It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of KOT4X

Pros:

Low minimum deposits for some account types

Multiple funding sources accepted, including cryptocurrencies

No withdrawal fees from the company side

Wide range of trading instruments

High maximum leverage of up to 1:500

Fast execution speed

Multiple customer care channels available

Cons:

Limited educational resources on the website

Limited account types compared to other brokers

Limited information about the company and its regulations on the website

Network fees apply when depositing via cryptocurrencies

No mobile app for trading

Inactivity fee charged after 90 days of no trading activity

No regulatory information available on the website

What type of broker is KOT4X?

STP stands for Straight-Through Processing and is a trading model where a broker acts as an intermediary between its clients and liquidity providers. In this model, the broker does not take the opposite side of the trade and does not have a conflict of interest with the client. Instead, the broker sends the orders directly to the liquidity providers, who execute them at the best available market prices. KOT4X operates as an STP broker, which means that traders benefit from transparency of market pricing and potentially better pricing and execution. This trading model is suitable for all trading strategies, and there is no price manipulation protection. However, one disadvantage of the STP model is that the broker has less control over spreads, and there are no guaranteed fixed spreads.

General information and regulation of KOT4X

KOT4X is an online forex broker founded in 2020 and located in St. Vincent and the Grenadines. It offers a variety of account types with different spreads, commissions, and minimum deposits, and a maximum leverage of up to 1:500. Deposits and withdrawals can be made through several cryptocurrencies or debit/credit cards via third-party providers. The customer care service includes options for call back, submitting a ticket, Instagram, and FAQs. While there are no educational resources on the website, KOT4X offers a range of trading instruments, including forex, commodities, and cryptocurrencies.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

Market instruments

KOT4X offers a diverse range of over 250 instruments for traders to choose from. This includes 55 currency pairs, 104 stocks, 31 cryptocurrencies, and 8 indices. The availability of multiple currency pairs provides traders with ample opportunity to explore different currency combinations and execute diverse trading strategies. Additionally, the inclusion of cryptocurrencies and stocks further expands the range of options available. However, KOT4X has a limited selection of commodities, and it does not offer fixed-income instruments such as bonds or treasury bills. While the number of indices available is smaller compared to other brokers, traders still have access to a variety of popular global indices. Overall, KOT4X provides traders with a diverse selection of instruments to choose from.

Spreads, commissions and other costs

KOT4X offers a variety of account options, each with its own spread and commission rates. The Standard pairs account has spreads from 0.8 pips and a commission of $7, while the Pro pairs account has spreads from 0.4 pips and a commission of $7. The VAR pairs account has spreads from 1.2 pips and no commission, and the Mini pairs account has spreads from 1.0 pips and a commission of $1. While the spread and commission rates can be high for certain account types, the commission structure is transparent, and there are no deposit or withdrawal fees. KOT4X also provides negative balance protection, which means that traders cannot lose more than their account balance. However, there may be high swap rates on certain instruments, and an inactivity fee is charged after 60 days of inactivity. The website does not provide comprehensive information on trading costs and fees, which can be a disadvantage for traders.

Trading accounts available in KOT4X

KOT4X offers traders four different account types: Standard pairs, Pro pairs, Var pairs, and Mini pairs. Each account type has different minimum deposit requirements, spreads, and commission fees. The Standard pairs account type requires a minimum deposit of $50 and offers spreads from 0.8 pips and a commission fee of $7. The Pro pairs account type, on the other hand, requires a minimum deposit of $500 and offers tighter spreads from 0.4 pips, but also charges a commission fee of $7. The Var pairs account type has no commission fee and requires a minimum deposit of $250, but offers wider spreads from 1.2 pips. Lastly, the Mini pairs account type requires a minimum deposit of $25 and offers spreads from 1.0 pips and a commission fee of $1. Overall, the variety of account types available allows traders to choose the one that best suits their needs and budget.

Trading platform(s) that KOT4X offers

MetaTrader 4 (MT4) is a popular trading platform that offers a range of advanced features for traders. One of the major advantages of MetaTrader4 is its industry-standard status, as it is widely used across the trading community, which means that traders can easily find support, resources and strategies online. Additionally, MetaTrader4 has an easy-to-use interface with a range of charting tools and indicators that can be customized to meet individual needs. Another advantage is that the platform has automated trading capabilities, allowing traders to implement strategies and execute trades automatically. However, one of the main disadvantages of MetaTrader4 is that it can be resource-intensive on older devices. Also, there are limited customization options available and no web-based or mobile version of the platform, which may be a disadvantage for traders who prefer trading on-the-go. Furthermore, while MetaTrader4 has a large community, it is limited to the number of integrated brokers available on the platform, which may limit some traders' choices.

