnings: Multiple user complaints and warnings have been posted online, flagging gibank.online as a likely scam operation. Complaints include account lockouts after depositing funds, indicating potential fraudulent activities.

Risk of Financial Loss: Engaging with gibank.online poses a high risk of financial loss or identity theft. Traders may face difficulties in accessing their funds or experience issues with withdrawals.

In conclusion, gibank.online is a platform that should be approached with extreme caution or avoided altogether. Its lack of regulation, limited information, poor website design, user complaints, and high risk of financial loss are significant red flags. It is advisable to choose regulated brokers with established credibility to ensure a safer and more reliable trading experience.

FAQs:

Q: Is gibank.online a regulated financial institution?

A: No, gibank.online operates without regulatory oversight, indicating a lack of official authorization or compliance with financial regulations.

Q: What trading platforms does gibank.online offer?

A: Gibank.online claims to offer the popular trading platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5), although the actual availability and functionality cannot be verified.

Q: Are there user complaints about gibank.online?

A: Yes, there are multiple user complaints and warnings online flagging gibank.online as a likely scam operation. Users have reported issues such as account lockouts and difficulties with fund withdrawals.

Q: Can I trust the customer support of gibank.online?

A: Based on user complaints and reviews, the quality of customer support provided by gibank.online is questionable. Users have reported poor and evasive responses from the customer service team.

Q: What are the risks of engaging with gibank.online?

A: Engaging with gibank.online poses a high risk of financial loss or identity theft. The lack of regulation, limited information, and user complaints indicate potential fraudulent activities and a lack of security for user funds.

FX1113952782

Hong Kong

Invest with GIB since last October. But the withdrawal process was closed shortly after without any notice

Exposure

2021-03-30

FX2938074535

Vietnam

I lost all my money. And I can't contact any staff here

Exposure

2021-03-23

房产抵押,汽车抵押友哥

Hong Kong

Gib scam company, its predecessor called Jufu Financial Funds, has been deceiving members into deposits but doesn't allow withdrawal. Various excuses are not given to members to withdraw funds. It is impossible to be transferred back to the principal by them. Please warn you. Friends stop believing that their lies are all deceptive.

Exposure

2021-03-14

趣哆哆

Hong Kong

The content is different from before. This company must abscond. How can I get my money back?

Exposure

2021-02-26

FX4961369632

Hong Kong

I have to buy and activate every time; the deposit is endless. Many of my family members have been deceived. I beg you to check it out. The Public Security Bureau has come to the door.

Exposure

2021-02-14

FX1903540746

Hong Kong

The predecessor of GIB was a Ponzi schem. Since I was fooled into the platform in February last year, it has only asked me to withdraw a few times, but the principal cannot be returned. Every time you inquire, they will find excuses. Deceive members, and now have a GUSDT juda coin. This coin is an air coin. Don't deposit gold anymore, and don't buy this coin in the currency circle. It must be fake!

Exposure

2021-02-08

李之凡

United States

I tried to access GIB's website but it seems to be down, and I saw some reports of people being scammed by them. It's concerning and disappointing to see companies like this taking advantage of people who are trying to invest their hard-earned money. I hope more people do their research before trusting any company with their funds.

Neutral

2023-03-24