Score

Unison FX

United Kingdom|2-5 years|

United Kingdom|2-5 years| http://www.unisonfx.com/en.html

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed Unison FX also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

unisonfx.com

Server Location

United States

Website Domain Name

unisonfx.com

Server IP

34.102.136.180

Company Summary

| Unison FX | Basic Information |

| Registered Country/Area | Unknown |

| Founded year | 1-2 years ago |

| Company Name | Unison FX Limited |

| Regulation | Suspicious Regulatory License |

| Minimum Deposit | $200 |

| Maximum Leverage | 1:400 |

| Spreads | From 0.0 pips (allegedly) |

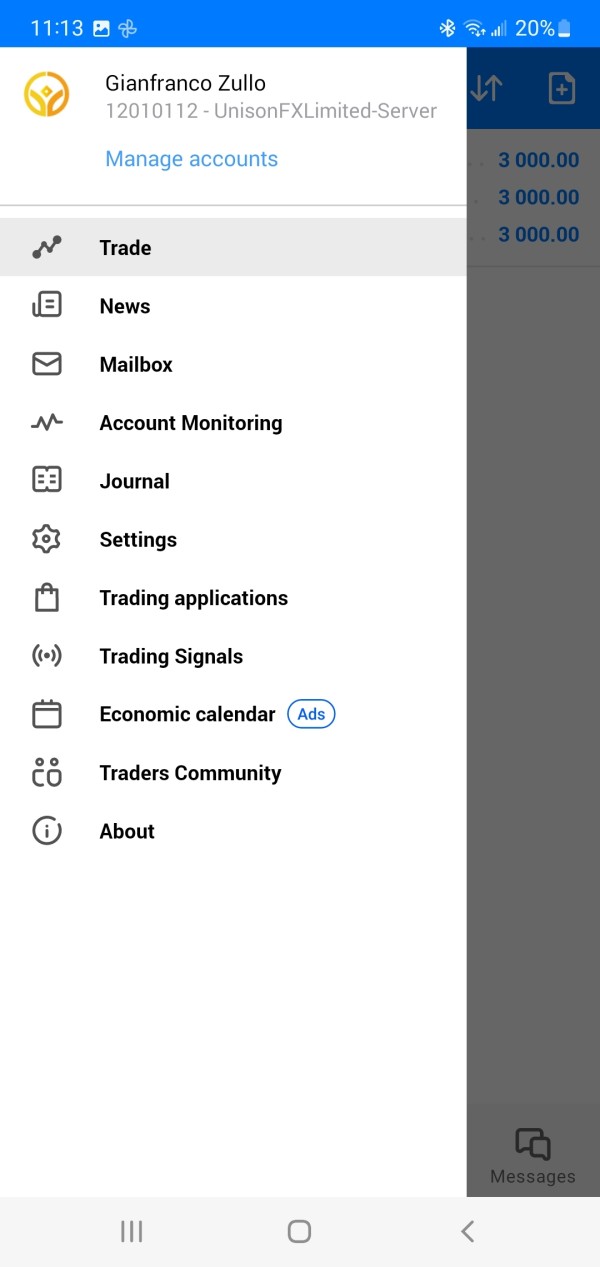

| Trading Platforms | MT5 trading platform |

| Tradable Assets | Foreign Exchange, Index, and Bulk Commodities |

| Account Types | Standard account only |

| Demo Account | No |

| Islamic Account | No |

| Customer Support | Email: cs@unisonfx.com |

| Payment Methods | Credit Cards (VISA, MasterCard), BPAY, NETELLER, Skrill, POLI, Union Pay, and Wire Transfer |

| Educational Tools | No |

Overview of Unison FX

Unison FX Limited, an enigmatic trading entity, operates without a disclosed country or area of registration. With a relatively short existence in the industry, having been founded within the past 1-2 years, this company raises concerns regarding its credibility. Besides, Unison FX Limited holds a regulatory license that is met with suspicion, casting doubt on the level of oversight and protection afforded to clients.

Unison FX offers foreign exchange, index, and bulk commodities trading. However, the absence of diverse account types limits the flexibility for clients, as only a standard account option is available. To open an account with Unison FX, a minimum deposit of $200 is required, and the maximum leverage offered by Unison FX is 1:400, implying a potentially high risk for investors. Furthermore, Unison FX does not provide a demo account, which hinders prospective clients from testing their trading strategies or evaluating the platform's performance in a risk-free environment.

The spread structure of Unison FX is advertised as starting from 0.0 pips, but this claim should be approached with skepticism, considering the questionable nature of their regulatory license. Traders are provided with the MT5 trading platform, a widely recognized platform known for its advanced features and functionality.

