Overview of Ava Trade MT5

Ava Trade MT5 is an online brokerage founded in 2006 and headquartered in Dublin, Ireland. The company operates globally, offering its trading platforms and financial services to retail and institutional clients in over 100 countries.

Ava Trade MT5 specializes in multi-asset trading, providing access to over 1,250 financial instruments including forex, stocks, commodities, indices, and cryptocurrencies. Its MetaTrader 5 (MT5) platform is targeted towards experienced traders that are looking for an advanced automated trading solution. Traders can access MT5 on desktop, web, and mobile to trade financial markets. Ava Trade MT5 account options include standard accounts with floating or fixed spreads, swap-free Islamic accounts, and demo accounts for practice.

Additional services offered include automated trading through Expert Advisors, technical analysis tools, risk management features, educational resources, and 24/7 multilingual support. Even though its regulation information is suspected to be cloned , research suggests the company is regulated in Australia, Japan, and British Virgin Islands.

Regulatory Information

Ava Trade MT5 holds various types of licenses and is subject to oversight by their respective regulatory bodies. The detailed regulation information is specified respectively as below. Please note that the “Suspicious Clone” status raises concerns.

Australia Securities & Investment Commission (ASIC):

The Australia Securities & Investment Commission (ASIC) is a regulatory agency based in Australia. It oversees financial markets and institutions within the country. ASIC has issued a Market Making (MM) license, numbered 406684, to AVA CAPITAL MARKETS AUSTRALIA PTY LTD. The current status of this institution is listed as a “Suspicious Clone.”

Financial Services Agency (FSA) - Japan:

The Financial Services Agency (FSA) is the regulatory authority in Japan responsible for supervising financial activities. In this case, the FSA has granted a Retail Forex License with the number 関東財務局長(金商)第1662号 to Ava Trade Japan K.K. The current status is marked as a “Suspicious Clone.”

Financial Conduct Authority (FCA) - United Kingdom:

The Financial Conduct Authority (FCA) is a regulatory body operating in the United Kingdom. It is responsible for overseeing financial markets and entities within the UK. AVA Trade EU Limited is the licensed institution under FCA's jurisdiction, holding a European Authorized Representative (EEA) license with the number 504072. Similar to the other agencies, the current status is listed as a “Suspicious Clone.”

Pros and Cons

Pros:

High leverage up to 1:400 - Traders can open much larger positions with less upfront capital, increasing potential profits but also risk.

Low spreads from 0.9 pips - Tight spreads reduce trading costs per transaction, especially beneficial for high frequency traders.

Supports MT5 platform - Provides automated trading capabilities through Expert Advisors and advanced features.

Wide range of tradable assets - Diverse selection of over 1250 CFDs across various markets to meet different trading strategies.

Multiple account types - Offers accounts tailored to needs of different traders, from standard to Islamic swap-free accounts.

Cons:

High minimum deposit ($100) - Relatively high deposit requirement can deter new retail traders with limited capital.

Limited demo account validity (21 days) - Short demo account expiry may not give enough time to test platform thoroughly.

Does not offer Islamic accounts on MT5 - Lack of swap-free accounts can discourage traders of Islamic faith.

Requotes and slippage - Latency in prices and order execution can lead to lower fills than expected.

High withdrawal fees - Extra processing charges applied on withdrawals makes taking money out costly.

