Overview of BANK OF CHINA

Bank of China Limited operates under the regulatory oversight of the UK's Financial Conduct Authority (FCA) and is located at 1 Lothbury, London. The bank offers a spectrum of financial services, encompassing Corporate Banking for businesses, including deposit accounts, corporate loans, foreign exchange, and trade services. Similarly, Personal Banking caters to individual needs, providing deposit accounts, mortgage solutions, remittance, currency exchange, and bank cards. Notably, Bank of China emphasizes its support for Renminbi (RMB) services, facilitating financial operations for both corporate and personal transactions.

Account offerings comprise RMB Current Accounts, Business Accounts in multiple currencies, a Student Prime Account for students needing a UK bank account, and diverse Savings Accounts denominated in GBP, USD, EUR, and RMB. While the bank provides a user-friendly trading platform accessible via mobile and online banking, its Great Wall International Credit Card offers global payment acceptance and ATM withdrawals, coupled with security features like SMS alerts and Verified by Visa. Collaborations with Global Blue and UnionPay International enhance payment options for UnionPay cardholders. However, negative reviews on platforms like wikifx raise concerns about the bank's trading and investment reliability.

Pros and Cons

BANK OF CHINA presents several advantages, including FCA regulation for Market Making, diverse account options, comprehensive RMB services, and a user-friendly trading platform. Moreover, it offers the Great Wall International Credit Card and collaborates with Global Blue for UnionPay acceptance. However, the bank faces challenges such as negative reviews on wikifx, fees and commissions, concerns about trading practices and platform reliability, as well as complaints about pyramid schemes and scams. While it provides multiple contact options for support, limited trading tools, information, and customer support channels remain areas of improvement.

Is BANK OF CHINA Legit?

Bank of China Limited is regulated by the Financial Conduct Authority in the United Kingdom as a Market Making (MM) licensed institution. Its regulatory status is currently active, and the effective date of its license is December 1, 2001. The institution is located at 1 Lothbury, London EC2R 7DB, United Kingdom, and can be contacted at phone number +44 02072828863 or via email at jon.sartoris@bankofchina.com. Its website is www.bankofchina.com/uk/. Traders should note that this broker does not have trading software.

Products & Services

Bank of China's Corporate Banking services encompass deposit accounts, corporate loans, treasury and foreign exchange services, and trade services like trade settlement, trade finance, and bank guarantees. The bank also provides comprehensive RMB services to support businesses in their financial operations.

For Personal Banking, Bank of China offers deposit accounts, mortgage solutions, remittance and currency exchange services, and bank cards for easy transactions. The bank extends various other services to cater to individual financial needs, along with comprehensive RMB services for RMB-related transactions.

Account Types

RMB Current Account: Bank of China (UK) offers RMB Current Accounts with no account opening or management fees. Customers can deposit, withdraw, and transfer funds in RMB, and use internet banking services.

Business Accounts: Bank of China (UK) provides easy-to-understand current accounts in multiple currencies, including Sterling, RMB, HKD, EUR, and USD. Features include low account management fees, no cash withdrawal fees, and a relationship manager for day-to-day banking activities.

Student Prime Account: “Student Prime” Account helps students open a UK bank account before departure from China. No account management fees, free monthly statements, and a Sterling debit card for commission-free cash withdrawals from UK ATMs. Eligible applicants must be full-time students with a UK university/college offer letter, aged 16 or above.

Savings Accounts: The bank offers several savings account options, such as the All-in-One Fixed Term Deposit Account and the Instant Access Savings Account. These accounts can be denominated in GBP, USD, EUR, and RMB. The All-in-One Fixed Term Deposit Account offers various terms and interest rates, while the Instant Access Savings Account provides easy access to funds without requiring notice. Both savings accounts do not have account management fees or cash paying in/withdrawal fees, making them suitable options for customers looking to save their money with the bank.

Additionally, they offer an All-in-One Fixed Term Deposit Account and an Instant Access Savings Account in various currencies without management or cash handling fees.

Fees & Commissions

Bank of China (UK) Limited charges various fees and commissions for its banking services. Some examples of these charges include: £10 per cancelled cheque, £5 to set up, amend, or cancel a standing order, £20 per foreign currency cheque sent abroad for collection, £15 to issue, amend, or cancel a bank draft, and £35 to send money outside the UK to countries/regions outside the EEA. The charges also apply to services like sending money within the UK via CHAPS, cash advance fees for credit cards, and foreign exchange transaction fees for debit card usage abroad. Safety deposit box rental fees range from £68 to £498 per year, depending on the box size, and safety deposit box related services have varying charges, such as £50 for replacing a lost key and £400 for force opening a locker with lost keys.

Deposit & Withdrawal

Bank of China (UK) Limited offers specific fees and charges for different types of transfers. Transfers to Bank of China (UK) accounts and other UK bank accounts via Faster Payments are free, while CHAPS transfers have a £15.00 fee. For transfers to bank accounts outside the UK, fees range from £6 to £14 based on the amount. Transfer limits per transaction and per day vary from £10,000 to £200,000 or equivalent. The bank provides RMB Pre-Settlement Remittance during specific operating hours. Additionally, the bank offers an Electronic Statement Service, allowing customers to access their bank statements in PDF format via internet or mobile banking. Historic statements can be accessed up to 3 years from enrollment in electronic statements.

