OnEquity Information

OnEquity, a trading platform affiliated with OnEquity Ltd, based in Seychelles, operates under the regulatory authority of the Seychelles Financial Services Authority (FSA) with license number SD154. The platform offers access to various market instruments, including Forex currencies, commodities, global indices, stock CFDs, spot metals, and cryptocurrency CFDs. It boasts low pricing and leverage options for Forex currency pairs, enhancing trading opportunities across different asset classes.

OnEquity provides three account types: Plus, Prime, and Elite, each requiring varying minimum deposits and offering different spreads, commissions, and trading instruments. The registration process is straightforward, requiring users to provide personal information and agree to the platform's terms and policies. OnEquity offers commission-free trading with spreads starting from 0.0 pips. The minimum deposit required to access trading activity is 25 USD, and the platform supports various deposit and withdrawal methods. Traders can access the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms for versatile cross-trading experiences.

Pros and Cons

Is OnEquity Legit?

OnEquity, owned and operated by the company OnEquity Ltd, is regulated by the Seychelles Financial Services Authority (FSA) with license number SD154.

Market Instruments

Forex Currencies: OnEquity provides access to the Forex market, offering a wide range of major, minor, and exotic currency pairs. Traders can benefit from low pricing with spreads starting as low as 0.1 pips on EUR/USD. Additionally, leverage options of up to 1:500 are available for these currency pairs, enhancing trading opportunities.

Commodities: The platform allows traders to engage in the trading of various commodities, including natural gas, wheat, crude oil, and cotton. These commodities are widely traded globally, making them suitable for both market speculation and portfolio hedging strategies.

Global Indices: With OnEquity, traders can access a diverse selection of global indices through a single trading platform. This includes popular indices from the EU, Asia, and the USA, such as NASDAQ 100 and GER40. Trading global indices provides opportunities for diversification and exposure to different markets.

Stock CFDs: OnEquity offers the trading of Contract for Difference (CFD) instruments on a wide range of stocks listed on major exchanges like NYSE, Euronext, and NASDAQ. Traders can enjoy superior execution and low pricing while investing in well-known companies such as Tesla and Amazon. The platform also offers low margin requirements, making it accessible to a broad range of traders.

Spot Metals: Traders looking to invest in precious metals can trade Gold, Platinum, and other precious metal commodities through OnEquity. The platform offers ultra-low spreads, fast execution, and zero commissions for spot metals trading. Precious metals can serve as a valuable addition to a diversified investment portfolio and act as a hedge during periods of inflation.

Cryptocurrency CFDs: OnEquity enables traders to participate in the cryptocurrency markets through Contract for Difference (CFD) trading. Cryptocurrencies like Bitcoin and Ethereum are available with leverage options of up to 1:20. One notable advantage is that traders can engage in cryptocurrency trading without the need to maintain a separate crypto wallet.

Account Types

Leverage

OnEquity offers varying leverage levels for different asset classes. Traders can access up to 1:500 leverage for Forex currencies, up to 1:400 for Metals and Commodities, up to 1:200 for Indices, 20% margin for Stock CFDs, and up to 1:20 for Cryptocurrency CFDs.

Spreads & Commissions

OnEquity offers spreads starting from as low as 0.0 pips, and there are no commissions charged for trading on their platform. Trading with OnEquity is commission-free, which means there are no additional fees applied to trades conducted on their trading accounts.

Minimum Deposit

The minimum deposit required by OnEquity is 25 USD. Trading activity on the platform becomes accessible once this minimum deposit amount has been credited to your account.

Deposit & Withdrawal

OnEquity provides a detailed list of deposit and withdrawal methods on its official website, ensuring transparency and convenience for users. The options include E-Wallets, Local APMs (Alternative Payment Methods), Crypto Wallets, and Bank Wire transfers. Both deposits and withdrawals through these methods are free of transaction fees.

Additionally, for deposits only, OnEquity offers several other payment methods including VISA, Mastercard with a processing time of 24 hours, as well as FairPay and Epay which have a quicker processing time of 30 minutes.

Deposit

Withdrawal:

Trading Platforms

OnEquity offers a range of trading platforms designed to deliver a versatile cross-trading experience. These platforms can be accessed via the web, tablet, or mobile device. Traders have the option to utilize both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for their trading needs. These platforms provide a powerful multi-asset trading environment with features such as in-depth price analysis, multiple order types including pending orders, a wide selection of over 80 technical indicators, and various order execution options. Additionally, custom Expert Advisors can be applied to enhance trading strategies.

Furthermore, OnEquity's MetaTrader 5 (MT5) platform offers additional capabilities, including support for 4 types of pending orders and 30 technical indicators. These platforms empower traders with the tools needed to execute their strategies.