Maximum leverage of KOT4X

KOT4X offers a maximum leverage of up to 1:500, which means that traders can control positions worth up to 500 times their initial investment. This can potentially lead to higher profits, as traders can take advantage of smaller price movements in the market. However, it also comes with higher risk, as losses can accumulate just as quickly as profits. Therefore, it is essential for traders to have a solid understanding of risk management techniques, and for inexperienced traders to avoid over-leveraging. Despite the potential advantages of higher leverage, it's important to note that regulated brokers may have lower maximum leverage limits, and that higher leverage may not be suitable for all traders.

Deposit and Withdrawal: methods and fees

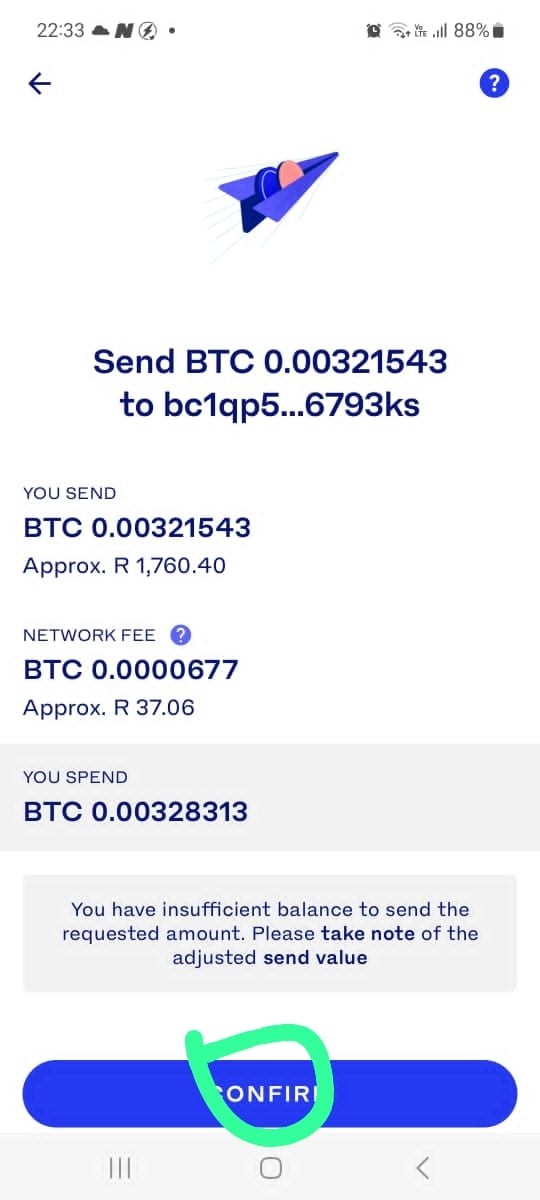

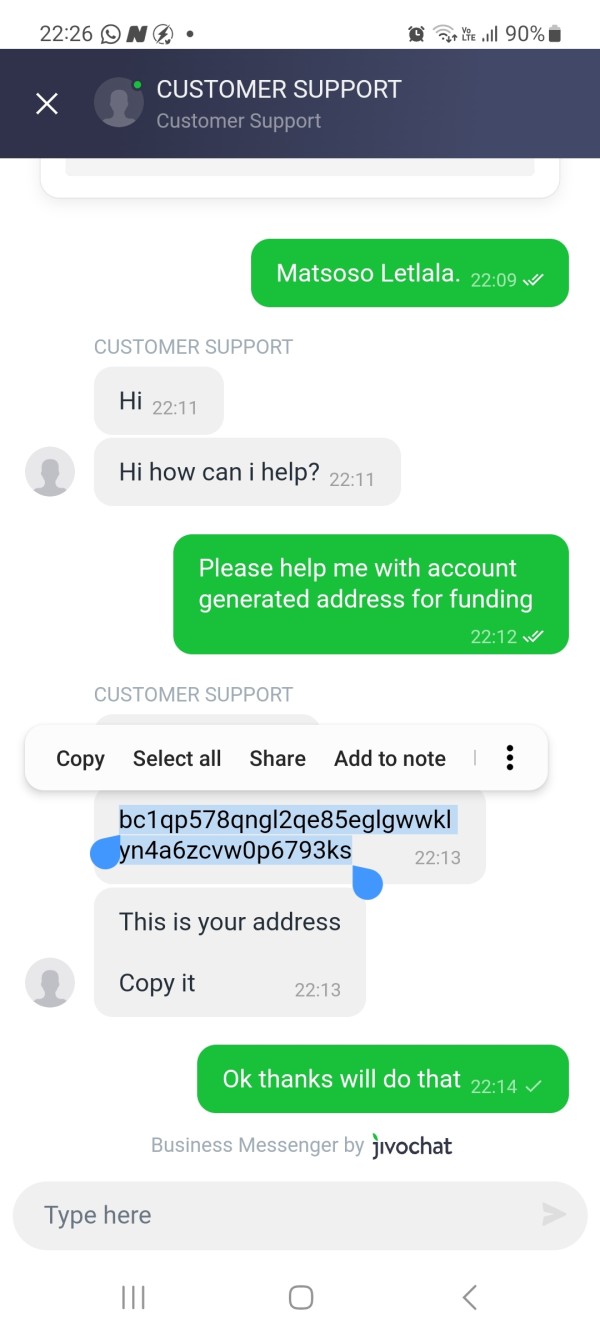

KOT4X offers its clients a variety of deposit and withdrawal options. The company accepts a range of cryptocurrencies including Bitcoin, Litecoin, Ethereum, and Ripple, as well as stablecoins like USDT and USD Coin. Additionally, clients can deposit via credit/debit card using third-party providers, although they will need to purchase Bitcoin and transfer it to KOT4X. One advantage of KOT4X's payment methods is that there are no deposit or withdrawal fees charged by the company, making it a cost-effective option for traders. However, clients should be aware that network fees may apply for cryptocurrency deposits, which are deducted from the blockchain network for processing transactions and not by KOT4X. Another potential disadvantage is that KOT4X's payment options are limited to cryptocurrencies and credit/debit cards via third-party providers, which may not be suitable for all traders.

Educational resources in KOT4X

KOT4X does not offer any educational resources on their website, which can be seen as a disadvantage for traders who are new to the industry or want to enhance their knowledge and skills. There are no webinars, seminars or training programs offered, which means that traders have to rely on their own knowledge and experience to trade effectively. Additionally, KOT4X does not offer access to trading signals or analysis, which can be problematic for traders who want to practice trading or receive guidance on their trades. However, it should be noted that more experienced traders who prefer to trade independently may not see this as a disadvantage.