Trading Platforms

Bank of China (UK) offers a user-friendly trading platform accessible through both its mobile app and online banking.

Cards & Payments

Bank of China (UK) Limited offers the Great Wall International Credit Card, which provides worldwide acceptance for payments, including online and over the telephone transactions without the need for a PIN. Cardholders can withdraw cash from ATMs displaying the VISA sign globally, subject to certain fees. The card also features a rewards program, allowing customers to earn points for every £1 spent and redeem them for gifts. Different card types are available with varying annual fees and interest rates. The bank also provides security measures such as SMS alerts and monitoring transactions for abnormal activity. Additionally, Bank of China (UK) Limited offers the Verified by Visa service for additional security and protection when making online purchases with participating retailers.

In collaboration with Global Blue, the bank enables UK merchants to accept UnionPay cards, catering to Chinese visitors who predominantly hold UnionPay cards. The partnership facilitates POS terminal solutions and daily settlement processes. Furthermore, Bank of China collaborates with UnionPay International to offer UnionPay card online payment solutions for eCommerce, leveraging the growing market of Chinese visitors in the UK and their spending power. This comprehensive approach provides more payment option.

Trading Tools

The trading tools of Bank of China include Promotions & Notices and Latest News. In Promotions & Notices, there have been temporary suspensions of Great Wall International Debit Cards and Credit Cards on various dates. Additionally, there was an important notice for fraud reminder and an annual report on a sustainability re-linked bond. In Latest News, Bank of China has been involved in various meetings and events with financial institutions and has successfully arranged bond issuances and signed strategic cooperation agreements with companies like Jaguar Land Rover Automotive PLC.

Customer Support

For customer support, you can contact Bank of China (UK) Limited at 1 Lothbury, London, EC2R 7DB. If you are in the UK, call 0800 38 95566, and if you are outside the UK, dial 0044 20 7282 8926. Alternatively, you can reach them via email at service.uk@bankofchina.com. However, please note that for security reasons, the bank does not accept account opening applications or instructions for account information alteration via email.

