Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

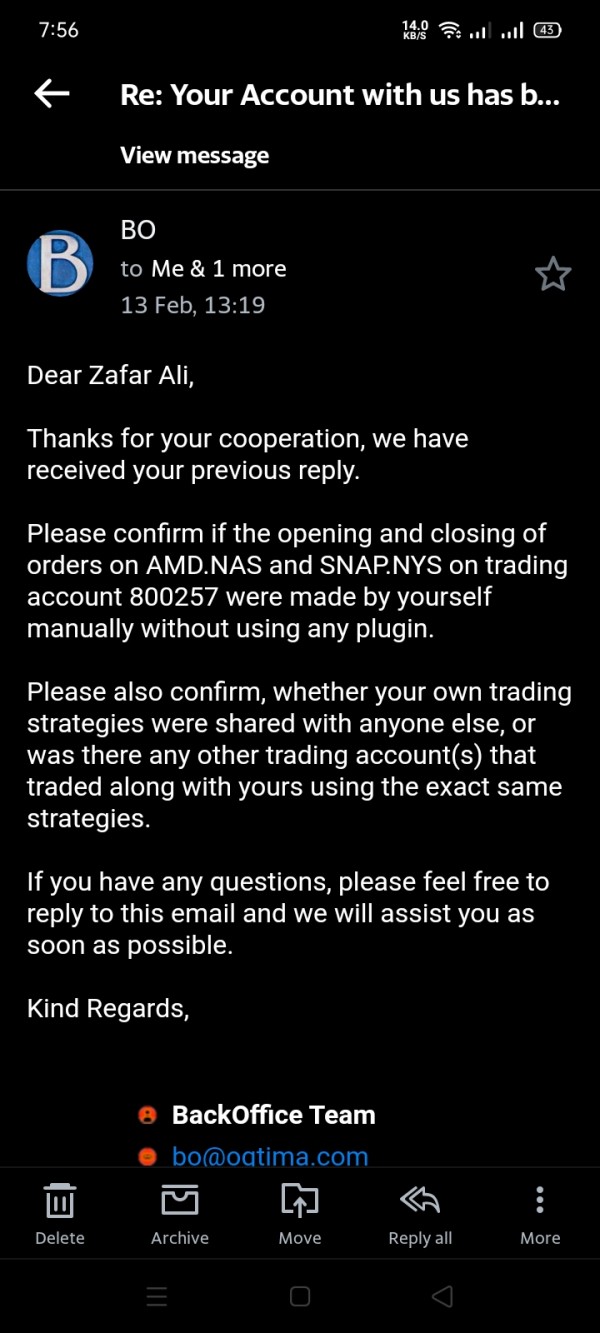

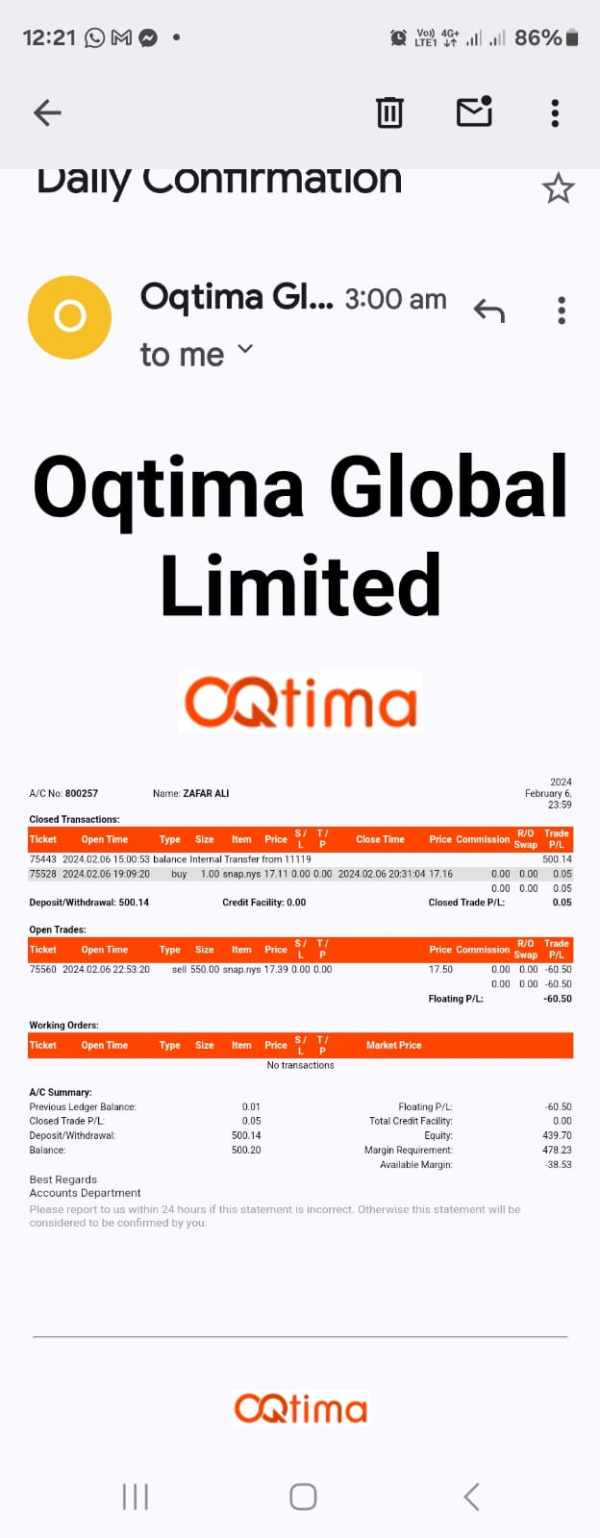

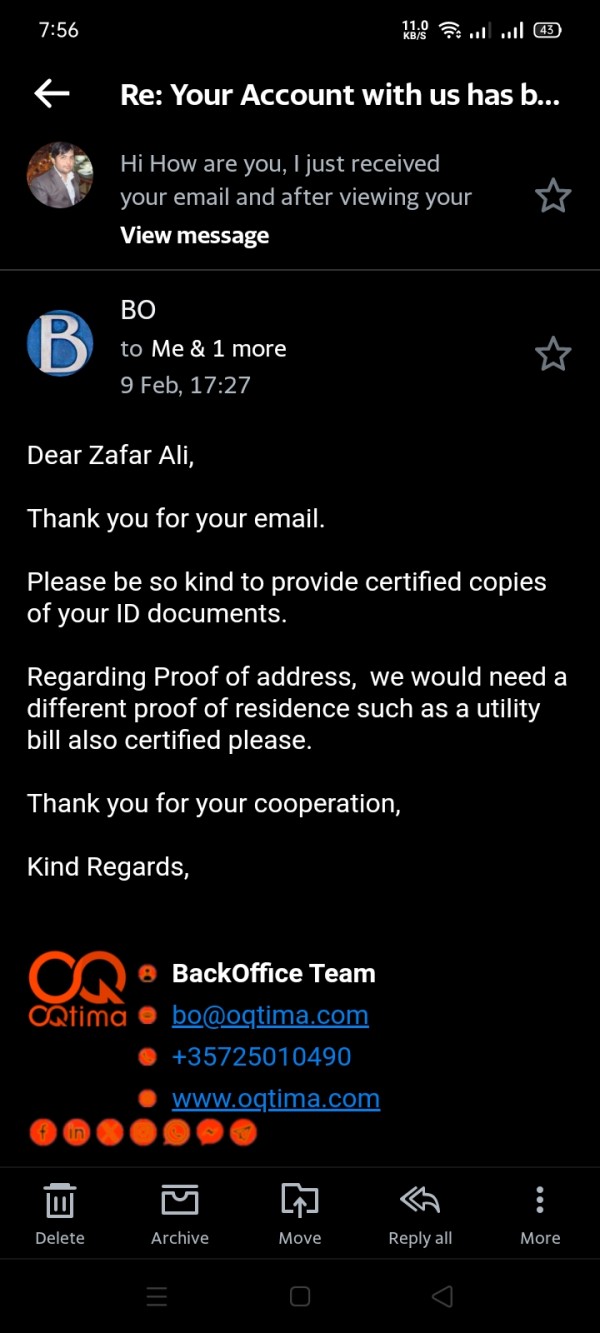

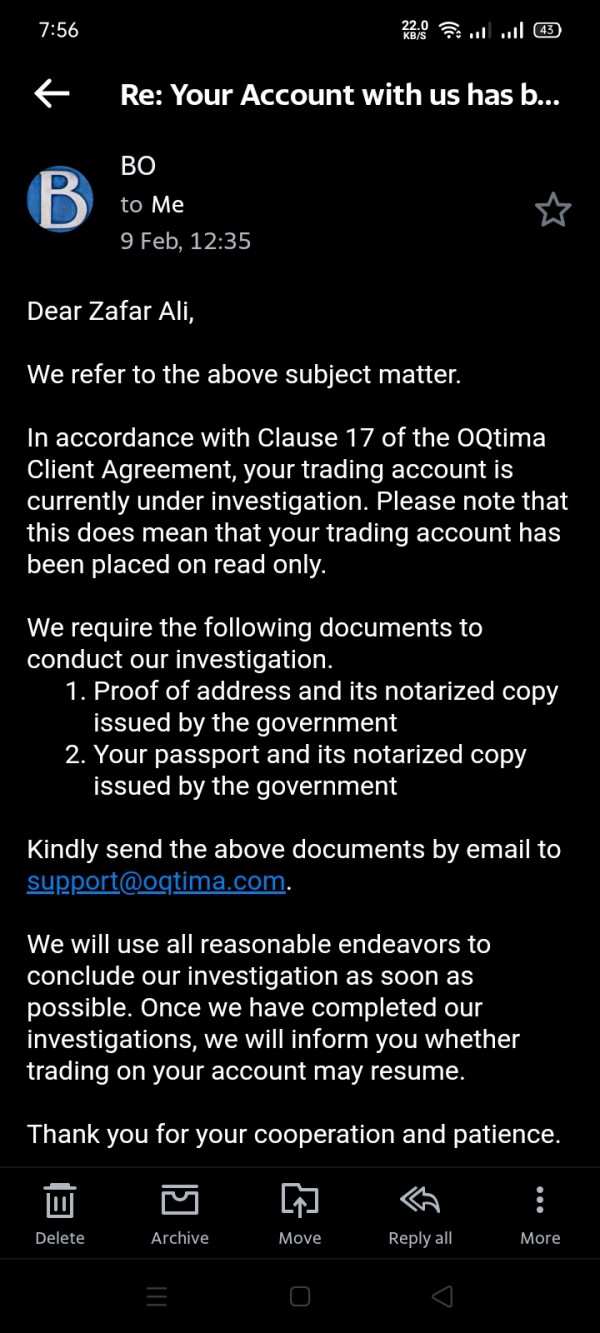

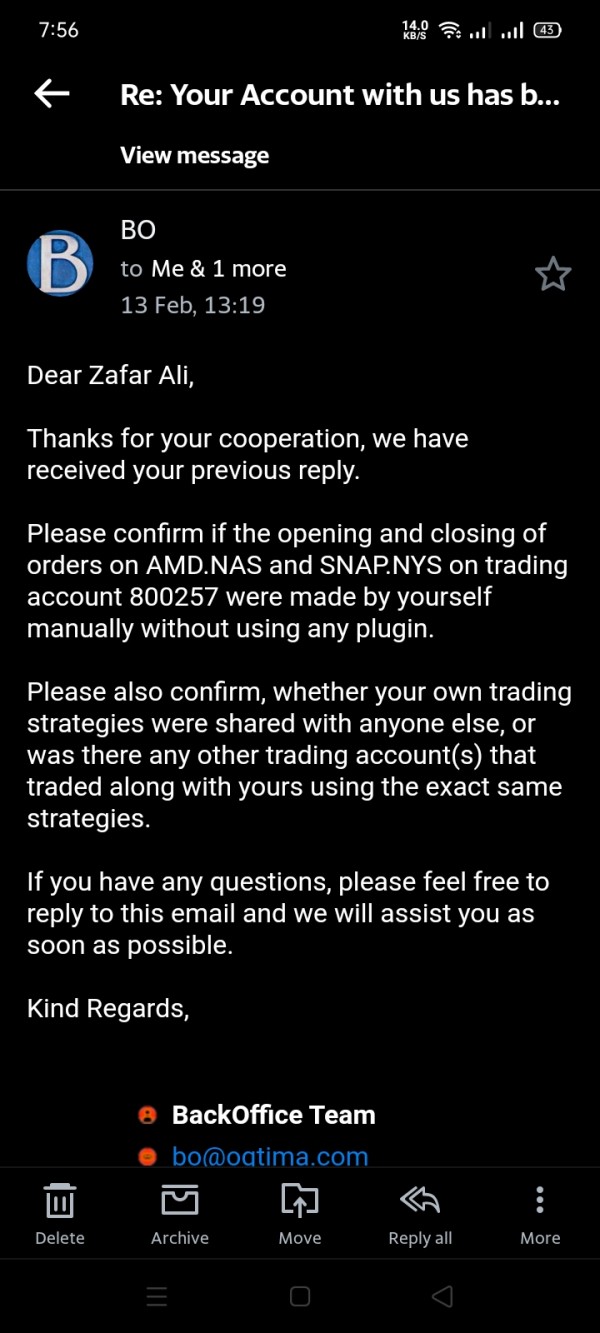

Zafar ali1119

Pakistan

Dear all traders Its 2 months i still didn't received my profit. Please stay away from this broker and withdraw your funds else this broker will stole your profits. Its a scam broker and will blame you for making profit with wrong way and will be happy if you lose your funds. Admin take action against this broker and provide me Justice