Customer service of KOT4X

Customer care is an essential aspect of any business, and KOT4X offers several options for its clients to get in touch with them. These options include Call Back, FAQs, Instagram, and Submit a Ticket. Call back is a feature that allows clients to request a call back from the customer support team, while FAQs provide a list of frequently asked questions and their answers. Clients can also connect with KOT4X through Instagram, which provides a more social and casual way to communicate. Lastly, submitting a ticket allows clients to send a specific inquiry or issue, and the support team will respond to them promptly.

Conclusion

In conclusion, KOT4X is a reputable online broker that offers a variety of trading instruments, including forex, commodities, and cryptocurrencies. With four different account types and a maximum leverage of 1:500, traders have flexibility in their trading strategies. Deposits and withdrawals can be made via a variety of cryptocurrencies and third-party platforms, and there are no withdrawal fees from the company side. While the company lacks educational resources, it offers customer support through a call-back system, FAQs, Instagram, and ticket submission. Overall, KOT4X provides a reliable and competitive trading environment for both beginner and experienced traders.

Frequently asked questions about KOT4X

What is KOT4X?

Answer: KOT4X is a forex and CFD brokerage firm that offers trading in a wide range of instruments, including over 250 instruments in 55 currencies, 104 stocks, 31 cryptos, and 8 indices. The company is headquartered in St. Vincent and the Grenadines and is not regulated.

What trading platforms does KOT4X offer?

Answer: KOT4X offers the popular MetaTrader 4 (MetaTrader4) trading platform, which is available for desktop and mobile devices. The MetaTrader4 platform is widely used by traders around the world for its advanced charting capabilities, automated trading tools, and wide range of technical indicators.

What are the minimum deposit requirements for KOT4X accounts?

Answer: KOT4X offers several different account types, each with its own minimum deposit requirement. The Mini pairs account has the lowest minimum deposit of $25, while the Pro pairs account has a minimum deposit of $500.

