Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

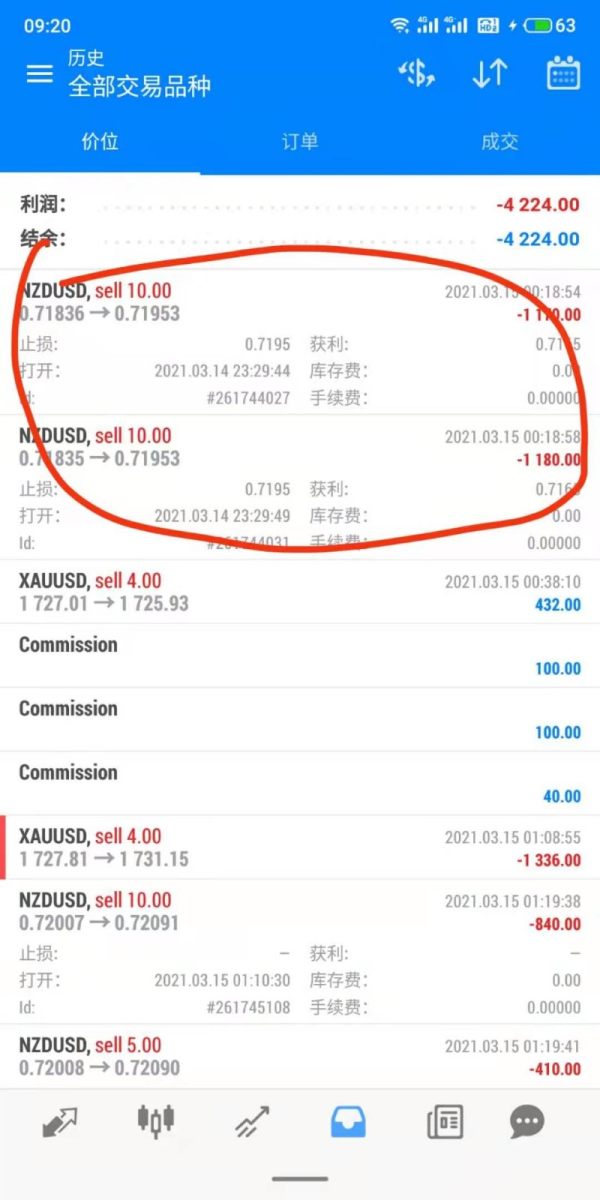

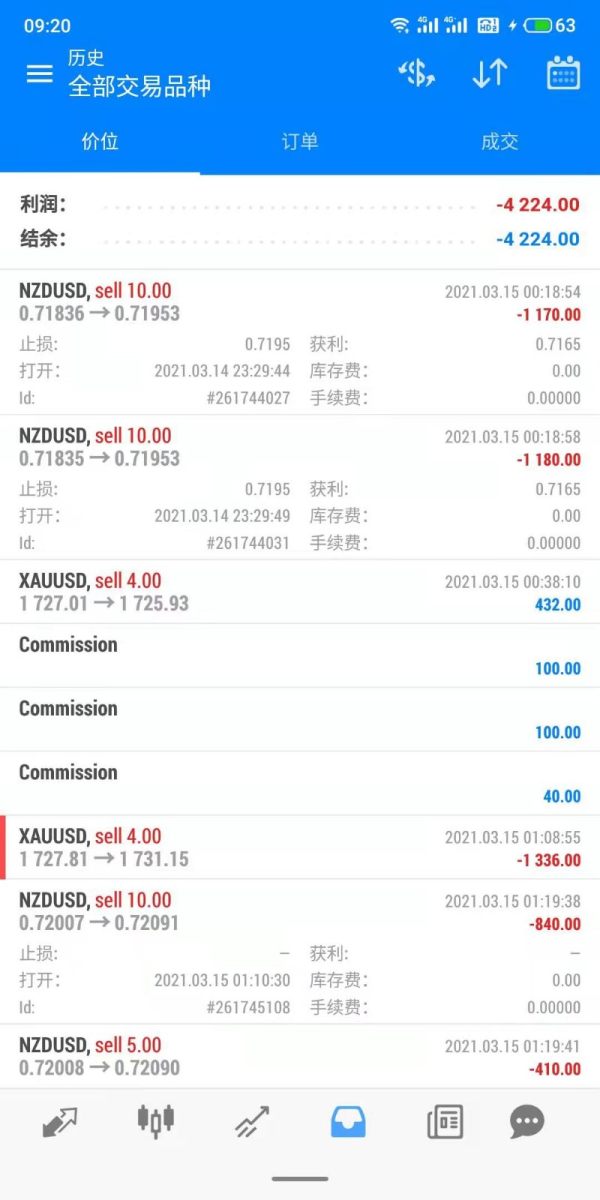

疯人笑:-D

Japan

For example, for XAU/USD at 1728.5, when I enter a lot, it will inexplicably become 1728.55. When I am out, I will make a profit of 450, and when I am out, it will become 420. If it is occasional, it will be fine. It is every order, the entry and exit points are all A part of it is higher than the display. Over time, the loss is self-evident, too much, the platform feedback is also invalid, the operation is lost, not excessive, this kind of dark operation is really hateful

Exposure

2021-03-15

FX1147331693

Taiwan

I received this advertisement from nag markets before, and now I came to wikifx to take a look, and found that its transaction speed is relatively average, and some people say it is a scam. His regulatory license is from Vanuatu, which is an offshore license that is not so safe. It is not recommended to trade with him.

Neutral

2022-12-14

Mericle

Belarus

Easy to use and small overnight charge if you keep an open trade. I have had a few different accounts with some others and this is rather easy to get around. Very fast execution of trades as well much quicker than others it is instant which I like you get the entry price you want.

Positive

2024-07-18

Jan de Vries

Netherlands

Been particularly impressed with the regular updates and improvements made to the platform. The advanced charting tools and technical indicators are incredibly detailed. However, honestly, risk management tools are okay. They provide the basic functionality needed to manage risk, but they're not particularly advanced or user-friendly.

Positive

2024-05-22

201955405

Colombia

So far I believe that the service provided by this company is satisfactory to me, and its transaction costs are within a reasonable range. The amount of spreads and commissions are not very high, which I really like. The fly in the ointment is that it is only regulated by the Vanuatu Financial Services Commission, which may not be so safe.

Positive

2022-11-23