Score

ADAR Capital

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://adar.capital

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesUsers who viewed ADAR Capital also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

adar.capital

Server Location

United States

Website Domain Name

adar.capital

Server IP

104.21.70.218

Company Summary

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience.

The information presented in this article is intended solely for reference purposes.

General Information

| Feature | Information |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | unregulated |

| Market Instrument | Forex, Indices, Shares, and Commodities |

| Account Type | Standard, Premium, and Platinum |

| Demo Account | N/A |

| Maximum Leverage | 1:500 |

| Spread | Vary on the account type |

| Commission | N/A |

| Trading Platform | WebTrader |

| Minimum Deposit | €250 |

| Deposit & Withdrawal Method | Bank Cards (MasterCard/Maestro/Visa) and Wire Transfers |

ADAR Capital is a forex broker registered in Saint Vincent and the Grenadines, providing access to a massive financial market. The broker provides access to over 200 financial markets, including Forex, shares, indices, and commodities. Traders can engage in Forex trading, trading major, minor, and exotic currency pairs. Additionally, ADAR Capital offers the opportunity to trade shares of various companies, participate in indices trading, and engage in commodities trading.

ADAR Capital offers three account types: Standard, Premium, and Platinum. Each account type has its own minimum deposit requirement, leverage options, and spreads. However, detailed information about additional features and benefits is lacking.

The broker offers leverage options ranging from 1:100 to 1:500. Spreads are set for each account type and start from 0.0 pips, with no commissions charged on trades. Deposits are processed instantly, while withdrawals may take up to 24 hours for processing and reach the client's account within 3-5 business days.

ADAR Capital utilizes its proprietary WebTrader as the trading platform, which may limit customization options compared to popular platforms like MT4 or MT5. The company provides customer support services through email and a contact form on its website.

It is important to note that there have been complaints from users about difficulties with withdrawals, account access, and sudden disconnections. These issues raise concerns about the company's customer support and reliability.

Here is the home page of this brokers official site:

Pros and Cons

ADAR Capital has both pros and cons to consider. On the positive side, the broker provides a diverse range of market instruments, allowing traders access to over 200 financial markets, including Forex, Shares, Indices, and Commodities. This provides opportunities for diversification and potential profits. However, there are also drawbacks to be aware of. Effective risk management is necessary due to the complexities and volatility associated with trading. Additionally, there may be a lack of detailed information on additional features or benefits, and the minimum deposit requirements for some account types may be high. It is important to carefully evaluate these factors before making any decisions.

| Pros | Cons |

| Provides diversification of portfolios | Requires effective risk management |

| Enables exposure to multiple financial markets | Different instruments can be volatile |

| Multiple account options for investors | Lack of detailed information on additional features or benefits |

| Varied leverage options to suit different needs | High minimum deposit requirements for some investors |

| Spreads from 0.0 pips | Lack of clarity on the services and support provided |

| No commissions | Absence of information on additional trading tools or resources |

Is ADAR Capital Legit?

ADAR Capital is a broker that does not currently possess valid regulation. It is important to note that the absence of proper regulatory oversight may expose investors to potential risks. As such, it is advised to exercise caution when considering any engagement with this broker. Without valid regulatory information, the credibility and security of the services provided by ADAR Capital may be uncertain. It is always prudent to thoroughly research and evaluate the regulatory standing of any financial institution before making any investment decisions.

Market Instruments

Traders can gain access to 200+ financial markets, including Forex, Indices, Shares, and Commodities.

Forex Trading-Major pairs, minor pairs, exotic pairs

Shares Trading-Hundreds of shares

Indices Trading-Dow Jones Industrial Average (USA), S& P 500 (USA), DAX (Germany), NASDAQ (USA).

Commodities Trading- Oil, Metals, and other Commodities

Account Types

ADAR Capital gives its clients three available trading account options, Standard, Premium, and Platinum. Your initial deposit determines your trading type, for example, €250 will set you into the Standard account. €2,500 is what a Premium trading account requires, and if you want to try the most advanced account, the Platinum account, you need to deposit at least €25,000, a large amount.

STANDARD ACCOUNT

The Standard Account has a minimum deposit requirement of €250 and offers leverage of up to 1:100. The account has a spread starting from 0.13 pips with zero commissions.

PREMIUM ACCOUNT

The Premium Account requires a higher minimum deposit of €2,500 and provides leverage of up to 1:300. The account offers a spread starting from 0.12 pips with zero commissions.

PLATINUM ACCOUNT

The Platinum Account is the highest tier and requires a minimum deposit of €25,000. It offers the highest leverage of up to 1:500. The account comes with a spread starting from 0.0 pips and zero commissions.

| Pros | Cons |

| Provides multiple account options for investors | Lack of detailed information on additional features or benefits |

| Varied leverage options to suit different needs | Minimum deposit requirements may be high for some investors |

| Spreads from 0.0 pips | Lack of clarity on the services and support provided |

| No commissions | Absence of information on additional trading tools or resources |

Leverage

ADAR Capital offers leverage options ranging from 1:100 to 1:500. High leverage is particularly beneficial for professional traders and scalpers. However, it's important to note that higher leverage also comes with increased risk, and proper risk management is advised when utilizing leverage.