Market Instruments

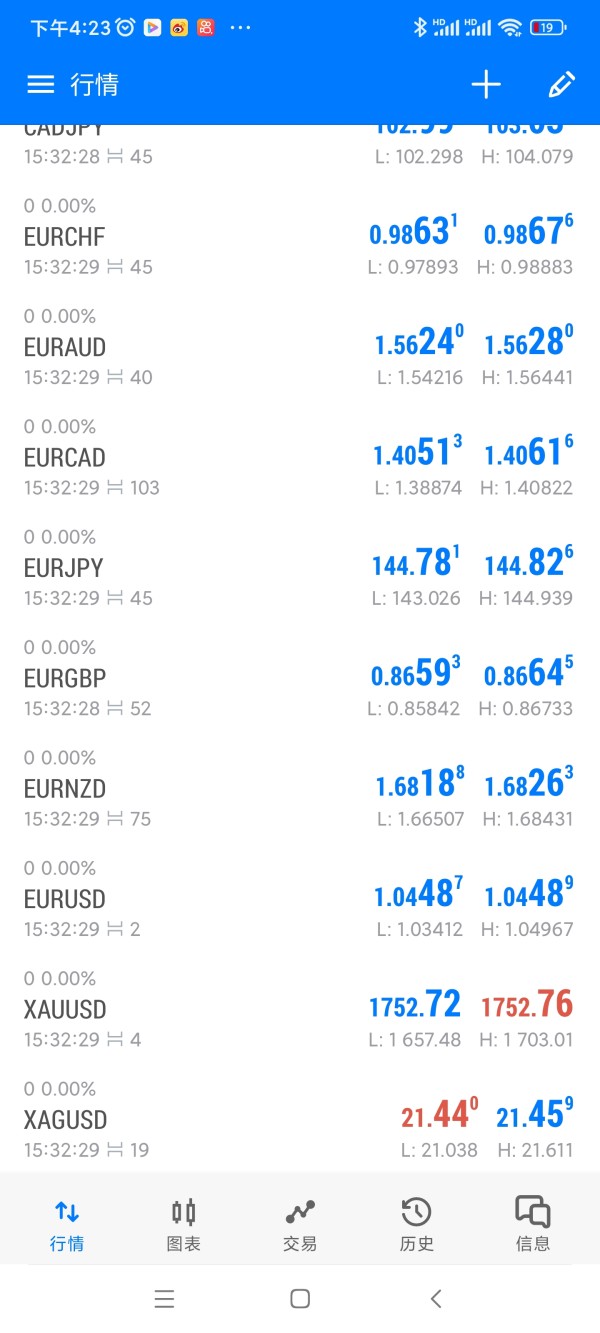

Ava Trade MT5 provides traders access to over 1,250 financial instruments across multiple asset classes including forex, stocks, commodities, indices, and cryptocurrencies.

Key trading products include:

Forex - Over 55 major, minor and exotic currency pairs including EUR/USD, GBP/USD, USD/JPY, etc.

Stocks - Hundreds of leading stocks from top global exchanges like NYSE, NASDAQ, London Stock Exchange, Hong Kong Exchange.

Commodities - CFDs on commodities like gold, silver, oil, natural gas, copper.

Indices - All major global indices like S&P 500, FTSE 100, DAX 40, Nikkei 225, ASX 200.

Cryptocurrencies - Major cryptos such as Bitcoin, Ethereum, Litecoin, Ripple and Bitcoin Cash.

ETFs - Major exchange-traded funds across various assets.

With a diverse product portfolio across various markets, Ava Trade MT5 provides traders plenty of trading opportunities catering to different strategies. The broker continously expands assets offering greater flexibility.

Account Types

AvaTrade MT5 offers a range of account types to cater to diverse trading preferences and experience levels. The Standard account, requiring a minimum deposit of $100, provides flexible spreads as low as 0.9 pips and a maximum leverage of 1:400 across a wide range of tradable assets. For traders adhering to Sharia principles, the Swap-Free Islamic account offers fixed spreads of 3 pips and does not charge overnight interest. It covers the same array of products as the Standard account.

Additionally, the Demo account, available with no initial deposit, mimics the Standard account's variable spreads and can be used indefinitely for risk-free practice. AvaTrade MT5 ensures that whether you prioritize tight spreads, swap-free trading, or gain experience before going live, there is an account type tailored to your needs.

How to Open an Account?

Opening an account with AvaTrade MT5 involves a simple 3-step process:

Register online: Visit the AvaTrade MT5 website and fill out the account application form with your personal details such as name, country, email address and phone number to register.