What funding sources are accepted by KOT4X?

Answer: KOT4X accepts several different funding sources, including cryptocurrencies like Bitcoin and Ethereum, as well as debit/credit card payments through third-party providers. There are no withdrawal fees from the company side, but network fees apply when depositing via Bitcoin.

What is the maximum leverage offered by KOT4X?

Answer: KOT4X offers a maximum leverage of up to 1:500, which means that traders can potentially increase their buying power by up to 500 times their initial investment. However, leverage can also increase the risk of losses, so it should be used with caution.

What customer support options are available at KOT4X?

Answer: KOT4X offers several customer support options, including call back requests, a ticket submission system, and an Instagram account for social media engagement. There is no live chat option, but the company does provide a comprehensive FAQ section on its website.

Does KOT4X offer educational resources for traders?

Answer: Unfortunately, KOT4X does not currently provide any educational resources for traders, such as tutorials or webinars. However, the company's MetaTrader4 platform does offer a range of built-in educational tools, including video tutorials and a comprehensive user guide.

Hibbs

United States

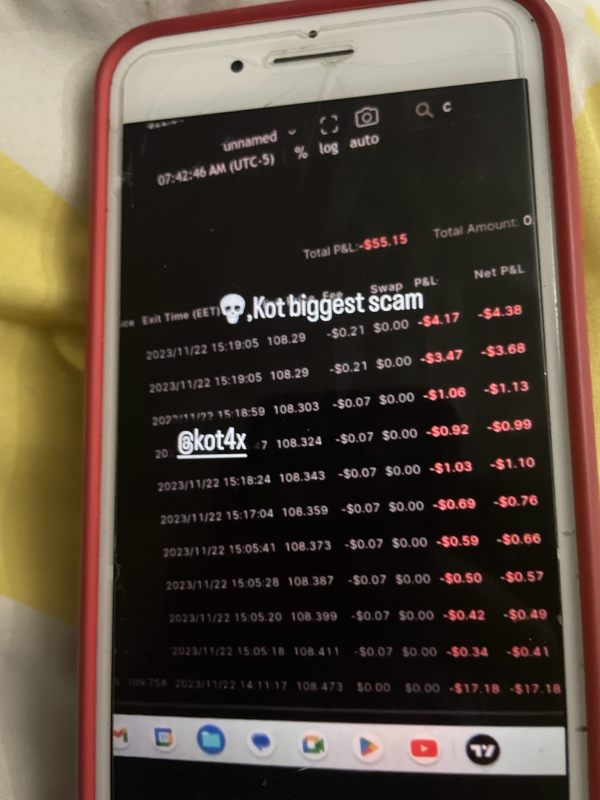

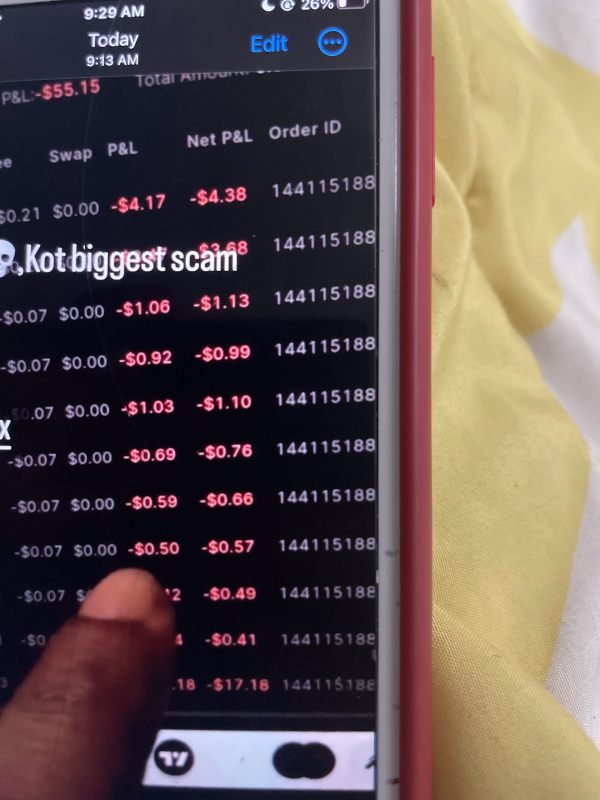

platform was placing trades in my trade account which was slowly deteriorating my account ,I did not realize this was happening until I started to journalize each trade I took