Spreads & Commissions

ADAR Capital offers three types of trading accounts: Standard, Premium, and Platinum. They have set spreads for all accounts and do not charge any commissions. The Standard account has spreads starting from 0.13 pips, the Premium account starts from 0.12 pips, and the Platinum account offers spreads starting from 0.0 pips. No commission fees are applied to trades across all account types.

Deposit & Withdrawal

To get started, clients are required to make a minimum deposit of €250. The accepted methods for deposits and withdrawals include Bank Cards (such as MasterCard, Maestro, and Visa) as well as Wire Transfers.

It is important to note that deposit and withdrawal commissions may vary depending on the client's bank. However, ADAR Capital ensures that all deposits are processed instantly, allowing clients to begin trading without delay. On the other hand, withdrawals may take up to 24 hours for processing and typically reach the client's account within 3-5 business days.

| Pros | Cons |

| Instant deposit processing | Withdrawals may take up to 24 hours for processing |

| Multiple payment options available | Withdrawals may take 3-5 business days to reach |

| Minimum deposit requirement of €250 |

Trading Platform

What ADAR Capital is not the MT4 or MT5 trading platform, a WebTrader instead. Anyway, you had better choose brokers who offer the leading MT4 and MT5, which are highly praised by traders and brokers alike due to their ease of use and great functionality, offering top-notch charting and flexible customization options. They are especially popular for their automated trading bots, a.k.a. Expert Advisors.

Deposit & Withdrawal

The minimum deposit to get started is €250, and clients can make deposits and withdrawals through Bank Cards (MasterCard/Maestro/Visa) and Wire Transfers.

Deposit and withdrawal commissions depend on the clients bank. All deposits are instant, while withdrawals can be processed in 24 hours, and reach your account in 3-5 business days.

Reviews

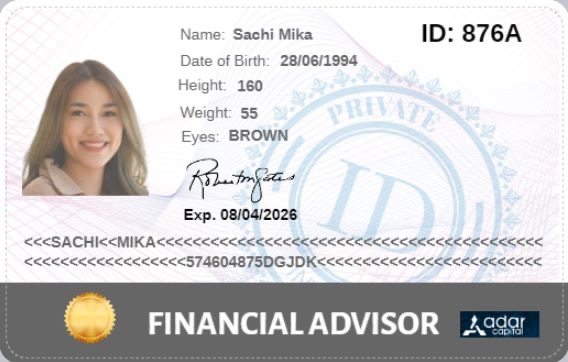

According to reviews on WikiFX, there have been complaints regarding ADAR Capital. Some users have reported difficulties with withdrawal requests, experiencing problems in accessing their accounts and sudden disconnections. For instance, one user mentioned their communication with a financial advisor abruptly ceased in April, leaving them unable to regain their assets. These issues raise concerns about the company's customer support and the ability to resolve such problems.

Customer Support

Contact this broker 24/5 using the following methods if you have any questions or problems with your trading: Email: support@adar.capital or fill in the “Contact Form” to get in touch.

Frequently Asked Questions (FAQs)

| Q 1: | Is ADAR Capital regulated? |

| A 1: | No. It has been verified that ADAR Capital currently has no valid regulation. |

| Q 2: | Does ADAR Capital offer the industry-standard MT4 & MT5? |

| A 2: | No. Instead, it offers a WebTrader. |

| Q 3: | What is the minimum deposit for ADAR Capital? |

| A 3: | The minimum initial deposit to open an account is €250. |

| Q 4: | Is ADAR Capital a good broker for beginners? |

| A 4: | No. ADAR Capital is not a good choice for beginners. Not only because of its unregulated condition, but also because of its high initial deposit requirement. |

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 4

Content you want to comment

Please enter...

Comment 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX1845152292

Japan

It started in February. Almost every day, I was chatting with the financial adviser, Mr. Sachi Mika. However, on April 21, I suddenly couldn't get in touch with my friend's image. My account is alive on the web. Because I want to regain the asset somehow, can you tell the way to the customer window and the person who is connected now?

Exposure

2023-04-27

追风少年

Malaysia

My experience is okay. ADAR Capital is a platform that I find very useful and easy to use. The site has all the information you need and also the customer service is there.

Neutral

2023-02-22

李阳56454

Singapore

Saint Vincent and the Grenadines is a small island in Latin America that is famous for providing offshore licenses, but what we need to know is that local financial institutions do not supervise foreign exchange. Danger!

Positive

2022-12-16

FX1186285587

Argentina

ADAR Capital does not provide services in Spanish, does not have a regulatory license, and was established less than a year ago. I can't think of any reason why I should trade with him.

Positive

2022-12-16