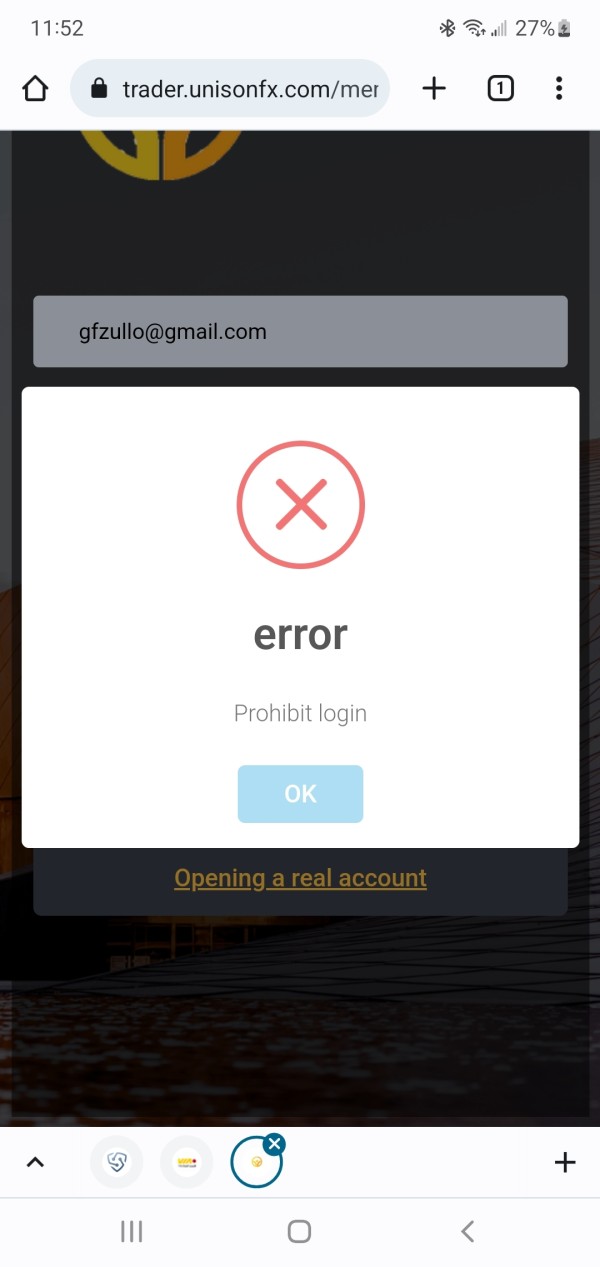

Is Unison FX legit or a scam?

Despite claims made by Unison FX Limited regarding its regulatory status, the actual oversight and legitimacy of the company remain dubious. Unison FX asserts that it is regulated by the NFA (National Futures Association) under regulatory license number 0550279

However, upon conducting a diligent search for verification on the NFA website, it becomes evident that Unison FX is not affiliated with or recognized by the NFA as a member.

Therefore, in the absence of a genuine and recognized regulatory oversight, traders should be vigilant and consider alternative brokers that operate within a transparent and well-established regulatory framework.

Market Intruments

Unison FX Limited offers a limited range of market instruments for trading purposes. The available options cover Foreign Exchange, Index, and Bulk Commodities.

Foreign Exchange trading, also known as Forex, entails the buying and selling of different currencies in the global financial market.

The availability of Index trading provides traders with an avenue to speculate on the performance of a specific stock market index.

Furthermore, Bulk Commodities trading offered by this broker give access to an avenue for speculating on the price movements of essential and widely traded commodities, such as metals, energy, and agricultural products.

Account Types

Unison FX Limited offers a solitary account type to its clients, which is the standard account, which serves as the only option available for traders. The standard account offered by Unison FX requires a minimum deposit of $200, thereby setting a baseline financial commitment for potential clients.

Moreover, it is important to highlight that Unison FX does not provide a demo account option. Demo accounts play a pivotal role in enabling traders to practice and familiarize themselves with the trading platform, as well as test their strategies in a simulated environment. The absence of a demo account can hinder the ability of traders, particularly those who are new to the financial markets, to gain hands-on experience and develop a level of proficiency before engaging in live trading.

Leverage

Unison FX Limited offers traders the possibility to utilize leverage in their trading activities, with leverage ratios reaching up to 1:400. Leverage can magnify both profits and losses, presenting traders with the potential for substantial gains as well as significant risks. It is important to recognize that the higher the leverage ratio, the greater the potential exposure to market fluctuations and the subsequent impact on trading capital.

Spreads & Commissions (Trading Fees)

Unison FX Limited operates with a structure that incorporates spreads and commissions as part of its trading framework. Spreads, in the context of financial markets, represent the difference between the bid and ask price of a financial instrument. While specifics regarding the spreads offered by Unison FX are not explicitly stated, it is important for traders to bear in mind that spreads are an inherent aspect of trading, and they directly impact the overall profitability of a trade. Wider spreads can potentially impede the swift execution and favorable outcome of trades, as they generate increased costs for traders. In addition to spreads, Unison FX may also apply commissions when executing trades.