Exposure

2023-11-29

no9117

South Africa

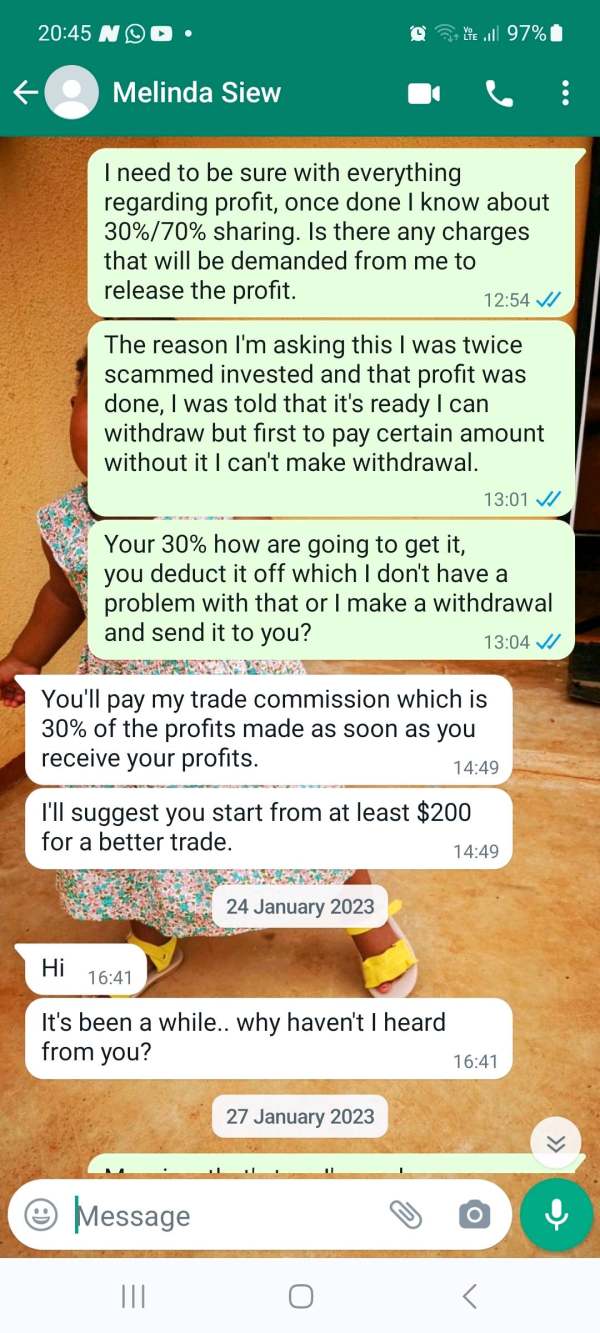

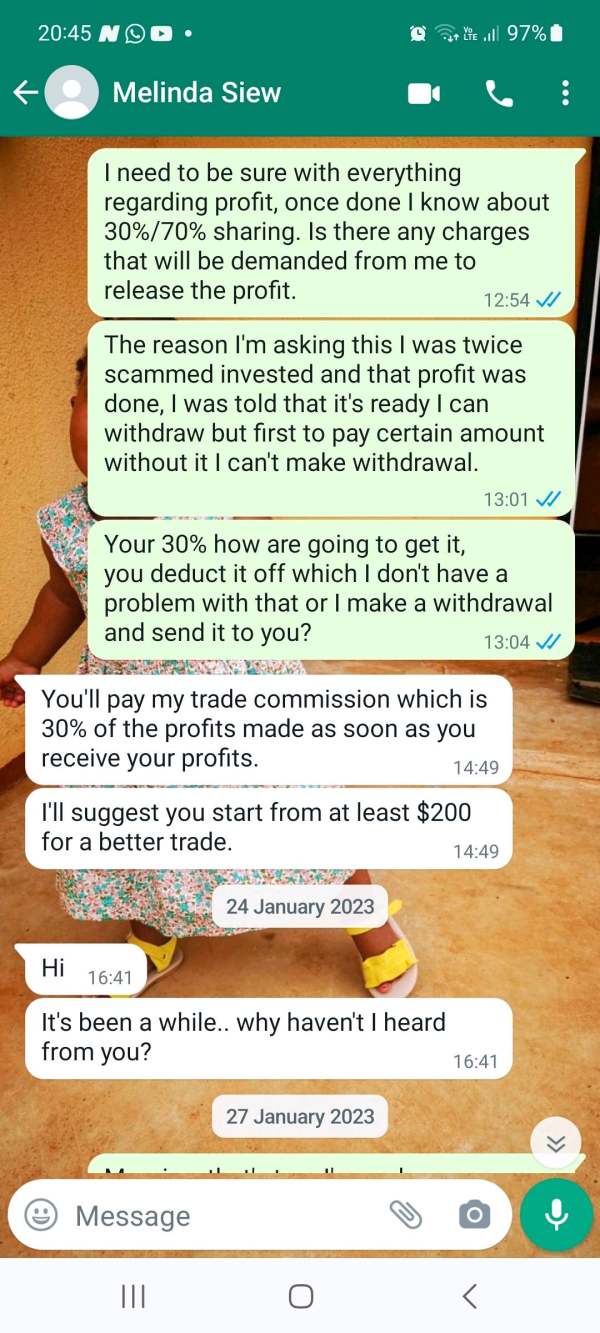

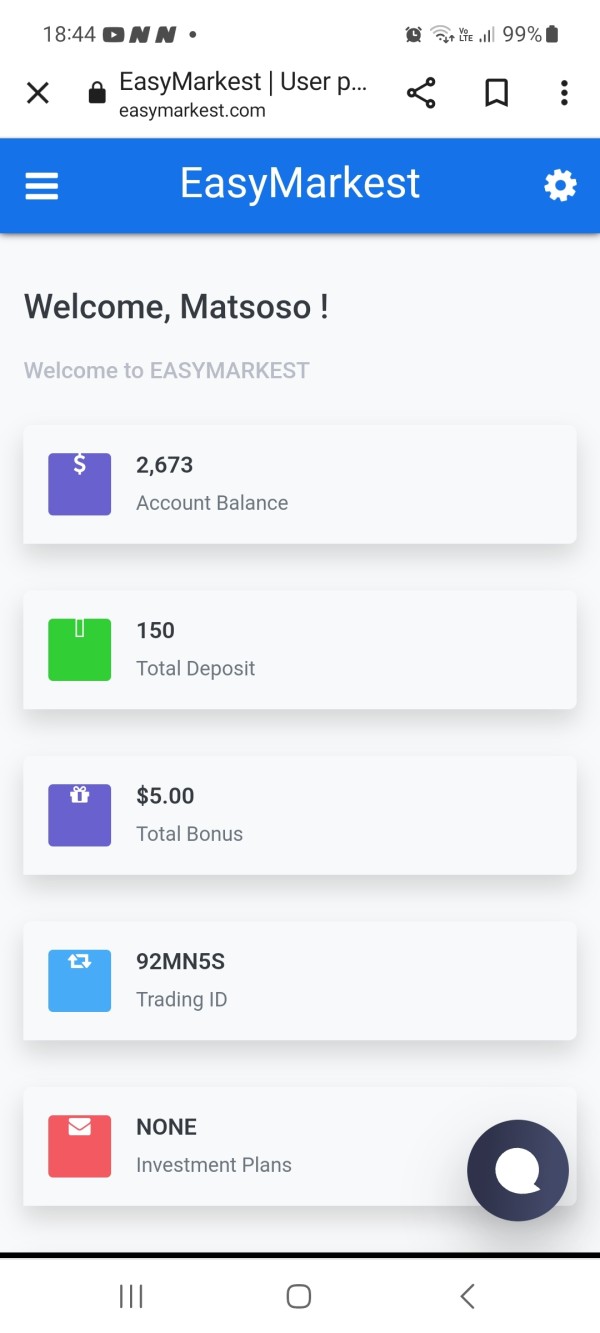

I met a lady on Facebook by the name of Melinda Siew, she's a trader, we came to an agreement sometime ago that she will do a trade for me when a profit is made I withdraw and gave her 30%. I deposited the money into Luno account and it was transferred to a platform which she sent me a link, it's name is easymarkest.com. she did a trading then tell me that I must not forget about 20% before withdrawal then our dispute started there.