Verify identity: Upload documents such as passport, proof of address to meet KYC norms for account validation and compliance purposes.

Make a deposit: Fund your account by wire transfer, e-payments systems like Neteller, Skrill or debit/credit cards including Visa and MasterCard.

Once the registration is approved and account funded with the minimum $100 deposit amount or equivalent, you get access to the powerful MT5 platform along with your account dashboard to start trading.

The online application and approval process usually takes 1-2 days allowing swift onboarding with AvaTrade MT5 to commence trading across a multitude of assets.

Leverage

AvaTrade MT5 provides traders with a range of maximum leverage levels across various trading products. Forex pairs offer the highest leverage at 1:400, allowing traders to open larger positions relative to their account capital. Indices follow with a leverage of 1:200, offering flexibility in position sizing.

However, for trading products like stock CFDs and cryptocurrencies, the leverage is comparatively lower at 1:20 and 1:2, respectively, reflecting their higher inherent risk. Commodities maintain a leverage level of 1:10. This tiered leverage model provides traders with the flexibility to manage risk exposure while maximizing profit potential, making it possible to trade larger positions with less upfront capital.

Spreads and Commissions

AvaTrade MT5 distinguishes itself by offering ultra-competitive spreads, starting as low as 0.9 pips, and does not charge additional commissions, resulting in cost-effective trading across a variety of assets.

For forex pairs, the broker provides the tightest spreads, making high-leverage trading potentially lucrative. Stock CFDs and indices have spreads starting from 0.1% and 0.4%, respectively, while commodities carry slightly higher spreads at 0.02%. Cryptocurrency CFDs offer competitive spreads at 0.5%, and ETFs have the highest typical spreads, up to 2%. With a pricing model focused on reducing transaction costs, AvaTrade MT5 is a favorable choice for active traders across diverse markets, allowing them to keep trading costs low while benefiting from competitive spreads.

Trading Platform

AvaTrade MT5 solely provides access to the MetaTrader 5 (MT5) platform developed by MetaQuotes software. Some key features of the MT5 platform are:

Advanced charting - Integrated trading charts offer multiple analytical tools with 21 timeframes and 100+ technical indicators to spot trading opportunities through technical analysis.

Expert Advisors - Allow automated trading by writing custom scripts and trading robots to automate strategy rules.

Algorithmic trading - Inbuilt MQL5 programming language to code trading algorithms, and backtest strategies through the Strategy Tester module.

Trade execution - Fast order execution supporting instant one-click trading, stopping losses, taking profits, and pending orders across multiple assets.

Customization - Highly flexible interface with the ability to customize charts, widgets, and workspace layouts.

Mobile access – IOS and Android mobile apps provide access to account dashboards, charts, and trades anytime and anywhere.

So in summary, the MT5 platform offered by AvaTrade provides both manual and automated traders advanced tools for trade analytics, automation, testing strategies, fast execution, and seamless mobile access facilitating traders to make better-informed decisions.

Deposit and Withdrawal

AvaTrade MT5 prioritizes a smooth and convenient experience for clients when it comes to depositing and withdrawing funds. They offer a variety of deposit methods, including instant credit/debit card transactions with no internal fees, as well as wire transfers and eWallet options like Neteller and Skrill, all requiring a minimum deposit of $100. On the withdrawal side, while eWallet withdrawals are fee-free and swift, credit/debit card and wire transfer withdrawals may incur fees and take longer processing times.

Overall, AvaTrade provides payment flexibility to cater to clients' funding needs and preferences, with minimum deposits starting at $100 or equivalent.

Customer Support

AvaTrade MT5 provides dedicated multilingual 24/5 customer support through various contact methods:

Traders have access to a skilled customer support staff available around the clock 5 days a week. The following options are available to get assistance or solutions to any platform or account issues faced:

Live Chat - Instant messaging service to chat with support representatives directly through the website or app.