Exposure

2024-03-20

Zafar ali1119

Pakistan

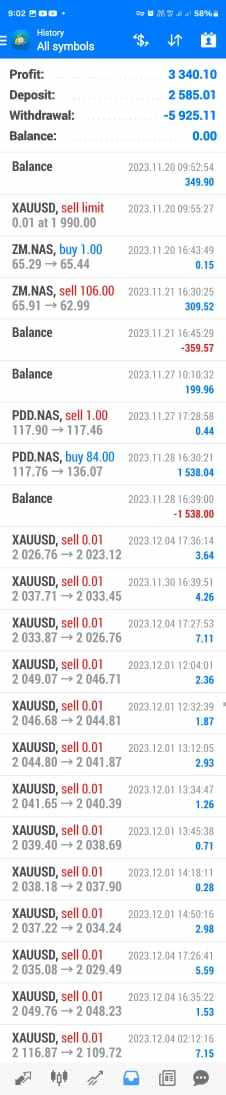

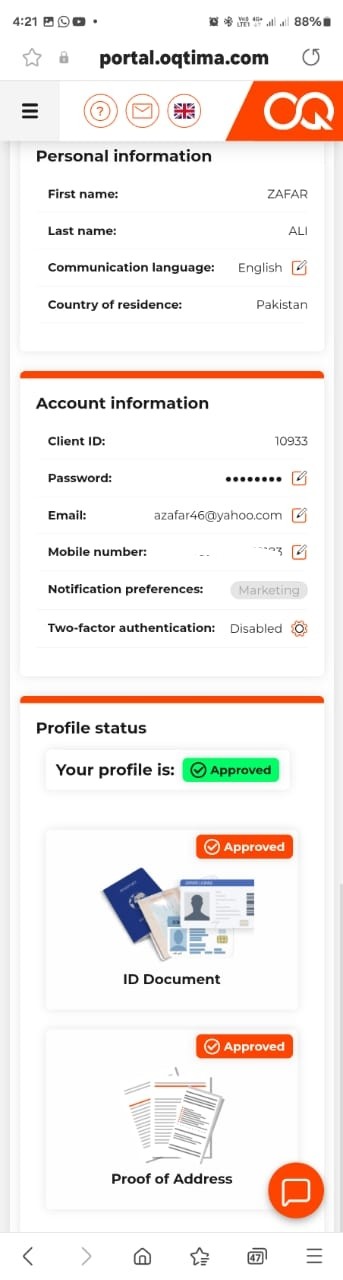

Hi i am replying to my previous review. Its my email azafar46@yahoo.com. All victims of Oqtima Global broker please contact me we as group will take every legal action against this broker its regulation. When we do profit they told we are doing abuse trading but they don't do such claims when we loss. Another person Mr Farooq withdrawn 3000$ profit from this broker with same trading Strategy in Same Product. He did profit of 1538,782,543$ in pdd,tesla & docu respectively(screenshots attached). I am also giving to all these proofs to their regulations. They giving profit to one person but don't give to other person. Admin please approve my review so other traders knows. Also please help us to provide us justice in declaring this broker as fraud