Reviews

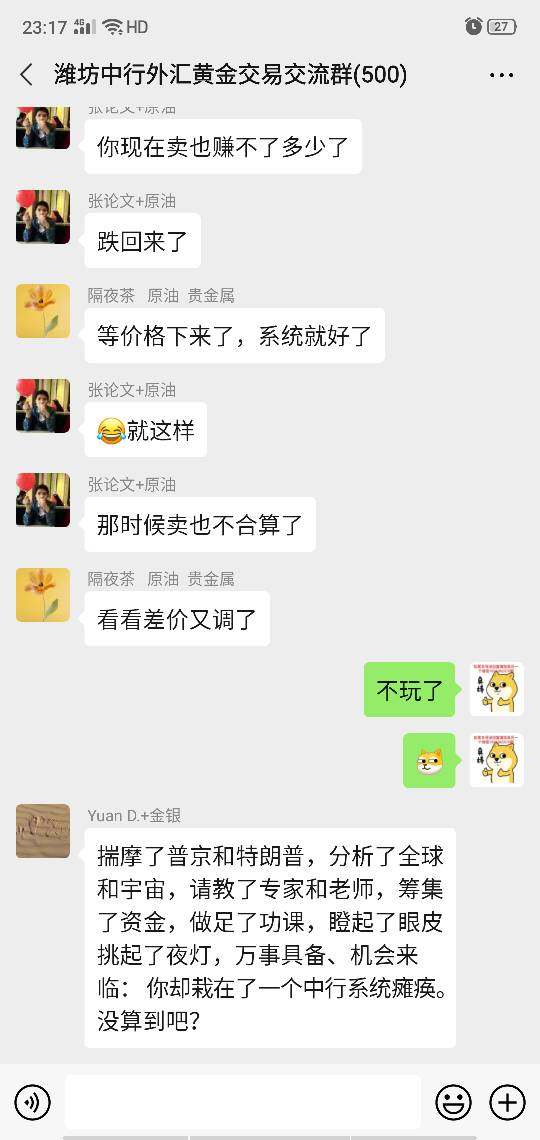

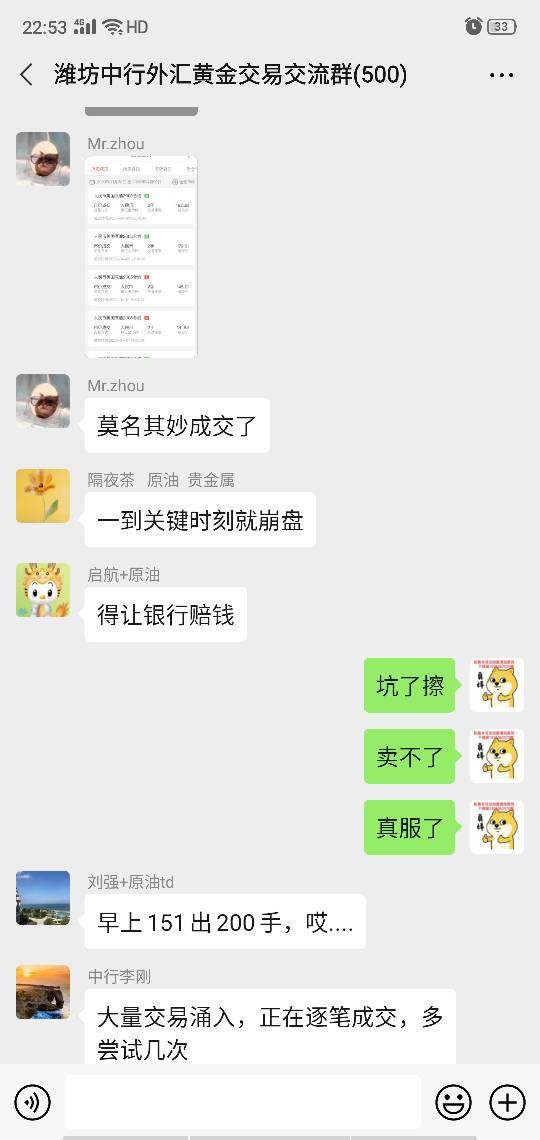

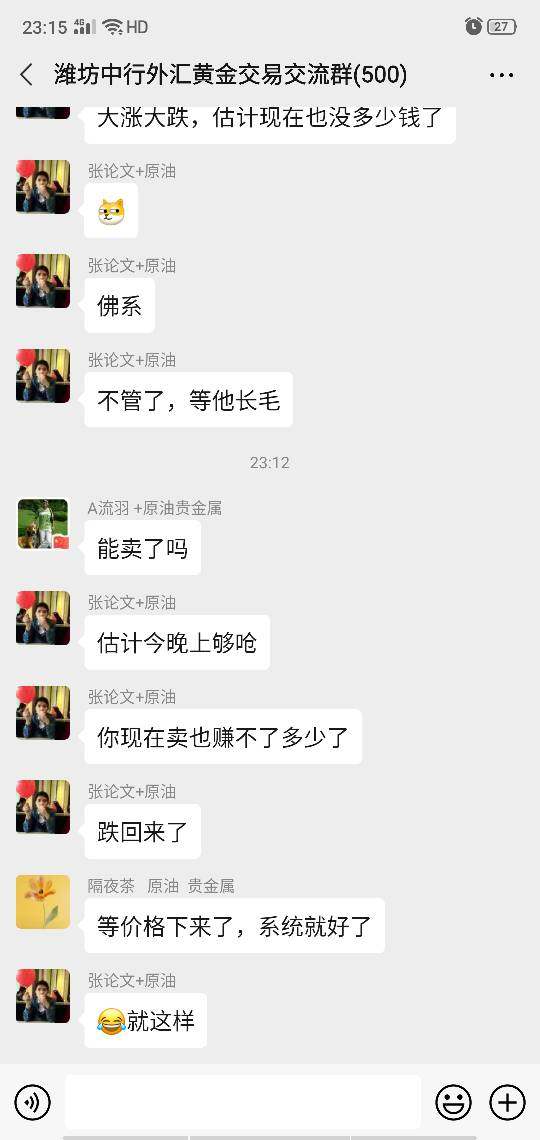

Bank of China has received negative reviews on wikifx, with exposure related to pyramid scheme complaints, scams, and system issues. One reviewer reported a negative experience with the Crude oil APP, claiming that the bank didn't sell when the market was going up, resulting in significant losses when the price plummeted. Another user accused Bank of China of being a fraud platform, experiencing issues with entering position-closing interface and system malfunctions during critical market moments. These reviews raise concerns about the bank's practices and reliability in trading and investment services.

FAQs

Q: Is BANK OF CHINA a legitimate institution?

A: Yes, BANK OF CHINA Limited is a legitimate institution regulated by the Financial Conduct Authority in the UK.

Q: What services does BANK OF CHINA offer for corporate banking?

A: BANK OF CHINA provides corporate banking services, including deposit accounts, loans, foreign exchange, and trade settlement.

Q: Can students open a bank account with BANK OF CHINA?

A: Yes, eligible students can open a UK bank account with the “Student Prime” Account, offering no management fees and additional benefits.

Q: What fees are associated with BANK OF CHINA's services?

A: BANK OF CHINA charges various fees, such as cheque cancellation, standing order setup, and foreign currency cheque processing fees.

Q: How can I contact BANK OF CHINA customer support?

A: You can reach customer support at 0800 38 95566 (UK) or 0044 20 7282 8926 (outside UK), or via email at service.uk@bankofchina.com.

Q: Are there any negative reviews about BANK OF CHINA's services?

A: Yes, there have been negative reviews related to pyramid scheme complaints and system issues on platforms like wikifx.