Email Support - For any general queries, documents or non-urgent requests, emails can be sent which are responded within 24 hours.

Phone Support - Toll-free local telephone numbers for over 30 countries are available so clients can call support lines during business hours and speak to a knowledgeable representative.

FAQ Section - Extensive database of frequently asked questions provides self-help for common technical or account related issues faced by traders.

Multi-Lingual - Support services offered in English along with Spanish, Arabic, Portuguese and Russian languages.

With dedicated reps reachable through various mediums from Monday-Friday, AvaTrade MT5 ensures seamless client assistance for a smooth trading experience across international markets.

Educational Resources

AvaTrade MT5 offers a comprehensive suite of research and educational resources that help traders learn and refine their trading skills across markets:

Traders can access AvaTrade's Sharp Trader website which provides a rich database of daily market news and analysis covering fundamental drivers, economic events, technical reviews,s and more across forex, commodities, and indices. In addition, there are videos highlighting trading basics through advanced strategy-building guides. An economic calendar keeps track of key global market events.

For further self-improvement, over 40 interactive e-courses are available explanations on technical indicators, risk management concepts, how central bank policies impact currencies and global capital flows and more. Traders can thus enhance their financial knowledge at their own pace.

Comparison with Similar Brokers

AvaTrade MT5, XM MT5, and RoboForex MT5 are prominent trading platforms offering access to the popular MetaTrader 5 (MT5) across a global client base. AvaTrade MT5 provides traders with competitive advantages, offering a maximum leverage of 1:400, a diverse range of over 1,250 CFDs, and tight spreads starting at just 0.9 pips. While XM MT5 and RoboForex MT5 offer even higher maximum leverage, they have wider spreads, including 0 pip spreads. AvaTrade stands out with a broader range of CFDs across multiple markets.

Overall, AvaTrade MT5 presents a compelling MT5 solution for traders seeking flexibility, strong execution quality, and reasonable costs, making it an attractive choice for active day traders.

Conclusion

In conclusion, AvaTrade MT5 is a platform that caters to experienced traders, systematic traders, and market enthusiasts, offering access to over 1,250 trading instruments through the advanced MetaTrader 5 platform. With high 1:400 leverage, competitive spreads as low as 0.9 pips, and zero commission pricing for popular asset classes like forex, cryptocurrency, commodities, and global equities, AvaTrade reduces funding barriers and transaction costs, especially in volatile markets.

The platform offers diverse account types, including Standard, Swap-free Islamic, and Demo accounts, catering to a wide range of user demands and globalizing its services with customization options. While its focus on MT5 limits platform choices, this concentration drives feature refinement. AvaTrade MT5 provides an array of risk management tools, automated trading options, and a custom development environment, empowering traders to advance their careers.

Moreover, AvaTrade offers multi-channel, always-available customer service to bridge communication gaps across geographies. For intermediate traders looking for optimal access, transparency, and control over next-generation trading essentials, AvaTrade MT5 stands out as a go-to brokerage, unlocking new possibilities in the world of trading.

FAQs

Q: What is the maximum number of positions I can have open on AvaTrade MT5?

A: A maximum of 200 open positions can be supported at any time on AvaTrade MT5 accounts.

Q: Does AvaTrade MT5 provide Virtual Private Server (VPS) hosting for trading bots?

A: Yes, AvaTrade offers VPS hosting starting from $35/month for uninterrupted EA trading and strategy testing.

Q: How do I activate the stop loss and take profit trading tools on MT5 platform?

A: The stop loss and take profit facilities can be set directly when placing a trade in the Order tab by entering values in the SL and TP fields.

Q: Is crypto trading allowed on MT5 Islamic swap-free accounts?

A: Unfortunately Islamic accounts are not offered by AvaTrade for MT5, so cryptocurrencies trading incur overnight/swap fees.

Q: What is the maximum account leverage available for stock CFD trading?

A: Stock CFDs on AvaTrade MT5 can be traded with a maximum leverage of 1:20 based on regulations.