Exposure

2024-03-01

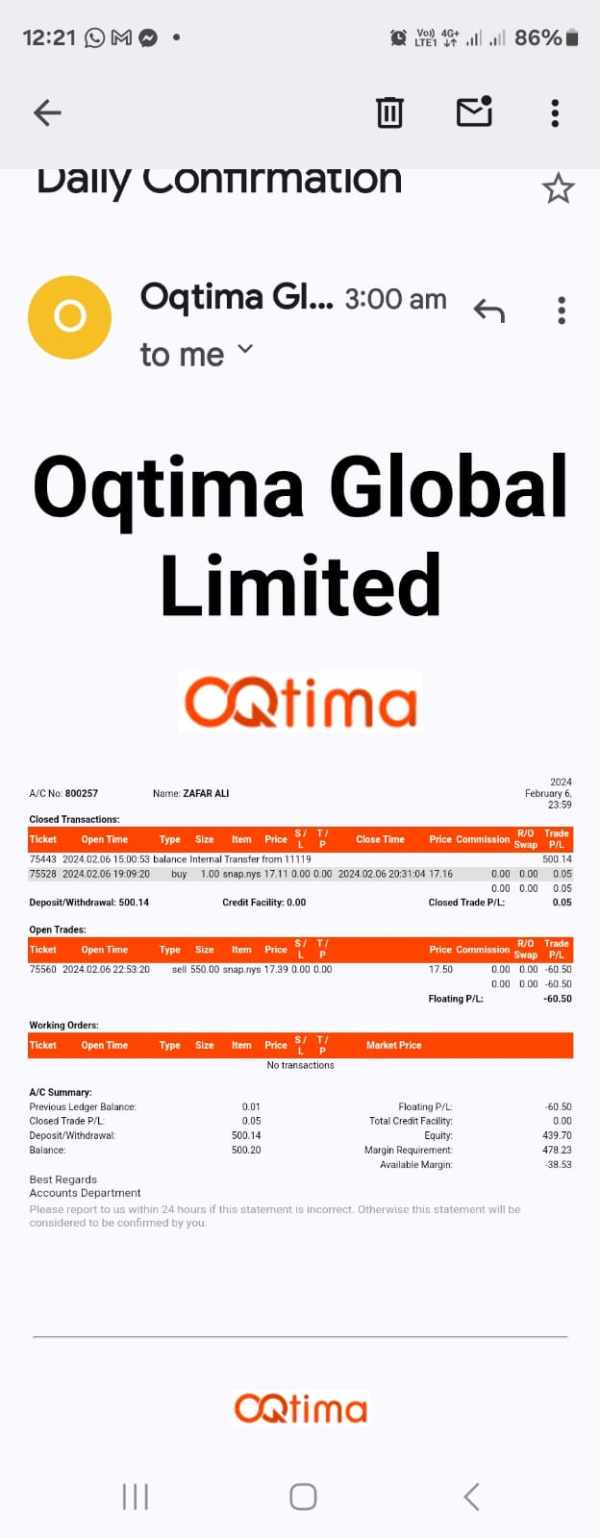

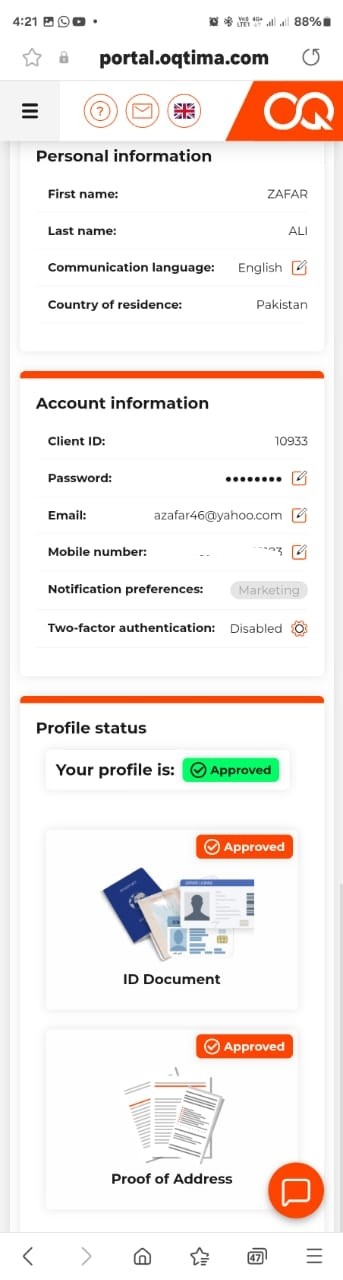

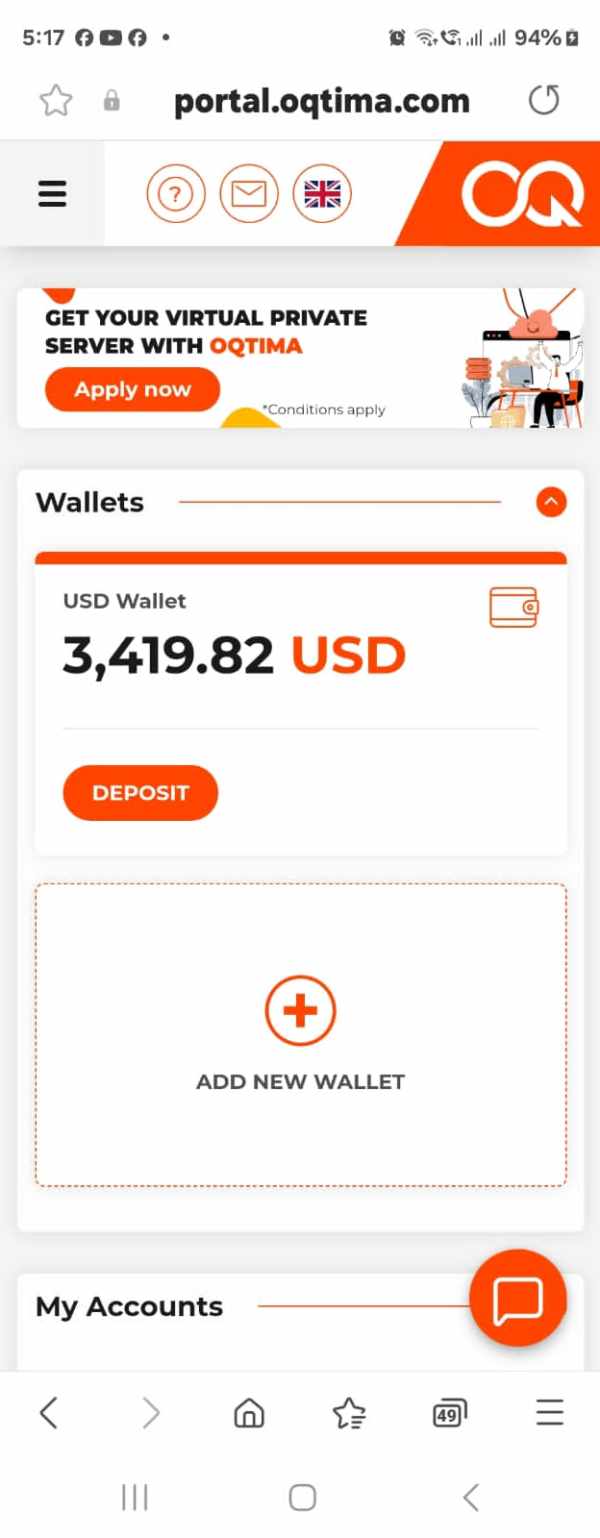

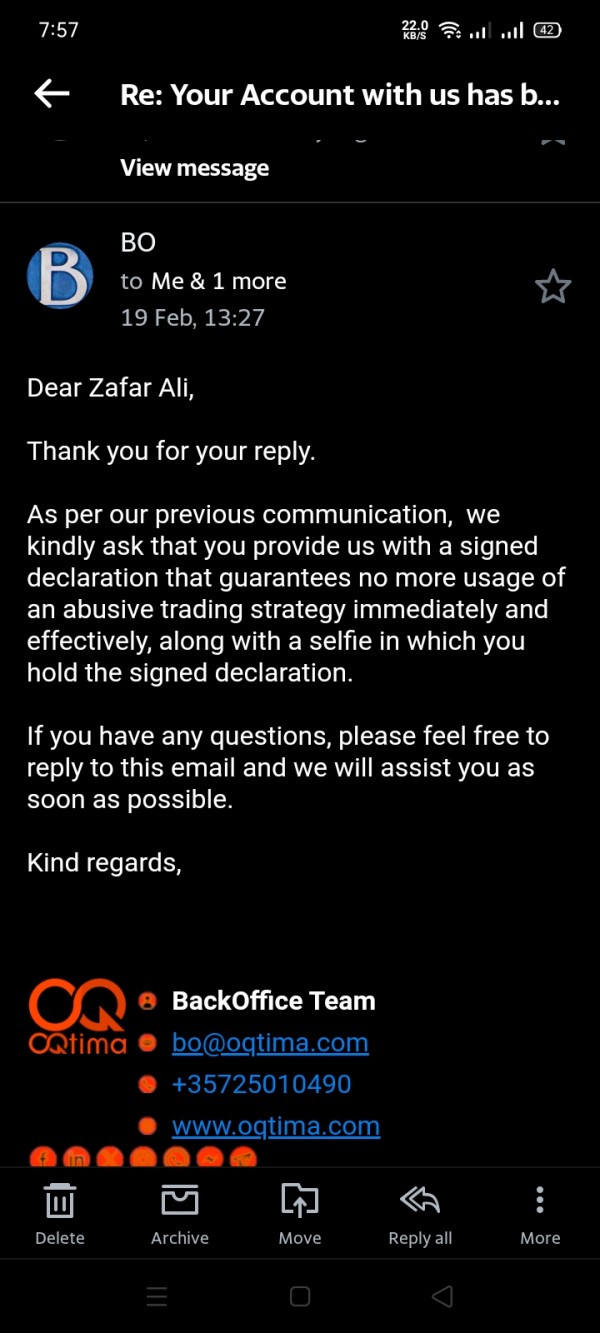

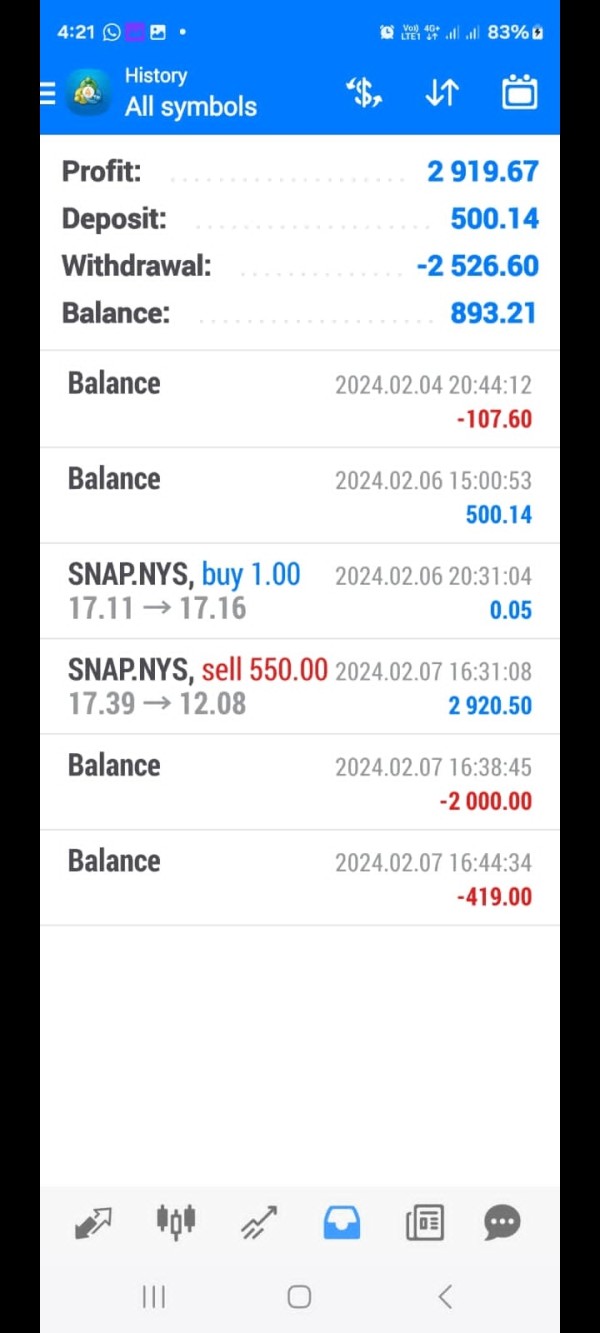

Zafar ali1119

Pakistan

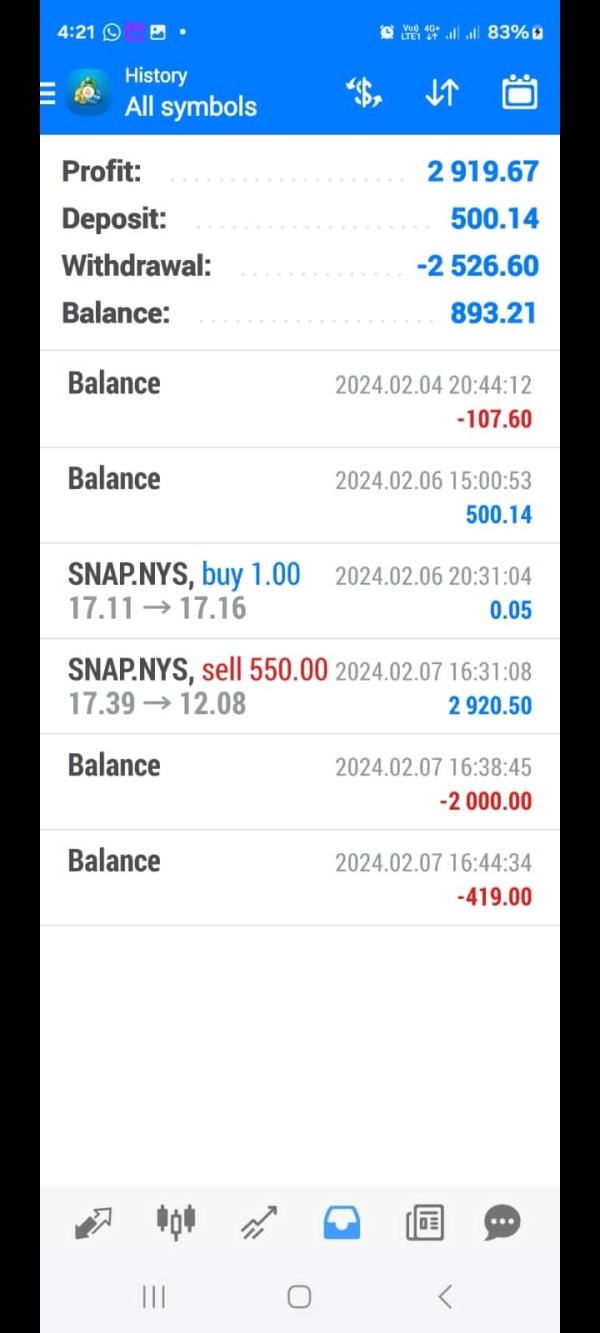

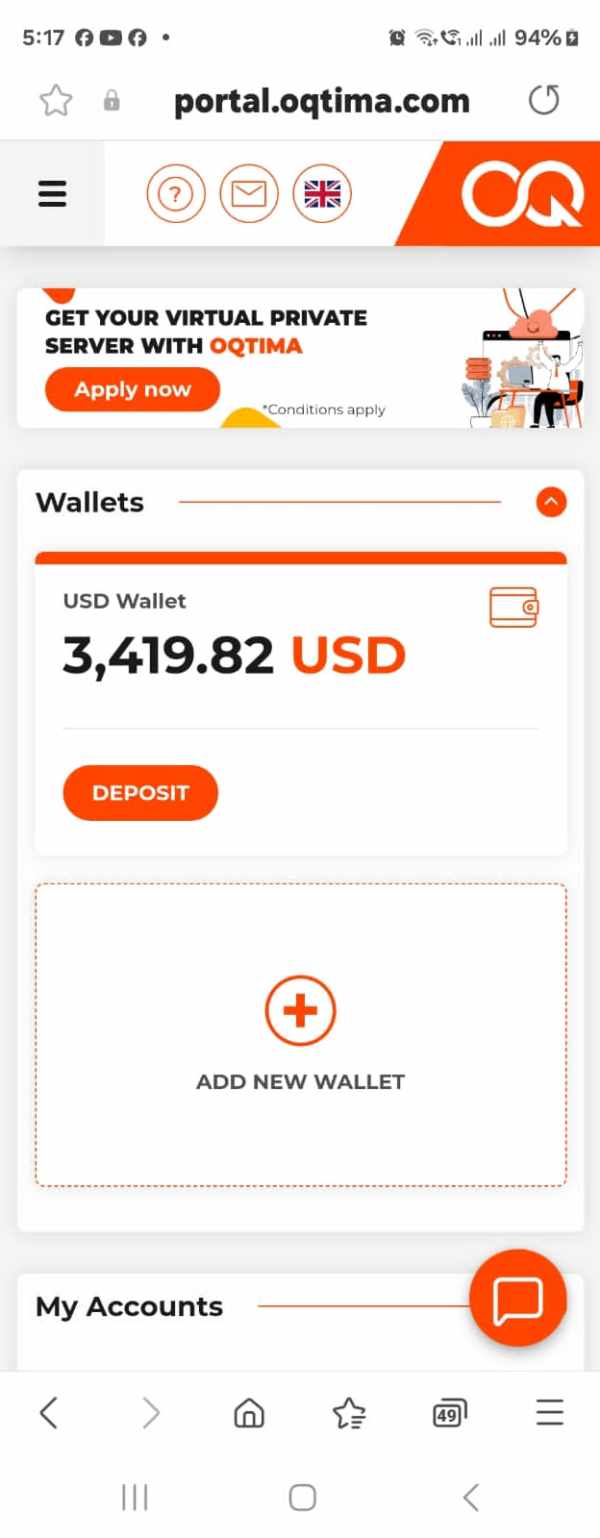

Hi my name is zafar ali. My registered account at oqtima broker is azafar46@yahoo.com. Oqtima broker is a scammer broker. Here is my review about this Oqtima Global broker. when i deposit lost 600$ in US shares Trading before, they returned my remaining balance of 100$. And after few days When i deposit again 500$ and trade again in us share and I do profit 2920$ in Us share Snap trading so they made excuses for illegal trades and trying to eat my profit 2920$ Since from 15 days they tortured me by demanding different documents and i provided even my account was already fully verified. This proves that it is an scammer broker. My deposit is 500$ and profit is 2920$. All forex trader listen openly This broker will never give you your profit. Everyone reading this review please withdraw your funds from this scam broker. I am going to post everywhere with all evidence of videos and screenshot. I am also opening case against them in their regulations. Admin kindly declare this broker as scam and help me to recover my 3419$.on Trust pilot reviews website few other victum of this scammer company Oqtima Global. He also told me again and again about my trading strategy in their email. What consern of this company about my trading strategy. Is regulated broker doing this. they also blocked my mt4 account and access to my portal.