Exposure

2023-08-16

Mayaz Ahmad

Bangladesh

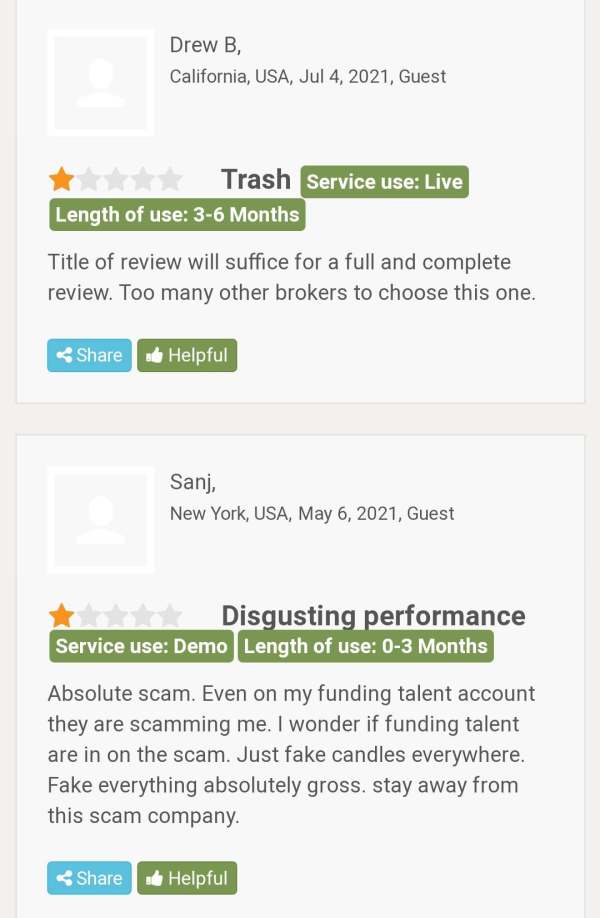

Many clients have complained that they were scammed in various ways by this broker. Stay away.

Exposure

2021-07-22

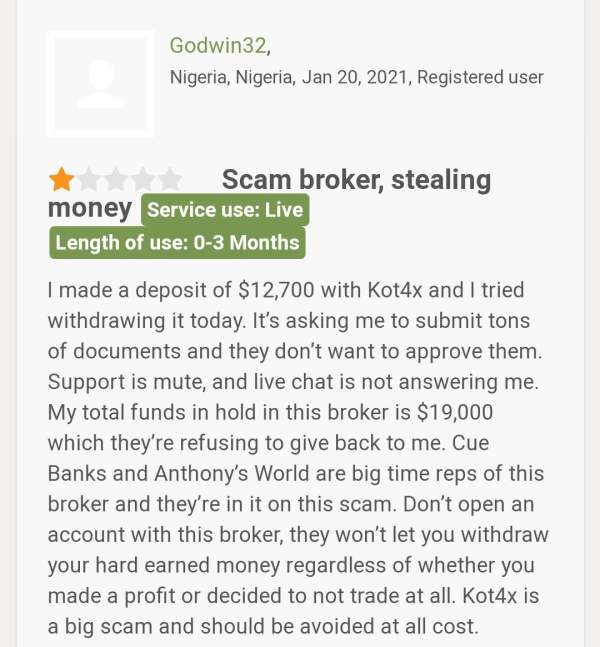

Mayaz Ahmad

Bangladesh

A client claims he could not withdraw his deposit from KOT4X and they did respond when he communicated this problem to them. He has warned others to stay away from this broker.

Exposure

2021-06-30

FX1525691881

Malaysia

I was initially drawn in by their user-friendly account-opening procedures, but soon after I was faced with questionable regulatory transparency. Finding detailed documentation was like hunting for a needle in a haystack, which is troublesome for anyone negotiating the landscape of forex trading. The trading platform's performance leaves much to be desired, with sporadic freezing and lagging issues. This has led to unwelcome slippage and incurable headaches for me, impacting my trading strategies gravely. Adding to the list is their frustratingly wide spreads, which eat into any possible profit margins, and high commissions. More often than not, I was left feeling like I was fighting against a tide, and not just the forex market.

Neutral

2023-12-04

小如改名叫昀泽r

Egypt

I really appreciate KOT4X’s customer service. They respond quickly and help you with my problems, very understanding. But the withdrawals can enter a little bit faster.

Neutral

2023-03-02

量化

Malaysia

The whole thing was a horrible experience for me. The withdrawal request I sent was ignored, and customer service took an extremely long time to respond to. While making a deposit is simple, withdrawing funds is a major hassle. Even when I informed them that the sizes of their positions were inaccurate, they did nothing to correct the situation. The correct price for a 0.10 position size is $1, not $10!

Neutral

2022-11-26