Non-Trading Fees

In addition to the trading-related costs, Unison FX Limited imposes non-trading fees that traders should be cognizant of before engaging in their services.

One such non-trading fee that traders may encounter is the inactivity fee. This fee is typically levied on accounts that have remained inactive for an extended period of time.

Another potential non-trading fee is the withdrawal fee. This fee is applicable when traders initiate withdrawals from their trading accounts.

Furthermore, Unison FX may apply fees for certain additional services, such as account management or data subscriptions. These fees are not directly linked to the execution of trades.

Trading Platform

Unison FX Limited offers traders access to the MetaTrader 5 (MT5) trading platform, renowned within the industry for its advanced functionalities and comprehensive features. MT5 serves as a robust and versatile platform, facilitating the execution of trades across various financial instruments and markets.

The MT5 platform presents users with a multitude of analytical tools and charting capabilities.The platform's comprehensive suite of technical indicators and customizable charting options enable traders to delve into market trends, patterns, and price movements. This extensive range of analytical tools equips traders with the necessary resources to formulate effective trading strategies and identify potential opportunities.

Moreover, the MT5 platform provides traders with the ability to automate trading activities through the implementation of algorithmic trading strategies ( EA advisor).

Deposit & Withdrawal

When initiating a deposit, traders are required to meet a minimum deposit requirement of $200, which serves as the baseline amount for opening a trading account with Unison FX.To provide convenience and flexibility to its clients, Unison FX supports several payment options. These include recognized credit cards such as VISA and MasterCard, as well as BPAY, NETELLER and Skrill, POLI, Union Pay and more.

Unfortunately, the information provided by Unison FX Limited regarding associated fees and processing times for deposits and withdrawals is not specific or transparent.

Customer Support

Unison FX Limited adopts an email-based customer support system, whereby clients can forward their concerns to cs@unisonfx.com.

Educational Resources

Unison FX Limited, unfortunately, does not offer any educational resources to its clients. The absence of such resources means that clients may not have access to a structured learning platform or materials to enhance their trading skills or knowledge.

Is Unison FXsuitable for beginners?

Unison FX may not be the most suitable choice for beginners in the forex market, considering three vital dimensions for forex beginners:

Firstly, Unison FX does not provide any educational resources. For beginners who are looking to acquire essential knowledge about forex trading, this lack of educational materials could be a significant drawback. Without educational resources, beginners may find it challenging to learn trading strategies, understand risk management, and navigate the complexities of the forex market effectively.

Secondly, Unison FX's customer support is primarily available through email communication. For beginners, having access to responsive and accessible customer support is crucial. Real-time assistance or immediate interaction with knowledgeable representatives can help beginners clarify doubts, receive guidance, and gain confidence in their trading decisions

Lastly, Unison FX does not offer a demo account. Demo accounts are invaluable for beginners as they allow for simulated trading without risking real money. With a demo account, beginners can practice trading strategies, familiarize themselves with the trading platform, and gain practical experience in a risk-free environment. The absence of a demo account deprives beginners of an opportunity to develop and refine their trading skills and gain confidence before transitioning to live trading.

Is Unison FX suitable for experienced traders ?

Unison FX is not suitable for experienced traders, and the following three vital dimensions can be considered:

Bad trading conditions: Experienced traders often require competitive trading conditions to execute their trading strategies effectively. This includes factors such as tight spreads, low latency execution, and reliable order execution. Unison FX does not seem to perform well concerning these trading conditions.

Lack of advanced trading tools: Experienced traders rely on advanced tools and features to analyze the market, identify trading opportunities, and manage their positions effectively. However, this broker fails to provide powerful trading tools to help experienced traders to accomplish their trading goals.

Poor cutsomer support: Experienced traders may encounter complex trading scenarios and require prompt and knowledgeable customer support, but Unison FX ends up with providing email support solely, which is slow and inefficient for experienced to address their trading problems.

Conclusion

Conclusively, Unison FX Limited, a relatively young broker, operates with a suspicious regulatory license, thereby raising concerns about its transparency and compliance. The platform offers access to forex, index, and bulk commodity markets, but there are limitations such as the absence of a demo account and Islamic account options. Poor customer support is provided, because they can only be available via email. Therefore, it is important to approach Unison FX with caution, considering its questionable regulatory standing and potential limitations.

FAQs

Q: Is Unison FX safe to trade with?

A: Unison FX is not regulated, unsafe to trade with.

Q: Does Unison FX provide access to different financial markets?

A: Yes, Unison FX provides access to a diverse range of financial markets, including forex, stocks, commodities, indices, and cryptocurrencies, offering traders a broad selection of trading opportunities.

Q: What types of trading accounts does Unison FX offer?

A: Unison FX does not tell what types of trading accounts it offers.

Q: What is the minimum deposit required by Unison FX?

A: The minimum deposit required by Unison FX is $200.

Q: Does Unison FX offer demo accounts?

A: No, this broker does not provide demo accounts.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now