Educational Resources and Tools

OnEquity provides a comprehensive suite of educational resources designed to enhance the trading knowledge and skills of its clients. These resources include:

- Market News: Stay updated with the latest happenings in the financial markets with timely and relevant news articles.

- Analysis: Gain insights through detailed market analysis that helps in making informed trading decisions.

- Tools:

- Economic Calendar: Keep track of important economic events that can impact market movements.

- Trader's Glossary: Familiarize yourself with trading terms and jargon to enhance your understanding of complex concepts.

- Trading Calculators: Utilize various calculators for risk management, profit estimation, and more to optimize your trading strategies.

- Webinars: Participate in webinars hosted by experienced traders and industry experts. These sessions cover a range of topics from basic trading principles to advanced strategies and market forecasts.

These educational tools are designed to support both novice and experienced traders by providing them with the necessary resources to navigate the markets effectively, understand market dynamics, and refine their trading tactics.

Customer Support

OnEquity offers customer support services with a 24/7 availability, ensuring assistance to traders during trading hours. You can reach their support team at their head office located at CT House, Office 6C, Providence, Mahe, Seychelles. Contact options include email support at support@onequity.com and phone support via +2484671965. Additionally, they can be found on various social media platforms such as LinkedIn, Instagram, Telegram, and YouTube for additional communication channels.

Conclusion

In conclusion, OnEquity operates under the regulatory authority of the Seychelles Financial Services Authority (FSA) with license number SD154. The platform offers access to various market instruments, including Forex currencies, commodities, global indices, stock CFDs, spot metals, and cryptocurrency CFDs, with low pricing and leverage options. However, there are indications that OnEquity may lack essential trading software, which necessitates caution when considering it as a trading platform. Additionally, the account types and educational tools provided have not been evaluated in this analysis. Traders should exercise caution and conduct thorough research before engaging with OnEquity to ensure their investment safety.

FAQs

What is the full company name of OnEquity?

OnEquity operates under the full company name “OnEquity Ltd” in Seychelles.

Is OnEquity regulated?

OnEquity operates under the regulatory authority of the Seychelles Financial Services Authority (FSA) with license number SD154.

What trading instruments are available on OnEquity?

OnEquity offers a diverse range of trading instruments, including Forex currencies, commodities, global indices, stock CFDs, spot metals, and cryptocurrency CFDs.

What are the account types offered by OnEquity?

OnEquity offers three account types: Plus Account, Prime Account, and Elite Account, each with different minimum deposit requirements and features.