Exposure

2024-02-21

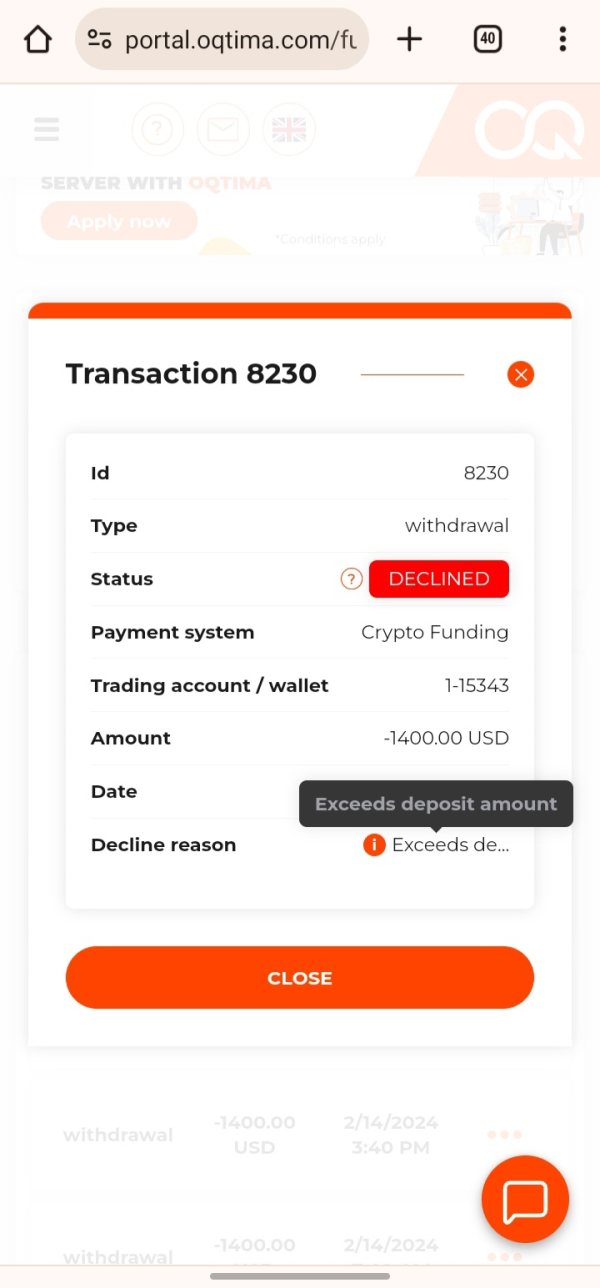

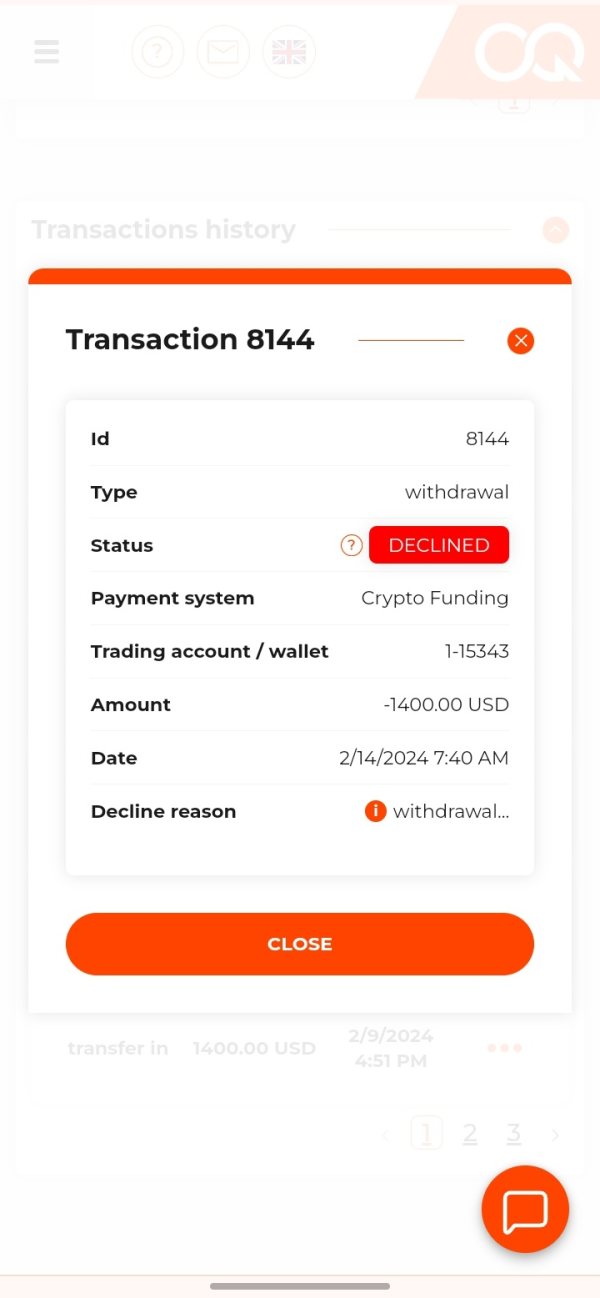

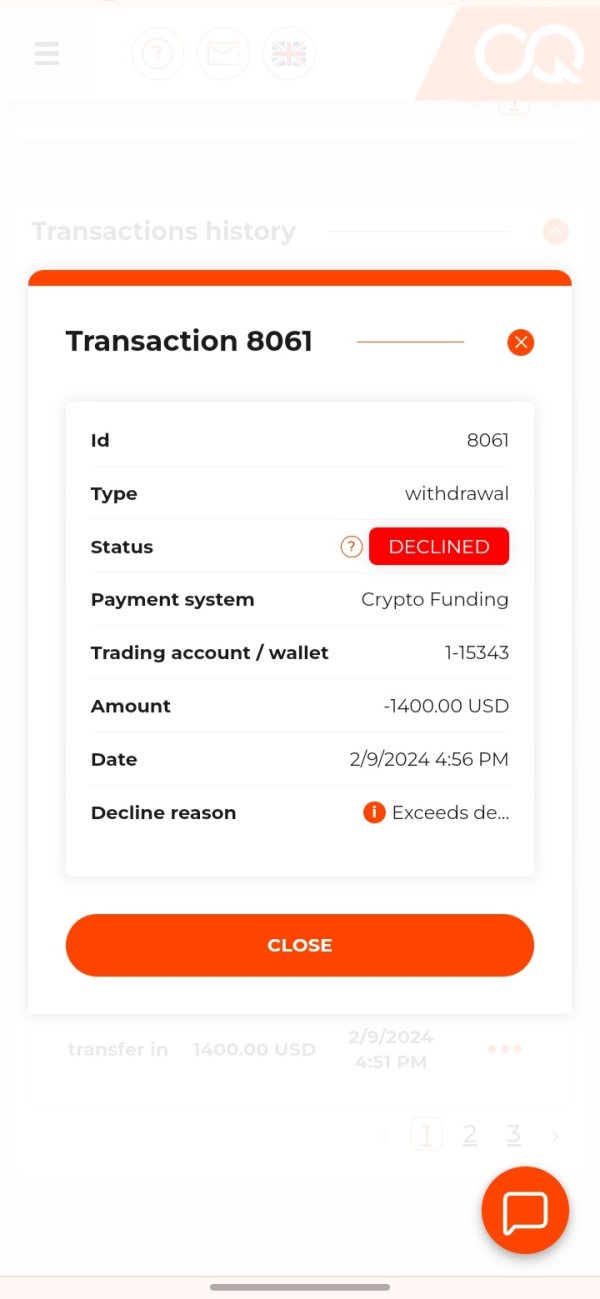

Life Trader

Pakistan

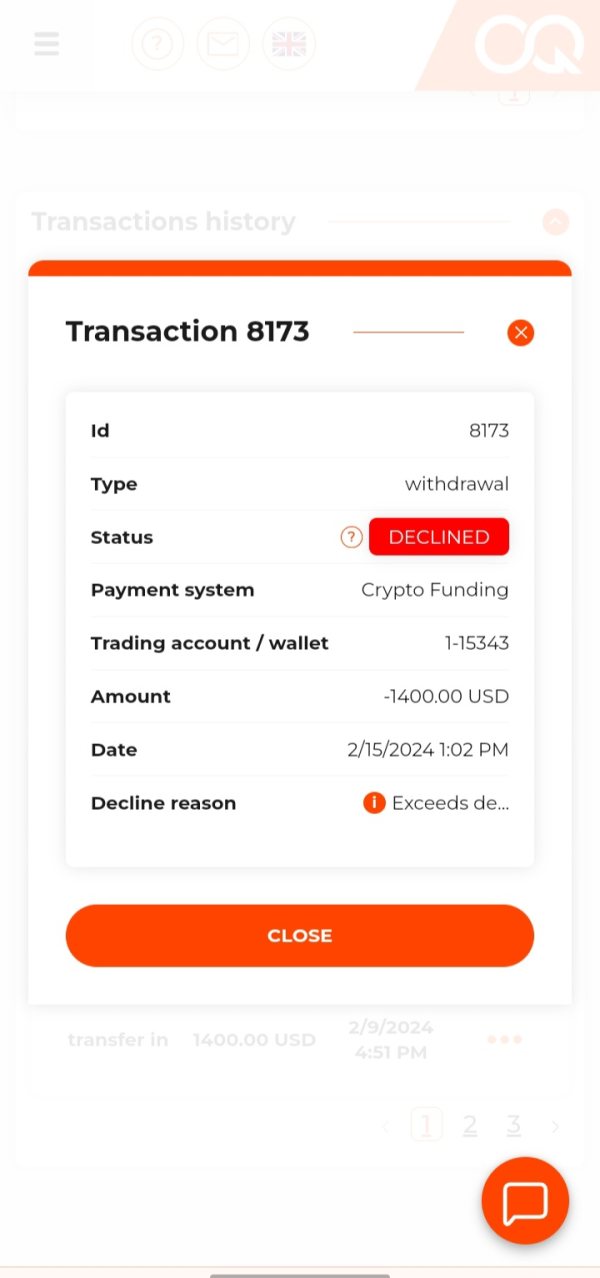

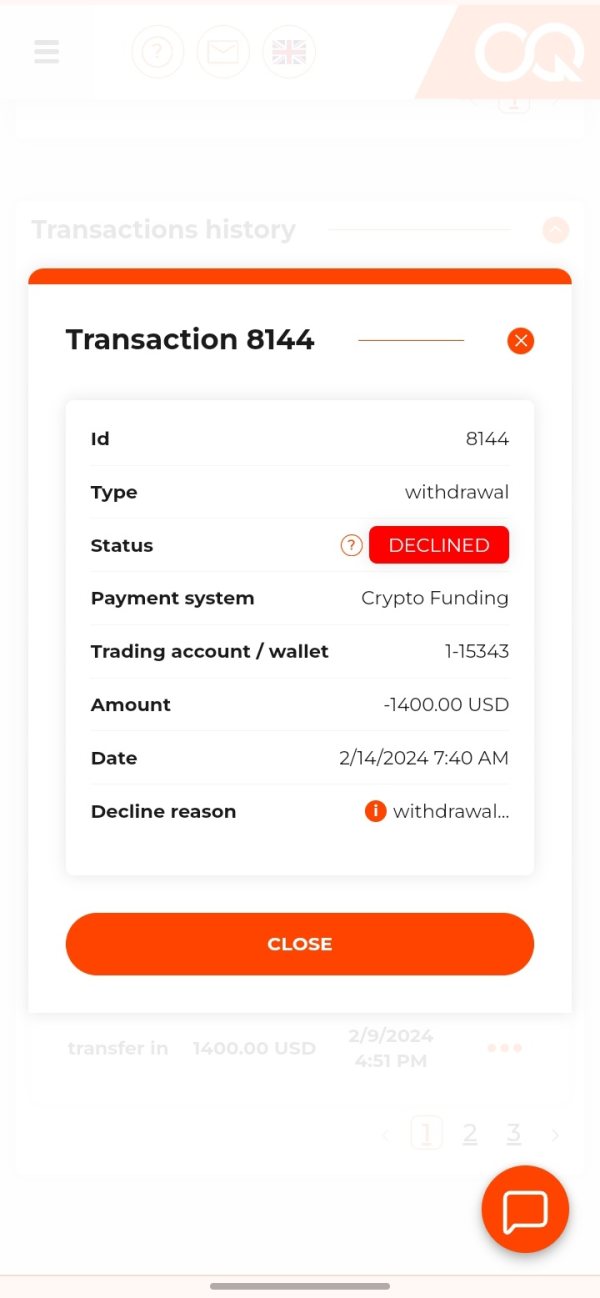

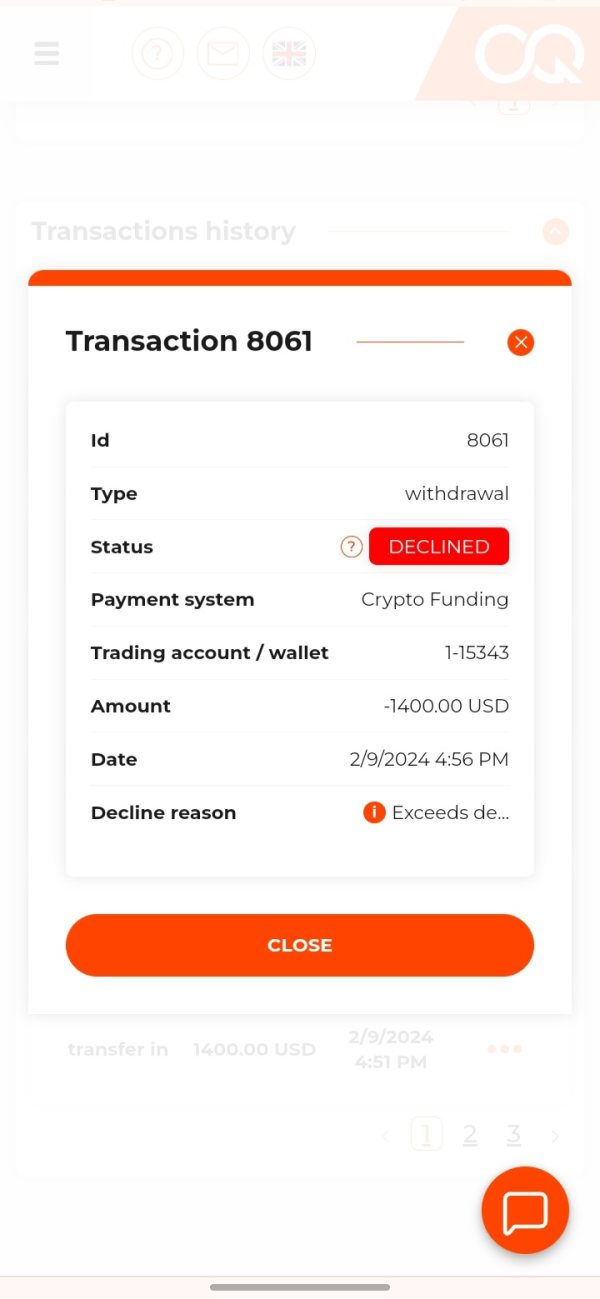

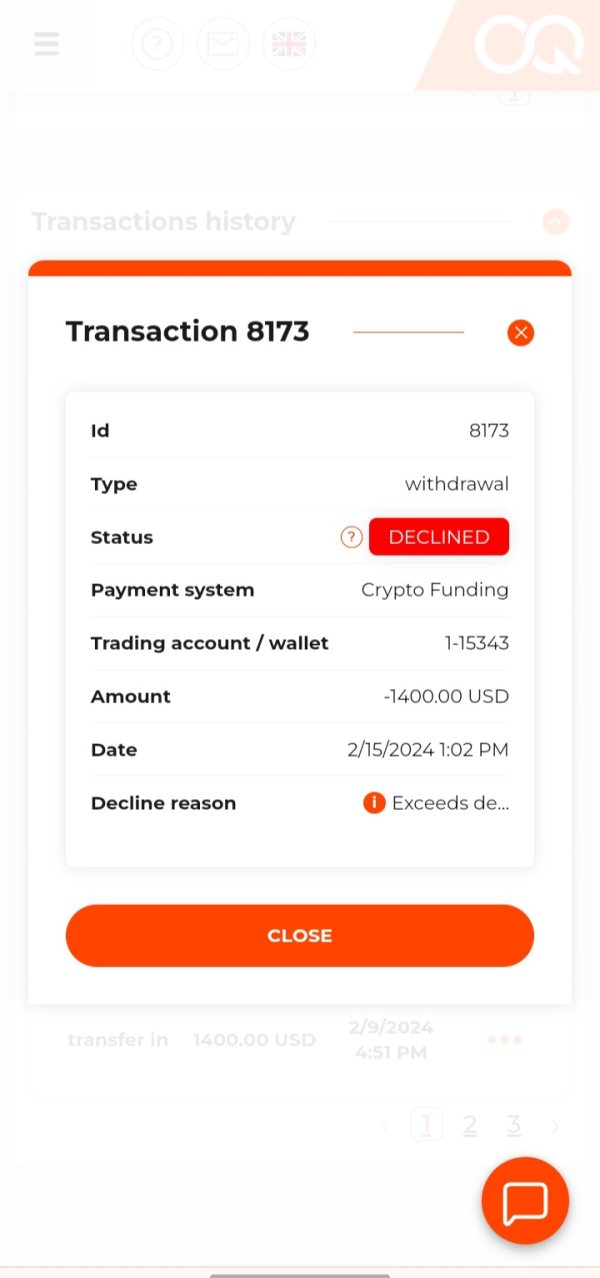

THIS BROKER IS DOING SCAM WITH CLIENTS!!! WHENEVER THE CLIENT MAKE PROFIT THEY WILL TERMINATE YOUR ACCOUNT AND THEN THEY WILL NOT ALLOW TO WITHDRAW YOUR AMOUNT!!! THEY HAVE DECLINED MY WITHDRAWAL REQUEST MORE THAN FIVE TIMES AND THE REASON THEY PROVIDE IS AMOUNT EXCEEDS THE DEPOSIT AMOUNT BECAUSE THEY DON'T WANT TO GIVE PROFIT AND WANT TO SCAM CLIENTS. PLEASE STAY AWAY FROM THIS SACMMER BECAUSE YOU WILL BE NOT ALLOWED TO WITHDRAW WHEN YOU MAKE PROFIT!!!!!

Exposure

2024-02-21

Life Trader

Pakistan