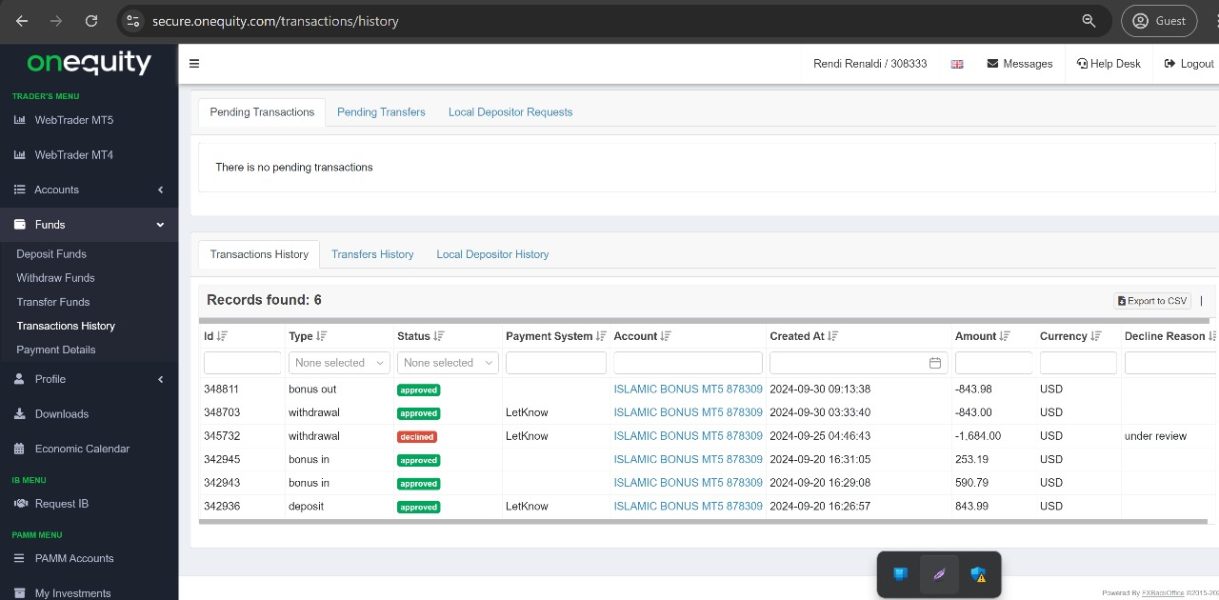

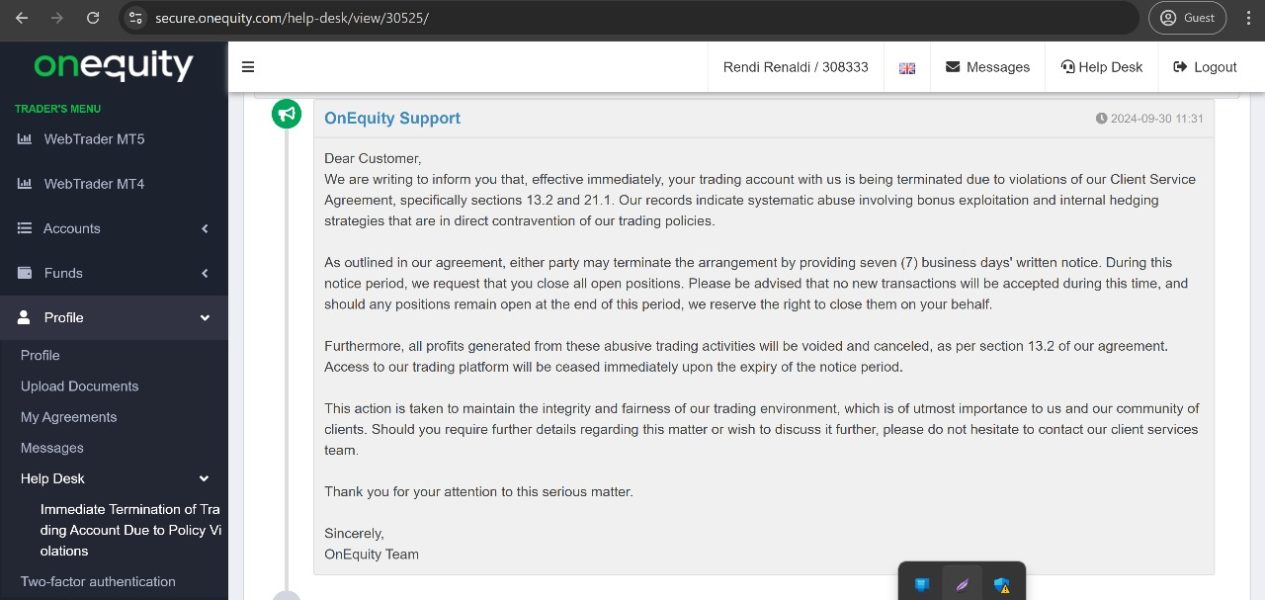

hansamuhito

Indonesia

Onequity broker has canceled my profits, claiming abuse of hedging. However, Onequity cannot prove that I engaged in abuse hedging. This is merely an excuse not to pay my profits. Initially, Onequity requested a selfie, which I provided. But in the end, they canceled my profits and only returned my initial deposit. In this case, I have been greatly disadvantaged by Onequity. Now I can no longer access my cabinet, and my trading account has been deleted. However, I have saved the screenshots. Be cautious with Onequity; they don’t pay out profits.

Exposure

2024-11-07

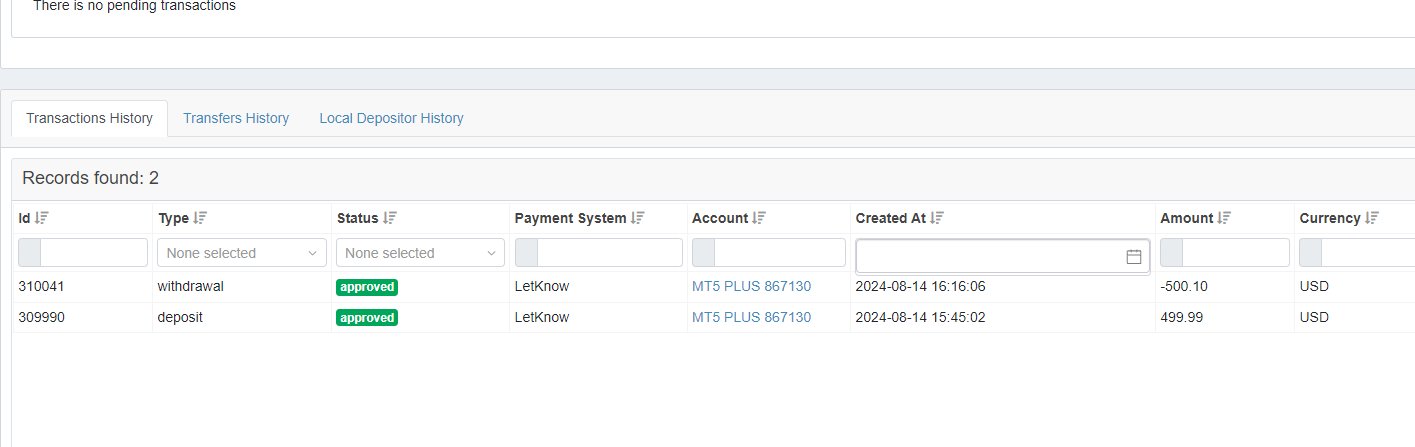

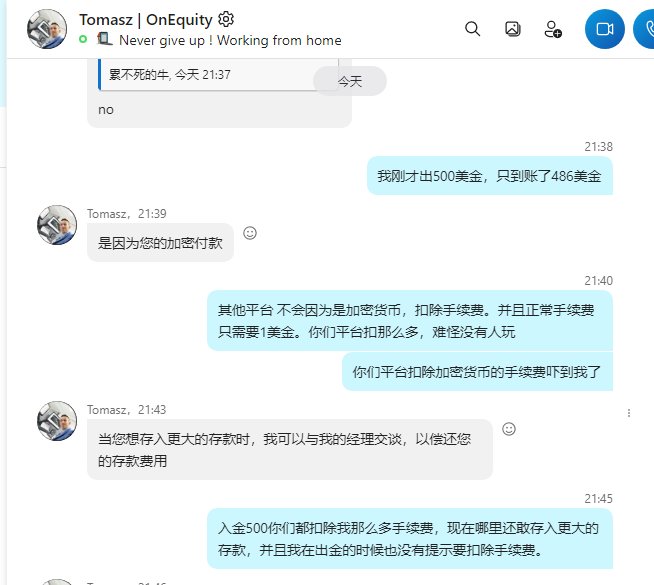

爱交易的小子

Hong Kong

I saw an activity on their website offering 100% bonus on deposits, with no indication that the promotion was unavailable in China. After depositing, I was informed that the region of China could not participate in this promotion. I then placed two trades and proceeded to withdraw funds. There was no notification about a withdrawal fee being charged. I withdrew $500 but only received $486 in my account, which felt deceptive. The manager stated that a fee is charged for all cryptocurrency transactions, but those of us who use USDT know that the fee should only be $1. The manager also suggested that I make a larger deposit and he would communicate with his superior to refund my transaction fees.

Exposure

2024-08-14

Nuotrader

Nigeria

The Forex trading journey with OnEquity felt like a rollercoaster ride—mostly, the downward slides! First off, they're like an untamed horse with no regulations whatsoever! Trusting them with my hard-earned money felt like putting the cat among the pigeons. Coming to the trading conditions—imagine going to an all-you-can-eat buffet, only to find the food stale and unappetizing! That's how their trading conditions felt like. The spreads were as high as the Burj Khalifa, giving me more downs than ups in my trades. The commissions were more like a rip-off! Their trading platform? More like navigating through a tech relic from the '90s. The chance of making a timely trade seemed to be as rare as hen's teeth with the abominable order execution speed. It's Forex trading for God's sake, not a leisurely stroll in the park!

Neutral

2023-12-04

FX1524833598

South Africa

Let me start off by saying that my experience with OnEquity has been frustrating, to say the least. I jumped on the OnEquity wagon after coming across their persuasive marketing promises. Let's just say, the reality has been, unfortunately, nothing close to their claims. First things first, browsing on their website, I was taken aback when I realized these folks don't even have a proper regulatory approval, which in my book is a red flag, waving big and bold. The fear of not having that regulatory safety net to fall back on? Man, it gives you chills! Now, stepping into their trading conditions, it was like walking into a house of mirrors - confusing and misleading. Their spreads? About as wide as the Grand Canyon, which ate a good slice of my trades. The order execution was not the "lightning fast" they claimed. Let's just say, I've seen sloths move faster! Worse still, their trading platform is nothing short of a nightmare - laggy and prone to freezing, especially during high volatility which is the exact time you want it to perform its best. And don't even get me started on the withdrawal process. It felt like trying to squeeze water from a rock!

Neutral

2023-12-02

Jarrad

Malaysia

Elite account, which I initially wanted to try, comes with a minimum deposit of $10,000. Despite my negotiations, no discounts were offered on this steep deposit requirement. So I gave up.

Neutral

2023-10-13

Charrge

Nigeria

OnEquity has got some seriously good customer support! Their team is knowledgeable, friendly, and always willing to go the extra mile to help. And their trading assets are diverse and offer traders plenty of opportunities to grow their portfolios.

Positive

2024-07-18

Marco Rossi

Italy

Loving vast product options! ♥♥♥From EU/US stocks to commodities, it has got it all. The platform's user experience is top-notch, no downtimes, no hiccups, just pure trading bliss!

Positive

2024-05-06