They have been declining my withdrawal request for more than two weeks and kept telling me that we will process your request. How ever now they have terminated my account because they don't want to allow me withdrawal Please stay away from them as i had made biggest mistake trusting them!!!!

Exposure

2024-02-21

Yooper

United States

As a fresh member of the OQtima trading community, I must say, it’s been a smooth ride so far. The customer service is spot-on and hasn't disappointed yet. Any hitches in execution? None that I've noticed. And their competitive spreads offer a great edge. Special shout-out to their swap-free account option, great stuff! A simple deposit process with plenty of options makes things even easier. So, if you're on the hunt for a decent broker - I'd say give OQtima a chance.

Neutral

2024-04-19

Pongtai

Vietnam

Having two oversight agencies really gives me a sense of security, and the diverse payment options make me feel at ease!

Positive

2024-07-31

FX1675756694

Spain

I've been using Oqtima for several weeksnow, and I am incredibly impressed with the platform. Its transformed my trading experience, offering a user-friendly interface that makes managing my trades straightforward and efficient. Plus the customer support team at Oqtima is top. They are responsive and resolved my issue in a few hours.

Positive

2024-07-18

Cancx

Vietnam

Pretty smooth. Love that I can start with just $20 and the spreads are super low. Very instant withdrawals and no fees for funding or pulling out money. Really makes trading straightforward and stress-free. 👍

Positive

2024-06-04

Michael036

Malaysia

I have opened an account with them few months now , trading conditions are fair enough and no issues with requotes or delays until now. Their spreads are quite good as well especially for the ECN account type

Positive

2023-09-14

FX1307322270

United States

I've seen ads for this company online before, but I think their website is too colorful and makes my eyes tired. Also I didn't see many user reviews, which made me afraid to invest here.

Positive

2023-03-03